by Calculated Risk on 7/10/2009 07:16:00 PM

Friday, July 10, 2009

Bank Failure #53: Bank of Wyoming, Thermopolis, Wyoming

A corkscrewed, spiraling fall

Time to drown sorrows.

by Soylent Green is People

From the FDIC: Central Bank & Trust, Lander, Wyoming, Assumes All of the Deposits of Bank of Wyoming, Thermopolis, Wyoming

Bank of Wyoming, Thermopolis, Wyoming, was closed today by the State of Wyoming, Department of Audit, Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....It is Friday ...

As of June 30, 2009, Bank of Wyoming had total assets of $70 million and total deposits of approximately $67 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $27 million. Central Bank & Trust's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Bank of Wyoming is the 53rd FDIC-insured institution to fail in the nation this year, and the first in Wyoming. The last FDIC-insured institution to be closed in the state was Westland, FS & LA, Rawlins, on July 26, 1991.

Short Sellers Beware

by Calculated Risk on 7/10/2009 04:53:00 PM

From the San Francisco Business Times: Sellers owe balances after short sales (ht Michael, SocketSite)

The rising tide of “short sales” by troubled home owners facing foreclosure is prompting lenders to become more aggressive in their attempts to pursue former homeowners for their loan losses in a short sale. In a short sale, a house is sold, with a lender’s approval, for an amount that won’t pay off the mortgages on the property.This is nothing new. Zach Fox (when he was still at the NC Times) reported in April: Lawyers say lenders set stage to collect on 'short sales'

Often, the troubled home owner assumes the loss will be eaten by the lender. But Bank of America and Chase have quietly added language in their short-sale agreements that require the borrower to sign a promissory note for the shortfall.

A spokesman for the American Bankers Association said this week that he wasn’t aware of the practice, suggesting how little attention has been paid so far to collection of these notes from troubled borrowers.

BofA says its intention is to protect investors holding the mortgages.

Lenders appear to be inserting language into short sale contracts that allow them to sue for any "deficiency," or the amount lost by a bank by selling a home for less than the mortgage ---- opening the door to collection agencies and court judgments that can run into the hundreds of thousands of dollars for some North County homeowners.It sounds like the banks will remove the language if asked. I'd suggest having a lawyer review the contract, and make sure "all loans are extinguished and debts forgiven".

...

One real estate agent who specializes in short sales, Chris Mackey of Carmel Valley, said about 50 percent of the short sale contracts he has seen include the language before he requests its removal. Banks generally have removed the language, he said.

... the North County Times obtained a short sale contract issued by Countrywide Financial Corp ... The contract warned the homeowner, who owned a house in El Cajon, that Countrywide "may pursue a deficiency judgment for the difference in the payment received and the total balance due ... "

FDIC Bank Failures, Fed Assets and the Market

by Calculated Risk on 7/10/2009 03:52:00 PM

First the market ... Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And the next two graphs are from the Cleveland Fed.  From Mike Bryan, a vice president and senior economist in the Atlanta Fed’s research department: Economic and financial data, neatly wrapped

From Mike Bryan, a vice president and senior economist in the Atlanta Fed’s research department: Economic and financial data, neatly wrapped

We thought if these summaries are useful internally, then a wider audience will also find them valuable. So beginning today we will publish our Economic Highlights and Financial Highlights, exclusive of any proprietary data, on our Web site. We anticipate updating these digests weekly.From the Financial Highlights on the Fed assets:

While the overall size of the Fed’s balance sheet has been shrinking slightly over the last two months, the composition of the balance sheet has changed. There have been sizeable declines in short-term lending to financials and lending to nonbank credit markets. Offsetting these declines have been increases in holdings of agency debt and mortgage backed securities (MBS) as well as increases in holdings of U.S. Treasury securities. Combined, these three categories have increased by about $460 billion since the week ended March 18.

The third graph shows the bank failures by asset size and state.

The third graph shows the bank failures by asset size and state.I'm looking forward to these highlights every week!

Now for this BFF (Bank Failure Friday) ...

Reich: "When Will The Recovery Begin? Never."

by Calculated Risk on 7/10/2009 02:52:00 PM

From Robert Reich: When Will The Recovery Begin? Never. (ht Bob Dobbs)

The so-called "green shoots" of recovery are turning brown in the scorching summer sun. In fact, the whole debate about when and how a recovery will begin is wrongly framed. On one side are the V-shapers who look back at prior recessions and conclude that the faster an economy drops ...Eventually the economy will start growing again ... but I think the "recovery" will be very sluggish.

Unfortunately, V-shapers are looking back at the wrong recessions. ...

That's where the more sober U-shapers come in. They predict a more gradual recovery ...

Personally, I don't buy into either camp. In a recession this deep, recovery ... depends on consumers who, after all, are 70 percent of the U.S. economy. And this time consumers got really whacked. Until consumers start spending again, you can forget any recovery ...

Eventually consumers will replace cars and appliances and other stuff that wears out, but a recovery can't be built on replacements. Don't expect businesses to invest much more without lots of consumers hankering after lots of new stuff. And don't rely on exports. The global economy is contracting.

Reich suggests the only market for cars will be replacements - but the replacement level (based on scrappage rates) is in the 12 to 13 million range. And that would be a significant increase from the current 9.7 million annual sales rate. That is still well below the peak, but recovery is from the bottom of the cliff - and is not measured from the previous peak.

Mortgage Pig Wear: Email Corrected

by Calculated Risk on 7/10/2009 01:07:00 PM

Yesterday I posted this information with an incorrect email address for Cathy. She can be reached at: stickelc@live.com

CR note: This is from Tanta's sister Cathy. For new readers, to find out about Tanta, please see Tanta: In Memoriam. Also see The Compleat UberNerd for some of her incredible articles. I really enjoy my Mortgage Pig sweatshirt! Thanks to everyone for your support, CR

The Last of the Mortgage Pig Wear

Thank you all for your orders – we raised $3,700 and hopefully you have something unique to help you remember Tanta.

We ended up with some extra completed items and we still have a few “Slap It” and “Holidays” transfers left for T-shirts (“Convexity” is sold out). I’m offering these outside of EBay – no additional charge for shipping in the continental US. Simply send an EMAIL to stickelc@live.com with your request and I’ll send back a confirmation. Then mail a check or money order along with shipping instructions and we’ll get the item out to you. The proceeds will be donated to the Ovarian Cancer Research Fund.

Again – thanks for your support and all of the kind words.

Cathy Stickelmaier

Completed Items:

Black Full-Zip, Hooded Sweatshirt w/Tanta Vive in Pink & White – Size XL - $40

Men’s White Polo Shirt – Size L - $32

White Long Sleeved T-Shirt with Slap-It Transfer – size L - $18

White Hooded Sweatshirt with Holidays Transfer – Size 2X - $30

White Hooded Sweatshirt with Holidays Transfer – Size XL - $30

(2) Short Sleeved T-Shirt with Holidays Transfer – size S - $15 each

(2) White Hooded Sweatshirt with Slap It Transfer – size L - $30 each

Transfer Items – made to order while transfers last:

White Long Sleeved T-Shirt with Slap It Transfer – Sizes S to 2XL - $18

White Short Sleeved T-Shirt with Slap It Transfer – Sizes S to 2XL - $15

White Long Sleeved T-Shirt with Holidays Transfer – Sizes S to 2XL - $18

White Short Sleeved T-Shirt with Holidays Transfer – Sizes S to 2XL - $15

"Substantial Doubt" Initial Filings

by Calculated Risk on 7/10/2009 10:54:00 AM

SEC data guy brings us some interesting data on SEC filings with companies expressing: "Substantial Doubt"

Below is a graph that shows the total number of distinct entities filing a 10-K or 10-Q over time. It also shows the number of distinct entities expressing "substantial doubt" for the first time in one of those filings

Note: Left scale doesn't start at zero, and the right scale is a 4 quarter average.

These are just initial expressions of "substantial doubt".

On a cumulative basis, a stunning number of filers are expressing concerns (more to come on this). For details, see SEC data guy's post.

University of Michigan Consumer Sentiment

by Calculated Risk on 7/10/2009 10:06:00 AM

From MarketWatch: July UMichigan consumer sentiment falls to 64.6

U.S. consumer sentiment fell sharply in early July, according to a survey released Friday by the University of Michigan and Reuters. Sentiment fell to 64.6 from 70.8 in June.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Consumer sentiment is a coincident indicator - it tells you what you pretty much already know.

And it tells us right now that consumer sentiment is still very weak.

GM Emerges from Bankruptcy, Press Conferenace at 9 AM ET

by Calculated Risk on 7/10/2009 08:53:00 AM

Here is the press conference at 9 AM ET:

From the NY Times: With Sale of Its Good Assets, G.M. Tries for a Fresh Start

General Motors completed a major step in its turnaround on Friday and closed the sale of its good assets to a new, government-backed carmaker....That was fast!

G.M.’s sale of its desirable assets, including brands like Chevrolet, Cadillac and GMC, to the new company — now named Vehicle Acquisition Company but soon to be renamed the General Motors Company — is meant to shed decades of buckling liabilities. The federal government will hold nearly 61 percent of the new company ...

The new company will be much smaller, with brands like Saturn, Hummer, Opel and Pontiac in the process of being sold or closed.

Trade Deficit Declined in May

by Calculated Risk on 7/10/2009 08:30:00 AM

The Census Bureau reports:

The ... total May exports of $123.3 billion and imports of $149.3 billion resulted in a goods and services deficit of $26.0 billion, down from $28.8 billion in April, revised. May exports were $1.9 billion more than April exports of $121.4 billion. May imports were $0.9 billion less than April imports of $150.2 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through May 2009.

Imports declined again in May, but U.S. exports were up slightly. On a year-over-year basis, exports are off 21% and imports are off 31%.

The second graph shows the U.S. trade deficit, with and without petroleum, through May.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Import oil prices increased slightly to $51.21 in May - the third monthly increase in a row. Spot prices have increased since May, so oil prices will rise further for June and July.

It appears the cliff diving for U.S. trade might be over - especially for U.S. exports.

White House Pleads for more Mortgage Mods

by Calculated Risk on 7/10/2009 12:21:00 AM

From the WaPo: White House Prods Banks

In a two-page letter [to the country's largest banks], Treasury Secretary Timothy F. Geithner and Shaun Donovan, secretary of the Department of Housing and Urban Development, acknowledge that the government program, known as Making Home Affordable, has yet to gain traction since being launched in March.The results have been disappointing so far, with few modifications and a high re-default rate. Also most of the modifications so far have been the "extend and pretend" type, with a capitalization of missed payments and fees, lower interest rates, and longer terms - leaving many borrowers with significant negative equity and high likelihood of a future default.

"We believe there is a general need for servicers to devote substantially more resources to this program for it to fully succeed and achieve the objectives we all share," the letter said.

...

The banks were also told to designate a senior liaison for the program and to prepare for a July 28 meeting with senior Treasury and HUD officials ...

"We are asking that all servicers expand servicing capacity and improve the execution quality of loan modifications in order to help the sizable number of homeowners at risk of foreclosure and eligible for the program," the letter said.

The administration will begin issuing monthly reports by Aug. 4 detailing lenders' performance ...

Thursday, July 09, 2009

Missing the Point on Stated Income Loans

by Calculated Risk on 7/09/2009 09:43:00 PM

This article quotes a couple of mortgage brokers who somehow think the loss of stated income loans is a bad thing - and one who thinks they will "re-emerge over the next six months" ...

From James Temple at the San Francisco Chronicle: Undocumented income makes it hard to get a loan

With more than $300,000 in combined annual income, tens of thousands of dollars in the bank and credit scores that top 800, Jennifer France and her partner would seem like ideal candidates for a mortgage refinance.This misses the point. It wasn't that stated income loans were "liar loans", although that is a fun name. The problem is: Stated income loans were borrower underwritten loans, not lender unwritten loans.

But when they applied to swap an interest-only loan on their nearly $1 million San Carlos home for a 30-year fixed that locked in today's low rates, they were summarily denied. The reason: effectively, because both operate their own businesses.

...

A few years ago, theirs would have been the ideal scenario for a stated-income or no-documentation loan, which allowed individuals with ample but unconventional sources of income to secure home loans. But after untold numbers of borrowers lied about their financial wherewithal to buy homes they couldn't afford, often with a wink and nod from mortgage brokers, nearly all lenders stopped offering what became known derisively as "liar loans." Now even the well-qualified borrowers for whom the products were first intended can't get them.

The borrowers above weren't denied because they "operate their own business". They were denied because they didn't meet the underwriting standards of the lender.

And a couple of posts from Tanta on the subject in 2007:

Just Say No To Stated Income. Excerpt:

Every lender can make an exception to the two-year average rule-of-thumb for determining "qualifying income." If you just stopped being Nurse Sue and became Assistant Professor of Nursing Sue, and you spent the last two years renting while you were building up your credentials for that career move, waiting to buy until it made more financial sense for you, and you can give me the W-2s, rental history, and employment agreement with Nursing U to prove it, I won't just make you a loan, I'll cut your cake and give you a big warm hug because you're my kind of borrower.And What's Really Wrong With Stated Income .

If you've been behind the counter at Taco Bell for the last two years, but just recently got put on the payroll at your brother-in-law's new vitamin supplement marketing startup company, and now you'd like to do a cash-out refi to make a little investment with? You will be "qualified" on your average Taco Bell income for the last two years. I'm the underwriter. I make the rules. You do not get to "underwrite yourself" by deciding that my rule on qualifying income is "unfair" to you and therefore you can get around them by "going stated."

And from the article:

Chris George, president of CMG Mortgage in San Ramon, predicts that no-doc loans and other nontraditional mortgages will begin to re-emerge over the next six months, as creditors gain confidence.Geesh - I hope not. Paging all regulators: Read Tanta's posts. Borrower underwritten loans should be permanently banned. Enough said.

Report: FDIC Unwilling to Back CIT Debt

by Calculated Risk on 7/09/2009 07:42:00 PM

From Bloomberg: FDIC Said to be Unwilling to Back CIT Debt on Risk (ht Bob_in_MA)

The [FDIC] is unwilling to give CIT Group Inc. access to its Temporary Liquidity Guarantee Program because the commercial lender’s credit quality is deteriorating [unidentified sources say] ... The FDIC, which has backed $274 billion in bond sales under the TLGP since Nov. 25, is concerned that guaranteeing CIT debt would put taxpayer money at risk ...CIT has about $75 billion in assets.

CIT ... became a bank in December to qualify for a government bailout and received $2.33 billion in funds from the U.S. Treasury. ... Without access to TLGP, CIT may default as soon as April, when a $2.1 billion credit line matures, according to Fitch Ratings.

The federal agency is in discussions with CIT about how the lender can strengthen its financial position to get approval, such as by raising capital, said one of the people. ...

Condo Association Files Bankruptcy

by Calculated Risk on 7/09/2009 04:25:00 PM

This might be the start of a number of condo / homeowner associations filing bankruptcy because of the housing bust ...

From the Daily Business Review: Bankruptcy: $1 million debt sends condo association into Chapter 11 (ht Soylent Green is People)

Facing almost $1 million in claims by unsecured creditors, a troublesome recreational lease, and at least 100 unit owners delinquent on payments of their fees, the association filed a Chapter 11 petition last month in U.S. Bankruptcy Court in Miami.

As one of the first condo association bankruptcies of the current economic crisis ... With residential foreclosures and personal bankruptcies soaring in South Florida, Maison Grande’s decision is expected to become more commonplace, said attorney Aleida Martinez Molina of Becker & Poliakoff in Coral Gables.

...

The significant drop in property values is a key factor pushing associations toward bankruptcy filings, said attorney Robert Kaye of Kaye & Bender in Fort Lauderdale. ... “In prior times, there was enough equity in all the properties [in an association] so that assets would likely exceed liabilities,” he said. “Now, since a large percentage of associations are upside down, that’s changing their view about bankruptcy. Their debts have overtaken their assets.”

Treasury Working on 'Plan C'

by Calculated Risk on 7/09/2009 03:06:00 PM

From the WaPo: Treasury Works on 'Plan C' To Fend Off Lingering Threats

... the Treasury Department has assembled a team to examine what could yet bring it down and has identified several trouble spots ... Informally known as Plan C, the internal project is focused on vexing problems such as the distressed commercial real estate markets, the high rate of delinquencies among homeowners, and the struggles of community and regional banks, said government sources familiar with the effort."A lot of scrutiny and a leap of faith"? More of the later, not enough of the former. It didn't take much "scrutiny" to understand there was substantial overbuilding in CRE, especially for retail space and for hotels. And yet banks kept making loans in 2006, 2007 and even in 2008 ...

...

The team is also responsible for considering potential government responses, but top officials within the Obama administration are wary of rolling out initiatives that would commit massive amounts of federal resources ...

The officials in charge of Plan C -- named to allude to a last line of defense -- face a particular challenge in addressing the breakdown of commercial real estate lending. ... these groups face a tidal wave of commercial real estate debt -- some estimates peg the total at more than $3 trillion -- that they will need to refinance. ...

Thousands of these institutions wrote billions of dollars in mortgages on strip malls, doctors offices and drive-through restaurants. These commercial loans required a lot of scrutiny and a leap of faith, and, for much of the decade, the smaller banks that leapt were rewarded with outsize profits.

In doing so, many took on bigger and bigger risks. By the beginning of the recession in December 2007, the median midsize bank held commercial real estate loans worth 3.55 times its capital cushion -- its reserve against unexpected losses -- according to the Federal Deposit Insurance Corp.

... Another issue identified by the Plan C team is homeowner delinquencies, which continue to rise as large numbers of people lose their jobs and miss monthly payments.

Charity: Mortgage Pig Wear Closeout

by Calculated Risk on 7/09/2009 01:28:00 PM

CR note: This is from Tanta's sister Cathy. For new readers, to find out about Tanta, please see Tanta: In Memoriam. Also see The Compleat UberNerd for some of her incredible articles. I really enjoy my Mortgage Pig sweatshirt! Thanks to everyone for your support, CR

The Last of the Mortgage Pig Wear

Thank you all for your orders – we raised $3,700 and hopefully you have something unique to help you remember Tanta.

We ended up with some extra completed items and we still have a few “Slap It” and “Holidays” transfers left for T-shirts (“Convexity” is sold out). I’m offering these outside of EBay – no additional charge for shipping in the continental US. Simply send an EMAIL to stickelc@live.com with your request and I’ll send back a confirmation. Then mail a check or money order along with shipping instructions and we’ll get the item out to you. The proceeds will be donated to the Ovarian Cancer Research Fund.

Again – thanks for your support and all of the kind words.

Cathy Stickelmaier

Completed Items:

Black Full-Zip, Hooded Sweatshirt w/Tanta Vive in Pink & White – Size XL - $40

Men’s White Polo Shirt – Size L - $32

White Long Sleeved T-Shirt with Slap-It Transfer – size L - $18

White Hooded Sweatshirt with Holidays Transfer – Size 2X - $30

White Hooded Sweatshirt with Holidays Transfer – Size XL - $30

(2) Short Sleeved T-Shirt with Holidays Transfer – size S - $15 each

(2) White Hooded Sweatshirt with Slap It Transfer – size L - $30 each

Transfer Items – made to order while transfers last:

White Long Sleeved T-Shirt with Slap It Transfer – Sizes S to 2XL - $18

White Short Sleeved T-Shirt with Slap It Transfer – Sizes S to 2XL - $15

White Long Sleeved T-Shirt with Holidays Transfer – Sizes S to 2XL - $18

White Short Sleeved T-Shirt with Holidays Transfer – Sizes S to 2XL - $15

Hotel RevPAR off 13%

by Calculated Risk on 7/09/2009 12:45:00 PM

Note: This report included a holiday weekend. Since vacation travel is holding up better than business travel I'd expect year-over-year RevPAR (and occupancy rate) to be off less than earlier this year for the summer months and especially for holiday weekends.

From HotelNewsNow.com: STR reports U.S. hotel performance for week ending 27 June 2009

In year-over-year measurements, the industry’s occupancy fell 6.0 percent to end the week at 57.7 percent. Average daily rate dropped 7.4 percent to finish the week at US$95.16. Revenue per available room for the week decreased 13.0 percent to finish at US$54.94.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 8.8% from the same period in 2008.

The average daily rate is down 7.4%, and RevPAR is off 13.0% from the same week last year.

Note: the occupancy rate will rebound in the next report - this is the normal pattern. The hotel occupancy rate is usually the highest during the peak vacation months of June, July and August and declines on weeks with holiday weekends.

Lawmaker: "The CRE time bomb is ticking"

by Calculated Risk on 7/09/2009 11:44:00 AM

From Dow Jones: US Lawmakers Sound Alarm About Commercial Real Estate Market

"The commercial real estate time bomb is ticking," Joint Economic Committee Chairman Rep. Carolyn Maloney, D-N.Y., said in opening remarks to a hearing before her panel Thursday.The article mentions the Fed's legacy CMBS TALF as helping the CRE market. The first auction is July 16th.

U.S. Sen. Sam Brownback, R-Kansas, said he was distressed about the situation the industry is facing.

Banks have yanked back on lending to developers of shopping malls, apartment complexes, hotels and office parks. ... The U.S. commercial real estate market is roughly $6.7 trillion in size and is underpinned by about $3.5 trillion of debt.

A few CRE stories this week:

Strip Mall Vacancy Rate Hits 10%, Highest Since 1992

"[W]e do not foresee a recovery in the retail sector until late 2012 at the earliest."Apartment Vacancy Rate at 22 Year High

Victor Calanog, director of research for Reis on Retail CRE

Hotel Recession Reaches 20 Months

U.S. Office Vacancy Rate Hits 15.9% in Q2

"It's bad. It's decaying and getting worse. Given the depth and magnitude of the recession, you can argue that we are facing a storm of epic proportions and we're only at the beginning."CRE: Another Half Off Sale

Victor Calanog, Reis director of research on the Office Market.

Property Taxes Fall in California

by Calculated Risk on 7/09/2009 10:24:00 AM

Even with plummeting house prices, it is hard for overall property taxes to decline in California. This is because the assessed value of properties held by long term homeowners is frequently far below market value - even after the recent steep decline in prices - so the assessed value for those homeowners continues to increase at 2% per year.

From the SacBee: California counties see property revenue fall

For the first time since the taxpayers' revolt of the 1970s, the total assessed value of properties is dropping in Sacramento and across California.For communities with many long term property owners, the property taxes are still increasing - because the assessed values are still below current market values.

The property tax roll in Sacramento County is down 6.4 percent from last year – to $131.6 billion; in Contra Costa County it's down 7 percent; and in Merced County it's down almost 13 percent.

...

While Sacramento County is dropping the assessed value on more than 170,000 properties, most of the remaining 230,000 residential properties won't see a reduction. Those owners can expect their normal 2 percent annual increase, county Assessor Ken Stieger said.

...

Also, the current assessment on many homes is still well below their actual market value, meaning they don't qualify for a reduction.

This is often the case for people who have owned their home for many years. The Proposition 13-mandated 2 percent annual increase has likely not kept pace with the double-digit annual percentage increases in market value.

Jon Lansner at the O.C. Register has a breakdown by cities in Orange County: Steepest property tax-value dips hit Santa Ana

Orange County’s first drop in taxable property values in 14 years was by no means an across-the-board drop.The increases are mostly for cities with long term homeowners.

The Assessor’s recap of the new taxable values for homes and other properties — remember, that’s different that actual values — show that 25 of Orange County’s 34 cities saw their taxable values driven down by falling home prices, with an average decline of 2.4%. And 9 had increases, with an average gain of 1.2%.

Weekly Unemployment Claims Decline, Record Continuing Claims

by Calculated Risk on 7/09/2009 08:42:00 AM

Note: The numbers are adjusted for the holiday, but this might still be an aberration.

The DOL reports on weekly unemployment insurance claims:

In the week ending July 4, the advance figure for seasonally adjusted initial claims was 565,000, a decrease of 52,000 from the previous week's revised figure of 617,000. The 4-week moving average was 606,000, a decrease of 10,000 from the previous week's revised average of 616,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending June 27 was 6,883,000, an increase of 159,000 from the preceding week's revised level of 6,724,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971.

Continued claims increased to a record 6.88 million.

The four-week average of weekly unemployment claims decreased this week by 10,000, and is now 52,750 below the peak of 13 weeks ago. It appears that initial weekly claims have peaked for this cycle.

However the level of initial claims (over 600 thousand 4-week average) is still very high, indicating significant weakness in the job market.

As a reminder, when looking at this report, I'd focus on the 4-week moving average of initial claims, not continued claims.

Depression Era Unemployment Rate

by Calculated Risk on 7/09/2009 12:14:00 AM

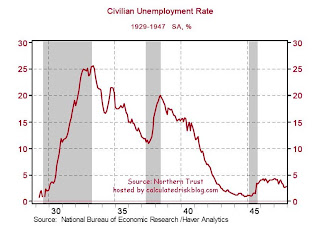

Just for information purposes, the following graph is from Northern Trust.

What was the high of the unemployment rate in the Great Depression?

The civilian unemployment rate was around 25% during several months of 1932-1933

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the unemployment rate from 1929 through 1947.

The surge in unemployment in 1937 was related to an attempt to unwind the monetary and fiscal stimulus policies, with disastrous results for employment. Just something to remember when the Fed and Treasury start to unwind the current stimulus programs.

Several people have commented on 1937 lately ...

Alan Blinder wrote in the New York Times in May:

From its bottom in 1933 to 1936, the G.D.P. climbed spectacularly (albeit from a very low base), averaging gains of almost 11 percent a year. But then, both the Fed and the administration of Franklin D. Roosevelt reversed course.And from Paul Krugman in the NY Times in June:

In the summer of 1936, the Fed looked at the large volume of excess reserves piled up in the banking system, concluded that this mountain of liquidity could be fodder for future inflation, and began to withdraw it. ...

About the same time, President Roosevelt looked at what seemed to be enormous federal budget deficits, concluded that it was time to put the nation’s fiscal house in order and started raising taxes and reducing spending. ...

Thus, both monetary and fiscal policies did an abrupt about-face in 1936 and 1937, and the consequences were as predictable as they were tragic. The United States economy, which had been rapidly climbing out of the cellar from 1933 to 1936, was kicked rudely down the stairs again ...

The first example of policy in a liquidity trap comes from the 1930s. The U.S. economy grew rapidly from 1933 to 1937, helped along by New Deal policies. America, however, remained well short of full employment.

Yet policy makers stopped worrying about depression and started worrying about inflation. The Federal Reserve tightened monetary policy, while F.D.R. tried to balance the federal budget. Sure enough, the economy slumped again, and full recovery had to wait for World War II.