by Calculated Risk on 6/29/2009 09:24:00 PM

Monday, June 29, 2009

Auto Sales Expected to be near 10 Million SAAR in June

There will be a flood of data released over the next three days, including the June employment numbers on Thursday. Other highlights include Case-Shiller house prices tomorrow and auto sales on Wednesday.

Several analysts expect an increase in auto sales in June, compared to May, on a seasonally adjusted annual rate (SAAR) basis. From the WSJ: Car-Sales Rebound Seen for June

[A]nnualized U.S. sales could hit 10 million this month for the first time in 2009, Ford Motor Co. analyst George Pipas said on Monday. The deep discounts that General Motors Corp. and Chrysler Group LLC have offered to boost sales are also likely to bolster June sales.But before everyone gets all Green Shootie ...

...

A GM spokesman also said an annualized 10 million sales rate is possible for June.

J.D. Power and Associates predicts annualized June sales of 10.3 million new cars and trucks, up from 9.9 million in May, while Edmunds.com expects the sales rate to top 10 million, though overall sales will still be 25% lower than a year ago.

This graph shows light vehicle sales since the BEA started keeping data in 1967.

This graph shows light vehicle sales since the BEA started keeping data in 1967.Breaking 10 million (SAAR) in June might put sales 10% off the bottom in February, but is is still more than 25% off from June 2008 (13.7 million light vehicle SAAR) and still near the bottom of the cliff.

Guaranty Financial: Last Hope is FDIC

by Calculated Risk on 6/29/2009 06:39:00 PM

In a 8-K regulatory filing today, Guaranty Financial stated the only "only remaining means by which the Company might possibly raise sufficient capital" is with the help of the FDIC. The Company expects current shareholders to be wiped out.

According to the Houston Business Journal (ht Tim), Guaranty has $14.4 billion in assets, and would be the largest bank to fail this year.

From the SEC filing:

Based on the current status of discussions involving its principal stockholders, other sources of financing, and certain regulatory authorities, the Board of Directors and management of the Company believe that the only remaining means by which the Company might possibly raise sufficient capital for it and its wholly-owned subsidiary, Guaranty Bank (the “Bank”), to comply with the Orders to Cease and Desist issued by the Office of Thrift Supervision (“OTS”) described in the Company’s Current Report on Form 8-K filed on April 8, 2009, is through a plan for open bank assistance (“Open Assistance”). The Open Assistance plan, which the Company is discussing with the Federal Deposit Insurance Corporation (“FDIC”) and the OTS, would involve a significant equity capital infusion from private investors, including the Company’s current principal stockholders, and an agreement under which the FDIC would absorb a portion of any losses associated with a pool of certain of the Company’s assets.

An Open Assistance plan must be approved by the FDIC. Before the FDIC can provide Open Assistance to the Bank, it must establish that the assistance is the least costly to the deposit insurance fund of all possible methods for resolving the financial condition of the Bank. The FDIC may deviate from the least cost requirement only in limited circumstances to avoid “serious adverse effects on economic conditions or financial stability” or “systemic risk” to the banking system. An additional condition to Open Assistance is that the OTS and FDIC must also determine that the Bank’s management is competent, has complied with all applicable laws, rules, and supervisory directives and orders, and has not engaged in any insider dealings, speculative practices, or other abusive activity. The FDIC may not approve an Open Assistance plan if it would benefit any stockholder or affiliate of the Company. As a result, the Company expects that the implementation of any Open Assistance plan would essentially eliminate the value of any of the Company’s currently outstanding equity interests, including shares of the Company’s common stock.

Open Assistance has historically been used extremely rarely by the FDIC, and there is no assurance that it would be available to the Company or the Bank in this case. In addition, while the Company has received expressions of interest from private investors with respect to the necessary capital infusion from private investors, it has not received capital commitments from any of these investors. Accordingly, the Company has not yet formally submitted to the FDIC its plan for Open Assistance, and it may ultimately not be able to do so. If a plan is formally submitted, the FDIC may choose not to approve it.

If the FDIC does not approve a plan for Open Assistance, the Company will no longer have the intent and ability to hold its mortgage-backed securities portfolio to recovery of unrealized losses, and, consequently, there would be substantial doubt that the Company would be able to continue as a going concern. In such case, the Company would be required to take material charges relating to the impairment of assets, in which case the preliminary financial information provided by the Company in previous Forms 12b-25 for the periods ended December 31, 2008 and March 31, 2009 should not be relied upon.

More on the Fifty Herbert Hoovers

by Calculated Risk on 6/29/2009 06:22:00 PM

From the Boston Globe: Patrick signs state budget (ht energyecon)

Governor Deval Patrick today signed a budget for next year that cuts aid to cities and towns, pares back programs throughout state government, and imposes $1 billion in additional taxes on Massachusetts residents, shoppers, and visitors.Higher taxes and less spending at the state level - what Krugman called the Fifty Herbert Hoovers

...

“This is without question an austere – and in some respects, painful – budget,” Patrick told reporters. “It contains many unavoidable spending cuts, and many of them will have a painful impact.”

He said the budget “reflects the stark economic realities of the time.”

Meanwhile - no progress in California on a budget.

FirstFed and Option ARMs "Last One Standing"

by Calculated Risk on 6/29/2009 03:11:00 PM

Here is an interesting article on FirstFed in the Los Angeles Business Journal: Last One Standing (ht Will)

Since souring option ARMs have taken down a number of big lenders, the big question looms: Will FirstFed, a savings and loan founded in Santa Monica on the eve of the Great Depression, be next?Basically FirstFed is the last of the Option ARM lenders (Wachovia, Countrywide, WaMu, IndyMac are all gone). And on their business:

...

In January, regulators placed the thrift under a cease-and-desist order over concerns that its capital supply was rapidly depleting. Even its auditor expressed doubt about its ability to survive.

Yet the institution is still around ...

FirstFed had been making option ARM loans without incident for more than 20 years. The loans held up well largely because option ARMs tended to be given to borrowers with good credit and proof of income.The average loan balance seems very high. From the Q1 10-Q SEC filing:

...

[By 2005 a] growing number of borrowers began opting for the minimum monthly payment, which sometimes did not even cover the interest rate. ...

[CR Note: by 2005, Option ARMs were being used for "affordability" instead of for cash management]

FirstFed readily admits it made the mistake of dropping its own standards in a misguided attempt to remain competitive. It did that mostly in 2005, a year in which the thrift originated $4.4 billion in single-family loans – primarily option ARMs and most without full verification of income or assets.

But the thrift was also one of the first to pull back. By late 2005 and into 2006, managers made the decision to stop underwriting the riskiest loans and begin requiring proof of income. Within two weeks, their business dropped in half.

[CR Note: Notice the risk layering. Not only were these Option ARMs, they were stated income (liar loan) Option ARMs and even no asset verification!]

...

In late 2007, with a $4.4 billion portfolio of option ARM loans set to recast, FirstFed began working aggressively to modify its at-risk loans.

...

In the past year and a half, FirstFed has modified some 2,000 loans, which constitute $2.8 billion of its option ARM portfolio ... a new effort currently under way could modify all but $400 million of the remaining loans.

At March 31, 2009, 1,511 loans with principal balances totaling $718.5 million had been modified.That is an average loan balance of $475 thousand and far short of the $2.8 in loan mods the article mentions - although FirstFed has probably modified a number of loans in Q2.

FirstFed is a candidate for BFF (or Thursday this week).

A comment on Fed Chairman Ben Bernanke

by Calculated Risk on 6/29/2009 01:27:00 PM

Given all the recent attacks, I'd be remiss if I didn't write something about Bernanke, but first ...

I've been a regular critic of Ben Bernanke. I thought he missed the housing and credit bubble when he was a member of the Fed Board of Governors from 2002 to 2005. And I frequently ridiculed his comments when he was Chairman of the President Bush's Council of Economic Advisers from June 2005 to January 2006.

In 2005, I posted these comments from Bernanke and disagreed strongly:

"While speculative behavior appears to be surfacing in some local markets, strong economic fundamentals are contributing importantly to the housing boom," ...And after Bernanke wrote a commentary in the WSJ: The Goldilocks Economy, I called it "bunkum" and I argued Bernanke was channeling Calvin Coolidge:

Those fundamentals, Bernanke said, include low mortgage rates, rising employment and incomes, a growing population and a limited supply of homes or land in some areas.

"For example, states exhibiting higher rates of job growth also tend to have experienced greater appreciation in house prices,"

The entire commentary is bunkum. But instead of correcting each of Bernanke's false assertions, I've found the template for his talking points:And I disagreed again in July 2005 when Bernanke said:No Congress of the United States ever assembled, on surveying the state of the Union, has met with a more pleasing prospect than that which appears at the present time. In the domestic field there is tranquillity and contentment, harmonious relations between management and wage earner, freedom from industrial strife, and the highest record of years of prosperity.Bernanke is now channeling Coolidge's monument to economic shortsightedness.

Calvin Coolidge, State of the Union Address, December 4, 1928

Top White House economic adviser Ben Bernanke said on Friday strong U.S. housing prices reflect a healthy economy and he doubts there will be a national decline in prices.And we can't forget Bernanke's "contained" to subprime comments in March 2007?

"House prices have gone up a lot," Bernanke said in an interview on CNBC television. "It seems pretty clear, though, that there are a lot of strong fundamentals underlying that.

"The economy is strong. Jobs have been strong, incomes have been strong, mortgage rates have been very low," the chairman of the White House Council of Economic Advisers said.

The pace of housing prices may slow at some point, Bernanke said, but they are unlikely to drop on a national basis.

"We've never had a decline in housing prices on a nationwide basis," he said, "What I think is more likely is that house prices will slow, maybe stabilize ... I don't think it's going to drive the economy too far from its full-employment path, though."

Although the turmoil in the subprime mortgage market has created severe financial problems for many individuals and families, the implications of these developments for the housing market as a whole are less clear. The ongoing tightening of lending standards, although an appropriate market response, will reduce somewhat the effective demand for housing, and foreclosed properties will add to the inventories of unsold homes. At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained.That became a running joke.

With that lengthy prelude, I've felt once Bernanke started to understand the problem, he was very effective at providing liquidity for the markets. The financial system faced both a liquidity and a solvency crisis, and it is the Fed's role to provide appropriate liquidity (we can disagree on what is appropriate). I don't think it is the Fed's role to run an insurance company - but I think that is as much the failure of Paulson's Treasury as overreach by the Fed.

And given all the recent attacks on Bernanke - many of them very personal - I'd like to reprint some of Jim Hamilton's comments: On grilling the Fed Chair

It is one thing to have different views from those of the Fed Chair on particular decisions that have been made-- I certainly have plenty of areas of disagreement of my own. But it is another matter to question Bernanke's intellect or personal integrity. As someone who's known him for 25 years, I would place him above 99.9% of those recently in power in Washington on the integrity dimension, not to mention IQ. His actions over the past two years have been guided by one and only one motive, that being to minimize the harm caused to ordinary people by the financial turmoil. Whether you agree or disagree with all the steps he's taken, let's start with an understanding that that's been his overriding goal.I agree with Professor Hamilton.

Fed's Rosengren on Macroprudential Oversight

by Calculated Risk on 6/29/2009 12:28:00 PM

Boston Fed President Eric Rosengren spoke this morning on The Roles and Responsibilities of a Systemic Regulator

One of my complaints five years ago was that lending standards were too lax (or non-existent), leverage was increasing rapidly, and lenders were clearly making loans that would probably not be repaid.

Rosengren addresses this issue:

Frequently, examiners spend significant time analyzing the adequacy of reserves, given asset quality. Reserve levels are calculated based on accounting standards that focus on incurred losses at the bank, rather than expected or unexpected losses. The incurred-loss model can sometimes be at odds with a more risk-based view that is more forward looking. By focusing on reserves in the manner defined by accounting rules, examiners are looking at history rather than focusing on whether banks have adequately provided for future losses. During periods when asset prices are rising rapidly and when nonperforming loans tend to be low, this construct can result in lower estimates for incurred losses and thus lower reserves – while at the same time, earnings and capital will likely be growing.UPDATE: Lama notes that Rosengren is incorrect about accounting just looking at "history", and reminds me of the guest piece he wrote in 2008: The Pig and The Balance Sheet

Periods when earnings are strong and nonperforming loans are low are likely the times that a macroprudential supervisor would need to be particularly vigilant. Rising asset prices are often accompanied by increases in leverage, as financial institutions provide financing for sectors of the economy that are growing rapidly. This growth frequently occurs with lessened attention to underwriting standards, a greater willingness to finance long-run positions with short-term liabilities, and a greater concentration of loans in areas that have grown rapidly. So – unlike the focus on incurred losses and accounting reserves of traditional safety and soundness supervision – a systemic regulator would need to be focused on forward-looking estimates of potential losses that could cause contagious failures of financial institutions.

bold emphasis added

And Rosengren concludes:

A systemic regulator or macroprudential supervisor would need not only the ability to monitor systemically important institutions, but also the ability to change behavior if firms are financing a boom by increasing leverage and liquidity risk. It follows that legislation that aims to design an effective systemic regulator needs to provide the regulator with the authority to make such changes. Understanding the activities of systemically important firms would require a clear picture of their leverage, their liquidity, and their risk management. Furthermore, to be truly effective in “leaning against the wind,” such a regulator would need the ability to prevent the build-up of excessive leverage or liquidity risk.However Rosengren doesn't address how the macroprudential supervisor would identify excessive leverage or liquidity risk. During every bubble there are always people in position of authority arguing everything is fine. As an example, here is what then Treasury Secretary Snow said on June 28, 2005 (has it really been 4 years?):

Snow tried to alleviate concerns that climbing nationwide housing prices could ultimately lead to an asset bubble that will burst at some point.He was flat-out wrong. And that was almost at the peak of the bubble (in activity).

"I think in some markets housing prices have risen out of alignment with underlying earnings," Snow said. But also answering the question whether there was a housing bubble in the United States his answer was a flat-out "no."

I think we need to clearly understand how we identify - in real time - these macroeconomic and systemic risks.

Romer: Big Stimulus Impact Starts Now

by Calculated Risk on 6/29/2009 10:20:00 AM

From the Financial Times: Romer upbeat on US economy

Ms Romer, chairman of the US president’s council of economic advisers, told the Financial Times in an interview she was “more optimistic” that the economy was close to stabilisation.I think a normal V-shaped recovery is very unlikely since the two usual drivers of economic recovery - residential investment and personal consumption expenditure - will both be crippled for some time.

...

Ms Romer said stimulus spending was “going to ramp up strongly through the summer and the fall”.

“We always knew we were not going to get all that much fiscal impact during the first five to six months. The big impact starts to hit from about now onwards,” she said.

Ms Romer said that stimulus money was being disbursed at almost exactly the rate forecast by the Office of Management and Budget. “It should make a material contribution to growth in the third quarter.”

But she acknowledged that cutbacks by states facing budget crises would push in the opposite direction.

Ms Romer said the latest economic data were encouraging, following a weaker patch a month ago. “I am more optimistic that we are getting close to the bottom,” she said.

...

But she added: “I still hold out hope it will be a V-shaped recovery. It might not be the most likely scenario but it is not as unlikely as many people think.

“We are going to get some serious oomph from the stimulus, there is the inventory cycle and I believe there is some pent-up demand by consumers.”

Freddie Mac June Investor Presentation

by Calculated Risk on 6/29/2009 08:48:00 AM

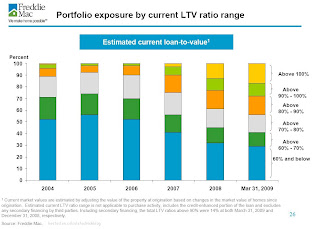

Here are a few graphs from the Freddie Mac June Investor Presentation. Click on graph for large image.

Click on graph for large image.

The first graph shows the average LTV of the Freddie Portfolio (graph doesn't start at zero).

The second graph shows the current breakdown by LTV and credit score.

According to Freddie Mac's estimate, 17% of the mortgages in their portfolio have negative equity. Another 11% of the loans have less than 10% equity.

Another 11% of the loans have less than 10% equity.

According to the Census Bureau, 51.6 million U.S. owner occupied homes had mortgages (end of 2007, see data here)

This would suggest that 8.8 million households have negative equity (51.6 million times 17%), and another 5.7 have 10% or less equity. However, the loans from Freddie Mac were better than most, and this is probably the lower bound for homeowners with negative equity. The third graphs show how the LTV breakdown has shifted over time as house prices have fallen.

The third graphs show how the LTV breakdown has shifted over time as house prices have fallen.

I'm surprised that any loans had negative equity in 2004, but just over 10% of the portfolio appeared to have LTV portfolio risk in 2004. Falling house prices has changed the mix!

Note: I'd consider the Zillow estimate of 20.4 million homeowners with negative equity as the upper bound (and I think their estimate is too high).

About 20.4 million of the 93 million houses, condos and co- ops in the U.S. were worth less than their loans as of March 31, according to Seattle-based real estate data service Zillow.com.There is much more in the Freddie Mac presentation.

Sunday, June 28, 2009

BIS: Toxic Assets Still a Threat

by Calculated Risk on 6/28/2009 09:52:00 PM

The Bank of International Settlements (BIS) will release their annual report tomorrow. The Guardian has a preview: Recovery threatened by toxic assets still hidden in key banks

... Despite months of co-ordinated action around the globe to stabilise the banking system, hidden perils still lurk in the world's financial institutions according to the Basle-based Bank of International Settlements.Also, the WSJ has an article on the incredibly shrinking PPIP: Wary Banks Hobble Toxic-Asset Plan

"Overall, governments may not have acted quickly enough to remove problem assets from the balance sheets of key banks," the BIS says in its annual report. "At the same time, government guarantees and asset insurance have exposed taxpayers to potentially large losses."

... As one of the few bodies consistently sounding the alarm about the build-up of risky financial assets and under-capitalised banks in the run-up to the credit crisis, the BIS's assessment will carry weight with governments. It says: "The lack of progress threatens to prolong the crisis and delay the recovery because a dysfunctional financial system reduces the ability of monetary and fiscal actions to stimulate the economy."

It also expresses concern about the dilemma facing policymakers on when to start reining in the recovery. "Tightening too early could thwart the recovery, whereas tightening too late may result in inflationary pressures from the stimulus in place, or contribute to yet another cycle of increasing leverage and bubbling asset prices. Identifying when to tighten is difficult even at the best of times, but even more so at the current stage," it says.

I think the stress tests showed that the U.S. should have pre-privatized BofA, Citigroup and GMAC. Oh well ...

How many Homeowners Sold to Rent at the Peak?

by Calculated Risk on 6/28/2009 07:26:00 PM

TJ & The Bear asks: "ocrenter had an interesting question over at JtR's BubbleInfo. Specifically, what percentage of homeowners that sold during the height of the bubble (04 to 06) went to cash and rented?" ocrenter is obviously curious about "cash on the housing sidelines".

We don't have the data to answer that question, but using the Census Bureau Residential Vacancies and Homeownership report, we can see that the number of occupied rental units bottomed in Q2 2004. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The number of occupied rental units bottomed in Q2 2004, and has increased by 3.8 millions units since then.

The homeownership rate also peaked in 2004, although it didn't start declining sharply until 2007.  Note: graph starts at 60% to better show the change.

Note: graph starts at 60% to better show the change.

There are probably several reasons why the number of renters started increasing in the 2nd half of 2004 (even though the housing bubble didn't peak in activity until the summer of 2005, and in prices until the summer of 2006.) More and more renters probably thought housing prices were too high by 2004 and put off buying, and some homeowners probably sold and became renters ...

To answer ocrenters question (somewhat), the number of renters increased by about 1.6million in the 2004 to 2006 period. A large number of those renters could have been homeowners who decided to sell and rent. We just don't have the data ...

Scientific American: Bubbles and Busts

by Calculated Risk on 6/28/2009 02:03:00 PM

Scientific American has a discussion of behavioral economics (Shiller's area) in the July issue. Here is a funny quote:

“Economists suffer from a deep psychological disorder that I call ‘physics envy'. We wish that 99 percent of economic behavior could be captured by three simple laws of nature. In fact, economists have 99 laws that capture 3 percent of behavior. Economics is a uniquely human endeavor ..."It probably isn't as dismal as Lo suggests!

Andrew Lo, a professor of finance at the Massachusetts Institute of Technology

Here is the article from Scientific American: The Science of Economic Bubbles and Busts (ht Jonathan) and a short excerpt:

... [T]he ideas of behavioral economists, who study the role of psychology in making economic decisions, are gaining increasing attention today, as scientists of many stripes struggle to understand why the world economy fell so hard and fast. And their ideas are bolstered by the brain scientists who make inside-the-skull snapshots of the [ventromedial prefrontal cortex] VMPFC and other brain areas. Notably, an experiment reported in March ... demonstrated that some of the brain’s decision-making circuitry showed signs of money illusion on images from a brain scanner. A part of the VMPFC lit up in subjects who encountered a larger amount of money, even if the relative buying power of that sum had not changed, because prices had increased as well.I've argued before that many buyers during the late stages of the bubble acted rationally. They could buy with little or no money down, and their house payments were below the comparable rent for a couple of years . If prices went up, they could sell as a profit - and if prices went down, they could strategically default. That was a systemic problem.

The illumination of a spot behind the forehead responsible for a misconception about money marks just one example of the increasing sophistication of a line of research that has already revealed brain centers involved with the more primal investor motivations of fear and greed ... A high-tech fusing of neuroimaging with behavioral psychology and economics has begun to provide clues to how individuals, and, aggregated on a larger scale, whole economies may run off track. Together these disciplines attempt to discover why an economic system, built with nominal safeguards against collapse, can experience near-catastrophic breakdowns.

...

The behavioral economists who are trying to pinpoint the psychological factors that lead to bubbles and severe market disequilibrium are the intellectual heirs of psychologists Amos Tversky and Daniel Kahneman, who began studies in the 1970s that challenged the notion of financial actors as rational robots. Kahneman won the Nobel Prize in Economics in 2002 for this work; Tversky would have assuredly won as well if he were still alive. Their pioneering work addressed money illusion and other psychological foibles, such as our tendency to feel sadder about losing, say, $1,000 than feeling happy about gaining that same amount.

A unifying theme of behavioral economics is the often irrational psychological impulses that underlie financial bubbles and the severe downturns that follow. Shiller, a leader in the field, cites “animal spirits”—a phrase originally used by economist John Maynard Keynes—as an explanation. The business cycle, the normal ebbs and peaks of economic activity, depends on a basic sense of trust for both business and consumers to engage one another every day in routine economic dealings. The basis for trust, however, is not always built on rational assessments. Animal spirits—the gut feeling that, yes, this is the time to buy a house or that sleeper stock—drive people to overconfidence and rash decision making during a boom. These feelings can quickly transmute into panic as anxiety rises and the market heads in the other direction. Emotion-driven decision making complements cognitive biases—money illusion’s failure to account for inflation, for instance—that lead to poor investment logic.

But animal spirits definitely helps explain the rush to buy that we saw at the peak of the bubble.

As an aside, I highlighted the one sentence because I've seen that behavior frequently. Some people are so afraid of losing money on each investment that they pass up on some very good investments. These individuals appear to assign a higher value to losing $1000, than gaining the same amount.

Boom Time: Personal Bankruptcies in SoCal

by Calculated Risk on 6/28/2009 10:29:00 AM

From the LA Times: Personal bankruptcies surge in Southern California

Going legally broke has made a big comeback -- especially in the Los Angeles area -- despite a mid-decade revision to the U.S. Bankruptcy Code intended to curb filings.Ahhh ... "adventuresome borrowers" ... sounds better than gamblers or speculators.

The number of Southern Californians seeking bankruptcy protection nearly doubled in 2008 from 2007 in the U.S. Bankruptcy Court's seven-county California Central District, by far the biggest increase in the nation.

Bankruptcy is still booming. Personal filings from January through April, the most recent month available, rose 75% in the Central District compared with the year-earlier period.

Bankruptcy experts attribute the growth mainly to the mortgage meltdown, which hit the region's adventuresome borrowers particularly hard.

| Click on cartoon for larger image in new window. Repeat: Cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |

Foreclosure Auction Bidding Wars

by Calculated Risk on 6/28/2009 01:31:00 AM

First from Matt Padilla: Frenzied bidding on discounted foreclosures

Whenever I attended auctions in 2007 and 2008, investors generally passed on properties. But on June 26 they jumped on houses and condos with discounts of greater than $100,000 on the debt and fees owed on each property.Normally lenders just bid what they are owed at auction, but I've been hearing for several months about some lenders bidding substantial under the amount owed. Jillayne discussed this a couple of months ago for an auction in Bellevue, WA.

For example, at least four people bid on a two-bedroom house in Anaheim on Zeyn Street. Winning bid: $206,000. Amount owed before foreclosure: $565,000. Discount: $359,000. ...

The discount is what the bank is willing to accept; it’s not directly related to the current market value, though I am sure the bank has a ballpark value in mind when it decides how much to accept.

...

A few other examples:

•Another property in Anaheim, a condominium on South Walnut, sold for $154,000, 57% off the debt owed of $358,000. At least three investors bid on it.

...

•A property on West Sunflower in Santa Ana went for $110,500, close to a third of $319,663 owed. ...

On a slightly different topic - many REOs are receiving multiple bids (because some lenders are trying to price them to start bidding wars). Here is a video from Jim the Realtor (after the ice cream truck bit) of an REO with 18 offers:

Saturday, June 27, 2009

Freddie Mac Delinquencies and Unemployment Rate

by Calculated Risk on 6/27/2009 09:37:00 PM

Yesterday I posted a graph of the Freddie Mac delinquency rate by month since 2005. I was asked if I could add the unemployment rate ... so by request ... Click on graph for large image.

Click on graph for large image.

This graph shows the Freddie Mac single family delinquency rate and the unemployment rate since 2005.

Note that the unemployment rate y-axis starts at 4% to match up the curves.

Here is the Freddie Mac portfolio data.

There are many reasons for the rising delinquency rate. Earlier today we discussed some new research suggesting a number of homeowners with negative equity are walking away from their homes ("ruthless default"). There are also negative events that can lead to delinquencies - like death, disease, and divorce - but one of the main drivers is probably loss of income.

New GM Agrees to Assume Future Product Liability Claims

by Calculated Risk on 6/27/2009 07:58:00 PM

From the WSJ: GM to Take on Future Product-Liability Claims (ht sportsfan, Basel Too)

General Motors Corp ... has agreed to assume legal responsibility for injuries drivers suffer from vehicle defects after the auto maker emerges from bankruptcy protection.This agreement doesn't cover current product liability plaintiffs - this just appears to cover future car-accident victims.

...

Under GM's original bankruptcy plan, the auto maker planned to leave such liabilities behind after selling its "good" assets to a "New GM" owned by the government. That meant future GM car-accident victims who believed faulty manufacturing caused their injuries would be unable to sue the New GM. Instead, they would have been treated as unsecured creditors, fighting over the remains of GM's old bankruptcy estate.

GM's move to take responsibility for future product-liability claims, outlined in a court filing late Friday evening, represents a partial victory for more than a dozen state attorneys general and several consumer advocacy groups.

...

Car-accident victims with pending lawsuits and those who had won damages against GM before it filed for bankruptcy would still be unable to bring claims against the new GM. They would remain with other unsecured creditors making claims against the "old GM." As GM's old estate winds down, those victims are likely to recover little or nothing.

Report: Hotel Values off 50% to 80% from Peak

by Calculated Risk on 6/27/2009 05:51:00 PM

From HotelNewsNow.com: California to see record number of hotel foreclosures

The number of California hotels in default or foreclosed on jumped 125% in the last 60 days. The state now has 31 hotels that have been foreclosed on and 175 in default, according to California-based Atlas Hospitality.Moody’s/REAL Commercial Property Price Indices showed CRE prices off almost 30% from the peak, but that was for office, industrial, apartments and retail. Hotels are even worse off, and a decline of 50% or more in appraised value from the peak seems possible with RevPAR off 20% and rising cap rates.

With 19.6% of the total, San Bernardino County leads the state in foreclosed hotels. Riverside County follows with 16.1% and San Diego County has 12.9%. Los Angeles County, with 12% of the total, has the most hotels in default. San Bernardino County is next with 9.7% and San Diego County follows with 8.0%.

...

No market or brand is immune in this downturn. In reviewing the hotels in default or foreclosed on, we found that over 75% of the loans originated from 2005 to 2007. During this period, over 2,500 California hotels either refinanced or obtained new purchase loan financing. Unfortunately, based on today’s market values, we estimate that none of these hotels have any equity remaining. The unprecedented decline in room revenues (California is down 21.5% year-to-date) combined with the jump in cap rates has resulted in a massive loss in values. We estimate that values are currently 50-80% lower than at the market’s peak in 2006-2007.

emphasis added

Once again the California's Inland Empire is getting crushed. (San Bernardino and Riverside counties in the article above)

New Research on Walking Away

by Calculated Risk on 6/27/2009 01:42:00 PM

Here is an interesting new paper on homeowners with negative equity walking away: Moral and Social Constraints to Strategic Default on Mortgages by Guiso, Sapienza and Zingales. (ht Bob_in_MA)

The WSJ Real Time Economics has a summary: When Is It Cheaper to Ditch a Home Than Pay?

The researchers found that homeowners start to default once their negative equity passes 10% of the home’s value. After that, they “walk away massively” after decreases of 15%. About 17% of households would default — even if they could pay the mortgage — when the equity shortfall hits 50% of the house’s value, they found.Walking away (what the researchers call a "strategic default" and the mortgage industry call a "ruthless default") is when the borrower decides to stop paying a mortgage even though they can still afford the payment. This has always been difficult to quantify. Whenever a lender calls a delinquent homeowner - if they can reach the homeowner - the homeowner always tells the lender some sob story about why they can't pay their mortgage (lost job, medical, rate reset, etc.). As the researchers note:

...

“Our research showed there is a multiplication effect, where the social pressure not to default is weakened when homeowners live in areas of high frequency of foreclosures or know others who defaulted strategically,” Zingales said. “The predisposition to default increases with the number of foreclosures in the same ZIP code.”

It is difficult to study the strategic default decision, because it is de facto an unobservable event. While we do observe defaults, we cannot observe whether a default is strategic. Strategic defaulters have all the incentives to disguise themselves as people who cannot afford to pay and so they will appear as non strategic defaulters in all the data.So the researchers conducted a survey to attempt to quantify the percent of strategic defaults. This has drawbacks - the questions are hypothetical and there are no actual monetary consequences - but the results seem somewhat reasonable.

emphasis added

Note: the researchers use Zillow for negative equity numbers, and I think those are overstated. I prefer the research of Mark Zandi at economy.com or estimates from First American CoreLogic.

I think one of the key points in the research are changing social norms - the more people a homeowner knows that he believes "walked away" the more open the homeowner will be to mailing in their keys. This is what I wrote in 2007:

One of the greatest fears for lenders (and investors in mortgage backed securities) is that it will become socially acceptable for upside down middle class Americans to walk away from their homes.This research suggests that this is happening in significant numbers.

This has led many people to suggest principle reductions (as opposed to payment modifications) is the only solution. Tom Petruno at the LA Times has more on this: Is it time for underwater homeowners to be given a get-out-of-debt-free card?

Government and private-lender attempts to stem the home foreclosure crisis so far have mostly focused on loan modifications or refinancing -- giving borrowers a temporary or permanent reduction in their monthly payments.And a final note, the researchers also touch on the recourse vs. non-recourse issue:

But some housing experts say the next wave of help will have to address the core problem for many homeowners: negative equity.

This camp believes that there is no alternative but outright forgiveness of a substantial chunk of mortgage debt for many people who are underwater in their homes and at risk of foreclosure.

While only few states have mandatory non-recourse mortgages (i.e., do not allow creditors to pursue borrowers who walk away from their mortgages for the difference between the amount of the mortgage and the resale value of the house), the cost of legal procedures is sufficiently high that most lenders are unwilling to sue a defaulted borrower unless he has significant wealth besides the home.And that fits with an email Tanta sent me in 2007 on recourse loans:

Back in my day working for a servicer, we never went after a borrower unless we thought the borrower defrauded us, willfully junked the property, or something like that. If it was just a nasty RE downturn, it rarely even made economic sense to do judicial FCs just to get a judgment the borrower was unlikely to able to pay. You could save so much time and money doing a non-judicial FC (if the state allowed it) that it was worth skipping the deficiency.

Norris on New and Existing Home Sales

by Calculated Risk on 6/27/2009 08:36:00 AM

From Floyd Norris at the NY Times: How Bad Is the Recession? Check New Home Sales

... For more than three decades, the sales volume of existing single-family homes and newly built houses tended to rise and fall by about the same percentage, as can be seen in the accompanying charts. To be sure, sales of new homes did tend to do a little worse during recessions, but the difference was small and short-lived.

...

At the peak of the housing boom in 2005, sales of both existing and new homes were running at twice the 1976 rate. This year, the sales rate for existing homes seems to have stabilized at about one-third higher than the 1976 rate. New-home sales also seem to have stabilized, but at about half the 1976 rate.

Excerpt from the New York Times.

Excerpt from the New York Times.Click on graph for NY Times Graphic.

Norris doesn't mention that the gap between the two series is a result of the extraordinary number of distressed existing home sales. This has pushed down new home sales (the builders can't compete with REO prices), and is keeping existing home sales elevated.

For more, see: Distressing Gap: Ratio of Existing to New Home Sales

I also linked to this post by Professor Brian Peterson earlier this week (including some thoughts prices): House Prices and New versus Existing Homes Sales

Friday, June 26, 2009

Gordon Brown as Susan Boyle

by Calculated Risk on 6/26/2009 11:59:00 PM

A little British humor ... with failed banks!

Note: if you don't know who Susan Boyle is, see Britains Got Talent 2009