by Calculated Risk on 3/27/2009 05:17:00 PM

Friday, March 27, 2009

FDIC on Omni National Bank, Atlanta Failure

Update: from Soylent Green Is People

Bank failures blight like crab grass...

Spray Round-Up on all....

From the FDIC: SunTrust Bank, Atlanta, Georgia, Receives the Insured Deposits of Omni National Bank, Atlanta, Georgia

Omni National Bank, Atlanta, Georgia, was closed today by the Office of the Comptroller of the Currency, which then appointed the Federal Deposit Insurance Corporation (FDIC) as receiver.This is the follow-up to the earlier post.

...

As of March 9, 2009, Omni National Bank had total assets of $956.0 million and total deposits of $796.8 million. At the time of closing, there were approximately $2.0 million in uninsured deposits that potentially exceeded the insurance limits. ...

...

The cost to the FDIC's Deposit Insurance Fund is estimated to be $290 million. Omni National Bank is the twenty-first bank to fail this year. The last bank failure in Georgia was FirstCity Bank, Stockbridge, on March 20, 2009.

Q1 GDP will be Ugly

by Calculated Risk on 3/27/2009 04:43:00 PM

First, a quick market update ...

Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

On Q1 GDP:

Earlier today the BEA released the February Personal Income and Outlays report. This report suggests Personal Consumption Expenditures (PCE) will probably be slightly positive in Q1 (caveat: this is before the March releases and revisions).

Since PCE is almost 70% of GDP, does this mean GDP will be OK in Q1?

Nope.

I expect Q1 2009 GDP to be very negative, and possibly worse than in Q4 2008. Right now I'm looking at something like a 6% to 8% decline (annualized) in real GDP (there is significant uncertainty, especially with inventory and trade).

The problem is the 30% of non-PCE GDP, especially private fixed investment. There will probably be a significant inventory correction too, and some decline in local and state government spending. But it is private fixed investment that will cliff dive. This includes residential investment, non-residential investment in structures, and investment in equipment and software.

A little story ...

Imagine ACME widget company with a steadily growing sales volume (say 5% per year). In the first half of 2008 their sales were running at 100 widgets per year, but in the 2nd half sales fell to a 95 widget per year rate. Not too bad.

ACME's customers are telling the company that they expect to only buy 95 widgets this year, and 95 in 2010. Not good news, but still not too bad for ACME.

But this is a disaster for companies that manufacturer widget making equipment. ACME was steadily buying new widget making equipment over the years, but now they have all the equipment they need for the next two years or longer.

ACME sales fell 5%. But the widget equipment manufacturer's sales could fall to zero, except for replacements and repairs.

And this is what we will see in Q1 2009. Real investment in equipment and software has declined for four straight quarters, including a 28.1% decline (annualized) in Q4. And I expect another huge decline in Q1.

For non-residential investment in structures, the long awaited slump is here. I expect declining investment over a number of quarters (many of these projects are large and take a number of quarters to complete, so the decline in investment could be spread out over a couple of years). And once again, residential investment has declined sharply in Q1 too.

When you add it up, this looks like a significant investment slump in Q1.

Bank Failure #21: Omni National Bank, Atlanta

by Calculated Risk on 3/27/2009 04:09:00 PM

Form Bloomberg: Omni National Bank in Georgia Shut, 21st U.S. Failure (ht Brad)

Omni National Bank of Atlanta was seized by federal regulators, the 21st U.S. bank to fail this year ...No word from the FDIC yet. Did Bloomberg jump the gun?

Omni National, with $980 million in assets, was shut by the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp. was named receiver, the OCC said today in a statement. ...

The failed bank had six branches in Georgia, Illinois, Florida and Texas, and two loan offices in Alabama and Pennsylvania, the OCC said. The lender opened in 2000. The FDIC, which arranges to sell the deposits and assets of failed banks, didn’t immediately identify a buyer for Omni National.

Default Rate Rises for Student Loans

by Calculated Risk on 3/27/2009 02:39:00 PM

From Bloomberg: Default Rate Rises for Student Loans, U.S. Government Reports (ht Anthony)

Student-loan default rates for people who recently left school rose to 6.9 percent from 5.2 percent a year earlier as a deteriorating economy weighed on borrowers, the U.S. government said.

... The rate is based on borrowers who were to begin making repayments between October 2006 and October 2007, and who fell at least nine months behind by late September 2008.

Almost 232,000 of those borrowers entered default, a 13 percent increase from the previous year and a jump of 43 percent from two years earlier, the department said.

Vehicle Sales: Cliff Diving in February

by Calculated Risk on 3/27/2009 11:34:00 AM

The BEA released vehicle sales for February this morning. Total auto and truck sales in the U.S. were 9.29 million (SAAR).

The automakers will release March sales numbers next Wednesday. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly vehicle sales (autos and trucks) as reported by the BEA at a Seasonally Adjusted Annual Rate (SAAR).

This shows that sales have plunged to a 9.29 million annual rate in February; the lowest since Dec 1981.

March 2009 sales will be down sharply from March 2008 too, but analysts will be looking for some stabilization on a seasonally adjusted basis. This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).

Currently this ratio is at 26.8 years, the highest ever. This is an unsustainable level (I doubt most vehicles will last 27 years!), and the ratio will probably decline over the next few years. This could happen with vehicles being removed from the fleet, but more likely because of a sales increase.

This suggests vehicle sales are much nearer the bottom than the top, and there will probably be some sort of modest rebound later this year.

Q4: Non-Residential Investment Revised

by Calculated Risk on 3/27/2009 11:04:00 AM

In addition to the Personal Income report this morning, the BEA released the final Q4 private fixed investment supplemental tables.

One of the key areas for downward revisions in the final Q4 GDP report was non-residential investment. These revisions were significant.

I'll use lodging as an example ... this first graph was based on the advanced GDP report: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in lodging as a percent of GDP.

In the advance report, lodging investment was reported at 0.34% of GDP - an all time high.

Note: prior to 1997, the BEA included Lodging in a category with a few other buildings. This earlier data was normalized using 1997 data, and is an approximation. The second graph is based on the final Q4 GDP report.

The second graph is based on the final Q4 GDP report.

Instead of increasing slightly in Q4 - as suggested by the advance report - lodging investment declined at a 15.7% annual rate in Q4.

Office investment declined at a 10.1% annual rate in Q4, and mall investment declined at a 11.3% annual rate.

The turning point for non-residential investment was in Q4. Let the cliff diving begin!

February PCE and Personal Saving Rate

by Calculated Risk on 3/27/2009 08:26:00 AM

The BEA released the Personal Income and Outlays report for February this morning. The report shows that PCE will probably make a positive contribution to GDP in Q1 2009.

Each quarter I've been estimating PCE growth based on the Two Month method. This method is based on the first two months of each quarter and has provided a very close estimate for the actual quarterly PCE growth.

Some background: The BEA releases Personal Consumption Expenditures monthly and quarterly, as part of the GDP report (also released separately quarterly).

You can use the monthly series to exactly calculate the quarterly change in real PCE. The quarterly change is not calculated as the change from the last month of one quarter to the last month of the next. Instead, you have to average all three months of a quarter, and then take the change from the average of the three months of the preceding quarter.

So, for Q1 2009, you would average real PCE for January, February, and March, then divide by the average for October, November and December. Of course you need to take this to the fourth power (for the annual rate) and subtract one.

The March data isn't released until after the advance Q1 GDP report. But we can use the change from October to January, and the change from November to February (the Two Month Estimate) to approximate PCE growth for Q1.

The two month method suggests real PCE growth in Q1 of 0.8% (annualized). Not much, but a significant improvement from the previous two quarters (declines of -3.8% and -4.3% in PCE).

The following graph shows this calculation: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows real PCE for the last 12 months. The Y-axis doesn't start at zero to better show the change.

The dashed red line shows the comparison between January and October. The dashed green line shows the comparison between February and November.

Since PCE was weak in December, the March to December comparison will probably be positive too.

This graph also show the declines in PCE in Q3 and Q4.

For Q3, compare July through September with April through June. Notice the sharp decline in PCE. The same was true in Q4.

This suggests that PCE will make a positive contribution to GDP in Q1.

Also interesting:

Personal saving -- DPI less personal outlays -- was $450.7 billion in February, compared with $478.1 billion in January. Personal saving as a percentage of disposable personal income was 4.2 percent in February, compared with 4.4 percent in January.This is substantially above the near zero percent saved of recent years.

This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing).

This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing).Although this data may be revised significantly, this does suggest households are saving substantially more than during the last few years (when they saving rate was close to zero). This is a necessary but painful step ... and a rising saving rate will repair balance sheets, but also keep downward pressure on personal consumption.

It is not much, but this is definitely a positive report.

Another Late Night Thread

by Calculated Risk on 3/27/2009 12:19:00 AM

Another open thread.

The U.S. futures are off a little right now ahead of the Personal Income and Outlays report Friday AM. This report should give us a strong clue on PCE for Q1.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets. The Asian markets are up a little tonight (in general).

And a graph of the Asian markets.

Best to all.

Thursday, March 26, 2009

House Prices vs. PCE

by Calculated Risk on 3/26/2009 06:24:00 PM

We do requests (sometimes). This is an update to a graph I posted last November.

This is a look at the real year-over-year (YoY) change in house prices vs. personal consumption expenditures (PCE) through Q4 2008:  Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows real Case-Shiller quarterly national prices adjusted using CPI less Shelter vs. real PCE. Note that YoY real Case-Shiller prices fell at a slightly slower pace in Q4 - only 17% - compared to 21% YoY in Q3, mostly because CPI less shelter declined in Q4.

For this limited data set (house price data is only available since 1987) the YoY changes move somewhat together, although house prices started declining before PCE during the current economic downturn. This difference in timing could be because of homeowners withdrawing equity from their homes (the Home ATM) even after prices first started falling. However the recent MEW data shows that the Home ATM is closed and consumption has declined sharply.

This doesn't tell us how much further real PCE will decline on a YoY basis - my initial guess was 4%, but it might be less.

Federal Reserve Assets Increasing Again

by Calculated Risk on 3/26/2009 04:26:00 PM

The Federal Reserve released the Factors Affecting Reserve Balances today. Total assets increased to $2.1 trillion.

[This] include information related to the Term Asset-Backed Securities Loan Facility (TALF). Credit was extended under the TALF for the first time on March 25, 2009.The TALF is just getting started with $4.7 billion yesterday.

Click on graph for larger image in new window.

After spiking last year to $2.31 trillion the week of Dec 18th, the Federal Reserve assets have declined somewhat.

Now the Federal Reserve is starting to expand their balance sheet again.

Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

Three trillion here we come! Or maybe four?

Nutting: Unemployment still rising

by Calculated Risk on 3/26/2009 04:14:00 PM

Rex Nutting writes at MarketWatch: Unemployment still rising

The raw numbers, not seasonally adjusted, [show] 6.4 million collecting state unemployment benefits, and an additional 1.4 million who were collecting the federal benefits that go to people who've been fruitlessly looking for a job for more than six months.The employment situation is grim, and even if GDP turns slightly positive later this year, the unemployment rate will probably rise all this year and into 2010.

The claims numbers don't show the whole story.

About 4 million more people are officially unemployed but not eligible for jobless benefits. In addition, 8.6 million can find only part-time work and another 2 million have given up looking for work. Nearly 15% of the workforce is unemployed, underemployed, or just plain discouraged.

More Retail Space Coming

by Calculated Risk on 3/26/2009 02:51:00 PM

From Kris Hudson at the WSJ: Developers Scale Back Luxury Projects as Economy Shifts

Amid the worst retail climate in decades, a number of shopping developments are slated to open this year ...For certain retail space, the absorption rate is negative because of all the store closings and retailer bankruptcies. Vacancy rates are already climbing sharply, and this additional 78 million square feet of retail space will push up the vacancy rate even more.

Real-estate developers are expected this year to complete more than 78 million square feet of new retail space in the top 54 U.S. markets, according to real-estate-research company Property & Portfolio Research Inc. While that is down from the 144 million square feet completed last year -- the peak number this decade -- the amount expected this year probably is more than the market can absorb in its second year of a recession.

...

The situation is a reminder of the vulnerabilities of commercial real-estate development to changes in the economy. Because it can take years to get a project from conception to completion, projects that sounded like a great idea a few years ago are fast becoming problematic for developers.

U.S. Hotel Occupancy Rate at 58.5%

by Calculated Risk on 3/26/2009 12:13:00 PM

From HotelNewsNow.com: STR reports U.S. performance for week ending 21 March 2009

In year-over-year measurements, the industry’s occupancy fell 4.7 percent to end the week at 58.5 percent. Average daily rate dropped 8.0 percent to finish the week at US$99.92. Revenue per available room for the week decreased 12.3 percent to finish at US$58.45.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 12.0% from the same period in 2008.

The average daily rate is down 8.0%, so RevPAR (Revenue per available room) is off 12.3% from the same week last year.

Geithner Calls for ‘New Rules of the Game’

by Calculated Risk on 3/26/2009 10:57:00 AM

From Bloomberg: Geithner Calls for ‘New Rules of the Game’ in Finance

... Geithner’s proposals would bring large hedge funds, private-equity firms and derivatives markets under federal supervision for the first time. A new systemic risk regulator would have powers to force companies to boost their capital or curtail borrowing, and officials would get the authority to seize them if they run into trouble.Imagine if the Federal Reserve had been the "systemic-risk regulator" during the bubble.

...

The administration’s regulatory framework would make it mandatory for large hedge funds, private-equity firms and venture-capital funds to register with the Securities and Exchange Commission. The SEC would be able to refer those firms to the systemic regulator, which could order them to raise capital or curtail borrowing.

The strategy also would require derivatives to be traded through central clearinghouses. And it would add new oversight for money-market mutual funds ....

While the Bush administration had proposed that the Federal Reserve take on the authority of a systemic-risk regulator, Geithner didn’t specify which agency should have the job. Bernanke has also called for such a regulator, and said the central bank should have some role.

According to Greenspan in 2005 "we don't perceive that there is a national bubble", just "a little froth", and even in March 2007 Bernanke said "the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained".

How would a systemic-risk regulator help if they miss the problem?

I'm not opposing this idea - I don't see how it could hurt - and I think having the FDIC, OTS, Fed, state agencies, and others all providing risk oversight is unworkable.

Unemployment Insurance: Continued Claims Over 5.5 Million

by Calculated Risk on 3/26/2009 08:37:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 21, the advance figure for seasonally adjusted initial claims was 652,000, an increase of 8,000 from the previous week's revised figure of 644,000. The 4-week moving average was 649,000, a decrease of 1,000 from the previous week's revised average of 650,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending March 14 was 5,560,000, an increase of 122,000 from the preceding week's revised level of 5,438,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 649,000.

Continued claims are now at 5.56 million - the all time record.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment, and shows the initial unemployment and continued claims are both at the highest level since the early '80s.

This is another very weak report and shows continued weakness for employment.

Wednesday, March 25, 2009

Geithner to Propose Regulatory Reform

by Calculated Risk on 3/25/2009 11:41:00 PM

From the WaPo: Geithner to Propose Vast Expansion Of U.S. Oversight of Financial System

Treasury Secretary Timothy F. Geithner plans to propose today a sweeping expansion of federal authority over the financial system ...Geithner is definitely busy ...

The Obama administration's plan ... would extend federal regulation for the first time to all trading in financial derivatives and to companies including large hedge funds and major insurers such as American International Group. The administration also will seek to impose uniform standards on all large financial firms, including banks, an unprecedented step that would place significant limits on the scope and risk of their activities.

...

The administration's signature proposal is to vest a single federal agency with the power to police risk across the entire financial system. The agency would regulate the largest financial firms, including hedge funds and insurers not currently subject to federal regulation. It also would monitor financial markets for emergent dangers.

Geithner plans to call for legislation that would define which financial firms are sufficiently large and important to be subjected to this increased regulation. Those firms would be required to hold relatively more capital in their reserves against losses than smaller firms, to demonstrate that they have access to adequate funding to support their operations, and to maintain constantly updated assessments of their exposure to financial risk.

...

The government also plans to push companies to pay employees based on their long-term performance, curtailing big paydays for short-term victories.

emphasis added

WSJ: Commercial Property Faces Crisis

by Calculated Risk on 3/25/2009 09:14:00 PM

From Lingling Wei at the WSJ: Commercial Property Faces Crisis (ht Mark, Patrick)

Commercial real-estate loans are going sour at an accelerating pace, threatening to cause tens or possibly even hundreds of billions of dollars in losses to banks already hurt by the housing downturn.Perfect hindsight? This CRE bust has been obvious for a few years ... maybe a little foresight would have helped.

The delinquency rate on about $700 billion in securitized loans backed by office buildings, hotels, stores and other investment property has more than doubled since September to 1.8% this month ... Foresight Analytics in Oakland, Calif., estimates the U.S. banking sector could suffer as much as $250 billion in commercial-real-estate losses in this downturn. The research firm projects that more than 700 banks could fail as a result of their exposure to commercial real estate.

...

In contrast to home mortgages -- the majority of which were made by only 10 or so giant institutions -- hundreds of small and regional banks loaded up on commercial real estate. As of Dec. 31, more than 2,900 banks and savings institutions had more than 300% of their risk-based capital in commercial real-estate loans, including both commercial mortgages and construction loans.

...

At First Bank of Beverly Hills in Calabasas, Calif., , the amount of commercial-property debt outstanding was 14 times the bank's total risk-based capital as of the end of last year. Delinquencies reached 12.9%, compared with the average of 7% among the nation's banks and thrifts.

"In perfect hindsight, we would have done less commercial real-estate lending," said Larry B. Faigin, president and CEO.

Shanty Towns

by Calculated Risk on 3/25/2009 07:43:00 PM

Earlier today, I commented that I hadn't seen any "Reaganvilles" like in the early '80s.

Oops ... spoke too soon.

From the NY Times: Cities Deal With a Surge in Shanty Towns

... Like a dozen or so other cities across the nation, Fresno is dealing with an unhappy déjà vu: the arrival of modern-day Hoovervilles, illegal encampments of homeless people that are reminiscent, on a far smaller scale, of Depression-era shanty towns. ...I guess I need to get out more. Still it's nothing like the early '80s, at least not yet.

While encampments and street living have always been a part of the landscape in big cities like Los Angeles and New York, these new tent cities have taken root — or grown from smaller homeless enclaves as more people lose jobs and housing — in such disparate places as Nashville, Olympia, Wash., and St. Petersburg, Fla.

In Seattle, homeless residents unhappy with the city’s 100-person encampment dubbed it Nickelsville, an unflattering reference to the mayor, Greg Nickels. ...

The sudden and surging number of homeless people in Fresno, a city of 500,000 people, has been a surprise. City officials say they have three major encampments near downtown, and smaller settlements along two local highways. All told, as many 2,000 people are homeless here ...

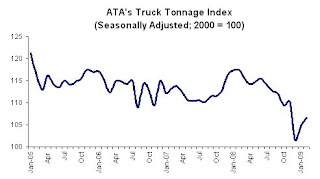

Report: Truck Tonnage Increased in February

by Calculated Risk on 3/25/2009 06:08:00 PM

From the American Trucking Association: ATA Truck Tonnage Rose 1.7 Percent in February Click on graph for larger image in new window.

Click on graph for larger image in new window.

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index edged 1.7 percent higher in February 2009, marking the second consecutive month-to-month increase. Still, the gain over the past two months, totaling 4.8 percent, did not even erase the 7.8 percent contraction in December 2008. In February, the seasonally adjusted tonnage index equaled just 106.5 (2000 = 100), which is still extremely low. Also in February, the fleets reported lower volumes than in January, as the not seasonally adjusted index fell another 2 percent last month on top of January’s 4.4 percent drop. In February, the not seasonally adjusted index equaled 95.3.The good news is the cliff diving might be over. The bad news is trucking is at the bottom of the cliff (after a 9.2% year-over-year decline).

Compared with February 2008, tonnage contracted 9.2 percent, which was the third-worst year-over-year decrease of the current cycle.

ATA Chief Economist Bob Costello was very cautious about reading too much into February’s seasonally adjusted month-to-month improvement. “As I said last month, tonnage will not fall every month on a seasonally adjusted basis, and just because it rose again in February doesn’t mean the economy is on the mend,” Costello said. “Tonnage plunged again on a year-over-year basis, which highlights the current weakness in the freight environment.” Costello also noted that fleets are still witnessing a tough environment and there is nothing that suggests freight volumes are about to embark on a sustained recovery.

emphasis added