by Calculated Risk on 5/14/2021 09:22:00 AM

Friday, May 14, 2021

Industrial Production Increased 0.7 Percent in April

From the Fed: Industrial Production and Capacity Utilization

Total industrial production increased 0.7 percent in April. The indexes for mining and utilities increased 0.7 percent and 2.6 percent, respectively; the index for manufacturing rose 0.4 percent despite a drop in motor vehicle assemblies that principally resulted from shortages of semiconductors. An important contributor to the gain in factory output was the return to operation of plants that were damaged by February's severe weather in the south central region of the country and had remained offline in March. The weather-induced drop in total industrial production in February and the subsequent rebound in March are now estimated to have been larger than reported last month.

At 106.3 percent of its 2012 average in April, total industrial production has moved up 16.5 percent from its level in April 2020 (the trough of the pandemic), but it was 2.7 percent below its pre-pandemic (February 2020) level. Capacity utilization for the industrial sector rose 0.5 percentage point in April to 74.9 percent, a rate that is 4.7 percentage points below its long-run (1972–2020) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April, but still below the level in February 2020.

Capacity utilization at 74.9% is 4.7% below the average from 1972 to 2020.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in April to 106.3. This is 2.7% below the February 2020 level.

The change in industrial production was below consensus expectations.

Retail Sales Unchanged in April

by Calculated Risk on 5/14/2021 08:43:00 AM

On a monthly basis, retail sales were unchanged from March to April (seasonally adjusted), and sales were up 51.2 percent from April 2020.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for April 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $619.9 billion, virtually unchanged from the previous month, and 51.2 percent above April 2020. ... The February 2021 to March 2021 percent change was revised from up 9.7 percent to up 10.7 percent.

emphasis added

Click on graph for larger image.

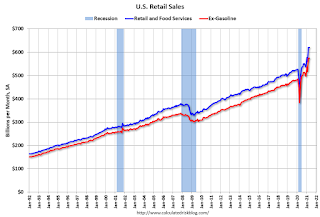

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.1% in April.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 49.5% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 49.5% on a YoY basis.Sales in April were slightly below expectations, however sales in March were revised up (February was revised down).

Thursday, May 13, 2021

Friday: Retail Sales, Industrial Production

by Calculated Risk on 5/13/2021 09:00:00 PM

Friday:

• At 8:30 AM ET, Retail sales for April is scheduled to be released. The consensus is for 1.0% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for April. The consensus is for a 1.2% increase in Industrial Production, and for Capacity Utilization to increase to 75.2%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for May).

May 13th COVID-19 New Cases, Hospitalizations

by Calculated Risk on 5/13/2021 05:27:00 PM

"If you’ve been fully vaccinated: You can resume activities that you did prior to the pandemic. You can resume activities without wearing a mask or staying 6 feet apart, except where required by federal, state, local, tribal, or territorial laws, rules, and regulations, including local business and workplace guidance."Get vaccinated!

1) 58.9% of the population over 18 has had at least one dose (70% goal by July 4th).

2) 119.0 million Americans are fully vaccinated (160 million goal by July 4th)

Note: I'll stop posting this daily once all three of these criteria are met:

1) 70% of the population over 18 has had at least one dose of vaccine, and

2) new cases are under 5,000 per day, and

3) hospitalizations are below 3,000.

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

The current 7-day average is 30,244, down from 30,718 reported yesterday, but still above the post-summer surge low of 23,000.

Existing Home Inventory Might Have Bottomed

by Calculated Risk on 5/13/2021 04:04:00 PM

I'm gathering existing home data for many local markets, and I'm watching inventory very closely this year.

As I noted in Some thoughts on Housing Inventory

The key for housing in 2021 will be inventory. If inventory stays extremely low, there will be more housing starts and a larger increase in house prices. However, if inventory increases significantly, there will be fewer starts and less price appreciation.The table below shows some early data for April.

Although inventory in these areas is down about 56% year-over-year, inventory is up month-to-month in most areas, and up 3.1% in total compared to March.

It is still early, but existing home inventory might have bottomed in March.

| Existing Home Inventory | |||||

|---|---|---|---|---|---|

| Apr-21 | Mar-21 | Apr-20 | YoY | MoM | |

| Atlanta | 6,964 | 7,418 | 19,697 | -64.6% | -6.1% |

| Boston | 3,788 | 3,201 | 3,467 | 9.3% | 18.3% |

| Colorado | 7,872 | 6,732 | 23,106 | -65.9% | 16.9% |

| Denver | 2,594 | 1,921 | 6,855 | -62.2% | 35.0% |

| Houston | 22,794 | 22,602 | 39,906 | -42.9% | 0.8% |

| Las Vegas | 2,346 | 2,369 | 7,815 | -70.0% | -1.0% |

| Maryland | 7,167 | 6,202 | 18,563 | -61.4% | 15.6% |

| New Hampshire | 1,852 | 1,576 | 4,295 | -56.9% | 17.5% |

| North Texas | 8,084 | 8,123 | 23,046 | -64.9% | -0.5% |

| Portland | 2,222 | 1,943 | 4,757 | -53.3% | 14.4% |

| Sacramento | 1,006 | 918 | 1,823 | -44.8% | 9.6% |

| South Carolina | 12,019 | 12,754 | 27,024 | -55.5% | -5.8% |

| Total1 | 76,114 | 73,838 | 173,499 | -56.1% | 3.1% |

| 1excluding Denver (included in Colorado) | |||||

Sacramento Real Estate in April: Sales up 52% YoY, Active Inventory down 45% YoY

by Calculated Risk on 5/13/2021 01:03:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year. Remember sales were weak in April 2020 due to the pandemic, so the YoY sales comparison is easy.

From SacRealtor.org: County median sales price nears $490,000, sales volume up 19%

April ended with 1,540 sales, up 19.2% from the 1,292 sales in March. Compared to one year ago (1,013), the current figure is up 52%.

...

The Active Listing Inventory increased 9.6% from March to April, from 918 units to 1,006 units. Compared with April 2020 (1,823), inventory is down 44.8%. The Months of Inventory remained at .7 Months.

...

The Median DOM (days on market) remained at 6 and the Average DOM decreased from 13 to 11. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,540 sales this month, 93.4% (1,439) were on the market for 30 days or less and 97.2% (1,498) were on the market for 60 days or less.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Sacramento Association of REALTORS® shows single family sales and inventory since March 2018. Usually inventory (red) was higher than sales (blue), but now there are more sales each month than inventory. Inventory declined sharply during the pandemic.

Note that inventory in April was up 9.6% from last month.

Hotels: Occupancy Rate Down 17% Compared to Same Week in 2019

by Calculated Risk on 5/13/2021 10:51:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. However, occupancy is still down significantly from normal levels.

The occupancy rate is down 17% compared to the same week in 2019.

Due to more supply in the marketplace, U.S. hotel occupancy fell slightly from the previous week, according to STR's latest data through May 8.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

May 2-8, 2021:

• Occupancy: 56.7%

• Average daily rate (ADR): US$110.19

• Revenue per available room (RevPAR): US$62.50

Demand was up week over week, but an increase in supply from both reopenings and new properties pulled national occupancy down. Major markets, such as New York City and San Francisco, are showing the most movement with properties coming back online.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Maryland Real Estate in April: Sales Up 27% YoY, Inventory Down 61% YoY

by Calculated Risk on 5/13/2021 10:21:00 AM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year. Remember sales were weak in April 2020 due to the pandemic, so the YoY sales comparison is easy.

From the Maryland Realtors for the entire state:

Closed sales in April 2021 were 8,566, up 27.1% from 6,739 in April 2020.

Active Listings in April 2021 were 7,167, down 61.4% from 18,563 in April 2020.

Inventory in April was up 15.6% from last month.

Months of Supply was 0.8 Months in April 2021, compared to 2.5 Months in April 2020.

Weekly Initial Unemployment Claims decrease to 473,000

by Calculated Risk on 5/13/2021 08:38:00 AM

The DOL reported:

In the week ending May 8, the advance figure for seasonally adjusted initial claims was 473,000, a decrease of 34,000 from the previous week's revised level. This is the lowest level for initial claims since March 14, 2020 when it was 256,000. The previous week's level was revised up by 9,000 from 498,000 to 507,000. The 4-week moving average was 534,000, a decrease of 28,250 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 2,250 from 560,000 to 562,250.This does not include the 103,571 initial claims for Pandemic Unemployment Assistance (PUA) that was up from 101,815 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 534,000.

The previous week was revised up.

Regular state continued claims decreased to 3,655,000 (SA) from 3,700,000 (SA) the previous week.

Note: There are an additional 7,283,703 receiving Pandemic Unemployment Assistance (PUA) that increased from 6,863,451 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 5,265,193 receiving Pandemic Emergency Unemployment Compensation (PEUC) up from 4,973,804.

Weekly claims were close to the consensus forecast.

Wednesday, May 12, 2021

Thursday: Unemployment Claims, PPI

by Calculated Risk on 5/12/2021 09:02:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 480 thousand from 498 thousand last week.

• Also at 8:30 AM, The Producer Price Index for April from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.4% increase in core PPI.