by Calculated Risk on 7/01/2009 12:59:00 PM

Wednesday, July 01, 2009

Report: As many as One in Five U.S. hotels may default

I've already posted most of the data in this article ... so I'll just excerpt a quote.

From Bloomberg: Hotel Loan Defaults Double as Recession Cuts Travel (ht mark, ghostfaceinvestah, brian)

As many as one in five U.S. hotel may default on their loans by the end of 2010 as the recession forces companies to spend less on travel and perks, according to Kenneth Rosen, an economist at the University of California.The hotel segment was the most overbuilt of all CRE - and that is saying something with all the excess retail space!

The value of hotel properties in default or foreclosure almost doubled to $17.3 billion in the second quarter through June 24 from $9 billion at the end of the first quarter, data compiled by Real Capital Analytics Inc. show. The New York-based research firm, which began tracking distressed commercial property in November, expects hotel defaults to increase by as much as $2 billion next quarter, said analyst Jessica Ruderman.

“Hotels without question will have the highest foreclosure rate of any commercial real-estate sector,” said Rosen ...

Ford June U.S. light vehicle sales down 11% YOY

by Calculated Risk on 7/01/2009 12:27:00 PM

From MarketWatch:

Ford June U.S. sales down 11% to 148,153 units

Ford to increase Q3 production to 485,000 vehicles

Volvo June U.S. sales down 0.6% to 7,042 units

Daimler June U.S. sales fell 26.5% to 16,271 vehicles.

MORE TO COME ...

Previous months:

Ford U.S. May sales fall 24.2%

Ford April U.S. vehicle sales off 31.3%

Ford U.S. March sales dropped 40.9%

February Ford sales were off 46.3% YoY

January off 42.1%

December off 32.4%

November off 31%

NAR: Pending Home Sales Index Increases Slightly

by Calculated Risk on 7/01/2009 10:49:00 AM

From the NAR: Pending Home Sales Record Fourth Straight Monthly Gain

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in May, increased 0.1 percent to 90.7 from an upwardly revised reading of 90.6 in April, and is 6.7 percent higher than May 2008 when it was 85.0. The last time there were four consecutive monthly gains was in October 2004.Yun is blaming the disconnect beteween pending and existing home sales on the change in apprasial rules, but there are probably other factors too - like rising mortgage rates, tighter lending standards, and the inability of homeowners to sell the current home.

...

Lawrence Yun, NAR chief economist, cautions that there could be delays in the number of contracts that go to closing. “Closed existing-home sales have improved but are coming in lower than expected because some contracts are delayed or falling through from the application of new appraisal rules for many transactions,” he said.

Constructon Spending Declines in May

by Calculated Risk on 7/01/2009 10:15:00 AM

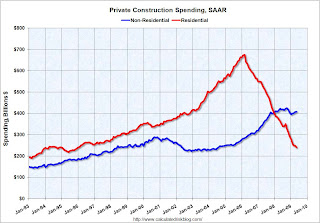

Private residential construction spending is 64.5% below the peak of early 2006.

Private non-residential construction spending is only off 4.1% below the peak of last September. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending fell further in May, and nonresidential spending was up a little (because of private spending on power), but will probably decline sharply over the next two years. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is off 3.3% on a year-over-year basis, and will turn strongly negative as projects are completed. Residential construction spending is still declining YoY, although the negative YoY change should be smaller going forward.

As I've noted before, these will probably be two key stories for late 2009: the collapse in private non-residential construction, and the probable bottom for residential construction spending. Both stories are still developing ...

From the Census Bureau: May 2009 Construction at $968.7 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $649.2 billion, 1.0 percent (±1.1%)* below the revised April estimate of $655.6 billion. Residential construction was at a seasonally adjusted annual rate of $240.2 billion in May, 3.4 percent (±1.3%) below the revised April estimate of $248.8 billion. Nonresidential construction was at a seasonally adjusted annual rate of $409.0 billion in May, 0.5 percent (±1.1%)* above the revised April estimate of $406.9 billion.

ISM Manufacturing Shows Contraction in June

by Calculated Risk on 7/01/2009 10:00:00 AM

From the Institute for Supply Management: June 2009 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector failed to grow in June for the 17th consecutive month, while the overall economy grew for the second consecutive month following seven months of decline, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.As noted, any reading below 50 shows contraction, although the pace of contraction has slowed.

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "Manufacturing continues to contract at a slower rate, but the trends in the indexes are encouraging as seven of 18 industries reported growth in June. Most encouraging is the gain in the Production Index, which is up 12.1 percentage points in the last two months to 52.5 percent. Aggressive inventory reduction continues and indications are that the de-stocking cycle is at or near the end in most industries, as the Customers' Inventories Index remained below 50 percent for the third consecutive month. The Prices Index was unchanged from May, indicating that the supply/demand balance is improving. Overall, a slow recovery for manufacturing is forming based on the current trends in the ISM data."

emphasis added

Employment: ADP, Challenger, Monster

by Calculated Risk on 7/01/2009 08:35:00 AM

ADP reports:

Nonfarm private employment decreased 473,000 from May to June 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from April to May was revised by 47,000, from a decline of 532,000 to a decline of 485,000.Note: the BLS reported a 338,000 decrease in nonfarm private employment in May, so once again ADP was not very useful in predicting the BLS number.

On the Challenger job-cut report from CNBC:

[P]lanned layoffs at U.S. firms fell for a fifth consecutive month in June, hitting the lowest since March 2008 ...And from Monster:

Planned job cuts announced by employers totaled 74,393 in June, down 33 percent from 111,182 in May, according to .... Challenger, Gray & Christmas.

"We typically see a decline in job cuts in the second quarter." [the report said]

...

It was the first time since last September that the monthly total was less than 100,000 and it was the lowest job-cut count since 53,579 job cuts were announced in March 2008.

It was also 9 percent lower than the same month a year ago, making it the first year-over-year decline since February 2008, Challenger added.

The Monster Employment Index slipped one point or one percent in June as online job opportunities fell modestly, largely in line with seasonal expectations. Year-over-year, the Index was down 28 percent ...The BLS reports tomorrow, and the consensus is for about 350,000 in reported job losses for June.

“While U.S. online job availability has remained largely flat since January, the annual pace improved during the second quarter, suggesting some expansion in underlying employer demand for workers,” said Jesse Harriott, senior vice president ... at Monster Worldwide. “Still, current levels of online job vacancies are at their lowest since January 2005, illustrating the extent to which hiring has slowed during this recession.”

MBA: Mortgage Refinance Applications Off 30%

by Calculated Risk on 7/01/2009 08:11:00 AM

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, was 444.8, a decrease of 18.9 percent on a seasonally adjusted basis from 548.2 one week earlier.

...

The Refinance Index decreased 30.0 percent to 1482.2 from 2116.3 the previous week and the seasonally adjusted Purchase Index decreased 4.5 percent to 267.7 from 280.3 one week earlier. The Refinance Index is at its lowest level since November 2008.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.34 percent from 5.44 percent ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index.

The Purchase index is still near recent lows, but the big story this week was the sharp decline in the Refinance index - probably because of the recent rise in borrowing costs.

Unemployment Forecast: Too Much "Hope"

by Calculated Risk on 7/01/2009 12:07:00 AM

From David Leonhardt at the NY Times: A Forecast With Hope Built In

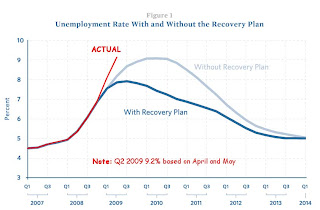

In the weeks just before President Obama took office, his economic advisers made a mistake. They got a little carried away with hope.Here is the January forecast with the actual data ...

... Without the stimulus, they saw the unemployment rate — then 7.2 percent — rising above 8 percent in 2009 and peaking at 9 percent next year. With the stimulus, the advisers said, unemployment would probably peak at 8 percent late this year.

We now know that this forecast was terribly optimistic.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph compares the actual quarterly unemployment rate (in red) with the Obama economic forecast from January 10th: The Job Impact of the American Recovery and Reinvestment Plan

There are two possible explanations that the administration was so wrong. ... The first explanation is that the economy has deteriorated because the stimulus package failed. ... The second answer is that the economy has deteriorated in spite of the stimulus.Very little of the stimulus has been spent so far, so it is premature to say it failed. However Romer recently was quoted in the Financial Times:

Ms Romer said stimulus spending was “going to ramp up strongly through the summer and the fall”.So we should see an impact in the 2nd half of 2009 ... and that starts now!

“We always knew we were not going to get all that much fiscal impact during the first five to six months. The big impact starts to hit from about now onwards,” she said.

Ms Romer said that stimulus money was being disbursed at almost exactly the rate forecast by the Office of Management and Budget. “It should make a material contribution to growth in the third quarter.”

Tuesday, June 30, 2009

SF Fed President Yellen on the Economy

by Calculated Risk on 6/30/2009 09:05:00 PM

San Francisco Fed President Janet Yellen has been rumored to be one of the front runners to replace Chairman Ben Bernanke (although most consider Larry Summers the front runner, assuming Bernanke isn't reappointed).

Tonight Dr. Yellen spoke in San Francisco: A View of the Economic Crisis and the Federal Reserve’s Response. Here are some excerpts on her views going forward:

I expect the recession will end sometime later this year. That would make it the longest and probably deepest downturn since the Great Depression. ...Yellen also discusses Fed policy, the Fed balance sheet, the fiscal deficit and inflation: "I think the predominant risk is that inflation will be too low, not too high, over the next several years."

I don’t like taking the wind out of the sails of our economic expansion, but a few cautionary points should be considered. I expect the pace of the recovery will be frustratingly slow. It’s often the case that growth in the first year after a recession is very rapid. That’s what happened as we came out of a very deep downturn in the early 1980s. Although I sincerely wish we would repeat that performance, I don’t think we will. In past deep recessions, the Fed was able to step on the accelerator by cutting the federal funds rate sharply, causing the economy to shoot ahead. This time, we already have our foot planted firmly on the floor. We can’t take the federal funds rate any lower than zero. I believe that the Fed’s novel programs are stimulating the flow of credit, but they simply aren’t as powerful levers as large rate cuts, so this time monetary policy alone can’t power a rapid recovery.

History also teaches us that it often takes a long time to recover from downturns caused by financial crises. In particular, financial institutions and markets won’t heal overnight. Our major banks have made excellent progress in establishing the capital buffers needed to continue lending even through a downturn that is more serious than we anticipate. But they are still nursing their wounds and credit will remain tight for some time to come.

I also think that a massive shift in consumer behavior is under way—one that will produce great benefits in the long run but slow our recovery in the short term. American households entered this recession stretched to the limit with mortgage and other debt. The personal saving rate fell from around 8 percent of disposable income two decades ago to almost zero. Households financed their lifestyles by drawing on increasing stock market and housing wealth, and taking on higher levels of debt. But falling house and stock prices have destroyed trillions of dollars in wealth, cutting off those ready sources of cash. What’s more, the stark realities of this recession have scared many households straight, convincing them that they need to save larger fractions of their incomes. In the long run, higher saving promises to channel resources from consumption to investment, making capital more readily available to retool industry and fix our infrastructure. But, in the here and now, such a rediscovery of thrift means fewer sales at the mall, and fewer jobs on assembly lines and store counters.

A fourth factor that could slow recovery is the unprecedented global nature of the recession. Neither we nor our trading partners can count on a boost from strong foreign demand. Finally, developments in the labor market suggest it could take several years to return to full employment. During this recession, an unusually high proportion of layoffs have been permanent as opposed to temporary, meaning workers won’t get called back when conditions improve. Also, we’ve seen an unprecedented level of involuntary part-time work, such as state workers on furlough a few days per month. Those workers are likely to return to full-time status before new workers are hired. To summarize, I expect that we will turn the growth corner sometime later this year, but I am not optimistic that the economy will spring back to normal anytime soon. What’s more, I expect the unemployment rate to remain painfully high for several more years.

That’s a dreary prediction, but there is also some risk that things could turn out worse. High on my worry list is the possibility of another shock to the still-fragile financial system. Commercial real estate is a particular danger zone. Property prices are falling and vacancy rates are rising in many parts of the country. Given the weak economy, prices could fall more rapidly and developers could face tough times rolling over their loans. Many banks are heavily exposed to commercial real estate loans. An increase in defaults could add to their financial stress, prompting them to tighten credit. The Fed and Treasury are providing loans to investors in securitized commercial mortgages, which should be a big help. But a risk remains of a severe shakeout in this sector.

emphasis added

June Economic Summary in Graphs

by Calculated Risk on 6/30/2009 06:23:00 PM

Here is a collection of real estate and economic graphs for data released in June ...

Note: Click on graphs for larger image in new window. For more info, click on link below graph to original post.

New Home Sales in May (NSA)

New Home Sales in May (NSA)The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the lowest sales for May since the Census Bureau started tracking sales in 1963. (NSA, 32 thousand new homes were sold in May 2009; the record low was 36 thousand in May 1982).

From: New Home Sales: Record Low for May

New Home Sales in May

New Home Sales in MayThis graph shows shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

"Sales of new one-family houses in May 2009 were at a seasonally adjusted annual rate of 342,000 ...

This is 0.6 percent (±17.8%)* below the revised April rate of 344,000 and is 32.8 percent (±10.9%) below the May 2008 estimate of 509,000."

From: New Home Sales: Record Low for May

New Home Months of Supply in May

New Home Months of Supply in MayThere were 10.2 months of supply in May - significantly below the all time record of 12.4 months of supply set in January.

"The seasonally adjusted estimate of new houses for sale at the end of May was 292,000. This represents a supply of 10.2 months at the current sales rate."

From: New Home Sales: Record Low for May

Existing Home Sales in May

Existing Home Sales in May This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May 2009 (4.77 million SAAR) were 2.4% higher than last month, and were 3.6% lower than May 2008 (4.95 million SAAR).

From: Existing Home Sales Graphs

Existing Home Inventory May

Existing Home Inventory Mayshows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.80 million in May. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

Typically inventory increases in May, and then really increases over the next couple months of the year until peaking in the summer. This decrease in inventory was a little unusual, and the next few months will be key for inventory.

Also, many REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs - this is possible.

From: Existing Home Sales Graphs

Existing Home Inventory May, Year-over-Year Change

Existing Home Inventory May, Year-over-Year ChangeThis graph shows the year-over-year change in existing home inventory.

If the trend of declining year-over-year inventory levels continues in 2009 that will be a positive for the housing market. Prices will probably continue to fall until the months of supply reaches more normal levels (closer to 6 months compared to the current 9.6 months), and that will take some time.

From: Existing Home Sales Graphs

Case Shiller House Prices for April

Case Shiller House Prices for AprilThis graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 33.1% from the peak, and off 1.0% in April.

The Composite 20 index is off 32.0% from the peak, and off 0.9% in April.

From: Case-Shiller: House Prices Fall in April

NAHB Builder Confidence Index in June

NAHB Builder Confidence Index in JuneThis graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) decreased to 15 in June from 16 in May. The record low was 8 set in January.

From: NAHB: Builder Confidence Decreases Slightly in June

Architecture Billings Index for May

Architecture Billings Index for May"A leading indicator of U.S. nonresidential construction spending held steady for a second month in May, suggesting an economic recovery has stalled, an architects' trade group said on Wednesday.

The Architecture Billings Index edged up a tenth of a point to 42.9 last month after a slight decline in the prior month, according to the American Institute of Architects....."

From: American Institute of Architects: Recovery has stalled

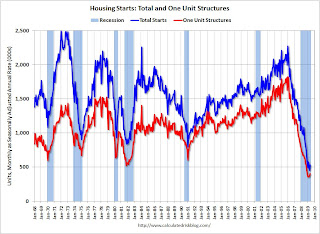

Housing Starts in May

Housing Starts in MayTotal housing starts were at 532 thousand (SAAR) in May, rebounding from the all time record low in April of 454 thousand. The previous record low was 488 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 401 thousand (SAAR) in May; above the record low in January and February (357 thousand) and above 400 thousand for the first time since last November.

From: Housing Starts May

Construction Spending in April

Construction Spending in AprilThis graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending was up slightly in April (compared to March), and nonresidential spending has peaked and will probably decline sharply over the next two years.

From: Construction Spending in April

May Employment Report

May Employment ReportThis graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 345,000 in May. The economy has lost almost 3.6 million jobs over the last 6 months, and over 6 million jobs during the 17 consecutive months of job losses.

The unemployment rate rose to 9.4 percent; the highest level since 1983.

Year over year employment is strongly negative (there were 5.4 million fewer Americans employed in May 2009 than in May 2008).

From: Employment Report: 345K Jobs Lost, 9.4% Unemployment Rate

May Employment Comparing Recessions

May Employment Comparing RecessionsThis graph graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses have really picked up over the last 8 months (4.6 million jobs lost, red line cliff diving on the graph), and the current recession is now one of the worst recessions since WWII in percentage terms - although not in terms of the unemployment rate.

From: Employment Report: 345K Jobs Lost, 9.4% Unemployment Rate

May Retail Sales

May Retail SalesThis graph shows the year-over-year change in nominal and real retail sales since 1993.

The Census Bureau reported that nominal retail sales decreased 10.8% year-over-year (retail and food services decreased 10.1%), and real retail sales also declined by 10.8% on a YoY basis.

From: Retail Sales in May: Off 10.8% from May 2008

LA Port Traffic in May

LA Port Traffic in MayThis graph shows the loaded inbound and outbound traffic at the port of Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 19.7% below May 2008.

Outbound traffic was 15.3% below May 2008.

There has been some recovery in exports over the last few months (the year-over-year comparison was off 30% from December through February). But this is the 3nd worst YoY comparison for imports - only February and April were worse. So imports from Asia appear especially weak.

From: LA Area Port Traffic in May

U.S. Imports and Exports Through April

U.S. Imports and Exports Through AprilThis graph shows the monthly U.S. exports and imports in dollars through April 2009.

Both imports and exports declined again in April. On a year-over-year basis, exports are off 21% and imports are off 31%!

From: Trade Deficit Increases Slightly in April

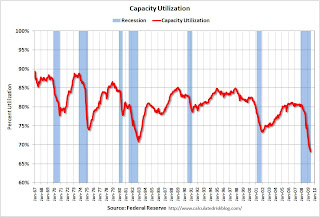

May Capacity Utilization

May Capacity UtilizationThis graph shows Capacity Utilization. This series is at another record low (the series starts in 1967).

"Industrial production decreased 1.1 percent in May after having fallen a downward-revised 0.7 percent in April. The average decrease in industrial production during the first three months of the year was 1.6 percent. Manufacturing output moved down 1.0 percent in May with broad-based declines across industries. Outside of manufacturing, the output of mines dropped 2.1 percent, and the output of utilities fell 1.4 percent. At 95.8 percent of its 2002 average, overall industrial output in May was 13.4 percent below its year-earlier level. The rate of capacity utilization for total industry declined further in May to 68.3 percent, a level 12.6 percentage points below its average for 1972-2008. Prior to the current recession, the low over the history of this series, which begins in 1967, was 70.9 percent in December 1982."

From: Industrial Production Declines, Capacity Utilization at Record Low

Vehicle Miles driven in April

Vehicle Miles driven in AprilThis graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.1% Year-over-year (YoY); the decline in miles driven was worse than during the early '70s and 1979-1980 oil crisis.

Note that rolling miles driven has a built in lag, and miles driven was larger in April 2009 than April 2008.

From: DOT: U.S. Vehicles Miles increase YoY in April

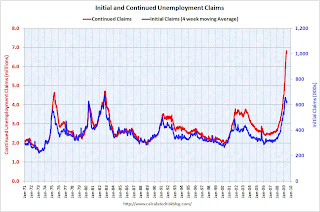

Unemployment Claims

Unemployment ClaimsThis graph shows weekly claims and continued claims since 1971.

Continued claims decreased to 6.74 million. This is 5.0% of covered employment.

Note: continued claims peaked at 5.4% of covered employment in 1982 and 7.0% in 1975.

The four-week average of weekly unemployment claims increased this week by 500, and is now 41,500 below the peak of 10 weeks ago. There is a reasonable chance that claims have peaked for this cycle.

From: Initial Unemployment Claims Increase

Restaurant Performance Index for May

Restaurant Performance Index for May"The outlook for the restaurant industry was dampened somewhat in May, as the National Restaurant Association’s comprehensive index of restaurant activity registered its first decline in five months. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 98.3 in May, down 0.3 percent from April and its 19th consecutive month below 100."

From: Restaurants: 21st Consecutive Month of Traffic Declines

Philly Fed State Conincident Indicators for May

Philly Fed State Conincident Indicators for MayHere is a map of the three month change in the Philly Fed state coincident indicators. Forty nine states are showing declining three month activity.

This is what a widespread recession looks like based on the Philly Fed states indexes.

From: Philly Fed State Coincident Indexes

Modifications and Re-Default

by Calculated Risk on 6/30/2009 04:42:00 PM

Earlier I posted some graphs on the surge in prime delinquecies from the OCC and OTS Release Mortgage Metrics Report for First Quarter 2009

See: OCC and OTS: Prime Delinquencies Surge in Q1

Here is some info on types of modifications:

While 185,156 mortgages were modified in the first quarter of 2009, 122,398 were “combination modifications” that changed more than one term of the loan. Of the modifications made in the first quarter of 2009, 70.2 percent included a capitalization of missed payments and fees, 63.2 percent included a reduction in interest rate, and 25.1 included an extended term. By comparison, 12.6 percent of the mortgages received modifications that froze the interest rate, 1.8 percent included a reduction of principal, and 1.1 percent included a deferral of principal. All modification actions during the quarter are indicated in the table below. Since nearly two-thirds of the modifications changed more than one loan term, the sum of the percentages in the table exceeds 100 percent.

The types of actions taken have different effects on the borrower’s principal and interest payments and may, over time, have different effects on the long-term sustainability of the loan.

Of the nearly two-thirds of modifications that were combination modifications that involved two or more changes to the terms of the loan, 83.4 percent of them included capitalization of missed payments and fees, 86.1 percent included reduced interest rates, 36.3 percent included extended maturities, 12.4 percent included interest rate freezes, 2.8 percent included principal reductions, and 1.6 percent included principal deferrals.

Click on graph for larger image.

Click on graph for larger image.In normal times, a capitalization of missed payments and fees is effective - because usually the homeowner fell behind for a short period because of a lost job or an emergency expense.

However, in these times with many homeowners underwater (with negative equity), capitalization isn't very effective. A reduced interest rate or longer term might be helpful.

And here are the re-default rates.

And here are the re-default rates. This graph shows that about 30% of modified loans re-default in the first quarter after modification and about half within the first year. This suggests modifications have not been very effective.

The percentage of loans that were 60 or more days delinquent or in the process of foreclosure rose steadily in the months subsequent to modification for all vintages where data were available. It is noteworthy that modifications implemented in the first two quarters of 2008 re-defaulted at a lower rate than those in the third quarter, measured at the same number of months after modification. Those modifications implemented in the fourth quarter of 2008 have re-defaulted at a slightly lower rate than the preceding quarter. However, it is too early to determine whether the data for the fourth quarter portend a sustained improvement in performance resulting from recent changes to modification practices.

House Prices: The Long Tail

by Calculated Risk on 6/30/2009 02:14:00 PM

First a couple of quotes:

From Bloomberg: Shiller Sees ‘Improvement’ in Rate of Home-Price Drop

Home prices saw a “striking improvement in the rate of decline” in April and trading in funds launched today indicates investors believe the U.S. housing slump is nearing a bottom, said Yale University economist Robert Shiller.From the WSJ: Home Prices Drop at Slower Pace

“At this point, people are thinking the fall is over,” Shiller, co-founder of the home price index that bears his name, said in a Bloomberg Radio interview today. “The market is predicting the declines are over.”

...

“My guess would be that home prices are going to level off -- they’re not going to keep falling,” Shiller said in a separate interview with Bloomberg Television. Still, it’s “hard to predict” a speculative market, and “I am not optimistic that we’re going to see any sharp rebound.”

Home prices in 20 major cities fell an average 0.6% in April, an improvement over the 2.2% decline the prior month, according to the Case-Shiller index produced by Standard & Poor's and released Tuesday.First, the 0.6% decline in the Composite 20 index (mentioned in the WSJ) is the Not Seasonally Adjusted (NSA) index. The NSA index was at 139.97 in March, and 139.18 in April.

...

David Blitzer, chairman of S&P's index committee, said in a statement that while "some stabilization may be appearing in some markets," the spring buying season usually helps buoy housing-market activity. "It will take some time to determine if a recovery is really here," he said.

The Composite 20 Seasonally Adjusted (SA) index was at 141.36 in March and 140.1 in April - a decline of 0.9% or 10.2% annualized.

So house prices were falling at about a 10% annualized rate in April - and that apparently feels like "stabilization"!

By most measure like price-to-income, price-to-rent and real prices, a large portion of the probable price declines are behind us. See: House Prices: Real Prices, Price-to-Rent, and Price-to-Income Note: that post is based on the quarterly Case-Shiller National price index.

But in many previous housing busts, there was a long tail of smaller price declines (especially in real terms).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the annualized rate of change, monthly, for the Case-Shiller Composite 10 SA index.

Note: The Composite 20 index mentioned in the WSJ only goes back to January 2000.

Notice that during the early '90s housing bust, prices fell on and off for a few years after the worst of the price declines were over.

The second graph shows this long tail of price declines in real terms (the composite 20 index adjusted with CPI less Shelter).

The second graph shows this long tail of price declines in real terms (the composite 20 index adjusted with CPI less Shelter). I'm not sure we've reached the "long tail" portion of this housing bust yet, but I think that prices will follow a similar pattern as previous busts, with prices falling in real terms for a few years after the worst of the price declines are over.

With record delinquencies, record foreclosures, few move-up buyers (impacting the mid-to-high end), a huge overhang of inventory, I believe prices will continue to fall in many areas.

California: 14 hours and counting to IOUs

by Calculated Risk on 6/30/2009 12:34:00 PM

Form the SF Gate: No sign of budget with deadline approaching (ht shill)

Despite a deadline looming tonight, Gov. Arnold Schwarzenegger and the Legislature were at a loss Monday over how to close the state's massive deficit, and there were no signs a compromise would be reached soon.Will retailers accept IOUs?

If no plan is adopted by 12:01 a.m. Wednesday, the state plans to issue IOUs to contractors, vendors, local governments and taxpayers expecting refunds beginning Thursday. The governor plans to force 220,000 state workers to take a third unpaid day off beginning in July ...

OCC and OTS: Prime Delinquencies Surge in Q1

by Calculated Risk on 6/30/2009 11:21:00 AM

From the Office of the Comptroller of the Currency and the Office of Thrift Supervision: OCC and OTS Release Mortgage Metrics Report for First Quarter 2009

This OCC and OTS Mortgage Metrics Report for the first quarter of 2009 provides performance data on first lien residential mortgages serviced by national banks and federally regulated thrifts. The report provides a comprehensive picture of mortgage servicing activities of most of the industry’s largest mortgage servicers, covering approximately 64 percent of all mortgages outstanding in the United States and incorporating information on all types of mortgages serviced, including subprime mortgages. The report covers more than 34 million loans totaling more than $6 trillion in principal balances and provides information on their performance from the beginning of 2008 through the end of the first quarter of 2009.Much of the report focuses on modifications and recidivism, but this report also shows far more seriously delinquent prime loans than subprime loans (by number, not percentage).

Negative trends continued for mortgage data for the first quarter of 2009, but with some hopeful signs on the modification front. Continued economic pressures, including rising levels of unemployment and a continuing decline in property values, resulted in an increased number of seriously delinquent mortgages and newly initiated foreclosure actions. The first quarter data also showed a relatively greater increase in seriously delinquent prime mortgages compared with other risk categories and a higher number of foreclosures in process across all risk categories as a variety of moratoria on foreclosures expired during the first quarter of 2009.

Click on graph for larger image.

Click on graph for larger image.We're all subprime now!

Note: "Approximately 14 percent of loans in the data were not accompanied by credit scores and are classified as “other.” This group includes a mix of prime, Alt-A, and subprime. In large part, the loans were result of acquisitions of loan portfolios from third parties where borrower credit scores at the origination of the loans were not available."

This report covers about two-thirds of all mortgages. There are far more prime loans than subprime loans - and the percentage of delinquent prime loans is much lower than for subprime loans. However, there are now significantly more prime loans than subprime loans seriously delinquent. And prime loans tend to be larger than subprime loans, so the losses from each prime loan will probably be higher.

The second graph shows foreclosure activity.

Newly initiated foreclosures picked up in Q1.

Completed foreclosures declined (because of the foreclosure moratorium), and foreclosures in process surged to 844 thousand.

Note that short sales are essentially irrelevant.

Restaurants: 21st Consecutive Month of Traffic Declines

by Calculated Risk on 6/30/2009 11:00:00 AM

Note: Any reading below 100 shows contraction.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Softened in May as Restaurant Performance Index Posted First Decline in Five Months

The outlook for the restaurant industry was dampened somewhat in May, as the National Restaurant Association’s comprehensive index of restaurant activity registered its first decline in five months. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 98.3 in May, down 0.3 percent from April and its 19th consecutive month below 100.

“With the performance of the current situation indicators holding relatively steady in May, the RPI’s decline was the result of restaurant operators’ dampened outlook for each of the four forward-looking indicators,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Although restaurant operators remain relatively optimistic that economic conditions will improve in six months, their outlook for sales growth and capital spending activity softened somewhat.”

...

Restaurant operators also reported negative customer traffic levels in May, marking the 21st consecutive month of traffic declines.

...

Capital spending activity remained relatively steady, despite the continued soft sales and traffic levels. Forty-one percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, down from 43 percent who reported similarly last month.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

This is another example of still contracting, but contracting at a slower pace than earlier this year.

Case-Shiller House Prices and Stress Test Scenarios

by Calculated Risk on 6/30/2009 09:30:00 AM

Please see: Case-Shiller: Prices Fall in April for the seasonally adjusted composite indices.

NOTE: I'm now using the Seasonally Adjusted (SA) composite 10 series.

This graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index, April: 151.27

Stress Test Baseline Scenario, April: 152.90

Stress Test More Adverse Scenario, April: 146.95

So far prices are tracking between the two stress test scenarios.

Case-Shiller: House Prices Fall in April

by Calculated Risk on 6/30/2009 09:00:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for April this morning.

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 33.1% from the peak, and off 1.0% in April.

The Composite 20 index is off 32.0% from the peak, and off 0.9% in April.

NOTE: Some websites are reporting the NSA results (month over month). I'm using the SA data (a better month-to-month comparison)

Prices are still falling and will probably decline for some time. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 18.0% over the last year.

The Composite 20 is off 18.1% over the last year.

This is near the worst year-over-year price declines for the Composite indices since the housing bubble burst started.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices fell in 16 of the 20 Case-Shiller cities in April. In Phoenix, house prices have declined 53.7% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% and 8% respectively from the peak. Prices have declined by double digits almost everywhere.

Prices fell in 16 of the 20 Case-Shiller cities in April. In Phoenix, house prices have declined 53.7% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% and 8% respectively from the peak. Prices have declined by double digits almost everywhere.

Denver, Dallas, Washington and Cleveland showed small price gains in April.

I'll compare house prices to the stress test scenarios soon.

States: More Little Hoovers

by Calculated Risk on 6/30/2009 12:11:00 AM

From the WSJ: Ten States Race to Finish Budgets

Ten states were scrambling Monday to pass budgets before a Tuesday deadline, with a handful -- including Arizona, Indiana and Mississippi -- facing the possibility of partial shutdowns if their legislatures don't act in time.Here is a new Center on Budget and Policy Priorities report (released today) with state by state tables.

...

Personal income-tax collections, which account for about 36% of state revenues, dropped 26% in this year's January-April period, according to data collected by the Rockefeller Institute of Government in Albany, N.Y.

Sales-tax revenues also have swooned, leaving 48 states with a combined revenue shortfall of $166 billion in the coming fiscal year, according to a report released Monday by the left-leaning Center on Budget and Policy Priorities.

...States without budgets in hand include California, Pennsylvania, North Carolina, Delaware, Illinois, Ohio and Connecticut ...

Monday, June 29, 2009

Auto Sales Expected to be near 10 Million SAAR in June

by Calculated Risk on 6/29/2009 09:24:00 PM

There will be a flood of data released over the next three days, including the June employment numbers on Thursday. Other highlights include Case-Shiller house prices tomorrow and auto sales on Wednesday.

Several analysts expect an increase in auto sales in June, compared to May, on a seasonally adjusted annual rate (SAAR) basis. From the WSJ: Car-Sales Rebound Seen for June

[A]nnualized U.S. sales could hit 10 million this month for the first time in 2009, Ford Motor Co. analyst George Pipas said on Monday. The deep discounts that General Motors Corp. and Chrysler Group LLC have offered to boost sales are also likely to bolster June sales.But before everyone gets all Green Shootie ...

...

A GM spokesman also said an annualized 10 million sales rate is possible for June.

J.D. Power and Associates predicts annualized June sales of 10.3 million new cars and trucks, up from 9.9 million in May, while Edmunds.com expects the sales rate to top 10 million, though overall sales will still be 25% lower than a year ago.

This graph shows light vehicle sales since the BEA started keeping data in 1967.

This graph shows light vehicle sales since the BEA started keeping data in 1967.Breaking 10 million (SAAR) in June might put sales 10% off the bottom in February, but is is still more than 25% off from June 2008 (13.7 million light vehicle SAAR) and still near the bottom of the cliff.

Guaranty Financial: Last Hope is FDIC

by Calculated Risk on 6/29/2009 06:39:00 PM

In a 8-K regulatory filing today, Guaranty Financial stated the only "only remaining means by which the Company might possibly raise sufficient capital" is with the help of the FDIC. The Company expects current shareholders to be wiped out.

According to the Houston Business Journal (ht Tim), Guaranty has $14.4 billion in assets, and would be the largest bank to fail this year.

From the SEC filing:

Based on the current status of discussions involving its principal stockholders, other sources of financing, and certain regulatory authorities, the Board of Directors and management of the Company believe that the only remaining means by which the Company might possibly raise sufficient capital for it and its wholly-owned subsidiary, Guaranty Bank (the “Bank”), to comply with the Orders to Cease and Desist issued by the Office of Thrift Supervision (“OTS”) described in the Company’s Current Report on Form 8-K filed on April 8, 2009, is through a plan for open bank assistance (“Open Assistance”). The Open Assistance plan, which the Company is discussing with the Federal Deposit Insurance Corporation (“FDIC”) and the OTS, would involve a significant equity capital infusion from private investors, including the Company’s current principal stockholders, and an agreement under which the FDIC would absorb a portion of any losses associated with a pool of certain of the Company’s assets.

An Open Assistance plan must be approved by the FDIC. Before the FDIC can provide Open Assistance to the Bank, it must establish that the assistance is the least costly to the deposit insurance fund of all possible methods for resolving the financial condition of the Bank. The FDIC may deviate from the least cost requirement only in limited circumstances to avoid “serious adverse effects on economic conditions or financial stability” or “systemic risk” to the banking system. An additional condition to Open Assistance is that the OTS and FDIC must also determine that the Bank’s management is competent, has complied with all applicable laws, rules, and supervisory directives and orders, and has not engaged in any insider dealings, speculative practices, or other abusive activity. The FDIC may not approve an Open Assistance plan if it would benefit any stockholder or affiliate of the Company. As a result, the Company expects that the implementation of any Open Assistance plan would essentially eliminate the value of any of the Company’s currently outstanding equity interests, including shares of the Company’s common stock.

Open Assistance has historically been used extremely rarely by the FDIC, and there is no assurance that it would be available to the Company or the Bank in this case. In addition, while the Company has received expressions of interest from private investors with respect to the necessary capital infusion from private investors, it has not received capital commitments from any of these investors. Accordingly, the Company has not yet formally submitted to the FDIC its plan for Open Assistance, and it may ultimately not be able to do so. If a plan is formally submitted, the FDIC may choose not to approve it.

If the FDIC does not approve a plan for Open Assistance, the Company will no longer have the intent and ability to hold its mortgage-backed securities portfolio to recovery of unrealized losses, and, consequently, there would be substantial doubt that the Company would be able to continue as a going concern. In such case, the Company would be required to take material charges relating to the impairment of assets, in which case the preliminary financial information provided by the Company in previous Forms 12b-25 for the periods ended December 31, 2008 and March 31, 2009 should not be relied upon.