by Calculated Risk on 12/28/2023 01:42:00 PM

Thursday, December 28, 2023

Update on FirstAm Cyber Attack

Update on FirstAm cyber attack (started on Dec 20th). This will impact December house closings. From FirstAm:

"FirstAm.com has been restored (with some limits to functionality). We will continue to post updates on this page as we return to normal business operations."

NAR: Pending Home Sales Unchanged in November; Down 5.2% Year-over-year

by Calculated Risk on 12/28/2023 10:00:00 AM

From the NAR: Pending Home Sales Recorded No Change in November

Pending home sales in November were identical to those in October, according to the National Association of REALTORS®. The Northeast, Midwest and West posted monthly gains in transactions while the South recorded a loss. All four U.S. regions registered year-over-year declines in transactions.This was below expectations. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – stayed at 71.6 in November. Year over year, pending transactions were down 5.2%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI rose 0.8% from last month to 64.4, a drop of 6.4% from November 2022. The Midwest index increased 0.5% to 76.2 in November, down 2.2% from one year ago.

The South PHSI declined 2.3% to 83.2 in November, decreasing 6.5% from the prior year. The West index climbed 4.2% in November to 54.0, falling 4.9% from November 2022.

emphasis added

Weekly Initial Unemployment Claims Increase to 218,000

by Calculated Risk on 12/28/2023 08:30:00 AM

The DOL reported:

In the week ending December 23, the advance figure for seasonally adjusted initial claims was 218,000, an increase of 12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 205,000 to 206,000. The 4-week moving average was 212,000, a decrease of 250 from the previous week's revised average. The previous week's average was revised up by 250 from 212,000 to 212,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 212,000.

The previous week was revised up.

Weekly claims were above the consensus forecast.

Wednesday, December 27, 2023

Thursday: Unemployment Claims, Pending Home Sales

by Calculated Risk on 12/27/2023 06:46:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 210 thousand, up from 205 thousand last week.

• At 10:00 AM, Pending Home Sales Index for November. The consensus is for a 0.9% increase in the index.

Inflation Adjusted House Prices 2.4% Below Peak; Price-to-rent index is 6.7% below recent peak

by Calculated Risk on 12/27/2023 11:55:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 2.4% Below Peak; Price-to-rent index is 6.7% below recent peak

Excerpt:

It has been over 17 years since the bubble peak. In the October Case-Shiller house price index released yesterday, the seasonally adjusted National Index (SA), was reported as being 70% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 10% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 1% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $424,000 today adjusted for inflation (41% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 2.4% below the recent peak, and the Composite 20 index is 3.3% below the recent peak in 2022.

In real terms, national house prices are 10.3% above the bubble peak levels. There is an upward slope to real house prices, and it has been about 17 years since the previous peak, but real prices are historically high.

Fannie and Freddie Serious Delinquencies in November: Single Family Mostly Unchanged, Multi-Family Increased

by Calculated Risk on 12/27/2023 08:19:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie Serious Delinquencies in November: Single Family Mostly Unchanged, Multi-Family Increased

Brief excerpt:

Single-family serious delinquencies were mostly unchanged in November, however, multi-family serious delinquencies increased.You can subscribe at https://calculatedrisk.substack.com/.

...

Freddie Mac reports that multi-family delinquencies increased to 0.28% in November, up from 0.15% in November 2022.

This graph shows the Freddie multi-family serious delinquency rate since 2012. Rates were still high in 2012 following the housing bust and financial crisis.

The multi-family rate increased following the pandemic and has increased recently as rent growth has slowed, vacancy rates have increased, and interest rates have increased sharply. This will be something to watch as rents soften, and more apartments come on the market.

Tuesday, December 26, 2023

Wednesday: Richmond Fed Mfg

by Calculated Risk on 12/26/2023 07:30:00 PM

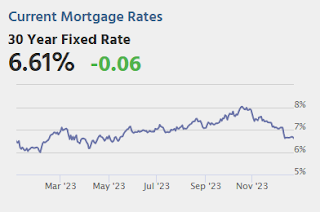

After dropping precipitously from over 8% in late October to well under 7% by December 14th, mortgage rates have been stone silent. In the 7 business days that have followed, the average top tier 30yr fixed rate hasn't moved enough to impact the typical mortgage quote. Our index has drifted microscopically higher and lower, never moving more than 0.02% from one day to the next, and never more than 0.03% from the center of the range. [30 year fixed 6.67%]Wednesday:

emphasis added

• At 10:00 AM ET, Richmond Fed Survey of Manufacturing Activity for December. This is the last of regional manufacturing surveys for December.

NOTE: No MBA mortgage survey this week.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 12/26/2023 01:24:00 PM

Two key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

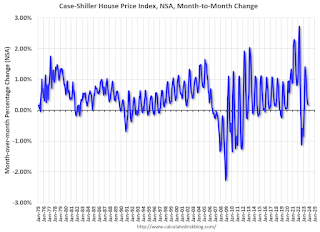

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through October 2023). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the more recent price surge changed the month-over-month pattern.

The swings in the seasonal factors were decreasing following the bust but have increased again recently - this time without a surge in distressed sales.

Comments on October Case-Shiller and FHFA House Prices

by Calculated Risk on 12/26/2023 09:45:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 4.8% year-over-year in October

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3-month average of August, September and October closing prices). October closing prices include some contracts signed in June, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted Case-Shiller National Index was at 0.65%. This was the ninth consecutive MoM increase following seven straight MoM decreases.

On a seasonally adjusted basis, prices increased in 19 of the 20 Case-Shiller cities on a month-to-month basis. Prices declined slightly in Portland in October. Seasonally adjusted, San Francisco has fallen 8.1% from the recent peak, Seattle is down 6.5% from the peak, Portland down 4.3%, Las Vegas is down 4.2%, and Phoenix is down 3.9%.

Case-Shiller: National House Price Index Up 4.8% year-over-year in October

by Calculated Risk on 12/26/2023 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3-month average of August, September and October closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Accelerates in October

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 4.8% annual change in October, up from a 4% change in the previous month. The 10-City Composite showed an increase of 5.7%, up from a 4.8% increase in the previous month. The 20-City Composite posted a year-over-year increase of 4.9%, up from a 3.9% increase in the previous month. Detroit reported the highest year-over-year gain among the 20 cities with an 8.1% increase in October, followed again by San Diego with a 7.2% increase. Portland fell 0.6% and remained the only city reporting lower prices in October versus a year ago.

...

Before seasonal adjustment, the U.S. National Index and 10-City Composite, posted 0.2% month-over-month increases in October, while the 20-City composite posted 0.1% increase.

After seasonal adjustment, the U.S. National Index, the 10-City and 20-City Composites each posted month-over-month increases of 0.6%.

"U.S. home prices accelerated at their fastest annual rate of the year in October”, says Brian D. Luke, Head of Commodities, Real & Digital assets at S&P DJI. Our National Composite rose by 0.2% in October, marking nine consecutive monthly gains and the strongest national growth rate since 2022.”

“Detroit kept pace as the fastest growing market for the second month in a row, registering an 8.1% annual gain. San Diego maintained the second spot with 7.2% annual gains, following by New York with a 7.1% gain. We are experiencing broad based home price appreciation across the country, with steady gains seen in nineteen of twenty cities. This month’s report reflects trendline growth compared to historical returns and little disparity among cities and regions.”

“Each of our 10-city, 20-city and National Index, remain at all-time highs, with 8 of 20 cities registering all-time highs (Miami, Atlanta, Chicago, Boston, Detroit, Charlotte, New York and Cleveland). While Portland remains slightly down compared to last year’s gains, Phoenix and Las Vegas have flipped to year over year gains. The Midwest and the Northeast region are fastest growing markets, while the Southwest and West regions have lagged other regions for over a year. A solid, if unspectacular report, this month’s index reflects a rising tide across nearly all markets.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.6% in October (SA) and is at a new all-time high.

The Composite 20 index is up 0.6% (SA) in October and is also at a new all-time high.

The National index is up 0.6% (SA) in October and is also at a new all-time high.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 5.7% year-over-year. The Composite 20 SA is up 4.9% year-over-year.

The National index SA is up 4.8% year-over-year.

Annual price changes were close to expectations. I'll have more later.