by Calculated Risk on 3/20/2021 04:16:00 PM

Saturday, March 20, 2021

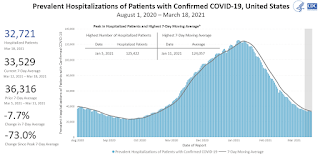

March 20 COVID-19 Test Results and Vaccinations

According to the CDC, 121.4 million doses have been administered. 16.7% of the population over 18 is fully vaccinated, and 30.7% of the population over 18 has had at least one dose.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Housing: Active Inventory down around 50% YoY

by Calculated Risk on 3/20/2021 01:24:00 PM

Yesterday I posted Some thoughts on Housing Inventory. I noted:

"It is likely the NAR [National Association of Realtors®] is overstating inventory since many MLSs include pending in the number of listings (as opposed to just active listings)."Housing economist Tom Lawler sent me the following graph.

This shows the YoY change in inventory for Realtor.com (with and without pending sales), and the YoY change in inventory from the NAR.

Click on graph for larger image.

Click on graph for larger image.This shows that the NAR report is similar to Realtor.com including pending sales.

Las Vegas Visitor Authority: No Convention Attendance, Visitor Traffic Down 64% YoY in January

by Calculated Risk on 3/20/2021 10:03:00 AM

From the Las Vegas Visitor Authority: January 2021 Las Vegas Visitor Statistics

Continued COVID impacts and the resulting absence of conventions and major tradeshows such as CES, World of Concrete, etc., translated to significant YoY declines in Jan visitation, occupancy and ADR. Las Vegas hosted roughly 1.3M visitors in Jan 2021, down -63.5% YoY.

Total occupancy for Jan improved MoM to 31.6% from 30.9% in Dec but was down from 85.9% in Jan 2020. While Weekend occupancy (48.3%) improved slightly MoM over Dec 2020, the temporarily dormant convention segment resulted in Midweek occupancy at 22.5%, down -61.3 pts YoY.

Average daily rates among open properties reached $90.71 (down -40.9% YoY) while RevPAR came in at approx. $28.66, down -78% vs. Jan 2020.

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (blue), 2020 (orange) and 2021 (red).

Visitor traffic was down 63.5% year-over-year.

The casinos started to reopen on June 4th (it appears about 97% of rooms have now opened).

Convention traffic was non-existent again in January, and was down 100% compared to January 2020.

Schedule for Week of March 21, 2021

by Calculated Risk on 3/20/2021 08:11:00 AM

The key reports this week are the third estimate of Q4 GDP, February New and Existing Home Sales, and February Personal Income and Outlays.

For manufacturing, the March Richmond and Kansas City manufacturing surveys will be released.

Also Fed Chair Powell testifies on the Coronavirus Aid, Relief, and Economic Security Act.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

9:00 AM: Discussion, Fed Chair Powell, How Can Central Banks Innovate in the Digital Age?, At the Bank for International Settlements Innovation Summit

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 6.50 million SAAR, down from 6.69 million.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 6.50 million SAAR, down from 6.69 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 6.29 million SAAR for February.

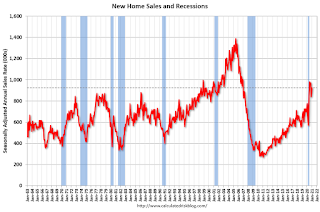

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 885 thousand SAAR, down from 923 thousand in January.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

12:00 PM: Testimony, Fed Chair Powell, Coronavirus Aid, Relief, and Economic Security Act, Before the Committee on Financial Services, U.S. House of Representatives

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.8% increase in durable goods orders.

10:00 AM: Testimony, Fed Chair Powell, Coronavirus Aid, Relief, and Economic Security Act, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 740 thousand from 770 thousand last week.

8:30 AM: Gross Domestic Product, 4th quarter 2020 (Third estimate). The consensus is that real GDP increased 4.1% annualized in Q4, the same as the second estimate of 4.1%.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 AM ET: Personal Income and Outlays, February. The consensus is for a 7.0% decrease in personal income, and for a 0.6% decrease in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 83.5.

10:00 AM: State Employment and Unemployment (Monthly), February 2021

Friday, March 19, 2021

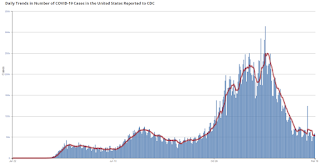

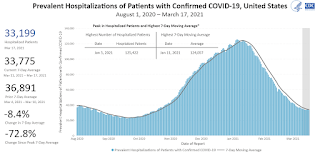

March 19 COVID-19 Test Results and Vaccinations

by Calculated Risk on 3/19/2021 08:06:00 PM

According to the CDC, 118.3 million doses have been administered. 16.2% of the population over 18 is fully vaccinated, and 29.8% of the population over 18 has had at least one dose.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

Some thoughts on Housing Inventory

by Calculated Risk on 3/19/2021 03:06:00 PM

Last December I wrote Some thoughts on Housing Inventory. We are seeing record low inventory almost everywhere, and here are some updates to that previous post.

The key for housing in 2021 will be inventory. If inventory stays extremely low, there will be more housing starts and a larger increase in house prices. However, if inventory increases significantly, there will be fewer starts and less price appreciation. So what will happen with inventory in 2021?

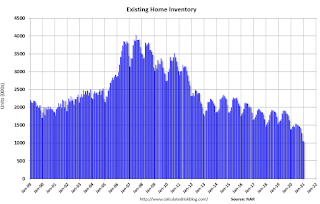

This graph, based on data from the National Association of Realtors® (NAR), shows nationwide inventory for existing homes.

According to the NAR, inventory was at 1.04 million in January. This was the lowest level on record for the month of January.

Inventory had steadily decreased following the housing bust, and seemed to mostly level out in 2017 through 2019. Then inventory really declined in 2020.

Prior to 2020, two of the key reasons inventory was low:

1) A large number of single family home and condos were converted to rental units. In 2015, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors. Most of these rental conversions were at the lower end, and that limited the supply for first time buyers.

2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80). The leading edge of the boomers are now turning 77 or so, and the boomers selling will probably gradually increase over the next 10 years.

In 2020, inventory really declined due to a combination of potential sellers keeping their properties off the market during a pandemic, and a pickup in buying due to record low mortgage rates, a move away from multi-family rentals and strong second home buying (to escape the high-density cities).

NOTE: This graph is updated using the Vintage 2019 estimates. IMPORTANT NOTE: Housing economist Tom Lawler has pointed out some issues with Census estimates, see: Lawler: The Dismal Demographics of 2020

See my post Demographics: Renting vs. Owning from a couple of weeks ago.

See my post Demographics: Renting vs. Owning from a couple of weeks ago.This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group peaked in 2018 / 2019 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak around 2023. This suggests demand for apartments will soften somewhat.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next decade.

Demographics are now positive for home buying, and this is a key reason I expected the increase in single family housing starts in 2020.

Note: Based on Lawler's work, I expect some downward revisions to the prime population following the 2020 Census (lower immigration, more prime age deaths). But the general story will remain the same.

First, making the assumption that the pandemic will be mostly over by mid-2021, we can make a few general predictions:

1. Potential sellers will be more willing to list their homes (and allow strangers into their homes).

2. The move away from dense cities will slow and maybe end. What makes cities attractive (jobs, cultural events and other entertainment), hasn't been available during the pandemic. That will change when the pandemic ends, and cities will be attractive again. Of course, the trends toward remote working, online shopping and home entertainment will likely continue, and this will allow some people to live anywhere.

Rhode Island Real Estate in February: Sales Up 4% YoY, Inventory Down 49% YoY

by Calculated Risk on 3/19/2021 02:36:00 PM

Note: I'm posting data for many local markets around the U.S. The story is the same everywhere ... inventory is at record lows.

For for the entire state Rhode Island:

Closed sales (single family and condos) in February 2021 were 776, up 4.2% from 745 in February 2020.

Active Listings (single family and condos) in February 2021 were 1,569, down 48.5% from 3,046 in February 2020.

Indiana Real Estate in February: Sales Up 6% YoY, Inventory Down 56% YoY

by Calculated Risk on 3/19/2021 01:35:00 PM

Note: I'm posting data for many local markets around the U.S. The story is the same everywhere ... inventory is at record lows.

For for the entire state Indiana:

Closed sales in February 2021 were 5,753, up 5.7% from 5,444 in February 2020.

Active Listings in February 2021 were 6,028, down 56.1% from 13,739 in February 2020.

Months of Supply was 0.7 Months in February 2021, compared to 1.8 Months in February 2020.

Q1 GDP Forecasts: Movin' on up!

by Calculated Risk on 3/19/2021 11:17:00 AM

Note that the forecasts of the automated systems (based on released data) are declining, whereas the forecasts of economists are increasing.

From Merrrill Lynch:

The net positive revisions to retail sales boosted our 1Q GDP tracking estimate up to 7.0% qoq saar from 5.5% previously. [Mar 19 estimate]From Goldman Sachs:

emphasis added

[W]e boosted our Q1 GDP tracking estimate by 1.5pp to +7.5% (qoq ar) and lowered our Q2 GDP growth forecast by the same amount (to +9.5%). [Mar 16 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 6.3% for 2021:Q1 and 1.2% for 2021:Q2. [Mar 19 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2021 is 5.7 percent on March 17, down from 5.9 percent on March 16. [Mar 17 estimate]

Alabama Real Estate in February: Sales Up 15% YoY, Inventory Down 44% YoY

by Calculated Risk on 3/19/2021 09:13:00 AM

Note: I'm posting data for many local markets around the U.S. The story is the same everywhere ... inventory is at record lows.

For the entire state of Alabama:

Closed sales in February 2021 were 5,197, up 14.6% from 4,533 in February 2020.

Active Listings in February 2021 were 9,950, down 44.0% from 17,770 in February 2020.

Months of Supply was 1.9 Months in February 2021, compared to 3.9 Months in February 2020.