by Calculated Risk on 12/20/2008 06:23:00 PM

Saturday, December 20, 2008

NY Times: Ideologues Aided Mortgage Crisis

From the NY Times: White House Philosophy Stoked Mortgage Bonfire

The global financial system was teetering on the edge of collapse when President Bush and his economics team huddled in the Roosevelt Room of the White House for a briefing that, in the words of one participant, “scared the hell out of everybody.”This article makes some interesting points, but misses some of the key causes of the crisis. As an example then Fed Chairman Alan Greenspan isn't even mentioned in the article, and he was counseling Mr. Bush on reducing regulations.

...

Mr. Bush, according to several people in the room, paused for a single, stunned moment to take it all in.

“How,” he wondered aloud, “did we get here?”

The article incorrectly focuses on minority ownership and Fannie and Freddie (a small role in the crisis) and barely touches on Wall Street - and completely ignores the securitization process (a major enabler to the crisis). But there are some interesting quotes:

"There is no question we did not recognize the severity of the problems,” said Al Hubbard, Mr. Bush’s former chief economics adviser, who left the White House in December 2007. “Had we, we would have attacked them.”I'd like to see a mea culpa from Greg Mankiw and few others too.

Looking back, Keith B. Hennessey, Mr. Bush’s current chief economics adviser, says he and his colleagues did the best they could “with the information we had at the time.” But Mr. Hennessey did say he regretted that the administration did not pay more heed to the dangers of easy lending practices. And both Mr. Paulson and his predecessor, John W. Snow, say the housing push went too far.

“The Bush administration took a lot of pride that homeownership had reached historic highs,” Mr. Snow said in an interview. “But what we forgot in the process was that it has to be done in the context of people being able to afford their house. We now realize there was a high cost.”

Even this story is from early 2007 when the crisis should have been obvious to everyone:

Jason Thomas had a nagging feeling.Geesh - early 2007 - and one guy had a "nagging feeling"? Oh my ...

The New Century Financial Corporation, a huge subprime lender whose mortgages were bundled into securities sold around the world, was headed for bankruptcy in March 2007. Mr. Thomas, an economic analyst for President Bush, was responsible for determining whether it was a hint of things to come.

At 29, Mr. Thomas had followed a fast-track career path that took him from a Buffalo meatpacking plant, where he worked as a statistician, to the White House. He was seen as a whiz kid, “a brilliant guy,” his former boss, Mr. Hubbard, says.

As Mr. Thomas began digging into New Century’s failure that spring, he became fixated on a particular statistic, the rent-to-own ratio.

Typically, as home prices increase, rental costs rise proportionally. But Mr. Thomas sent charts to top White House and Treasury officials showing that the monthly cost of owning far outpaced the cost to rent. To Mr. Thomas, it was a sign that housing prices were wildly inflated and bound to plunge, a condition that could set off a foreclosure crisis as conventional and subprime borrowers with little equity found they owed more than their houses were worth.

It was not the Bush team’s first warning. The previous year, Mr. Lindsay, the former chief economics adviser, returned to the White House to tell his old colleagues that housing prices were headed for a crash. But housing values are hard to evaluate, and Mr. Lindsay had a reputation as a market pessimist, said Mr. Hubbard, adding, “I thought, ‘He’s always a bear.’ ”

In retrospect, Mr. Hubbard said, Mr. Lindsay was “absolutely right,” and Mr. Thomas’s charts “should have been a signal.”

Thread music ...

CRE Owner "Walking Away"

by Calculated Risk on 12/20/2008 10:16:00 AM

From the St. Petersburg Times: BayWalk owner proposes deal to surrender deed, walk away (hat tip Terry)

Hoping to avoid drawn-out foreclosure proceedings, BayWalk owner Fred Bullard said Friday he is negotiating a deal to simply surrender the deed to the downtown entertainment complex and walk away.And good luck pursuing him for any penalities:

Under the proposal, a bank would take control of the retail and restaurant portion of BayWalk and appoint a trustee to run the complex until a suitable buyer is found.

The technical owner of BayWalk, STP Redevelopment, has no other assets and was created solely to own BayWalk.As I've noted before, CRE owners are much more willing to just walk away than residential owners.

Friday, December 19, 2008

Retail Space to be Vacated

by Calculated Risk on 12/19/2008 09:27:00 PM

Back in October, the WSJ reported that mall vacancy rates increase sharply in Q3:

For strip centers and other open-air shopping venues, the vacancy rate climbed to 8.4% in the third quarter from 8.1% in the second quarter. That marks the highest rate since 1994, according to Reis. Meanwhile, retailers' closures outpaced new leases by 2.8 million square feet in U.S. strip centers in the third quarter, the third consecutive quarterly net decline. It is the first nine-month period of so-called negative net absorption since Reis started tracking the data in 1980.

...

The vacancy rate at malls in the top 76 U.S. markets rose to 6.6% in the third quarter, up from 6.3% in the previous quarter, to its highest level since late 2001, according to Reis.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the strip mall vacancy rate since Q2 2007. Note that the graph doesn't start at zero to better show the change.

But clearly it is about to get much worse.

Hat tip wc for the following!

Pre black Friday closing & liquidation announcements have come from Shoe Pavilion, Steve & Barry's, Gordman's, Radio Shack, JoAnn Fabric, Boscov's, Bennigan's, Winn Dixie, Office Max, Comp USA, Pier 1, and Sigrid Olsen. Of the 2 billion square feet of community/neighborhood retail space in the largest 76 metropolitan areas, vacancy has increased by 0.75% so far in 2008 (source: REIS).This list isn't exhaustive - we could add other retailers closing stores, filing bankruptcy or going out of business such as Sharper Image, Starbucks, The Disney Store, Wilson's Leather, Talbots, Ann Taylor, Bombay Co. and more.

In the last 2 months the number and severity of announcements from retailers has gotten worse. Based on press releases, and an estimate of average store size, I believe these 9 retailers [alone] will be leaving about 47 million square feet of space:

From the WSJ: Linens 'n Things to Be Liquidated 10/14/2008

From the WSJ: Linens 'n Things to Be Liquidated 10/14/2008From MarketWatch: Mervyns Closing all Stores After 60 Years in Business 10/30/2008

From the Consumerist: Santa's Not Coming: All KB Toys Stores To Be Liquidated And Closed KB Toys 12/11/2008

From the Tribune-Democrat: Value City closes 11/25/2008

From the WSJ: Circuit City Seeks Haven In Bankruptcy Protection 11/11/2008

From Costar: Bally Total Fitness Files Bankruptcy, Again 12/5/2008

From the Press Telegram: Shoe Pavilion shutting down all 64 stores 10/20/2008

From the WSJ: U.S. court OKs Tweeter Chapter 7 liquidation 12/5/2008

From the Times Dispatch: Judge allows RoomStore purchase of Mattress Discounters 12/4/2008

The percent of total retail space is estimate based on 2 billion square foot number; this is only the 76 markets covered by REIS (2007 Q3 = 1,965,651,000. 2010 forecast = 2,026,266,000).CR note: this is just a rough estimate - and many analysts are expecting a number of additional retail bankruptcies in January - but it is pretty clear the mall vacancy rate will rise sharply in 2009.

If 3/4 of the closing stores are in the top 76 metro areas defined by REIS, these 9 retailers alone will increase vacancy by 1.8% (compared with 0.75% during 2008).

Schwarzenegger may force unpaid time off for state employees

by Calculated Risk on 12/19/2008 07:26:00 PM

From Bloomberg: Schwarzenegger May Order Unpaid Leave for Employees

California Governor Arnold Schwarzenegger may force all state workers to take two days of unpaid leave each month to conserve money ... The practice would begin in February and would last through June 2010 ...

The executive order also would seek to cut the state’s workforce by 10 percent through firings if necessary and would freeze new hiring ...

The leave would amount to a 10 percent pay cut ...

Crude Oil below $33 per Barrel

by Calculated Risk on 12/19/2008 04:39:00 PM

From Bloomberg: New York Oil Falls as Stockpiles at Cushing, Oklahoma, Climb

Crude oil dropped below $33 a barrel in New York as rising stockpiles at Cushing, Oklahoma, leave little room to store supplies for delivery next year.UPDATE: For those that missed it, the article also mentions:

The more-active February contract rose 69 cents, or 1.7 percent, to $42.36.But my key points concerning the economic impact are the same.

For the U.S. economy, I think there are two points worth repeating: 1) this decline in oil prices will significantly reduce PCE for gasoline, oil and other energy goods - and provide a stimulus for U.S. household to either save more, or spend more on other items, and 2) the oil price decline will also impact investment in domestic oil production (also foreign oil production, but that doesn't direclty impact the U.S. economy).

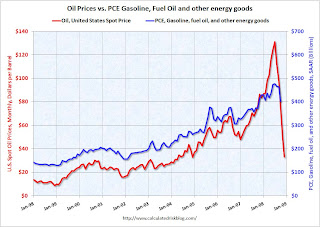

The following graph shows the monthly personal consumption expenditures (PCE) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly).

Click on graph for larger image in new window.

Click on graph for larger image in new window. At current oil prices, it appears oil related PCE could fall to $250 billion or so SAAR, from close to $500 billion SAAR in July. This is a savings of almost $20 billion per month compared to July. And that would be helpful and definitely provide some cushion for consumers. This might show up as more savings, as opposed to other consumption, but rebuilding savings is probably a necessary step towards rebuilding household balance sheets.

Data sources: PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product line 117. Oil prices from EIA U.S. Spot Prices.

The second graph (repeated from earlier in the week) compares real oil prices (data from the St. Louis Fed, adjusted with CPI) and real investment in petroleum exploration and wells in the U.S. (data from the BEA).

This doesn't include investment in alternative energy sources.

Not surprisingly there is a strong correlation between oil prices and investment. With oil prices now in the $33 per barrel range, this suggests that domestic investment could fall under $20 billion per year or so. This is another area of non-residential investment that will probably see a significant decline in 2009.

Not surprisingly there is a strong correlation between oil prices and investment. With oil prices now in the $33 per barrel range, this suggests that domestic investment could fall under $20 billion per year or so. This is another area of non-residential investment that will probably see a significant decline in 2009.

T2 Partners: "Why There Is More Pain to Come"

by Calculated Risk on 12/19/2008 01:25:00 PM

There is a lot of great data in this report, but be careful how you use it.

From T2 Partners: An Overview of the Housing/Credit Crisis And Why There Is More Pain to Come (hat tip Chad) Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is an example of great data, but it could be very misleading. The total for household mortgages (including 2nds and HELOCs) is $10.57 trillion according the the Fed's Q3 Flow of Funds report.

If you start adding up the household mortgages on this chart ($0.7 trillion for subprime, $1.0 trillion for Alt-A, $2.1 trillion for HELOCs, $2.4 trillion for Jumbos, $4.6 trillion for Agency MBS, and $4.7 trillion for Prime) you discover that there is some significant double counting (most Agency MBS is Prime - so that is a huge source of the double counting).

There are similar problems elsewhere in the report, but overall the information is great.

Q3 2008: Mortgage Equity Extraction Strongly Negative

by Calculated Risk on 12/19/2008 10:55:00 AM

Here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction for Q3 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q3 2008, Dr. Kennedy has calculated Net Equity Extraction as minus $64.1 billion, or negative 2.4% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.  Dr. Kennedy provides several other measures of equity extraction. The second graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

Dr. Kennedy provides several other measures of equity extraction. The second graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

This measure is also slightly negative.

The Fed's Flow of Funds report shows the amount of mortgages outstanding is declining, and this is partially because of debt cancellation per foreclosure sales, and partially due to homeowners paying down their mortgages (as opposed to borrowing more). Note: most homeowners pay down their principal a little each month (unless they have an IO or Neg AM loan), so with no new borrowing, equity extraction would always be negative.

But this suggests that the Home ATM is closed, and MEW is no longer supporting consumption.

The Auto Bailout

by Calculated Risk on 12/19/2008 10:43:00 AM

From the WSJ: Auto Makers to Get $17.4 Billion

The White House announced a $17.4 billion rescue package for the troubled Detroit auto makers that allows them to avoid bankruptcy and leaves many of the big decisions for the incoming Obama administration.

...

The deal would extend $13.4 billion in loans to General Motors Corp. and Chrysler LLC in December and January, with another $4 billion likely available in February.

...

The agreement designates a person to oversee the government's effort, although officials stopped short of referring to that as a "car czar." For the outgoing Bush administration, that person will be Treasury Secretary Henry Paulson.

Thursday, December 18, 2008

GM and Chrylser Bailout Plan might be announced Friday

by Calculated Risk on 12/18/2008 09:08:00 PM

From Bloomberg: GM, Chrysler Said to Be Poised for U.S. Loans to Get Into March

General Motors Corp. and Chrysler LLC would get U.S. loans to stay afloat until March under a Bush administration rescue plan that may be unveiled as soon as today ...We are all banks now!

The Treasury Department may lend to the automakers through their credit arms, GMAC LLC and Chrysler Financial, to avoid having other industrial companies line up for access to the $700 billion Troubled Asset Relief Program ...

Federal Reserve Assets

by Calculated Risk on 12/18/2008 08:07:00 PM

Here is another look at the Fed's balance sheet (released today). As a reminder, Dallas Fed President Richard Fisher commented in early November that he expected the Fed assets to grow to $3 trillion by the end of this year.

"I would not be surprised to see them aggregate to $3 trillion—roughly 20 percent of GDP—by the time we ring in the New Year."

Click on graph for larger image in new window.

The Federal Reserve assets increased to $2.312 trillion this week.

Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

Although the assets are still increasing, it looks like Fisher was overly pessimistic - $3 trillion by year end seems less likely now.