by Calculated Risk on 2/05/2025 08:30:00 AM

Wednesday, February 05, 2025

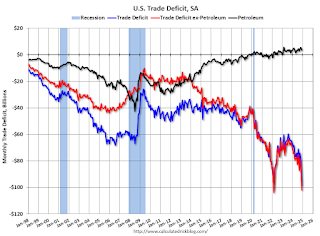

Trade Deficit increased to $98.4 Billion in December

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $98.4 billion in December, up $19.5 billion from $78.9 billion in November, revised.

December exports were $266.5 billion, $7.1 billion less than November exports. December imports were $364.9 billion, $12.4 billion more than November imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports and imports increased in November.

Exports are up 2.5% year-over-year; imports are up 12.4% year-over-year.

Both imports and exports have generally increased recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have been increasing.

The trade deficit with China increased to $25.0 billion from $22.0 billion a year ago. It is likely some importers were trying to beat potential tariffs.

ADP: Private Employment Increased 183,000 in January

by Calculated Risk on 2/05/2025 08:15:00 AM

“We had a strong start to 2025 but it masked a dichotomy in the labor market,” said Nela Richardson, chief economist, ADP. “Consumer-facing industries drove hiring, while job growth was weaker in business services and production.”This was above the consensus forecast of 150,000. The BLS report will be released Friday, and the consensus is for 170,000 non-farm payroll jobs added in January.

emphasis added

MBA: Mortgage Refinance Applications Increased in Weekly Survey; Purchase Applications Declined

by Calculated Risk on 2/05/2025 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 31, 2025. Last week’s results include an adjustment for the Martin Luther King holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 2.2 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 19 percent compared with the previous week. The Refinance Index increased 12 percent from the previous week and was 17 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index increased 15 percent compared with the previous week and was 0.2 percent higher than the same week one year ago.

“Mortgage rates moved lower last week, consistent with lower Treasury yields following the FOMC meeting and a volatile week for stock market. The 30-year fixed rate declined to its lowest level in six weeks at 6.97 percent,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Mortgage applications responded to these lower rates and were up for the week overall, driven by a 12 percent increase in refinance applications, which had their strongest week since December 2024.”

Added Kan, “Purchase activity had a tougher week, with declines across all loan types. The average loan size for a purchase loan has increased since the start of the year and continued that trend last week with weaker government purchase activity, which reached $447,300, the highest level since October 2024.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.97 percent from 7.02 percent, with points increasing to 0.64 from 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 0.2% year-over-year unadjusted.

Tuesday, February 04, 2025

Wednesday: Trade Deficit, ADP Employment, ISM Services

by Calculated Risk on 2/04/2025 07:58:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 150,000 payroll jobs added in January, up from 122,000 added in December.

• At 8:30 AM, Trade Balance report for December from the Census Bureau. The consensus is the trade deficit to be $87.0 billion. The U.S. trade deficit was at $78.2 billion in November.

• At 10:00 AM, ISM Services Index for January.

U.S. Courts: Bankruptcy Filings Increase 14 Percent in 2024; 33% Below Pre-Pandemic Levels

by Calculated Risk on 2/04/2025 04:40:00 PM

From the U.S. Courts: Bankruptcy Filings Rise 14.2 Percent

Total bankruptcy filings rose 14.2 percent, with increases in both business and non-business bankruptcies, in the twelve-month period ending Dec. 31, 2024. This continues an ongoing rebound in filings after more than a decade of sharply dropping totals.

According to statistics released by the Administrative Office of the U.S. Courts, annual bankruptcy filings totaled 517,308 in the year ending December 2024, compared with 452,990 cases in the previous year.

Business filings rose 22.1 percent, from 18,926 to 23,107, in the year ending Dec. 31, 2024. Non-business bankruptcy filings rose 13.9 percent to 494,201, compared with 434,064 in December 2023.

Bankruptcy totals for the previous 12 months are reported four times annually.

For more than a decade, total filings fell steadily, from a high of nearly 1.6 million in September 2010 to a low of 380,634 in June 2022. Total filings have increased each quarter since then, but they remain far lower than historical highs.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the business and non-business bankruptcy filings by calendar year since 1997.

The sharp decline in 2006 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005".

2024 was the 4th lowest year for bankruptcy filings, and 33% below the pre-pandemic level in 2019.

Heavy Truck Sales Increased 5% YoY in January

by Calculated Risk on 2/04/2025 02:44:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the January 2025 seasonally adjusted annual sales rate (SAAR) of 534 thousand.

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 288 thousand SAAR in May 2020.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Fannie and Freddie: Single Family Serious Delinquency Rates Increased in December

by Calculated Risk on 2/04/2025 11:27:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family Serious Delinquency Rates Increased in December

Excerpt:

Freddie Mac reported that the Single-Family serious delinquency rate in December was 0.59%, up from 0.56% November. Freddie's rate is up year-over-year from 0.55% in December 2023, however, this is below the pre-pandemic level of 0.60%.

Freddie's serious delinquency rate peaked in February 2010 at 4.20% following the housing bubble and peaked at 3.17% in August 2020 during the pandemic.

Fannie Mae reported that the Single-Family serious delinquency rate in December was 0.56%, up from 0.53% in November. The serious delinquency rate is up year-over-year from 0.55% in December 2023, however, this is below the pre-pandemic lows of 0.65%.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

BLS: Job Openings Decreased to 7.6 million in December

by Calculated Risk on 2/04/2025 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings decreased to 7.6 million on the last business day of December, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and total separations were little changed at 5.5 million and 5.3 million, respectively. Within separations, quits (3.2 million) and layoffs and discharges (1.8 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for December; the employment report this Friday will be for January.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in December to 7.60 million from 8.12 million in November.

The number of job openings (black) were down 15% year-over-year.

Quits were down 7% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Monday, February 03, 2025

Tuesday: Job Openings

by Calculated Risk on 2/03/2025 08:31:00 PM

We know that mortgage rates are driven by financial markets and we know that financial markets have experienced volatility amid the roll-out of new tariffs over the weekend. But rates are starting the current week right in line with Friday's latest levels (themselves, little-changed from any other day last week). [30 year fixed 7.05%]Tuesday:

emphasis added

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for December from the BLS.

Vehicles Sales Decrease to 15.60 million SAAR in January

by Calculated Risk on 2/03/2025 05:00:00 PM

Wards Auto released their estimate of light vehicle sales for January: U.S. Light-Vehicle Sales Start 2025 With 4% Increase in January (pay site).

There did not appear to be an end-of-month boost in demand, either as a rebound from the mid-month weather-related losses or pull-ahead volume in case of still-possible future tariff-related price increases. However, January’s gain marked the fourth straight year-over-year increase in volume and fifth consecutive for the seasonally adjusted annual rate.

Click on graph for larger image.

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards' estimate for January (red).

Sales in January were at the consensus forecast.