by Calculated Risk on 6/13/2009 01:25:00 PM

Saturday, June 13, 2009

Cities Downsize to Survive

From The Telegraph: US cities may have to be bulldozed in order to survive (ht Chad, Brian)

The government looking at expanding a pioneering scheme in Flint, one of the poorest US cities, which involves razing entire districts and returning the land to nature.

Local politicians believe the city must contract by as much as 40 per cent, concentrating the dwindling population and local services into a more viable area.

The radical experiment is the brainchild of Dan Kildee, treasurer of Genesee County, which includes Flint.

Having outlined his strategy to Barack Obama during the election campaign, Mr Kildee has now been approached by the US government and a group of charities who want him to apply what he has learnt to the rest of the country.

Mr Kildee said he will concentrate on 50 cities, identified in a recent study by the Brookings Institution, an influential Washington think-tank, as potentially needing to shrink substantially to cope with their declining fortunes.

Most are former industrial cities in the "rust belt" of America's Mid-West and North East. They include Detroit, Philadelphia, Pittsburgh, Baltimore and Memphis.

In Detroit ... there are already plans to split it into a collection of small urban centres separated from each other by countryside.

"The real question is not whether these cities shrink – we're all shrinking – but whether we let it happen in a destructive or sustainable way," said Mr Kildee. "Decline is a fact of life in Flint. Resisting it is like resisting gravity."

Fitch Expects Home Prices to Fall through 2nd Half of 2010

by Calculated Risk on 6/13/2009 08:44:00 AM

Fitch expects "home prices will fall an additional 12.5% nationally and 36% in California" from Q1 2009.

And, oh, you remember subprime?

From HousingWire: Subprime Bloodletting Continues at Fitch

Fitch Ratings today made massive downgrades on various vintage ‘05 through ‘08 subprime residential mortgage-backed securities (RMBS), indicating the extent of the fallout related to subprime defaults has yet to subside.Here is the Fitch statement: Fitch Takes Various Actions on 543 2005-2008 U.S. Subprime RMBS Deals

The rating agency slashed hundreds of RMBS ratings further into junk territory.

On home prices:

The projected losses also reflect an assumption that from the first quarter of 2009, home prices will fall an additional 12.5% nationally and 36% in California, with home prices not exhibiting stability until the second half of 2010. To date, national home prices have declined by 27%. Fitch Rating's revised peak-to-trough expectation is for prices to decline by 36% from the peak price achieved in mid-2006. The additional 9% decline represents a 12.5% decline from today's levels.In explaining the downgrades, Fitch said the actions reflect updated loss expectations and further economic deterioration:

“The home price declines to date have resulted in negative equity for approximately 50% of the remaining performing borrowers in the 2005-2007 vintages. In addition to continued home price deterioration, unemployment has risen significantly since the third quarter of last year, particularly in California where the unemployment rate has jumped from 7.8% to 11%.”

Friday, June 12, 2009

Study: Home Equity Borrowers in Danger

by Calculated Risk on 6/12/2009 10:54:00 PM

"The conventional view is that housing appreciation is good because it reduces (default) risk. Not according to my theory, which is housing appreciation is bad. It encourages junior-lien borrowing. When appreciation stops, somebody is going to be left in a bad position."From Matt Padilla at the O.C. Register: Second mortgages: Lines of danger?

Michael LaCour-Little, finance professor at Cal State Fullerton (emphasis added)

Record foreclosures hitting Orange County involve more than just newbie buyers who got in over their heads.And look at these numbers:

Some housing watchers say evidence is mounting that even veteran homeowners got caught up in housing euphoria and now are paying for it.

The latest argument comes from Michael LaCour-Little, a finance professor at Cal State Fullerton. He is lead author of a new study, which found that during the housing boom some long-time owners borrowed against all their property's equity gain, or paper profits. They treated their houses like cash machines.

...

It's long been assumed that homebuyers who purchased at housing's peak with little money down are among the most likely to face foreclosure. They owed more than their property was worth once prices tanked.

But the study concludes 'cashing-out' is about as predictive of foreclosure for the same reason: negative equity.

Professor LaCour-Little tracked all houses and condos set for foreclosure auctions, known as trustee's sales, in the first two weeks of November 2006, 2007 and 2008 in Orange, Los Angeles, Riverside, San Bernardino and San Diego counties. ...There will be many foreclosures of homes bought before the bubble (or in the early stages of the bubble), because the homeowners extracted too much equity from the home. This is not surprising, but probably means more foreclosures than policymakers expect.

For the early November 2008 data sample, he tracked 2,358 properties and found 79 percent of borrowers had at least a second mortgage. Some also had third and fourth liens. ...

The 2008 foreclosures were purchased in "median" year 2004, meaning half the purchases were before and half after. That suggests more than half the purchases were before housing's peak in 2005 and 2006.

Senatorial Splendor

by Calculated Risk on 6/12/2009 09:36:00 PM

Since the FDIC cancelled Friday ... here is Senator Voinovich showing us his charting skills.

FDIC's Bair: Banking Crisis Not Over

by Calculated Risk on 6/12/2009 06:27:00 PM

From Forbes: Bair Cautions Banking Crisis Is Not Over (ht jb)

Sheila Bair ... said Friday that while the crisis that swept through the financial world last year has subsided somewhat, it was far from over and there would be "many more bank failures" ahead.

"I think there's still some challenges, I think we need to be realistic. There are still some troubled assets on the books and we still have an economy that's under significant stress," said Bair in a 90-minute interview with Forbes reporters and editors on Friday.

We still don't know how deep the recession is going to be," she said, adding, "we'll still be well below what we were in the S&L days."

...

"Hopefully there are no more events that create liquidity stresses on the banks," Bair said, knocking on a wooden conference room table, "and now we're having more good old-fashioned capital insolvencies."

... she worried aloud about the current trend toward making the Federal Reserve banking's regulator-in-chief. ... "No other developed country gives their central bank the kind of power we give our central bank," Bair said.

"[The Fed] had authority to prescribe across-the-board lending standards for mortgages, and a lot of people said they should do that and they just didn't," Bair says as an example of where too many roles led to lapses. "Where does the consumer role go on your priority list? At some point it just doesn't get done. It just doesn't get the focus it should."

BFF and Market

by Calculated Risk on 6/12/2009 04:00:00 PM

Some stats: There have been 37 FDIC bank failures in 2009 (about 1.6 per week). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the bank failures per week through the first 23 weeks of 2009.

There have been six weeks with no failures, and two weeks with four failures.

Note: Corus Bankshares Inc. faces a June 18th deadline imposed by bank regulators to raise capital or find a buyer. I wouldn't be surprised if Corus is seized next week. The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Setser: Who bought all the recently issued Treasuries?

by Calculated Risk on 6/12/2009 03:03:00 PM

From Brad Setser at Follow the Money: Just who bought all the Treasuries the issued in late 2008 and early 2009?

... the Fed’s flow of funds data leaves little doubt that — at least during the first quarter — the rise in public borrowing was fully offset by a fall in private borrowing.

Who bought all the Treasuries the US government has issued in the last four quarters of data (q2 2008 to q1 2009)? Foreign demand for Treasuries — as we have discussed extensively — hasn’t disappeared, unlike foreign demand for other kinds of US debt. But foreign demand hasn’t increased at the same pace as the Treasury’s need to place debt. The gap was filled largely by a rise in demand for Treasuries from US households.

Before the crisis, foreign purchases formerly accounted for almost all new Treasury issuance. Over the last 12 months, foreign demand accounted for more like half of total issuance even as foreigners bought a record sum of Treasuries. And from what we know about the second quarter, I don’t think the basic story has changed.And for a great series of charts comparing the current recession to prior recessions (from Paul Swartz): The Recession in Historical Context

Credit Indicators

by Calculated Risk on 6/12/2009 12:28:00 PM

Here is another look at a few credit indicators:

From Dow Jones: Key US Dollar Libor Rate Falls To Record Low

The cost of borrowing longer-term U.S. dollars in the London interbank market fell Friday, with the three-month rate reaching its lowest level since the advent of British Bankers Association Libor fixings back in 1986 as funding pressures continued to ease.

Data from the BBA showed three-month dollar Libor, seen as a key gauge of the effectiveness of the Federal Reserve's monetary policy, dropped to 0.62438% from Thursday's 0.62938%.

The three-month rate peaked at 4.81875% on Oct. 10.

Click on graph for larger image in new window.

Click on graph for larger image in new window.There has been improvement in the A2P2 spread. This has declined to 0.55. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

| Meanwhile the TED spread is now down to the normal range of 46.21. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. |

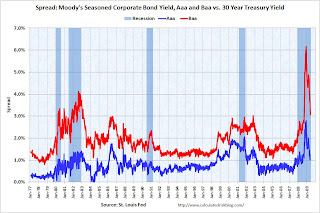

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.The spread has decreased sharply, but the spreads are still high, especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.This is a broad index of investment grade corporate debt:

The Merrill Lynch US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market.Back in early March, Warren Buffett mentioned that credit conditions were tightening again - and this was probably one of the indexes he was looking at. Since March, the index has declined steadily.

University of Michigan Consumer Sentiment

by Calculated Risk on 6/12/2009 10:10:00 AM

From MarketWatch: Consumer sentiment rises to 69 in June

U.S. consumer sentiment rose in June, but remained at relatively low levels, according to media reports of a survey released Friday by the University of Michigan and Reuters. The consumer sentiment index rose to 69 in mid-June from 68.7 in May.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Consumer sentiment is a coincident indicator - it tells you what you pretty much already know.

But it does give me an excuse for a graph ...

Right now consumer sentiment is still very weak.

UK: One in Ten Homeowners with Negative Equity

by Calculated Risk on 6/12/2009 08:49:00 AM

From The Times: One in ten homeowners fall into negative equity

One in ten homeowners fell into negative equity during the first three months of the year, the highest proportion for 15 years, the Bank of England said today.The UK has about 10 million homeowners with mortgages; the U.S. has about 51.6 million.

The Bank estimated that between 7 and 11 per cent of homeowners with a mortgage owed more to their lender than their property was worth, the equivalent of 700,000 to 1.1 million householders.

...

Around 200,000 buy-to-let investors were also estimated to owe more on their mortgage than their property was worth ...

The research said that the overall number of those in negative equity during the first quarter of 2009 was comparable with those who suffered the problem in the mid-1990s, during the last housing market correction.

The Bank said house prices had fallen by around 20 per cent between the autumn of 2007 and the spring of 2009, the largest nominal fall in property values on record. In contrast, it took six years for house prices to fall by 15 per cent between 1989 and 1995.

Moody's has estimated there 14.8 million homeowners with negative equity in the U.S. (just under 30% of homeowners with mortgages) so the problem seems more severe in the U.S.

NY Times: U.S. Better Off than Europe

by Calculated Risk on 6/12/2009 12:34:00 AM

Update: This is ugly from the Irish Times: Annual deflation rate hits 4.7% (ht Brian)

Prices fell 4.7 per cent in the year to May, the steepest rate since 1933, according to new data from the Central Statistics Office (CSO).From Nelson Schwartz at the NY Times: U.S. Recovery Could Outstrip Europe’s Pace

The Consumer Price Index (CPI) fell 4.7 per cent on an annual basis and by 0.5 per cent in the month. This compares to an increase of 0.8 per cent recorded in May 2008.

Some private economists are even predicting that the American economy will resume growth in the fourth quarter, while Europe’s economy is expected to remain in recession well into 2010, after contracting an estimated 4.2 percent this year compared with an expected 2.8 percent decline in the United States.Not much to say - misery loves company.

“The shock originated in the U.S., but Europe is paying a higher price,” said Jean Pisani-Ferry, a former top financial adviser to the French government who is now director of Bruegel, a research center in Brussels.

...

“I think America is further ahead in terms of fixing problems with the banks,” said Mr. Pisani-Ferry, “and countries like Germany have been hurt tremendously by the decline in world trade.”

Figures released this week showed that German exports plunged 28.7 percent in April from a year earlier, the steepest drop since the government began keeping records in 1950.

...

Underscoring the risk that hopes for a quick turnaround anywhere may be premature, the World Bank said Thursday that it expected the global economy to shrink by nearly 3 percent in 2009, far deeper than the 1.7 percent contraction it predicted just over two months ago.

And both Europe and the United States face the specter of rapidly rising unemployment, even if a rebound is beginning.

Thursday, June 11, 2009

Hamilton on CDS Trade: "A fool and his money ..."

by Calculated Risk on 6/11/2009 08:20:00 PM

I was going to post something on this CDS trade, but Professor Hamilton did a much better job than I could: How to lose on a sure-fire bet

Read Hamilton's take ...

Here are the details of the trade from the WSJ: A Daring Trade Has Wall Street Seething

The trade involved credit-default swaps and securities backed by subprime mortgages. The original securities ... were backed by $335 million of subprime mortgages mostly on homes in California made at the housing bubble's peak in 2005 ...

Following a wave of refinancing and defaults, only $29 million of the loans were left outstanding by March 2009, half of which were delinquent or in default...

Believing the securities would become worthless, traders at J.P. Morgan bought credit-default swaps over the past year from Amherst ... Other banks including RBS Securities ... and BofA also bought swaps on the securities from different trading partners.

The banks ... paid as much as 80 to 90 cents for every dollar of insurance, the going rate last fall according to dealer quotes, expecting to receive a dollar back when the securities became worthless ...

At one point, at least $130 million of bets had been made on the performance of around $27 million in securities ...

In late April, traders at some banks were shocked to find out from monthly remittance reports that the bonds they had bet against had been paid off in full. Normally an investor can't pay off loans like that but if the amount of outstanding loans falls to less than 10% of the original pool, the servicer ... can buy them and make bondholders whole.

That's what happened in this case. In April, a servicer called Aurora Loan Services at the behest of Amherst purchased the remaining loans and paid off the bonds.

Households with Mortgages: Approximately 20 Percent Equity

by Calculated Risk on 6/11/2009 05:11:00 PM

One of the headlines from the Fed's Flow of Funds report this morning was that household percent equity had fallen to a record low 41.4%.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows homeowner percent equity since 1952.

This is a simple calculation: divide home mortgages ($10,464 billion) by household real estate assets ($17,870 billion) gives us the percent mortgage debt (58.6%). Subtract from one gives us the percent homeowner equity (41.4%).

But what does this tell us?

What we really want to know is the percent equity for homeowners with mortgages. According to the Census Bureau, 31.6% of all U.S. owner occupied homes had no mortgage in 2007 (most recent data). These homeowners tend to be older, or more risk adverse, and few of them will probably borrow from their home equity.

You can't do a direct subtraction because the value of these paid-off homes is, on average, lower than the mortgaged 68.4%. But we can construct a model based on data from the 2007 American Community Survey.

Note: See data at bottom of this post. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the distribution of U.S. households by the value of their home, with and without a mortgage. This data is for 2007.

By using the mid-points of each range, and solving for the price of the highest range to match the then Fed's estimate of household real estate assets at the end of 2007: $20.5 Trillion, we can estimate the total dollar value of houses with and without mortgages.

Using this method, the total value of U.S. houses, at the end of 2007, with mortgages was $15.1 Trillion or 73.6% of the total. The value of houses without mortgages was $5.4 Trillion or 26.4% of the total U.S. household real estate.

Assuming 73.6% of current total assets is for households with mortgages (so $13.2 trillion of $17.87 trillion total), and since all of the mortgage debt ($10.464 trillion) is from the households with mortgages, these homes have an average of 20.4% equity. It's important to remember this includes some homes with 90% equity, and millions of homes with zero or negative equity.

Data from 2007 American Community Survey:

United States | ||

Estimate | Margin of Error | |

|---|---|---|

Total: | 75,515,104 | +/-227,236 |

With a mortgage: | 51,615,003 | +/-152,731 |

Less than $50,000 | 2,037,849 | +/-21,748 |

$50,000 to $99,999 | 6,443,236 | +/-45,023 |

$100,000 to $149,999 | 8,023,775 | +/-48,465 |

$150,000 to $199,999 | 7,318,809 | +/-43,489 |

$200,000 to $299,999 | 9,538,216 | +/-46,625 |

$300,000 to $499,999 | 10,196,919 | +/-44,000 |

$500,000 or more | 8,056,199 | +/-35,865 |

Not mortgaged: | 23,900,101 | +/-91,776 |

Less than $50,000 | 3,577,700 | +/-30,890 |

$50,000 to $99,999 | 4,665,031 | +/-35,455 |

$100,000 to $149,999 | 3,765,972 | +/-28,355 |

$150,000 to $199,999 | 2,968,680 | +/-24,691 |

$200,000 to $299,999 | 3,227,661 | +/-23,430 |

$300,000 to $499,999 | 3,080,889 | +/-21,963 |

$500,000 or more | 2,614,168 | +/-17,619 |

Hotel RevPAR off 22.9 Percent

by Calculated Risk on 6/11/2009 03:40:00 PM

From HotelNewsNow.com: STR reports US performance for week ending 6 June 2009

In year-over-year measurements, the industry’s occupancy fell 13.9 percent to end the week at 56.6 percent. Average daily rate dropped 10.5 percent to finish the week at US$95.90. Revenue per available room [RevPAR] for the week decreased 22.9 percent to finish at US$54.24.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 11.8% from the same period in 2008.

The average daily rate is down 10.5%, so RevPAR is off 22.9% from the same week last year.

CRE "Partial Interest Only Loans" Coming Due

by Calculated Risk on 6/11/2009 03:01:00 PM

From Bloomberg: Bondholders Face Losses From Commercial Mortgages(th Ron)

Investors in bonds that packaged $62 billion of debt for U.S. offices, hotels and shopping malls are bracing for more loan defaults through 2010 as Bank of America Merrill Lynch says landlords’ monthly payments may jump 20 percent or more.Hey, Option ARMs for commercial real estate ... hoocoodanode prices would fall?

Principal is coming due on the so-called partial interest only loans ... About $179 billion of such loans were written between 2005 and 2007 and bundled into bonds ... About 87 percent of mortgages sold as securities in 2007 allowed owners to put off paying principal for several years or until maturity, compared with 48 percent in 2004

Fed: Household Net Worth Off $14 Trillion

by Calculated Risk on 6/11/2009 12:00:00 PM

The Fed released the Q1 2009 Flow of Funds report today: Flow of Funds.

According the Fed, household net worth is now off $14 Trillion from the peak in 2007. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit Net Worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was relatively stable for almost 50 years, and then ... bubbles!

Household percent equity was at an all time low of 41.4%.

For blocked image users: Household Percent Equity

This graph shows homeowner percent equity since 1952.

When prices were increasing dramatically, the percent homeowner equity was declining because homeowners were extracting equity from their homes. Now, with prices falling, the percent homeowner equity is Cliff Diving!

Note: approximately 31% of households do not have a mortgage. So the 50+ million households with mortgages have far less than 41.4% equity. For blocked image users: Household Real Estate Assets Percent GDP

For blocked image users: Household Real Estate Assets Percent GDP

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP is now declining rapidly. Mortgage debt declined, but increased slightly as a percent of GDP in Q1.

Option ARMs: Paying $98 a month on a $350 Thousand Mortgage

by Calculated Risk on 6/11/2009 10:00:00 AM

From Bloomberg: Option ARMs Threaten U.S. Housing Rebound as 2011 Resets Peak

Shirley Breitmaier took out a $315,000 option ARM to refinance a previous loan on her house.And compare these two comments:

Her payments started at 3/8 of 1 percent, or less than $100 a month ... The 73-year-old widow may see it jump to $3,500 a month in two years ... She’ll be required to start paying principal and interest to amortize the debt when the loan reaches 145 percent of the original amount borrowed.

[CR Note: the 145% recast level is much higher than normal. This is now a GMAC loan]

...

About 1 million option ARMs are estimated to reset higher in the next four years, according to real estate data firm First American CoreLogic of Santa Ana, California. About three quarters of those loans will adjust next year and in 2011, with the peak coming in August 2011 when about 54,000 loans recast, the data show.

[CR Note: recast, not reset. This article uses the two terms interchangeably]

...

“The option ARM recasts will drive up the foreclosure supply, undermining the recovery in the housing market,” [Susan Wachter, a professor of real estate finance at the University of Pennsylvania’s Wharton School in Philadelphia] said in an interview. “The option ARMs will be part of the reason that the path to recovery will be long and slow.”

“This loan is a perfect example front to back, bottom to top, of everything that has gone wrong over the last five to seven years,” [Cameron Pannabecker, the owner of Cal-Pro Mortgage] said. “The consumer had a product pushed on them that they had no hope of understanding.”I agree with Pannabecker.

...

“The problem is, real estate values went down,” [Peter Paul of Paul Financial, the loan orginator] said.

And here is a repeat of the most recent reset / recast chart from Credit Suisse.

Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans.

As Tanta noted: "Reset" refers to a rate change. "Recast" refers to a payment change.

Resets are not a huge problem as long as interest rates stay low, but recasts could be significant. There are some questions about how the Wells Fargo pick-a-pay portfolio fits into this chart, since Wells Fargo doesn't expect significant recasts until 2012 (see A Bank Is Survived by Its Loans )

Retail Sales in May: Off 10.8% from May 2008

by Calculated Risk on 6/11/2009 08:31:00 AM

On a monthly basis, retail sales increased 0.5% from April to May (seasonally adjusted), and sales are off 10.8% from May 2008 (retail and food services decreased 9.6%). Much of the increase was due to higher gas prices.

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (May PCE prices were estimated as the average increase over the previous 3 months).

The Census Bureau reported that nominal retail sales decreased 10.8% year-over-year (retail and food services decreased 10.1%), and real retail sales also declined by 10.8% on a YoY basis.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, and may have bottomed at a much lower level.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $340.0 billion, an increase of 0.5 percent (±0.5%)* from the previous month, but 9.6 percent (±0.7%) below May 2008. Total sales for the March through May 2009 period were down 9.7 percent (±0.5%) from the same period a year ago. The March to April 2009 percent change was revised from -0.4 percent (±0.5%)* to -0.2 percent (±0.2%)*.Maybe the cliff diving is over, but no green shoots ....

Retail trade sales were up 0.5 percent (±0.7%)* from April 2009, but 10.8 percent (±0.7%) below last year. Gasoline stations sales were down 33.8 percent (±1.5%) from May 2008 and motor vehicle and parts dealers sales were down 19.6 percent (±2.3%) from last year.

Unemployment Claims: Record 6.8 Million Continued Claims

by Calculated Risk on 6/11/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending June 6, the advance figure for seasonally adjusted initial claims was 601,000, a decrease of 24,000 from the previous week's revised figure of 625,000. The 4-week moving average was 621,750, a decrease of 10,500 from the previous week's revised average of 632,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending May 30 was 6,816,000, an increase of 59,000 from the preceding week's revised level of 6,757,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971.

Continued claims increased to 6.82 million. This is 5.1% of covered employment.

Note: continued claims peaked at 5.4% of covered employment in 1982 and 7.0% in 1975. So this isn't a record as a percent of covered employment.

The four-week average of weekly unemployment claims decreased this week by 10,500, and is now 37,000 below the peak of 8 weeks ago. There is a reasonable chance that claims have peaked for this cycle, but continued claims are still increasing - so it is still too early to call.

The level of initial claims (over 601 thousand) is still high, indicating significant weakness in the job market.

RealtyTrac: Foreclosure Activity May Hit 1.8 Million by Mid-Year

by Calculated Risk on 6/11/2009 02:49:00 AM

Note: Foreclosure "activity" is defined as Notice of Default (NODs), scheduled auctions and bank repossessions. A large number of NODs are cured, so this isn't the number of properties that the banks' repossess.

From RealtyTrac: U.S. Foreclosure Activity Decreases 6 Percent in May U.S.

RealtyTrac® ... today released its May 2009 U.S. Foreclosure Market Report™, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 321,480 U.S. properties during the month, a decrease of 6 percent from the previous month but an increase of nearly 18 percent from May 2008. The report also shows that one in every 398 U.S. housing units received a foreclosure filing in May.The NODs are already spiking (most of the moratoriums have ended), but it takes awhile for this to lead to repossessions and REOs.

“May foreclosure activity was the third highest month on record, and marked the third straight month where the total number of properties with foreclosure filings exceeded 300,000 — a first in the history of our report,” said James J. Saccacio, chief executive officer of RealtyTrac. “While defaults and scheduled foreclosure auctions were both down from the previous month, bank repossessions, or REOs, were up 2 percent thanks largely to substantial increases in several states, including Michigan, Arizona, Washington, Nevada, Oregon and New York. We expect REO activity to spike in the coming months as foreclosure delays and moratoria implemented by various state laws come to an end.”

emphasis added

From Bloomberg: U.S. Foreclosure Filings Top 300,000 as Bank Seizures Loom

U.S. foreclosure filings surpassed 300,000 for the third straight month in May and may hit a record 1.8 million by the first half of the year, RealtyTrac Inc. said.

...

Additional U.S. home foreclosures will probably total 6.4 million by mid-2011, and inventories of foreclosed homes awaiting sale will probably peak in mid-2010 at about 2 million properties, JPMorgan Chase & Co. analysts led by John Sim wrote in a June 5 report.

...

The May total was the third-highest in RealtyTrac records dating to January 2005.