by Calculated Risk on 5/25/2009 11:41:00 AM

Monday, May 25, 2009

Foreclosures and Mosquito Hunters

From Carolyn Said at the SF Chronicle: Aerial hunter sniffs out mosquito-ridden pools

Last year, mosquito districts hired [Aerial Services of Livermore] to fly over almost every county in California. It covered 3,500 square miles - about one-third of the state's urban area - and "harvested" 27,000 algae-ridden pools, providing the districts with photographs, maps, street addresses, latitude/longitude and parcel data, including ownership.This story isn't new - but it is interesting:

"We find lots of mosquito sources at foreclosed homes," said John Rusmisel, district manager for Alameda County's Mosquito Abatement District. "It's an ongoing and big problem."

[Bob Franklin] bought a Cessna plane with a 30-inch-wide hole in the bottom to mount a downward-facing camera. The hole is a $40,000 option, as it requires rerouting wires and making structural changes. ... He wrote software for flight planning, camera control and specialized image processing.I find it amusing that he got the idea for the business while towing an advertising banner for Circuit City.

Real Estate Agents Giving Up

by Calculated Risk on 5/25/2009 09:11:00 AM

From the LA Times: Realtors are abandoning a listing ship

Already weakened by the sour housing market, the profession faces increasing challenges from Internet-based services that help people save thousands on a home purchase.

The number of agents typically declines in a housing slump and rebounds when the market recovers. But this time, "when we see an upturn in the cycle, any recovery in the ranks of residential real estate brokers will be limited by a reduced need for their services," said Stuart Gabriel, director of UCLA's Ziman Center for Real Estate.

"The real estate brokerage industry is not going away, but the combination of efficiency gains via the Internet and the cyclical downturn will both be significant forces to their rapidly shrinking ranks," Gabriel said.

The National Assn. of Realtors reports a 13% drop in membership since 2006.

Click on graph for larger image in new window.

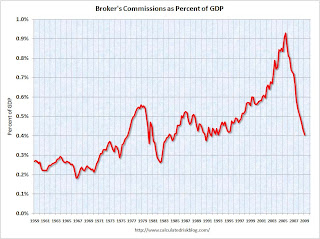

Click on graph for larger image in new window. This graph shows broker's commissions as a percent of GDP.

Not surprisingly - giving the housing bubble - broker's commissions soared in recent years, rising from $56 billion in 2000, to $109 billion in 2005. Commissions have declined to an annual rate of $57 billion in Q1 2009 - the lowest since 2000.

As a percent of GDP (shown on graph), broker's commissions are at the lowest level since 1993. All data from the BEA.

Here is a simple formula: Commissions = transactions X price X commission percent.

Broker's commissions increased because of both soaring prices and soaring activity. A double bubble.

Now a combination of lower prices, less activity, and innovation is putting pressure on commissions, and leading to fewer real estate agents.

Late Night Cranes

by Calculated Risk on 5/25/2009 12:29:00 AM

The U.S. Markets are closed Monday for Memorial Day (enjoy with your friends and family!). This will be a busy week for housing data: Case-Shiller house prices on Tuesday, existing home sales on Wednesday, and new home sales on Thursday. Should be interesting ...

The Asian markets are mixed tonight.

This video fits with an earlier post: Lost Vegas. This video is from about a year and a half ago ... but the Vegas skyline looked similar a few months ago when I was driving through Nevada ... maybe not Dubai (or Beijing) but still crazy!

Sunday, May 24, 2009

NY Times: We're All Subprime Now!

by Calculated Risk on 5/24/2009 09:24:00 PM

From Peter Goodman and Jack Healy at the NY Times: Job Losses Push Safer Mortgages to Foreclosure (ht shaun)

In the latest phase of the nation’s real estate disaster, the locus of trouble has shifted from subprime loans ... to the far more numerous prime loans issued to those with decent financial histories.

...

From November to February, the number of prime mortgages that were delinquent at least 90 days, were in foreclosure or had deteriorated to the point that the lender took possession of the home increased more than 473,000, exceeding 1.5 million, according to a New York Times analysis of data provided by First American CoreLogic, a real estate research group. Those loans totaled more than $224 billion.

During the same period, subprime mortgages in those three categories increased by fewer than 14,000, reaching 1.65 million. The number of similarly troubled Alt-A loans — those given to people with slightly tainted credit — rose 159,000, to 836,000.

Over all, more than four million loans worth $717 billion were in the three distressed categories in February, a jump of more than 60 percent in dollar terms compared with a year earlier.

Geithner Blames Borrowers and more, but not Regulators for Bubble

by Calculated Risk on 5/24/2009 05:38:00 PM

A WaPo interview with Secretary Geithner ...

WaPo's Lois Romano: "You mentioned that Americans borrowed beyond their means. When you look at the collapse of the housing market, who do you think bears the greatest responsibility? Is it the banks for pushing these loans? Is it the consumer for borrowing over their means? The regulators? Where do you see the fault lines there?"

Geithner: "For something this big and damaging to happen it takes a lot of mistakes over time. And it is that combination of things. Interest rate here and around the world were kept too low for too long. Investors made - took a bunch of risks without understanding the risks. They were betting on the expectation that house prices would continue to go up - to go up forever. Rating agencies failed to rate these products adequately. Supervisors failed to underwrite loans with sufficiently conservative standards. So those basic checks and balances failed. And people borrowed too much. It took all those things for it to happen."

CR Note: (short transcript by CR). Although there were many factors in the housing and credit bubble, the two keys were: 1) rapid innovation in the mortgage industry (securitization, automated underwriting, rapidly expanded wholesale lending, etc), and 2) a complete lack of oversight by regulators. As the late William Seidman wrote in his memoir (published in 1993): "Instruct regulators to look for the newest fad in the industry and examine it with great care. The next mistake will be a new way to make a loan that will not be repaid."

Geithner failed to mention the rapid changes in lending and the failure of government oversight as the two critical causes of the bubble. Either Geithner misspoke or he still doesn't understand what happened - and that is deeply troubling.

VIDEO Here (embedding was causing problems)

Lost Vegas

by Calculated Risk on 5/24/2009 01:13:00 PM

"These are times completely different than anything I have experienced in my lifetime. I didn't see this coming, and when it hit it hit virtually overnight."According to the Las Vegas Convention and Visitors Authority, vistor volume is off 6.5% from last year, room rates are off 31.6%, and convention attendance is off 30%.

Mayor Oscar Goodman told CNN, from John King: Luck running low in Las Vegas

This puts RevPAR (Revenue per available room) off 36%!

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows visitor volume and convention attendance since 1970. Vistors are back to 1998 levels, however the number of rooms has increased 28.5% since then - from 109,365 rooms in 1998 to 140,529 in 2008. Ouch.

Note: 2009 is estimated based on data through March.

In addition to building too many hotel rooms, there is an oversupply of office and retail space too. From Voit Real Estate Services on Offices:

The Las Vegas office market continued to report increased vacancies, weaker demand and reduced pricing through the first quarter of 2009. An imbalance in the commercial office sector has clearly emerged as selected portions of the market reported vacancies well beyond historical high points.And Voit on retail:

...

During the quarter, new supply entered the market as existing product reported a net loss in occupancies. The valley-wide average vacancy rate reached 19.6 percent, which represented a 2.0-point increase from the preceding quarter (Q4 2008). Compared to the prior year (Q1 2008), vacancies were up 4.9 points from 14.7 percent. As a point of reference, average vacancies bottomed out in the third quarter of 2005 at 8.1 percent.

emphasis added

By the close of the first quarter of 2009, the Las Vegas retail market continued to be impacted by a softening economic climate, reduced consumer spending and a number of corporate restructurings for retailers. Overall vacancies climbed to 9.3 percent, which represented a 1.9-point rise from the preceding quarter. Compared to the same quarter of the prior year, vacancies were up 3.7 points from 5.6 percent.And, of course, Las Vegas had a huge housing bubble too:

Market expansions continued to despite the downturn as a number of retail centers were well under construction by late-2008. Approximately 812,900 square feet completed construction, bringing total market inventory to 51.3 million square feet. As of March 31, 2009, a total of 2.5 million square feet was in some form of construction. It is worth noting a couple of major retail projects have stalled construction (1.7 million square feet) ...

The market reported negative demand for the second consecutive quarter with 221,000 square feet of negative net absorption.

This graph shows the Case-Shiller house price index for Las Vegas. This is one of most exaggerated bubbles in the U.S.

This graph shows the Case-Shiller house price index for Las Vegas. This is one of most exaggerated bubbles in the U.S.Prices almost doubled from January 2003 to the peak in early 2006 - and now are off almost 50% from the peak!

And don't forget the condos ...

This photo (credit: Anthony May 4, 2009) shows the only activity at ManhattanWest condo project in Vegas - a security guard relaxing in the sun.

This photo (credit: Anthony May 4, 2009) shows the only activity at ManhattanWest condo project in Vegas - a security guard relaxing in the sun.And ManhattanWest isn't the only halted project in Las Vegas (From the Las Vegas Review-Journalin March: ManhattanWest latest casualty of crisis):

Last year, Mira Villa condos and Vantage Lofts stopped construction and went into bankruptcy. Sullivan Square had barely begun excavation before the project was canceled. Spanish View Towers was the first high-rise project to stop construction after partially building an underground parking garage.

House Price Round Trip

by Calculated Risk on 5/24/2009 10:43:00 AM

This is another "Deal of the Week" from Zach Fox at the North County Times (San Diego): New construction, same discount.

August 2000: $310,000 (new)

January 2006: $620,000

March 2009: $339,000

Zach describes the house: 'four bedrooms, two-and-a-half baths, 2,231 square feet and a lot some might compare to a postage stamp.'

Saturday, May 23, 2009

Fed Vice Chairman Kohn on Economy

by Calculated Risk on 5/23/2009 07:30:00 PM

From Federal Reserve Vice Chairman Donald Kohn: Interactions between Monetary and Fiscal Policy in the Current Situation

A few excerpts:

[I]n the current weak economic environment, a fiscal expansion may be much more effective in providing a sustained boost to economic activity. With traditional monetary policy currently constrained from further reductions in the target policy rate, and with many analysts forecasting lower-than-desired inflation and a persistent, large output gap, agents may anticipate that the target federal funds rate will remain near zero for an extended period. In this situation, fiscal stimulus could lead to a considerably smaller increase in long-term interest rates and the foreign exchange value of the dollar, and to smaller decreases in asset prices, than under more normal circumstances. Indeed, if market participants anticipate the expansionary fiscal policy to be relatively temporary, and the period of weak economic activity and constrained traditional monetary policy to be relatively extended, they may not expect any increase in short-term interest rates for quite some time, thus damping any rise in long-term interest rates.And on the transition back to normal monetary policy:

emphasis added

An important issue with our nontraditional policies is the transition back to a more normal stance and operations of monetary policy as financial conditions improve and economic activity picks up enough to increase resource utilization. These actions will be critical to ensuring price stability as the real economy returns to normal. The decision about the timing of a turnaround in policy will be similar to that faced by the Federal Open Market Committee (FOMC) in every cyclical downturn--it has to choose when, and how quickly, to start raising the federal funds rate. In the current circumstances, the difference will be that we will have to start this process with an unusually large and more extended balance sheet.Kohn argues:

In my view, the economy is only now beginning to show signs that it might be stabilizing, and the upturn, when it begins, is likely to be gradual amid the balance sheet repair of financial intermediaries and households. As a consequence, it probably will be some time before the FOMC will need to begin to raise its target for the federal funds rate. Nonetheless, to ensure confidence in our ability to sustain price stability, we need to have a framework for managing our balance sheet when it is time to move to contain inflation pressures.

Our expanded liquidity facilities have been explicitly designed to wind down as conditions in financial markets return to normal, because the costs of using these facilities are set higher than would typically prevail in private markets during more usual times.

The Phoenix Housing Boom

by Calculated Risk on 5/23/2009 05:38:00 PM

A couple of articles on Phoenix...

From David Streitfeld at the NY Times: Amid Housing Bust, Phoenix Begins a New Frenzy

With this sweltering desert city enduring one of the largest tumbles in housing prices for any urban area since the Depression, there is an unrelenting stream of foreclosures to choose from. On some days, hundreds are offered for sale at the auctions that take place on the plaza in front of the county courthouse.And from Nicholas Riccardi at the LA Times: Phoenix's housing bust goes boom

There is also a large supply of foreclosed families who can no longer qualify for a loan. And that is prompting a flood of investors like Mr. Jarvis, who wants to turn as many of these people as possible into rent-paying tenants in the houses they used to own.

...

The low end of the real estate market here — and in some equally hard-hit places like inland California and coastal Florida — is becoming as wild as anything during the boom.

One real estate agent was showing a foreclosed house to a prospective client when a passer-by saw the open door, came in and snapped up the property. Another agent says she was having the lock changed on a bank-owned home when a man happened by, found out from the locksmith that it was available, and immediately bought it. Bidding wars are routine.

After four years of renting because they were priced out of the real estate market, Jamia Jenkins and Scott Renshaw concluded the time had arrived for them to buy.It is important to note that this activity is at the low end, and many of these buyers are cash flow investors (assuming they can find renters).

They saw that home prices had dropped so fast here -- faster than in any other big city in the nation -- that mortgage payments would be less than the $900 they paid in rent. The city is littered with foreclosed houses, so the couple figured they could easily snatch up something in the low $100,000s.

Three months later, they're still looking.

They have submitted 13 offers and been overbid each time.

"It's just pathetic," said Jenkins, 53. "Investors are going out there and outbidding everyone."

“If Phoenix loses population,” Mr. Jarvis says, “then buying houses here is a bad bet.”But this is just at the low end. Since most of the activity is distressed sales - foreclosures and short sales - there are no move up buyers. As Mike Orr, a Phoenix real estate analyst notes in the LA Times:

Orr thinks mid- and high-priced properties still will lose value in the coming months.And Streitfeld concludes:

"I wouldn't be investing in luxury right now," he said.

As Mr. Jarvis scouts for houses, he sometimes finds a familiar one. In February, he saw a home that one of his brothers bought from a builder in 2005, camping out overnight for the opportunity. With its value now shrunk, the brother was letting it go to foreclosure.At the low end there is demand from first time buyers, renters and cash flow investors. The supply is coming from foreclosures and short sales - and when that activity eventually slows, the supply will probably come from these investors!

Mr. Jarvis’s daughter Jade also bought a house at the market’s peak — in her case to live in. The other day she asked for advice: should she keep paying the mortgage on something that had declined in value by 60 percent? His conclusion: “probably not.”

“Am I teaching my kids right by letting them walk away from something they made a commitment to?” Mr. Jarvis wonders.

But without move up buyers, where will the mid-to-high priced buyers come from? That is an important question.

For more, see House Price Puzzle: Mid-to-High End

Agricultural Land Prices Decline Sharply in Q1

by Calculated Risk on 5/23/2009 01:08:00 PM

From the Chicago Fed: Farmland Values and Credit Conditions

There was a quarterly decrease of 6 percent in the value of “good” agricultural land—the largest quarterly decline since 1985—according to a survey of 227 bankers in the Seventh Federal Reserve District on April 1, 2009. Also, the year-over-year increase in District farmland values eroded to just 2 percent in the first quarter of 2009.

Click on graph for larger image in new window.

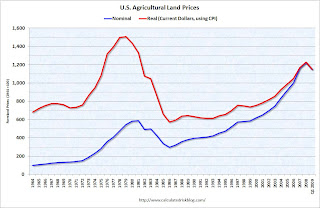

Click on graph for larger image in new window. This graphs shows nominal and real farm prices based on data from the Chicago Fed.

In real terms, the current increase in farm prices wasn't as severe as the bubble in the late '70s and early '80s that led to numerous farm foreclosures in the U.S.

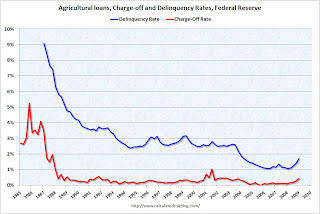

The second graph shows the charge-off and delinquency rates for agricultural loans from the Federal Reserve.

The second graph shows the charge-off and delinquency rates for agricultural loans from the Federal Reserve.The charge-off data goes back to 1985, the delinquency data back to 1987.

Many farmers borrowed against the increase in land values in the '70s, and then couldn't make the payments after land prices collapsed in the early '80s; leading to higher agricultural loan defaults.

So far prices have only fallen for one quarter, but the delinquency and charge-offs rates are already starting to increase.

Looking at the collapse in farm prices in the early '80s, it is not surprising that John Mellencamp wrote "Rain On The Scarecrow" in 1985.

Shiller: Possible Double Dip Recession in U.K.

by Calculated Risk on 5/23/2009 09:12:00 AM

From The Times: Professor Robert Shiller warns Britain may suffer a double recession

One of the world's most influential economists warns today that Britain faces the prospect of two recessions in quick succession.Shiller is talking about the British economy, but the U.S. economy has many of the same problems.

Robert Shiller, Professor of Economics at Yale University, said that the recent stock market bounce should be treated with caution.

...

The apparent upturn could soon go into reverse, he told The Times, marking a repeat of economic patterns in the 1930s and the 1980s. Such a double-dip slowdown has been nicknamed by economists a “W-shaped” recession, where recovery is so fragile, the country could be plunged into another slowdown as soon as it emerged from the last.

...

Last week Alistair Darling, the Chancellor, brushed aside doubts that his Budget forecasts had been overoptimistic and predicted that the recession would be over by Christmas. Many economists in the City believe that Britain will stagnate until the end of 2010 and that unemployment will continue to rise well after that.

... he warned that “there is a real possiblity of another recession. We may well see more bad news. It is a real failure of the imagination to think otherwise.”

He said that there were a number of issues that threatened any long-term recovery for the British economy - rising unemployment, mortgage defaults, and another wave of new company failures that “could surprise us yet”.

Professor Shiller also said that the banks were still harbouring large portfolios of troubled assets.

...

He added: “In 1931 in the US, President Hoover unveiled his recovery plan - there was a huge stock market rally — the market improved but it didn't hold because bad news kept coming in. Increased confidence can be a self-fulfilling prophecy but it doesn't always hold.”

Professor Shiller said, however, that he believed another likely scenario to be one where Britain would face a continuous decline with house prices falling for a number of years, drawing comparisons with the decade of misery in Japan in the 1990s.

Friday, May 22, 2009

FDIC Bank Failures: By the Numbers

by Calculated Risk on 5/22/2009 10:40:00 PM

Three banks were closed by the FDIC this week, for a total of 36 banks so far in 2009. The largest was BankUnited in Florida with $12.8 billion in assets.

To put those failures into perspective, here are three graphs: the first shows the number of bank failures by year since the FDIC was founded, and the second graph includes bank failures during the Depression. The third graph shows the size of the assets and deposits (in current dollars). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Back in the '80s, there was some minor multiple counting ... as an example, when First City of Texas failed on Oct 30, 1992 there were 18 different banks closed by the FDIC. This multiple counting was minor, and there were far more bank failures in the late '80s and early '90s than this year.

Note: there are approximately 8,300 FDIC insured banks currently. The second graph includes the 1920s and shows that failures during the S&L crisis were far less than during the '20s and early '30s (before the FDIC was enacted).

The second graph includes the 1920s and shows that failures during the S&L crisis were far less than during the '20s and early '30s (before the FDIC was enacted).

Note how small the S&L crisis appears on this graph! The number of bank failures soared to 4000 (estimated) in 1933.

During the Roaring '20s, 500 bank failures per year was common - even with a booming economy - with depositors typically losing 30% to 40% of their bank deposits in the failed institutions. No wonder even the rumor of a problem caused a run on the bank! The third graph shows the bank failures by total assets and deposits per year in current dollars adjusted with CPI. This data is from the FDIC (1) and starts in 1934.

The third graph shows the bank failures by total assets and deposits per year in current dollars adjusted with CPI. This data is from the FDIC (1) and starts in 1934.

WaMu accounted for a vast majority of the assets and deposits of failed banks in 2008, and it is important to remember that WaMu was closed by the FDIC, and sold to JPMorgan Chase Bank, at no cost to the Deposit Insurance Fund (DIF).

There are many more bank failures to come over the next couple of years, mostly because of losses related to Construction & Development (C&D) and Commercial Real Estate (CRE) loans, but so far, especially excluding WaMu, the total assets and deposits of failed FDIC insured banks is much smaller than in the '80s and early '90s.

Of course this is FDIC insured bank failures only. An investment bank like Lehman isn't included. Nor is the support for AIG, Citigroup and all the other "too big to fail" institutions ...

(1) The FDIC assets and deposit data is here. Click on Failures & Assistance Transactions.

Bank Failure #36: Citizens National Bank, Macomb, Illinois

by Calculated Risk on 5/22/2009 07:43:00 PM

Stronger banks ingest the weak

No morsel remains

by Soylent Green is People

From the FDIC: Morton Community Bank, Morton, Illinois, Assumes All of the Deposits of Citizens National Bank, Macomb, Illinois

Citizens National Bank, Macomb, Illinois, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Morton Community Bank, Morton, Illinois, to assume all of the deposits of Citizens National Bank, excluding those from brokers.

...

As of May 13, 2009, Citizens National Bank had total assets of $437 million and total deposits of approximately $400 million. Morton Community Bank agreed to purchase approximately $240 million of assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $106 million. Morton Community Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Citizens National Bank is the 36th FDIC-insured institution to fail in the nation this year, and the fifth in Illinois. The last FDIC-insured institution to be closed in the state was Strategic Capital Bank, Champaign, earlier today.

Bank Failure #35: Strategic Capital Bank, Champaign , Illinois

by Calculated Risk on 5/22/2009 07:07:00 PM

Addicted to public cash

Only flushed away

by Soylent Green is People

From the FDIC: Midland States Bank, Effingham, Illinois, Assumes All of the Deposits of Strategic Capital Bank, Champaign , Illinois

Strategic Capital Bank, Champaign, Illinois, was closed today by the Illinois Department of Financial and Professional Regulation, Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Midland States Bank, Effingham, Illinois, to assume all of the deposits of Strategic Capital Bank.

...

As of May 13, 2009, Strategic Capital Bank had total assets of $537 million and total deposits of approximately $471 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $173 million. Midland States Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Strategic Capital Bank is the 35th FDIC-insured institution to fail in the nation this year, and the fourth in Illinois. The last FDIC-insured institution to be closed in the state was Heritage Community Bank, Glenwood, on February 27, 2009.

Bernanke: "What have I done?"

by Calculated Risk on 5/22/2009 04:14:00 PM

The post title needs context ...

We all have moments we will never forget. One of mine occurred when I entered Harvard Yard for the first time, a 17-year-old freshman. It was late on Saturday night, I had had a grueling trip, and as I entered the Yard, I put down my two suitcases with a thump. I looked around at the historic old brick buildings, covered with ivy. Parties were going on, students were calling to each other across the Yard, stereos were blasting out of dorm windows. I took in the scene, so foreign to my experience, and I said to myself, "What have I done?"Excerpts from Fed Chaiman Bernanke's commencement address at Boston College School of Law, Newton, Massachusetts on dealing with the reality of unpredictability:

Ben Bernanke, May 22, 2009

I'd like to offer a few thoughts today about the inherent unpredictability of our individual lives and how one might go about dealing with that reality. As an economist and policymaker, I have plenty of experience in trying to foretell the future, because policy decisions inevitably involve projections of how alternative policy choices will influence the future course of the economy. The Federal Reserve, therefore, devotes substantial resources to economic forecasting. Likewise, individual investors and businesses have strong financial incentives to try to anticipate how the economy will evolve. With so much at stake, you will not be surprised to know that, over the years, many very smart people have applied the most sophisticated statistical and modeling tools available to try to better divine the economic future. But the results, unfortunately, have more often than not been underwhelming. Like weather forecasters, economic forecasters must deal with a system that is extraordinarily complex, that is subject to random shocks, and about which our data and understanding will always be imperfect. In some ways, predicting the economy is even more difficult than forecasting the weather, because an economy is not made up of molecules whose behavior is subject to the laws of physics, but rather of human beings who are themselves thinking about the future and whose behavior may be influenced by the forecasts that they or others make. To be sure, historical relationships and regularities can help economists, as well as weather forecasters, gain some insight into the future, but these must be used with considerable caution and healthy skepticism.And on how he ended up becoming an economist:

After I arrived at college, unpredictable factors continued to shape my future. In college I chose to major in economics as a compromise between math and English, and because a senior economics professor liked a paper I wrote and offered me a summer job. In graduate school at MIT, I became interested in monetary and financial history when a professor gave me several books to read on the subject. I found historical accounts of financial crises particularly fascinating. I determined that I would learn more about the causes of financial crises, their effects on economic performance, and methods of addressing them. Little did I realize then how relevant that subject would become one day. Later I met my wife Anna, to whom I have been married now for 31 years, on a blind date.I'm sure someone has a good blind date joke that would fit here.

The Oil Cushion: Getting Smaller

by Calculated Risk on 5/22/2009 03:09:00 PM

Last year I wrote a post about how falling oil prices would provide some cushion for the U.S. economy: The Oil Cushion. Here is another update ...

The following graph shows the monthly personal consumption expenditures (PCE) at a seasonally adjusted annual rate (SAAR) for gasoline, oil and other energy goods compared to the U.S. spot price for oil (monthly). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Last quarter I noted:

"The good news is at current oil prices (U.S. spot prices averaged about $39 per barrel in February), oil related PCE will be in the $250 billion seasonally adjusted annual rate (SAAR) range in Q1 - well below the $440 billion SAAR of the first 8 months of 2008.

This is a savings of about $16 billion per month compared to the first 8 months of 2008. That savings will definitely provide a cushion for consumers."

As expected, the BEA reported "PCE, Gasoline, fuel oil, and other energy goods" at $265 billion (SAAR) in Q1.

Now, with spot prices pushing $60 per barrel, oil related PCE will probably come in close to $300 billion (SAAR) in Q2.

That is still provides a sizable cushion compared to the first eight months of 2008 (about $11 billion per month), but this is a drag compared to Q1.

Data sources:

PCE from BEA underlying detail tables: Table 2.4.5U. Personal Consumption Expenditures by Type of Product line 117.

Oil prices from EIA U.S. Spot Prices.

Mortgage Pig Wear for Charity is Back!

by Calculated Risk on 5/22/2009 01:16:00 PM

A great Memorial Day gift for the UberNerd in your family! And the proceeds go to fight cancer ...

But first ... Cathy shared this email from Tanta:

Long time the CFO she sought,

And rested she from her own QC

And stood a while in thought.

And as in uffish thought she froze

The S&P with eyes aflame

Came woofling through her CMOs

And burbled as it came.

One two! One two! And through and through!

The rater’s blade went snicker-snack

She started B but with a C

She came galumphing back.

“And hast thou slain the MBS?

My whole loans too? My hedges all?

O frabjous day! Alas! Allay!

My margin got a call!”

‘Twas brillig, and the slivey toves . . .

Doris Tanta Dungey, July 18, 2007

(based on "Jabberwocky" by Lewis Carroll)

Notes from Cathy (Tanta' sister):

These items are produced as they are ordered and we do apologize about the size and color confusion. The best method is to enter this information in the PayPal message box when completing the order.So far the Mortgage Pig Wear raised over $3,500 for charity! From more on other donations, see: Tanta's Bench and Charity Update

We will accept check orders outside of Ebay but that will slow things down. Please EMAIL: rwstick AT yahoo DOT com (Dick) with the item, size and color and we will return the cost with shipping. Once the check is received with shipping instructions we will process the order.

Back in October, after Tanta came home from the hospital and agreed to come to Ohio with me, we had an idea to create Mortgage Pig Wear and donate the proceeds from the sales to the UMMS Greenebaum Cancer Center.

We have friends in Springboro, OH who own a small, local embroidery company called Image Mark-it that is owned and staffed by the type of caring folks who would want to be involved in a project like this. Jumped at the chance, is more like it.

We enlisted her 16 year-old nephew (my son) to handle the shipping and for that he would receive $1.00 per item in his college fund. Tanta would provide the "quality control" or lovingly ride herd on him. She couldn't wait.

Over the past 4 weeks we have "digitized" the pig for the embroidery on sweatshirts and polos and created high quality photo transfers for T-shirts and sweatshirts. Tanta lived long enough to see the samples but not to see the items go into production and be offered for sale. I still can't believe it.

I worried about what to do with this on Saturday so I simply asked Tanta. She wanted us to proceed. My son and my husband both asked her as well - and both got the same answer "Please go ahead with The Mortgage Pig Wear".

In the last day or so as I read the various tributes to her, I saw references to cure vs care. So we've made a small change - we're offering the embroidered pig items with proceeds donated to the Ovarian Cancer Research Fund (www.ocrf.org) and the photo-transfer items split between UMMS Greenebaum and OSUMC James Cancer Centers.

I hope you enjoy wearing these as much as the folks at Image Mark-it and I have enjoyed creating them. We are planning to work very hard to keep up with demand - and for all of us it's a labor of love.

| Holiday |

|

| Click on the Mortgage Pig™ for a larger image in new window. |

| Slap it |

|

| Convexity |

|

Credit Crisis Indicators

by Calculated Risk on 5/22/2009 09:50:00 AM

From the British Bankers' Association reported that the three-month dollar Libor rates were fixed at 0.66%. The LIBOR peaked at 4.81875% on Oct 10, 2008.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

There has been improvement in the A2P2 spread. This has declined to 0.48. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread of around 20 bps.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

| Meanwhile the TED spread has decreased further and is now at 48.45. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. |

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.The spread has decreased sharply over the last few months. The spreads are still high, especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.

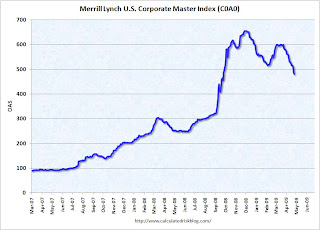

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.This is a broad index of investment grade corporate debt:

The Merrill Lynch US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market.Back in early March, Warren Buffett mentioned that credit conditions were tightening again - and this was probably one of the indexes he was looking at. Since March, the index has declined - but is still above normal levels.

Overall it appears the credit crisis has eased significantly.

WSJ: Ghost Malls

by Calculated Risk on 5/22/2009 09:07:00 AM

Not a new topic, but still interesting ...

From the WSJ: Recession Turns Malls Into Ghost Towns

One industry rule of thumb holds that any large, enclosed mall generating sales per square foot of $250 or less -- the U.S. average is $381 -- is in danger of failure. By that measure, Eastland is one of 84 dead malls in a 1,032-mall database compiled by Green Street. (The database focuses heavily on malls owned by publicly traded landlords and doesn't account for several dozen failing malls in private hands.) If retail sales continue to decline at current rates, the dead-mall roster could exceed 100 properties by the end of this year, according to Green Street. That's up from an estimated 40 failing malls in 2006, before the recession began.

"This time around, because of the dramatic changes in consumer spending practices, we're very likely to see more malls in the death spiral than we've ever seen before," says Green Street analyst Jim Sullivan.

...

For towns and cities that are home to dying malls, the fallout can be devastating. Malls hire hundreds of workers and are significant contributors to the local tax base. In suburbs and small towns, malls often are the only major public spaces and the safest venues for teenagers to shop, hang out and seek part-time work.