by Calculated Risk on 5/01/2024 08:15:00 AM

Wednesday, May 01, 2024

ADP: Private Employment Increased 192,000 in April

Private sector employment increased by 192,000 jobs in April and annual pay was up 5.0 percent year-over-year, according to the April ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”). ...This was above the consensus forecast of 180,000. The BLS report will be released Friday, and the consensus is for 210 thousand non-farm payroll jobs added in April.

“Hiring was broad-based in April,” said Nela Richardson, chief economist, ADP. “Only the information sector – telecommunications, media, and information technology – showed weakness, posting job losses and the smallest pace of pay gains since August 2021.”

emphasis added

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 5/01/2024 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 26, 2024.

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.3 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 1.4 percent compared with the previous week. The Refinance Index decreased 3 percent from the previous week and was 1 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 14 percent lower than the same week one year ago.

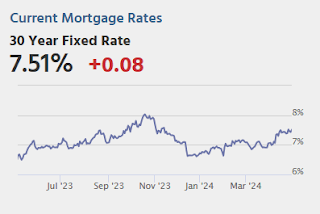

“Inflation remains stubbornly high, and this trend is convincing markets that rates, including mortgage rates, are going to stay higher for longer. No doubt, this is a headwind for the housing and mortgage markets, with the 30-year fixed mortgage rate increasing to 7.29 percent last week, the highest level since November 2023,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Application volume for both purchase and refinances declined over the week and remain well below last year’s pace. One notable trend is that the ARM share has reached its highest level for the year at 7.8 percent. Prospective homebuyers are looking for ways to improve affordability, and switching to an ARM is one means of doing that, with ARM rates in the mid-6 percent range for loans with an initial fixed period of 5 years.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 7.29 percent from 7.24 percent, with points decreasing to 0.65 from 0.66 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

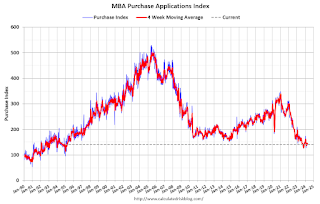

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 14% year-over-year unadjusted.

Tuesday, April 30, 2024

Wednesday: FOMC Announcement, ADP Employment, Construction Spending, Job Openings, ISM Mfg, Vehicle Sales

by Calculated Risk on 4/30/2024 07:03:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 180,000 payroll jobs added in April, down from 184,000 added in March.

• At 10:00 AM, ISM Manufacturing Index for April. The consensus is for the ISM to be at 50.1, down from 50.3 in March.

• Also at 10:00 AM, Construction Spending for March. The consensus is for a 0.3% increase in construction spending.

• Also at 10:00 AM, Job Openings and Labor Turnover Survey for March from the BLS.

• At 2:00 PM, FOMC Meeting Announcement. No change to to the Fed funds rate is expected.at this meeting.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

• All day, Light vehicle sales for April. The expectation is for light vehicle sales to be 15.7 million SAAR in April, up from 15.5 million in March (Seasonally Adjusted Annual Rate).

HVS: Q1 2024 Homeownership and Vacancy Rates

by Calculated Risk on 4/30/2024 01:00:00 PM

The Census Bureau released the Residential Vacancies and Homeownership report for Q1 2024 today.

The results of this survey were significantly distorted by the pandemic in 2020.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. Analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

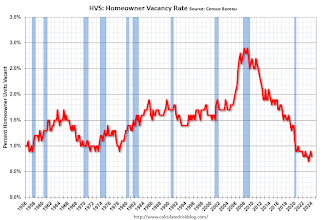

National vacancy rates in the first quarter 2024 were 6.6 percent for rental housing and 0.8 percent for homeowner housing. The rental vacancy rate was not statistically different from the rate in the first quarter 2023 (6.4 percent) and virtually the same as the rate in the fourth quarter 2023 (6.6 percent).

The homeowner vacancy rate of 0.8 percent was virtually the same as the rate in the first quarter 2023 (0.8 percent) and not statistically different from the rate in the fourth quarter 2023 (0.9 percent).

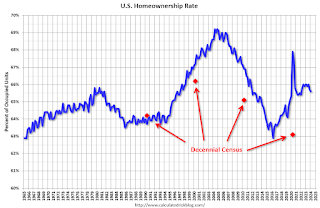

The homeownership rate of 65.6 percent was not statistically different from the rate in the first quarter 2023 (66.0 percent) and not statistically different from the rate in the fourth quarter 2023 (65.7 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The HVS homeownership rate decreased to 65.6% in Q1, from 65.7% in Q4.

The results in Q2 and Q3 2020 were distorted by the pandemic and should be ignored.

The HVS homeowner vacancy decreased to 0.8% in Q1 from 0.9% in Q4.

The HVS homeowner vacancy decreased to 0.8% in Q1 from 0.9% in Q4. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

Comments on February House Prices, FHFA: House Prices Up 7.0% YoY

by Calculated Risk on 4/30/2024 09:48:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 6.4% year-over-year in February; FHFA: House Prices Increased in February, up 7.0% YoY

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3-month average of December, January and February closing prices). January closing prices include some contracts signed in October, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.41%. This was the thirteen consecutive MoM increase, and a larger MoM increase than the previous three months.

On a seasonally adjusted basis, prices increased month-to-month in 19 of the 20 Case-Shiller cities. Only Tampa saw a month-over-month decrease in February. Seasonally adjusted, San Francisco has fallen 8.2% from the recent peak, Seattle is down 6.1% from the peak, Portland down 4.0%, and Phoenix is down 3.1%.

Case-Shiller: National House Price Index Up 6.4% year-over-year in February

by Calculated Risk on 4/30/2024 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3-month average of December, January and February closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index’s Upward Trend Persists in February 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.4% annual gain in February, up from a 6.0% rise in the previous month. The 10- City Composite showed an increase of 8.0%, up from a 7.4% increase in the previous month. The 20- City Composite posted a year-over-year increase of 7.3%, up from a 6.6% increase in the previous month. San Diego continued to report the highest year-over-year gain among the 20 cities with an 11.4% increase in February, followed by Chicago and Detroit , with an increase of 8.9%. Portland, though still holding the lowest rank after reporting two consecutive months of the smallest year-over-year growth, had a significant increase in annual gain of 2.2% in February.

...

The U.S. National Index, the 20-City Composite, and the 10-City Composite, for the first time since November 2023, showed a pre-seasonality adjustment increase of 0.6%, 0.9% and 1.0% respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.4%, while the 20-City and the 10-City Composite both reported month-over-month increases of 0.6%.

“U.S. home prices continued their drive higher,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “Our National Composite rose by 6% in January, the fastest annual rate since 2022. Stronger gains came from our 10- and 20-City Composite indices, rising 7.4% and 6.6%, respectively. For the second consecutive month, all cities reported increases in annual prices, with San Diego surging 11.2%. On a seasonal adjusted basis, home prices have continued to break through previous all-time highs set last year”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.6% in February (SA). The Composite 20 index was up 0.6% (SA) in February.

The National index was up 0.4% (SA) in February.

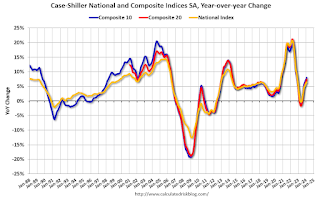

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA was up 8.0% year-over-year. The Composite 20 SA was up 7.3% year-over-year.

The National index SA was up 6.4% year-over-year.

Annual price changes were above expectations. I'll have more later.

Monday, April 29, 2024

Tuesday: Case-Shiller House Prices

by Calculated Risk on 4/29/2024 08:06:00 PM

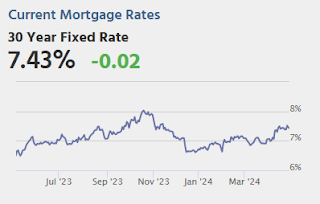

Mortgage rates didn't change much at all over the weekend with the average lender still in the highest territory since November. The average conventional 30yr fixed rate is just under 7.5% for top tier scenarios.Tuesday:

Things could end up changing quite a bit by the end of this week owing to a slew of important events and economic reports. [30 year fixed 7.43%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for February. The consensus is for a 6.7% year-over-year increase in the Comp 20 index for February.

• Also at 9:00 AM, FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:45 AM, Chicago Purchasing Managers Index for April. The consensus is for a reading of 45.0, up from 41.4 in March.

• At 10:00 AM, the Q1 2024 Housing Vacancies and Homeownership from the Census Bureau.

Q1 2024 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 4/29/2024 03:02:00 PM

The BEA released the underlying details for the Q1 advance GDP report on Friday.

The BEA reported that investment in non-residential structures decreased at a 0.1% annual pace in Q1.

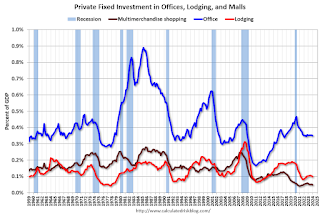

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices (blue) increased slightly in Q1 and was up 4.1% year-over-year. And declined slightly as a percent of GDP.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 1% year-over-year in Q1. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased in Q1 compared to Q4, and lodging investment was up 1% year-over-year.

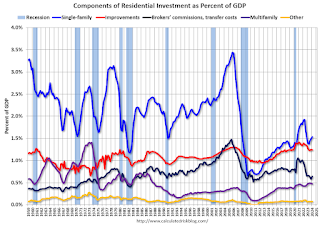

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single-family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single-family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).Investment in single family structures was up to $433 billion (SAAR) (about 1.5% of GDP) and was up 16% year-over-year.

Investment in multi-family structures was down in Q1 compared to Q4 to $133 billion (SAAR), but still up 12% YoY.

Investment in home improvement was at a $351 billion (SAAR) in Q1 (about 1.2% of GDP). Home improvement spending was strong during the pandemic but has declined as a percent of GDP recently.

Hotels: Occupancy Rate decreased 0.3% Year-over-year

by Calculated Risk on 4/29/2024 01:11:00 PM

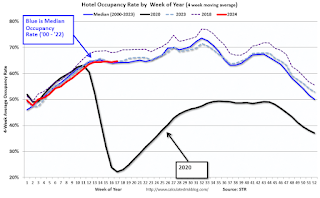

U.S. hotel performance showed mixed results from the previous week, according to CoStar’s latest data through 20 April. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

14-20 April 2024 (percentage change from comparable week in 2023):

• Occupancy: 66.8% (-0.3%)

• Average daily rate (ADR): US$158.60 (+1.5%)

• Revenue per available room (RevPAR): US$105.94 (+1.2%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

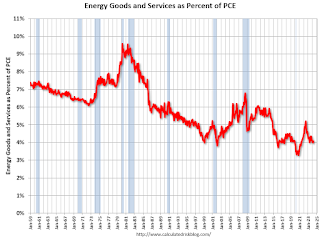

Energy expenditures as a percentage of PCE

by Calculated Risk on 4/29/2024 11:01:00 AM

During the early stages of the pandemic, energy expenditures as a percentage of PCE hit an all-time low of 3.3% of PCE. Then energy expenditures increased to 2018 levels by the end of 2021.

This graph shows expenditures on energy goods and services as a percent of total personal consumption expenditures. This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA.

In general, energy expenditures as a percent of PCE has been trending down for decades. The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.