by Calculated Risk on 7/14/2009 08:30:00 AM

Tuesday, July 14, 2009

Retail Sales in June

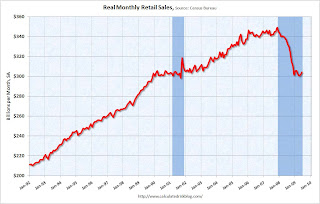

On a monthly basis, retail sales increased 0.6% from May to June (seasonally adjusted), and sales are off 9.6% from June 2008 (retail ex food services decreased 10.3%). Excluding autos and gas, retail sales fell again in June.

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (June PCE prices were estimated as the average increase over the previous 3 months).

The Census Bureau reported that nominal retail sales decreased 10.3% year-over-year (retail and food services decreased 9.6%), and real retail sales declined by 9.7% on a YoY basis. The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, and may have bottomed - but at a much lower level.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for June, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $342.1 billion, an increase of 0.6 percent (±0.5%) from the previous month, but 9.0 percent (±0.7%) below June 2008. Total sales for the April through June 2009 period were down 9.6 percent (±0.5%) from the same period a year ago. The April to May 2009 percent change was unrevised from 0.5 percent (±0.3%).Maybe the cliff diving is over, but retail sales are still at the bottom of the cliff ...

Retail trade sales were up 0.8 percent (±0.7%) from May 2009, but 10.0 percent (±0.7%) below last year. Gasoline stations sales were down 31.6 percent (±1.5%) from June 2008 and motor vehicle and parts dealers sales were down 14.1 percent (±2.5%) from last year.

Monday, July 13, 2009

Report: Private-Equity Firms Bidding for Corus Assets

by Calculated Risk on 7/13/2009 10:54:00 PM

Just a reminder, with BankUnited the stories of private-equity bidders appeared on Tuesday May 19th and BankUnited was seized by the FDIC two days later.

From the WSJ: Starwood Enters Bidding for Corus Assets

Barry Sternlicht's Starwood Capital Group, a private-equity firm specializing in real-estate investments, is bidding on assets of Corus Bankshares Inc ...Corus faced a June 18th deadline to boost its capital levels ... that wasn't met.

"We're bidding on a bank," Mr. Sternlicht said during a conference call with investors in Starwood funds on Monday. Without naming the bank, he said it is heavily concentrated in real-estate lending and has more than 110 construction loans. People with knowledge of the matter identified the bank as Corus.

... Investors don't appear to be interested in buying the entire bank, but instead are looking at buying the bank's assets out of receivership if regulators take over.

As with BankUnited, the line "buying the bank's assets out of receivership" says it all. Say goodnight, Gracie.

Appraisal Update

by Calculated Risk on 7/13/2009 08:00:00 PM

There have been quite a few complaints about the new appraisal rules from real estate agents, homebuilders and mortgage brokers.

Last Friday Freddie Mac updated their appraisal guidelines and clarified that the appraiser is not required to use distressed sales (REOs, short sales):

The appraiser’s selection of comparable sales is crucial to providing an accurate opinion of value based on market data. With respect to comparable sales, the appraiser must choose appropriate comparable sales, and certify that the comparable sales chosen are those most similar to the subject property. In underwriting the appraisal, the underwriter must consider whether any adjustments are supported and are reasonable. The amount and number of any adjustments must also be considered. Typically, the higher the amount of the adjustments or the number of adjustments the more likely the comparable sales might not be representative of the subject property. Freddie Mac does not have requirements about what comparable sales the appraiser is to use. For example, we do not require appraisers to use Real Estate Owned (REO), foreclosure or short sales. However, if the appraiser determines that these are representative of the properties available to typical purchasers for the market in which the property is located, appraisers must consider their use.My favorite paragraph in the bulletin is:

To determine that a Mortgage is eligible for sale to Freddie Mac, a Seller/Servicer must conclude that the Borrower is creditworthy (acceptable credit reputation and capacity) and the Mortgaged Premises (collateral) are adequate for the transaction. Credit reputation, capacity and collateral are often called the “three Cs” of underwriting; if one of these components is not acceptable or if there is excessive layering of risk across components, the Mortgage is not eligible for sale to Freddie Mac. Sellers must accurately evaluate and determine a Borrower’s ability to repay the Mortgage.Imagine that.

NY Magazine: The Billyburg Bust

by Calculated Risk on 7/13/2009 05:55:00 PM

From David Amsden at New York Magazine: The Billyburg Bust (ht Jennifer). A few excerpts:

With sales across Brooklyn down a staggering 57 percent from a year ago, Williamsburg, with its high density of new construction, has taken on an ominous disposition. Walk down virtually any block and you’ll come across an amenity-laden building that sits nearly empty: relics of a moment in history that seems, increasingly, like a fever dream. Some developers with iffy financing have quietly been forced to go rental, others have lowered prices to the point where losses are inevitable, and a handful of projects, including two buildings Maundrell had been selling, have gone into foreclosure.Amsden takes us on a tour and gives several examples like this one:

Most unsettling are the cases of the developers who seem to have vanished, leaving behind so many vacant lots and half-completed buildings—eighteen, to be precise, more than can be found in all of the Bronx—that large swaths of the neighborhood have come to resemble a city after an air raid.

Later that afternoon, I made my way to a building called Warehouse 11, on the corner of Roebling and North 11th Streets. Marketed by David Maundrell, the building has 120 total units (plus the requisite yoga center, playroom, parking garage, 24-hour concierge, gym, and communal sundeck). While the model apartment seemed an appealing enough place to live, there was something generally off about the building as a whole: Despite having been on the market since early 2008, only 30 percent of the units were in contract, and it was clear that construction wasn’t complete. The list prices, too, were significantly higher than comparable products, as if the developer had not been informed about the current state of the economy. A few weeks later, I noticed the front doors of the lobby had been padlocked shut. The process of foreclosure had begun.According to Amsden the developer borrowed $50 million from Capital One, and another $12 million from private equity. Apparently bids are coming in close to $30 million ... another half off sale!

Market and Credit Indicators

by Calculated Risk on 7/13/2009 03:20:00 PM

Investors seem bipolar, with the S&P 500 up about 2.5% today ... Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The British Bankers' Association reported that the three-month dollar Libor rates were fixed at 0.509%. This is up slightly from Friday's record low of 0.505%. The LIBOR peaked at 4.81875% on Oct 10, 2008.  There has been improvement in the A2P2 spread. This has declined to 0.31. This is far below the record (for this cycle) of 5.86 after Thanksgiving, and still above the normal spread of around 20 bps.

There has been improvement in the A2P2 spread. This has declined to 0.31. This is far below the record (for this cycle) of 5.86 after Thanksgiving, and still above the normal spread of around 20 bps.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

Meanwhile the TED spread has decreased further and is now at 33.9. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. This graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

This graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The spread has decreased sharply over the last few months. The spreads are still high, especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.Meanwhile from Bloomberg: ‘Fallen Angels’ Jump to Third-Highest Monthly Total, S&P Says

Fifteen companies lost their investment-grade ratings in June, the third-highest monthly tally since 1987, according to Standard & Poor’s.Even though credit indicators have improved, there are plenty of companies in deep trouble.

With rankings for two additional issuers cut to junk status, the number of “fallen angels” climbed to 60 this year with a combined debt of $209.2 billion, S&P analysts led by Diane Vazza in New York said in a report today.

...

The largest fallen angel this year is CIT Group Inc. ...

Report: Option ARMs Performing Worse than Subprime

by Calculated Risk on 7/13/2009 12:36:00 PM

From the WSJ: Pick-a-Pay Loans: Worse Than Subprime

For the third straight month, option adjustable-rate mortgages are generating proportionally more delinquencies and foreclosures than subprime mortgages ...We knew this day was coming.

As of April, 36.9% of Pick-A-Pay loans were at least 60 days past due, while 19% were in foreclosure, according to data from First American CoreLogic, a unit of Santa Ana, Calif.-based First American Corp. In contrast, 33.9% of subprime loans were delinquent, with 14.5% of those loans in foreclosure, the figures show.

By the way, the Healdsburg Housing Bubble has a nice analysis of the Credit Suisse Reset chart, and makes a strong argument that many of the recasts will be later than the chart indicates: Reset Chart from Credit Suisse has a Major Error

Wells Fargo, who holds more Option-ARMs on its books than any other institution, states in their last 10-Q filing:There is much more in HBB's post, but this suggests that the problem will presist for some time (much longer than shown by the Credit Suisse chart).Based on assumptions of a flat rate environment, if all eligible customers elect the minimum payment option 100% of the time and no balances prepay, we would expect the following balance of loans to recast based on reaching the principal cap: $4 million in the remaining three quarters of 2009, $9 million in 2010, $11 million in 2011 and $32 million in 2012... In addition, we would expect the following balance of ARM loans having a payment change based on the contractual terms of the loan to recast: $20 million in the remaining three quarters of 2009, $51 million in 2010, $70 million in 2011 and $128 million in 2012.In short, Wells expects $56 million in Option ARMs to recast due to the loan balance reaching 125% of the value of the original loan and another $269 million to recast based on the terms of the loan. Given that we’re talking about a portfolio of over $100 BILLION of these loans, this means ESSENTIALLY NO LOANS WILL RECAST due to the negative amortization limits or contractual terms before 2012.

Both assumptions seemed suspect, yet, they are in fact true. Looking at page 55 of the Golden West 10-K from 2005 we read:...most of our loans are scheduled to have a payment change without respect to any annual limit in order to reamortize the loan over its remaining life at the end of the tenth year or when the loan balance reaches 125% of the original amount. We term this reamortization a “recast.” Historically, most loans in our portfolio have paid off before the loan’s payment is recast.History doesn’t look like it will be a good guide going forward but this at least clearly spells out what we are facing. If recasts don’t happen contractually for 10 years this means that the $49 billion of Golden West Option ARMs originated in 2004 will recast in 2014, and the $51 billion originated in 2005 will recast in 2015.

Shiller on Housing

by Calculated Risk on 7/13/2009 10:19:00 AM

"One thing is true about housing, it is a very inefficient market - and it shows momentum. And in fact, when the rate of decline slows that is evidence that the rate of decline will continue to slow because there has been a second derivative effect that is actually in the data historically."UPDATE: Ignore the Tech Ticker story title - Shiller said he felt an echo bubble was unlikely.

Robert Shiller, July 13, 2009

An interview with Robert Shiller at Tech Ticker: “Another Bubble” In Housing? It Could Happen, Says Yale’s Robert Shiller (ht Dirk van Dijk)

The slowing rate of decline in home prices is likely to continue but the housing market is "still in an abysmal situation," says Robert Shiller, a professor of economics at Yale. ... [Shiller] says the housing market could "languish for many years," due to the "huge inventory" of unsold holds, "shadow inventory" of homes kept off the market by banks and other potential sellers, and "a lot of financial problems."Housing markets are very inefficient - and that is why it takes several years for prices to fall to a market clearing price. Even if the rate of price declines has slowed, there will probably be a long tail of real price declines in many areas.

[Shiller] believes "there could be another bubble" in housing, once the excess inventory is worked off. "This is not my more probable scenario [but] people have gotten very speculative in their attitudes toward housing," he says.

"My more probable scenario is languishing of the housing market for years."

Robert Shiller

Government loses £10.9 Billion in RBS and Lloyds

by Calculated Risk on 7/13/2009 09:09:00 AM

From the Telegraph: UK Government has lost £10.9bn on stakes in RBS and Lloyds

UK Financial Investments (UKFI) said in its annual report that its loss on the two stakes - 70pc of RBS and 43pc of Lloyds Banking Group - had reached £10.9bn at the end of June.UKFI is the entity set up to manage the UK Government’s ownership in banks. And there are more losses coming ...

...

Analysts at UBS have speculated that Lloyds could be forced to write off as much as £13bn on mortgage and commercial property lending, and lending to businesses, when it posts its results for the first half of the year on August 5.

Sunday Night Futures and a little Humor

by Calculated Risk on 7/13/2009 12:46:00 AM

First, yesterday I posted a funny article about Wells Fargo NA suing Wells Fargo NA (and other defendants). See: Wells Fargo Sues Wells Fargo, Wells Fargo Denies Allegations (ht Rama)

Also gasoline prices fell: U.S. gasoline prices fall to $2.56/gallon

According to the nationwide Lundberg survey of gas stations, Americans are paying about $1.55 less per gallon than they were on July 11, 2008, when the price-per-gallon of gas touched a high of $4.11.Futures are off slightly ...

...

Two weeks ago, the national average for self-serve, regular unleaded gas was $2.6613 per gallon.

Futures from barchart.com

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

And the Asian markets are off close to 2%.

Best to all.

Sunday, July 12, 2009

Second Stimulus Debate: Geithner vs. Krugman and Delong

by Calculated Risk on 7/12/2009 09:04:00 PM

From Treasury Secretary Geithner (via Tom Petruno at the LA Times):

"I think all economists believe, and this was inherent in the design of the program, that the biggest thrust or force would start to take effect in the second half of this year. And we’re going to start to see that happen. But I don’t think that’s a judgment we need to make now, can’t really make it now prudently, responsibly."From Brad Delong: Fiscal Policy: The Obama Administration Is Not Making Much Sense These Days

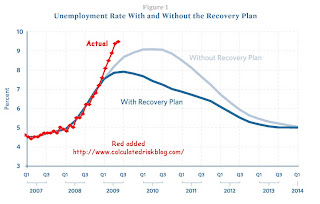

Last December the Obama administration ... decided on a fiscal stimulus package which they believed would have minor effects on the economy in the first two quarters of 2009 and major effects--would push unemployment down below what it would other wise have been by more than half a percentage point--starting in the third quarter of 2009. They believed that the economy was not that weak, and that with the fiscal stimulus package taking effect unemployment would be peaking now at a rate of 7.9%.

...

The financial crisis of last fall hit the economy's levels of production, spending, and employment much harder than people thought at the time. If we had known then what we know now, it would have been prudent then to propose twice as large a fiscal stimulus program as the Obama administration in fact did propose.

...

If I were running the government, I would be trying to make up that GDP shortfall right now: I would be rushing a clean $170 billion--$500 per citizen--aid-to-states-that-maintain-effort package through the congress this week.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph (similar to Brad's) compares the BLS reported monthly unemployment rate (in red) with the Obama economic forecast from January 10th: The Job Impact of the American Recovery and Reinvestment Plan

Geithner is correct about the stimulus kicking in during the 2nd half of 2009, and Delong agrees. But Delong is pointing out that the economy is in much worse shape than originally expected, and he argues if the Obama Administration knew in January what we know today, the package would have been much larger. Maybe. But thinking back - there was a huge political problem with the word "trillion" - so a much larger package would have been very difficult (although the composition could have been different).

From Paul Krugman: Vegematic policy advocacy

Like Brad, I’m not too happy with the policy justifications we’re getting from the administration. It’s perfectly clear that the stimulus was too small; I think they know that too. But they’ve made a political judgment that (a) they can’t push another round through and (b) the thing to do right now is defend the policy they already have.My guess is another stimulus package is coming - but the Obama Administration is in a political bind and they will have to wait a few more months. The second package will probably be introduced after the third quarter - or once the unemployment rate reaches 10% - and my guess is it will be about half the size of the package proposed by Dr. Delong.

Maybe they’re right.

Lenders Walking Away

by Calculated Risk on 7/12/2009 06:02:00 PM

From the Milwaukee Journal Sentinel: Lenders abandoning foreclosed properties (ht Michael)

Rodney Lass figured his days as a homeowner were over when he was hit with a foreclosure judgment more than a year ago.We've heard this story before - the lender starts foreclosure, and then discovers the house is worthless (or in this case has a negative value because the house is condemned). In this case, the foreclosure went through, but the lender never recorded the deed with the court leaving the property in the previous owner's name.

He stopped rehabbing his two-story Bay View home and moved on.

But what Lass didn't realize until recently is that the house remains in his name today.

He's still responsible for the taxes, upkeep of the property and the mortgage, leaving Lass perplexed.

"Why would I pay for something that I don't own anymore?" Lass said.

The foreclosure, however, failed to go through after the California-based lender decided it didn't want the gutted house. Lass said he found out for certain that he still owned it from the Journal Sentinel.

Today, the house at 703 E. Lincoln Ave. sits condemned ...

The home represents a growing phenomenon known as walkaways - properties for which lenders sue for foreclosure but never take the title.

No one wants the property now, and the city will probably bear the costs of demolition. Meanwhile the abandoned house is a nuisance for the neighbors - even the bandos won't live there.

Selected GDP Forecasts

by Calculated Risk on 7/12/2009 01:59:00 PM

Professor Roubini thinks the economy will be in recession through the end of 2009, and that the recovery will be "shallow". More from Christian Menegatti at RGE Monitor:

The general consensus is that this recession will end sometime in the second half of 2009. While RGE Monitor expects more quarters of negative real GDP growth in 2009, we also expect the pace of contraction of economic activity to slow significantly. We forecast negative real GDP growth in Q2 2009 and Q3 2009, and for real GDP to remain flat in Q4. After the sharp contraction in economic activity in 2009, growth will reenter positive territory only in 2010, and then at a very sluggish rate, well below potential.Paul Kasriel at Northern Trust is a little more optimistic: When We Get “There”, Will We Know It?

Back in April, our forecast update commentary was entitled, “Are We There Yet?” The “there” referred to a resumption of real growth in the overall economy. Our answer in April was “no,” which also happens to be our answer in July. When will we get there? Our answer in April was the fourth quarter of this year, which also happens to be our answer now. Assuming we get there in the fourth quarter, would most households and businesses in America know it if they were not so informed by the media? Probably not. We anticipate another “jobless recovery,” which implies a relatively feeble one. We would not be surprised to hear terms early in 2010 such as “double dip.”I think Kasriel might be a little too optimistic about 2010.

Jan Hatzius at Goldman Sachs sees a little positive GDP growth starting in Q3, and a sluggish recovery (no link).

Here are the quarter by quarter real GDP (annualized) forecasts from Northern Trust and Goldman:

| Quarter | Northern Trust | Goldman Sachs |

|---|---|---|

| Q2 2009 | -2.2% | -1.0% |

| Q3 2009 | -2.1% | 1.0% |

| Q4 2009 | 2.3% | 1.0% |

| Q1 2010 | 1.2% | 1.5% |

| Q2 2010 | 2.4% | 1.5% |

| Q3 2010 | 2.4% | 2.0% |

| Q4 2010 | 3.3% | 2.0% |

I think the real GDP growth will turn slightly positive sometime in the 2nd half of this year, but my guess is 2010 will be barely positive, with the unemployment rate rising for most of 2010.

Report: Lloyds to writeoff up to £13bn

by Calculated Risk on 7/12/2009 09:42:00 AM

The confessional is still open ...

From The Times: Lloyds braced for £13bn writeoff (about $21 billon)

LLOYDS BANKING GROUP is poised to write off as much as £13 billion on its loans to commercial property, businesses and mortgage holders ...Remember when a multi-billion dollar writeoff was shocking?

First-half results due to be posted in three weeks will show that its losses are accelerating ...

UBS analysts expect Lloyds to announce a bottom line half-year loss of £6.3 billion as a result of the soaring provisions.

Saturday, July 11, 2009

Wells Fargo Sues Wells Fargo, Wells Fargo Denies Allegations

by Calculated Risk on 7/11/2009 10:52:00 PM

For a little Saturday night amusement ...

From FoxBusiness: Wells Fargo Bank Sues Itself (ht Rama)

... I could not resist asking Wells Fargo Bank NA why it filed a civil complaint against itself in a mortgage foreclosure case in Hillsborough County, Fla.Your TARP money hard at work ...

...

In this particular case, Wells Fargo holds the first and second mortgages on a condominium, according to Sarasota, Fla., attorney Dan McKillop, who represents the condo owner.

As holder of the first, Wells Fargo is suing all other lien holders, including the holder of the second, which is itself.

... court documents clearly label "Wells Fargo Bank NA" as the plaintiff and "Wells Fargo Bank NA" as a defendant.

Wells Fargo hired Florida Default Law Group., P.L., of Tampa, Fla., to file the lawsuit against itself.

And then Wells Fargo hired another Tampa law firm -- Kass, Shuler, Solomon, Spector, Foyle & Singer P.A. -- to defend itself against its own lawsuit, according to court documents.

Wells Fargo's defense lawyers even filed an answer to their client's own complaint.

"Defendant admits that it is the owner and holder of a mortgage encumbering the subject real property," the answer reads. "All other allegations of the complaint are denied."

Researchers: "Few Preventable Foreclosures"

by Calculated Risk on 7/11/2009 07:24:00 PM

From Manuel Adelino, Kristopher Gerardi, and Paul S. Willen writing at the Boston Fed: Why Don’t Lenders Renegotiate More Home Mortgages? Redefaults, Self-Cures, and Securitization

(ht Holden Lewis, Mortgage Matters at Bankrate.com)

One of the key questions these researchers ask is: Why don't lenders renegotiate1 with delinquent borrowers more often?

If a lender makes a concession to a borrower by, for example, reducing the principal balance on the loan, it can prevent a foreclosure. This is clearly a good outcome for the borrower, and possibly good for society as well. But the key to the appeal of renegotiation is the belief that it can also benefit the lender, as the lender loses money only if the reduction in the value of the loan exceeds the loss the lender would sustain in a foreclosure.Just last week, Gretchen Morgenson at the NY Times made this argument: So Many Foreclosures, So Little Logic

all emphasis added

[T]he most fascinating, and frightening, figures in the [subprime loan] data detail how much money is lost when foreclosed homes are sold. In June, the data show almost 32,000 liquidation sales; the average loss on those was 64.7 percent of the original loan balance.And the Fed economists respond:

Here are the numbers: the average loan balance began at almost $223,000. But in the liquidation sale, the property sold for $144,000 less, on average. ...

Given losses like these, [Alan M. White, an assistant professor at the Valparaiso University law school in Indiana] said he was perplexed that lenders and their representatives were resisting reducing principal when they modify loans. His data shows how rare it is for lenders to reduce principal. In June, for example, 3,135 loans — just 17.2 percent of the total modified — involved write-downs of principal, interest or fees. The total loss from these write-downs was just $45 million in June.

And yet, the losses incurred in foreclosure sales involving loans in the securitization trusts were a staggering $4.59 billion in June. “There is 100 times as much money lost in foreclosure sales as there was in writing down balances in modifications,” Mr. White said. “That is not rational economic behavior.”

If banks have written down the value of these loans to the 40 cents on the dollar that they are fetching on foreclosures — the only true value for these homes right now — then why don’t they bite the bullet and reduce the loan amount outstanding for the troubled borrowers?

We argue for a very mundane explanation: lenders expect to recover more from foreclosure than from a modified loan. This may seem surprising, given the large losses lenders typically incur in foreclosure, which include both the difference between the value of the loan and the collateral, and the substantial legal expenses associated with the conveyance. The problem is that renegotiation exposes lenders to two types of risks that can dramatically increase its cost. The first is what we will call “self-cure” risk. As we mentioned above, more than 30 percent of seriously delinquent borrowers “cure” without receiving a modification; if taken at face value, this means that, in expectation, 30 percent of the money spent on a given modification is wasted. The second cost comes from borrowers who redefault [30 and 45 percent]; our results show that a large fraction of borrowers who receive modifications end up back in serious delinquency within six months. For them, the lender has simply postponed foreclosure; in a world with rapidly falling house prices, the lender will now recover even less in foreclosure. In addition, a borrower who faces a high likelihood of eventually losing the home will do little or nothing to maintain the house or may even contribute to its deterioration, again reducing the expected recovery by the lender.I'd argue for a third reason: If it became widely known that lenders routinely reduce the principal balance for delinquent borrowers with negative equity, this would be an incentive for a large number of additional homeowners to stop paying their mortgages.

These economists would argue that the lenders are behaving rationally and that foreclosure - when all costs are considered - is frequently the least costly alternative.

1 The economists define “renegotiation” as "concessionary modifications that serve to reduce a borrower’s monthly payment. These may be reductions in the principal balance or interest rate, extensions of the term, or combinations of all three." Under this definition, they do not include the most common modification: capitalization of late payments and fees.

Unemployment and GDP

by Calculated Risk on 7/11/2009 05:50:00 PM

The WSJ Real Time Economics blog mentioned Okun's law yesterday (a relationship between changes in GDP and unemployment): Job Losses Outpace GDP Decline (ht Bob_in_MA)

In a research note, [Alliance Bernstein economist Joseph] Carson says job losses in prior downturns have been roughly proportional to the decline in gross domestic product. But in the current recession, the proportion of jobs lost is running about a third greater than the drop in real GDP.

The correlation between GDP growth and unemployment is called Okun’s Law, after the late economist Arthur Okun who documented it in the 1960s. But the numerical relationship that Okun estimated – and other economists have since refined – has broken down. His original estimate suggested about a 3% decline in GDP for every 1% increase in unemployment. Before joining the Fed, Ben Bernanke, working with Andrew Abel, figured more recent suggested about a 2% decrease in output for every 1% increase in unemployment.

Click on graph for larger image.

Click on graph for larger image.This graph shows the quarterly change in real GDP (annualized) vs. the change in unemployment rate. The red markers are for 2008 and Q1 2009.

Usually the trend line is drawn as linear, but I made it a 2nd order polynomial here.

The red markers are above the trend line, but within the normal scatter.

For Q2 the unemployment rate increased 1.2% (from Q1, quarterly average), and the annualized real GDP change will probably be in the -1% to -2% range - so that is also above the trend (a larger than expected change in unemployment based on the change in real GDP).

Okun's law is just a general relationship, and the relationship appears to have changed over time (as mentioned in the WSJ).

Note: the graph shows the quarterly change in real GDP annualized (the way it is reported by the BEA each quarter). In the WSJ post, they mentioned "a 2% [or 3%] decrease in output for every 1% increase in unemployment". A 2% decrease in quarterly output would be reported by the BEA as over 8% annualized for the quarter.

California IOU Update

by Calculated Risk on 7/11/2009 01:41:00 PM

From the SF Gate: State leaders talking again - budget woes go on

California's fiscal crisis continued unabated Friday with most major banks refusing to cash the state's IOUs starting today, the state controller delaying $4 billion in payments to public schools ...And Felix Salmon has a nice chart on who gets paid cash, and who gets IOUs: California: The haves and have-nots

State Controller John Chiang and state Superintendent of Instruction Jack O'Connell said $4 billion in payments to local school districts that were supposed to go out on Friday will be delayed until July 30. The move will conserve cash for the state, which has been issuing IOUs since July 2. ...

As of Friday morning, the state controller had mailed 101,930 IOUs covering more than $389 million in payments, said Hallye Jordan, a spokeswoman for Chiang.

And despite a plea from state Treasurer Bill Lockyer that banks extend their Friday deadline to accept the IOUs, most refused to do so.

Citibank agreed to a one-week extension, while Bank of the West said it will accept IOUs until further notice. The banks that rejected extension requests include Bank of America, Wells Fargo, JPMorgan Chase and Union Bank ...

And from Controller John Chiang yesterday: Controller Releases Year-End Cash Figures

“California continues to pay for its history of unbalanced budgets. The State spent $10.4 billion more than it collected last year alone, and is now without enough cash to cover all of its payment obligations,” said Chiang.Many other states have serious budget problems too.

“Our major sources of revenue have continued their trend downward, leaving no viable option but to craft a new budget that recognizes California’s recovery has yet to begin.”

Personal income taxes in June were $987 million below (-18.0%) estimates in the May Revision, and sales taxes were short by $154 million (-5.8%). Corporate taxes were $1.31 billion above estimates (41.2%). Corporate taxes in May and June were boosted by a surge of payments from corporate taxpayers hoping to avoid a new State penalty.

The State started the fiscal year with a $1.45 billion cash deficit, which grew to $11.9 billion on June 30, 2009. Borrowed money from special funds provided enough cash to fund State operations through June 30. The Controller faced a large cash shortfall at the end of July, forcing his office to begin issuing registered warrants or “IOUs” to any General Fund payment that was not protected by the State Constitution, federal law, or court decision. Without IOUs, the State would have run out of cash and begun missing those protected payments at the end of July.

While updated cash projections show that IOUs will preserve enough cash to make those protected payments through September, the cash shortfall in October will endanger the State’s ability to make those payments.

Roubini and Shiller on U.S. Economy

by Calculated Risk on 7/11/2009 09:03:00 AM

A little Saturday morning video ... offered without comment.

Bloomberg - Roubini Says U.S. Recession Will Last Six More Months (Click here for full video)

00:00 Outlook for the U.S. economy, recession

07:07 Reasons for current economic condition

11:50 Unemployment rate; fiscal consolidation

18:29 Case-Shiller Index; green shoots in housing

30:05 Second stimulus package; consumer spending

34:43 Roubini, Shiller respond to questions.

Here is a short preview ...

CIT Hires Bankruptcy Adviser

by Calculated Risk on 7/11/2009 01:09:00 AM

CIT Group (no relation to Citigroup) is like GE Capital. They provide financing for almost 1 million businesses and had about 76 billion in assets as of March 31st.

From the WSJ: Major Lender Faces Crunch

CIT Group Inc ... is preparing for a possible bankruptcy filing ... CIT has retained the law firm of Skadden, Arps, Slate, Meagher & Flom LLP, ...Apparently the government thinks CIT's competitors could pick up most or all of their business.

...

CIT has a $1 billion payment due in mid-August and it is unclear the company "will be able to handle that," said this person. The company will give more guidance when it discusses second quarter earnings in two weeks.

...

A bankruptcy filing by CIT could affect thousands of small borrowers, from Dunkin' Donuts franchisees to restaurant owners and clothing retailers.

... the government has made it clear it doesn't see the company as a systemic risk to the financial system. The people familiar with the matter said the government feels that other lenders, such as J.P. Morgan Chase & Co. or Deutsche Bank AG, can handle many of the same loans that CIT specializes in, such as loans to small retailers or rail-car leasing firms.

Meanwhile, competitors like GE Capital Corp. and GMAC LLC have been able to sell debt with the backing of the government's top credit rating.

Friday, July 10, 2009

Sacramento: 70 Percent Distressed Sales in June

by Calculated Risk on 7/10/2009 10:12:00 PM

Just using Sacramento as an example ... I wish the NAR broke out the data like this! Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (normal resales), and distressed sales (Short sales and REO sales). Here is the June data.

They started breaking out REO sales last year, but this is the first monthly report with short sales.

Just over 70% of all resales (single family homes and condos) were distressed sales.

Total sales in June were off 7% compared to June 2008, and that breaks a string of YoY increases.

This is just a reminder - with 70% distressed sales, there will be few move-up buyers for the higher priced areas.