by Calculated Risk on 12/09/2021 08:34:00 AM

Thursday, December 09, 2021

Weekly Initial Unemployment Claims Decrease to 184,000

The DOL reported:

In the week ending December 4, the advance figure for seasonally adjusted initial claims was 184,000, a decrease of 43,000 from the previous week's revised level. This is the lowest level for initial claims since September 6, 1969 when it was 182,000. The previous week's level was revised up by 5,000 from 222,000 to 227,000. The 4-week moving average was 218,750, a decrease of 21,250 from the previous week's revised average. This is the lowest level for this average since March 7, 2020 when it was 215,250. The previous week's average was revised up by 1,250 from 238,750 to 240,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 218,750.

The previous week was revised up.

Regular state continued claims increased to 1,992,000 (SA) from 1,954,000 (SA) the previous week.

Weekly claims were well below the consensus forecast.

Wednesday, December 08, 2021

Thursday: Unemployment Claims, Q3 Flow of Funds

by Calculated Risk on 12/08/2021 08:58:00 PM

Thursday:

• At 8:30 AM ET,: The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, up from 222 thousand last week.

• At 12:00 PM, Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

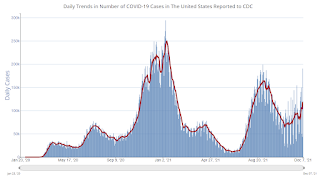

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 60.4% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 200.4 | --- | ≥2321 | |

| New Cases per Day3🚩 | 117,488 | 82,848 | ≤5,0002 | |

| Hospitalized3🚩 | 52,605 | 47,372 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,097 | 798 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Lawler: Updates on Key Drivers of US Population Growth

by Calculated Risk on 12/08/2021 03:02:00 PM

Today, in the Real Estate Newsletter: Lawler: Updates on Key Drivers of US Population Growth

Excerpt:

This is an article from housing economist Tom Lawler (this is important for understanding demographics):

Based on provisional CDC data on US births and deaths, and using a reasonable “guesstimate” on Net International Migration based on available immigration data, it appears as if the US resident population from 7/1/2020 to 7/1/2021 grew by just 486,290, or 0.15%. That growth would be the lowest in over a century.

emphasis added

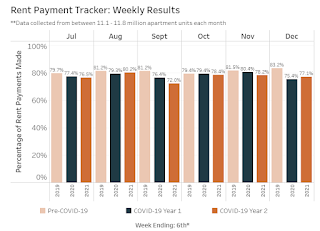

NMHC: Rent Payment Tracker Shows Households Paying Rent Increased YoY in Early December

by Calculated Risk on 12/08/2021 12:31:00 PM

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 77.1 percent of apartment households made a full or partial rent payment by December 6 in its survey of 11.8 million units of professionally managed apartment units across the country.

This is a 1.7 percentage point increase from the share who paid rent through December 6, 2020 and compares to 83.2 percent that had been paid by December 6, 2019. This data encompasses a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

The NMHC Rent Payment Tracker metric provides insight into changes in resident rent payment behavior over the course of each month, and, as the dataset ages, between months. While the tracker is intended to serve as an indicator of resident financial challenges, it is also intended to track the recovery as well, including the effectiveness of government stimulus and subsidies.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 6th of the month compared to 2019 and to the first COVID year.

This is mostly for large, professionally managed properties.

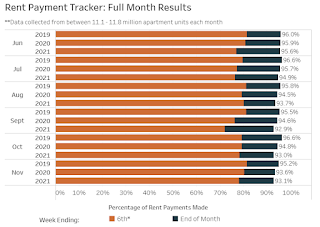

The second graph shows full month payments through November compared to the same month the prior year.

BLS: Job Openings Increased to 11.0 million in October

by Calculated Risk on 12/08/2021 10:05:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings increased to 11.0 million on the last business day of October, the U.S. Bureau of Labor Statistics reported today. Hires were little changed at 6.5 million and total separations edged down to 5.9 million. Within separations, the quits rate decreased to 2.8 percent following a series high in September. The layoffs and discharges rate was unchanged at 0.9 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spike in layoffs and discharges in March 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in October to 11.033 million from 10.602 million in September.

The number of job openings (yellow) were up 61% year-over-year.

Quits were up 24% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

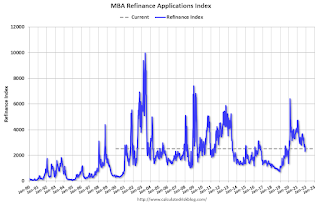

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 12/08/2021 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 3, 2021. The previous week’s results included an adjustment for the Thanksgiving holiday.

... The Refinance Index increased 9 percent from the previous week and was 37 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index increased 28 percent compared with the previous week and was 8 percent lower than the same week one year ago.

“Mortgage rates declined for the first time in a month, prompting a pickup in refinancing, with government refinances increasing more than 20 percent over the week. While the 30-year fixed mortgage rate and 15- year fixed mortgage rate both declined only one basis point, the FHA rate fell 7 basis points, driving the surge in government refinances. Borrowers are continuing to act on these opportunities, but if rates trend higher as MBA is forecasting, the window of opportunity to refinance will continue to get smaller,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The purchase market was slower last week, with applications falling after four consecutive increases. Activity is still close to the highest level since March 2021, which is a positive sign as the year comes to an end. Purchase activity continues to be constrained by a lack of inventory, combined with rapid rates of home-price appreciation and mortgage rates higher than in 2020.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) decreased to 3.30 percent from 3.31 percent, with points decreasing to 0.39 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With relatively low rates, the index remains slightly elevated, but down sharply from last year.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 8% year-over-year unadjusted.

According to the MBA, purchase activity is down 8% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).

Tuesday, December 07, 2021

Wednesday: Job Openings

by Calculated Risk on 12/07/2021 07:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for October from the BLS.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 60.1% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 199.7 | --- | ≥2321 | |

| New Cases per Day3🚩 | 117,179 | 80,266 | ≤5,0002 | |

| Hospitalized3🚩 | 51,742 | 46,659 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,117 | 807 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Leading Index for Commercial Real Estate "Declines in November"; Up Sharply Year-over-year

by Calculated Risk on 12/07/2021 03:06:00 PM

From Dodge Data Analytics: Dodge Momentum Index Declines In November

The Dodge Momentum Index fell 4% in November to 171.7 (2000=100) — down from the revised October reading of 178.1. The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. In November, commercial planning fell 8% while institutional planning moved 5% higher.

The value of nonresidential building projects continues to move in a sawtooth pattern, alternating between a month of gains followed by a loss. Since the pandemic began, nonresidential building projects entering planning have been more volatile than in past cycles, likely driven by increased challenges from higher prices and lack of labor.

Despite these issues and a lack of underlying demand for some building types such as offices and hotels, the Momentum Index remains near a 14-year high. Compared to November 2020, the Momentum Index was 44% higher in November 2021. The commercial planning component was 45% higher, and institutional was 41% higher.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 171.7 in November, down from 178.1 in October.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggested a decline in Commercial Real Estate construction through most of 2021, but a pickup towards the end of the year, and growth in 2022.

1st Look at Local Housing Markets in November

by Calculated Risk on 12/07/2021 10:51:00 AM

Today, in the Real Estate Newsletter: 1st Look at Local Housing Markets in November

Excerpt:

Denver, Las Vegas, Northwest (Seattle), and San Diego

From Denver Metro Association of Realtors® (DMAR): DMAR Real Estate Market Trends ReportFrom October to November, the market saw a staggering 33.41 percent decrease in month-end active inventory, dropping to 2,248. Throughout the entire Denver Metro area, there are currently only 1,444 single-family detached properties and 804 attached properties to buy.

Over the past five years, month-end active inventory dropped between 23.36 percent in 2016 and 27.92 percent in 2019. Theoretically, if inventory stayed the course and dropped 25 percent this year, the market would end the year at 1,686 active properties leading into 2022, which is drastically lower than the end of 2020 and would lead to the most competitive year yet. With 2,248 active listings on the market and that number expected to go down by the end of the month, expectations are set that 2022 will be a wild and competitive ride.

emphasis addedHere is a summary of active listings for these housing markets in November. Inventory was down 27.2% in November MoM from October, and down 36.3% YoY.

Inventory almost always declines seasonally in November, so the MoM decline is not a surprise. Last month, these four markets were down 33% YoY, so the YoY decline in November is larger than in October. This isn’t indicating a slowing market.

Trade Deficit Decreased to $67.1 Billion in October

by Calculated Risk on 12/07/2021 08:39:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $67.1 billion in October, down $14.3 billion from $81.4 billion in September, revised.

October exports were $223.6 billion, $16.8 billion more than September exports. October imports were $290.7 billion, $2.5 billion more than September imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in October.

Exports are up 18% compared to October 2020; imports are up 22% compared to October 2020.

Both imports and exports decreased sharply due to COVID-19, and have now bounced back (imports more than exports),

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, imports and exports of petroleum products are close to zero.

The trade deficit with China increased to $31.4 billion in October, from $30.0 billion in October 2020.