by Calculated Risk on 5/01/2009 08:13:00 PM

Friday, May 01, 2009

Bank Failure 32: America West Bank, Layton, Utah

Whom do they remind you of?

Moe, Curly, Larry.

by Soylent Green is People

From the FDIC: Cache Valley Bank, Logan, Utah, Assumes All of the Deposits of America West Bank, Layton, Utah

America West Bank, Layton, Utah, was closed today by the Utah Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Cache Valley Bank, Logan, Utah, to assume all of the deposits of America West.

...

As of December 31, 2008, America West Bank had total assets of approximately $299.4 million and total deposits of $284.1 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $119.4 million. Cache Valley Bank's acquisition of all of the deposits of America West Bank was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives.

America West Bank is the 32nd bank to fail in the nation this year and the second in Utah. The last FDIC-insured institution to fail in the state was MagnetBank, Salt Lake City, on January 30, 2009.

WSJ: Citi Needs "Up to $10 Billion" in Capital

by Calculated Risk on 5/01/2009 07:54:00 PM

From the WSJ: Citi Said to Need Up to $10 Billion

Citigroup Inc. may need to raise as much as $10 billion in new capital, according to people familiar with the matter ...If Citi isn't required to raise capital, I doubt there will be much confidence in the stress test results. I was expecting a much higher number than $10 billion.

The bank ... is negotiating with the Federal Reserve and may need less if regulators accept the bank's arguments about its financial health ... In a best-case scenario, Citigroup could wind up having a roughly $500 million cushion above what the government is requiring.

Also, from the NY Times: Citigroup to Sell Japanese Units for $5.56 Billion

Citigroup said Friday that it would sell its Japanese brokerage and investment banking units for $5.56 billion, securing much-needed capital before results due this coming week from a U.S. government “stress test” of its financial health.

...

Citigroup said it would realize a loss of $200 million on the transaction, which would generate $2.5 billion in tangible common equity, a measure of financial health.

Bank Failure 31: Citizens Community Bank, Ridgewood, New Jersey

by Calculated Risk on 5/01/2009 05:05:00 PM

Mixing money aroma...

Two Jersey banks merge.

by Soylent Green is People

From the FDIC: North Jersey Community Bank, Englewood Cliffs, New Jersey, Assumes All of the Deposits of Citizens Community Bank, Ridgewood, New Jersey

Citizens Community Bank, Ridgewood, New Jersey, was closed today by the New Jersey Department of Banking and Insurance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with North Jersey Community Bank, Englewood Cliffs, New Jersey, to assume all of the deposits of Citizens Community Bank.

...

As of December 31, 2008, Citizens Community Bank had total assets of approximately $45.1 million and total deposits of $43.7 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $18.1 million. North Jersey Community Bank's acquisition of the deposits of Citizens Community Bank was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives.

Citizens Community Bank is the 31st bank to fail in the nation this year and the first in New Jersey. The last FDIC-insured institution to fail in the state was Dollar Savings Bank, Newark, on February 14, 2004.

Bank Failure 30: Silverton Bank, National Association, Atlanta, Georgia

by Calculated Risk on 5/01/2009 04:14:00 PM

Silverton Bank, crash and burn.

May might be hectic

by Soylent Green is People

From the FDIC: FDIC Creates Bridge Bank to Take Over Operations of Silverton Bank, National Association, Atlanta, Georgia

The Federal Deposit Insurance Corporation (FDIC) created a bridge bank to take over the operations of Silverton Bank, National Association, Atlanta, Georgia, after the bank was closed today by the Office of the Comptroller of the Currency (OCC). ...

Silverton Bank did not take deposits directly from the general public nor did it make loans to consumers. It was a commercial bank that provided correspondent banking services to its client banks.

Silverton Bank had approximately 1,400 client banks in 44 states, and operated six regional offices. It provided a variety of services for its clients, including credit card operations, clearing accounts, investments, consulting, purchasing loans, and selling loan participations. Since the FDIC created a new bank to take over the operations of Silverton Bank, there is not expected to be any meaningful impact on the bank's clients.

...

At the time of its closing, Silverton Bank had approximately $4.1 billion in assets and $3.3 billion in deposits, all of which are expected to be within the FDIC's insurance limits.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $1.3 billion. Silverton Bank is the 30th bank to fail in the nation this year and the sixth in Georgia. The last FDIC-insured institution to fail in the state was American Southern Bank, Kennesaw, on April 24

Auto Sales: Very weak in April

by Calculated Risk on 5/01/2009 03:24:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

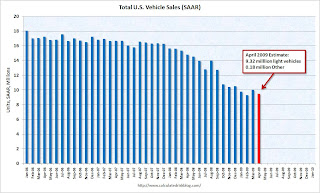

This graph shows the historical vehicle sales from the BEA (blue) and an estimate for April (light vehicle sales of 9.32 million SAAR from AutoData Corp).

Note: this graph includes a small number of heavy vehicle sales to compare to the BEA.

On a seasonally adjusted basis, total sales were still above the February level, but not much.

A few quotes:

"Industrywide, April felt more like a dust bowl than a spring garden for new car sales."

Jim O'Donnell, president of BMW in North America, May 1, 2009.

"It's kind of like the anchor bouncing a long on the bottom of the lake. It has found bottom and it's tripping along a little bit. I think we have found the bottom in aggregate."

Mark LeNeve, GM vice president for sales and marketing, sales conference call, May 1, 2009.

"The industry appears to have stabilized, as it's been fairly level for the past four months. We know where the bottom is, and as the economy struggles to recover, vehicle sales should follow."

Chrysler President Jim Press, May 1, 2009.

Comparing Quarterly and Monthly PCE

by Calculated Risk on 5/01/2009 03:00:00 PM

Here is a common question:

Q: I was looking at the Q1 Advance GDP report, and it showed that PCE was up 2.2%. However the March Personal Income and Outlay report showed that real March PCE was off -0.2%, after increasing 0.1% in February, and 0.9% in January. How did they get 2.2% for Q1 PCE growth? How does that compare to the monthly numbers?

A: First, the reported change in the Personal Income report is from the previous month (not annualized). The quarterly GDP report is the annualized change from Q4 to Q1.

Second, the quarterly change is from the average PCE in Q4 to the average PCE in Q1. Look at the following chart ...

Click on graph for larger image in new window.

Note: graph doesn't start at zero to show the change. All numbers are in billions.

This shows both the quarterly (red) and monthly (blue) PCE data (2000 dollars).

If you average October, November and December PCE, you get the Q4 PCE. And Q1 PCE is the average of January, February and March.

The math is simple: $8,214.2 (Q1 2009) divided by $8170.5 (Q4 2008) equals 1.00535. Take that to the 4th power (to annualize), subtract 1, and that gives the annualized rate of change in real PCE from Q4 to Q1: 2.2%.

Notice that the month-to-month change isn't useful in comparing to the quarterly change. Also notice that I didn't even report the March PCE numbers - that was mostly captured in the Q1 GDP report - and the monthly series is noisy.

The first two Personal Income reports each quarter are much more useful than the final month. When the April Personal Income report is released, the media will focus on the month-to-month change. However I will compare April PCE to January PCE - and then May PCE to February. This is the "two month" estimate for Q2 PCE (notice the calculation compares to the same month of the previous quarter, not the previous month).

For some time I had been forecasting a slump in consumer spending, and then using the two month method, I was able to declare the slump had arrived, see: Personal Income for August Indicates Consumer Recession and Estimating PCE Growth for Q3 2008

[T]his will be the first decline in PCE since Q4 1991. This is strong evidence that the indefatigable U.S. consumer is finally throwing in the towel.I was also among the first to point out PCE would probably be positive in Q1: February PCE and Personal Saving Rate

This suggests that PCE will make a positive contribution to GDP in Q1.The monthly data is extremely useful for forecasting - especially the first two months of each quarter.

Corus Posts Loss, Warns of Possible Receivership

by Calculated Risk on 5/01/2009 01:45:00 PM

Just a preview for Bank Failure Friday ...

From the Corus 8-K SEC Filing this morning (ht Kevin):

Both the [Federal Reserve Bank of Chicago and the Office of the Comptroller of the Currency] will continue to monitor the results of our operations, including liquidity and capital and based on their assessment of our ability to continue to operate in a safe and sound manner, may take further actions including placing the Bank into conservatorship or receivership. Additional actions taken by our regulators may negatively impact our ability to continue as a going concern.From the South Florida Business Journal: Fla. condo lender Corus Bank warns of receivership

Corus Bank said it had $2 billion in nonperforming loans and $499 million in foreclosed property as of March 31. That covered 32 percent of the bank’s $7.7 billion in assets.On Feb 18th Corus announced a consent order with regulators.

It might not have been a great business model to focus on Florida condos.

Ford Sales off 31.3% YoY in April

by Calculated Risk on 5/01/2009 12:22:00 PM

From Reuters: Ford April U.S. vehicle sales off 31.3 pct

This is a year-over-year comparison: April 2009 vs. April 2008.

In March, Ford reported sales off 40.9%

In February Ford sales were off 46.3% YoY

And in January Ford sales were off 42.1%

December: 32.4%

November: 31%

The other manufacturers will report later.

Update: Toyota U.S. April sales fall 41.9% to 126,540

Update2: GM U.S. April sales down 33.2% to 172,150 units

Update3: Chrysler April U.S. sales fall 48%

Reports: Stress Tests Results to be Released May 7th

by Calculated Risk on 5/01/2009 11:03:00 AM

The WSJ, Bloomberg and others are reporting the results of the stress tests will be released Thursday May 7th (apparently in the afternoon).

The release will include capital needs for each individual bank, plus estimated losses by loan categories.

According to the Fed white paper, the data is being collected for 12 loan categories, so hopefully they will release projected losses by each category.

From Bloomberg: Regulators Said to Plan Stress-Test Disclosures on May 7

(no link yet)

The Federal Reserve and U.S. banking regulators will reveal the results of the tests on the country’s 19 largest banks on May 7 after financial markets close, according to a government official.From CNBC: Results of Bank 'Stress Tests' To Be Released on Thursday

The government will unveil both aggregate information and firm-specific details about the capital buffer required to absorb losses if the recession worsens ...

ISM Manufacturing Shows Contraction in April

by Calculated Risk on 5/01/2009 09:59:00 AM

From the Institute for Supply Management: April 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector failed to grow in April for the 15th consecutive month, and the overall economy contracted for the seventh consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.As noted, any reading below 50 shows contraction, although the pace of contraction has slowed.

...

Manufacturing contracted in April as the PMI registered 40.1 percent, which is 3.8 percentage points higher than the 36.3 percent reported in March. This is the 15th consecutive month of contraction in the manufacturing sector. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

...

"The decline in the manufacturing sector continues to moderate. After six consecutive months below the 40-percent mark, the PMI, driven by the New Orders Index at 47.2 percent, shows a significant improvement. While this is a big step forward, there is still a large gap that must be closed before manufacturing begins to grow once again. The Customers' Inventories Index indicates that channels are paring inventories to acceptable levels after reporting inventories as 'too high' for eight consecutive months. The prices manufacturers pay for their goods and services continue to decline; however, copper prices have bottomed and are now starting to rise. This is definitely a good start for the second quarter."

emphasis added

In other news, new manufacturer orders were down, from the Census Bureau:

New orders for manufactured goods in March, down seven of the last eight months, decreased $3.2 billion or 0.9 percent to $345.3 billion, the U.S. Census Bureau reported today.

NMHC: Apartment Market Conditions Continue to Worsen

by Calculated Risk on 5/01/2009 09:23:00 AM

Note: Any reading below 50 indicates conditions are worsening; above 50 improving. So the increase in the index to 16 means the apartment conditions are worsening, but at a slower pace.

"Worse conditions" implies higher vacancy rates and lower rents - so it is good for renters.

From the National Multi Housing Council (NMHC): Apartment Market Still Suffering Downturn, Though Pace Is Decelerating, According To National Multi Housing Council Survey

Apartment market conditions continue to worsen, though the pace is decelerating, according to the National Multi Housing Council's (NMHC) latest Quarterly Survey of Apartment Market Conditions.

While all four market indexes remained below 50 (index numbers below 50 indicate conditions are worsening; numbers above 50 indicate conditions are improving), they all rose from three months ago. In particular, about half of respondents thought conditions were unchanged in the sales volume, equity finance, and debt finance markets.

“This global downturn has led to the most challenging economic conditions in at least five decades, and the apartment industry is suffering like other industries," noted Mark Obrinsky, NMHC's Chief Economist. "Capital remains difficult to obtain, and the sharp and continuing drop in employment, in particular, is sapping demand for apartments in markets throughout the country."

“Interestingly,” he continued, “despite considerable media focus on the “shadow rental” market, only a slim majority of respondents noted greater competition from condos and single-family rentals than in previous years.”

The Market Tightness Index, which measures changes in occupancy rates and/or rents, rose to 16 from 11 last quarter. Nevertheless, 73 percent of respondents said markets were looser (meaning higher vacancy and/or lower rents). While this was the seventh straight quarter in which the index has been below 50, the low reading may partially represent normal seasonal weakness.

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

It is common in a recession for apartment vacancies to rise, as households double up by moving in with a friend or family member. However an added factor in this recession is all the single family homes being offered as rentals. This is possible additional competition for apartments:

In a special fifth question to NMHC’s Quarterly Survey, one-third (33 percent) said such competition [from condos and single-family rentals] was unchanged. Another four percent thought there was less competition, and 11 percent don’t consider condos and single-family rentals to be significant competition for apartments in their markets. A slightly majority, 52 percent, did report more competition from condos and single-family rentals than in previous years.Competition from condos and single-family rentals probably depends on location.

Thursday, April 30, 2009

Chrysler Bankruptcy Issues

by Calculated Risk on 4/30/2009 11:46:00 PM

For those interested in the legal issues surrounding the Chrysler bankruptcy, here are a couple of posts from attorney Steven Jakubowski.

First, an overview of situation and Chrysler balance sheet:

Part I: Assessing The Financial Carnage

Second, a discussion of some of the legal issues:

Part II: Testing The Limits Of Section 363 Sales

Jakubowski concludes:

So, who will win? Really, only the true speculator and/or holder of Chrysler credit default swaps will (and perhaps Fiat if they--unlike their predecessors--can make it work), as my first post on the financial carnage at Chrysler demonstrates. My guess is that after much briefing, discovery, and expedited litigation over the next 60 days, Judge Gonzalez will show enough angst to worry both sides that they stand to lose, thus resulting in a compromise that settles the matter and allows the transaction to go forward. But with all Chrysler plants and operations now idled pending a final sale, the pressure to get the deal consummated and return people to work will be so overwhelming that it's hard to imagine Judge Gonzalez not approving the transaction in some form that's acceptable to everyone (except perhaps the dissenting lenders).

New Homes Demolished in Victorville, CA

by Calculated Risk on 4/30/2009 08:49:00 PM

Hat tip to several - thanks! Note: Victorville is east of Los Angeles at the southern edge of the Mojave desert.

Report: Stress Test Results Delayed

by Calculated Risk on 4/30/2009 08:34:00 PM

From Bloomberg: U.S. Stress Test Results Delayed as Early Conclusions Debated

The Federal Reserve will postpone the release of stress tests on the biggest U.S. banks while executives debate preliminary findings with examiners ... The results, originally scheduled for publication on May 4, now may not be revealed until toward the end of next week ... A new release date may be announced as soon as tomorrow, they said.Note that President Obama announced today that GMAC would be receiving government aide (as part of Chrysler deal, GMAC will takeover all financing of Chrysler vehicles). GMAC is one of the 19 banks undergoing stress tests.

CNBC: Stress Test Results for Each Bank May be Released

by Calculated Risk on 4/30/2009 05:54:00 PM

From CNBC: US May Release Stress Test Results for Specific Banks

U.S. officials are leaning toward announcing the "stress test" results of individual banks next week instead of just summary results ...Transparency is important. It seems the basic principle should be: Banks that require public support should disclose the details of the stress tests to the public.

The plan on exactly how to release the results "is not very far along," the source said, adding that regulators are looking to disclose a lot of supervisory information about banks that is usually kept confidential.

If a bank does not want to disclose details of the stress test - no problem, they are a private enterprise. But shouldn't they immediately return any TARP money and stop using any special Fed/FDIC/Treasury liquidity programs?

April Economic Summary in Graphs

by Calculated Risk on 4/30/2009 04:00:00 PM

Here is a collection of real estate and economic graphs for data released in April ...

New Home Sales in March

New Home Sales in MarchThe first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the lowest sales for March since the Census Bureau started tracking sales in 1963. (NSA, 34 thousand new homes were sold in March 2009; the previous low was 36 thousand in March 1982).

From: New Home Sales: 356 Thousand SAAR in March

Housing Starts in March

Housing Starts in MarchTotal housing starts were at 510 thousand (SAAR) in March, just above the revised record low of 488 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 358 thousand in March; just above the revised record low in January (356 thousand).

From: Housing Starts: Near Record Low

Construction Spending in February

Construction Spending in FebruaryThis graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

"Residential construction was at a seasonally adjusted annual rate of $275.1 billion in February, 4.3 percent below the revised January estimate of $287.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $390.7 billion in February, 0.3 percent above the revised January estimate of $389.5 billion."

From: Construction Spending Declines in February

March Employment Report

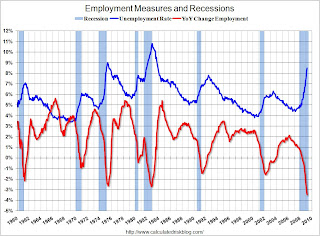

March Employment ReportThis graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 663,000 in March. January job losses were revised to

741,000. The economy has lost almost 3.3 million jobs over the last 5 months, and over 5 million jobs during the 15 consecutive months of job losses.

The unemployment rate rose to 8.5 percent; the highest level since 1983.

From: Employment Report: 663K Jobs Lost, 8.5% Unemployment Rate

March Retail Sales

March Retail SalesThis graph shows the year-over-year change in nominal and real retail sales since 1993.

On a monthly basis, retail sales decreased 1.1% from February to March (seasonally adjusted), but sales are off 10.7% from March 2008 (retail and food services decreased 9.4%). Automobile and parts sales declined 2.3% in March (compared to February), but excluding autos, all other sales declined -0.9%.

From: Retail Sales Decline in March

LA Port Traffic in March

LA Port Traffic in MarchThis graph shows the loaded inbound and outbound traffic at the port of Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 6% below last March and 35% above last month.

Outbound traffic was 9.8% below March 2008, and 25% above February.

From: LA Port Import Traffic Rebounds

U.S. Imports and Exports Through February

U.S. Imports and Exports Through FebruaryThe first graph shows the monthly U.S. exports and imports in dollars through February 2009. The recent rapid decline in foreign trade continued in February. Note that a large portion of the recent decline in imports was related to the fall in oil prices, however the decline in February was mostly non-oil related.

From: U.S. Trade Deficit: Lowest Since 1999

March Capacity Utilization

March Capacity UtilizationThis is some serious cliff diving. Also - since capacity utilization is at a record low (the series starts in 1967), there is little reason for investment in new production facitilies.

The Federal Reserve reported that "industrial production fell 1.5 percent in March after a similar decrease in February. For the first quarter as a whole, output dropped at an annual rate of 20.0 percent, the largest quarterly decrease of the current contraction. At 97.4 percent of its 2002 average, output in March fell to its lowest level since December 1998 and was nearly 13 percent below its year-earlier level.

From: Industrial Production Declines Sharply in March

NAHB Builder Confidence Index in April

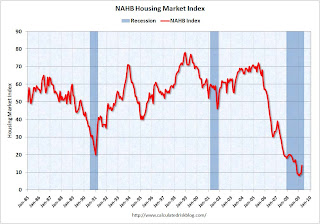

NAHB Builder Confidence Index in AprilThis graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 14 in April from 9 in March. The record low was 8 set in January.

The increase in April follows five consecutive months at either 8 or 9.

From: NAHB: Builder Confidence Increases in April

Architecture Billings Index for March

Architecture Billings Index for March"After a series of historic lows, the Architecture Billings Index (ABI) was up more than eight points in March. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the March ABI rating was 43.7, up from the 35.3 mark in February. This was the first time since September 2008 that the index was above 40..."

From: Architecture Billings Index Increases in March

Vehicle Miles driven in February

Vehicle Miles driven in FebruaryThis graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis.

From: DOT: U.S. Vehicle Miles Off 0.9% in February

Existing Home Sales in March

Existing Home Sales in March This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2009 (4.57 million SAAR) were 3.0% lower than last month, and were 7.1% lower than March 2008 (4.92 million SAAR).

It's important to note that about 45% of these sales were foreclosure resales or short sales. Although these are real transactions, this means activity (ex-distressed sales) is under 3 million units SAAR.

From: Existing Home Sales Decline in March

Existing Home Inventory March

Existing Home Inventory MarchThis graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.74 million in March. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

Typically inventory increases slightly in March, and then really increases over the next few months of the year until peaking in the summer. This decrease in inventory was small, and the next few months will be key for inventory.

Also, most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs - this is possible, but not confirmed.

From: Existing Home Sales Decline in March

Case Shiller House Prices for February

Case Shiller House Prices for FebruaryThis graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.6% from the peak, and off 2.1% in February.

The Composite 20 index is off 30.7% from the peak, and off 2.2% in February.

From: Case-Shiller: House Prices Fall Sharply in February

Homeownership Rate for Q1

Homeownership Rate for Q1The homeownership rate decreased to 67.3% and is now back to the levels of Q2 2000.

Note: graph starts at 60% to better show the change.

The homeownership rate increased because of demographics and changes in mortgage lending. The increase due to demographics (older population) will probably stick, so I expect the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.

From: Q1 2009: Homeownership Rate at 2000 Levels

Homeownership Vacancy Rate Q1

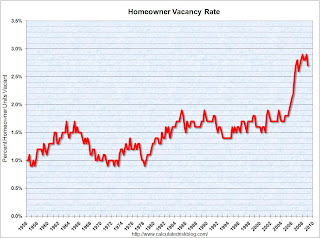

Homeownership Vacancy Rate Q1The homeowner vacancy rate was 2.7% in Q1 2009.

A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, so perhaps the vacancy rate has stabilized in the 2.7% to 2.9% range.

This leaves the homeowner vacancy rate about 1.0% above normal ...

From: Q1 2009: Homeownership Rate at 2000 Levels

Rental Vacancy Rate for Q1

Rental Vacancy Rate for Q1The rental vacancy rate was steady at 10.1% in Q1 2009.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%.

From: Q1 2009: Homeownership Rate at 2000 Levels

Unemployment Claims

Unemployment ClaimsThis graph shows weekly claims and continued claims since 1971.

The four week moving average is at 637,250, off 21,500 from the peak 3 weeks ago.

Continued claims are now at 6.27 million - the all time record.

From: Unemployment Claims: Record Continued Claims

Restaurant Performance Index for March

Restaurant Performance Index for March"The outlook for the restaurant industry improved in March, as the National Restaurant Association’s comprehensive index of restaurant activity rose for the third consecutive month. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.7 in March, up 0.2 percent from February and 1.3 percent during the last three months."

From: Restaurant Performance Index Increases Slightly

New Home Sales: March

New Home Sales: MarchThis graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in March 2009 were at a seasonally adjusted annual rate of 356,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.From: New Home Sales: 356 Thousand SAAR in March

This is 0.6 percent (±19.0%)* below the revised February rate of 358,000 and is 30.6 percent (±10.7%) below the March 2008 estimate of 513,000.

New Home Months of Supply: March

New Home Months of Supply: MarchThere were 10.7 months of supply in March - significantly below the all time record of 12.5 months of supply set in January.

"The seasonally adjusted estimate of new houses for sale at the end of March was 311,000. This represents a supply of 10.7 months at the current sales rate."

From: New Home Sales: 356 Thousand SAAR in March

Hotel Occupancy Off 8.4 Percent

by Calculated Risk on 4/30/2009 02:05:00 PM

From HotelNewsNow.com: STR reports U.S. data for week ending 25 April

In year-over-year measurements, the industry’s occupancy fell 8.4 percent to end the week at 59.4 percent. Average daily rate dropped 6.1 percent to finish the week at US$100.44. Revenue per available room [RevPAR] for the week decreased 14.1 percent to finish at US$59.67.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 9.6% from the same period in 2008.

The average daily rate is down 6.1%, so RevPAR is off 14.1% from the same week last year.

The Q1 advance GDP report showed a 44.2% annualized in decline in non-residential structure investment, and I expect lodging investment to decline even more over the next 18 to 24 months. Why build more hotels with RevPAR off 14% YoY?

Chrysler Bankruptcy Announcement at Noon ET

by Calculated Risk on 4/30/2009 11:40:00 AM

From CNBC: Chrysler To File for Bankruptcy, Sources Tell CNBC

Chrysler will file for bankruptcy ... two administration officials said Thursday.Here is the CNBC feed.

...

A statement from President Barack Obama and members of his autos task force on Chrysler's situation and the auto industry is scheduled for 12 Noon EST.

...

The stance will likely set the tone for similar discussions with bondholders of General Motors which is now on the clock to restructure its operations by the end of May.

Restaurant Performance Index Increases Slightly

by Calculated Risk on 4/30/2009 11:06:00 AM

Note: Any reading below 100 shows contraction. So the improvement in the index to 97.7 means the business is still contracting, but contracting at a slower pace.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Improved as the Restaurant Performance Index Rose for the Third Consecutive Month

The outlook for the restaurant industry improved in March, as the National Restaurant Association’s comprehensive index of restaurant activity rose for the third consecutive month. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.7 in March, up 0.2 percent from February and 1.3 percent during the last three months.

“Although the RPI remained below 100 for the 17th consecutive month, which signals contraction, there are clear signs of improvement,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Restaurant operators reported a positive six-month economic outlook for the first time in 18 months, and capital spending plans rose to a 9-month high.”

...

Restaurant operators also reported negative customer traffic levels for the 19th consecutive month in March.

...

Capital spending activity in the restaurant industry held relatively steady in recent months.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The index values above 100 indicate a period of expansion; index values below 100 indicate a period of contraction.

Based on this indicator, the restaurant industry has been contracting since November 2007.

Q1: Office, Mall and Lodging Investment

by Calculated Risk on 4/30/2009 09:27:00 AM

Here are some graphs of office, mall and lodging investment through Q1 2009 based on the underlying detail data released this morning by the BEA ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in lodging (based on data from the BEA) as a percent of GDP. The recent boom in lodging investment has been stunning. Lodging investment peaked at 0.33% of GDP in Q3 2008 and is now declining sharply (0.28% in Q1 2009).

I expect lodging investment to continue to decline through at least 2010, to perhaps one-third of the peak.

Note: prior to 1997, the BEA included Lodging in a category with a few other buildings. This earlier data was normalized using 1997 data, and is an approximation. Investment in multimerchandise shopping structures (malls) peaked in Q4 2007 and is continuing to decline. As projects are completed, mall investment should fall much further.

Investment in multimerchandise shopping structures (malls) peaked in Q4 2007 and is continuing to decline. As projects are completed, mall investment should fall much further.

As David Simon, Chief Executive Officer or Simon Property Group, the largest U.S. shopping mall owner said earlier this year:

"The new development business is dead for a decade. Maybe it’s eight years. Maybe it’s not completely dead. Maybe I’m over-dramatizing it for effect."

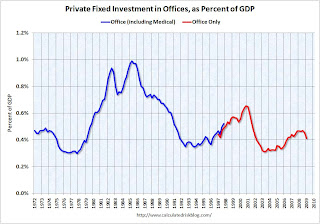

The third graph shows office investment as a percent of GDP since 1972. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.

The third graph shows office investment as a percent of GDP since 1972. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.Note: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

The non-residential structures investment bust is here and will continue for some time.