by Calculated Risk on 5/19/2009 07:51:00 PM

Tuesday, May 19, 2009

Home Depot on Housing Market

From the Financial Times: Home Depot chief warns on US housing

Growing optimism over the US housing market may be premature, a leading retailer warned on Tuesday.Now that the foreclosure moratorium is over, the pace of foreclosures is picking up again. And, according to Mr. Blake, this will probably impact the home improvement companies.

...

"We are concerned about the accelerating rates of foreclosures, particularly in the western part of the country,” [Frank Blake, chief executive of Home Depot] said, noting that one out of every 54 homes in California was in foreclosure.

Mr Blake said that a slowing foreclosure rate in California during the fourth quarter had led to an improvement in regional store sales but the trend had then reversed as foreclosure rates rose again in the first quarter.

The shift “provides a cautionary note on signalling a recovery prematurely”, he said. “Before we see real improvement we believe we need to see sustainable deceleration in foreclosures.”

Median Price Mix Example

by Calculated Risk on 5/19/2009 05:35:00 PM

The following table shows how the mix of units can skew the median price. This is just an example (not based on actual data).

In this example, from 2002 to 2005 low priced homes doubled in price, and high priced homes increased by two-thirds. The mix remained the same (50 units of each), and the median price increased 75%.

| Item | 2002 | 2005 | 2007 | 2009 | 2010 |

|---|---|---|---|---|---|

| Low Price | $100 | $200 | $200 | $100 | $100 |

| High Price | $300 | $500 | $500 | $400 | $300 |

| Low End Units Sold | 50 | 50 | 40 | 40 | 20 |

| High End Units Sold | 50 | 50 | 50 | 10 | 30 |

| Median Price | $200 | $350 | $500 | $100 | $300 |

| Change in Low Price | -- | 100% | none | -50% | none |

| Change in High Price | -- | 67% | none | -20% | -25% |

| Change in Median Price | -- | 75% | 43% | -80% | 200% |

Now look at what happened in 2007. Since subprime imploded first, the number of units sold at the low end decreased to 40 from 50. Everything else stayed the same - and just the change in the mix (higher percentage of high end homes) pushed up the median price! Note that the median price (light blue) increased WITHOUT any actual prices increasing. This happened at the beginning of the housing bust in many areas.

In the period I marked as 2009, the low end prices have fallen all the way back to 2002 prices. However the high end prices have only fallen 20%. The low end is seeing fairly high activity (40 units), but at the high end sales activity has collapsed (10 units). Look at the median price (in orange) - it has fallen more than the prices have declined for even the low end!

And finally, in 2010, prices fall further at the high end - and have stabilized at the low end. As prices fall, the volume picks up at the high end. And what happens to the median price? It increases by 200% (marked in red)!

UPDATE: Oops - I used average instead of median a couple of places (sorry - technical problems today),

This illustrates why we need to be very careful with median prices (like from NAR, DataQuick or other sources). The mix can distort the price, and I expect to read about median prices increasing later this year or in 2010, even though actual prices are still falling!

Market and GM Update

by Calculated Risk on 5/19/2009 04:01:00 PM

From Reuters: GM Bankruptcy Would Include Quick Sale to Feds

If General Motors files for bankruptcy ... plans include a quick sale of the automaker's healthy assets to a new company owned by the U.S. government, a source familiar with the situation said Tuesday.

...the plan also called for the government to forgive the bulk of $15.4 billion worth of emergency loans that the U.S. has already provided to GM.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is still the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The second graph shows the S&P 500 since 1990.

The second graph shows the S&P 500 since 1990. The dashed line is the closing price today.

The market is only off 42% from the peak.

SoCal House Sales: "Hot Inland, Cool on Coast"

by Calculated Risk on 5/19/2009 02:46:00 PM

Note: I think California data provides an overview of the key dynamics in the housing market.

From DataQuick: Southland home sales hot inland, cool on coast; median price dips

Southern California homes sold at a faster pace than a year ago for the 10th consecutive month in April as first-time buyers and investors continued to target distressed inland properties. ...Key points:

A total of 20,514 new and resale houses and condos closed escrow in the six-county Southland last month. That was up 5.2 percent from 19,506 in March and up 31.4 percent from 15,615 a year ago ... Last month’s sales were the highest for that month since April 2006, when 27,114 homes sold, but were 18.2 percent below the average April sales total since 1988, when DataQuick’s statistics begin.

Foreclosure resales – homes sold in April that had been foreclosed on in the prior 12 months – accounted for 53.6 percent of all Southland resales last month. It was the seventh consecutive month in which post-foreclosure properties made up more than half of all resales.

The deep discounts associated with foreclosures have created stiff competition for builders, who last month sold the lowest number of newly constructed homes for an April since at least 1988.

At the same time, the number of single-family houses that resold last month was at record or near-record-high levels for an April in many of the more affordable, foreclosure-heavy inland markets. They included Palmdale, Lancaster, Moreno Valley, Perris, Indio, San Jacinto, Lake Elsinore and Victorville.

The sales picture was dramatically different in many older, high-end communities closer to the coast, where foreclosures and deep discounts are less common. Sales of existing houses remained at or near record lows for an April in markets such as Beverly Hills, Malibu, Palos Verdes Peninsula, Manhattan Beach and Pacific Palisades.

Fed Announces TALF for Legacy CMBS

by Calculated Risk on 5/19/2009 02:15:00 PM

From the Federal Reserve: Federal Reserve announces that certain high-quality commercial mortgage-backed securities will become eligible collateral under the Term Asset-Backed Securities Loan Facility (TALF)

The Federal Reserve Board on Tuesday announced that, starting in July, certain high-quality commercial mortgage-backed securities issued before January 1, 2009 (legacy CMBS) will become eligible collateral under the Term Asset-Backed Securities Loan Facility (TALF).Term Asset-Backed Securities Loan Facility (Legacy CMBS): Terms and Conditions

...

The CMBS market, which has financed approximately 20 percent of outstanding commercial mortgages, including mortgages on offices and multi-family residential, retail and industrial properties, came to a standstill in mid-2008. The extension of eligible TALF collateral to include legacy CMBS is intended to promote price discovery and liquidity for legacy CMBS. The resulting improvement in legacy CMBS markets should facilitate the issuance of newly issued CMBS, thereby helping borrowers finance new purchases of commercial properties or refinance existing commercial mortgages on better terms.

To be eligible as collateral for TALF loans, legacy CMBS must be senior in payment priority to all other interests in the underlying pool of commercial mortgages and, as detailed in the attached term sheet, meet certain other criteria designed to protect the Federal Reserve and the Treasury from credit risk. The FRBNY will review and reject as collateral any CMBS that does not meet the published terms or otherwise poses unacceptable risk.

Eligible newly issued and legacy CMBS must have at least two triple-A ratings from DBRS, Fitch Ratings, Moody’s Investors Service, Realpoint, or Standard Poor’s and must not have a rating below triple-A from any of these rating agencies.

Term Asset-Backed Securities Loan Facility (Legacy CMBS): Frequently Asked Questions

TARP Repayment Restrictions

by Calculated Risk on 5/19/2009 01:28:00 PM

From CNBC: Banks Are Facing Restrictions On Repaying TARP: Sources

Among the conditions: no bank will be allowed to repay the TARP until after June 8, when 10 of the 19 biggest banks must present plans to boost their capital under the government's stress tests.I'm not sure what "another stress test" means or why they will only be approved in batches. Being able to issue non-government guaranteed debt makes sense.

...

The government also won't allow any one bank to repay the TARP first but will approve them in batches.

...

The banks face other restrictions: they still have to pass another stress test, issue debt that isn't government guaranteed, demonstrate the ability to self-fund in the market and win the approval of their banking supervisor.

...

The Treasury will also announce a process for auctioning TARP warrants ...

Quarterly Housing Starts and New Home Sales

by Calculated Risk on 5/19/2009 10:58:00 AM

The Census Bureau has released the "Quarterly Starts and Completions by Purpose and Design" report for Q1 2009 today.

Monthly housing starts (even single family starts) cannot be compared directly to new home sales, because the monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows that there were 52,000 single family starts, built for sale, in Q1 2009 and that is less than the 87,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA). This suggests homebuilders are selling more homes than they are starting.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions), although this is not perfect because homebuilders have recently been stuck with “unintentional spec homes” because of the high cancellation rates. Click on graph for larger image in new window.

Click on graph for larger image in new window.

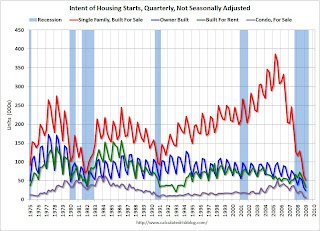

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the last six quarters, starts have been below sales – and new home inventories have been falling. The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Condo starts have collapsed to almost zero (5,000 started in Q1 2009) and owner built units have fallen by about 75% from the peak. Units built for rent have held up the best, and they are still off about 60% from the highs of recent years.

Condo starts in Q1 were the all time record low for Condos built for sale (5,000), breaking the previous record of 8,000 set in Q1 1991 (data started in 1975). Owner built units set a new record low (24,000 units compared to 35,000 units in Q1 1982), and of course single family units built for sale set a record low (52,000 compared to 64,000 in Q4 2008 and 71,000 in Q4 1981).

FDIC Receives Bids for BankUnited

by Calculated Risk on 5/19/2009 10:31:00 AM

Form Bloomberg: WL Ross, Carlyle Group Said to Make Bid for BankUnited Assets

WL Ross & Co. and private-equity firms including Carlyle Group made a bid to buy BankUnited Financial Corp. assets out of receivership from the government, a person familiar with the matter said."Out of receivership" says it all. This is unusual in that the bidders are picking over the carcass in public (usually the FDIC is more secretive about bank seizures).

The firms, which also include Blackstone Group LP and Centerbridge Capital Partners LLC, submitted their offer to the Federal Deposit Insurance Corp. this morning ...

emphasis added

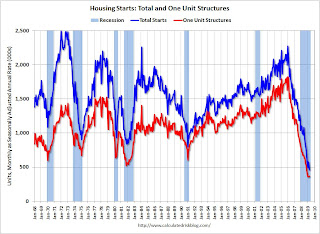

Housing Starts at Record Low in April

by Calculated Risk on 5/19/2009 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 458 thousand (SAAR) in April, the all time record low. The previous record low was 488 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 368 thousand (SAAR) in April; just above the revised record low in January (357 thousand).

Permits for single-family units were 373 thousand in April, suggesting single-family starts will remain at about the same level in May.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Note that single-family completions of 549 thousand are still significantly higher than single-family starts (368 thousand). This is important because residential construction employment tends to follow completions, and completions will probably decline further.

It is still too early to call the bottom for single family starts in January, however I do expect housing starts to bottom sometime in 2009.

Monday, May 18, 2009

Credit Card Changes: Make the Prudent Pay

by Calculated Risk on 5/18/2009 11:42:00 PM

From the NY Times: Overhaul Likely for Credit Cards

Banks are expected to look at reviving annual fees, curtailing cash-back and other rewards programs and charging interest immediately on a purchase instead of allowing a grace period of weeks, according to bank officials and trade groups.This seems unlikely (reviving annual fees, charging immediate interest) because of competition. At least I hope it is unlikely!

“It will be a different business,” said Edward L. Yingling, the chief executive of the American Bankers Association, which has been lobbying Congress for more lenient legislation on behalf of the nation’s biggest banks. “Those that manage their credit well will in some degree subsidize those that have credit problems.”

WSJ: Small Banks Face $100 Billion in CRE Losses

by Calculated Risk on 5/18/2009 09:12:00 PM

From the WSJ: Local Banks Face Big Losses

Commercial real-estate loans could generate losses of $100 billion by the end of next year at more than 900 small and midsize U.S. banks if the economy's woes deepen, according to an analysis by The Wall Street Journal.The WSJ analyzed 940 small and midsized banks, using the Federal Reserve's "more adverse" stress test scenario. The WSJ analysis showed that about two-thirds of the banks, under the "more adverse" scenario, will be below the "level considered comfortable by regulators" without raising additional capital.

...

Total losses at those banks could surpass $200 billion over that period ...

The FDIC will be very busy ...

Note: There are about 8,300 FDIC insured institutions. The WSJ analyzed bank holding companies that filed financial reports with the Federal Reserve for the year ended Dec. 31.

Fed: Delinquency Rates Surged in Q1 2009

by Calculated Risk on 5/18/2009 05:07:00 PM

The Federal Reserve reports that delinquency rates rose sharply in Q1 in all categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the delinquency rates at the commercial banks for residential real estate, commercial real estate and consumer credit cards.

Commercial real estate delinquencies (6.4%) are rising rapidly, and are at the highest rate since the early '90s (as delinquency rates declined following the S&L crisis).

Residential real estate (7.91%) and consumer credit card (6.5%) delinquencies are at the highest levels since the Fed started tracking the data (since Q1 '91).

Although there is credit deterioration everywhere, the rise in these three categories is especially significant. There was also a significant increase in C&I delinquencies (commerical & industrial).

Note: The Fed defines commercial as "construction and land development loans, loans secured by multifamily residences, and loans secured by nonfarm, nonresidential real estate", and many of the problems are probably in the C&D loans. These are the loans that will probably lead to the closure of many regional banks.

Also check out the charge-off rates. The charge-off rate for residential real estate increased from 1.58% to 1.8, and for consumer credit cards from 6.33% to 7.49%.

Just more evidence of severe credit problems at the commercial banks.

Report: Goldman, Morgan Stanley, JPMorgan to Repay TARP

by Calculated Risk on 5/18/2009 04:56:00 PM

From Bloomberg: Goldman, JPMorgan, Morgan Stanley Said to Apply for TARP Exit

Goldman Sachs Group Inc., JPMorgan Chase & Co. and Morgan Stanley applied to repay the combined $45 billion they received in October from the government’s Troubled Asset Relief Program, said people familiar with the matter.This will separate the strong banks from the weak.

The three New York-based banks need approval from the Federal Reserve ...

The refunds would be the first by the biggest banks that participated in the program. As of May 15, 14 of the smaller banks that received capital under the program had already repaid it ...

Selling non-guaranteed debt is a prerequisite for repaying TARP money. ... The banks will also have to decide whether to try to buy back the warrants that the government received as part of the TARP investments.

FASB Rule Change for Qualifying Special Purpose Entities

by Calculated Risk on 5/18/2009 03:44:00 PM

From Bloomberg: FASB Rule Will Force Banks to Move Assets Onto Books

Citigroup Inc. and JPMorgan Chase & Co. will be required starting next year to add billions of dollars of assets and liabilities to their balance sheets under rules approved by the Financial Accounting Standards Board.Note: the stress tests included off-balance sheet commitments.

The rules [are] effective for annual reporting periods after Nov. 15 ... U.S. regulators said the 19 lenders subjected to stress tests completed this month would have to bring about $900 billion of assets onto their balance sheets because of the FASB changes ...

And from the WaPo: Board to Ban Accounting Practice That Helped Lending Proliferate (ht Michael)

NAHB: Builder Confidence Increases in May

by Calculated Risk on 5/18/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 16 in May from 14 in April from. The record low was 8 set in January.

The increase in April and May followed five consecutive months at either 8 or 9.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB (added): Builder Confidence Continues To Rise In May

“The fact that the May HMI continued to tick up from April's five-point increase provides confirming evidence that the improved confidence level was no fluke,” added NAHB Chief Economist David Crowe. “This continued increase indicates that home builders feel we’re at or near the bottom of the market and that positive signs lie ahead for builders and potential home buyers, provided that builder access to production credit significantly improves.”

...

Two out of three of the HMI’s component indexes rose in May. The index gauging current sales conditions rose two points to 14, while the index gauging sales expectations for the next six months rose three points to 27. The index gauging traffic of prospective buyers remained unchanged, at 13.

Regionally, the Northeast posted a three-point gain in its HMI score, to 18, while the South posted a one-point gain to 18, the West rose four points to 12, and the Midwest held even at 14.

Three Month Dollar LIBOR Falls to 79 basis points

by Calculated Risk on 5/18/2009 11:51:00 AM

From Bloomberg: Dollar Libor Drops Most in Two Months as Markets Thaw

The London interbank offered rate, or Libor, for three- month loans slid four basis points to 79 basis points today, the biggest decline since March 19, according to British Bankers’ Association data. It decreased for the past 34 days, including a drop of 11 basis points last week, the most since January.Anyone with a LIBOR ARM is happy right now.

And a couple of other credit indicators:

There has been improvement in the A2P2 spread. This has declined to 0.47. This is far below the record (for this cycle) of 5.86 after Thanksgiving, and only slightly above the normal spread.

There has been improvement in the A2P2 spread. This has declined to 0.47. This is far below the record (for this cycle) of 5.86 after Thanksgiving, and only slightly above the normal spread.This is the spread between high and low quality 30 day nonfinancial commercial paper.

| Meanwhile the TED spread has decreased further over the last week, and is now at 61.97. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. |

Last week, FDIC Sheila Bair said "the liquidity crisis is over for good". That might be a little optimistic (some ARS markets are still frozen), but it does appear the Fed has eased the liquidity crisis for now. The Treasury is still working on the solvency issues.

Foreclosure Resales: Slow in High Priced Areas

by Calculated Risk on 5/18/2009 10:17:00 AM

From Matt Padilla at the O.C. Register: County absorbs first wave of foreclosures

Banks have seized homes in Orange County at a pace that dwarfs the darkest days of the housing downturn in the 1990s. Yet eager buyers have grabbed those properties, keeping the county's foreclosure inventory in check, according to a special report from MDA DataQuick.

Hold the sigh of relief.

Some economists see a second wave of foreclosures coming.

Click on photo for larger image in new window.

Click on photo for larger image in new window.This graphic from the O.C. Register shows where foreclosures are selling - and where they are not selling.

In the low priced areas, first time homebuyers and cash flow investors are buying the foreclosures. But in the high priced areas, there are far fewer buyers - especially since there are few move up buyers.

[F]oreclosure sales appear to be lagging on the coast.Here comes the second wave of foreclosures - mostly in mid-to-high priced areas. And these foreclosures will be much harder to sell.

Laguna Beach's 92651 had the highest ratio of unsold foreclosures at 53.8 percent – out of 52 foreclosures, just 24 had sold by April 10. San Clemente's 92672 is right behind with an unsold ratio of 43.9 percent, followed by Laguna Woods' 92637 at 42.9 percent.

Kerry Vandell, finance professor and director of UCI's real estate center, said high prices along the coast cause properties to sell slowly, whether foreclosure or not. For one thing, mortgage rates are higher on bigger loans, he said.

Rates are higher because government-backed mortgages are limited to about $730,000. Anything over that limit is also harder to get.

Laura Pephens, a San Clemente-based banking consultant and director with the California Mortgage Bankers Association, said there is another reason why coastal foreclosures are slower to sell. Banks are more reluctant to lower their asking prices, because the loan balances are bigger.

For more:

From the San Francisco Chronicle: More high-end properties sitting on the market

House Price Puzzle: Mid-to-High End and Home Sales: One and Done

Lowe's: "Pressures on consumers remain intense"

by Calculated Risk on 5/18/2009 08:41:00 AM

Press Release: Lowe's Reports First Quarter Sales and Earnings Results

"The economic pressures on consumers remain intense, and bigger ticket projects continue to be postponed as wary home improvement consumers watch the economic climate and housing market dynamics very closely," [Robert A. Niblock, Lowe's chairman and CEO said] "But, as spring arrived, we saw relative strength in smaller, outdoor projects."From the WSJ: Lowe's Earnings Slide 22%, Narrows Revenue Outlook

[Lowe's] now sees [fiscal-year] revenue ranging from down 2% to up 1%, from February's view of down 2% to up 2%. It still sees same-store sales down 4% to 8%.A 4% to 8% decline in same store sales is a very difficult environment and indicates that home improvement remains very weak.

Sunday Night Futures

by Calculated Risk on 5/18/2009 12:04:00 AM

SoCal is shaken, but not stirred. (Magnitude 5.0 quake in LA)

The Housing Market Index will be released on Monday, and housing starts on Tuesday.

The U.S. futures are off tonight:

CBOT mini-sized Dow

Futures from barchart.com

CME Globex Flash Quotes

And the Asian markets. The Asian markets are mostly off tonight (Nikkei off 2.6%)

Best to all.

Sunday, May 17, 2009

Report: Smaller U.S. Banks need $24 Billion in Capital

by Calculated Risk on 5/17/2009 08:59:00 PM

From the Financial Times: Smaller US banks need additional $24bn

Small and medium-sized US banks must raise some $24bn to meet the capital standards set by the government in its stress tests of large institutions, research for the Financial Times shows.Unlike the large banks, it appears these banks will be forced to merge or allowed to fail (and taken over by the FDIC).

News of the potential capital shortfall could increase pressure on many of the 7,900 US banks that form the backbone of the US financial system.

As many as 500 more banks could close, according to investment bank Sandler O’Neill ... The government’s stress-case would result in capital shortfalls for 38 per cent of the 200 banks below the 19 largest financial institutions ...