by Calculated Risk on 7/19/2022 02:56:00 PM

Tuesday, July 19, 2022

Slowdown in Showings Suggests Further Declines in Existing Home Sales in Coming Months

Today, in the Calculated Risk Real Estate Newsletter: Slowdown in Showings Suggests Further Declines in Existing Home Sales in Coming Months

A brief excerpt:

The following data is courtesy of David Arbit, Director of Research at the Minneapolis Area REALTORS® and NorthstarMLS (posted with permission). Here is a link to their data.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

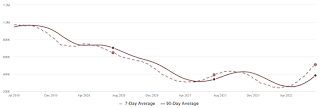

This graph shows the 7-day average showings for the Twin Cities area for 2019, 2020, 2021, and 2022. The 7-day average showings (red) are currently off 23% from 2019.

Click on graph for larger image.

This slowdown in showings started in May and accelerated in June. The existing home sales for June will be released tomorrow, and that is for closings in June. Closings in June were mostly for contracts signed in April and May. This slowdown in showings suggests further declines in closed sales over the next few months.

There was a huge dip in showings in 2020 (black) at the start of the pandemic, and then showing were well above 2019 (blue) levels for the rest of the year. And showings in 2021 (gold) were very strong in the first half of the year, and then were closer to 2019 in the 2nd half.

Note that there were dips in showings during holidays (July 4th, Memorial Day, Thanksgiving and Christmas), and also dips related to protests and curfews related to the deaths of George Floyd and Daunte Wright.

2022 (red) started off solid but is now well below the previous three years.

June Housing Starts: All-Time Record Housing Units Under Construction

by Calculated Risk on 7/19/2022 09:17:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: June Housing Starts: All-Time Record Housing Units Under Construction

Excerpt:

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Red is single family units. Currently there are 824 thousand single family units under construction (SA). This is just below the previous two months, and otherwise is the highest level since November 2006. Single family units under construction might have peaked since single family starts are now declining. The reason there are so many homes under construction is probably due to supply constraints.

Blue is for 2+ units. Currently there are 856 thousand multi-family units under construction. This is the highest level since March 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Combined, there are a record 1.680 million units under construction. This is above the previous record of 1.628 million units that were under construction in 1973 (mostly apartments in 1973 for the baby boom generation).

Housing Starts Decreased to 1.559 million Annual Rate in June

by Calculated Risk on 7/19/2022 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in June were at a seasonally adjusted annual rate of 1,559,000. This is 2.0 percent below the revised May estimate of 1,591,000 and is 6.3 percent below the June 2021 rate of 1,664,000. Single‐family housing starts in June were at a rate of 982,000; this is 8.1 percent below the revised May figure of 1,068,000. The June rate for units in buildings with five units or more was 568,000.

Building Permits:

Privately‐owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,685,000. This is 0.6 percent below the revised May rate of 1,695,000, but is 1.4 percent above the June 2021 rate of 1,661,000. Single‐family authorizations in June were at a rate of 967,000; this is 8.0 percent below the revised May figure of 1,051,000. Authorizations of units in buildings with five units or more were at a rate of 666,000 in June.

emphasis added

Click on graph for larger image.

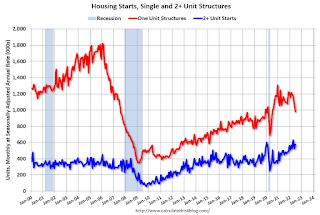

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (blue, 2+ units) increased in June compared to May. Multi-family starts were up 15.6% year-over-year in June.

Single-family starts (red) decreased in June and were down 15.7% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery.

Total housing starts in June were slightly above expectations, and starts in April and May, were revised up, combined.

I'll have more later …

Monday, July 18, 2022

Tuesday: Housing Starts

by Calculated Risk on 7/18/2022 09:18:00 PM

• At 8:30 AM ET, Housing Starts for June. The consensus is for 1.586 million SAAR, up from 1.549 million SAAR in May.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2🚩 | 122,639 | 110,404 | ≤5,0001 | |

| Hospitalized2🚩 | 31,463 | 31,169 | ≤3,0001 | |

| Deaths per Day2🚩 | 336 | 320 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases Slightly to 0.81% in June"

by Calculated Risk on 7/18/2022 04:00:00 PM

Note: This is as of June 30th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases Slightly to 0.81% in June

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 4 basis points from 0.85% of servicers’ portfolio volume in the prior month to 0.81% as of June 30, 2022. According to MBA’s estimate, 405,000 homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 3 basis points to 0.35%. Ginnie Mae loans in forbearance increased 1 basis point to 1.26%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 18 basis points to 1.68%.

“The overall forbearance rate in June stayed relatively flat with just a 4-basis-point decline from May,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Borrowers continue to exit forbearance, but at a much slower pace than six or nine months ago. New forbearance requests are still trickling in, as permitted under the CARES Act, resulting in very little movement in the overall percentage of loans in forbearance.”

Added Walsh, “There are some early indicators of borrower stress resulting from high inflation and rising interest rates, among other factors. For example, overall servicing portfolio performance dropped by 14 basis points to 95.71% current in June, and the performance of post-forbearance workouts declined by 140 basis points to 81.34%. It is worth monitoring post-forbearance workouts for all borrowers, and particularly for borrowers with government loans, who are typically the most vulnerable to economic slowdowns.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans is decreasing, and, at the end of June, there were about 405,000 homeowners in forbearance plans.

3rd Look at Local Housing Markets in June, Sales Down Sharply, Inventory "Surged"

by Calculated Risk on 7/18/2022 01:21:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in June, Sales Down Sharply, Inventory "Surged"

A brief excerpt:

California doesn’t report monthly inventory numbers, but they do report the year-over-year change. Here is the press release from the California Association of Realtors® (C.A.R.): California home sales and price curb in June as housing demand cools, C.A.R. reportsThere is much more in the article. You can subscribe at https://calculatedrisk.substack.com/Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 344,970 in June, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2022 if sales maintained the June pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales. June’s sales pace was down 8.4 percent on a monthly basis from 376,560 in May and down 20.9 percent from a year ago, when 436,020 homes were sold on an annualized basis.

California’s median home price declined 4.0 percent in June to $863,790 from the revised record-high of $900,170 recorded in May. The June price was 5.4 percent higher than the $819,630 recorded last June. The moderation in the median home price was due partly to a change in the mix of sales in June, as the high-end market started pulling back.

With both closed sales and pending sales slowing by more than 20 percent, total active listings surged 64.4 percent in June, the largest year-over-year growth in more than seven years. Active listings in June also climbed to the highest level since November 2019, with a month-to-month increase of 28.8 percent from May.... Housing economist Tom Lawler expects the NAR to report sales at a seasonally adjusted annual rate of 5.12 million in June. The consensus is for 5.40 million.

Contracts for sales in June were mostly signed in April and May, when mortgage rates were lower than in June, so we will probably see further declines in sales in July and August

NAHB: Builder Confidence "Plunges" to 55 in July

by Calculated Risk on 7/18/2022 10:07:00 AM

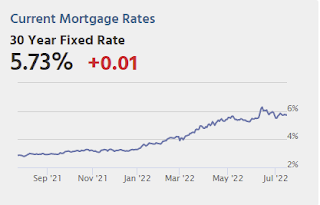

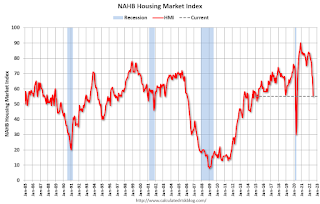

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 55, down from 67 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Plunges as Affordability Woes Mount

Builder confidence plunged in July as high inflation and increased interest rates stalled the housing market by dramatically slowing sales and buyer traffic. In a further sign of a weakening housing market, builder confidence in the market for newly built single-family homes posted its seventh straight monthly decline in July, falling 12 points to 55, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This marks the lowest HMI reading since May 2020 and the largest single-month drop in the history of the HMI, except for the 42-point drop in April 2020.

“Production bottlenecks, rising home building costs and high inflation are causing many builders to halt construction because the cost of land, construction and financing exceeds the market value of the home,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga. “In another sign of a softening market, 13% of builders in the HMI survey reported reducing home prices in the past month to bolster sales and/or limit cancellations.”

“Affordability is the greatest challenge facing the housing market,” said NAHB Chief Economist Robert Dietz. “Significant segments of the home buying population are priced out of the market. Policymakers must address supply-side issues to help builders produce more affordable housing.”

...

All three HMI components posted declines in July: Current sales conditions dropped 12 points to 64, sales expectations in the next six months declined 11 points to 50 and traffic of prospective buyers fell 11 points to 37.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell six points to 65, the Midwest dropped four points to 52, the South fell eight points to 70 and the West posted a 12-point decline to 62.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was well below the consensus forecast, but still above 50.

Housing Inventory July 18th Update: Up 30% Year-over-year

by Calculated Risk on 7/18/2022 08:54:00 AM

Inventory is increasing rapidly. Inventory bottomed seasonally at the beginning of March 2022 and is now up 110% since then. More than double!

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

1. The seasonal bottom (happened on March 4th for Altos) ✅

2. Inventory up year-over-year (happened on May 13th for Altos) ✅

3. Inventory up compared to two years ago (currently down 21.4% according to Altos)

4. Inventory up compared to 2019 (currently down 47.6%).

Five High Frequency Indicators for the Economy

by Calculated Risk on 7/18/2022 08:31:00 AM

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices. Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

The TSA is providing daily travel numbers.

This data is as of July 17th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 12.3% from the same day in 2019 (87.7% of 2019). (Dashed line)

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $334 million last week, up about 14% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through July 9th. The occupancy rate was down 14.5% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

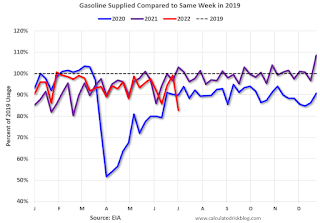

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of July 8th, gasoline supplied was down 17.3% compared to the same week in 2019.

Recently gasoline supplied has been running somewhat below 2019 levels.

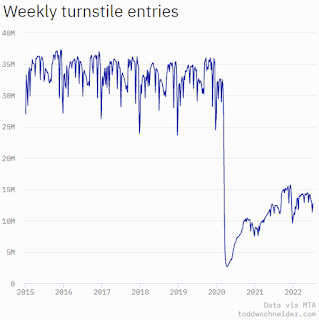

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. Currently traffic is less than half of normal.

This data is through Friday, July 15th.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, July 17, 2022

Monday: Homebuilder Survey

by Calculated Risk on 7/17/2022 08:15:00 PM

Weekend:

• Schedule for Week of July 17, 2022

Monday:

• At 10:00 AM ET, The July NAHB homebuilder survey. The consensus is for a reading of 66, down from 67. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 9 and DOW futures are up 50 (fair value).

Oil prices were down over the last week with WTI futures at $97.26 per barrel and Brent at $100.85 per barrel. A year ago, WTI was at $72, and Brent was at $74 - so WTI oil prices are up 35% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $4.50 per gallon. A year ago, prices were at $3.15 per gallon, so gasoline prices are up $1.35 per gallon year-over-year.