by Calculated Risk on 9/13/2021 08:10:00 AM

Monday, September 13, 2021

Seven High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of September 12th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 23.2% from the same day in 2019 (76.8% of 2019). (Dashed line)

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through September 11, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday. The 7-day average for the US is down 6% compared to 2019.

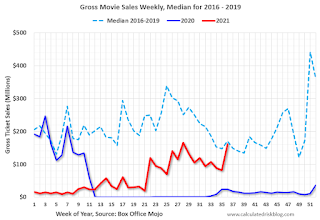

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $162 million last week, down only about 5% from the median for the week due to the blockbuster "Shang-Chi and the Legend of the Ten Rings".

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Occupancy is above the horrible 2009 levels. With solid leisure travel, the Summer months and Labor Day had decent occupancy - but it is uncertain what will happen in the Fall with business travel.

This data is through September 4th. The occupancy rate was unchanged compared to the same week in 2019, boosted by Labor Day demand and Hurricane Ida. Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of September 3rd, gasoline supplied was down 2.0% compared to the same week in 2019.

There have been five weeks so far this year when gasoline supplied was up compared to the same week in 2019.

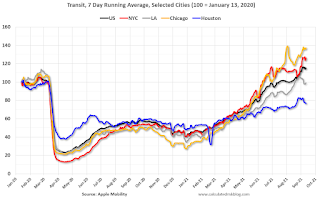

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through September 11th for the United States and several selected cities.

This data is through September 11th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 115% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, September 10th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, September 12, 2021

Sunday Night Futures

by Calculated Risk on 9/12/2021 06:30:00 PM

Weekend:

• Schedule for Week of September 12, 2021

• The Rapid Increase in Rents

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 9 and DOW futures are up 70 (fair value).

Oil prices were up over the last week with WTI futures at $69.75 per barrel and Brent at $72.94 per barrel. A year ago, WTI was at $37, and Brent was at $39 - so WTI oil prices are UP 90% year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.16 per gallon. A year ago prices were at $2.16 per gallon, so gasoline prices are up $1.00 per gallon year-over-year.

The Rapid Increase in Rents

by Calculated Risk on 9/12/2021 01:05:00 PM

The Rapid Increase in Rents

NOTE: This is the new Newsletter that focuses solely on Real Estate. It is completely Free at this time. Please subscribe!

This Newsletter article discusses:

What is happening with rents?

Why are rents increasing rapidly?

What will happen?

Saturday, September 11, 2021

Newsletter Articles this Week

by Calculated Risk on 9/11/2021 02:59:00 PM

Note: I've started a newsletter focused solely on real estate. This newsletter is currently completely FREE and also ad free.

At the Calculated Risk Newsletter this week:

• Housing: A Look at "Affordability" Indexes

• Forbearance Will Not Lead to a Huge Wave of Foreclosures

• Homebuilder Comments in August: “Supply shortages are getting worse."

• 6 Local Housing Markets in August: Denver, Las Vegas, San Diego, North Texas (Dallas/Ft. Worth), Northwest (Seattle), Santa Clara (San Jose)

• 4 More Local Housing Markets in August: Atlanta, New Hampshire, Portland, Sacramento

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

Schedule for Week of September 12, 2021

by Calculated Risk on 9/11/2021 08:11:00 AM

The key economic reports this week are August Consumer Price Index (CPI) and Retail Sales.

For manufacturing, August Industrial Production, and the September New York and Philly Fed surveys, will be released this week.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for August.

8:30 AM: The Consumer Price Index for August from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.3% increase in core CPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 18.6, up from 18.3.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.5% increase in Industrial Production, and for Capacity Utilization to increase to 76.4%.

8:30 AM: The initial weekly unemployment claims report will be released. There were 310 thousand initial claims last week.

8:30 AM ET: Retail sales for August will be released. The consensus is for a 0.7% decrease in retail sales.

8:30 AM ET: Retail sales for August will be released. The consensus is for a 0.7% decrease in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 20.0, up from 19.4.

10:00 AM: State Employment and Unemployment (Monthly) for August 2021

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for September).

Friday, September 10, 2021

FDIC: Problem Banks Declined, Residential REO Declined in Q2

by Calculated Risk on 9/10/2021 04:51:00 PM

The FDIC released the Quarterly Banking Profile for Q2 2021 this week:

Net income totaled $70.4 billion, an increase of $51.9 billion (281 percent) from the same quarter a year ago, primarily due to a $73 billion (117.3 percent) decline in provision expense.

...

Total loan and lease balances increased $33.2 billion (0.3 percent) from the previous quarter. This was the first quarterly increase in loan volume since second quarter 2020. An increase in credit card loan balances (up $30.9 billion, or 4.1 percent), supplemented by an increase in auto loan balances (up $18.9 billion, or 3.8 percent), drove the growth.

Loans that were 90 days or more past due or in nonaccrual status (i.e., noncurrent loans) continued to decline (down $13.2 billion, or 10.8 percent) from first quarter 2021. The noncurrent rate for total loans declined 12 basis points from the previous quarter to 1.01 percent. Net charge-offs also continued to decline (down $8.3 billion, or 53.2 percent) from a year ago. The total net charge-off rate dropped 30 basis points to 0.27 percent—the lowest level on record.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The FDIC reported the number of problem banks declined by four from the first quarter to 51.

This graph from the FDIC shows the number of problem banks and assets at 51 institutions.

Note: The number of assets for problem banks increased significantly back in 2018 when Deutsche Bank Trust Company Americas was added to the list (it must still be on the list given the assets of problem banks).

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $1.73 billion in Q2 2020 to $0.85 billion in Q2 2021. This is the lowest level of REOs in many years. (probably declined sharply due to foreclosure moratoriums and forbearance programs).

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $1.73 billion in Q2 2020 to $0.85 billion in Q2 2021. This is the lowest level of REOs in many years. (probably declined sharply due to foreclosure moratoriums and forbearance programs).This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

September 10th COVID-19: A Little Progress

by Calculated Risk on 9/10/2021 03:59:00 PM

NOTE: There will be no weekend updates on COVID.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 53.6% | 52.9% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 177.9 | 175.5 | ≥2321 | |

| New Cases per Day3 | 136,738 | 155,347 | ≤5,0002 | |

| Hospitalized3 | 91,795 | 93,146 | ≤3,0002 | |

| Deaths per Day3 | 1,110 | 1,236 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 14 states and D.C. have between 50% and 59.9% fully vaccinated: Oregon at 58.9%, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, and South Dakota at 51.1%.

Next up (total population, fully vaccinated according to CDC) are Kentucky at 49.8%, Arizona at 49.5%, Kansas at 49.3%, Ohio at 49.1%, Nevada at 48.9%, Texas at 48.7%, Utah at 48.6% and Alaska at 48.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

4 More Local Housing Markets in August: Atlanta, New Hampshire, Portland, Sacramento

by Calculated Risk on 9/10/2021 02:19:00 PM

Starting this month, I'm going to post local market data (Sales, Active Inventory, New listings) several times during the month on the CalculatedRisk Newsletter.

Here are 4 more of about 30 local markets that I track: 4 More Local Housing Markets in August

This includes Atlanta, New Hampshire, Portland, and Sacramento.

Q3 GDP Forecasts: Downgraded to Around 4%

by Calculated Risk on 9/10/2021 01:11:00 PM

GDP forecasts have been downgraded sharply for Q3 due to COVID.

| Merrill | Goldman | GDPNow | |

|---|---|---|---|

| 7/30/21 | 7.0% | 9.0% | 6.1% |

| 8/20/21 | 4.5% | 5.5% | 6.1% |

| 9/10/21 | 4.5% | 3.5% | 3.7% |

From BofA Merrill Lynch:

We continue to track 4.5% qoq saar for 3Q GDP. [Sept 10 estimate]From Goldman Sachs:

emphasis added

We now expect GDP growth of 3.5% in Q3. [Sept 9 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2021 is 3.7 percent on September 10 [Sept 10 estimate]

Hotels: Occupancy Rate Unchanged Compared to Same Week in 2019

by Calculated Risk on 9/10/2021 10:52:00 AM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic.

The occupancy rate was unchanged compared to the same week in 2019 due to Labor Day demand and Hurricane Ida.

Labor Day weekend leisure travel and Hurricane Ida-related demand lifted U.S. hotel occupancy out of a five-week slump.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

After declining for the past five weeks, weekly U.S. hotel occupancy inched up 30 basis points for the week ending Sept. 4 to 61.3%, according to the latest data from CoStar hospitality analytics firm STR. Weekend occupancy, Friday and Saturday, increased to 77%, which was the country’s highest since the first week of August.

Compared with Labor Day weekend in 2019, which was a week earlier, occupancy was nearly the same, indicating the desire to travel remains strong despite the increase in COVID-19 cases, and occupancy declines over the past several weeks are more due to the return of in-person schools and the slow materialization of business and group travel.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Note: Y-axis doesn't start at zero to better show the seasonal change.