by Calculated Risk on 3/25/2009 02:31:00 PM

Wednesday, March 25, 2009

New Home Sales: Is this the bottom?

Earlier today I posted some graphs of new home sales, inventory and months of supply.

A few key points:

This is 4.7 percent (±18.3%) above the revised January rate of 322,000, but is 41.1 percent (±7.9%) below the February 2008 estimate of 572,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the February "rebound".

You have to look closely - this is an eyesight test - and you will see the increase in sales (if you expand the graph).

Not only was this the worst February in the Census Bureau records, but this was the 2nd worst month ever on a seasonally adjusted annual rate basis (only January was worse).

This graph shows existing home sales and new home sales through February.

This graph shows existing home sales and new home sales through February. For a number of years the ratio between new and existing home sales was pretty steady. After activity in the housing market peaked in 2005, the ratio changed. This change was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

To close the gap, existing home sales need to fall or new home sales increase - or a combination of both. This will probably take several years ...

The following table, from Business Cycle: Temporal Order, shows a simplified typical temporal order for emerging from a recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

There are a number of reasons why housing and personal consumption won't rebound quickly, but they will probably bottom soon. And that means the recession is moving to the lagging areas of the economy. But we know the first signs to watch: Residential Investment (RI) and PCE.

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Fed's Yellen: The Uncertain Economic Outlook

by Calculated Risk on 3/25/2009 01:11:00 PM

From San Francisco Fed President Janet Yellen: The Uncertain Economic Outlook and the Policy Responses.

Dr. Yellen does an excellent job of describing the economy (pretty grim comments!), but I'd like to focus on just a short section:

With the caveat that my forecast is subject to exceptional uncertainty in the present environment, my best guess is similar to that of most forecasters, who expect to see moderately positive real GDP growth rates beginning later this year or early in 2010, followed by a gradual recovery.This is a very important point for forecasters - to distinguish between growth rates and levels. Even if the economy "bottoms" in the 2nd half of this year, it will be at a very low level compared to the last few years, and the recovery will probably be very sluggish. This means unemployment will continue to rise in 2010 - and it will still feel like a recession to many people.

However, I am well aware that my views are strikingly more optimistic than those I hear from the vast majority of my business contacts. They tend to see conditions as dire and getting worse. In fact, many of them can’t believe I would even suggest what they see as such a patently rosy scenario! So why is it that so many of us who prepare forecasts seem to be more optimistic than many others? I think there are several reasons. First, as forecasters, we distinguish between growth rates and levels. It’s true that the Blue Chip consensus shows moderate positive growth rates in output in the second half of this year. But even so, the level of the unemployment rate would still rise throughout 2009 and into 2010. So, in this sense, the worst of the recession is not expected to occur until next year. And, even by the end of 2011, I would expect the unemployment rate to be above its full-employment level. So I wouldn’t call this a particularly rosy scenario.

Second, it takes less than many people think for real GDP growth rates to turn positive. Just the elimination of drags on growth can do it. For example, residential construction has been declining for several years, subtracting about 1 percentage point from real GDP growth. Even if this spending were only to stabilize at today’s very low levels—not a robust performance at all—a 1 percentage point subtraction from growth would convert into a zero, boosting overall growth by 1 percentage point. A decline in the pace of inventory liquidation is another factor that could contribute to a pickup in growth. Inventory liquidation over the last few months has been unusually severe, especially in motor vehicles—a typical recession pattern. All it would take is a reduction in the pace of liquidation—not outright inventory building—to raise the GDP growth rate. In addition, pent-up demand for autos, durable goods, or even housing could emerge and boost demand for these items once their stocks have declined to low enough levels.

emphasis added

Forecasts: 12% Unemployment in California

by Calculated Risk on 3/25/2009 11:28:00 AM

From the LA Times: UCLA Anderson Forecast: dark days (ht Brad)

UCLA economists are coming out with a new forecast today that offers a grim picture of the year ahead.And from the Sacramento Bee: 12% jobless rate forecast for state, followed by slow recovery

Nationwide, the unemployment rate will worsen -- peaking late next year at 10.5%. And in California, which has been battered by tumbling housing, retail and manufacturing sectors, the jobless rate will soar to 11.9% by mid-2010, the latest UCLA Anderson Forecast says.

"The national economic outlook remains bleak," wrote David Shulman, a senior economist for UCLA.

"As a result of the prolonged contraction, the economy will likely lose 7.5 million jobs peak to trough and unemployment will soar."

...

The researchers cite the unprecedented losses to U.S. balance sheets -- $9 trillion in stocks and $5.5 trillion in home values.

The financial crisis, they say, has swelled into such a global problem that national policy may be ineffectual. The United States needs its international trading partners to reverse their slowdowns and reignite the exchange of imports and exports.

Nationally, the UCLA forecasters say the economy will begin to grow slowly by the fourth quarter of this year. That's when residential construction should also begin to turn around, but exports will continue to slide downward until the beginning of 2010.

California unemployment will peak at just over 12 percent late this year, setting a modern record, according to the latest forecast from the University of the Pacific.The California unemployment rate hit 10.5% in February.

Recovery will come slowly. Unemployment won't sink back into single digits until late 2011, or some two years after the recession is expected to officially end, according to a forecast released Tuesday by UOP.

...

At 12 percent, unemployment would be the highest since modern record-keeping began in 1976. The old record is 11 percent, reached three times in the early 1980s.

In the early '80s, I remember seeing many more homeless people than now, and there were a number of "Reaganvilles" in my area (a take-off on the Hoovervilles of the Great Depression). So far this recession looks and feel less severe than the early '80s, although the unemployment rate is about the same - and forecast to go higher.

New Home Sales: Just above Record Low

by Calculated Risk on 3/25/2009 10:00:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate of 337 thousand. This is slightly above the record low of 322 thousand in January. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red column for 2009. This is the lowest sales for February since the Census Bureau started tracking sales in 1963. (NSA, 27 thousand new homes were sold in February 2009; the previous low was 29 thousand in February 1982).

As the graph indicates, sales in February 2009 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in February 2009 were at a seasonally adjusted annual rate of 337,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And one more long term graph - this one for New Home Months of Supply.

This is 4.7 percent (±18.3%) above the revised January rate of 322,000, but is 41.1 percent (±7.9%) below the February 2008 estimate of 572,000.

There were 12.2 months of supply in February - just below the al time record of 12.9 months of supply set in January.

There were 12.2 months of supply in February - just below the al time record of 12.9 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of February was 330,000. This represents a supply of 12.2 months at the current sales rate.

Update: Corrected Y-Axis label.

Update: Corrected Y-Axis label. The final graph shows new home inventory. For new homes, both sales and inventory are falling quickly - since starts have fallen off a cliff.

Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

This is a another extremely weak report. Even with the small increase in sales, sales are near record lows. And months of supply is also just off the record high. I'll have more on new home sales later today ...

Martin Wolf: "Successful bank rescue still far away"

by Calculated Risk on 3/25/2009 09:01:00 AM

Martin Wolf writes in the Financial Times: Successful bank rescue still far away. (ht Bierca) An except on the Geithner Toxic Plan:

[W]ill it work? That depends on what one means by “work”. This is not a true market mechanism, because the government is subsidising the risk-bearing. Prices may not prove low enough to entice buyers or high enough to satisfy sellers. Yet the scheme may improve the dire state of banks’ trading books. This cannot be a bad thing, can it? Well, yes, it can, if it gets in the way of more fundamental solutions, because almost nobody – certainly not the Treasury – thinks this scheme will end the chronic under-capitalisation of US finance.

...

Why might this scheme get in the way of the necessary recapitalisation? There are two reasons: first, Congress may decide this scheme makes recapitalisation less important; second and more important, this scheme is likely to make recapitalisation by government even more unpopular.

...

[I]magine what happens if, after “stress tests” of the country’s biggest banks are completed, the government concludes – surprise, surprise! – that it needs to provide more capital. How will it persuade Congress to pay up?

The danger is that this scheme will, at best, achieve something not particularly important – making past loans more liquid – at the cost of making harder something that is essential – recapitalising banks.

This matters because the government has ruled out the only way of restructuring the banks’ finances that would not cost any extra government money: debt for equity swaps, or a true bankruptcy.

...

I fear, however, that the alternative – adequate public sector recapitalisation – is also going to prove impossible. Provision of public money to banks is unacceptable to an increasingly enraged public, while government ownership of recapitalised banks is unacceptable to the still influential bankers. This seems to be an impasse.

...

The conclusion, alas, is depressing. Nobody can be confident that the US yet has a workable solution to its banking disaster. On the contrary, with the public enraged, Congress on the war-path, the president timid and a policy that depends on the government’s ability to pour public money into undercapitalised institutions, the US is at an impasse.

...

If this is not frightening, I do not know what is.

Durable Goods Orders Rise in February

by Calculated Risk on 3/25/2009 08:43:00 AM

From the Census Bureau:

New orders for manufactured durable goods in February increased $5.5 billion or 3.4 percent to $165.6 billion, the U.S. Census Bureau announced today. This increase follows six consecutive monthly decreases, including a 7.3 percent January decrease. Excluding transportation, new orders increased 3.9 percent. Excluding defense, new orders increased 1.7 percent.This appears to be a small bounce back from six consecutive monthly declines in durable goods.

This is still a decline of 22% from February 2008.

Late Night Futures

by Calculated Risk on 3/25/2009 01:03:00 AM

By popular request, an open thread and a few sources for futures and the foreign markets.

The U.S. futures are about neutral right now ahead of the durable goods and new home sales reports Wednesday morning.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets. The Asian market are about even too.

And a graph of the Asian markets.

And here is Krugman on Bloomberg: 'Geithner plan won't work' (ht bearly)

Best to all.

Tuesday, March 24, 2009

Equity Extraction Data

by Calculated Risk on 3/24/2009 09:07:00 PM

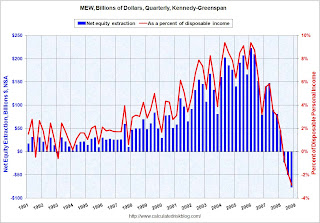

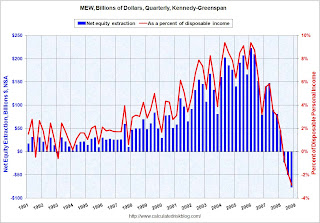

Earlier today I graphed the mortgage equity extraction data for Q4 2008 from Dr. James Kennedy at the Fed.

Thanks again to Dr. Kennedy for all the data!

For those interested, here is the equity extraction data from the Fed (excel file) Enjoy!

IMPORTANT NOTE: If you use this data, please read this note from the Fed:

Attached are the estimates of home equity extraction and related data through the fourth quarter of 2008, courtesy of Jim Kennedy. Please note that there will be no further updates to this data series.Here is a repeat of the total MEW graph:

These data are the product of a research project undertaken by Jim and Alan Greenspan. The data are not an official publication or product of the Federal Reserve Board. If you cite these data, please reference one of the two papers that Jim wrote with Alan Greenspan. For example, a reference might read something like this:

"Updated estimates provided by Jim Kennedy of the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41."

Since the fall of 2005, when the first paper Jim wrote with Alan Greenspan was released, Jim has updated the data periodically, usually quarterly, a few days after publication of the Flow of Funds data.

Click on graph for larger image in new window.

Click on graph for larger image in new window.For Q4 2008, Dr. Kennedy has calculated Net Equity Extraction as minus $77 billion, or negative 2.9% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

Obama Press Conference on the Economy at 8 PM ET

by Calculated Risk on 3/24/2009 07:50:00 PM

UPDATE: Form the WSJ: Obama Says 'Signs of Progress' Emerging in Economy

Here is the CNBC feed.

Here is the FOX feed.

Volcker on Inflation, the Dollar and China

by Calculated Risk on 3/24/2009 04:55:00 PM

On inflation (from Dow Jones):

“One historic way of getting yourself out of this situation — or trying to — is to inflate. Either you do it deliberately or you allow it to happen,” [Vlocker] said. “And if we permit that to happen then I think all these dollars will come tumbling down on us.” ...And on China:

“I get a little nervous when I see the Federal Reserve announcements that they want have the amount of inflation that’s conducive to recovery,” Volcker said. “I don’t know what ‘the amount of inflation that’s conducive to recovery’ would be appropriate. I’d much rather they say that they want to maintain stability in the currency, which is conducive to confidence and recovery.”

“I think the Chinese are a little disingenuous to say, ‘Now isn’t it so bad that we hold all these dollars.’ They hold all these dollars because they chose to buy the dollars, and they didn’t want to sell the dollars because they didn’t want to depreciate their currency. It was a very simple calculation on their part, so they shouldn’t come around blaming it all on us.”

Fed to Start Buying Longer Term Treasury Securities on Wednesday

by Calculated Risk on 3/24/2009 03:00:00 PM

From the New York Fed: New York Fed Issues Tentative Operation Schedule, FAQs for Treasury Purchases, Updated FAQs for Agency Debt and Agency MBS Purchases

The first outright Treasury coupon purchase will be conducted on Wednesday, March 25, 2009, and will settle Thursday, March 26, 2009. Results will be posted on the New York Fed’s website following the operation.According to the current schedule, the Fed will be buying 7 to 10 year securities tomorrow. On Friday they will be buying 2 to 3 year securities. And on Monday they will buying in the 17 to 30 year range.

Starting on Wednesday, April 1, 2009, and continuing every two weeks, the New York Fed will issue a tentative operation schedule for its purchases of longer-dated Treasury securities, including the maturity sector or sectors to be targeted.

What is the backup plan?

by Calculated Risk on 3/24/2009 01:40:00 PM

From TPM: We Don't Need No Stinkin' Contingencies

Rep. Gresham Barrett: What is the backup plan?

Secretary Geithner: This plan will work.

Q4 Mortgage Equity Extraction Strongly Negative

by Calculated Risk on 3/24/2009 11:37:00 AM

Here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction for Q4 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q4 2008, Dr. Kennedy has calculated Net Equity Extraction as minus $77 billion, or negative 2.9% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income. Dr. Kennedy provides several other measures of equity extraction. The second graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

Dr. Kennedy provides several other measures of equity extraction. The second graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

This measure is near zero ($7.2 billion for the quarter) and is probably a better estimate of the impact of MEW on consumption. When people refinance with cash out or draw down HELOCs, they usually spend the money.

The Fed's Flow of Funds report shows the amount of mortgages outstanding is declining, and this is partially because of debt cancellation per foreclosure sales, and partially due to homeowners paying down their mortgages (as opposed to borrowing more). Note: most homeowners pay down their principal a little each month (unless they have an IO or Neg AM loan), so with no new borrowing, equity extraction would always be negative.

Clearly the Home ATM has now been closed for a few quarters.

Note: This will be the last update of MEW from Dr. Kennedy. My thanks to Jim Kennedy and the other contributors to the MEW updates.

MBA: Refinance Boom will Boost Mortgage Originations to $2.7 Trillion in 2009

by Calculated Risk on 3/24/2009 10:20:00 AM

From Paul Jackson at Housing Wire: MBA: Originations Could Top $2.7 Trillion in 2009

[T]he Mortgage Bankers Association, which said that it had increased its forecast of mortgage originations in 2009 by over $800 billion, due to a refinancing boom ... The MBA said it now expects originations to total $2.78 trillion, which would make 2009 the fourth highest originations year on record, behind only 2002, 2003, 2005.It sounds like the mortgage brokers will be busy this year!

...

“This boost is due entirely to the expected increase in mortgage refinancing activity motivated by the drop in interest rates following last week’s Federal Reserve’s announcement on the Treasury bond and mortgage-backed securities purchases programs and the Fannie Mae and Freddie Mac refinance programs,” the mortgage lobbying and trade group said in a press statement.

...

This origination boom, however, will differ from recent years past — while previous record origination years of 2002, 2003 and 2005 had large amounts of subprime loans and jumbo loans, the MBA said it expects 2009 originations to consist almost entirely of conforming and/or FHA-eligible mortgages.

...

The MBA projected that total existing home sales for 2009 will drop 2.5 percent from 2008 to 4.8 million units, while new home sales will decline a far sharper 39 percent in 2009 to 293,000 units.

This refinance boom will lower the payments for homeowners with conforming loans, but that doesn't help much in the higher priced areas.

Geithner: New Powers Needed to Seize Non-bank Financial Companies

by Calculated Risk on 3/24/2009 09:07:00 AM

Geithner and Bernanke are scheduled to testify at 10AM ET.

From Bloomberg: Geithner to Call for New Powers to Avoid AIG Repeat

U.S. Treasury Secretary Timothy Geithner will call for expanded government powers to deal with failing non-bank financial institutions such as American International Group Inc., an administration official said.

Geithner, who testifies today before the House Financial Services Committee on AIG’s rescue, is expected to focus on the need for new tools for financial institutions other than banks, similar to those that the Federal Deposit Insurance Corp. has for winding down failed lenders and insuring consumer bank deposits, the official said.

The authority would allow the Treasury, in collaboration with the Federal Reserve, regulators and the president, to step in and more easily combat problems at systemically important institutions on the verge of failure ...

Monday, March 23, 2009

Krugman Discusses Geithner's Toxic Plan on News Hour

by Calculated Risk on 3/23/2009 11:57:00 PM

On existing home sales, here are a few posts:

Existing Home Sales Increase Slightly in February

More on Existing Home Sales

Existing Home Sales: Turnover Rate

News Hour - Paul Krugman & Donald Marron discuss Geithner's plan Part I

Part II:

Goolsbee Responds to Krugman

by Calculated Risk on 3/23/2009 10:19:00 PM

Austan Goolsbee, of the White House Council of Economic Advisers responds to Paul Krugman on Hardball. (ht David)

A couple of comments: Goolsbee claims "if the private guy makes money, the government makes money. If the private guy loses money, the government loses money." Goolsbee is correct on an individual pool, but investors can buy multiple pools and Nemo has an excellent example of how the investors can make money, and the government lose money.

Goolsbee should read that example.

At 4:40 Goolsbee essentially agrees with Krugman's column:

[T]he Geithner scheme would offer a one-way bet: if asset values go up, the investors profit, but if they go down, the investors can walk away from their debt. So this isn’t really about letting markets work. It’s just an indirect, disguised way to subsidize purchases of bad assets.It's not a complete one-way bet on any individual pool because the investors do put a small amount of money down - and that small amount is at risk. But Krugman was referring to the non-recourse debt and he is correct.

BTW, Tanta once ripped Goolsbee - very funny: Dr. Goolsbee: I’ll Stop Impersonating an Economist If You Quit Underwriting Mortgage Loans

Report: China Suggests New Reserve Currency

by Calculated Risk on 3/23/2009 08:11:00 PM

Update: here is the essay in English (ht Comrade Coinz)

From the Financial Times: China calls for new reserve currency

China’s central bank on Monday proposed replacing the US dollar as the international reserve currency with a new global system controlled by the International Monetary Fund.This is just a suggestion for the long term ...

In an essay posted on the People’s Bank of China’s website, Zhou Xiaochuan, the central bank’s governor, said the goal would be to create a reserve currency “that is disconnected from individual nations and is able to remain stable in the long run, thus removing the inherent deficiencies caused by using credit-based national currencies”.

...

To replace the current system, Mr Zhou suggested expanding the role of special drawing rights ... Today, the value of SDRs is based on a basket of four currencies – the US dollar, yen, euro and sterling ... China’s proposal would expand the basket of currencies forming the basis of SDR valuation to all major economies and set up a settlement system between SDRs and other currencies so they could be used in international trade and financial transactions.

Some Positive Comments on the Geithner Toxic Plan

by Calculated Risk on 3/23/2009 05:27:00 PM

From Mark Thoma at Economist's View: Which Bailout Plan is Best?

... I prefer nationalization because it provides a certainty in terms of what will happen that the other plans do not provide, the Geithner plan in particular, but it also appears to suffer from the political handicap of appearing (to some) to be "socialist," and there are arguments that the Geithner plan provides better economic incentives than nationalization (though not everyone agrees with this assertion). The Geithner plan also has its political problems, problems that will get much worse if the loans that are part of the proposal turn out to be bad as some, but not all, fear.I tend to agree with Mark on this. The Geithner plan is suboptimal, but it is probably the best we can get in the current environment. I'd add a caveat: this plan is easy for the banks to game or arb - and if a bank is caught gaming this plan, the AIG bonus flap will seem like a light Summer breeze.

...

I am willing to get behind this plan and to try to make it work. It wasn't my first choice, I still think nationalization is better overall, but I am not one who believes the Geithner plan cannot possibly work. Trying to change it now would delay the plan for too long and more delay is absolutely the wrong step to take. There's still time for minor changes to improve the program as we go along, and it will be important to implement mid course corrections, but like it or not this is the plan we are going with and the important thing now is to do the best that we can to try and make it work.

From Matt Padilla: Economists mostly bullish on $500 billion toxic asset plan

An excerpt:

“My gut reaction is that this is an excellent plan. This plan will go a long way toward getting banks in better position to lend more aggressively and break the deleveraging feedback loop that is now in place."I think this is a myth that banks will lend "more aggressively" once the toxic assets are off their balance sheets. To whom? Perhaps Anderson is making the moral hazard argument here - maybe he is saying since the banks (and their investors) are being bailed out with above market prices for toxic assets that they will once again engage in risky lending. I hope that isn't his argument.

Scott Anderson, senior economist, Wells Fargo

The key problem with the Geithner plan is that it incentivizes investors to pay more than market value for toxic assets by providing a non-recourse loan and with below market interest rates. (See Krugman on the price impact of a non-recourse loan). The investors do not receive this incentive, the banks do. And the taxpayers pay it, so this is a transfer of wealth from taxpayers to the shareholders of the banks.

This can be thought of as a European style put option - it can only be exercised at expiration. The taxpayers will pay the price of the option in the future, the investors receive any future benefit, and the banks receive the current value of the option in cash. Geithner apparently believes the future value will be zero, and that is a possibility. If so, this is a great plan - if not, the taxpayers will pay that future value (and it could be significant).

Still I agree with Mark Thoma:

[T]his is the plan we are going with and the important thing now is to do the best that we can to try and make it work.Oh well, Paul Kedrosky quotes T. Boone Pickens today:

My dad said a fool with a plan can beat a genius with no plan.

Stock Market: Up, up and Away!

by Calculated Risk on 3/23/2009 04:00:00 PM

An amazing day ...

DOW up 6.8% (about 500 points)

S&P 500 up 7.1% (54 points)

NASDAQ up 6.8% (almost 100 points) Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. The second graph shows the S&P 500 since 1990.

The second graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

If you bought in May 1997 - congratulations - you are now even (not counting inflation and dividends).