by Calculated Risk on 1/09/2025 07:46:00 PM

Thursday, January 09, 2025

Friday: Employment Report

• At 8:30 AM ET, Employment Report for December. The consensus is for 160,000 jobs added, and for the unemployment rate to be unchanged at 4.2%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for January)

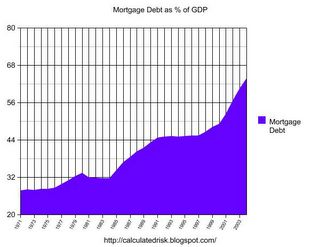

The Housing Bubble and Mortgage Debt as a Percent of GDP

by Calculated Risk on 1/09/2025 11:44:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Update: The Housing Bubble and Mortgage Debt as a Percent of GDP

A brief excerpt:

Two years ago, I wrote The Housing Bubble and Mortgage Debt as a Percent of GDP. Here is an update to a couple of graphs. The bottom line remains the same: There will not be cascading price declines in this cycle due to distressed sales.There is much more in the article.

In a 2005 post, I included a graph of household mortgage debt as a percent of GDP. Several readers asked if I could update the graph.

First, from February 2005 (20 years ago!):The following chart shows household mortgage debt as a % of GDP. Although mortgage debt has been increasing for years, the last four years have seen a tremendous increase in debt. Last year alone mortgage debt increased close to $800 Billion - almost 7% of GDP. ...And a serious problem is what happened!

Many homeowners have refinanced their homes, in essence using their homes as an ATM.

It wouldn't take a RE bust to impact the general economy. Just a slowdown in both volume (to impact employment) and in prices (to slow down borrowing) might push the general economy into recession. An actual bust, especially with all of the extensive sub-prime lending, might cause a serious problem.

December Employment Preview

by Calculated Risk on 1/09/2025 08:55:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus is for 160,000 jobs added, and for the unemployment rate to be unchanged at 4.2%.

There were 227,000 jobs added in November, and the unemployment rate was at 4.2%.

We expect a below-consensus 125k increase in payrolls (vs. +160k consensus) in December. We are below consensus because 1) Big Data indicators point to slower job growth in December and 2) we estimate that an unfavorable calendar configuration could be a 50k drag. ... We forecast that the unemployment rate edged up to 4.3%.From BofA:

emphasis added

We expect nonfarm payrolls to rise by 175k in Dec after coming in at 227k in Nov (Exhibit 1). This above-consensus (160k) forecast is driven by initial jobless claims remaining extremely low in Dec. In terms of the HH survey, we expect some payback in Dec for two consecutive months of weak employment. This should keep the u-rate at 4.2%.• ADP Report: The ADP employment report showed 122,000 private sector jobs were added in December. This was below consensus forecasts and suggests job gains below consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM indexes are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased to was at 45.3%, down from 48.1%. This would suggest about 45,000 jobs lost in manufacturing. The ADP report indicated 11,000 manufacturing jobs lost in December.

The ISM® services employment index decreased to 51.4% from 51.5%. This would suggest 110,000 jobs added in the service sector. Combined this suggests 65,000 jobs added, far below consensus expectations. (Note: The ISM surveys have been way off recently)

• Unemployment Claims: The weekly claims report showed more initial unemployment claims during the reference week at 220,000 in December compared to 215,000 in November. This suggests slightly more layoffs in December compared to November.

Weekly Initial Unemployment Claims Decrease to 201,000

by Calculated Risk on 1/09/2025 08:30:00 AM

This was released yesterday (due to National Day of Mourning). The DOL reported:

In the week ending January 4, the advance figure for seasonally adjusted initial claims was 201,000, a decrease of 10,000 from the previous week's unrevised level of 211,000. The 4-week moving average was 213,000, a decrease of 10,250 from the previous week's unrevised average of 223,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 213,000.

The previous week was unrevised

Weekly claims were lower than the consensus forecast.

Wednesday, January 08, 2025

Thursday: National Day of Mourning for former President Jimmy Carter, Unemployment Claims

by Calculated Risk on 1/08/2025 08:12:00 PM

• The US NYSE and the NASDAQ will be closed in observance of a National Day of Mourning for former President Jimmy Carter.

• At 6:00 AM ET, NFIB Small Business Optimism Index for December.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 210 thousand from 211 thousand last week.

Leading Index for Commercial Real Estate Increased 10% in December

by Calculated Risk on 1/08/2025 04:15:00 PM

From Dodge Data Analytics: Dodge Momentum Index Grows 10% in December

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, grew 10.2% in December to 212.0 (2000=100) from the revised November reading of 192.3. Over the month, commercial planning increased 14.2% while institutional planning improved 2.5%.

“Commercial activity rebounded strongly in December, thanks to a re-acceleration in data center and warehouse planning activity,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “Overall, the strong performance of the Momentum Index this past year is expected to support nonresidential construction spending throughout 2025.”

On the commercial side, data center and warehouse planning drove much of the growth this month, while stronger healthcare and education activity supported the institutional portion. In December, the DMI was up 19% when compared to year-ago levels. The commercial segment was up 30% from December 2023, while the institutional segment was flat over the same period. The influence of data centers on the DMI this year has been substantial. If we remove all data center projects in 2023 and 2024, commercial planning would be up 8% from year-ago levels, and the entire DMI would be up 5%.

...

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 212.0 in December, up from 192.3 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a slowdown in early 2025, but a pickup in mid-2025.

FOMC Minutes: "The process [of reaching inflation target] could take longer than previously anticipated"

by Calculated Risk on 1/08/2025 02:38:00 PM

From the Fed: Minutes of the Federal Open Market Committee, December 17–18, 2024. Excerpt:

With regard to the outlook for inflation, participants expected that inflation would continue to move toward 2 percent, although they noted that recent higher-than-expected readings on inflation, and the effects of potential changes in trade and immigration policy, suggested that the process could take longer than previously anticipated. Several observed that the disinflationary process may have stalled temporarily or noted the risk that it could. A couple of participants judged that positive sentiment in financial markets and momentum in economic activity could continue to put upward pressure on inflation. All participants judged that uncertainty about the scope, timing, and economic effects of potential changes in policies affecting foreign trade and immigration was elevated. Reflecting that uncertainty, participants took varied approaches in accounting for these effects. A number of participants indicated that they incorporated placeholder assumptions to one degree or another into their projections. Other participants indicated that they did not incorporate such assumptions, and a few participants did not indicate whether they incorporated such assumptions.

emphasis added

1st Look at Local Housing Markets in December

by Calculated Risk on 1/08/2025 01:02:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in December

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to December 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the first look at several early reporting local markets in December. I’m tracking over 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

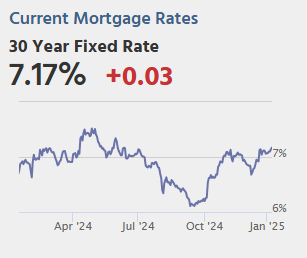

Closed sales in December were mostly for contracts signed in October and November when 30-year mortgage rates averaged 6.43% and 6.81%, respectively (Freddie Mac PMMS). This was an increase from the average rate for homes that closed in November, but down from the average rate of 7.5% in October and November 2023.

...

In December, sales in these markets were up 18.1% YoY. Last month, in November, these same markets were up 17.6% year-over-year Not Seasonally Adjusted (NSA).

Note that most of these early reporting markets have shown stronger year-over-year sales than most markets (for the last several months).

Important: There was one more working day in December 2024 (21) as compared to December 2023 (20). So, the year-over-year change in the headline SA data will less than the NSA data suggests (there are other seasonal factors).

...

This was just several early reporting markets. Many more local markets to come!

Wholesale Used Car Prices Decreased in December; Up 0.4% Year-over-year

by Calculated Risk on 1/08/2025 09:58:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decreased in December

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were lower in December compared to November. The Manheim Used Vehicle Value Index (MUVVI) fell to 204.8, an increase of 0.4% from a year ago. The seasonal adjustment to the index reduced the change for the month, as non-seasonally adjusted values declined at a higher rate. The non-adjusted price in December decreased by 0.8% compared to November, moving the unadjusted average price up 0.3% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

ADP: Private Employment Increased 122,000 in December

by Calculated Risk on 1/08/2025 08:15:00 AM

From ADP: ADP National Employment Report: Private employers added 122,000 jobs in December

“The labor market downshifted to a more modest pace of growth in the final month of 2024, with a slowdown in both hiring and pay gains. Health care stood out in the second half of the year, creating more jobs than any other sector.This was below the consensus forecast of 143,000. The BLS report will be released Friday, and the consensus is for 150,000 non-farm payroll jobs added in December.

emphasis added