by Calculated Risk on 10/21/2023 02:11:00 PM

Saturday, October 21, 2023

Real Estate Newsletter Articles this Week: Existing-Home Sales Decreased to New Cycle Low

At the Calculated Risk Real Estate Newsletter this week:

• September Housing Starts: Near Record Number of Multi-Family Housing Units Under Construction

• NAR: Existing-Home Sales Decreased to 3.96 million SAAR in September; New Cycle Low

• NMHC: "Apartment Market Continues to Loosen"

• Preliminary 2024 Housing Forecasts

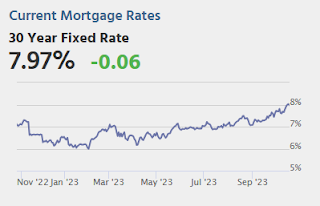

• 30-Year Mortgage Rates Hit 8.0%

• Lawler: Early Read on Existing Home Sales in September

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/

Schedule for Week of October 22, 2023

by Calculated Risk on 10/21/2023 08:11:00 AM

The key reports this week are the advance estimate of Q3 GDP and September New Home sales.

Another key indicator is Personal Income and Outlays and PCE prices for September.

For manufacturing, the Richmond and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 679 thousand SAAR, up from 675 thousand in August.

4:35 PM: Speech, Fed Chair Jerome Powell, Introductory Remarks, At the 2023 Moynihan Lecture in Social Science and Public Policy, Washington, D.C.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 205 thousand initial claims, up from 198 thousand last week.

8:30 AM: Gross Domestic Product, 3rd quarter 2022 (advance estimate). The consensus is that real GDP increased 4.1% annualized in Q3, up from 2.1% in Q2.

8:30 AM ET: Durable Goods Orders for September from the Census Bureau. The consensus is for a 0.6% increase in durable goods orders.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for October.

10:00 AM: Pending Home Sales Index for September. The consensus is 1.0% increase in the index.

8:30 AM ET: Personal Income and Outlays for September. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 3.4% YoY, and core PCE prices up 3.7% YoY.

10:00 AM: University of Michigan's Consumer sentiment index (Final for October). The consensus is for a reading of 63.2.

Friday, October 20, 2023

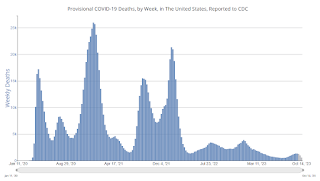

Oct 20th COVID Update: Deaths and Hospitalizations Decreased

by Calculated Risk on 10/20/2023 08:08:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 13,533 | 14,724 | ≤3,0001 | |

| Deaths per Week2 | 1,254 | 1,311 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

NMHC: "Apartment Market Continues to Loosen"

by Calculated Risk on 10/20/2023 02:46:00 PM

Today, in the Calculated Risk Real Estate Newsletter: NMHC: "Apartment Market Continues to Loosen"

A brief excerpt:

Apartment market conditions continued to weaken in the National Multifamily Housing Council's (NMHC) Quarterly Survey of Apartment Market Conditions for October 2023, as the Market Tightness (21), Sales Volume (24), Equity Financing (18), and Debt Financing (9) indexes all came in well below the breakeven level (50).There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

• The Market Tightness Index came in at 21 this quarter—below the breakeven level (50)—indicating looser market conditions for the fifth consecutive quarter. Nearly two-thirds of respondents (64%) reported markets to be looser than three months ago, while only 6% thought markets have become tighter. Meanwhile, 27% of respondents thought that market conditions were unchanged over the past three months.

Q3 GDP Tracking: Around 4%

by Calculated Risk on 10/20/2023 12:53:00 PM

The preliminary estimate of Q3 GDP will be released next Thursday, Oct 26th. The consensus estimate is real GDP increased at a 4.1% annualized rate in Q3.

From BofA:

Overall, the data flow since our last weekly pushed up our 3Q US GDP tracking estimate from 3.8% to 4.3% q/q saar. [Oct 20th estimate]From Goldman:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +4.0% (qoq ar). [Oct 19th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2023 is 5.4 percent on October 18, unchanged from October 17 after rounding. [Oct 18th estimate]

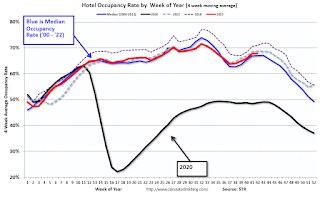

Hotels: Occupancy Rate Decreased 2.3% Year-over-year

by Calculated Risk on 10/20/2023 10:21:00 AM

U.S. hotel performance increased from the previous week, and year-over-year comparisons remained mixed, according to CoStar’s latest data through 14 October.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

8-14 October 2023 (percentage change from comparable week in 2022):

• Occupancy: 68.5% (-2.3%)

• Average daily rate (ADR): US$164.25 (+3.2%)

• Revenue per available room (RevPAR): US$112.51 (+0.8%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2023, black is 2020, blue is the median, and dashed light blue is for 2022. Dashed purple is for 2018, the record year for hotel occupancy.

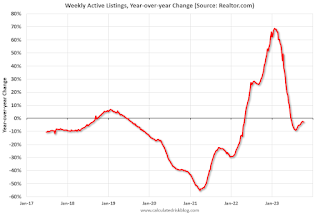

Realtor.com Reports Weekly Active Inventory Down 2.7% YoY; New Listings Down 4.4% YoY

by Calculated Risk on 10/20/2023 08:32:00 AM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Danielle Hale: Weekly Housing Trends View — Data Week Ending Oct 14, 2023

• Active inventory declined, with for-sale homes lagging behind year ago levels by 2.7%. For 17 straight weeks, the number of homes available for sale has registered below that of the previous year.

• New listings–a measure of sellers putting homes up for sale–were down again this week, by 4.4% from one year ago. Since mid-2022, new listings have registered lower than prior year levels, as the mortgage-rate lock-in effect freezes homeowners with low-rate existing mortgages in place. Although the year over year declines are smaller now than the double-digit pace seen earlier in 2023, declines from the pre-pandemic period are still substantial.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was down 2.7% year-over-year - this was the seventeenth consecutive week with a YoY decrease following 58 consecutive weeks with a YoY increase in inventory.

Thursday, October 19, 2023

Fed Chair Powell: "Inflation is still too high", expects "a period of below-trend growth"

by Calculated Risk on 10/19/2023 12:00:00 PM

Speech by Chair Powell on the economic outlook. Excerpts:

Inflation readings turned lower over the summer, a very favorable development. The September inflation data continued the downward trend but were somewhat less encouraging. Shorter-term measures of core inflation over the most recent three and six months are now running below 3 percent. But these shorter-term measures are often volatile. In any case, inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal. We cannot yet know how long these lower readings will persist, or where inflation will settle over coming quarters. While the path is likely to be bumpy and take some time, my colleagues and I are united in our commitment to bringing inflation down sustainably to 2 percent.

...

To date, declining inflation has not come at the cost of meaningfully higher unemployment—a highly welcome development, but a historically unusual one. Healing of supply chains in conjunction with the rebalancing of demand and supply in the labor market has allowed disinflation without substantially weaker economic activity. Indeed, economic growth has consistently surprised to the upside this year, as most recently seen in the strong retail sales data released earlier this week. Forecasters generally expect gross domestic product to come in very strong for the third quarter before cooling off in the fourth quarter and next year. Still, the record suggests that a sustainable return to our 2 percent inflation goal is likely to require a period of below-trend growth and some further softening in labor market conditions.

emphasis added

NAR: Existing-Home Sales Decreased to 3.96 million SAAR in September; New Cycle Low, First Sign of House Price Weakness

by Calculated Risk on 10/19/2023 10:40:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.96 million SAAR in September; New Cycle Low

Excerpt:

Sales Year-over-Year and Not Seasonally Adjusted (NSA)There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!

The fourth graph shows existing home sales by month for 2022 and 2023.

Sales declined 15.4% year-over-year compared to September 2022. This was the twenty-fifth consecutive month with sales down year-over-year. This was a new cycle low, below the 4.00 million SAAR in January 2023.

NAR: Existing-Home Sales Decreased to 3.96 million SAAR in September

by Calculated Risk on 10/19/2023 10:00:00 AM

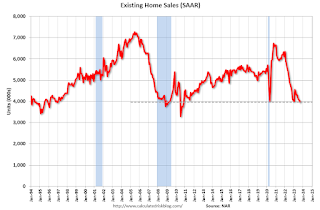

From the NAR: Existing-Home Sales Fell 2.0% in September

Existing-home sales faded in September, according to the National Association of REALTORS®. Among the four major U.S. regions, sales rose in the Northeast but receded in the Midwest, South and West. All four regions registered year-over-year sales declines.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – waned 2.0% from August to a seasonally adjusted annual rate of 3.96 million in September. Year-over-year, sales dropped 15.4% (down from 4.68 million in September 2022).

...

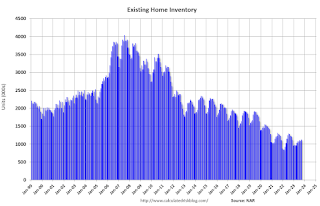

Total housing inventory registered at the end of September was 1.13 million units, up 2.7% from August but down 8.1% from one year ago (1.23 million). Unsold inventory sits at a 3.4-month supply at the current sales pace, up from 3.3 months in August and 3.2 months in September 2022.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in September (3.96 million SAAR) were down 2.0% from the previous month and were 15.4% below the September 2022 sales rate.

According to the NAR, inventory increased to 1.13 million in September down from 1.10 million the previous month.

According to the NAR, inventory increased to 1.13 million in September down from 1.10 million the previous month.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 8.1% year-over-year (blue) in September compared to September 2022.

Inventory was down 8.1% year-over-year (blue) in September compared to September 2022. Months of supply (red) increased to 3.4 months in September from 3.3 months the previous month.

This was slightly above the consensus forecast. I'll have more later.