by Calculated Risk on 11/18/2024 06:53:00 PM

Monday, November 18, 2024

Tuesday: Housing Starts

The average top tier conventional 30yr fixed rate was just a hair over 7% on Friday afternoon and the same is true at the start of the new week.Tuesday:

...

As for the risk of more serious volatility, the only sure bet is that the first two weeks of December are the most important 2 weeks left in 2024. This has to do with the economic data on tap and its impact on the Fed announcement that will follow on the 3rd week. [30 year fixed 7.08%]

emphasis added

• At 8:30 AM ET, ,Housing Starts for October. The consensus is for 1.338 million SAAR, down from 1.354 million SAAR.

• At 10:00 AM, State Employment and Unemployment (Monthly) for October 2024

MBA Survey: Share of Mortgage Loans in Forbearance Increases to 0.47% in October

by Calculated Risk on 11/18/2024 05:20:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Increases to 0.47% in October

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.47% as of October 31, 2024. According to MBA’s estimate, 235,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.4 million borrowers since March 2020.At the end of October, there were about 235,000 homeowners in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance increased 7 basis points to 0.20% in October 2024. Ginnie Mae loans in forbearance increased by 30 basis points to 1.06%, and the forbearance share for portfolio loans and private-label securities (PLS) increased 6 basis points to 0.43%.

“Approximately 65,000 more borrowers are in forbearance compared to one month ago,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “While forbearances are still low compared to the height of the pandemic, the monthly increase in forbearances is the largest since May 2020 and likely driven by the effects of Hurricanes Helene and Milton.”

Added Walsh, “Of those loans in forbearance, 45 percent are related to natural disasters while the remaining 55 percent are primarily related to temporary hardship such as job loss, death, divorce, or disability. Notwithstanding the storms, some borrowers may be experiencing other economic distress. October marks the fifth consecutive month in which the forbearance rate has increased, and the performance of overall servicing portfolios and loan workouts weakened compared to this time one year ago.

emphasis added

3rd Look at Local Housing Markets in October; First Year-over-year Sales Gain Since August 2021

by Calculated Risk on 11/18/2024 12:47:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in October

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to October 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the third look at local markets in October. I’m tracking over 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in October were mostly for contracts signed in August and September when 30-year mortgage rates averaged 6.50% and 6.18%, respectively (Freddie Mac PMMS). These were the lowest mortgage rate in 2 years!

...

Here is a look at months-of-supply using NSA sales. Note the regional differences, especially in Florida and Texas (although October statistics in Florida were impacted by Hurricane Milton). This pickup in inventory is impacting prices in Florida.

...

Many more local markets to come!

NAHB: Builder Confidence Increased in November

by Calculated Risk on 11/18/2024 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 46, up from 43 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB:

Builder Confidence Moves Higher as Election Uncertainty is Lifted

Builder sentiment improved for the third straight month and builders expect market conditions will continue to improve with Republicans winning control of the White House and Congress.

Builder confidence in the market for newly built single-family homes was 46 in November, up three points from October, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today.

“With the elections now in the rearview mirror, builders are expressing increasing confidence that Republicans gaining all the levers of power in Washington will result in significant regulatory relief for the industry that will lead to the construction of more homes and apartments,” said NAHB Chairman Carl Harris, a custom home builder from Wichita, Kan. “This is reflected in a huge jump in builder sales expectations over the next six months.”

“While builder confidence is improving, the industry still faces many headwinds such as an ongoing shortage of labor and buildable lots along with elevated building material prices,” said NAHB Chief Economist Robert Dietz. “Moreover, while the stock market cheered the election result, the bond market has concerns, as indicated by a rise for long-term interest rates. There is also policy uncertainty in front of the business sector and housing market as the executive branch changes hands.”

The latest HMI survey also revealed that 31% of builders cut home prices in November. This share has remained essentially unchanged since July, hovering between 31% and 33%. Meanwhile, the average price reduction was 5%, slightly below the 6% rate posted in October. The use of sales incentives was 60% in November, slightly down from 62% in October.

...

All three HMI sub-indices were up in November. The index charting current sales conditions rose two points to 49, the component measuring sales expectations in the next six months increased seven points to 64 and the gauge charting traffic of prospective buyers posted a three-point gain to 32.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased four points to 55, the Midwest moved three points higher to 44, the South edged up one point to 42 and the West held steady at 41.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was above the consensus forecast.

Housing Nov 18th Weekly Update: Inventory Up 0.1% Week-over-week, Up 26.7% Year-over-year

by Calculated Risk on 11/18/2024 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, November 17, 2024

Sunday Night Futures

by Calculated Risk on 11/17/2024 06:57:00 PM

Weekend:

• Schedule for Week of November 17, 2024

Monday:

• At 10:00 AM ET, The November NAHB homebuilder survey. The consensus is for a reading of 42, down from 44. Any number below 50 indicates that more builders view sales conditions as poor than good.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 5 and DOW futures are down 39 (fair value).

Oil prices were down over the last week with WTI futures at $66.78 per barrel and Brent at $70.91 per barrel. A year ago, WTI was at $76, and Brent was at $81 - so WTI oil prices are down about 12% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.03 per gallon. A year ago, prices were at $3.29 per gallon, so gasoline prices are down $0.26 year-over-year.

Hotels: Occupancy Rate Decreased 3.5% Year-over-year

by Calculated Risk on 11/17/2024 08:57:00 AM

As projected for election week, the U.S. hotel industry reported negative year-over-year performance comparisons, according to CoStar’s latest data through 9 November. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

3-9 November 2024 (percentage change from comparable week in 2023):

• Occupancy: 62.6% (-3.5%)

• Average daily rate (ADR): US$156.11 (-0.1%)

• Revenue per available room (RevPAR): US$97.73 (-3.5%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, November 16, 2024

Real Estate Newsletter Articles this Week: Watch Months-of-Supply!

by Calculated Risk on 11/16/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Part 1: Current State of the Housing Market; Overview for mid-November 2024

• Part 2: Current State of the Housing Market; Overview for mid-November 2024

• NY Fed: Mortgage Originations by Credit Score, Delinquencies Increase, Foreclosures Remain Low

• 2nd Look at Local Housing Markets in October

• Watch Months-of-Supply!

• Lawler: Early Read on Existing Home Sales in October

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of November 17, 2024

by Calculated Risk on 11/16/2024 08:11:00 AM

The key economic reports this week are Housing Starts and Existing Home sales.

For manufacturing, the November Philly and Kansas City Fed surveys, will be released this week.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 42, down from 44. Any number below 50 indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. This graph shows single and total housing starts since 1968.

The consensus is for 1.338 million SAAR, down from 1.354 million SAAR.

10:00 AM: State Employment and Unemployment (Monthly) for October 2024

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 222 thousand initial claims, up from 217 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 5.0, down from 10.3.

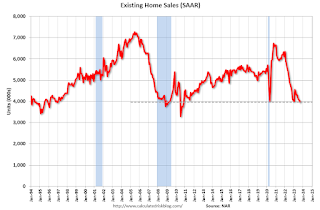

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 3.88 million SAAR, up from 3.84 million in September.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 3.88 million SAAR, up from 3.84 million in September.The graph shows existing home sales from 1994 through the report last month.

11:00 AM: the Kansas City Fed manufacturing survey for November.

10:00 AM: University of Michigan's Consumer sentiment index (Final for November).

Friday, November 15, 2024

November 15th COVID Update: COVID in Wastewater Continues to Decline

by Calculated Risk on 11/15/2024 07:46:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 675 | 783 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.