by Calculated Risk on 5/07/2009 12:36:00 AM

Thursday, May 07, 2009

Government: Stress Test Results to be released at 5 PM ET

Joint statement from Treasury, Fed, FDIC and Comptroller: The Treasury Capital Assistance Program and the Supervisory Capital Assessment Program

During this period of extraordinary economic uncertainty, the U.S. federal banking supervisors believe it to be important for the largest U.S. bank holding companies (BHCs) to have a capital buffer sufficient to withstand losses and sustain lending even in a significantly more adverse economic environment than is currently anticipated. In keeping with this aim, the Federal Reserve and other federal bank supervisors have been engaged in a comprehensive capital assessment exercise--known as the Supervisory Capital Assessment Program (SCAP)--with each of the 19 largest U.S. BHCs.So the Fed will release the losses and loss rates for each of the 12 categories in outlined in the Fed White Paper. And these are the losses for the "more adverse" scenario.

The SCAP will be completed this week and the results released publicly by the Federal Reserve Board on Thursday May 7th, 2009 at 5pm EDT. In this release, supervisors will report--under the SCAP "more adverse" scenario, for each of the 19 institutions individually and in the aggregate--their estimates of: losses and loss rates across select categories of loans; resources available to absorb those losses; and the resulting necessary additions to capital buffers. The estimates reported by the Federal Reserve represent values for a hypothetical 'what-if' scenario and are not forecasts of expected losses or revenues for the firms. Any BHC needing to augment its capital buffer at the conclusion of the SCAP will have until June 8th, 2009 to develop a detailed capital plan, and until November 9th, 2009 to implement that capital plan.

emphasis added

There is much more ...

Wednesday, May 06, 2009

Stress Test Table: Morgan Stanley Needs $1.5 Billion

by Calculated Risk on 5/06/2009 08:01:00 PM

Here are some updates to the table: Morgan Stanley has been changed to needing $1.5 billion, Capital One passed, State Street needs an unspecified amount.

| Name | Total Assets (Billions) | Stress Test Results |

|---|---|---|

| 1. Bank of America | 2,500 | Needs $34 billion |

| 2. JPMorgan Chase | 2,175 | Pass |

| 3. Citigroup | 1,947 | Needs $5 billion |

| 4. Wells Fargo | 1,310 | Needs $15 billion |

| 5. Goldman Sachs | 885 | Pass |

| 6. Morgan Stanley | 659 | Needs $1.5 billion |

| 7. MetLife | 502 | Pass |

| 8. PNC Financial Services | 291 | ??? |

| 9. U.S. Bancorp | 267 | ??? |

| 10. Bank of New York Mellon | 238 | Pass |

| 11. GMAC | 189 | Needs $11.5 billion |

| 12. SunTrust | 189 | ??? |

| 13. State Street | 177 | Needs $$$ |

| 14. Capital One Financial Corp. | 166 | Pass |

| 15. BB&T | 152 | ??? |

| 16. Regions Financial Corp. | 146 | Needs $$$ |

| 17. American Express | 126 | Pass |

| 18. Fifth Third Bancorp | 120 | Needs $3.3 billion (1) |

| 19. KeyCorp | 105 | Needs $3.3 billion (1) |

(1) Citi estimate. (ht Turbo)

Senate Passes Expanded FDIC Credit Line

by Calculated Risk on 5/06/2009 06:05:00 PM

From Reuters: US Senate expands credit lines to FDIC reserves

The U.S. Senate on Wednesday approved a measure to expand a government credit line for the Federal Deposit Insurance Corp ... The FDIC ... has been able to tap the Treasury Department for up to $30 billion since 1991. That credit line would be increased to $100 billion under the new bill.Part of this is for the PPIP, see: Sorkin's ‘No-Risk’ Insurance at F.D.I.C.

The House of Representatives has already passed its version of the legislation ...

Besides raising the cap on FDIC borrowing, the bill gives the federal insurer a $500 billion credit limit that will sunset at the end of next year.

[The F.D.I.C. is] going to be insuring 85 percent of the debt, provided by the Treasury, that private investors will use to subsidize their acquisitions of toxic assets. The program ... is the equivalent of TARP 2.0. Only this time, Congress didn’t get a chance to vote.

...

The F.D.I.C. is insuring the program, called the Public-Private Investment Program, by using a special provision in its charter that allows it to take extraordinary steps when an “emergency determination by secretary of the Treasury” is made to mitigate “systemic risk.”

Foreclosures: The 2nd Wave

by Calculated Risk on 5/06/2009 04:30:00 PM

From Nick Timiraos at the WSJ: Another Sign of Foreclosure Trouble in California

The homeowner association delinquency rate can serve as a leading indicator of sorts because homeowners usually stop paying dues before they stop paying their mortgage. The 90-day delinquency rate on dues for the 260 homeowner associations in California managed by Merit Property Management jumped to 5.3% in March from 2.8% last June. Delinquencies first spiked to 2.6% in December 2007 from 0.8% in March 2007.

... The rising number of HOA delinquencies and the boost in pre-foreclosure notices could be a harbinger of things to come. “There’s reason to believe in California there may be a second wave of foreclosures,” [Andrew Schlegel, Merit communities financial vice president] says.

More Stress Test Leaks: Morgan Stanley, JPMorgan, AmEx all Pass

by Calculated Risk on 5/06/2009 02:32:00 PM

From MarketWatch: Morgan Stanley doesn't need more capital: report

From WSJ: J.P. Morgan, American Express Won't Need New Capital

[F]ederal banking regulators have informed Regions Financial Corp., a regional bank based in Birmingham, Ala., that it needs to raise new capital, according to a person familiar with the matter.From Bloomberg: Bank of America, Citigroup, Wells Fargo, GMAC Need More Capital

A spokesman at Regions declined to comment Wednesday. The size of the cushion that regulators told bank executives they need to protect Regions from potential losses wasn't immediately clear.

Here is a scorecard by asset size (let me know if you hear of any other leaks - we will know it all tomorrow!):

| Name | Total Assets (Billions) | Stress Test Results |

|---|---|---|

| 1. Bank of America | 2,500 | Needs $34 billion |

| 2. JPMorgan Chase | 2,175 | Pass |

| 3. Citigroup | 1,947 | Needs |

| 4. Wells Fargo | 1,310 | Needs $15 billion |

| 5. Goldman Sachs | 885 | Pass |

| 6. Morgan Stanley | 659 | Pass |

| 7. MetLife | 502 | Pass |

| 8. PNC Financial Services | 291 | ??? |

| 9. U.S. Bancorp | 267 | ??? |

| 10. Bank of New York Mellon | 238 | Pass |

| 11. GMAC | 189 | Needs $11.5 billion |

| 12. SunTrust | 189 | ??? |

| 13. State Street | 177 | ??? |

| 14. Capital One Financial Corp. | 166 | ??? |

| 15. BB&T | 152 | ??? |

| 16. Regions Financial Corp. | 146 | Needs $$$ |

| 17. American Express | 126 | Pass |

| 18. Fifth Third Bancorp | 120 | Needs $3.3 billion (1) |

| 19. KeyCorp | 105 | Needs $3.3 billion (1) |

(1) Citi estimate. (ht Turbo)

ADP and BLS

by Calculated Risk on 5/06/2009 01:32:00 PM

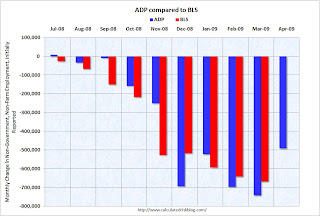

I added a caution with the ADP employment report this morning: "The ADP employment report hasn't been very useful in predicting the BLS numbers ..."

Several readers have sent me graphs showing that ADP and BLS employment numbers track pretty well over time. That is true - after revisions.

However I think in real time the ADP report isn't that useful for forecasting the BLS numbers (although it might offer a suggestion). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the ADP and BLS employment numbers (note: non-government) as originally released since last Summer.

Here is the original releases for ADP and for the BLS.

Although the two reports generally move together, there have been a number of significant misses; as examples: September, November and December of last year.

The consensus for BLS reported job losses is 630,000 (including government, to be announced Friday), and the ADP report suggests the losses might be a little lower.

However, initial weekly unemployment claims only declined slightly in April, and for the headline number (that includes government - not included in ADP) there have been a number of reports of local government layoffs.

John A. Challenger, chief executive officer of the placement company, said [this morning] ... “state and local governments, as well as school districts, are really feeling the impact of this downturn.”I think the job losses could be less than the average of the last 5 months (averaged 660 thousand per month), but not much less.

Report: Wells Fargo Needs $15 Billion in Capital

by Calculated Risk on 5/06/2009 12:15:00 PM

From Bloomberg: Wells Fargo Said to Need $15 Billion in New Capital

Wells Fargo & Co., the fourth-largest U.S. bank by assets, requires about $15 billion in new capital as a result of regulators’ stress test on the lender ...The leaks just keep coming ...

JPMorgan Chase & Co. doesn’t need to raise its capital, people with knowledge of its results said, while Goldman Sachs Group Inc. and Bank of New York Mellon Corp. have taken actions that suggest they also passed their reviews.

Foreclosures: More movin' on up!

by Calculated Risk on 5/06/2009 10:10:00 AM

From Bloomberg: Rich Americans Default on Luxury Homes Like Subprime Victims (ht Lance)

Chuck Dayton put down a quarter of the $950,000 purchase price when he bought his house in Newport Beach, California, in 2004. ... Dayton, 43, went into default four months ago because he couldn’t afford payments on the three-bedroom home, located within a block of the Pacific Ocean.The next wave of defaults is building ... this time in the mid-to-high range.

...

Dayton said he financed the purchase of his home, 40 miles south of Los Angeles in Orange County, with a payment-option adjustable-rate mortgage now serviced by JPMorgan’s Washington Mutual.

...

Dayton refinanced in February 2007 with a $1 million loan from Washington Mutual ... He also took out two private mortgages and now has a balance of $106,000 on those loans ... Dayton went into default on Jan. 29 and owes $46,584 in delinquent payments and penalties, according to First American CoreLogic ...

The number of U.S. homes valued at more than $729,750, the jumbo-loan limit in the most affluent areas, entering the foreclosure process jumped 127 percent during the first 10 weeks of this year from the same period of 2008, data compiled by RealtyTrac Inc. of Irvine, California, show. The rate rose 72 percent for homes valued at less than $417,000 and 78 percent for all homes

Other Employment Reports

by Calculated Risk on 5/06/2009 08:50:00 AM

The ADP employment report hasn't been very useful in predicting the BLS numbers, but here it is anyway: April ADP Report:

Nonfarm private employment decreased 491,000 from March to April 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from February to March was revised by 34,000, from a decline of 742,000 to a decline of 708,000.And from Bloomberg: U.S. April Job Cuts Rise 47% From a Year Ago, Challenger Says

Job cuts announced by U.S. employers in April increased 47 percent from a year earlier, led by government agencies and companies in the automotive industry, while the total was the lowest since October.The BLS report for April will be released Friday. Hopefully the pace of job losses has slowed - over the last 5 months the BLS has reported 3.3 million net jobs lost!

...

“Job cuts are still at recession levels, but the fact that they are falling is certainly promising and may suggest that employers are starting to feel a little more confident about future business conditions,” John A. Challenger, chief executive officer of the placement company, said in a statement. Still, he said, “state and local governments, as well as school districts, are really feeling the impact of this downturn.”

Tuesday, May 05, 2009

Report: BofA Needs $34 Billion in Capital

by Calculated Risk on 5/05/2009 11:58:00 PM

From Reuters: Bank of America to need $34 billion in capital: source

Bank of America (BAC.N) has been deemed to need an additional $34 billion in capital, according to the results of a government stress test, a source familiar with the results said on Tuesday.From the WSJ: BofA Needs $35 Billion Jolt

And Bloomberg: Tests Said to Show Bank of America Has Biggest Need

Regulators have determined that Bank of America Corp. has the largest need for new capital among the 19 biggest U.S. banks subjected to stress tests, according to people familiar with the matter.

Citigroup Inc.’s shortfall is more limited because the company already plans to convert government preferred shares to common stock, the people said.

Homeowners Underwater

by Calculated Risk on 5/05/2009 09:47:00 PM

There is substantial disagreement on the number of homeowners underwater (they owe more than their homes are worth). At the end of 2008, American CoreLogic estimated there were 8.2 million homeowners underwater.

Zillow.com is now estimating 26.9 million homeowners with negative equity.

From the WSJ: House-Price Drops Leave More Underwater

Real-estate Web site Zillow.com said that overall, the number of borrowers who are underwater climbed to 26.9 million at the end of the first quarter from 16.3 million at the end of the fourth quarter.This is a substantial difference. Apparently Zillow assumes that borrowers with HELOCs have drawn down the maximum amount, and I suppose they use their house price software. My guess is Economy.com's estimate is closer.

...

Moody's Economy.com estimates that of 78.2 million owner-occupied single-family homes, 14.8 million borrowers, or 19%, owed more than their homes were worth at the end of the first quarter, up from 13.6 million at the end of last year.

No matter - the number is huge. And many of these borrowers are in danger of default if they experience a negative event (death, disease, divorce, unemployment, etc.)

Report: U.S. Setting Conditions for Banks to Repay TARP

by Calculated Risk on 5/05/2009 07:18:00 PM

From the WSJ: U.S. to Set Condition for Banks Repaying TARP (ht MrM)

Banks that want to return Troubled Asset Relief Program funds will have to demonstrate their ability to wean themselves off ... a guarantee of debt issuance offered by the Federal Deposit Insurance Corp. ...One of the running jokes is that the banks will repay the TARP funds "soon". If the banks have to wait until they are weaned off the FDIC loan guarantee program, "soon" will probably be a couple of years.

Firms will have to show they don't need the FDIC guarantee to issue debt ... Regulators could detail the complete set of guidelines dictating how banks can repay TARP as early as Wednesday.

There are 97 financial institutions that have issued $336 billion in debt under the FDIC Temporary Liquidity Guarantee Program (TLGP). Summary here.

However most of this debt was issued by just 31 very large Bank and Thrift Holding Companies (update: cap is based on secured debt, not just liabilities).

Homebuilders on the Housing Market

by Calculated Risk on 5/05/2009 05:39:00 PM

Several major homebuilders have just reported. Here are a few quotes:

“The operating environment for housing remained very difficult during the first quarter of 2009. The housing market continues to face rising unemployment, tight mortgage availability, increased foreclosure activity and declining home prices, all putting negative pressure on buyer demand."

Richard J. Dugas, Jr., President and CEO of Pulte Homes, Press Release

["M]arket conditions in the homebuilding industry are still challenging, characterized by rising foreclosures, high inventory levels of both new and existing homes, increasing unemployment, tight credit for homebuyers and eroding consumer confidence."

Donald R. Horton, Chairman of the Board, D.R. Horton Press Release

"Housing markets remained challenged throughout the quarter, with the positives of historic affordability and low interest rates offset by rising foreclosures and high resale inventories."

Timothy R. Eller, chairman and CEO of Centex, Press Release

Challenging. Difficult. Rising Foreclosures. High inventory levels. Still a very difficult environment for the homebuilders.

The little bit of good news was the cancellation rate improved (after skyrocketing in the 2nd of 2008):

Pulte: The cancellation rate improved to 21% for the first quarter of 2009 compared with 47% for the fourth quarter of 2008 and 28% for the first quarter of 2008.

D.R. Horton: The Company’s cancellation rate (cancelled sales orders divided by gross sales orders) for the second quarter of fiscal 2009 was 30%.

These cancellation rates are still above normal (Note: "Normal" for Horton is in the 16% to 20% range, so 30% is still high.), but these are the lowest cancellation rates since early 2006.

Krugman's White House Dinner

by Calculated Risk on 5/05/2009 03:49:00 PM

From Newsweek: Prisoners of the White House (ht Jonathan)

On the night of April 27, for instance, the president invited to the White House some of his administration's sharpest critics on the economy, including New York Times columnist Paul Krugman and Columbia University economist Joseph Stiglitz. Over a roast-beef dinner, Obama listened and questioned while Krugman and Stiglitz, both Nobel Prize winners, pushed for more aggressive government intervention in the banking system.I haven't seen any comments from Stiglitz or on Krugman's blog - maybe the food wasn't very good.

Update: Krugman: Nothing to say "... the conversation was off the record."

More on Demolished Houses in Victorville

by Calculated Risk on 5/05/2009 02:36:00 PM

Last week a number of blogs posted a video from VisionVictory of new homes being demolished in Victorville, CA.

Here is the story from Peter Hong in the LA Times: Housing crunch becomes literal in Victorville

The Victorville demolition is one of the most dramatic ends to a bad bet made during the housing boom, but abandoned developments have become an all-too-common sight in California. Nearly 250 residential developments totaling 9,389 homes have been halted across the state, according to one research firm.And from the WSJ: No Sale: Bank Wrecks New Houses

The developer of the Victorville project had hoped to sell the houses for more than $300,000 as they were being built last year, Forrester said. But reality quickly diverged from that vision. ...

Officials of Guaranty Bank of Austin, Texas, which took over the development last year, were unavailable for comment. But Victorville city spokeswoman Yvonne Hester said the bank decided not to throw good money after bad.

"It just didn't pencil out for them," she said. "They'd have to spend a lot of money to turn around and sell the houses. They just made a financial decision to just demolish them."

A video of a backhoe knocking down homes in Victorville, Calif., was posted on YouTube by the founder of a Web site called Vision Victory.And more video at MarketWatch.

A Texas bank is about done demolishing 16 new and partially built houses acquired in Southern California through foreclosure, figuring it was better to knock them down than to try selling them in the depressed housing market.

Guaranty Bank of Austin is wrecking the structures to provide a "safe environment" for neighbors of the abandoned housing tract in Victorville, a high-desert city about 85 miles northeast of Los Angeles, a bank spokesman said.

Fact Checking Bernanke on Real Estate

by Calculated Risk on 5/05/2009 12:26:00 PM

Here are some comments by Fed Chairman Ben Bernanke on real estate:

Data: Existing home sales peaked in June 2005, new home sales in July 2005, and housing starts in January 2006. Prices peaked in July 2006 (Case-Shiller Composite 10 index) and residential investment has been a drag on GDP starting in Q1 2006. If anything, the housing market has been in decline for almost four years.

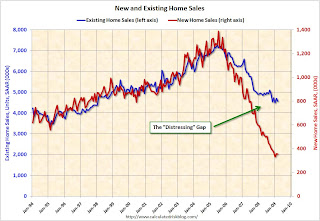

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales (left axis) and new home sales (right axis) since January 1994 through March 2009.

If you look closely, you can see that Bernanke is correct that existing home sales have been "fairly stable since late last year" and "new homes have firmed a bit recently".

Note: I believe the recent gap between existing and new home sales was caused by distressed sales. With all of the REO and short sales, builders can't compete. This has pushed down new home sales, and kept existing home sales relatively high (compared to new home sales).

But I believe Bernanke is wrong about both new and existing home sales being at "depressed levels".

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.There is no question that new home sales are at depressed levels. This is the lowest level of new home sales activity since the Census Bureau started tracking the data in 1963. And this data is not adjusted for changes in population (or number of households), and that would make the current slump even worse.

But the story is different for existing home sales:

This graph shows existing home turnover as a percent of owner occupied units. Sales for 2009 are estimated at the March rate of 4.57 million units.

This graph shows existing home turnover as a percent of owner occupied units. Sales for 2009 are estimated at the March rate of 4.57 million units.I've also included inventory as a percent of owner occupied units (all year-end inventory, except 2009 is for March).

The turnover rate is just below the median of the last 40 years - and will probably fall further in coming years.

Existing home sales are not at "depressed levels", unless you exclude all the foreclosure resales.

I think foreclosure resales are much more significant than lower mortgage rates. According to the NAR, something like 40% to 45% of all existing home sales are distressed (Foreclosure resales or short sales). And according to DataQuick in California:

Of the existing homes sold last month [March], 57.4 percent were properties that had been foreclosed on. A year ago it was 35.5 percent.I'd argue that the primary reason existing home sales appear to have stabilized is because of foreclosure-related activity.

This is correct. New home inventory is declining and new home sales have been higher than new home "built for sale" starts since late 2007 (see Quarterly Housing Starts and New Home Sales). Progress is being made on reducing inventory, but the months of supply is still elevated (at 10.7 months in March).

"Poor" doesn't describe the level of distress, but Bernanke is correct. About a month ago I compiled a summary of articles and data for retail, offices, apartments and lodging: Vacancies, vacancies, vacancies ... and falling rents There has been more data since then, but it all shows vacancy rates are rising in all categories (occupancy rates falling for hotels), and rents (and room rates) are falling. Conditions in CRE are definitely grim.

My only disagreement with Dr. Bernanke is on the existing home market. I don't think current existing home sales are "depressed" and I believe sales will fall further in the future.

April ISM Non-Manufacturing Index Shows Slower Contraction

by Calculated Risk on 5/05/2009 12:06:00 PM

This was released earlier this morning ...

From the ISM: April 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector contracted in April ...Still contracting, but at a slower rate.

"The NMI (Non-Manufacturing Index) registered 43.7 percent in April, 2.9 percentage points higher than the 40.8 percent registered in March, indicating contraction in the non-manufacturing sector for the seventh consecutive month, but at a slower rate. The Non-Manufacturing Business Activity Index increased 1.1 percentage points to 45.2 percent. The New Orders Index increased 8.2 percentage points to 47 percent, and the Employment Index increased 4.7 percentage points to 37 percent. The Prices Index increased 0.9 percentage point to 40 percent in April, indicating a slightly slower decrease in prices from March." [said Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee]

Bernanke on the Economic Outlook at 10 AM ET

by Calculated Risk on 5/05/2009 09:43:00 AM

Fed Chairman Ben Bernanke will testify before Congress on the economic outlook.

Prepared testimony below the video links ...

Here is the CNBC feed.

And a live feed from C-SPAN.

Prepared Testimony: The economic outlook. A few excerpts:

Recent Economic Developments

The U.S. economy has contracted sharply since last autumn, with real gross domestic product (GDP) having dropped at an annual rate of more than 6 percent in the fourth quarter of 2008 and the first quarter of this year. Among the enormous costs of the downturn is the loss of some 5 million payroll jobs over the past 15 months. The most recent information on the labor market--the number of new and continuing claims for unemployment insurance through late April--suggests that we are likely to see further sizable job losses and increased unemployment in coming months.

However, the recent data also suggest that the pace of contraction may be slowing, and they include some tentative signs that final demand, especially demand by households, may be stabilizing. Consumer spending, which dropped sharply in the second half of last year, grew in the first quarter. In coming months, households' spending power will be boosted by the fiscal stimulus program, and we have seen some improvement in consumer sentiment. Nonetheless, a number of factors are likely to continue to weigh on consumer spending, among them the weak labor market and the declines in equity and housing wealth that households have experienced over the past two years. In addition, credit conditions for consumers remain tight.

The housing market, which has been in decline for three years, has also shown some signs of bottoming. Sales of existing homes have been fairly stable since late last year, and sales of new homes have firmed a bit recently, though both remain at depressed levels. Although some of the boost to sales in the market for existing homes is likely coming from foreclosure-related transactions, the increased affordability of homes appears to be contributing more broadly to the steadying in the demand for housing. In particular, the average interest rate on conforming 30-year fixed-rate mortgages has dropped almost 1-3/4 percentage points since August, to about 4.8 percent. With sales of new homes up a bit and starts of single-family homes little changed from January through March, builders are seeing the backlog of unsold new homes decline--a precondition for any recovery in homebuilding.

In contrast to the somewhat better news in the household sector, the available indicators of business investment remain extremely weak. Spending for equipment and software fell at an annual rate of about 30 percent in both the fourth and first quarters, and the level of new orders remains below the level of shipments, suggesting further near-term softness in business equipment spending. Recent business surveys have been a bit more positive, but surveyed firms are still reporting net declines in new orders and restrained capital spending plans. Our recent survey of bank loan officers reported further weakening of demand for commercial and industrial loans.1 The survey also showed that the net fraction of banks that tightened their business lending policies stayed elevated, although it has come down in the past two surveys.

Conditions in the commercial real estate sector are poor. Vacancy rates for existing office, industrial, and retail properties have been rising, prices of these properties have been falling, and, consequently, the number of new projects in the pipeline has been shrinking.

...

The Economic Outlook

We continue to expect economic activity to bottom out, then to turn up later this year. Key elements of this forecast are our assessments that the housing market is beginning to stabilize and that the sharp inventory liquidation that has been in progress will slow over the next few quarters. Final demand should also be supported by fiscal and monetary stimulus. An important caveat is that our forecast assumes continuing gradual repair of the financial system; a relapse in financial conditions would be a significant drag on economic activity and could cause the incipient recovery to stall. I will provide a brief update on financial markets in a moment.

Even after a recovery gets under way, the rate of growth of real economic activity is likely to remain below its longer-run potential for a while, implying that the current slack in resource utilization will increase further. We expect that the recovery will only gradually gain momentum and that economic slack will diminish slowly. In particular, businesses are likely to be cautious about hiring, implying that the unemployment rate could remain high for a time, even after economic growth resumes.

In this environment, we anticipate that inflation will remain low.

More Losses at GMAC

by Calculated Risk on 5/05/2009 09:26:00 AM

From Bloomberg: GMAC Reports $675 Million Loss as Loan Defaults Rise

GMAC LLC, the auto and home lender that received a $6 billion government bailout, reported a first- quarter loss of $675 million on surging loan defaults ...GMAC is one of the 19 stress test banks.

New vehicle loans plunged 74 percent from a year earlier to $3.4 billion, an increase compared with the fourth quarter’s $2.7 billion, GMAC said. Auto loans more than 30 days past due rose to 3.1 percent in the first quarter from 2.4 percent in the same period a year earlier ...

Chrysler Bankruptcy: Take III

by Calculated Risk on 5/05/2009 02:02:00 AM

For those interested in the legal issues surrounding the Chrysler bankruptcy, here is another post from attorney Steven Jakubowski.

Chrysler Bankruptcy Analysis - Part III: Will The "Absolute Priority Rule" Kill The Sale?

... Chrysler's (and soon GM's) court battles afford us a rare opportunity to witness one of bankruptcy law's most fundamental questions being litigated in the highest stakes battles of all time, that being:Fascinating stuff. And the clock is ticking ...When does the "absolute priority rule" (see FRB-Cleveland's strict construction of the rule back in 1996 here and compare it to the US Government's position today), which establishes a hierarchy of recovery rights among creditor classes, take a back seat to the "fresh start," rehabilitative policy of chapter 11?Chrysler's opening memorandum touched upon this question by focusing on the US Supreme Court'd classic pronouncement in NLRB v. Bildisco & Bildisco, 465 U.S. 513, 528 (1984), where the Court stated that the "fundamental purpose of reorganization is to prevent the debtor from going into liquidation, with an attendant loss of jobs and possible misuse of economic resources." This principle, Chrysler argues, is paramount and (quoting NY's judicial patriarch, Bankruptcy Judge Lifland, in the old Eastern Airline case) "all other bankruptcy policies are subordinated" to it. (Mem. at 4).

Many, however, will surely disagree with Judge Lifland's statement from 20 years ago that all bankruptcy policies should be subordinated to the reorganization objectives of the Bankruptcy Code.