by Calculated Risk on 7/06/2009 09:27:00 PM

Monday, July 06, 2009

D.C. Office Market: Vacancies Increase, Rents Fall

Stop me if you've heard this story before ...

From V. Dion Haynes at the WaPo: Local Office Vacancies Soar, Driving Down Rent

The office vacancy rates in the District, Northern Virginia and suburban Maryland rose substantially in the second quarter, forcing building owners to push down rents to fill empty space ...And in Chicago, from Crain's Rising vacancies, distress in suburban office market

The result is that the vacancy rate rose to 10.2 percent in the second quarter from 8.5 percent in the first quarter in the District, to 13.9 percent from 12.9 percent in Northern Virginia; and to 13.9 percent from 13.1 percent in suburban Maryland.

Almost one-fourth of the 96 million square feet of office space in the suburbs is now vacant ... The rising vacancy rate, which has soared to 24.3% from 19.8% two years ago ... While rents overall haven’t dropped dramatically, down just 2% for the year, landlords are upping tenant improvement allowances and offering lots of free rent.

CRE: Half Off Sale in San Francisco and More

by Calculated Risk on 7/06/2009 06:24:00 PM

A few interesting stories. The first story (more than half off from the peak price) the buyer bought the loan, and then the current owner transferred the deed in lieu of foreclosure. The second story is a photo essay of the real estate bust, and third story is about the City Center project in Las Vegas.

From the San Francisco Business Times: Sale shows San Francisco property values in free fall (ht Steve)

A downtown San Francisco office building that sold for $400 a square foot in 2006 has traded for just $172 a square foot, a 57 percent decline ...From the NY Times Magazine, a photo essay: Ruins of the Second Gilded Age (ht Shawn)

The sale, at a price that represents about 25 percent of replacement cost, represents the first San Francisco office building sale in a year. ... Colliers International Executive Vice President Tony Crossley said the price “gives the market a data point it has been lacking.”

And from the WSJ (condos): Buyer's Remorse Hits Vegas Project (ht ShortCourage)

One of the costliest and highest-profile condominium developments in the country -- the $8.4 billion City Center project in Las Vegas -- is facing a revolt from some early buyers. ... So far, buyers have put down $313 million in deposits on 1,500 units in the 2,440-unit complex. Those who agreed to buy early on now fear they will take possession of condos whose market values are far below what they agreed to pay. Many of the contracts were signed in 2006 and 2007 ...

S&P Increases Loss Estimates for Alt-A and Subprime RMBS

by Calculated Risk on 7/06/2009 04:49:00 PM

From Reuters: S&P raises loss expectations for risky US mortgages

Standard & Poor's on Monday boosted its expectations for losses on risky loans backing U.S. mortgage securities ... [this] "significantly impact" bonds originally carrying AAA ratings, S&P said in a report.According to the article, S&P noted a surge in the inventory of bank-owned properties. Here is the S&P report.

...

S&P boosted loss projections for subprime loans made at the peak of the market in 2006 and 2007 to 32 percent and 40 percent from 25 percent and 31 percent, respectively. For 2005 loans, loss projections rose to 14 percent from 10.5 percent.

For Alt-A loans ... loss projections for 2006 and 2007 mortgages rose to 22.5 percent and 27 percent from 17.3 percent and 21 percent, respectively. S&P expects Alt-A loans from 2005 to post losses of 10 percent, up from its previous estimate of 7.75 percent.

Loss severities ... are expected to rise to 70 percent for 2006 and 2007 subprime bonds and 60 percent for Alt-A bonds issued in those years, S&P added.

Update: From the S&P report: Standard & Poor's Chief Economist David Wyss expects "home prices will decline by an additional 5%-7% from the 2006 peak before residential real estate prices start to stabilize in the first half of 2010, marking an overall decline of approximately 37% from the July 2006 peak."

Fitch Downgrades Calif. long-term bond rating to 'BBB'

by Calculated Risk on 7/06/2009 03:57:00 PM

Fitch's analysis suggests that issuing IOUs will only work until October, at which point the cash shortfall will start impacting priority spending.

Note: "GO" General Obligation.

Press Release: Fitch Downgrades State of California GOs to 'BBB'; Maintains Rating Watch Negative

The downgrade to 'BBB' is based on the state's continued inability to achieve timely agreement on budgetary and cash flow solutions to its severe fiscal crisis. Since no agreement was reached by the June 30, 2009 fiscal year (FY) end, the state's controller has now begun issuing registered warrants (IOUs) for certain non-priority payments to preserve cash, and the budget gap to be addressed has increased to $26.3 billion from $24.3 billion. The use of IOUs for non-priority payments would offset cash shortfalls into September 2009 as now currently projected.Fitch downgraded California from A to A-minus just 10 days ago.

The Rating Watch Negative reflects the short-term risk, in Fitch's view, that institutional gridlock could persist, further aggravating the state's already severe economic, revenue and liquidity challenges and weighing on the state's credit. Resolution of the Negative Watch will depend on actions taken to address the cash flow imbalance. The 'BBB' rating indicates that expectations of default risk remain low, although the rating is well below that of most other tax supported issuers. GO debt in California has a constitutional prior claim on revenues, although after education; appropriation debt has a lesser legal claim, but the controller prioritizes payment directly after GO debt service, ahead of other mandatory payments.

With issuance of IOUs for non-priority payments, margins for meeting constitutional and court-required contractual commitments are narrowing. After September 2009, absent any proposed budget and payment adjustments, cash deficits will expand dramatically. Cash flow solutions, including the ability to access short-term borrowing, are inextricably tied to reaching timely agreement on effective and credible budget solutions.

...

The inability of the state to reach agreement has prompted the controller to begin issuing IOUs for non-priority payments, primarily disbursements to vendors, for certain social services, and for tax refunds, in order to ensure payment of priority payments, including GO and lease debt service. The controller's office estimates that $3 billion in IOUs will be issued during July 2009; priority payments of $10.8 billion will be made for education, debt service, Medicaid, payroll, pensions and other mandatory contractual obligations. Projections will be revised to reflect June revenue performance and other changes but as currently estimated, cumulative cash deficits of $3.7 billion are projected through August, offset by $4.5 billion in non-priority payments that could be covered with IOUS, excluding tax refunds. However, by the end of October, the projected cash deficit expands to $16.1 billion, well beyond non-priority spending of only $10.6 billion, excluding tax refunds.

emphasis added

The Booming Repo Business

by Calculated Risk on 7/06/2009 02:02:00 PM

From Jim Wasserman at the SacBee: Repo business soars as Sacramento area home sales slump

... As the U.S. foreclosure crisis grinds on, the detailed work of processing, repairing and selling thousands of homes repossessed by banks is real estate's new gold. In the past year, repo-related business has rapidly grown to national scale, fueling job growth in Colorado, Texas, Ohio and elsewhere to service the meltdown in markets like Sacramento and the Central Valley along with Phoenix, Las Vegas and Florida.I've spoken with a number of real estate agents that are really busy, and conversely some agents (mostly high end) that having nothing to do but count their listings. The low-to-mid end business is tough though - many homes receive multiple offers (Jeff Collins at the O.C. Register reports on one home with 135 offers). And even if a transaction is completed, the deals are frequently 'one and done' as opposed to the chain reaction of a more normal market.

... [Austin-based Field Asset Services], which repairs, cleans and maintains repos right down to mowing the lawns weekly, has almost tripled its hiring in the past 18 months. Austin business publications gush over the firm's "hiring spree," its 550 employees and third expansion into larger offices in a year.

Clearly, the housing distress that has overwhelmed states like California has become big business.

BTW, Wasserman also writes a blog (with Dale Kasler) at the SacBee, the Home Front.

TALF CMBS Update

by Calculated Risk on 7/06/2009 11:54:00 AM

Just a quick update on the Term Asset-Backed Securities Loan Facility (TALF) for Commercial Mortgage Backed Securities (CMBS).

At the end of last week, the NY Fed announced a TALF CMBS auction on July 16th. The details are here.

Many market participants expected the Fed to include CMBS "originally rated AAA" because S&P has recently placed a large number of CMBS on watch for downgrade. This did not happen and is apparently a shock to many participants.

The Fed updated the terms and conditions. The Fed is really restricting legacy eligibility:

TALF loans for legacy CMBS will beOne participant told me that all potential trades are being heavily scrutinized too:usedrequired to fund recent secondary market transactions between unaffiliated parties that are executed on an arm’s length basis.

"[Y]ou cannot leverage a bond you already own, and you can't sell and buyback a bond you already own to create a trade. That's an interesting twist."Clarification: July 16 is the first operation for Legacy TALF, which provides loans against Legacy CMBS securities. Legacy securities were issued before January 1 2009.

The new issue CMBS program, for securities issued after January 1 2009, started in June.

The first TALF CMBS auction on June 16th attracted no interest.

ISM Non-Manufacturing Index Shows Contraction in June

by Calculated Risk on 7/06/2009 10:03:00 AM

From the Institute for Supply Management: June 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector contracted in June, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.The service sector is still contracting but at a slightly slower pace than in May. Not exactly a green shoot.

"The NMI (Non-Manufacturing Index) registered 47 percent in June, 3 percentage points higher than the 44 percent registered in May, indicating contraction in the non-manufacturing sector for the ninth consecutive month, but at a slower rate. The Non-Manufacturing Business Activity Index increased 7.4 percentage points to 49.8 percent. The New Orders Index increased 4.2 percentage points to 48.6 percent, and the Employment Index increased 4.4 percentage points to 43.4 percent. The Prices Index increased 6.8 percentage points to 53.7 percent in June, indicating an increase in prices paid from May. This is the first time the index has registered above 50 percent since October 2008. According to the NMI, six non-manufacturing industries reported growth in June. Respondents' comments continue to be mixed and tend to be industry- and company-specific about business conditions."

GM Bankruptcy Plan Approved

by Calculated Risk on 7/06/2009 09:03:00 AM

From the NY Times: Court Ruling Clears Path for G.M. to Restructure

A federal judge approved a plan by General Motors late on Sunday to sell its best assets to a new, government-backed company ...The ruling is being appealed.

In his 95-page opinion, Judge Gerber wrote that he agreed with G.M.’s main contention: that the asset sale was needed to preserve its business in the face of steep losses and government financing that is scheduled to run out by the end of the week.

“Bankruptcy courts have the power to authorize sales of assets at a time when there still is value to preserve — to prevent the death of the patient on the operating table,” Judge Gerber wrote.

...

Other groups, including those representing product liability claims and asbestos litigants, ... fought against G.M.’s plan. Under the terms of the sale, most of those claims would remain with the remnants of G.M. in bankruptcy, meaning they were likely to recover little, if anything.

This was quick - GM filed for bankruptcy on June 1st.

Loan Mod Frauds

by Calculated Risk on 7/06/2009 12:27:00 AM

The scamsters are thriving ...

From Jessica Garrison at the LA Times: In California, mortgage scammers find easy pickings

Maricela Castellanos sat at her desk, the telephone pressed to her ear, a chill running through her body.These scamsters pretended to be from Castellanos bank. They offered her an attractive loan modification that lowered her monthly payments, and instructed her to send the payments to a "Payment Processing Department" at a P.O. Box. They even had a 1-800 number. Amazing.

A representative from her mortgage company was on the line with troubling information about the loan on Castellanos' Hesperia home.

No one at the company had previously been in contact with her, Castellanos recalled the man saying. The bank had no record of a new loan agreement with her, he said, nor had it received cashier's checks for $2,260 and $1,408.23 she said she had sent.

Castellanos had been a victim of an alleged loan modification swindle -- a financial crime in which scammers pretend to help distressed borrowers renegotiate their mortgages with their banks but instead pocket the money and leave the homeowners in worse straits than before.

Law enforcement officials say the scams are becoming increasingly prevalent, especially in California, where the Department of Real Estate has reported an explosion from 10 open cases a year ago to more than 750 this spring. Nationally, U.S. Atty. Gen. Eric Holder has said that the FBI's "rescue scam" caseload is up 400% from five years ago.

Sunday, July 05, 2009

Gordon Brown Sounds "Second-wake up call for the world economy"

by Calculated Risk on 7/05/2009 10:13:00 PM

"There are many voices saying that the worst of the downturn is over, but there is no room for complacency."Gordon Brown, July 6, 2009

...

If we do not take the necessary action now to strengthen the world economy and put in place the conditions for sustainable world growth, we will be confronted with avoidable unemployment for years to come."

From The Times: Recession may get worse, Gordon Brown warns world leaders

The worst of the recession may be yet to come and world leaders are in danger of hampering the recovery, Gordon Brown will say today.Maybe Brown was reading Roubini!

As he begins a week of meetings with world leaders, the Prime Minister will strike an unexpectedly gloomy note about the prospects of an upturn and will demand that fellow heads of government “sound a second-wake up call for the world economy”.

...

Mr Brown will also say that although public finances need to be sustainable in the long term, “now is not the time for fiscal contraction”.

A Second Stimulus Plan?

by Calculated Risk on 7/05/2009 07:03:00 PM

From ABC's This Week, George Stephanopoulos interviews Vice President Joe Biden:

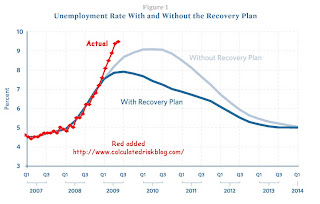

STEPHANOPOULOS: While we've been here, some pretty grim job numbers back at home -- 9.5 percent unemployment in June, the worst numbers in 26 years.Here is the January forecast with the BLS reported data ...

How do you explain that? Because when the president and you all were selling the stimulus package, you predicted at the beginning that, to get this package in place, unemployment will peak at about 8 percent. So, either you misread the economy, or the stimulus package is too slow and to small.

BIDEN: The truth is, we and everyone else misread the economy. The figures we worked off of in January were the consensus figures and most of the blue chip indexes out there.

...

BIDEN: ... So the second question becomes, did the economic package we put in place, including the Recovery Act, is it the right package given the circumstances we're in? And we believe it is the right package given the circumstances we're in.

We misread how bad the economy was, but we are now only about 120 days into the recovery package. The truth of the matter was, no one anticipated, no one expected that that recovery package would in fact be in a position at this point of having to distribute the bulk of money.

STEPHANOPOULOS: No, but a lot of people were saying that you needed to do something bigger and bolder then, including the economist Paul Krugman. He's saying -- right now he's saying the same thing again -- don't wait. You need a second stimulus, you need it now.

BIDEN: Look, what we have to do now is we have to properly, adequately, transparently and effectively spend out the $787 billion.

...

The question is, how do you now -- do we -- what we have to do, George, is we have to, as this rolls out, put more pace on the ball. The second hundred days you're going to see a lot more jobs created.

And the reason you are is now all of these contracts for the over several thousand highway projects that have approved.

...

STEPHANOPOULOS: ? today are going to run out of unemployment in September. That means for a lot of those people, if there is not a second stimulus, they're going to be out in the cold.

BIDEN: Well, look, we have increased the amount of money unemployed -- those on unemployment rolls have gotten, 12 million are getting more money because of the stimulus package.

We've increased the number of people eligible by 2 million people. We've given a tax cut to 95 percent of the people who get a pay stub. They have somewhere -- $60 bucks a month out there that's going into the economy.

There is a lot going on, George. And I think it's premature to make the judgment?

STEPHANOPOULOS: So no second stimulus?

BIDEN: No, I didn't say that. I think it's premature to make that judgment. This was set up to spend out over 18 months. ... And so this is just starting, the pace of the ball is now going to increase.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph compares the BLS reported monthly unemployment rate (in red) with the Obama economic forecast from January 10th: The Job Impact of the American Recovery and Reinvestment Plan

The Obama administration underestimated the rise in unemployment (so did I last year), so the question is: does this mean a 2nd stimulus plan?

Krugman says don't wait:

But never mind the hoocoodanodes and ayatollahyaseaux. What’s important now is that we don’t compound the understimulus mistake by adopting what Biden seems to be proposing — namely, a wait and see approach. Fiscal stimulus takes time. If we wait to see whether round one did the trick, round two won’t have much chance of doing a lot of good before late 2010 or beyond.Update: as of June, almost 4.4 million people were unemployed and had exhausted their regular unemployment benefits. Most are now receiving extended benefits, but - at the least - it might be prudent to have additional extended benefits ready to go later this year.

Unemployment Rate and Part Time Employees

by Calculated Risk on 7/05/2009 05:08:00 PM

The following article suggests that the large number of part time workers will slow any labor recovery:

‘I don’t need to hire anybody new. I need to work my existing workers more.’That seems to make sense, but I wondered if it has been true in previous recessions (that a large number of part time workers - for economic reasons - became fully employed before the unemployment rate started to decline).

Here is the article from The Boston Globe: Grappling with part-time work

According to the Bureau of Labor Statistics, there are 9.1 million Americans working part time for economic reasons, more than double the 4.5 million in 2007. That compares with a 50 percent rise in the recession of 1981-82 and a 25 percent increase in the recession of 1990.The following graph shows the unemployment rate and the percent of the civilian labor force that is working part time for economic reasons.

...

For the economy as a whole, the glut of part-time workers could slow any recovery.

“At no time have we ever seen an increase of that magnitude, which is why labor markets are far weaker than the unemployment rate is telling us,’’ says Andrew Sum, director of Northeastern University’s Center for Labor Market Studies.

“When the economy turns around if you have so many people that are in slack work, you’ll say, ‘I don’t need to hire anybody new. I need to work my existing workers more.’ It’s going to be a lot harder to bring the unemployment rate down.’’

Click on graph for larger image in new window.

Click on graph for larger image in new window.Looking back at previous recessions, it doesn't appear that there was a decline in part time workers (for economic reasons) prior to a decline in the unemployment rate.

That doesn't mean part time workers aren't hurting - many are (as noted in the article), but it appears the the number of part time workers, and the unemployment rate, usually peak at about the same time. This time might be different, but I wouldn't count on it.

Offices: Rising Vacancies, Falling Rents

by Calculated Risk on 7/05/2009 01:27:00 PM

Rising vacancies. Falling rents. Negative absorption. The trend continues ...

From the Baltimore Business Journal: D.C. area office vacancies reach 12.3%

The Washington, D.C., area’s commercial real estate market saw a net absorption of negative 726,100 square feet in the second quarter, the third straight quarter of negative absorption ... the Washington region’s office vacancy rate has now reached 12.3 percent.From Reuters: Manhattan office vacancy hits 15-year high-report

... "we are entering into a period of steady rent declines" [said Kevin Thorpe, director of market research for Cassidy & Pinkard Colliers]

emphasis added

The vacancy rate for top quality Midtown Manhattan office buildings reached its highest level in 15 years and asking rents fell nearly 11 percent in the second quarter, a Jones Lang LaSalle (JLL.N) report said.

Click on graph for larger image in new window.

Click on graph for larger image in new window.For Q1, REIS reported the office vacancy rate nationwide rose to 15.2% from 14.5% in Q4 2008.

This graph shows the office vacancy rate starting 1991.

The Q2 data should be released this week.

Apartment Rents Decline in Los Angeles

by Calculated Risk on 7/05/2009 09:43:00 AM

From Lauren Beale at the Los Angeles Times: Vacancies give renters room to negotiate

The first quarter saw the largest rent decline in a decade for Los Angeles County, Reis' [Victor Calanog, director of research] said. Effective rents, those that take concessions into account, fell 1.7% in the first quarter of this year from the fourth quarter of 2008, while asking rents dropped 1%.And vacancy rates are rising:

The rate climbed to 5.3% in the first quarter from 3.8% in the first quarter of 2008, said [Reis' Calanog] ... In contrast, vacancies had been hovering between 2% and 3% for the last decade.Declining rents puts more pressure on house prices ... and rents could continue to fall through 2010.

...

The last time vacancy rates were this high in Los Angeles County was in the early 1990s, when they hit 5%.

Here are some comments from BRE (a REIT) in February:

We believe we are looking at a negative rent curve for the next two years.

We believe on a composite basis, market rents in 2009 could fall between 3 and 6% from peak levels in 2008. And the rent cuts in 2010 could be deeper ...

Saturday, July 04, 2009

Report: Subprime and Alt-A Loss Severity Hits 64.7% in June

by Calculated Risk on 7/04/2009 10:52:00 PM

From Gretchen Morgenson at the NY Times: So Many Foreclosures, So Little Logic

Alan M. White, an assistant professor at the Valparaiso University law school in Indiana analyzed data on 3.5 million subprime and alt-A mortgages in securitization pools overseen by Wells Fargo.Well, it is an article by poor Gretchen, so we need to highlight a funny...

...

In June, the data show almost 32,000 liquidation sales; the average loss on those was 64.7 percent of the original loan balance.

Here are the numbers: the average loan balance began at almost $223,000. But in the liquidation sale, the property sold for $144,000 less, on average. ...

Loss severities, like foreclosures, are rising. In November, losses averaged 56.1 percent of the original loan balance; in February, 63.3 percent.

Loan modifications occur when a lender agrees to change terms of a troubled borrower’s mortgage; the most common approach is to reduce the loan’s interest rate. ... Lenders and their representatives, however, don’t like to modify loans through interest rate cuts ...I guess they don't like doing the most common approach!

Note: the database analyzed by Professor White is for subprime and Alt-A only, whereas the OCC data includes prime loans - so it is hard to compare. Here is the OCC report for Q1: OCC and OTS: Prime Delinquencies Surge in Q1

And a couple of earlier posts on the OCC report:

Homer Economicus

by Calculated Risk on 7/04/2009 08:32:00 PM

This piece "Mortgages Made Simpler" by Richard Thaler, is a discussion of the proposed Obama Administration regulatory requirement that lenders offer consumers "plain vanilla" mortgages. From the Treasury regulatory reform proposals (page 66):

We propose that the regulator be authorized to define standards for “plain vanilla” products that are simpler and have straightforward pricing. The CFPA should be authorized to require all providers and intermediaries to offer these products prominently, alongside whatever other lawful products they choose to offer.I found the following description amusing:

Traditional economics is based on imaginary creatures sometimes referred to as “Homo economicus.” I call them Econs for short. Econs are amazingly smart and are free of emotion, distraction or self-control problems. Think Mr. Spock from “Star Trek.”I like the idea that all consumers be offered a "plain vanilla" mortgage option, and also that many of the non-traditional mortgage products come with warning labels.

Real people are not Econs. Real people have trouble balancing their checkbooks, much less calculating how much they need to save for retirement; they sometimes binge on food, drink or high-definition televisions. They are more like Homer Simpson than Mr. Spock. Call them Homer economicus if you like, or just Humans. Behavioral economics is the study of Humans in markets.

Designing policies for Econs is pretty straightforward. Because they are smart consumers and make good choices, the best policies give them as many choices as possible and simply assure that they have access to all the relevant information.

Humans, however, can use a bit more help, especially when the options are hard to understand.

Of course most CR readers are probably "Homo economicus" and are free to opt out.

FDIC Bank Closure from the Acquirer's Perspective

by Calculated Risk on 7/04/2009 04:34:00 PM

Matt Padilla at the O.C. Registers interviews the CEO of a bank that recently acquired a failed bank: Profiting from an Irvine bank failure

Note: This regards the failure of MetroPacific Bank in Irvine, California on June 26th (just over a week ago).

Q. How did you learn a bank was going to fail and its assets be sold?There is much more in the interview including some comments on commercial real estate lending.

A. [Glenn Gray CEO of SunWest]: It first starts with us, or any bank, that wants to be a bidder letting the FDIC know that. ... We did that several months ago, when we anticipated that, unfortunately, bank failures were going to be an ongoing occurrence.

Then we turn the clock back to about four weeks ago. The FDIC notified us of a potential failed bank situation. They spoke in very general terms, describing a business bank with about $80 million in assets in Orange County with a single branch. They asked, ‘Are you interested?. Well, yes, that fits our profile: community banks in Orange County or North San Diego.

Next they say here’s your password, go to a secure Web site and find more information. Once we visit the site we understand which bank it is ... The data are macro level. But there is enough information for you to start to form an opinion, and you don’t have to put in bid yet.

Next they told us we would have two days of due diligence. We came on site, visiting the bank in an area segregated from the rest of the employees. Most employees didn’t know we were on site. There was an FDIC representative there. Now we start to get into more micro level detail. ... We met some people, but couldn’t get into their background or interview them.

Once the on-site review was done, we got a couple of days to form a bid. We finished up on a Thursday and had to provide a bid the following Tuesday. The next day (Wednesday June 24) they asked for some clarification and a little negotiation. Thursday (June 25) they notified us that our bid was accepted. Friday morning (June 26) we met with a larger group of FDIC employees and they did a walk through of what was going to happen. Then it happened that Friday at 4 p.m. They went in and took over the bank and we followed them.

NY Times: 'Tax Bill Appeals'

by Calculated Risk on 7/04/2009 01:39:00 PM

Here are some green shoots ... property tax appeals are growing like weeds!

From Jack Healy at the NY Times: Tax Bill Appeals Take Rising Toll on Governments

Homeowners across the country are challenging their property tax bills in droves as the value of their homes drop, threatening local governments with another big drain on their budgets.And a few quotes ...

The requests are coming in record numbers, from owners of $10 million estates and one-bedroom bungalows, from residents of the high-tax enclaves surrounding New York City, and from taxpayers in the Rust Belt and states like Arizona, Florida and California, where whole towns have been devastated by the housing bust.

“It’s worthy of a Dickens story,” said Gus Kramer, the assessor in Contra Costa County, Calif., outside San Francisco.

“We’ve been absolutely getting killed,” said Robert W. Singer, the mayor of Lakewood Township, N.J. ...The article has several stories from around the country.

“We’re hearing from people like this every day,” [Jeff Furst, the appraiser in St. Lucie County, Fla] said. In St. Lucie ... property tax revenue is expected to fall 20 percent, and tax appeals are 10 times as high as they are normally. “Most people are going to see a significant decline in their tax bill.”

Mr. Kramer, the assessor in Contra Costa County, said homeowners started swamping his office with requests for new assessments in December. As many as 500 people would call in one day. His voice mail message now begins: “If you’re calling to request an informal review of your property value due to the declining real estate market.”

New Jersey has really high property taxes - the article provides an example of a house assessed at $1.8 million with a $53,000 per year property tax bill (almost 3 times higher than a house with a similar appraised value in California). When that house in New Jersey sells (currently listed at $1.3 million) or is reappraised, the local tax revenues will take a hit. And that same story is being repeated over and over ...

LA Times: 'Another wave of foreclosures'

by Calculated Risk on 7/04/2009 09:08:00 AM

From Don Lee at the LA Times: Another wave of foreclosures is poised to strike

Just as the nation's housing market has begun showing signs of stabilizing, another wave of foreclosures is poised to strike, possibly as early as this summer, inflicting new punishment on families, communities and the still-troubled national economy.Hoocoodanode? And just wait for the Option ARM recast wave ...

...

Just how big the foreclosure wave will be is unclear. But loan defaults are up sharply. ... rising foreclosures will depress home values, pushing more homeowners underwater. Mark Zandi of Moody's Economy.com estimates that 15.4 million homeowners -- or about 1 in 5 of those with first mortgages -- owe more on their homes than they are worth.

...

"Absolutely," Chase Bank spokesman Tom Kelly said when asked about an impending surge in foreclosures. ... Bank of America spokesman Dan Frahm said the company was projecting a "slow increase" in the number of monthly foreclosures, potentially reaching 30% above previous normal levels.

...

But anecdotal reports indicate that foreclosure sales have started to climb again in the second quarter. And the pipeline is clearly getting fuller.

... just recently, said [Jerry Abbott, a broker and co-owner of Grupe Real Estate in Stockton], there's been a surge of requests for so-called broker price opinions, or appraisals that lenders often ask brokers to provide just before they put a foreclosed property on the market.

"I think it's going to be a very big wave," he said. "Just like what we saw through 2008."

Failed Banks and Brokered Deposits

by Calculated Risk on 7/04/2009 01:02:00 AM

This article provides a history of brokered deposits, and discusses the potential dangers, and the inability of regulators to limit the practice.

From Eric Lipton and Andrew Martin at the NY Times: For Banks, Wads of Cash and Loads of Trouble

[B]rokered deposits ... is one of the primary factors in the accelerating wave of failures among small and regional banks nationwide. The estimated cost to the Federal Deposit Insurance Corporation over the last 18 months is $7.7 billion, and growing.Regulators have tried to limit brokered accounts. Recently the FDIC suggested higher insurance premiums for fast growing banks that depend on brokered deposits. However, just as the FDIC tightened the rules slightly, the banks are finding new ways to attract hot money:

...

The 79 banks that have failed in the United States over the last two years had an average load of brokered deposits four times the national norm ... And a third of the failed banks, the analysis shows, had both an unusually high level of brokered deposits and an extremely high growth rate — often a disastrous recipe for banks.

...

The 371 still-operating banks on Foresight’s “watch list” as of March held brokered deposits that, on average, were twice the norm.

[B]anks — even those considered unsound — [are turning] to a “listing service,” a source of hot money by another name. Instead of paying a broker, banks pay to subscribe to an electronic bulletin board of credit unions with money to park.This is a well known problem - George Hanc at the FDIC wrote in 1999: Deposit Insurance Reform: State of the Debate.

One listing service, QwickRate, based in Marietta, Ga., has just 18 employees crammed into a tiny second-floor office. But it delivered $1.6 billion in hot money to banks in May, up from $450 million last May. The growth is coming partly because banks on the edge of failure are coming to the service for a lifeline.

emphasis added

Owners of insolvent or barely solvent banks have strong incentives to favor risky behavior because losses are passed on to the insurer, whereas profits accrue to the owners.