by Calculated Risk on 3/03/2009 09:12:00 AM

Tuesday, March 03, 2009

James Baker: "Prevent Zombie Banks"

James Baker writes in the Financial Times: How Washington can prevent ‘zombie banks’

[T]he US may be repeating Japan’s mistake by viewing our current banking crisis as one of liquidity and not solvency. Most proposals advanced thus far assume that, once confidence in financial markets is restored, banks will recover.There are calls across the political spectrum to avoid zombie banks. No one wants to nationalize the banks, just preprivatize the "hopeless".

But if their assumption is wrong, we risk perpetuating US zombie banks and suffering a lost American decade.

...

First, we need to understand the scope of the problem. The Treasury department – working with the Federal Reserve – must swiftly analyse the solvency of big US banks. Treasury secretary Timothy Geithner’s proposed “stress tests” may work. Any analyses, however, should include worst-case scenarios. We can hope for the best but should be prepared for the worst.

Next, we should divide the banks into three groups: the healthy, the hopeless and the needy. Leave the healthy alone and quickly close the hopeless. The needy should be reorganised and recapitalised, preferably through private investment or debt-to-equity swaps but, if necessary, through public funds. It is time for triage.

This is similar to my suggestion (and others) a few weeks ago:

The banks will probably fall into one of three categories:BTW the banks have been told to submit their stress test results to the Treasury by Wednesday March 11th. Although the stress test appears inadequate, and the 3rd option - "closing the hopeless" - is apparently off the table.

1) No additional assistance required. ...

2) The banks in between that will need additional capital. This is where the Capital Assistance Program comes in: ...

3) Banks that will need to be nationalized or sold.

...

The sooner the better, although March 12th works for me (30 days from Geithner's speech)! ...

Monday, March 02, 2009

House "Deal of the Week"

by Calculated Risk on 3/02/2009 10:19:00 PM

For market discussion and graphs of the Grizzly Bear, see: Market: More Cliff Diving

Note: For the grim economic news in graphs, please see my post yesterday: February Economic Summary in Graphs

Here is another Deal of the Week from Zach Fox at the San Diego North County Times: Turning back the clock in Vista

The featured 1,600 square feet, three-bedroom, two-bath house in Vista, CA was built in 1982.

Sold in August 1989: $165,000

Sold in August 2005: $520,000

Sold in December 2008: $100,000

Zach doesn't say, but I bet the house was trashed by the most recent owner. In general Vista is a decent area, and this is quite a round trip.

For those interested, here are few sources for futures and the foreign markets.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets. (ht Jeffrey)

Best to all.

WSJ: Leaked Details on Public-Private Entities Buying Bad Bank Assets

by Calculated Risk on 3/02/2009 08:40:00 PM

From the WSJ: Funding for 'Bad Banks' Starts to Get Fleshed Out

The Obama administration ... is considering creating multiple investment funds to purchase the bad loans and other distressed assets that lie at the heart of the financial crisis ...By offering low interest non-recourse loans, these public-private entities can pay a higher than market price for the toxic assets (since there is no downside risk). This amounts to a direct subsidy from the taxpayers to the banks. It is amazing how many different ways they've tried to recycle the same bad idea.

The Obama team announced its intention to partner with the private sector to buy $500 billion to $1 trillion of distressed assets as part of its revamping of the $700 billion bank bailout last month. ...

... one leading idea is to establish separate funds to be run by private investment managers. The managers would have to put up a certain amount of capital. Additional financing would come from the government, which would share in any profit or loss.

These private investment managers would run the funds, deciding which assets to buy and what prices to pay. The government would contribute money from the $700 billion bailout, with additional financing likely coming from the Federal Reserve and by selling government-backed debt. Other investors, such as pension funds, could also participate. To encourage participation, the government would try to minimize risk for private investors, possibly by offering non-recourse loans.

... the government wants to encourage private investors to buy up the assets in a way that would come closer to setting a market price where no market currently exists.

Ken (CR Companion fame) on Comments

by Calculated Risk on 3/02/2009 06:15:00 PM

The Haloscan comment system crash on Friday. Ken has suggested the following:

With this recent haloscan failure, I’ve been investigating JS-Kit and its alternatives (disqus, intensedebate, sezwho). I’ve been frustrated by how ill suited they are to a community like CalculatedRisk, which is really more a real time salon than a blog with semi-static comments.

I’ve also had an evolving interest in enhancing the commenting experience for Calculated Risk users, first through CR Companion, and more recently in building a prototype for a searchable index. Lately I’ve been bubbling with ideas on what could be done to improve things specifically for this blog. But I’ve also been somewhat wary of taking the project on, as this truly is a 24/7 community, and I’ve witnessed how harshly judgment can come over the tubz (the recent Louis CK Everything’s Amazing, Nobody’s Happy bit comes to mind). I may be a CR addict, but I do have a family and personal life, and would like to keep them.

It occurred to me today that there is an alternative. There are clearly a great many talented IT people on this blog, several of whom have already demonstrated both their interest and mojo quite effectively. Perhaps some of you might be interested in joining into the process of building and maintaining an alternative system that is written specifically for us? One that could satisfy the various nits many of you have?

What I’m envisioning is building a site that runs in parallel to JS-Kit for awhile, posting back and forth, much like CRBot’s iRC channel, for safety’s sake.

To get the ball rolling, here are some of the features I’ve been picturing, grouped by Must Haves and Would Be Cool. I imagine you have some of your own ...

Must HavesWould Be CoolFast Simple Generic browser support, including mobile devices Registration (simple, relatively anonymous, with openID support) Multiple moderators (for CR’s sanity) Permalinks per comment Homepage links Threading with a better UI for real time (before you say “yuck!” or “huh?”, let me put together a prototype so you can see what I mean) Choice of a decent editor, with preview and edits within a 5 minute window Keyword searchable archives, with slices by user, CR Post, date, tag (see below) Multiple handles, single user Personal profiles (member since, homepage, deep thoughts, etc.) Visitor count Anyone interested? There’ll be need for client and server developers, sysadmin types, graphic designers, testers, lawyers, nay-sayers, etc. This might take awhile, but it’ll be worth it.Autorefresh (like CR Companion, only more efficient) CRVIX and other stats Tags per comment/thread (e.g. news, well-said, funny, youtube, thread-music, thread-of-the-day) Word clouds per CR post, or per user to give a quick sense of what’s being discussed (or constantly ranted about) Private ratings and filters, ala CR Companion (I’ve taken to heart the desire to avoid a public popularity contest) Top Ten Threads of the Day New post notification (CRBot/The Pig), maybe even from multiple sites like CRBot does (with tags, so people can ignore if desired) A financial dashboard mashup An easy way to paste in references to previous comments

Market: More Cliff Diving

by Calculated Risk on 3/02/2009 03:48:00 PM

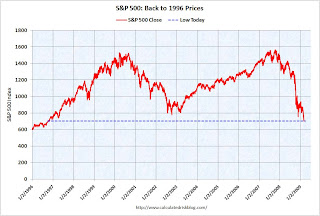

The S&P 500 closed just above 700. We are back to 1996 prices ...

The low in 1997 was 737.01.

The low in 1996 was 598.48. Click on graph for larger image in new window.

Click on graph for larger image in new window.

DOW off about 4.3%

S&P 500 off about 4.7%

NASDAQ off 4.0%

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". (If not updated right way, Doug should update in a few minutes)

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Vehicle Sales in January

by Calculated Risk on 3/02/2009 02:22:00 PM

The BEA released vehicle sales for January this morning. Total auto and truck sales in the U.S. were below 10 million (SAAR) for the first time since 1982. I've update the sales and turnover graphs below with the January data.

The automakers will release February sales numbers tomorrow, and here is a preview from MarketWatch: No sales bounce in sight for automakers

The total industry decline, according to Edmunds.com, is expected to reach 41.4%. Most forecasts on Wall Street call for a seasonally adjusted annual rate of sales in the low 9-million range, down from 9.6 million last month, which marked a 26-year low.

...

"The crisis in the automotive market continues to worsen, but we believe we are nearing the bottom of this cycle," J.D. Power analyst Jeff Schuster said in a report last week. "Our expectation is for February or March to be the low point, but a high degree of uncertainty and risk remains for the second half of 2009."

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows monthly vehicle sales (autos and trucks) as reported by the BEA at a Seasonally Adjusted Annual Rate (SAAR).

This shows that sales have plunged to just over a 9.75 million annual rate in January - the lowest rate since 1982. If the car analysts are correct, February will be even worse.

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).Currently this ratio is at 25.5 years, the highest ever. This is an unsustainable level (I doubt most vehicles will last 25 years!), and the ratio will probably decline over the next few years. This could happen with vehicles being removed from the fleet, but more likely because of a sales increase.

This suggests vehicle sales are much nearer the bottom than the top, and there will probably be some sort of modest rebound later this year or in 2010.

January PCE and Personal Saving Rate

by Calculated Risk on 3/02/2009 11:36:00 AM

Amid all the gloom this morning - the AIG bailout and massive losses, the weak manufacturing ISM index, the cliff diving construction spending numbers - there was this Personal Income and Outlays report for January from the BEA.

This report showed that personal income increased in January, however the increase was mostly because of special factors related to government and military wage increases. But this report also showed that PCE was up slightly from October to January (the period that matters for GDP); about 0.7% in real terms annualized. Not much - and this is just one data point and could be revised, and this might be impacted by gift cards (this data uses the January retail numbers) - but perhaps PCE won't fall completely off a cliff in Q1. I still expect PCE to decline sharply in Q1, but maybe not as rapidly as in Q3 2008 (-3.8% SAAR) and Q4 2008 (-4.3% SAAR)

(SAAR: seasonally adjusted annual rate)

Also interesting:

Personal saving -- DPI less personal outlays -- was $545.5 billion in January, compared with $416.8 billion in December. Personal saving as a percentage of disposable personal income was 5.0 percent in January, compared with 3.9 percent in December.This increase in the percent saved is an important part of the rebalancing process and helps repair household balance sheets.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing).

Although this data may be revised significantly, this does suggest households are saving substantially more than during the last few years (when they saving rate was close to zero). This is a necessary but painful step ... and a rising saving rate will repair balance sheets, but also keep downward pressure on personal consumption.

February 2009 Manufacturing ISM: Employment Index at Record Low

by Calculated Risk on 3/02/2009 10:30:00 AM

From the ISM: February 2009 Manufacturing ISM Report On Business®

"Manufacturing continues to decline at a rapid rate in February. While production has slowed its rate of decline, employment continues to fall precipitously. Prices continue to decline, but price advantages are not sufficient to overcome manufacturers' apparent loss of demand. Survey respondents appear generally pessimistic about recovery in 2009."Manufacturing is still contracting, and employment is especially weak with the employment index at a record low (since the index started in 1948).

...

Manufacturing contracted in February as the PMI registered 35.8 percent, which is 0.2 percentage point higher than the 35.6 percent reported in January. This is the 13th consecutive month of contraction in the manufacturing sector. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

...

ISM's Employment Index registered 26.1 percent in February, which is 3.8 percentage points lower than the 29.9 percent reported in January. This is the seventh consecutive month of decline in employment. An Employment Index above 49.7 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

Construction Spending: Non-Residential Cliff Diving

by Calculated Risk on 3/02/2009 10:01:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months to two years. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is now at the year ago level and will turn strongly negative going forward. Residential construction spending is still declining, although the YoY change will probably be less negative going forward.

These are two key stories for 2009: the collapse in private non-residential construction, and the probably bottom for residential construction spending.

From the Census Bureau: January 2009 Construction at $986.2 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $682.6 billion, 3.7 percent (±1.1%) below the revised December estimate of $709.0 billion. Residential construction was at a seasonally adjusted annual rate of $291.5 billion in January, 2.9 percent (±1.3%) below the revised December estimate of $300.3 billion. Nonresidential construction was at a seasonally adjusted annual rate of $391.0 billion in January, 4.3 percent (±1.1%) below the revised December estimate of $408.7 billion.

AIG: $61.7 Billion Loss

by Calculated Risk on 3/02/2009 06:21:00 AM

For the Fed and Treasury AIG restructuring announcement, please see the previous post.

From MarketWatch: AIG reports fourth-quarter loss of over $61 billion

[AIG] said its fourth-quarter loss widened to $61.66 billion, or $22.95 a share, from the $5.29 billion loss in the year-earlier period. Continued severe credit market deterioration, particularly in commercial mortgage-backed securities, and charges related to ongoing restructuring-related activities weighed down results.The numbers just keep getting bigger ...

Treasury and Fed: AIG Restructuring Plan

by Calculated Risk on 3/02/2009 06:15:00 AM

From the Fed: U.S. Treasury and Federal Reserve Board Announce Participation in AIG Restructuring Plan

The U.S. Treasury Department and the Federal Reserve Board today announced a restructuring of the government's assistance to AIG in order to stabilize this systemically important company in a manner that best protects the U.S. taxpayer. ...

The company continues to face significant challenges, driven by the rapid deterioration in certain financial markets in the last two months of the year and continued turbulence in the markets generally. ...

As significantly, the restructuring components of the government's assistance begin to separate the major non-core businesses of AIG, as well as strengthen the company's finances. The long-term solution for the company, its customers, the U.S. taxpayer, and the financial system is the orderly restructuring and refocusing of the firm. This will take time and possibly further government support, if markets do not stabilize and improve.

...

Treasury has stated that public ownership of financial institutions is not a policy goal and, to the extent public ownership is an outcome of Treasury actions, as it has been with AIG, it will work to replace government resources with those from the private sector to create a more focused, restructured, and viable economic entity as rapidly as possible. This restructuring is aimed at accelerating this process. Key steps of the restructuring plan include:

Preferred Equity

The U.S. Treasury will exchange its existing $40 billion cumulative perpetual preferred shares for new preferred shares with revised terms that more closely resemble common equity and thus improve the quality of AIG's equity and its financial leverage. The new terms will provide for non-cumulative dividends and limit AIG's ability to redeem the preferred stock except with the proceeds from the issuance of equity capital.

Equity Capital Commitment

The Treasury Department will create a new equity capital facility, which allows AIG to draw down up to $30 billion as needed over time in exchange for non-cumulative preferred stock to the U.S. Treasury. This facility will further strengthen AIG's capital levels and improve its leverage.

Federal Reserve Revolving Credit Facility

The Federal Reserve will take several actions relating to the $60 billion Revolving Credit Facility for AIG established by the Federal Reserve Bank of New York (New York Fed) in September 2008, to further the goals described above.

[see statement for more details]

Sunday, March 01, 2009

AIG: Earnings at 6 AM ET, Webcast at 8:30 AM

by Calculated Risk on 3/01/2009 10:25:00 PM

American International Group, Inc. (AIG) will report its fourth quarter and full year 2008 results on Monday, March 2, 2009 at approximately 6:00 a.m. EST. AIG’s earnings release and financial supplement will be available in the Investor Information section of www.aigcorporate.com following the filing of AIG’s Form 10-K for the year ended December 31, 2008.From the WSJ: U.S. Revamps Bailout of AIG

AIG Chairman and Chief Executive Officer Edward M. Liddy will host a conference call, broadcast live over the Internet, on Monday, March 2, 2009 at 8:30 a.m. EST to discuss AIG’s fourth quarter results.

The audio webcast of the conference call can be accessed at www.aigwebcast.com.

The new deal, the government's fourth for AIG, represents a nearly complete reversal from the one first laid out in mid-September. Back then, federal officials acted as a demanding lender, forcing the insurer to pay a steep interest rate for what was expected to be a short-term loan. Now the government is relaxing loan terms by wiping out interest in hopes of preserving AIG's value over a longer period.AIG: a black hole.

With the latest move, AIG will have the benefit of up to $70 billion from the TARP program; it got a $40 billion TARP investment in November. The total amounts to 10% of the $700 billion financial-sector rescue fund, money that most lawmakers did not expect would go toward propping up a troubled insurer. Officials believed they had little choice but to use the TARP money, particularly because they lack the authority to unwind a troubled firm such as AIG the way the government can do now with failing banks.

Sunday Evening Futures

by Calculated Risk on 3/01/2009 07:50:00 PM

Just an open thread (I'm working on fixing the comments):

For those interested, here are few sources for futures and the foreign markets.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

Right now the futures are off a little for the U.S. markets. It appears DOW 7000 is in jeopardy.

Best to all.

HSBC Update

by Calculated Risk on 3/01/2009 03:15:00 PM

As we discussed yesterday, AIG will not be alone in the confessional tomorrow. HSBC is about to announce a £17bn hit on bad loans.

Now the Financial Times reports: HSBC to scale back US lending

HSBC will on Monday announce plans to scale back its US consumer finance operations as the bank launches a £12bn-plus ($17bn) rights issue ... HSBC is expected to say that it is further shrinking HSBC Finance Corporation, its US-based credit card and mortgage lender ...The WSJ has a headline only: HSBC plans to cease U.S. personal loans and mortgages but will continue to provide credit cards.

I'm sure HSBC regrets the Household International acquisition!

NY Times: "When Will the Recession Be Over?"

by Calculated Risk on 3/01/2009 02:32:00 PM

The NY Times asked several economists and forecasters 'When Will the Recession Be Over?'

Here are a few excerpts:

Beware the False Dawn

By STEPHEN S.ROACH (Chairman of Morgan Stanley Asia)

IT would be premature to declare an end to America’s recession at the first sign of a resumption of growth. After the unusually steep declines in the economy late last year and early this year, a statistical rebound in the second half of 2009 would hardly be shocking. ... But any such whiffs of growth are likely to herald a false dawn, because the consumer remains in terrible shape. ...A Long Goodbye

This points to an unusually anemic upturn, at best — not strong enough to keep the unemployment rate from rising to near 10 percent over the next year and a half. Since it’s hard to call that a recovery, it looks to me as if this recession won’t end until late 2010 or early 2011.

By A. MICHAEL SPENCE (Stanford Professor, Nobel prize, economics)

THE short answer is not soon.An Ordinary Crisis

The recession is global: exports, production and consumption are in high-speed descent. The headwinds are powerful because of excessive leverage, damaged balance sheets and the resulting tight credit.

...

Governments and central banks are the only major sources of credit, liquidity and incremental demand ... If governments are quick and clear in their intentions and intervene in a coordinated way in both the real economy and the financial sector, we will probably have an unusually long and deep global recession through 2010. If they don’t, it is likely to be worse than that.

By GEORGE COOPER

TODAY’S financial crisis is the biggest in recent history, when measured by its speed, the scale of its capital losses or its global reach. Yet viewed from another perspective the crisis is surprisingly ordinary, following the same path as dozens of previous bubbles.There are number of other short Op-Eds from Nouriel Roubini, James Grant and others.

...

If we go by the first measure [started in mid'80s] we may see two or more decades of readjustment. If we go by the second [started turn of the millennium], we are still probably in the early stages of the credit correction, meaning that while the technical recession could be over by the end of the year, the broader credit cycle will likely remain a significant drag on economic activity well into the next decade. Either way, we have a long way to go.

More AIG

by Calculated Risk on 3/01/2009 10:50:00 AM

| First a repeat of Eric's great AIG cartoon! Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis |

From the WSJ: Rating Agencies Endorse Revised AIG Bailout

Major credit rating agencies have signed off on the latest revamp of American International Group Inc.'s $150 billion government rescue package ... Both Standard & Poor's and Moody's Investors Services have quietly endorsed the terms of the revised bailout ...One aspect of the plan is clear - taxpayers will be more exposed.

The agreement clears the way for the insurer's board to give its final approval when it meets on Sunday. AIG's latest restructuring ... is expected to be announced with the insurer's results on Monday.

... Many details of the new plan aren't clear but ... it will result in a complete reconfiguration of AIG. ... The revised plan relies on a series of complicated financial maneuvers that will reduce AIG's interest and debt burdens, while also deepening government involvement and taxpayer exposure.

Report: AIG Deal Near

by Calculated Risk on 3/01/2009 02:08:00 AM

From Reuters: Exclusive: AIG near deal on new terms of bailout (ht Brad)

American International Group Inc is close to a deal with the U.S. government ... The revised AIG agreement is expected to include an additional equity commitment of about $30 billion, more lenient terms on an existing preferred investment, and a lower interest rate on a $60 billion government credit line ...It sounds like the deal will be announced on Monday.

AIG will also give the U.S. Federal Reserve ownership interests in American Life Insurance (Alico), ... [and] American International Assurance Co (AIA) in return for reducing its debt ... The board ... is due to meet on Sunday to vote on the deal ...

Saturday, February 28, 2009

Late Night Comments

by Calculated Risk on 2/28/2009 11:59:00 PM

Just a few comments on comments ...

I'm working with JS-Kit. They have moved all the old comments over to the new database.

Hopefully we can have the default be "flat". And we can add a refresh (that takes the user to the bottom).

JS-Kit will also be adding the following features:

Best to all. And thanks for your patience.

HSBC to take £17bn Bad Loan Provision

by Calculated Risk on 2/28/2009 05:08:00 PM

From The Times: HSBC takes £17bn hit on bad loans

HSBC is to own up to the full horror of its American sub-prime business, Household, when it unveils a £7 billion goodwill write-off in addition to a £17 billion provision against rising bad loans.Oh, the horror! The confessional remains busy, and AIG will be dropping by on Monday.

The provisions will be announced tomorrow alongside a heavily discounted £12 billion rights issue – the biggest ever held in Britain – and a dividend cut ...

The fundraising will make HSBC the strongest bank in the world that has not received a cash injection from the state. Its tier-one ratio, a key measure of financial strength, will rise from 8.5% to 10.5%. Analysts say it will provide a $40 billion (£28 billion) buffer against further bad debts.