by Calculated Risk on 6/14/2024 08:11:00 AM

Friday, June 14, 2024

Hotels: Occupancy Rate Decreased 0.1% Year-over-year

The U.S. hotel industry reported higher performance results from the previous week but mixed comparisons year over year, according to CoStar’s latest data through 8 June. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

2-8 June 2024 (percentage change from comparable week in 2023):

• Occupancy: 69.1% (-0.1%)

• Average daily rate (ADR): US$160.90 (+1.8%)

• Revenue per available room (RevPAR): US$111.26 (+1.7%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Thursday, June 13, 2024

Realtor.com Reports Active Inventory Up 36.0% YoY

by Calculated Risk on 6/13/2024 05:55:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 35.2% YoY, but still down almost 34% compared to April 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending June 8, 2024

• Active inventory increased, with for-sale homes 36.0% above year-ago levels

For the 31st straight week, there were more homes listed for sale versus the prior year, giving homebuyers more options. This past week, the inventory of homes for sale grew by 36.0% compared with last year. This growth in inventory is primarily driven by housing markets in the South, which saw a 47.2% year-over-year increase in inventory in May.

• New listings—a measure of sellers putting homes up for sale—were up this week, by 8.0% from one year ago

Seller activity continued to climb annually last week, accelerating compared to the previous two weeks’ growth. With recent mortgage rates fluctuating around 7%, potential sellers are closely monitoring these changes and adjusting their listing decisions accordingly.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 31st consecutive week.

A Very Early Look at 2025 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 6/13/2024 02:01:00 PM

The BLS reported yesterday:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 3.3 percent over the last 12 months to an index level of 308.163 (1982-84=100). For the month, the index increased 0.1 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U and is not seasonally adjusted (NSA).

• In 2023, the Q3 average of CPI-W was 301.236.

The 2023 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled is for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 3.3% year-over-year in May, and although this is very early - we need the data for July, August and September - my very early guess is COLA will probably be between 2.5% and 3.0% this year, the smallest increase since 1.3% in 2021.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one-year lag. The National Average Wage Index is not available for 2023 yet, although we know wages increased solidly in 2023. If wages increased 5% in 2023, then the contribution base next year will increase to around $177,000 in 2025, from the current $168,600.

Remember - this is a very early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

Part 2: Current State of the Housing Market; Overview for mid-June 2024

by Calculated Risk on 6/13/2024 10:49:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-June 2024

A brief excerpt:

Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-June 2024 I reviewed home inventory, housing starts and sales.There is much more in the article.

In Part 2, I will look at house prices, mortgage rates, rents and more.

...

Other measures of house prices suggest prices will be up about the same YoY in the April Case-Shiller index. The NAR reported median prices were up 5.7% YoY in April, up from 4.7% YoY in March. ICE reported prices were “cooling”, but still up 5.1% YoY in April, down from 5.7% YoY in March, and Freddie Mac reported house prices were up 6.5% YoY in April, down from 6.6% YoY in March.

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. Based on recent monthly data, and the FMHPI, the YoY change in the Case-Shiller index will likely be about the same YoY in April as in March.

Weekly Initial Unemployment Claims Increase to 242,000

by Calculated Risk on 6/13/2024 08:30:00 AM

The DOL reported:

In the week ending June 8, the advance figure for seasonally adjusted initial claims was 242,000, an increase of 13,000 from the previous week's unrevised level of 229,000. The 4-week moving average was 227,000, an increase of 4,750 from the previous week's unrevised average of 222,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 227,000.

The previous week was unrevised.

Weekly claims were much higher than the consensus forecast.

Wednesday, June 12, 2024

Thursday: Unemployment Claims, PPI

by Calculated Risk on 6/12/2024 07:56:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, down from 229 thousand last week.

• Also at 8:30 AM, The Producer Price Index for May from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.3% increase in core PPI.

FOMC Statement and Projections: No Change to Fed Funds Rate

by Calculated Risk on 6/12/2024 03:51:00 PM

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee's 2 percent inflation objective.Here are the projections. Since the last projections were released, the economy has performed close to FOMC expectations.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Michelle W. Bowman; Lisa D. Cook; Mary C. Daly; Philip N. Jefferson; Adriana D. Kugler; Loretta J. Mester; and Christopher J. Waller.

emphasis added

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| June 2024 | 1.9 to 2.3 | 1.8 to 2.2 | 1.8 to 2.1 | |

| Mar 2024 | 2.0 to 2.4 | 1.9 to 2.3 | 1.8 to 2.1 | |

The unemployment rate was at 4.0% in April and the projections for Q4 2024 were revised up slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| June 2024 | 3.9 to 4.2 | 3.9 to 4.3 | 3.9 to 4.3 | |

| Mar 2024 | 3.9 to 4.1 | 3.9 to 4.2 | 3.9 to 4.3 | |

As of April 2024, PCE inflation increased 2.7 percent year-over-year (YoY). The projections for PCE inflation were revised up.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| June 2024 | 2.5 to 2.9 | 2.2 to 2.4 | 2.0 to 2.1 | |

| Mar 2024 | 2.3 to 2.7 | 2.1 to 2.2 | 2.0 to 2.1 | |

PCE core inflation increased 2.8 percent YoY in April. The projections for core PCE inflation were revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| June 2024 | 2.8 to 3.0 | 2.3 to 2.4 | 2.0 to 2.1 | |

| Mar 2024 | 2.5 to 2.8 | 2.1 to 2.3 | 2.0 to 2.1 | |

Part 1: Current State of the Housing Market; Overview for mid-June 2024

by Calculated Risk on 6/12/2024 12:16:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-June 2024

A brief excerpt:

This 2-part overview for mid-May provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

Here is a graph of new listing from Realtor.com’s May 2024 Monthly Housing Market Trends Report showing new listings were up 6.2% year-over-year in May. New listings are still well below pre-pandemic levels. From Realtor.com:

However, sellers continued to list their homes in higher numbers this May as newly listed homes were 6.2% above last year’s levels. While a notable deceleration from last month’s 12.2% growth rate, it marks the seventh month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but still below normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be above 7%.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Cleveland Fed: Median CPI increased 0.2% and Trimmed-mean CPI increased 0.1% in May

by Calculated Risk on 6/12/2024 11:30:00 AM

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% in May. The 16% trimmed-mean Consumer Price Index increased 0.1%. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 6/12/2024 08:50:00 AM

Here are a few measures of inflation:

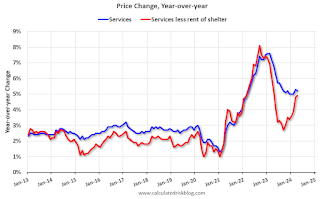

The first graph is the one Fed Chair Powell had mentioned when services less rent of shelter was up around 8% year-over-year. This declined, but has turned up recently, and is now up 5.0% YoY.

This graph shows the YoY price change for Services and Services less rent of shelter through May 2024.

Services less rent of shelter was up 5.0% YoY in May, up from 4.9% YoY in April.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were at -1.7% YoY in May, down from -1.2% YoY in April.

Here is a graph of the year-over-year change in shelter from the CPI report (through May) and housing from the PCE report (through April)

Here is a graph of the year-over-year change in shelter from the CPI report (through May) and housing from the PCE report (through April)Shelter was up 5.4% year-over-year in May, down from 5.5% in April. Housing (PCE) was up 5.6% YoY in April, down slightly from 5.8% in March.

Core CPI ex-shelter was up 1.9% YoY in May, down from 2.1% in April.