by Calculated Risk on 12/23/2022 10:43:00 AM

Friday, December 23, 2022

New Home Sales Increased in November; Previous 3 Months Revised Down Sharply

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Increased in November; Previous 3 Months Revised Down Sharply

Brief excerpt:

The next graph shows the months of supply by stage of construction. “Months of supply” is inventory at each stage, divided by the sales rate.You can subscribe at https://calculatedrisk.substack.com/.

There are 1.2 months of completed supply (red line). This is getting close to the normal level.

The inventory of new homes under construction is at 5.5 months (blue line). This elevated level of homes under construction is due to supply chain constraints.

And about 2.0 months of potential inventory have not been started (grey line) - about double the normal level. Homebuilders are probably waiting to start some homes until they have a firmer grasp on prices and demand.

...

As I discussed two months ago, the Census Bureau overestimates sales, and underestimates inventory when cancellation rates are rising, see: New Home Sales and Cancellations: Net vs Gross Sales. So, take the headline sales number with a large grain of salt - the actual negative impact on the homebuilders is far greater than the headline number suggests!

There are a large number of homes under construction, and this suggests we will see a sharp increase in completed inventory over the next several months - and that will put pressure on new home prices.

New Home Sales Increase to 640,000 Annual Rate in November

by Calculated Risk on 12/23/2022 10:08:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 640 thousand.

The previous three months were revised down sharply.

Sales of new single‐family houses in November 2022 were at a seasonally adjusted annual rate of 640,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.8 percent above the revised October rate of 605,000, but is 15.3 percent below the November 2021 estimate of 756,000.

emphasis added

Click on graph for larger image.

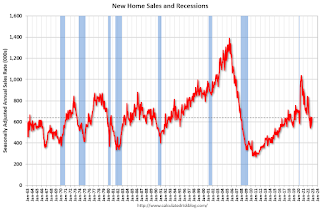

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales are below pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply decreased in November to 8.6 months from 9.3 months in October.

The months of supply decreased in November to 8.6 months from 9.3 months in October. The all-time record high was 12.1 months of supply in January 2009. The all-time record low was 3.5 months, most recently in October 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of November was 461,000. This represents a supply of 8.6 months at the current sales rate."

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In November 2022 (red column), 46 thousand new homes were sold (NSA). Last year, 54 thousand homes were sold in November.

The all-time high for November was 86 thousand in 2005, and the all-time low for November was 20 thousand in 2010.

This was above expectations, however sales in the three previous months were revised down. I'll have more later today.

Personal Income increased 0.4% in November; Spending increased 0.1%

by Calculated Risk on 12/23/2022 08:36:00 AM

The BEA released the Personal Income and Outlays report for November:

Personal income increased $80.1 billion (0.4 percent) in November, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $68.6 billion (0.4 percent) and personal consumption expenditures (PCE) increased $19.8 billion (0.1 percent).The November PCE price index increased 5.5 percent year-over-year (YoY), down from 6.1 percent YoY in October.

The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent. Real DPI increased 0.3 percent in November and real PCE increased less than 0.1 percent; goods decreased 0.6 percent and services increased 0.3 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through November 2022 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was above expectations, and the increase in PCE was below expectations.

Using the two-month method to estimate Q4 real PCE growth, real PCE was increasing at a 4.0% annual rate in Q3 2022. (Using the mid-month method, real PCE was increasing at 3.0%)

Thursday, December 22, 2022

Friday: Durable Goods, Personal Income & Outlays, New Home Sales

by Calculated Risk on 12/22/2022 08:25:00 PM

Friday:

• At 8:30 AM ET, Durable Goods Orders for November. The consensus is for a 0.1% increase..

• Also, at 8:30 AM: Personal Income and Outlays for November. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for a 0.3% increase in the PCE prices index, and the Core PCE price index to increase 0.2%. PCE prices are expected to be up 5.7% YoY, and core PCE prices up 4.7% YoY.

• At 10:00 AM: New Home Sales for November from the Census Bureau. The consensus is for 595 thousand SAAR, down from 632 thousand in October.

• Also, at 10:00 AM: University of Michigan's Consumer sentiment index (Final for December).

• Also, at 10:00 AM: State Employment and Unemployment (Monthly) for November 2022

Freddie Mac: Mortgage Serious Delinquency Rate unchanged in November

by Calculated Risk on 12/22/2022 04:48:00 PM

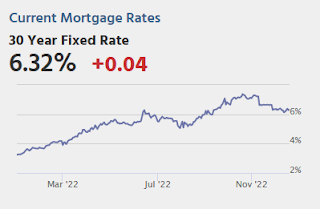

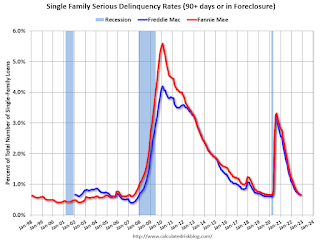

Freddie Mac reported that the Single-Family serious delinquency rate in November was 0.66%, unchanged from 0.66% October. Freddie's rate is down year-over-year from 1.24% in November 2021.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report but are not reported to the credit bureaus.

Realtor.com Reports Weekly Active Inventory Up 58% YoY; New Listings Down 17% YoY

by Calculated Risk on 12/22/2022 04:43:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Economist Jiayi Xu: Weekly Housing Trends View — Data Week Ending Dec 17, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory growth held steady with for-sale homes up 58% above one year ago. Inventory growth continues to climb higher this week after its first pause in early December.

...

• New listings–a measure of sellers putting homes up for sale–were again down, this week by 17% from one year ago

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note the rapid increase in the YoY change earlier this year, from down 30% at the beginning of the year, to up 29% YoY at the beginning of July.

Vehicle Sales Forecast: "Sales to Weaken Again in December"

by Calculated Risk on 12/22/2022 02:22:00 PM

From WardsAuto: U.S. Light-Vehicle Sales to Weaken Again in December; Inventory Set to Rise (pay content). Brief excerpt:

If Winter Storm Elliott is as bad as predicted, it will create another headwind to December deliveries on top of inventory-related issues, fear of recession and rising prices and interest rates. Conversely, because the bad weather is hitting broad swaths of the U.S. at a time when most vehicle assembly plants will be closed anyway for the holiday season, production losses should be minimal and end-of-month inventory will not significantly suffer because of it.

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for December (Red).

The Wards forecast of 13.0 million SAAR, would be down 8% from last month, but up 2% from a year ago (sales weakened in the second half of 2021, due to supply chain issues).

Lawler: Update on Rent Trends

by Calculated Risk on 12/22/2022 11:12:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: Lawler: Update on Rent Trends

Excerpt:

From housing economist Tom Lawler:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!

Recently released data from various private entities that track US rent trends indicate that US rent growth has weakened considerably this Fall, and several measures suggest that rents have fallen by more than the seasonal norm over the last few months.

Here is a table showing monthly % changes in the Apartment List Rent Index (ALRI, not smoothed), the Zillow Observed Rent Index (ZORI, smoothed via 3-month moving average), and the CoreLogic Single Family Rent Index (CLSFRI, smoothed via 3-month moving average.) I’ve included the ALRI on a 3-month moving average basis to be comparable to the other two indices.

...

These rent indices show not only has US rent growth slowed sharply, but that rents have actually begun to fall this Fall, and by more than the seasonal norm.

Q3 GDP Growth Revised Up to 3.2% Annual Rate

by Calculated Risk on 12/22/2022 08:39:00 AM

From the BEA: Gross Domestic Product (Third Estimate), GDP by Industry, and Corporate Profits (Revised), Third Quarter 2022

Real gross domestic product (GDP) increased at an annual rate of 3.2 percent in the third quarter of 2022, according to the "third" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 0.6 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised up from 1.7% to 2.3%. Residential investment was revised down from -26.8% to -27.1%.

The "third" estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.9 percent. The updated estimates primarily reflected upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment. For more information, refer to "Updates to GDP."

...

Real gross domestic income (GDI) increased 0.8 percent in the third quarter, an upward revision of 0.5 percentage point from the previous estimate. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 2.0 percent in the third quarter, an upward revision of 0.4 percentage point.

emphasis added

Weekly Initial Unemployment Claims increase to 216,000

by Calculated Risk on 12/22/2022 08:33:00 AM

The DOL reported:

In the week ending December 17, the advance figure for seasonally adjusted initial claims was 216,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 211,000 to 214,000. The 4-week moving average was 221,750, a decrease of 6,250 from the previous week's revised average. The previous week's average was revised up by 750 from 227,250 to 228,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 221,750.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.