by Calculated Risk on 6/18/2009 10:00:00 AM

Thursday, June 18, 2009

Philly Fed: Manufacturing Sector Declines Slow "Dramatically"

Still contracting, but the pace of contraction has slowed "dramatically".

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

Declines in the region's manufacturing sector were much less in evidence in June, according to results for this month's Business Outlook Survey. Indexes for general activity, new orders, and shipments showed notable improvement, suggesting recent declines have lessened dramatically. Indicative of ongoing weakness, however, firms reported sustained declines in employment and work hours this month.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from -22.6 in May to -2.2 this month, its highest reading since September 2008 when the index was positive for one month...

Broad indicators of future activity showed significant improvement this month. The future general activity index remained positive for the sixth consecutive month and increased markedly from 47.5 in May to 60.1, its highest reading since September 2003 (see Chart). The index has now increased 71 points since its trough in December.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

"The index has been negative for 18 of the past 19 months, a span that corresponds to the current recession."

Weekly Unemployment Claims

by Calculated Risk on 6/18/2009 08:29:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending June 13, the advance figure for seasonally adjusted initial claims was 608,000, an increase of 3,000 from the previous week's revised figure of 605,000. The 4-week moving average was 615,750, a decrease of 7,000 from the previous week's revised average of 622,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending June 6 was 6,687,000, a decrease of 148,000 from the preceding week's revised level of 6,835,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971.

Continued claims decreased to 6.69 million. This is 5.0% of covered employment.

Note: continued claims peaked at 5.4% of covered employment in 1982 and 7.0% in 1975.

The four-week average of weekly unemployment claims decreased this week by 7,000, and is now 43,000 below the peak of 9 weeks ago. There is a reasonable chance that claims have peaked for this cycle, and the decline in continued claims is a positive.

However the level of initial claims (over 608 thousand) is still very high, indicating significant weakness in the job market.

Krugman points out (See: Unemployment claims and employment change)

[T]he level of new claims is basically an indicator of the rate of change of employment. And we are nowhere near the point at which employment looks ready to expand, or for that matter to stop falling at a terrifying rate.

What the figure [see Krugman's graph] suggests is that to stabilize employment, we’d have to see new claims drop below 400,000 or so.

Report: State Personal Income Tax Cliff Diving

by Calculated Risk on 6/18/2009 12:09:00 AM

From the WSJ: State Income-Tax Revenues Sink

State income-tax revenue fell 26% in the first four months of 2009 compared to the same period last year, according to a survey of states by the nonprofit Nelson A. Rockefeller Institute of Government.Here is a Draft of State Revenue Report

The report ... is one of the most up-to-date measures of how deep the recession is digging into Americans' wallets and, consequently, state coffers.

...

The time span notably includes the April 15 deadline for filing taxes, a critical time for states to collect revenues.

And a couple of graphs:

Click on graph for larger image in new window

Click on graph for larger image in new windowThe first graph, from the Nelson A. Rockefeller Institute of Government report, compares the first four months of 2009 to the first four months of 2008, and also compares April 2009 to April 2008 for eight regions. Note that the YoY change for April is worse in all regions than the first four month comparison.

The second graph is the four month comparison of each state (four states had no data).

The second graph is the four month comparison of each state (four states had no data).California isn't the worst, but the state relies heavily on income taxes.

Arizona is just getting crushed - and the pain is widespread.

Wednesday, June 17, 2009

Report: Risk Concentration, Lax Oversight, Brought Down Downey

by Calculated Risk on 6/17/2009 08:21:00 PM

Note: Downey Savings & Loan was seized by regulators on Nov 21, 2008, at an estimated cost to the Deposit Insurance Fund (DIF) of $1.4 billion.

From E. Scott Reckard at the LA Times Money & Co blog: Report: Lax oversight allowed Downey Savings' loan binge

Federal regulators responded inadequately from 2005 on as billions of dollars in high-risk mortgages piled up at weakly managed Downey Savings and Loan, the U.S. Treasury Department inspector general said in a report on last year’s failure of the Newport Beach thrift.Here is a Downey ad from the loose lending period (not in report):

The Office of Thrift Supervision ... began warning Downey management in 2002 about its heavy issuance of pay-option adjustable-rate mortgages but failed to rein in the practice, the report said.

...

Yet despite the warnings, "OTS examiners did not require Downey to limit concentrations in higher-risk loan products," said the 71-page inspector general report, posted Tuesday on the Treasury Department’s website.

Not sure of the exact date of this advertisement, but thanks for the memories! (hat tip Elroy).

From the report:

The primary causes of Downey’s failure were the thrift’s high concentrations in single-family residential loans which included concentrations in option adjustable rate mortgage (ARM) loans, reduced documentation loans, subprime loans, and loans with layered risk; inadequate risk-monitoring systems; the thrift’s unresponsiveness to OTS recommendations; and high turnover in the thrift’s management. These conditions were exacerbated by the drop in real estate values in Downey’s markets.And oversight from the OTS was insufficient:

OTS examiners did not require Downey to limit concentrations in higher-risk loan products. We believe that in light of the OTS’s repeated expressions of concern and management’s unresponsiveness to those concerns, OTS should have been more forceful, at least by 2005, to limit such concentrations. In interviews, OTS examiners commented that this would have been difficult since there was no history of losses in Downey’s option ARM, low documentation, and layered-risk loans from 2002 to 2006. However, both ND Bulletin 02-17 and the successor ND Bulletin 06-14 provide that examiners can direct thrifts to discontinue activities that lead to a specific high-risk concentration when proper oversight and controls are not in place. We believe that if there is one lesson to be learned from Downey’s failure it is that a lack of losses in the short term should not negate the need to address risk exposure such as high concentrations.

This graph from the Inspector General's report (with color added) shows the shift over time to reduced documentation loans. This add risk to already risky products and should have been a huge red flag.

This graph from the Inspector General's report (with color added) shows the shift over time to reduced documentation loans. This add risk to already risky products and should have been a huge red flag."Reduced documentation" is code word for borrower underwritten, as opposed to lender unwritten loans. Not surprisingly, reduced documentation loans perform worse than full documentation loans.

At the same time Downey was shifting to more and more reduced doc loans, they were also increasing the percentage of Option ARMs.

(See the ad above)

This was a toxic combination of risk layering.

BofE's Mervyn King : No Bank should be too big to fail

by Calculated Risk on 6/17/2009 06:01:00 PM

A couple of quotes from The Times: Mervyn King presses his case to limit size of banks

Mervyn King said he wanted a restriction on the size of banks, and that investment banks might have to be split from retail banks. ... he said banks should not be allowed to grow so large that they were deemed too big to fail.That last sentence shows King's frustration - after the crisis is over, it will be business as usual, unless the regulatory reforms have teeth.

...

“It is not sensible to allow large banks to combine high street retail banking with risky investment banking or funding strategies, and then provide an implicit state guarantee against failure,” Mr King said.

The State could limit providing a guarantee for depositors to high street banks that offered straight-forward services. Alternatively, riskier banks should have to hold much more capital. Finally, banks may have to provide their own plan for how they could be wound down in the event of failure. “Making a will should be as much a part of good housekeeping for banks as it is for the rest of us,” Mr King said.

... he was not sure how the Bank [BofE] would use its enhanced authority because its new tools were limited to issuing warnings that were likely to be ignored. “The Bank finds itself in a position rather like that of a church whose congregation attends weddings and burials but ignores the sermons in between,” he said.

Even then it is just a matter of time - and lobbying. The banks are notorious for having no institutional memory.

Nine Banks Repay $66.3 Billion in TARP Funds

by Calculated Risk on 6/17/2009 04:05:00 PM

UPDATE: State Street repaid $2 billion according to Bloomberg, so the total is $68.3 billion.

From DOW JONES: Financial Firms Repay $66.3B In TARP Funds

Ten banks were given $68.3 billion last fall and received approval last week to repay the funds. So far, just State Street Corp. (STT) - which ranked 9th in terms of the amount it received at $2 billion - has yet to announce its repayment.It is a little confusing because Northern Trust (NTRS) wasn't one of the 19 stress test banks.

JPMorgan, U.S. Bancorp (USB), American Express Co. (AXP), Bank of New York Mellon Corp. (BK), BB&T Corp. (BBT) and Northern Trust Corp. (NTRS) also announced plans to buy back the related warrants associated with TARP. Goldman, Morgan Stanley and Capital One Financial Corp. (COF) didn't address the warrants.

| Name | TARP Amount | Repay |

|---|---|---|

| Bank of America | $52.5 billion | No way! |

| Citigroup | $50 billion | No way! |

| JPMorgan Chase | $25 billion | Repaid |

| Wells Fargo | $25 billion | - |

| GMAC | $12.5 billion | No way! |

| Goldman Sachs | $10 billion | Repaid |

| Morgan Stanley | $10 billion | Repaid |

| PNC Financial Services | $7.6 billion | - |

| U.S. Bancorp | $6.6 billion | Repaid |

| SunTrust | $4.9 billion | - |

| Capital One Financial Corp. | $3.6 billion | Repaid |

| Regions Financial Corp. | $3.5 billion | - |

| Fifth Third Bancorp | $3.4 billion | - |

| American Express | $3.4 billion | Repaid |

| BB&T | $3.1 billion | Repaid |

| Bank of New York Mellon | $3 billion | Repaid |

| KeyCorp | $2.5 billion | - |

| State Street | $2 billion | Repaid |

| MetLife | None | - |

DataQuick: SoCal Home Sales Increase

by Calculated Risk on 6/17/2009 02:10:00 PM

From DataQuick: Southland median sale price inches up for first time since ‘07

Southern California home sales rose for the 11th consecutive month in May as sales of $500,000-plus homes started to come back. The median price paid increased slightly from the prior month for the first time since July 2007, the result of a shift in market activity where sales of deeply discounted foreclosures waned and mid- to high-end purchases rose, a real estate information service reported.Yesterday I noted that Cramer was fooled by the rise in median prices (as reported by NAR). DataQuick makes this clear that the increase was because of a slight change in mix. Prices are still falling.

emphasis added

A total of 20,775 new and resale houses and condos closed escrow in San Diego, Orange, Los Angeles, Ventura, Riverside and San Bernardino counties last month. That was up 1.3 percent from 20,514 in April and up 22.8 percent from 16,917 a year ago, according to San Diego-based MDA DataQuick.

Sales have increased year-over-year for 11 consecutive months.

May’s sales were the highest for that month since May 2006, when 30,303 homes sold, but were 21.2 percent below the average May sales total since 1988, when DataQuick’s statistics begin.

Foreclosure resales – homes sold in May that had been foreclosed on in the prior 12 months – accounted for 50.2 percent of all Southland resales. That was down from 53.5 percent in April and from a peak of 56.7 percent in February. May’s figure was the lowest since foreclosure resales were 50.9 percent of all resales last October.

The remarkably sharp declines in the Southland’s median sale price over the past year have been exacerbated by a shift toward an above-average number of sales occurring in lower-cost inland markets rife with discounted foreclosures. However, the number of homes lost to foreclosure declined over the winter, leaving fewer for bargain hunters to scoop up this spring. Meantime, sales have begun to rise a bit in many mid- to high-end markets, which could be due at least in part to sellers dropping their asking prices.

Last month 83 percent of the existing Southland houses sold were purchased for less than $500,000, compared with 84.8 percent in April. Conversely, sales $500,000 and above rose from 15.2 percent of sales in April to 17 percent in May. The last time the $500,000-plus market made up more than 17 percent of all sales was last October, when they were 19.9 percent of sales.

...

“We appear to be in the early stages of the market gradually tilting back toward a more normal balance of sales across the home price spectrum. As more sellers get realistic, more buyers get off the fence and more lenders offer reasonable terms for high-end purchase financing, we’ll see a more normal share of sales in the more established, higher-cost areas that have been nearly comatose,” said John Walsh, MDA DataQuick president.

...

Absentee buyers, including investors who will have their property tax bills sent to a different address, bought 19.4 percent of the Southland homes sold last month. That’s up from 16.9 percent a year ago and 18.6 percent in April. The monthly average since 2000: 15 percent.

...

Foreclosure activity remains near record levels ...

The Obama Regulatory Reform Plan

by Calculated Risk on 6/17/2009 12:55:00 PM

From the Treasury: President Obama to Announce Comprehensive Plan for Regulatory Reform

President Obama will lay out a comprehensive regulatory reform plan this afternoon to modernize and protect the integrity of our financial system. ... The President will be joined by Treasury Secretary Tim Geithner, representatives from the regulatory community, consumer groups, the financial industry and members of Congress for an event in the East Room later this afternoon.And a little reading material ...

White Paper: Requiring Strong Supervision And Appropriate Regulation Of All Financial Firms

Strengthening Consumer Protection

Providing The Government With Tools To Effectively Manage Failing Institutions

Improving International Regulatory Standards And Cooperation

A few excerpts:

We propose the creation of a Financial Services Oversight Council to facilitate information sharing and coordination, identify emerging risks, advise the Federal Reserve on the identification of firms whose failure could pose a threat to financial stability due to their combination of size, leverage, and interconnectedness (hereafter referred to as a Tier 1 FHC), and provide a forum for resolving jurisdictional disputes between regulators.CR: No off balance sheet nonsense and they propose to regulate the shadow banking system.

...

Any financial firm whose combination of size, leverage, and interconnectedness could pose a threat to financial stability if it failed (Tier 1 FHC) should be subject to robust consolidated supervision and regulation, regardless of whether the firm owns an insured depository institution.

...

Capital and management requirements for FHC status should not be limited to the subsidiary depository institution. All FHCs should be required to meet the capital and management requirements on a consolidated basis as well.

emphasis added

On derivatives:

All OTC derivatives markets, including CDS markets, should be subject to comprehensive regulation that addresses relevant public policy objectives: (1) preventing activities in those markets from posing risk to the financial system; (2) promoting the efficiency and transparency of those markets; (3) preventing market manipulation, fraud, and other market abuses; and (4) ensuring that OTC derivatives are not marketed inappropriately to unsophisticated parties.

UCLA Forecast: Weakest Recovery of Post War Era

by Calculated Risk on 6/17/2009 11:58:00 AM

Here is a fairly positive outlook. I think they are overly optimistic on house prices (forecasting an increase of 0.9% nationwide in 2010). Note: the Anderson forecast has a pretty good track record, but they missed the current recession (a major miss!)

From Reuters: U.S. poised for weak recovery : UCLA forecast

"The free-fall stage of the recession appears to be over and in fact we anticipate that the economy will record positive, albeit minimal, growth as early as the third quarter," ... We are forecasting the weakest economic recovery of the post-war era with real growth on the order of 2 percent to 3 percent," the report said.More from Jeff Collins at the O.C. Register:

"Simply put, we believe that the economy will be weighed down by newly chastened consumers attempting to increase their saving rate and a wrenching structural adjustment in the financial services, automotive and retail industries,"

The lion’s share of the housing decline is behind us, the UCLA Anderson Forecast reports today.

U.S. home prices have fallen 31% from the peak and are still falling. But home prices should start rising again by late 2009 or early 2010, the forecast said.

In addition:

•New home prices will increase 0.9% nationwide in 2010 and 2.9% in 2011, according to the forecast. The 2011 price still is forecast to be 13% below the peak, however.

[CR: This seems too optimistic. I think prices will fall through 2010 nationally, and for a longer period in some higher priced bubble areas]

•The forecast warns: “Because house price bear markets tend to have ‘long tails,’ do not expect any swift rise in prices over the next several years. Indeed, there are still more ’shoes to drop’ as a new round of Alt-A mortgage resets hits the market in 2010-11 and foreclosures rise on prime mortgages weighed down by high unemployment.”

•The supply of homes listed for sale has gone down faster in Orange County than in the nation as a whole, said Jerry Nickelsburg, co-author of the Anderson Forecast.

•“People are on the sidelines, and they’ll come back into the market when they see the benefit of waiting is no longer there,” Nickelsburg said.

•In Orange County, that’ll start to happen later this year, he said.

•New home construction bottomed out in California in the first quarter of this year, and in the second quarter nationwide, the forecast said.

[CR: This could be correct. I've been expecting new home construction to bottom sometime this year.]

•Developers now are under-building, and the market is primed for growth since homebuilding is failing to keep up with population growth.

•Nickelsburg said that while there is pent-up demand for new homes, potential buyers are on the sidelines — living with their parents, for example — and have yet to jump back into the market.

Owners' Equivalent Rent

by Calculated Risk on 6/17/2009 10:23:00 AM

Owners' equivalent rent (OER) is a major component of CPI (23.8% of CPI, see Cleveland Fed), and even though rents are falling in most areas, OER is still increasing (up 2.1% Year-over-year and up 1.8% annualized in May).

For a discussion from the BLS of rent measures see: How the CPI measures price change of Owners’ equivalent rent of primary residence (OER) and Rent of primary residence (Rent)

The expenditure weight in the CPI market basket for Owners’ equivalent rent of primary residence (OER) is based on the following question that the Consumer Expenditure Survey asks of consumers who own their primary residence:UPDATE: I misread the BLS document.“If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?”

The survey question above is for weighting. The price relative for OER is calculated by sampling non rent-controlled renters every six months. These average rents are divided by the sample six months earlier - and converted to a monthly change (by taking to the 1/6th power).

From the BLS document above: "The first step is standardizing the collected (market) rents, putting them on a monthly basis, and adjusting them for a number of circumstances that should not affect the CPI."

I apologize for any confusion.

END UPDATE.

The following graph shows the year-over-year (YoY) in the REIT rents (from Goldman Sachs), Owners' equivalent rent of primary residence and Rent of primary residence (both from the BLS). The Apartment Tightness Index from the National Multi Housing Council is on the right Y-axis.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows that the Apartment Tightness Index leads REIT rents, and that the BLS measures of rent follow.

This suggests further declines in the YoY REIT rents, and future disinflation for the BLS measures of rent.

CPI Increases Slightly, Off 1.3% in Past Year

by Calculated Risk on 6/17/2009 08:34:00 AM

From Rex Nutting at MarketWatch: Consumer prices inch 0.1% higher in May

U.S. consumer prices increased a seasonally adjusted 0.1% in May as higher gasoline prices were largely offset by falling food prices, the Labor Department reported Wednesday.

It was the first increase in the consumer price index in three months.

The core CPI ... also rose a seasonally adjusted 0.1% in May.

The CPI has fallen 1.3% in the past year, the sharpest decline in prices since April 1950.

MBA: Mortgage Applications Decrease

by Calculated Risk on 6/17/2009 07:47:00 AM

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, was 514.4, a decrease of 15.8 percent on a seasonally adjusted basis from 611.0 one week earlier.The Purchase Index is now at the level of the late '90s.

...

The Refinance Index decreased 23.3 percent to 1998.1 from 2605.7 the previous week and the seasonally adjusted Purchase Index decreased 3.5 percent to 261.2 from 270.7 one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.50 percent from 5.57 percent ...

With the 10 year yield moving down (3.67% yesterday from 3.99% a week ago), 30-year fixed mortgage rates decreased slightly this week. But mortgage rates are still significantly higher than three weeks ago (4.81%), and that increase in mortgage rates has led to significantly fewer refinance applications.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Although we can't compare directly to earlier periods because of the changes in the index, this shows no pick up in overall sales activity.

Tuesday, June 16, 2009

Obama Administration Releases Details of Proposed Financial Regulatory Overhaul

by Calculated Risk on 6/16/2009 09:52:00 PM

The WaPo has the document: Near-Final Draft of Document on Regulatory Overhaul (pdf)

From the WaPo: Financial Regulatory Overhaul Is Detailed

The plan is an attempt to overhaul an outdated system of financial regulations, according to senior administration officials.From MarketWatch: Fed may become systemic regulator, hike capital requirements

It would vastly increase the powers of the Federal Reserve ... It also would create a new agency to protect consumers of mortgages, credit cards and other financial products.

President Obama is expected to formally unveil the proposal [Wednesday]. The administration also plans to release an 85-page white paper detailing the plans and justifying each element as a direct response to the causes of the financial crisis.

...

The proposed Consumer Financial Protection Agency would have broad authority to regulate the relationship between financial companies and consumers of mortgage loans, credit cards, checking accounts and other financial products. It would define standards, police compliance and penalize delinquent firms. Other agencies, particularly the Federal Reserve, would surrender some powers.

The proposal will also call for the elimination of the Office of Thrift Supervision and the Federal Thrift Charter, subsuming the agency into a new "National Bank Supervisor," agency based on the Office of Comptroller of the Currency that will supervise all federally chartered depository institutions.

The Accidental Slumlord

by Calculated Risk on 6/16/2009 09:25:00 PM

I've been joking about "accidental landlords" for a couple of years, and how these properties are just more shadow housing inventory.

Daniel McGinn takes it a step further, and describes his own misadventures in Newsweek How I became an Accidental Slumlord (ht Tim waiting for 2012)

... As America copes with a painful hangover from a decade-long real-estate orgy, I'm dealing with a headache of my own. Four years ago, at the height of the boom, I visited Pocatello to write a story for NEWSWEEK about how out-of-state investors had begun buying cheap rental properties there, drawn by ultralow sales prices and a solid rental market. ... A year later, while writing a book about the housing boom, I decided to dive in myself. In late 2006, after seeing only e-mailed photos, an appraisal and an inspection report, I paid $62,750 for a two-unit rental property in Pocatello, which is 2,450 miles from my Massachusetts home. I didn't expect to get rich; my main motivation was to have a good story for the book. By that measure, the deal was a success; when House Lust came out in 2008, the chapter in which I described my early misadventures as a property magnate (an early tenant went to jail; my first property manager made off with $1,300) helped fuel reviews and interviews. But now, long after the buzz over the book has died down, I'm stuck with a house in Idaho—and friends who call me a long-distance slumlord.This is more nightmare than investment. But it could have been worse. I'll never understand why people invest in properties sight unseen.

...

Thanks to an energetic local property manager, my two apartments have never been vacant. Many months the combined rent of $690 covers the $503 mortgage payment and other expenses. Still, I'm frequently hit with repair bills (a broken stove, a leaking underground water line) that send me into the red. And even after the tax write-offs, my costs have exceeded the rental income by more than $2,500 since I purchased it.

...

My reaction to seeing my property and my tenants for the first time is common among out-of-state landlords who've visited their property. "When somebody is paying $300 a month in rent, in general they aren't the Rothschilds," says a 47-year-old Los Angeles schoolteacher who visited his own Pocatello duplex for the first time in December. "You're getting somebody who that's all they can afford." Although he'd seen photos of his property before he purchased it, this investor—who declined to be named because he's embarrassed to have made such a "boneheaded" investment—was surprised by its poor condition, citing holes in the walls, an awkward layout and general dinginess.

Cramer Gets Confused on Housing

by Calculated Risk on 6/16/2009 07:04:00 PM

NOTE: I'm not just picking on Cramer. I'm trying to emphasize two key points: 1) there will be two bottoms for housing, and 2) the median price is useless with a changing mix.

I've cautioned that people would make the following analysis errors ...

From CNBC: Cramer: Housing Has Officially Bottomed

Residential real estate has finally found a floor, Cramer told viewers on Tuesday.First, for almost every housing bust there have been two distinct bottoms: the first for activity (like housing starts) and the second for prices. Maybe this time is different, but I think Cramer is confusing activity for price.

...

How can Cramer be so sure? New housing data reported today showed a dramatic change for the better, especially in some of the hardest-hit areas in the US. That news, along with much lower prices and the working off of inventory, validate his prediction, made last August, that housing would stabilize this month, ending its multiyear declines.

...

What does a bottom look like? It’s the combination of ramping sales, and sales in certain areas are up ten times those of last year, and an end to falling prices. That’s exactly what we’ve seen for the past three months, Cramer said.

For more on the two bottoms, see: More on Housing Bottoms

On price, Cramer is probably looking at the median sales price from the National Association of Realtors. This shows that the median price has flattened over the last four months. But the median price has been heavily distorted by foreclosure sales in low end areas. A much better measure of price is the Case-Shiller index, and that shows prices fell at a 25% annual rate in Q1 nationally on a seasonally adjusted basis.

It was predictable that some people would confuse activity with price (remember there will probably be two bottoms). And it was predictable that some people would get confused when the median price started to flatten out (as the mix slowly changed) even though prices are still falling.

Jim the Realtor: Tour of Shadow Inventory

by Calculated Risk on 6/16/2009 04:54:00 PM

Jim takes us on a tour of a few REOs not yet on the market in the north San Diego County Coastal region. Jim says he couldn't find many foreclosed properties that aren't listed.

Some of these homeowners really dipped into the home ATM. Amazing. The home on 3 acres in Rancho Santa Fe isn't much, but that is a very nice area (and that is why the price is so high).

Stock Market Update

by Calculated Risk on 6/16/2009 04:00:00 PM

By popular demand ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

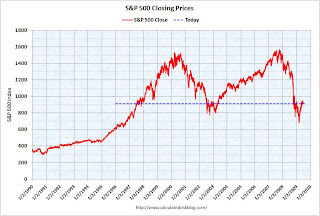

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up almost 35% from the bottom (235 points), and still off almost 42% from the peak (653 points below the max). The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Tiered House Prices

by Calculated Risk on 6/16/2009 03:18:00 PM

In the previous post, I disagreed a little with the JPMorgan analysts - I noted:

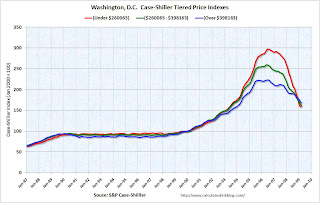

Prices increased more in percentage terms in the low priced areas of California (like the Inland Empire and Sacramento) than in the high priced coastal areas. So prices will probably fall further in percentage terms from the peak in the low priced areas.Case-Shiller has some tiered house price indices for a number of cities, and most of the bubble cities show this pattern (more appreciation in the low priced areas).

| Click on graph for larger image in new window. Here are a few select cities. The first is Washington, D.C. Note the price range of the tiers changes by city. |

The second graph is for Miami. |  |

| The third graph is for San Francisco. Most other bubble areas show a similar pattern of larger percentage price increases for the lower tier. |

JPMorgan Analysts Predict 60% House Price Decline for High End

by Calculated Risk on 6/16/2009 01:30:00 PM

From Bloomberg: ‘Millionaire Homes’ May Lose Value Until 2012 (ht James)

... “Tighter lending standards and the lack of cheap financing for these borrowers continue to be key issues,” the New York- based [JPMorgan Chase & Co. analysts] wrote [in a June 12 report], referring to “jumbo” mortgages. That’s after so-called interest-only and option adjustable-rate loans were a “major driver” of soaring values, they said.Most of the low end sales are "one and done" (the seller is a bank), and this will lead to a dearth of move up buyers. This lack of move up buyers, and tight financing will impact demand for the mid-to-high end. Although the percentage of foreclosures will be less in the high end areas than the low priced areas, the foreclosures are still coming (see Alt-A Foreclosures in Sonoma and Foreclosure Resales: Slow in High Priced Areas )

...

“Currently, we have national home prices bottoming in 2011,” they said. “However, prices for more expensive homes may not bottom out until 2012, and ultimately result in peak-to- trough declines in excess of 60 percent (compared to 40 percent nationally).”

“California is probably worse than other states, but higher-priced homes in general are going to be a problem,” Sim said in a telephone interview today.

However I disagree with the JPMorgan analysts on the relative price declines. Prices increased more in percentage terms in the low priced areas of California (like the Inland Empire and Sacramento) than in the high priced coastal areas. So prices will probably fall further in percentage terms from the peak in the low priced areas.

Also, I think the price declines will occur over a longer period in the high priced areas (like the JPMorgan analysts), so the nominal price declines will be less (assuming a little inflation). But those are minor details - I agree there are further substantial price declines ahead.

$13.9 Trillion Total Maximum Government Support Announced

by Calculated Risk on 6/16/2009 12:14:00 PM

The FDIC released the Summer 2009 Supervisory Insights today. The report includes the following table showing all the government support announced in 2008 and soon thereafter. The maximum capacity is $13.9 trillion.

I thought people would like to see the details (not all will be used).

Government Support for Financial Assets and Liabilities Announced in 2008 and Soon Thereafter ($ in billions) | |||

|---|---|---|---|

| Important note: Amounts are gross loans, asset and liability guarantees and asset purchases, do not represent net cost to taxpayers, do not reflect contributions of private capital expected to accompany some programs, and are announced maximum program limits so that actual support may fall well short of these levels | |||

| Year-end 2007 | Year-end 2008 | Subsequent or Announced Capacity If Different | |

| Treasury Programs | |||

| TARP investments1 | $0 | $300 | $700 |

| Funding GSE conservatorships2 | $0 | $200 | $400 |

| Guarantee money funds3 | $0 | $3,200 | |

| Federal Reserve Programs | |||

| Term Auction Facility (TAF)4 | $40 | $450 | $900 |

| Primary Credit5 | $6 | $94 | |

| Commercial Paper Funding Facility (CPFF)6 | $0 | $334 | $1,800 |

| Primary Dealer Credit Facility (PDCF)5 | $0 | $37 | |

| Single Tranche Repurchase Agreements7 | $0 | $80 | |

| Agency direct obligation purchase program8 | $0 | $15 | $200 |

| Agency MBS program8 | $0 | $0 | $1,250 |

| Asset-backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF)9 | $0 | $24 | |

| Maiden Lane LLC (Bear Stearns)9 | $0 | $27 | |

| AIG (direct credit)10 | $0 | $39 | $60 |

| Maiden Lane II (AIG)5 | $0 | $20 | |

| Maiden Lane III (AIG)5 | $0 | $27 | |

| Reciprocal currency swaps11 | $14 | $554 | |

| Term securities lending facility (TSLF) and TSLF options program(TOP)12 | $0 | $173 | $250 |

| Term Asset-Backed Securities Loan Facility (TALF)13 | $0 | $0 | $1,000 |

| Money Market Investor Funding Facility (MMIFF)14 | $0 | $0 | $600 |

| Treasury Purchase Program (TPP)15 | $0 | $0 | $300 |

| FDIC Programs | |||

| Insured non-interest bearing transactions accounts16 | $0 | $684 | |

| Temporary Liquidity Guarantee Program (TLGP)17 | $0 | $224 | $940 |

| Joint Programs | |||

| Citi asset guarantee18 | $0 | $306 | |

| Bank of America asset guarantee19 | $0 | $0 | $118 |

| Public-Private Investment Program (PPIP)20 | $0 | $0 | $500 |

| Estimated Reductions to Correct for Double Counting | |||

| TARP allocation to Citi and Bank of America asset guarantee21 | – $13 | ||

| TARP allocation to TALF21 | – $80 | ||

| TARP allocation to PPIP21 | – $75 | ||

| Total Gross Support Extended During 2008 | $6,788 | ||

| Maximum capacity of support programs announced through first quarter 200922 | $13,903 | ||

Table notes:

1 $300 is as of 1-23-2009 as reported in SIGTARP report of February 6 2009; EESA authorized $700.

2 Year-end reflects Treasury announcement of September 7, 2009, capacity reflects Treasury announcement of February 18, 2009; funding authorized under Housing and Economic Recovery Act.

3 Informal estimate of amount guaranteed at year-end 2008, provided by Treasury staff.

4 Year-end balances from Federal Reserve Statistical Release H.R. 1, “Factors Affecting Reserve Balances” (henceforth, H.R. 1); capacity from “Domestic Open Market Operations During 2008” (Report to the Federal Open Market Committee, January 2009), page 24.

5 Year-end balances from H.R. 1.

6 Year-end balances from H.R. 1; capacity from “Report Pursuant to Section 129 of the Emergency Economic Stabilization Act of 2008: Commercial Paper Funding Facility,” accessed May 26, 2009, from http://www.newyorkfed.org/aboutthefed/annual/annual08/CPFFfinstmt2009.pdf.

7 Year-end balances from H.R. 1; see also “Domestic Open Market Operations During 2008” (henceforth “DOMO report”) report to the Federal Open Market Committee, January 2009, page 11, summary of activity in program announced March 7 by the Federal Reserve.

8 Year-end balances from H.R. 1, capacity from Federal Reserve announcements of November 25, 2008 and March 18, 2009.

9 H.R. 1.

10 Year-end balances from H.R. 1; capacity from periodic report pursuant to EESA, “Update on Outstanding Lending Facilities Authorized by the Board Under Section 13(3) of the Federal Reserve Act,” February 25, 2009, page 8, henceforth referred to as “Update;” Federal Reserve AIG support is separate from Treasury support that is included in the TARP line item.

11 Year-end balances reported in DOMO report, page 25.

12 Year-end balances from H.R. 1; capacity from Federal Reserve announcement of March 11, 2008, Federal Reserve Bank of New York press release of August 8, 2008, and discussion at page 22 of DOMO report.

13 From “Update,” page 2.

14 From “Report Pursuant to Section 129 of the Emergency Economic Stabilization Act of 2008: Money Market Investor Funding Facility,” accessed May 26, 2009, from http://www.federalreserve.gov/monetarypolicy/files/129mmiff.pdf; Federal Reserve to fund 90 percent of financing or $540 billion.

15 Program and capacity announced by the Federal Reserve, March 18, 2009.

16 FDIC Quarterly Banking Profile, Fourth Quarter 2008, (henceforth, “QBP”) Table III-C.

17 Year-end outstanding from QBP, Table IV-C; total estimated cap for all entities opting in the program from QBP, Table II-C.

18 Announcement by FDIC, Treasury, and Federal Reserve November 23, 2008.

19 Announcement by FDIC, Treasury, and Federal Reserve of January 16, 2009.

20 To purchase legacy assets, as described in Treasury, FDIC, and Federal Reserve announcement of March 23, 2009. $500 refers to maximum capacity of Legacy Loans Program; funding for the Legacy Securities Program is believed to be subsumed under the TALF.

21 SIGTARP quarterly report of April, 2009, page 38.

22 Year-end 2008 amounts plus the amount by which announced capacity exceeds the year-end 2008 amount, minus the amount of known double counting.