by Calculated Risk on 1/06/2021 12:32:00 PM

Wednesday, January 06, 2021

U.S. Heavy Truck Sales down 5% Year-over-year in December

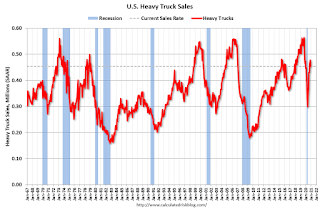

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the December 2020 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all time high of 575 thousand SAAR in September 2019.

However heavy truck sales started declining in late 2019 due to lower oil prices.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Click on graph for larger image.

Heavy truck sales really declined towards the end of March due to COVID-19 and the collapse in oil prices, but have since rebounded.

Heavy truck sales were at 454 thousand SAAR in December, down from 477 thousand SAAR in November, and down 5% from 475 thousand SAAR in December 2019.

For the year, heavy truck sales were 409 thousand, down 22.3% from 527 thousand in 2019. This was the fewest heavy truck sales since 2016.

December Vehicles Sales increased to 16.27 Million SAAR; Annual Sales off 14.7%

by Calculated Risk on 1/06/2021 09:51:00 AM

The BEA released their estimate of light vehicle sales for December this morning. The BEA estimates sales of 16.27 million SAAR in December 2020 (Seasonally Adjusted Annual Rate), up 4.1% from the November sales rate, and down 3.2% from December 2019.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and the BEA's estimate for December (red).

The impact of COVID-19 was significant, and April was the worst month.

Since April, sales have increased, but are still down year-over-year,

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate of 16.27 million SAAR.

Note: dashed line is current estimated sales rate of 16.27 million SAAR.Annual sales in 2020, at 14.46 million, were down 14.7% from 16.95 million in 2019.

Las Vegas Real Estate in December: Sales up 27% YoY, Inventory down 38% YoY

by Calculated Risk on 1/06/2021 09:31:00 AM

This report is for closed sales in December; sales are counted at the close of escrow, so the contracts for these homes were mostly signed in October and November.

The Las Vegas Realtors reported Southern Nevada home prices end the year in record territory; LVR housing statistics for December 2020

LVR reported a total of 4,097 existing local homes, condos and townhomes were sold during December. Compared to the same time last year, December sales were up 26.7% for homes and up 30.9% for condos and townhomes.1) Overall sales were up 27.4% year-over-year to 4,097 in December 2020 from 3,214 in December 2019.

According to LVR, the total number of existing local homes, condos, townhomes and other residential properties sold in Southern Nevada during 2020 was 41,617. That’s up from 41,269 total sales in 2019. By comparison, LVR reported 42,876 total sales in 2018 and 45,388 in 2017.

“I think we surprised a lot of people with how the local housing market not only held up, but set records, during an otherwise rough year for our community and our local economy,” said 2021 LVR President Aldo Martinez. “I don’t see much changing in the early part of 2021. Demand for housing remains high. Our housing supply and mortgage interest rates are still very low. As long as these trends continue, it’s a good bet that local home prices will keep rising.”

By the end of December, LVR reported 3,240 single-family homes listed for sale without any sort of offer. That’s down 41.5% from one year ago. For condos and townhomes, the 1,153 properties listed without offers in December represent a 25.9% drop from one year ago.

…

Despite the coronavirus crisis and economic downturn, the number of so-called distressed sales remains near historically low levels. LVR reported that short sales and foreclosures combined accounted for just 0.9% of all existing local property sales in December. That compares to 1.8% of all sales one year ago, 2.9% two years ago and 3.6% three years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 7,093 in 2019 to 4,393 in December 2020. Note: Total inventory was down 38.1% year-over-year. And months of inventory is low.

3) Low level of distressed sales.

ADP: Private Employment decreased 123,000 in December

by Calculated Risk on 1/06/2021 08:20:00 AM

Private sector employment decreased by 123,000 jobs from November to December according to the December ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.The BLS report will be released Friday, and the consensus is for 100 thousand non-farm payroll jobs added in December. Of course the ADP report has not been very useful in predicting the BLS report.

“As the impact of the pandemic on the labor market intensifies, December posted the first decline since April 2020,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The job losses were primarilly concentrated in retail and leisure and hospitality.”

emphasis added

MBA: Mortgage Applications Decrease "Over a Two-Week Period" in Latest Weekly Survey

by Calculated Risk on 1/06/2021 07:00:00 AM

From the MBA: Mortgage Applications Decreased Over a Two-Week Period in Latest

MBA Weekly Survey

Mortgage applications decreased 4.2 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 1, 2021. The results include adjustments to account for the holidays.

... The holiday adjusted Refinance Index decreased 6 percent from two weeks ago. The unadjusted Refinance Index was 34 percent lower than two weeks ago and was 100 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 0.8 percent from two weeks ago. The unadjusted Purchase Index decreased 30 percent compared with two weeks earlier and was 3 percent higher than the same week one year ago.

“Mortgage rates started 2021 close to record lows, most notably with the 30-year fixed rate at 2.86 percent, and the 15-year fixed rate at a survey low of 2.40 percent. The record-low rates for fixed-rate mortgages is good news for borrowers looking to refinance or buy a home, as around 98 percent of all applications are for fixed-rate loans,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite these low rates, overall application activity fell sharply during the holiday period – which is typical every year. Refinance applications were 6 percent lower than two weeks ago, and purchase activity less than 1 percent from its pre-holiday level.”

Added Kan, “The steady demand for home buying throughout most of 2020 should continue in 2021. MBA’s is forecasting for purchase originations to rise to $1.59 trillion this year – an all-time high.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 2.86 percent from 2.90 percent, with points increasing to 0.35 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 3% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, January 05, 2021

Wednesday: ADP Employment

by Calculated Risk on 1/05/2021 09:15:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for December. This report is for private payrolls only (no government). The report showed 307,000 jobs added in November.

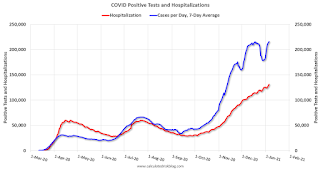

January 5 COVID-19 Test Results; Record Hospitalizations, Record 7-Day Cases

by Calculated Risk on 1/05/2021 06:54:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,620,506 test results reported over the last 24 hours.

There were 214,378 positive tests.

Over 11,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 13.2% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record Hospitalizations

• Record 7-Day Cases

MBA Survey: "Share of Mortgage Loans in Forbearance Remains Flat at 5.53%"

by Calculated Risk on 1/05/2021 04:22:00 PM

Note: This is as of December 27th.

From the MBA: Share of Mortgage Loans in Forbearance Remains Flat at 5.53%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance remained unchanged relative to the prior week at 5.53% as of December 27, 2020. According to MBA’s estimate, 2.7 million homeowners are in forbearance plans.

...

The share of loans in forbearance remained relatively unchanged in the final two weeks of 2020, maintaining the trend of hovering around 5.5 percent for the last two months. However, the share for Ginnie Mae loans continues to inch up and is now at its highest level since the week of November 1st,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Forbearance requests and exits both slowed markedly, and servicer call volume dropped sharply over the holidays.”

Fratantoni continued, “While the increasing number of COVID-19 cases continues to slow economic activity, the passed stimulus legislation should provide financial support for many households as the vaccine rollout commences.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has generally been trending down.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week from 0.10% to 0.06%, the lowest level since the week ending March 15."

Housing Inventory: Zillow vs. NAR

by Calculated Risk on 1/05/2021 12:28:00 PM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Yesterday I posted an inventory graph courtesy of Altos Research.

Here is a graph comparing weekly inventory from Zillow Research with monthly inventory from the NAR.

Housing inventory is at record lows, and inventory is something I will be watching closely this year.

ISM Manufacturing index Increased to 60.7 in December

by Calculated Risk on 1/05/2021 10:29:00 AM

The ISM manufacturing index indicated expansion in December. The PMI was at 60.7% in December, up from 57.5% in November. The employment index was at 51.5%, up from 48.4% last month, and the new orders index was at 67.9%, up from 65.1%.

From ISM: Manufacturing PMI® at 60.7%; December 2020 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in December, with the overall economy notching an eighth consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This was above expectations.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

"The December Manufacturing PMI® registered 60.7 percent, up 3.2 percentage points from the November reading of 57.5 percent. This figure indicates expansion in the overall economy for the eighth month in a row after contracting in March, April, and May, which ended a period of 131 consecutive months of growth. The New Orders Index registered 67.9 percent, up 2.8 percentage points from the November reading of 65.1 percent. The Production Index registered 64.8 percent, an increase of 4 percentage points compared to the November reading of 60.8 percent. The Backlog of Orders Index registered 59.1 percent, 2.2 percentage points higher compared to the November reading of 56.9 percent. The Employment Index returned to expansion territory at 51.5 percent, 3.1 percentage points higher from the November reading of 48.4 percent. The Supplier Deliveries Index registered 67.6 percent, up 5.9 percentage points from the November figure of 61.7 percent. The Inventories Index registered 51.6 percent, 0.4 percentage point higher than the November reading of 51.2 percent. The Prices Index registered 77.6 percent, up 12.2 percentage points compared to the November reading of 65.4 percent. The New Export Orders Index registered 57.5 percent, a decrease of 0.3 percentage point compared to the November reading of 57.8 percent. The Imports Index registered 54.6 percent, a 0.5-percentage point decrease from the November reading of 55.1 percent."

emphasis added

This suggests manufacturing expanded at a faster pace in December than in November.