by Calculated Risk on 8/13/2021 05:30:00 PM

Friday, August 13, 2021

August 13th COVID-19: Over 140,000 New Cases Reported Today

Congratulations to the residents of California and Pennsylvania on joining the 80% club! Go for 90%!!! (80% of adults have had at least one shot).

The 7-day average deaths is the highest since May 19th.

According to the CDC, on Vaccinations.

Total doses administered: 354,777,950, as of a week ago 349,787,479. Average doses last week: 0.71 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose✅ | 71.6% | 71.5% | 70.6% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 167.7 | 167.4 | 165.9 | ≥1601 |

| New Cases per Day3🚩 | 116,508 | 114,208 | 100,981 | ≤5,0002 |

| Hospitalized3🚩 | 64,231 | 62,117 | 47,709 | ≤3,0002 |

| Deaths per Day3🚩 | 514 | 491 | 424 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Short term goal met (even if late). | ||||

KUDOS to the residents of the 21 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts, Connecticut, Maine, New Jersey, New Mexico, Rhode Island, Pennsylvania, California are at 80%+, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado, Florida and D.C. are all over 70%.

Next up are Utah at 69.7%, Nebraska at 68.9%, Wisconsin at 68.6%, Kansas at 68.1%, South Dakota at 67.8%, Nevada at 67.6%, Texas at 67.5%, and Iowa at 67.1%.

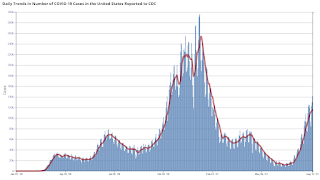

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Santa Clara Real Estate in July: Sales Up 29% YoY, Inventory Down 7% YoY

by Calculated Risk on 8/13/2021 01:04:00 PM

I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the Santa Clara Realtors (includes San Jose):

Closed sales (single family and condos) in July 2021 were 1,783, up 29.4% from 1,378.

in July 2020.

Active Listings in July 2021 were 1,820, down 6.7% from 1,9501 in July 2020. (1estimate)

Inventory in July was up 3.0% from the previous month, and up 58.4% from the record low in December 2020.

Early Q3 GDP Forecasts: Around 6% to 7% with "Significant downside risk"

by Calculated Risk on 8/13/2021 11:16:00 AM

From BofA:

We look for growth of 7.0% qoq SAAR in 3Q ... We forecast retail sales fell by 2.3% mom in July, reflecting cooling service demand on Delta concerns and weaker online spend from the pull forward in the timing of Prime day. This poses significant downside risk to our 3Q GDP forecast; if we are correct, 3Q GDP tracking could fall to 3%. [August 13 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 3.8% for 2021:Q3. [August 13 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 6.0 percent on August 6, down from 6.1 percent on August 5. [August 6 estimate]

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 8/13/2021 09:23:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of August 10th.

From Andy Walden at Black Knight: Another Week of Significant Forbearance Declines

In the wake of last week’s 71,000 drop over the first days of August, our McDash Flash daily mortgage performance dataset showed another significant decline in the number of active forbearance plans in the days since. The total number of active plans declined by 83,000 since last Tuesday, pushing the total number of homeowners in forbearance below 1.8 million for the first time since early in the pandemic.

As we’ve mentioned in the past, the largest movement in the number of forbearances tends to be seen early on in each month, as plans scheduled for three-month reviews in the month prior are reviewed for extension or removal.

As of August 10, 1.74 million homeowners remain in COVID-19-related forbearance plans, representing 3.3% of all active mortgages, including 1.9% of GSE, 5.8% of FHA/VA and 3.9% of loans held in bank portfolio and private securitizations.

Improvement was seen across the board. Portfolio and PLS loans saw the strongest reduction, with a 43,000 (-7.8%) decline in active plans. The number of FHA loans in forbearance fell by 25,000 (-3.5%) from the week prior, while GSE loans saw a 15,000 (-2.7%) decline. That puts the number of active plans down 125,000 (-6.7%) from the same time last month.

Click on graph for larger image.

Plan starts, including both new plans and restarts, pulled back again this week, hitting their lowest weekly mark since early July (again). Of the 185,000 plans reviewed over the past week, 62% were exits.

More than 250,000 plans are currently slated for review for extension/removal throughout August. An estimated one-third of those are set to reach their final expiration based on current allowable forbearance term lengths. Volumes of final expirations will increase significantly in September and October.

emphasis added

San Diego Real Estate in July: Sales Down 4% YoY, Inventory Down 42% YoY

by Calculated Risk on 8/13/2021 08:22:00 AM

I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the San Diego Realtors:

Closed sales (attached and detached) in July 2021 were 3,600, down 4.5% from 3,769

in July 2020.

Active Listings in July 2021 were 3349, down 41.9% from 5,763 in July 2020.

Months of Supply for attached was 1.0 Months in July 2021, compared to 1.9 Months in July 2020.

Inventory in July was down slightly from the previous month, and up 13.0% from the record low in March 2021.

Thursday, August 12, 2021

August 12th COVID-19: Crisis in Florida and Texas

by Calculated Risk on 8/12/2021 07:37:00 PM

First, on the economic impact of the delta variant from BofA today:

'Our big data business cycle indicator is at risk of a regime shift from "boom" to "soft patch" because of the Delta wave.'Florida and Texas are in a serious crisis (see graphs and comments at bottom).

The 7-day average deaths is the highest since May 22nd.

According to the CDC, on Vaccinations.

Total doses administered: 353,859,894, as of a week ago 348,966,419. Average doses last week: 0.70 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose✅ | 71.5% | 71.3% | 70.4% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 167.4 | 167.1 | 165.6 | ≥1601 |

| New Cases per Day3🚩 | 114,190 | 112,751 | 96,453 | ≤5,0002 |

| Hospitalized3🚩 | 62,041 | 59,755 | 45,456 | ≤3,0002 |

| Deaths per Day3🚩 | 492 | 479 | 406 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Short term goal met (even if late). | ||||

KUDOS to the residents of the 21 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts, Connecticut, Maine, New Jersey, New Mexico and Rhode Island are at 80%+, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado, Florida and D.C. are all over 70%.

Next up are Utah at 69.7%, Nebraska at 68.8%, Wisconsin at 68.5%, Kansas at 68.0%, South Dakota at 67.6%, Nevada at 67.4%, Texas at 67.1%, and Iowa at 66.8%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

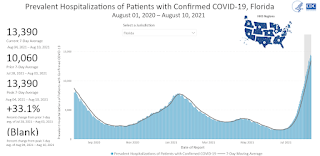

Hospitalizations in Florida are already at a record level, and Florida is running out of ICU beds.

Hospitalizations in Florida are already at a record level, and Florida is running out of ICU beds.According to data from the HHS on hospital utilizations, over 90% of ICU beds in Florida are occupied, and more than half of those are COVID patients. Grim

And on Texas, from the Texas Tribune: “I am frightened by what is coming”: Texas hospitals could soon be overwhelmed by COVID-19 caseload, officials say

Texas hospitals are on the brink of catastrophe, close to being completely overwhelmed by COVID-19 patients, leaders of some of the state’s largest hospitals told state lawmakers Tuesday.

Official after official used their strongest descriptions to get the point across to legislators: Hospitalizations are rising too fast for them to keep up with, and it may be too late to do anything about it.

“While more vaccination is the only thing that can ultimately bring this pandemic to an end, we need more decisive actions now to prevent a catastrophe the likes of which we only imagined last year,” Dr. Esmaeil Porsa, CEO of Harris Health System in Houston, told the Texas Senate Health and Human Services Committee on Tuesday.

South Carolina Real Estate in July: Sales Down 10% YoY, Inventory Down 40% YoY

by Calculated Risk on 8/12/2021 02:14:00 PM

I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the South Carolina Realtors for the entire state:

Closed sales in July 2021 were 9,658, down 9.5% from 10,675 in July 2020.

Active Listings in July 2021 were 12,869,, down 40.4% from 21,592 in July 2020.

Months of Supply for attached was 1.4 Months in July 2021, compared to 2.6 Months in July 2020.

Inventory in July was up 15.3% from the previous month, and up 23.1% from the record low in May 2021.

Maryland Real Estate in July: Sales Down 3% YoY, Inventory Down 31% YoY

by Calculated Risk on 8/12/2021 12:06:00 PM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the Maryland Realtors for the entire state:

Closed sales in July 2021 were 9,685, down 3.2% from 10,001 in July 2020.

Active Listings in July 2021 were 10,164, down 30.8% from 14,685 in July 2020.

Months of Supply was 1.1 Months in July 2021, compared to 2.0 Months in July 2020.

Inventory in July was up 18.9% from last month, and up 64% from the all time low in March 2021.

Hotels: Occupancy Rate Down 8% Compared to Same Week in 2019

by Calculated Risk on 8/12/2021 10:10:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic. So STR is comparing to the same week in 2019.

The occupancy rate is down 8.3% compared to the same week in 2019.

Reflecting seasonality and greater concern around the Delta variant, U.S. hotel occupancy and average daily rate (ADR) dipped from the previous weeks, according to STR‘s latest data through August 7.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

August 1-7, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 68.0% (-8.3%)

• Average daily rate (ADR): $140.97 (+5.1%)

• Revenue per available room (RevPAR): $95.89 (-3.6%)

...

*Due to the steep, pandemic-driven performance declines of 2020, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.

Minnesota Real Estate in July: Sales Down 9% YoY, Inventory Down 30% YoY

by Calculated Risk on 8/12/2021 09:13:00 AM

Note: I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the Minnesota Realtors®:

Total Residential Units Sold in July 2021 were 9,615, down 8.7% from 10,530 in July 2020.

Active Residential Listings in July 2021 were 11,854, down 29.7% from 16,861 in July 2020.

Months of Supply was 1.5 Months in July 2021, compared to 2.3 Months in July 2020.

This graph from the Minnesota Realtors® shows inventory in Minnesota since 2012. Inventory had been trending down, and then was somewhat flat for a few years, and then declined significantly during the pandemic.

Active inventory was up 8.6% from the previous month, and up 43.3% seasonally from the all time low in February 2021. Usually, at this time of the year, we'd expect active inventory of around 23,000 in Minnesota, so current inventory is still extremely low.