by Calculated Risk on 5/14/2024 01:54:00 PM

Tuesday, May 14, 2024

Part 2: Current State of the Housing Market; Overview for mid-May 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-May 2024

A brief excerpt:

On Friday, in Part 1: Current State of the Housing Market; Overview for mid-May 2024 I reviewed home inventory, housing starts and sales.There is much more in the article.

In Part 2, I will look at house prices, mortgage rates, rents and more.

...

Other measures of house prices suggest prices will be up about the same YoY in the March Case-Shiller index. The NAR reported median prices were up 4.8% YoY in March, up from 5.6% YoY in February. ICE reported prices were up 5.6% YoY in March, down from 6.0% YoY in February, and Freddie Mac reported house prices were up 6.6% YoY in March, up from 6.5% YoY in February.

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. Based on recent monthly data, and the FMHPI, the YoY change in the Case-Shiller index will likely be about the same YoY in March as in February.

NY Fed Q1 Report: Household Debt and Delinquency Rates Increased

by Calculated Risk on 5/14/2024 11:00:00 AM

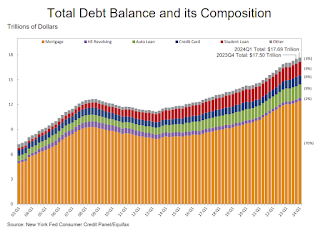

From the NY Fed: Household Debt Rose by $184 Billion in Q1 2024; Delinquency Transition Rates Increased Across All Debt Types

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The report shows total household debt increased by $184 billion (1.1%) in the first quarter of 2024, to $17.69 trillion. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

The New York Fed also issued an accompanying Liberty Street Economics blog post examining credit card utilization and its relationship with delinquency. The Quarterly Report also includes a one-page summary of key takeaways and their supporting data points.

“In the first quarter of 2024, credit card and auto loan transition rates into serious delinquency continued to rise across all age groups,” said Joelle Scally, Regional Economic Principal within the Household and Public Policy Research Division at the New York Fed. “An increasing number of borrowers missed credit card payments, revealing worsening financial distress among some households.”

Mortgage balances rose by $190 billion from the previous quarter and was $12.44 trillion at the end of March. Balances on home equity lines of credit (HELOC) increased by $16 billion, representing the eighth consecutive quarterly increase since Q1 2022, and now stand at $376 billion. Credit card balances decreased by $14 billion to $1.12 trillion. Other balances, which include retail cards and consumer loans, also decreased by $11 billion. Auto loan balances increased by $9 billion, continuing the upward trajectory seen since 2020, and now stand at $1.62 trillion.

Mortgage originations continued increasing at the same pace seen in the previous three quarters, and now stand at $403 billion. Aggregate limits on credit card accounts increased modestly by $63 billion, representing a 1.3% increase from the previous quarter. Limits on HELOC grew by $30 billion and have grown by 14% over the past two years, after 10 years of observed declines.

Aggregate delinquency rates increased in Q1 2024, with 3.2% of outstanding debt in some stage of delinquency at the end of March. Delinquency transition rates increased for all debt types. Annualized, approximately 8.9% of credit card balances and 7.9% of auto loans transitioned into delinquency. Delinquency transition rates for mortgages increased by 0.3 percentage points yet remain low by historic standards.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are three graphs from the report:

The first graph shows household debt increased in Q1. Household debt previously peaked in 2008 and bottomed in Q3 2013. Unlike following the great recession, there wasn't a decline in debt during the pandemic.

From the NY Fed:

Aggregate household debt balances increased by $184 billion in the first quarter of 2024, a 1.1% rise from 2023Q4. Balances now stand at $17.69 trillion and have increased by $3.5 trillion since the end of 2019, just before the pandemic recession.

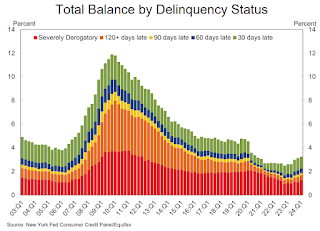

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate increased in Q1. From the NY Fed:

Aggregate delinquency rates increased in the first quarter of 2024. As of March, 3.2% of outstanding debt was in some stage of delinquency, up by 0.1 percentage point from the fourth quarter. Still, overall delinquency rates remain 1.5 percentage points lower than the fourth quarter of 2019.

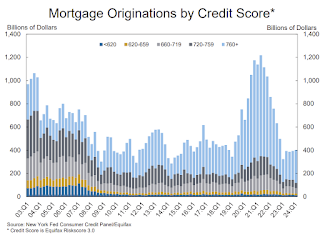

The third graph shows Mortgage Originations by Credit Score.

The third graph shows Mortgage Originations by Credit Score.From the NY Fed:

Credit quality of newly originated loans was steady, with 3% of mortgages and 16% of auto loans originated to borrowers with credit scores under 620, roughly unchanged from the fourth quarter. The median credit score for newly originated mortgages was flat at 770, while the median credit score of newly originated auto loans was four points higher than last quarter at 724, the highest on record.There is much more in the report.

CPI Previews

by Calculated Risk on 5/14/2024 08:21:00 AM

CPI for April will be released on Wednesday. The consensus is for 0.3% increase in CPI (up 3.4% YoY), and a 0.3% increase in core CPI (up 3.6% YoY). Here are a couple of analyst's forecasts.

From BofA:

For the April CPI report, we forecast headline CPI rose by 0.3% m/m. Based on our forecast, the y/y rate should tick down to 3.4%. The main factor behind our expectation for a relatively firmer headline CPI print is energy prices. Meanwhile, we expect core inflation to also print at 0.3% m/m. This would be a noticeable moderation from the 0.37% m/m 1Q average.From Goldman:

We expect a 0.28% increase in April core CPI (vs. 0.3% consensus), corresponding to a year-over-year rate of 3.61% (vs. 3.6% consensus). We expect a 0.37% increase in April headline CPI (vs. 0.4% consensus), which corresponds to a year-over-year rate of 3.42% (vs. 3.4% consensus). Our forecast is consistent with a 0.19% increase in CPI core services excluding rent and owners’ equivalent rent and with a 0.22% increase in core PCE in April. ... Going forward, we expect monthly core CPI inflation to remain in the 0.25-0.30% range for the next few months before slowing to around 0.2% by end-2024.

Monday, May 13, 2024

Tuesday: PPI, Fed Chair Powell, Q1 Quarterly Report on Household Debt and Credit

by Calculated Risk on 5/13/2024 08:10:00 PM

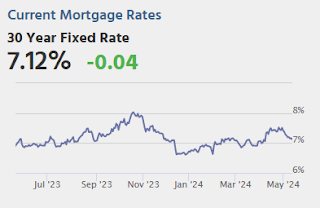

With essentially nothing on the event calendar to start the new week, it was fair to expect a continuation of the same sideways drift that characterized last week. It's not the future can ever be predicted when it comes to markets, but we can say the flat trajectory is the least surprising outcome for Monday. That same trajectory will be increasingly surprising over the next 2 days, with a special focus on Wednesday (CPI day). Even Tuesday deserves some respect with the Producer Price Index and a moderated discussion from a European banking conference with Fed Chair Powell. Today's Fed-speak wasn't worth any volatility, but the NY Fed's consumer survey showed an uptick in inflation expectations and made for a modest intraday bump at 11am ET. [30 year fixed 7.12%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for April.

• At 8:30 AM, The Producer Price Index for April from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 10:00 AM: Discussion, Fed Chair Jerome H. Powell, Moderated Discussion with Chair Powell and De Nederlandsche Bank (DNB) President Klaas Knot, At the Annual General Meeting, Foreign Bankers’ Association, Amsterdam

• At 11:00 AM, NY Fed: Q1 Quarterly Report on Household Debt and Credit

Heavy Truck Sales Increased in April

by Calculated Risk on 5/13/2024 01:53:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the April 2024 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

2nd Look at Local Housing Markets in April

by Calculated Risk on 5/13/2024 11:02:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in April

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to April 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the second look at local markets in April. I’m tracking over 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in April were mostly for contracts signed in February and March when 30-year mortgage rates averaged 6.78% and 6.82%, respectively (Freddie Mac PMMS). This is down from the 7%+ mortgage rates in the August through November period (although rates are now back above 7% again)..

...

In April, sales in these markets were up 6.7% YoY. In March, these same markets were down 9.5% year-over-year Not Seasonally Adjusted (NSA).

Sales in most of these markets are down compared to January 2019. Sales in Grand Rapids and Nashville are up compared to 2019.

...

This is a year-over-year increase NSA for these markets. However, there were two more working days in April 2024 compared to April 2023, so sales Seasonally Adjusted will be lower year-over-year than Not Seasonally Adjusted sales.

...

Many more local markets to come!

Housing May 13th Weekly Update: Inventory up 1.6% Week-over-week, Up 35.0% Year-over-year

by Calculated Risk on 5/13/2024 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, May 12, 2024

Sunday Night Futures

by Calculated Risk on 5/12/2024 08:09:00 PM

Weekend:

• Schedule for Week of May 12, 2024

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $78.26 per barrel and Brent at $82.79 per barrel. A year ago, WTI was at $70, and Brent was at $75 - so WTI oil prices are up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.60 per gallon. A year ago, prices were at $3.53 per gallon, so gasoline prices are up $0.07 year-over-year.

Trends in Educational Attainment in the U.S. Labor Force

by Calculated Risk on 5/12/2024 08:21:00 AM

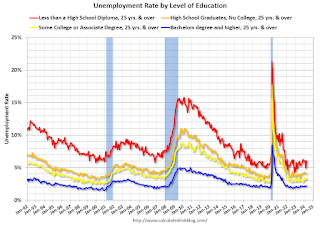

The first graph shows the unemployment rate by four levels of education (all groups are 25 years and older) through April 2024. Note: This is an update to a post from a few years ago.

Unfortunately, this data only goes back to 1992 and includes only three recessions (the stock / tech bust in 2001, and the housing bust/financial crisis, and the 2020 pandemic). Clearly education matters with regards to the unemployment rate, with the lowest rate for college graduates at 2.2% in April, and highest for those without a high school degree at 6.0% in April.

All four groups were generally trending down prior to the pandemic, and all are close to pre-pandemic levels now.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This brings up an interesting question: What is the composition of the labor force by educational attainment, and how has that been changing over time?

Here is some data on the U.S. labor force by educational attainment since 1992.

This is the only category trending up (although flattened a little recently). "Some college", "high school" and "less than high school" have been trending down.

Based on recent trends, probably half the labor force will have at least a bachelor's degree sometime next decade (2030s).

Some thoughts: Since workers with bachelor's degrees typically have a lower unemployment rate, rising educational attainment is probably a factor in pushing down the overall unemployment rate over time.

Also, I'd guess more education would mean less labor turnover, and that education is a factor in lower weekly claims.

A more educated labor force is a positive for the future.

Saturday, May 11, 2024

Real Estate Newsletter Articles this Week: Housing Starts: Record Average Length of Time from Start to Completion in 2023

by Calculated Risk on 5/11/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Housing Starts: Record Average Length of Time from Start to Completion in 2023

• Part 1: Current State of the Housing Market; Overview for mid-May 2024

• 1st Look at Local Housing Markets in April

• Asking Rents Mostly Unchanged Year-over-year

• ICE Mortgage Monitor: Annual home price growth eased in March

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.