by Calculated Risk on 7/24/2019 07:41:00 PM

Wednesday, July 24, 2019

Thursday: Unemployment Claims, Durable Goods, Q2 Homeownership, Kansas City Fed Mfg

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, down from 216 thousand last week.

• Also at 8:30 AM, Durable Goods Orders for June from the Census Bureau. The consensus is for a 0.7% increase in durable goods orders.

• At 10:00 AM, The Q2 2019 Housing Vacancies and Homeownership report from the Census Bureau.

• At 11:00 AM, the Kansas City Fed manufacturing survey for July. This is the last of regional manufacturing surveys for June.

New Home Sales and Recessions

by Calculated Risk on 7/24/2019 04:37:00 PM

I've been asked to update the second graph in this post: Housing and Recessions

As I noted in earlier posts, when the YoY change in New Home Sales falls about 20%, a recession will usually follow. The one exception for this data series was the mid '60s when the Vietnam buildup kept the economy out of recession. Note that the sharp decline in 2010 was related to the housing tax credit policy in 2009 - and was just a continuation of the housing bust.

This graph shows the YoY change in New Home Sales from the Census Bureau.

Note: the New Home Sales data is smoothed using a three month centered average before calculating the YoY change. The Census Bureau data starts in 1963.

It is interesting to look at the '86/'87 and the mid '90s periods. New Home sales fell in both of these periods, although not quite 20%. As I noted in earlier posts, the mid '80s saw a surge in defense spending and MEW that more than offset the decline in New Home sales. In the mid '90s, nonresidential investment remained strong.

Although new home sales were down towards the end of 2018, the decline wasn't that large historically. As I noted last Fall, I wasn't even on recession watch. Now new home sales are up slightly year-over-year, and 2019 will probably have the most sales since 2007. No worries.

Philly Fed: State Coincident Indexes increased in 46 states in June

by Calculated Risk on 7/24/2019 12:56:00 PM

From the Philly Fed:

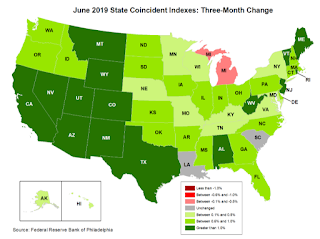

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for June 2019. Over the past three months, the indexes increased in 47 states, decreased in one state, and remained stable in two, for a three-month diffusion index of 92. In the past month, the indexes increased in 46 states, decreased in one state, and remained stable in three, for a one-month diffusion index of 90.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some grey and red states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

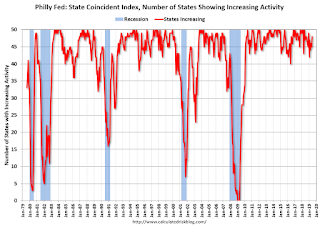

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In June, 48 states had increasing activity (including minor increases).

A few Comments on June New Home Sales

by Calculated Risk on 7/24/2019 10:47:00 AM

New home sales for June were reported at 646,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised down.

This was the highest sales for June since June 2007, and annual sales in 2019 should be the best year for new home sales since 2007.

Earlier: New Home Sales increased to 646,000 Annual Rate in June.

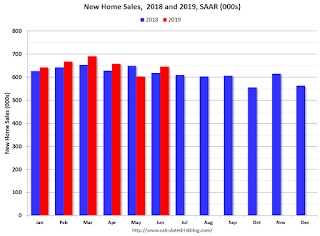

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).

Sales in June were up 4.5% year-over-year compared to June 2018.

Year-to-date (through June), sales are up 2.2% compared to the same period in 2018.

This comparison was the most difficult in the first half of 2018, so this is a solid first half for 2019.

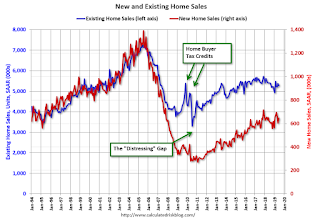

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

Even though distressed sales are down significantly, following the bust, new home builders focused on more expensive homes - so the gap has only closed slowly.

I still expect this gap to close. However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 646,000 Annual Rate in June

by Calculated Risk on 7/24/2019 10:14:00 AM

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 646 thousand.

The previous three months were revised down.

"Sales of new single‐family houses in June 2019 were at a seasonally adjusted annual rate of 646,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.0 percent above the revised May rate of 604,000 and is 4.5 percent above the June 2018 estimate of 618,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in June to 6.3 months from 6.7 months in May.

The months of supply decreased in June to 6.3 months from 6.7 months in May. The all time record was 12.1 months of supply in January 2009.

This is near the top of the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of June was 338,000. This represents a supply of 6.3 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is close to normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In June 2019 (red column), 57 thousand new homes were sold (NSA). Last year, 56 thousand homes were sold in June.

The all time high for June was 115 thousand in 2005, and the all time low for June was 28 thousand in 2010 and in 2011.

This was below expectations of 655 thousand sales SAAR, and sales in the three previous months were revised down. I'll have more later today.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 7/24/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 19, 2019.

... The Refinance Index decreased 2 percent from the previous week and was 81 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 6 percent higher than the same week one year ago.

...

“Mortgage applications were down last week, even as rates moved lower across the board, with the 30-year fixed rate at 4.08 percent. Refinance activity was lower, but we did see government refinance applications increase, driven solely by a 12 percent rise in FHA applications,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Mortgage rates right now are comparable to the average rate of 4.10 percent for June, but refinances last week were 7 percent lower than last month. This is an indication that as we see rates lower for longer, borrowers need more of a drop in rates to consider refinancing.”

Added Kan, “Purchase applications decreased for the second straight week and have been somewhat volatile lately, but were still 6 percent higher than a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.08 percent from 4.12 percent, with points decreasing to 0.33 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to around 4% now.

Just about anyone who bought or refinanced over the last year or so can refinance now. But it would take another significant decline in rates for a further large increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 6% year-over-year.

Tuesday, July 23, 2019

Wednesday: New Home Sales

by Calculated Risk on 7/23/2019 07:38:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for June from the Census Bureau. The consensus is for 655 thousand SAAR, up from 626 thousand in May.

"Chemical Activity Barometer Fell in July"

by Calculated Risk on 7/23/2019 04:55:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Fell in July

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), eased 0.2 percent in July on a three-month moving average (3MMA) basis following three months of gains in March-May and weak months in the winter. On a year-over-year (Y/Y) basis, the barometer fell 0.2 percent (3MMA).

...

A pattern of fluctuating barometer readings – months up followed by months down – indicates late-cycle activity,” said Kevin Swift, chief economist at ACC. “The CAB reading continues to signal moderate gains in U.S. commercial and industrial activity through late 2019, but rising volatility suggests change may be on the way.”

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB suggests that the YoY increase in industrial production will probably slow further.

Richmond Fed: "Fifth District Manufacturing Activity Weakened in July"

by Calculated Risk on 7/23/2019 01:47:00 PM

Earlier from the Richmond Fed: Fifth District Manufacturing Activity Weakened in July

Fifth District manufacturing activity weakened in July, according to the most recent survey from the Richmond Fed. The composite index fell from 2 in June to −12 in July, its lowest reading since January 2013, as all three components — shipments, new orders, and employment — registered declines. Backlogs of orders also fell, reaching a value of −26, its lowest reading since April 2009. Firms reported worsening local business conditions, as this index dropped from 7 to −18, its largest one-month drop on record. However, respondents were optimistic that conditions would improve in the coming months.This was a very weak report.

Survey results indicated that employment and the average workweek declined in July. However, wage growth continued among survey respondents. Firms continued to struggle to find workers with the necessary skills and expect that struggle to continue in the next six months.

emphasis added

Comments on June Existing Home Sales

by Calculated Risk on 7/23/2019 10:29:00 AM

Earlier: NAR: Existing-Home Sales Decreased to 5.27 million in June

A few key points:

1) The key for housing - and the overall economy - is new home sales, single family housing starts and overall residential investment.

Overall, this is still a somewhat reasonable level for existing home sales. No worries.

2) Inventory is still low, and was unchanged year-over-year (YoY) in June. Inventory had been up YoY every month since July 2018.

3) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in June. The consensus was for sales of 5.34 million SAAR. Lawler estimated the NAR would report 5.25 million SAAR in June, and the NAR actually reported 5.27 million SAAR.

4) Year-to-date sales are down about 4.2% compared to the same period in 2018. On an annual basis, that would put sales around 5.15 million in 2019. Sales slumped at the end of 2018 and in January 2019 due to higher mortgage rates, the stock market selloff, and fears of an economic slowdown.

The comparisons will be easier towards the end of the year.

Sales NSA in June (527,000, red column) were well below sales in June 2018 (570,000, NSA), and were the lowest sales for June since 2014.