by Calculated Risk on 3/05/2009 10:58:00 AM

Thursday, March 05, 2009

Report: Record 5.4 Million U.S. Homeowners Delinquent or in Foreclosure

From the WSJ: Delinquent Mortgages Hit Record Level

A record 5.4 million U.S. homeowners with a mortgage, or nearly 12%, were either behind on payments or in foreclosure at the end of last year, according to [the Mortgage Bankers Association] ...I haven't seen the actual report yet, and I'm especially interested in increases by loan category.

The percentage of loans at least 30 days past due rose to a record 7.88%, up from 6.99% in the third quarter and 5.82% a year earlier -- the biggest quarterly jump for delinquencies since the survey began in 1972.

The percentage of loans somewhere in the foreclosure process was 3.30% in the fourth quarter, up from 2.97% in the third quarter ...

The sharpest increases in loans 90-days past due were in Louisiana, New York, Georgia, Texas and Mississippi ...

The Stress Test "19"

by Calculated Risk on 3/05/2009 09:56:00 AM

In the Treasury White Paper on the Capital Assistance Program, the Treasury announced that the 19 largest bank are current undergoing stress tests:

Examinations will be conducted across the 19 banking organization with assets in excess of $100 billion, as measured according to the data reported for 2008Q4 in the Board of Governors of the Federal Reserve System Consolidated Financial Statements for Bank Holding Companies.Paul Kiel at ProPublica has compiled a list of the likely 19 banks by total assets: GMAC, MetLife Among Banks Undergoing Stress Tests

| Name | Total Assets (Billions) |

|---|---|

| 1. JPMorgan Chase | 2,175 |

| 2. Citigroup | 1,947 |

| 3. Bank of America (1) | 1,822 |

| 4. Wells Fargo | 1,310 |

| 5. Goldman Sachs | 885 |

| 6. Morgan Stanley | 659 |

| 7. MetLife | 502 |

| 8. PNC Financial Services | 291 |

| 9. U.S. Bancorp | 267 |

| 10. Bank of New York Mellon | 238 |

| 11. GMAC | 189 |

| 12. SunTrust | 189 |

| 13. State Street | 177 |

| 14. Capital One Financial Corp. | 166 |

| 15. BB&T | 152 |

| 16. Regions Financial Corp. | 146 |

| 17. American Express | 126 |

| 18. Fifth Third Bancorp | 120 |

| 19. KeyCorp | 105 |

This shows that the assets are concentrated in just a few large banks.

(1) Note: Data as of Q4 2008. Merrill is not included in the BofA asset numbers. IF added, BofA would have almost $2.5 trillion in assets (ht Evan).

Initial Jobless Claims: Slight Decrease

by Calculated Risk on 3/05/2009 08:30:00 AM

Note: Weekly claims is historically a noisy series. So, for initial claims, most analysts use the 4-week moving average - and that increased again this week.

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 28, the advance figure for seasonally adjusted initial claims was 639,000, a decrease of 31,000 from the previous week's revised figure of 670,000. The 4-week moving average was 641,750, an increase of 2,000 from the previous week's revised average of 639,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 21 was 5,106,000, a decrease of 14,000 from the preceding week's revised level of 5,120,000. The 4-week moving average was 5,011,000, an increase of 76,750 from the preceding week's revised average of 4,934,250.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 641,750 the highest since 1982.

Continued claims are now at 5.11 million - just below the record set last week - and above the previous all time peak of 4.71 million in 1982.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment.

Another weak initial claims report ...

Wednesday, March 04, 2009

Late Night Futures

by Calculated Risk on 3/04/2009 11:59:00 PM

By popular request, an open thread and a few sources for futures and the foreign markets. Hopefully the comments are working better ...

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets.

Best to all.

CRE: Investment in Hotels, Offices and Malls

by Calculated Risk on 3/04/2009 09:30:00 PM

There was a strong downward revision in non-residential structure investment in the Q4 GDP report. The CRE investment bust is here - and will get much worse based on the Fed's recent Senior Loan Officer Opinion Survey and the Architecture Billings Index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in lodging (based on data from the BEA) as a percent of GDP. The recent boom in lodging investment has been stunning. Lodging investment is now at 0.33% of GDP - slightly below the all time high set in Q3 2008 - and preparing to cliff dive!

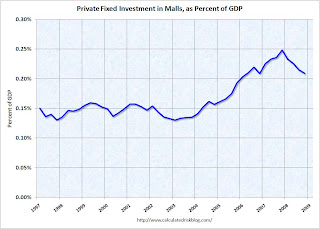

Note: prior to 1997, the BEA included Lodging in a category with a few other buildings. This earlier data was normalized using 1997 data, and is an approximation. Investment in multimerchandise shopping structures (malls) decreased in Q4 2008 to .21% of GDP, after peaking in Q4 2007 at .25% of GDP. This is a pretty steep decline, but now it appears that new mall construction is about to almost stop.

Investment in multimerchandise shopping structures (malls) decreased in Q4 2008 to .21% of GDP, after peaking in Q4 2007 at .25% of GDP. This is a pretty steep decline, but now it appears that new mall construction is about to almost stop.

As David Simon, Chief Executive Officer or Simon Property Group, the largest U.S. shopping mall owner said a few weeks ago:

"The new development business is dead for a decade. Maybe it’s eight years. Maybe it’s not completely dead. Maybe I’m over-dramatizing it for effect."

The third graph shows office investment as a percent of GDP since 1972. Office investment decreased slightly in Q4 2008. With the office vacancy rate rising sharply, office investment will probably decline all this year.

The third graph shows office investment as a percent of GDP since 1972. Office investment decreased slightly in Q4 2008. With the office vacancy rate rising sharply, office investment will probably decline all this year.Note: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

Investment in all three categories - malls, lodging and offices - will decline sharply in 2009.

Fed's Lockhart on Real Estate

by Calculated Risk on 3/04/2009 08:04:00 PM

From Atlanta Fed President Dennis Lockhart: On Real Estate and Other Risks to the Economic Outlook A few excerpts. First on the rental market:

I should also comment on the weakening multifamily residential real estate picture. No two rental markets are exactly alike. But to generalize, those markets trending the worst probably share one or more characteristics. They had excessive condo construction or condo conversion activity. Such markets are seeing unsold units return as rentals. They had very high home price appreciation in the years 2004—07 with large amounts of speculative house construction activity. Today, in several markets, houses compete with apartments as rentals. And they have been experiencing high and rising foreclosure rates.Although Lockhart mentioned that houses are competing with apartments as rentals, he doesn't mention that this is happening for two reasons: 1) homeowners who can't sell their homes (or are "waiting for a better market") are renting their homes, and 2) many REOs are being purchased by cash flow investors as rentals helping to increase rental supply and push down rents.

And on Commercial real estate (CRE):

While historically smaller than residential real estate, commercial real estate (or nonresidential structures) accounts for a not-insignificant portion of the American economy—at least 4 percent of GDP directly and perhaps more, depending on estimates. ...This is good data. Although the CRE bust will be significant, it will not be as large an impact as the residential bust.

There are currently some $2.5 trillion of commercial property loans on the balance sheets of financial institutions and in commercial mortgage-backed securities (CMBS) markets. In contrast, residential mortgage debt amounts to about $11 trillion.

Some 25 percent of commercial real estate debt is securitized, compared with 60 percent of outstanding home mortgage debt. The volume of CMBS has more than doubled since 2003, a bit faster than the growth of overall commercial real estate debt.

There are several subsectors of commercial real estate: retail, office, hotel, and industrial. All are facing problems.This gives me an excuse, in the next post, to update the graphs of office, mall and hotel investment based on the revisions to Q4 GDP.

There is a growing imbalance of retail space for several reasons. A lot of new retail space was added in areas that saw a high level of home construction, much of which has not been absorbed.

This imbalance is aggravated by general weakness in the retail industry. Established retail centers are seeing rising vacancy rates. When an anchor tenant leaves a shopping center, or overall occupancy falls below a threshold level, other tenants are often free to cancel their leases. Industry data indicate that abandoned retail store expansions and store closings have reached levels not seen since the recession and real estate slump of 1991–92.

The hotel subsector is facing excess supply in the face of soft demand. Occupancy rates declined about 8 percentage points in the fourth quarter of 2008, according to industry sources. Summer tourism was hurt by high gas prices, and now business travel is declining as companies scale back in a weak economy.

Also, with the decline in the economy and rising unemployment, office and industrial vacancies have been rising. In virtually all segments of commercial real estate, there is downward pressure on property values because of new construction coming on stream—construction started before the recession fully set in—coupled with the effects of the economic downturn.

Interestingly, the only property type currently withstanding downward pressures is warehouse. This seems to be, perversely, at least partly because of the back-up of inventories resulting from weak consumer spending and adverse retail and manufacturing conditions.

Mortgage Modification and 2nd Mortgages

by Calculated Risk on 3/04/2009 06:19:00 PM

I'm back from my civic duty, and starting to read the newly released details of the Mortgage Modification Plan. The second mortgage sections are interesting.

This first reference to 2nd liens seems to be part of Home Affordable Refinance Program (Part I of the plan).

From the Making Home Affordable, Updated Detailed Program Description Fact Sheet

Second Liens: While eligible loan modifications will not require any participation by second lien holders, the program will include additional incentives to extinguish second liens on loans modified under the program, in order to reduce the overall indebtedness of the borrower and improve loan performance. Servicers will be eligible to receive compensation when they contact second lien holders and extinguish valid junior liens (according to a schedule to be specified by the Treasury Department, depending in part on combined loan to value). Servicers will be reimbursed for the release according to the specified schedule, and will also receive an extra $250 for obtaining a release of a valid second lien.So the 2nd lien holder will have a choice: do nothing, or take some unspecified compensation to extinguish the 2nd.

Then there is this section that seems to be in Part II: Home Affordable Modification Program Housing Counselor Q&As:

What if the borrower has a second mortgage and would like to apply for a Home Affordable Modification?Is that saying they will pay the 2nd holder up to $1000 under Part II?

Under the Home Affordable Modification program, junior lien holders will be required to subordinate to the modified loan. However, through the Home Affordable Modification an incentive payment of up to $1,000 is available to pay off junior lien holders. Servicers are eligible to receive an additional $500 incentive payment for efforts made to extinguish second liens on loans modified under this program.

Note: Part I is the section allowing homeowner with Fannie and Freddie held mortgages to refinance upto 105% LTV. This section makes sense since this lowers Fannie and Freddie's risk on loans they already own or guarantee. Under Part II the lender must bring the total monthly payments on mortgages to 38% of the borrowers gross income, and then the U.S. will match dollar for dollar from 38% down to 31% debt-to-income ratio for the borrower.

LA Times: Housing Development Sites Become "Wasteland"

by Calculated Risk on 3/04/2009 05:00:00 PM

From the LA Times: As projects grind to a halt, home sites turn to wasteland

By day, it's far too quiet at the site of a planned housing and retail development on a former Navy base in Oakland.Some of these units have been mothballed (with fences and guards), others essentially abandoned. This is just more supply waiting for the market to improve.

At night, neighbors can hear the thieves come out.

They rip out copper wire, haul away pipes and take anything else they can steal from dozens of buildings on the site, abandoned after Irvine developer SunCal Cos. fell victim to the economy.

It's a scene not uncommon throughout California...

"I hear hacking and see scary bonfires in the middle of the night," said Don Johnson, a retired Coast Guard employee who lives near the defunct Oak Knoll Naval Medical Center in Oakland.

Nearly 250 residential developments with a combined total of 9,389 houses and condominiums have been halted in California, according to research firm Hanley Wood Market Intelligence. The units, worth close to $3.5 billion, were in various stages of development.

Market Rebound

by Calculated Risk on 3/04/2009 03:59:00 PM

The Fed may say the economy has weakened (see Beige Book), but the markets rebounded today ...

Dow up 2.2%

S&P 500 up 2.4%

NASDAQ up 2.5%

Back to full posting later today ...

Fed's Beige Book

by Calculated Risk on 3/04/2009 03:00:00 PM

Reports from the twelve Federal Reserve Districts suggest that national economic conditions deteriorated further during the reporting period of January through late February. Ten of the twelve reports indicated weaker conditions or declines in economic activity; the exceptions were Philadelphia and Chicago, which reported that their regional economies "remained weak." The deterioration was broad based, with only a few sectors such as basic food production and pharmaceuticals appearing to be exceptions. Looking ahead, contacts from various Districts rate the prospects for near-term improvement in economic conditions as poor, with a significant pickup not expected before late 2009 or early 2010.And on real estate:

Residential real estate markets remained in the doldrums in most areas, with only scattered, very tentative signs of stabilization reported. The pace of sales remained very low in most areas and declined further in some; most Districts reported small declines, but New York cited a sales drop of 60 to 65 percent in Manhattan compared with twelve months earlier. By contrast, Cleveland, Richmond, Dallas, and San Francisco each reported a rising or better-than-expected sales pace for existing or new homes in some areas, attributed largely to falling prices and improved financing terms for some types of home mortgages. House prices continued to decline, reportedly at double-digit paces in some areas, with little or no signs of a deceleration evident. Builders in various Districts generally remain pessimistic regarding recovery prospects this year, and consequently the pace of new home construction declined further in most areas.Grim outlook, especially for CRE. (sorry for slow post, I'm on jury duty!)

Demand for commercial, industrial, and retail space fell further during the reporting period, with some evidence of more rapid deterioration than in preceding periods. Vacancy rates rose and lease rates declined on a widespread basis; New York noted that commercial real estate markets "weakened noticeably," while Atlanta described reports on commercial real estate that were "decidedly more negative" than in previous periods. Construction activity has declined commensurately, and assorted reports suggest that market participants expect this weakness to continue at least through the end of 2009. Cleveland noted that public works projects have shown stability of late, although they declined in the San Francisco District as a result of the budgetary struggles of some state and local governments there. Credit constraints and uncertainty were reported to be a drag on commercial construction and leasing activity in the Philadelphia, Chicago, Dallas, and San Francisco Districts.

emphasis added

Employment Data

by Calculated Risk on 3/04/2009 11:49:00 AM

I don't have much confidence in the ADP numbers, but here they are anyway ...

From CNBC: ADP Shows Record Job Losses; Planned Layoffs Down

ADP said on Wednesday that private employers cut 697,000 jobs in February versus a revised 614,000 jobs lost in January.And on the Challenger layoff report:

The January job cuts were originally reported at 522,000.

It was the biggest job loss since the report's launch in 2001 ...

[P]lanned layoffs at U.S. firms fell 23 percent in February from January's seven-year peak, but remained well above long term averages as the protracted U.S. recession took a heavy toll on employment, ...The consensus for the BLS report on Friday is about 650,000 fewer jobs, but I've seen some forecast much higher (in the 850,000 range). We can be pretty sure the number will be very ugly.

"The decline in job cuts last month offers some hope that January was the peak and we will now see layoffs begin to fall or at least stabilize," said John A. Challenger, chief executive officer of Challenger, Gray & Christmas, in a statement.

But he said monthly job cuts may remain above 100,000 in the first half of the year and possibly for the rest of 2009.

February ISM Non-Manufacturing Index Shows Faster Contraction

by Calculated Risk on 3/04/2009 10:00:00 AM

From the Institute for Supply Management: February 2009 Non-Manufacturing ISM Report On Business®

"The NMI (Non-Manufacturing Index) registered 41.6 percent in February, 1.3 percentage points lower than the 42.9 percent registered in January, indicating contraction in the non-manufacturing sector for the fifth consecutive month at a slightly faster rate. The Non-Manufacturing Business Activity Index decreased 4 percentage points to 40.2 percent. The New Orders Index decreased 0.9 percentage point to 40.7 percent, and the Employment Index increased 2.9 percentage points to 37.3 percent. The Prices Index increased 5.6 percentage points to 48.1 percent in February, indicating a slower decrease in prices from January. According to the NMI, one non-manufacturing industry reported growth in February. Respondents are concerned about the soft market conditions, the negative outlook for employment and the overall state of the economy."This is another weak report.

Treasury Releases Detailed Guidelines on Mortgage Modification Plan

by Calculated Risk on 3/04/2009 09:24:00 AM

From MarketWatch: Treasury says mortgage plan to help up to 9 mln homeowners

The Treasury Department released guidelines to its mortgage modification plan on Wednesday and said that the program will help up to 9 million homeowners avoid foreclosure. The guidelines will enable servicers to begin modifying mortgages right away ... The Treasury program also includes incentives for removing second liens on loans.From financialstability.gov (Treasury site):

Summary of Guidelines

Modification Program Guidelines

Counselor Q&A

Fact Sheet

Report: 8.3 Million U.S. Homeowners with Negative Equity

by Calculated Risk on 3/04/2009 09:08:00 AM

From Bloomberg: More Than 8.3 Million U.S. Mortgages Are Underwater

More than 8.3 million U.S. mortgage holders owed more on their loans in the fourth quarter than their property was worth as the recession cut home values by $2.4 trillion last year, First American CoreLogic said.Late last year Mark Zandi at Moody's Economy.com estimated that there were "roughly 12 million households, or 16%, owe more than their homes are worth". The difference between the estimates is probably because a large number of homeowners have little equity - and small changes in home price assumptions change the number underwater significantly. The differences in percentages is because CoreLogic is using only households with mortgages; Zandi used all households (about 31% of households have no mortgages).

An additional 2.2 million borrowers will be underwater if home prices decline another 5 percent, First American, a Santa Ana, California-based seller of mortgage and economic data, said in a report today. Households with negative equity or near it account for a quarter of all mortgage holders.

Toll Brothers: More Losses, No Pick-up in Activity

by Calculated Risk on 3/04/2009 06:48:00 AM

"We have not yet seen a pick-up in activity at our communities other than ordinary seasonal increases for this time of year."Press Release: Toll Brothers Reports 1st Qtr 2009 Results

Robert I. Toll, chairman and chief executive officer, March 4, 2009

Toll Brothers ... today reported a FY 2009 first quarter net loss of $88.9 million ... which included pre-tax write-downs totaling $156.6 million.Toll's normal cancellation rate is about 7%.

...

Joel H. Rassman, chief financial officer, stated: "Given the numerous uncertainties related to sales paces, sales prices, mortgage markets, cancellations, market direction and the potential for and size of future impairments, it is particularly difficult in the current climate to provide guidance for the rest of FY 2009. As a result, we will not provide earnings guidance at this time."

...

FY 2009's first-quarter cancellation rate (current-quarter cancellations divided by current-quarter signed contracts) was 37.1% ...

In summary: More losses. More write-downs. More cancellations. No guidance. No pick-up in activity.

Tuesday, March 03, 2009

Interesting Technical Pattern Developing*

by Calculated Risk on 3/03/2009 09:30:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

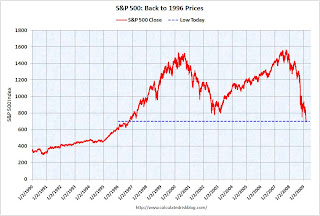

Reader Nate suggests the S&P 500 is just tracing out the Mortgage Pig™. (ht Nate and IF)

* IF suggested the post title.

Mortgage Pig™ says: "In UR Poolz Killin your convexity."

For those interested, here are few sources for futures and the foreign markets.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets.

Best to all.

Office Furniture: Cliff Diving

by Calculated Risk on 3/03/2009 08:32:00 PM

From Reuters: U.S. office furniture orders, shipments plunge in January

U.S. office furniture orders and shipments fell about 25 percent in January, reflecting the biggest year-over-year percentage declines since the 2001-02 recession, a trade group said.

The Business and Institutional Furniture Manufacturers Association said January orders fell 25 percent to $565 million and shipments fell 26 percent to $630 million.

BIFMA also lowered its 2009 forecast for orders to a decline of 26.5 percent, compared with its prior estimate of a drop of 11.6 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the actual consumption of office furniture in the U.S. (including imports) and the Business and Institutional Furniture Manufacturers Association forecast for 2009.

The slump in the office market - with rapidly rising office vacancies - is having a secondary impact on office suppliers. This is similar to what happened to the home furnishing bust over the last few years because of the bursting of the housing bubble. Based on this forecast, the U.S. office furniture market will probably be back to the 1994 to 1995 level.

Pensions: Another Trillion Dollar Bailout?

by Calculated Risk on 3/03/2009 05:25:00 PM

From David Evans at Bloomberg: Hidden Pension Fiasco May Foment Another $1 Trillion Bailout (ht James & Bob)

Public pension funds across the U.S. are hiding the size of a crisis that’s been looming for years. Retirement plans play accounting games with numbers, giving the illusion that the funds are healthy.Evans points out that many pension plans have been funded based on optimistic projections of future investment returns. He gives several examples including:

...

The misleading numbers posted by retirement fund administrators help mask this reality: Public pensions in the U.S. had total liabilities of $2.9 trillion as of Dec. 16, according to the Center for Retirement Research at Boston College. Their total assets are about 30 percent less than that, at $2 trillion.

With stock market losses this year, public pensions in the U.S. are now underfunded by more than $1 trillion.

The nation’s largest public pension fund, California Public Employees’ Retirement System, has been reporting an expected rate of return of 7.75 percent for the past eight years, and 8 percent before that, according to Calpers spokesman Clark McKinley.There is much more in the article.

Its annual return during the decade from Dec. 31, 1998, to Dec. 31, 2008, has been 3.32 percent, and last year, when markets tanked, it lost 27 percent.

Note: Back in 2007 Evans wrote a great article on a Florida state run investment pool investing in SIVs.

Stock Market: S&P 100 points from 1995

by Calculated Risk on 3/03/2009 03:49:00 PM

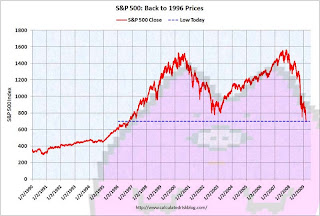

The S&P 500 closed below 700 today at 696 and change. We are back to 1996 prices ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.By popular demand I've extend this graph back to 1990.

The low in 1996 was 598.48.

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". (If not updated right way, Doug should update in a few minutes)

The 2nd worst bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

GM Sales off 53%, Toyota Off 40%

by Calculated Risk on 3/03/2009 01:52:00 PM

Headline from MarketWatch: GM U.S. February sales down 53% to 126,170 units

Also from MarketWatch: Toyota U.S. sales down 39.8% to 109,583 units in February

Last month GM reported U.S. sales fell 48.9% compared to January 2008, so the numbers are still getting worse.