by Calculated Risk on 6/19/2023 01:48:00 PM

Monday, June 19, 2023

Some More Good News for Homebuilders

Today, in the Calculated Risk Real Estate Newsletter: Some More Good News for Homebuilders

A brief excerpt:

Every housing cycle is different; however, I’ve been arguing that this cycle wouldn’t be anything like the new home market that followed the housing bust, and that this recovery would be more similar to other previous cycles.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

Here is an updated graph from the previous posts showing new home sales from the Census Bureau for four periods: 1978-1982, 1989 -1993, 2005-2020, and current (red). The prior peak in sales is set to 100 (updated through the April New Home sales release).

Also, it is likely that the Census Bureau is underestimating sales now since cancellation rates are falling! See: New Home Sales and Cancellations for a discussion on how cancellations impact the Census’ sales numbers.

NAHB: Builder Confidence Increased in June

by Calculated Risk on 6/19/2023 10:10:00 AM

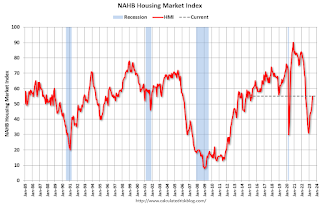

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 55, up from 50 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Moves into Positive Territory in June

Solid demand, a lack of existing inventory and improving supply chain efficiency helped shift builder confidence into positive territory for the first time in 11 months.

Builder confidence in the market for newly built single-family homes in June rose five points to 55, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This marks the sixth straight month that builder confidence has increased and is the first time that sentiment levels have surpassed the midpoint of 50 since July 2022.

A bottom is forming for single-family home building as builder sentiment continues to gradually rise from the beginning of the year. This month marks the first time in a year that both the current and future sales components of the HMI have exceeded 60, as some buyers adjust to a new normal in terms of interest rates. The Federal Reserve nearing the end of its tightening cycle is also good news for future market conditions in terms of mortgage rates and the cost of financing for builder and developer loans. Nonetheless, access for these loans has become more difficult to obtain over the last year, which will ultimately result in lower lot supplies as the industry tries to expand off cycle lows.

...

In another sign of gradual optimism for the state of demand for single-family homes, the June HMI survey shows that overall, builders are gradually pulling back on sales incentives:

• 25% of builders reduced home prices to bolster sales in June. The share was 27% in May and 30% in April. It has declined steadily since peaking at 36% in November 2022.

• The average price reduction was 7% in June, below the 8% rate in December 2022.

• 56% of builders offered incentives to buyers in June, slightly more than in May (54%), but fewer than in December 2022 (62%).

...

All three major HMI indices posted gains in June. The HMI index gauging current sales conditions rose five points to 61, the component charting sales expectations in the next six months increased six points to 62 and the gauge measuring traffic of prospective buyers increased four points to 37.

Looking at the three-month moving averages for regional HMI scores, the Northeast edged up two points to 47, the Midwest increased four points to 43, the South moved three points higher to 55 and the West posted a five-point gain to 46.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was above the consensus forecast.

Housing June 19th Weekly Update: Inventory Increased 1.8% Week-over-week

by Calculated Risk on 6/19/2023 08:21:00 AM

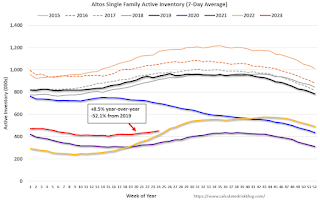

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, June 18, 2023

LA Port Inbound Traffic Down Sharply YoY in May

by Calculated Risk on 6/18/2023 08:55:00 AM

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

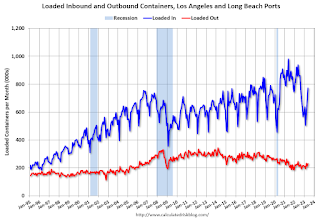

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 2.0% in May compared to the rolling 12 months ending in April. Outbound traffic decreased 0.6% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.Saturday, June 17, 2023

Real Estate Newsletter Articles this Week: Current State of the Housing Market

by Calculated Risk on 6/17/2023 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Lawler: Early Read on Existing Home Sales in May

• 3rd Look at Local Housing Markets in May

• Lawler: Update on Mortgage/Treasury Spreads

• Part 2: Current State of the Housing Market; Overview for mid-June

• Part 1: Current State of the Housing Market; Overview for mid-June

• 2nd Look at Local Housing Markets in May

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Most content is available for free (and no Ads), but please subscribe!

Schedule for Week of June 18, 2023

by Calculated Risk on 6/17/2023 08:11:00 AM

The key reports this week are May Housing Starts and Existing Home Sales.

Fed Chair Powell provides the Semiannual Monetary Policy Report to Congress on Wednesday and Thursday.

All US markets will be closed in observance of Juneteenth National Independence Day

10:00 AM: The June NAHB homebuilder survey. The consensus is for a reading of 51, up from 50 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM ET: Housing Starts for May.

8:30 AM ET: Housing Starts for May. This graph shows single and total housing starts since 1968.

The consensus is for 1.405 million SAAR, up from 1.401 million SAAR in April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to Congress, Before the U.S. House Financial Services Committee

During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 266 thousand initial claims, up from 262 thousand last week.

8:30 AM ET: Chicago Fed National Activity Index for May. This is a composite index of other data.

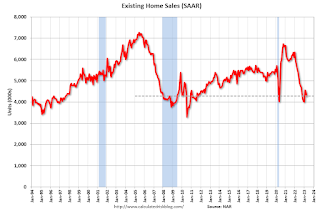

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 4.24 million SAAR, down from 4.28 million.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 4.24 million SAAR, down from 4.28 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 4.25 million SAAR for May.

10:00 AM: Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to Congress, Before the U.S. Senate Committee on Banking, Housing, and Urban Affairs

11:00 AM: the Kansas City Fed manufacturing survey for June.

No major economic releases scheduled.

Friday, June 16, 2023

June 16th COVID Update: New Pandemic Lows for Deaths and Hospitalizations

by Calculated Risk on 6/16/2023 09:17:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 6,133 | 6,642 | ≤3,0001 | |

| Deaths per Week2 | 588 | 682 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Lawler: Early Read on Existing Home Sales in May

by Calculated Risk on 6/16/2023 05:35:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, comprising over 225,000 transactions, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.25 million in May, down 0.7% from April’s preliminary pace and down 21.3% from last May’s seasonally adjusted pace. Unadjusted sales should show a smaller YOY % decline, reflecting this May’s higher business day count relative to last May’s.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was down by about 0.5% from last May.

3rd Look at Local Housing Markets in May

by Calculated Risk on 6/16/2023 03:27:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in May

A brief excerpt:

This is the third look at local markets in May. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Closed sales in May were mostly for contracts signed in March and April. Since 30-year fixed mortgage rates were in the 6% to 6.5% range in March and April - compared to the 4% to 5% range the previous year - closed sales were down significantly year-over-year in May.

...

In May, sales in these markets were down 16.3%. In April, these same markets were down 24.9% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in April for these markets, however seasonally adjusted, it is closer. Another factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates.

This data suggests the May existing home sales report will show another significant YoY decline and the 21st consecutive month with a YoY decline in sales.

More local markets to come!

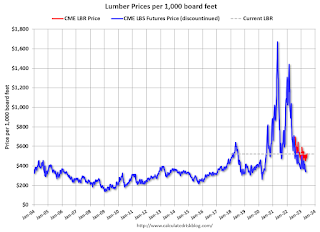

Update: Lumber Prices Down About 25% YoY

by Calculated Risk on 6/16/2023 09:52:00 AM

SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16th. I've now switched to a new physically-delivered Lumber Futures contract that was started in August 2022. Unfortunately, this impacts long term price comparisons.

This graph shows CME random length framing futures through May 16th (blue), and the new physically-delivered Lumber Futures (LBR) contract starting in August 2022 (Red).

Click on graph for larger image.

Click on graph for larger image.We didn't see a significant runup in prices this Spring due to the housing slowdown.