by Calculated Risk on 8/24/2014 11:33:00 AM

Sunday, August 24, 2014

The recovery in U.S. Heavy Truck Sales

Click on graph for larger image.

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is current estimated sales rate.

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009 on a seasonally adjusted annual rate (SAAR). Since then sales have more than doubled and hit 413 thousand (SAAR) in July 2014 (about the same is in April of this year) .

The level in April was the highest level since early 2007 (over 7 years ago). Sales are now above the average (and median) of the last 20 years - but still below the peaks - so I expect some more growth in sales.

Saturday, August 23, 2014

Schedule for Week of August 24th

by Calculated Risk on 8/23/2014 01:04:00 PM

The key reports this week are July New Home sales on Monday, the second estimate of Q2 GDP on Thursday, and Case-Shiller house prices on Tuesday.

For manufacturing, the August Dallas, Richmond and Kansas City Fed surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

10:00 AM: New Home Sales for July from the Census Bureau.

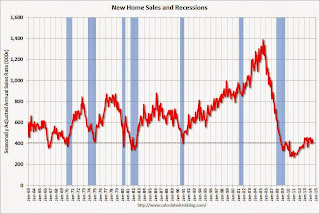

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the June sales rate.

The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in July from 406 thousand in June.

10:30 AM: Dallas Fed Manufacturing Survey for August.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 5.1% increase in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for June. Although this is the June report, it is really a 3 month average of April, May and June..

9:00 AM: S&P/Case-Shiller House Price Index for June. Although this is the June report, it is really a 3 month average of April, May and June.. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through the May 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 8.4% year-over-year increase in the Composite 20 index (NSA) for June. The Zillow forecast is for the Composite 20 to increase 8.1% year-over-year, and for prices to be unchanged month-to-month seasonally adjusted.

9:00 AM: FHFA House Price Index for June. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

10:00 AM: Conference Board's consumer confidence index for August. The consensus is for the index to decrease to 89.7 from 90.9.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 300 thousand from 298 thousand.

8:30 AM: Gross Domestic Product, 2nd quarter 2014 (second estimate). The consensus is that real GDP increased 4.0% annualized in Q2, unchanged from 4.0% in the advance estimate.

10:00 AM ET: Pending Home Sales Index for July. The consensus is for a 0.5% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for August. This is the last of the Fed regional surveys for August.

8:30 AM: Personal Income and Outlays for July. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for August. The consensus is for an increase to 56.0, up from 52.6 in July.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for August). The consensus is for a reading of 80.3, up from the preliminary reading of 79.2, and down from the July reading of 82.5.

Unofficial Problem Bank list declines to 445 Institutions

by Calculated Risk on 8/23/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 22, 2014.

Changes and comments from surferdude808:

Quiet week as expected that is front of the FDIC providing an update on its enforcement action activity. This week there were two removals that lower the Unofficial Problem Bank List count to 445 with assets of $141.0 billion. We updated assets figures for q2 financials, so $833 million of the $1.0 billion decline in assets comes from the latest figures. A year ago, the list held 714 institutions with assets of $253.1 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 445.

Two banks found their way off the list through merger with a healthier institution. First Bank of Miami, Coral Gables, FL ($193 million) merged with the Apollo Bank, Miami, FL. Flint River National Bank, Camilla, GA ($19 million) merged with Five Star Credit Union, Dothan, AL, with this being an infrequent type of merger with a credit union as the survivor.

Next week, we expect the FDIC to provide an update on its enforcement action activity on Friday and release q2 industry results including the official problem bank list numbers maybe earlier in the week.

Friday, August 22, 2014

ECB's Draghi: Unemployment in the euro area

by Calculated Risk on 8/22/2014 03:06:00 PM

From ECB President Mario Draghi at Jackson Hole: Unemployment in the euro area

No one in society remains untouched by a situation of high unemployment. For the unemployed themselves, it is often a tragedy which has lasting effects on their lifetime income. For those in work, it raises job insecurity and undermines social cohesion. For governments, it weighs on public finances and harms election prospects. And unemployment is at the heart of the macro dynamics that shape short- and medium-term inflation, meaning it also affects central banks. Indeed, even when there are no risks to price stability, but unemployment is high and social cohesion at threat, pressure on the central bank to respond invariably increases.On Fiscal Policy:

1. The causes of unemployment in the euro area

The key issue, however, is how much we can really sustainably affect unemployment, which in turn is a question – as has been much discussed at this conference – of whether the drivers are predominantly cyclical or structural. As we are an 18 country monetary union this is necessarily a complex question in the euro area, but let me nonetheless give a brief overview of how the ECB currently assesses the situation.

Figure 1: Change in the unemployment rate since 2008 – the euro area and the US

The long recession in the euro area

The first point to make is that the euro area has suffered a large and particularly sustained negative shock to GDP, with serious consequences for employment. This is visible in Figure 1, which shows the evolution of unemployment in the euro area and the US since 2008. Whereas the US experienced a sharp and immediate rise in unemployment in the aftermath of the Great Recession, the euro area has endured two rises in unemployment associated with two sequential recessions.

From the start of 2008 to early 2011 the picture in both regions is similar: unemployment rates increase steeply, level off and then begin to gradually fall. This reflects the common sources of the shock: the synchronisation of the financial cycle across advanced economies, the contraction in global trade following the Lehman failure, coupled with a strong correction of asset prices – notably houses – in certain jurisdictions.

From 2011 onwards, however, developments in the two regions diverge. Unemployment in the US continues to fall at more or less the same rate. In the euro area, on the other hand, it begins a second rise that does not peak until April 2013. This divergence reflects a second, euro area-specific shock emanating from the sovereign debt crisis, which resulted in a six quarter recession for the euro area economy. Unlike the post-Lehman shock, however, which affected all euro area economies, virtually all of the job losses observed in this second period were concentrated in countries that were adversely affected by government bond market tensions.

Turning to fiscal policy, since 2010 the euro area has suffered from fiscal policy being less available and effective, especially compared with other large advanced economies. This is not so much a consequence of high initial debt ratios – public debt is in aggregate not higher in the euro area than in the US or Japan. It reflects the fact that the central bank in those countries could act and has acted as a backstop for government funding. This is an important reason why markets spared their fiscal authorities the loss of confidence that constrained many euro area governments’ market access. This has in turn allowed fiscal consolidation in the US and Japan to be more backloaded.Conclusion:

Thus, it would be helpful for the overall stance of policy if fiscal policy could play a greater role alongside monetary policy, and I believe there is scope for this, while taking into account our specific initial conditions and legal constraints. These initial conditions include levels of government expenditure and taxation in the euro area that are, in relation to GDP, already among the highest in the world. And we are operating within a set of fiscal rules – the Stability and Growth Pact – which acts as an anchor for confidence and that would be self-defeating to break.

Unemployment in the euro area is a complex phenomenon, but the solution is not overly complicated to understand. A coherent strategy to reduce unemployment has to involve both demand and supply side policies, at both the euro area and the national levels. And only if the strategy is truly coherent can it be successful.Draghi is pleading for help from fiscal policymakers (Bernanke also pleaded with Congress in US for fiscal help - to no avail - but as the graph shows, the situation is even worse in Europe).

Without higher aggregate demand, we risk higher structural unemployment, and governments that introduce structural reforms could end up running just to stand still. But without determined structural reforms, aggregate demand measures will quickly run out of steam and may ultimately become less effective. The way back to higher employment, in other words, is a policy mix that combines monetary, fiscal and structural measures at the union level and at the national level. This will allow each member of our union to achieve a sustainably high level of employment.

We should not forget that the stakes for our monetary union are high. It is not unusual to have regional disparities in unemployment within countries, but the euro area is not a formal political union and hence does not have permanent mechanisms to share risk, namely through fiscal transfers. [19] Cross-country migration flows are relatively small and are unlikely to ever become a key driver of labour market adjustment after large shocks.

Thus, the long-term cohesion of the euro area depends on each country in the union achieving a sustainably high level of employment. And given the very high costs if the cohesion of the union is threatened, all countries should have an interest in achieving this.

ATA Trucking Index increased 1.3% in July

by Calculated Risk on 8/22/2014 02:01:00 PM

Here is a minor indicator that I follow, from ATA: ATA Truck Tonnage Index Increased 1.3% in July

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index rose 1.3% in July, following a decrease of 0.8% the previous month. In July, the index equaled 130.2 (2000=100) versus 128.6 in June. The index is off just 0.6% from the all-time high in November 2013 (131.0).

Compared with July 2013, the SA index increased 3.6%, up from June’s 2.3% year-over-year gain. The latest year-over-year increase was the largest in three months. ...

“After a surprising decrease in June, tonnage really snapped back in July,” said ATA Chief Economist Bob Costello. “This gain fits more with the anecdotal reports we are hearing from motor carriers that freight volumes are good.”

Costello added that tonnage is up 4.9% since hitting a recent low in January.

“The solid tonnage number in July fits with the strong factory output reading and a jump in housing starts for the same month,” he said. “I continue to expect moderate, but good, tonnage growth for the rest of the year.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 3.6% year-over-year.

DOT: Vehicle Miles Driven increased 0.9% year-over-year in May

by Calculated Risk on 8/22/2014 12:22:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by +0.9 (2.4 billion vehicle miles) for May 2014 as compared with May 2013. Travel for the month is estimated to be 264.2 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2014 changed by +0.2 (2.9 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways ...

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 78 months - 6 1/2 years - and still counting. Currently miles driven (rolling 12 months) are about 2.2% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In May 2014, gasoline averaged of $3.75 per gallon according to the EIA. That was up from May 2013 when prices averaged $3.67 per gallon.

In May 2014, gasoline averaged of $3.75 per gallon according to the EIA. That was up from May 2013 when prices averaged $3.67 per gallon. Of course gasoline prices are just part of the story. The lack of growth in miles driven over the last 6+ years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven - but it does seem like miles driven is now increasing slowly.

Fed Chair Yellen: Unemployment Rate "somewhat overstates" Improvement in Labor Market

by Calculated Risk on 8/22/2014 10:00:00 AM

From Fed Chair Janet Yellen at Jackson Hole Economic Symposium: Labor Market Dynamics and Monetary Policy. Excerpts:

One convenient way to summarize the information contained in a large number of indicators is through the use of so-called factor models. Following this methodology, Federal Reserve Board staff developed a labor market conditions index from 19 labor market indicators, including four I just discussed. This broadly based metric supports the conclusion that the labor market has improved significantly over the past year, but it also suggests that the decline in the unemployment rate over this period somewhat overstates the improvement in overall labor market conditions.More excerpts:

emphasis added

[W]ith the economy getting closer to our objectives, the FOMC's emphasis is naturally shifting to questions about the degree of remaining slack, how quickly that slack is likely to be taken up, and thereby to the question of under what conditions we should begin dialing back our extraordinary accommodation. As should be evident from my remarks so far, I believe that our assessments of the degree of slack must be based on a wide range of variables and will require difficult judgments about the cyclical and structural influences in the labor market. While these assessments have always been imprecise and subject to revision, the task has become especially challenging in the aftermath of the Great Recession, which brought nearly unprecedented cyclical dislocations and may have been associated with similarly unprecedented structural changes in the labor market--changes that have yet to be fully understood.

So, what is a monetary policymaker to do? Some have argued that, in light of the uncertainties associated with estimating labor market slack, policymakers should focus mainly on inflation developments in determining appropriate policy. To take an extreme case, if labor market slack was the dominant and predictable driver of inflation, we could largely ignore labor market indicators and look instead at the behavior of inflation to determine the extent of slack in the labor market. In present circumstances, with inflation still running below the FOMC's 2 percent objective, such an approach would suggest that we could maintain policy accommodation until inflation is clearly moving back toward 2 percent, at which point we could also be confident that slack had diminished.

Of course, our task is not nearly so straightforward. Historically, slack has accounted for only a small portion of the fluctuations in inflation. Indeed, unusual aspects of the current recovery may have shifted the lead-lag relationship between a tightening labor market and rising inflation pressures in either direction. For example, as I discussed earlier, if downward nominal wage rigidities created a stock of pent-up wage deflation during the economic downturn, observed wage and price pressures associated with a given amount of slack or pace of reduction in slack might be unusually low for a time. If so, the first clear signs of inflation pressure could come later than usual in the progression toward maximum employment. As a result, maintaining a high degree of monetary policy accommodation until inflation pressures emerge could, in this case, unduly delay the removal of accommodation, necessitating an abrupt and potentially disruptive tightening of policy later on.

Conversely, profound dislocations in the labor market in recent years--such as depressed participation associated with worker discouragement and a still-substantial level of long-term unemployment--may cause inflation pressures to arise earlier than usual as the degree of slack in the labor market declines. However, some of the resulting wage and price pressures could subsequently ease as higher real wages draw workers back into the labor force and lower long-term unemployment. As a consequence, tightening monetary policy as soon as inflation moves back toward 2 percent might, in this case, prevent labor markets from recovering fully and so would not be consistent with the dual mandate.

Thursday, August 21, 2014

Lawler: Fannie Survey on How Lenders “Adapt” to ATR/QM

by Calculated Risk on 8/21/2014 07:59:00 PM

From housing economist Tom Lawler:

The Fannie Mae Economic & Strategic Research Group released the results of a recent survey of senior mortgage executives designed to see how mortgage lenders had and/or would “adapt” to the new Ability-To-Repay (ATR) and Qualified Mortgage (QM) standards that become effective January 10, 2014. A total of 201 executives representing 186 institutions completed the survey between May 28 – June 8,2014.

Here are the results for a subset of the questions.

| Impact of ATR/QM Rules (% of Respondents) | |||

|---|---|---|---|

| Ease | Basically Unchanged | Tighten | |

| Credit Standards | 6% | 58% | 36% |

| Increase | Remain About the Same | Decrease | |

| Operational Costs | 74% | 19% | 7% |

| Strategy on Non-QM Mortgage Loans | |||

| Actively Pursue | Wait and See | Do NOT Plan to Pursue | |

| Non-QM Loans | 19% | 46% | 34% |

A presentation on the survey results is available at Impact of Qualified Mortgage Rules and Quality Control Review

A Few Comments on Existing Home Sales

by Calculated Risk on 8/21/2014 03:31:00 PM

The most important number in the NAR report each month is inventory. This morning the NAR reported that inventory was up 5.8% year-over-year in July. It is important to note that the NAR inventory data is "noisy" and difficult to forecast based on other data.

The headline NAR inventory number is not seasonally adjusted, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko has sent me the seasonally adjusted inventory. NOTE: The NAR does provide a seasonally adjusted months-of-supply, although that is in the supplemental data.

This shows that inventory bottomed in January 2013 (on a seasonally adjusted basis), and inventory is now up about 10.7% from the bottom. On a seasonally adjusted basis, inventory was only up 0.2% in July compared to June.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, many "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were down 4.3% from July 2013, but normal equity sales were probably up from July 2013, and distressed sales down sharply. The NAR reported that 9% of sales were distressed in July (from a survey that is far from perfect):

Distressed homes – foreclosures and short sales – accounted for 9 percent of July sales, down from 15 percent a year ago and the first time they were in the single-digits since NAR started tracking the category in October 2008. Six percent of July sales were foreclosures and 3 percent were short sales.Last year in July the NAR reported that 15% of sales were distressed sales.

A rough estimate: Sales in July 2013 were reported at 5.38 million SAAR with 15% distressed. That gives 807 thousand distressed (annual rate), and 4.57 million equity / non-distressed. In July 2014, sales were 5.15 million SAAR, with 9% distressed. That gives 464 thousand distressed - a decline of over 40% from July 2013 - and 4.69 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up slightly (even with less investor buying).

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in July (red column) were below the level of sales in July 2013, and above sales for 2008 through 2012.

Overall this was a solid report.

Earlier:

• Existing Home Sales in July: 5.15 million SAAR, Inventory up 5.8% Year-over-year

Philly Fed Manufacturing Survey increases to 28 in August, Highest since March 2011

by Calculated Risk on 8/21/2014 12:45:00 PM

Earlier from the Philly Fed: August Manufacturing Survey

The diffusion index of current general activity increased from a reading of 23.9 in July to 28.0 this month. The index has increased for three consecutive months and is at its highest reading since March 2011 The new orders and shipments indexes remained positive but fell to near their levels in June. The new orders index decreased 20 points [to 14.7], while the shipments index decreased 18 points.This was above the consensus forecast of a reading of 15.5 for July.

...

The current indicators for labor market conditions suggested continued modest expansion in employment. The employment index remained positive for the 14th consecutive month but declined 3 points from its reading in July [to 9.1] ...

Most of the survey’s broad indicators of future growth showed improvement this month. The future general activity index increased 8 points and is at its highest reading since June 1992 emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through August. The ISM and total Fed surveys are through July.

The average of the Empire State and Philly Fed surveys was solid in August, and this suggests another strong ISM report for August.