by Calculated Risk on 7/16/2009 12:24:00 AM

Thursday, July 16, 2009

BofA: Double Secret Probation

From the WSJ: U.S. Regulators to BofA: Obey or Else

Bank of America Corp. is operating under a secret regulatory sanction ... the so-called memorandum of understanding gives banks a chance to work out their problems ...

Citigroup Inc. has been operating since last year under a similar order with the Office of the Comptroller of the Currency...

In a letter that was reviewed by The Wall Street Journal, the Fed criticized Bank of America's management and directors for being "overly optimistic" about risk and capital. The bank's capital position "was vulnerable" even before the Merrill deal, the Fed concluded, citing "acquisition activity" that included last year's takeover of mortgage lender Countrywide Financial Corp.

Wednesday, July 15, 2009

Report: California Close to Budget Deal

by Calculated Risk on 7/15/2009 08:39:00 PM

From the LA Times: California Approaches a Deal on Budget Cuts (ht Rob Dawg)

California lawmakers neared a deal Wednesday with Gov. Arnold Schwarzenegger to close the state’s $26 billion budget gap ...The furloughs continue, and this will lead to more layoffs especially at the local level.

Details emerging from the talks suggested that the deal will require extraordinarily deep cuts to school systems and local governments, and ... substantial cuts to health care and other social services.

...

The state’s education budget of nearly $52 billion seemed destined for another large hit — likely $1.5 billion — on top of substantial reductions earlier this year, officials said. ... Public colleges and universities across the state have already prepared for millions of dollars in cutbacks by furloughing employees. Statewide furloughs of three days a month for government employees are likely to continue through the rest of the fiscal year.

CIT: Government Support Unlikely

by Calculated Risk on 7/15/2009 06:09:00 PM

Update 2: WSJ is reporting that a Treasury official says that the U.S. expects to lose entire TARP investment in CIT ($2.3 billion). I think that means a BK is certain, probably before the market opens tomorrow.

From MarketWatch:

CIT says government support unlikely near term

CIT says board, management evaluating alternatives

CIT: Appears no likelihood of add't gov't support

CIT: Talks with government agencies have ceased

Bankruptcy is probable.

Update: CIT Press Release:

CIT Group Inc., a leading provider of financing to small businesses and middle market companies, today announced that it has been advised that there is no appreciable likelihood of additional government support being provided over the near term.

The Company’s Board of Directors and management, in consultation with its advisors, are evaluating alternatives.

DataQuick: SoCal Homes Sales Up

by Calculated Risk on 7/15/2009 05:08:00 PM

Note: Ignore the median home price during periods of rapidly changing mix.

From DataQuick: Southland home sales highest since late ’06; median price up again

Southern California home sales rose in June to the highest level in 30 months as the number of deals above $500,000 continued to climb. ...

A total of 23,262 new and resale houses and condos closed escrow in San Diego, Orange, Los Angeles, Ventura, Riverside and San Bernardino counties last month. That was up 12.0 percent from 20,775 in May and up 29.0 percent from a revised 18,032 a year ago, according to San Diego-based MDA DataQuick.

Sales have increased year-over-year for 12 consecutive months.

June’s sales were the highest for that month since 2006, when 31,602 homes sold, but were 17.7 percent below the average June sales total since 1988, when DataQuick’s statistics begin. June sales peaked at 40,156 in 2005 and hit a low last year.

Foreclosures remained a major force in June, but their impact on the resale market eased for the third consecutive month.

Foreclosure resales – homes sold in June that had been foreclosed on in the prior 12 months – represented 45.3 percent of Southland resales last month, down from 49.7 percent in May and down from a peak 56.7 percent in February this year. Last month’s level was the lowest since foreclosure resales were 43.7 percent of resales in July 2008.

...

The recent shift toward higher-cost markets contributing more to overall sales has put upward pressure on the region’s median sale price – the point where half of the homes sold for more and half for less. The median dived sharply over the past year not just because of price depreciation but because of a shift toward an unusually large share of sales occurring in lower-cost, foreclosure-heavy areas.

...

“The rising median should still be viewed mainly as a sign the market’s moving back toward a more normal distribution of sales across the home price spectrum.” ... said John Walsh, DataQuick president.

...

Foreclosure activity remains near record levels ... Financing with multiple mortgages is low, down payment sizes and flipping rates are stable, and non-owner occupied buying is above-average in some markets, MDA DataQuick reported.

Stock Market Update

by Calculated Risk on 7/15/2009 04:00:00 PM

By popular demand ... the S&P 500 was up almost 3% today. The NASDAQ was up 3.5%. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up almost 38% from the bottom (256 points), and still off 40% from the peak (632 points below the max). The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Trading Halted on CIT

by Calculated Risk on 7/15/2009 03:44:00 PM

From CNBC: CIT Shares Halted as Decision On US Aid for Lender Nears

Shares of CIT Group were halted late Wednesday as financial regulators neared a decision on aiding the troubled lender, CNBC has learned.

A resolution of the CIT situation is expected within the next 24 hours, sources said.

Show me the Engines of Growth

by Calculated Risk on 7/15/2009 02:33:00 PM

Back in February I pointed out that I expected to see some economic rays of sunshine this year. But I never expected an immaculate recovery forecast from the FOMC.

Although I've argued repeatedly that a "Great Depression 2" was extremely unlikely, I think the other extreme - an immaculate recovery - is also unlikely.

It is probably a good time to review the usual engines of a recovery. (see Business Cycle: Temporal Order for the order in and out of a recession)

The following table shows a simplified typical temporal order for emerging from a recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

Housing usually leads the economy both into and out of recessions (this was true for the Great Depression too). However this time, with the huge overhang of excess inventory and high levels of distressed sales, it seems unlikely that residential investment will pick up significantly any time soon.

Note: Residential investment is mostly new home construction and home improvements.

And that leaves Personal Consumption Expenditures (PCE), and as households increase their savings rate to repair their balance sheets and work down their debt, it seems unlikely that PCE will increase significantly any time soon. Maybe there will be a pickup in auto sales from the current depressed levels, but in general a strong increase in PCE seems unlikely. So even if the economy bottoms in the 2nd half of 2009, any recovery will probably be very sluggish.

Most companies are not investing in new equipment and software - other than the normal equipment replacement purchases - because they already have too much capacity. They will not need to expand until their sales pick up significantly. So it seems unlikely that investment in equipment and software would boom until consumer spending has increased. Of course increased U.S. exports would help - but export to whom? China, and a few others ... but most of the world is also hurting.

I still think the keys are Residential Investment (RI) and PCE, and therefore I think the recovery will be sluggish. The increasingly severe slump in CRE and non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

FOMC Minutes: Immaculate Recovery

by Calculated Risk on 7/15/2009 02:03:00 PM

Here are the June FOMC minutes. Economic outlook:

In the forecast prepared for the June meeting, the staff revised upward its outlook for economic activity during the remainder of 2009 and for 2010. Consumer spending appeared to have stabilized since the start of the year, sales and starts of new homes were flattening out, and the recent declines in capital spending did not look as severe as those that had occurred around the turn of the year. Recent declines in payroll employment and industrial production, while still sizable, were smaller than those registered earlier in 2009. Household wealth was higher, corporate bond rates had fallen, the value of the dollar was lower, the outlook for foreign activity was better, and financial stress appeared to have eased somewhat more than had been anticipated in the staff forecast prepared for the prior FOMC meeting. The projected boost to aggregate demand from these factors more than offset the negative effects of higher oil prices and mortgage rates. The staff projected that real GDP would decline at a substantially slower rate in the second quarter than it had in the first quarter and then increase in the second half of 2009, though less rapidly than potential output. The staff also revised up its projection for the increase in real GDP in 2010, to a pace above the growth rate of potential GDP. As a consequence, the staff projected that the unemployment rate would rise further in 2009 but would edge down in 2010. Meanwhile, the staff forecast for inflation was marked up. Recent readings on core consumer prices had come in a bit higher than expected; in addition, the rise in energy prices, less-favorable import prices, and the absence of any downward movement in inflation expectations led the staff to raise its medium-term inflation outlook. Nonetheless, the low level of resource utilization was projected to result in an appreciable deceleration in core consumer prices through 2010.The Fed sees an immaculate recovery. That seems unlikely to me.

Looking ahead to 2011 and 2012, the staff anticipated that financial markets and institutions would continue to recuperate, monetary policy would remain stimulative, fiscal stimulus would be fading, and inflation expectations would be relatively well anchored. Under such conditions, the staff projected that real GDP would expand at a rate well above that of its potential, that the unemployment rate would decline significantly, and that overall and core personal consumption expenditures inflation would stay low.

emphasis added

Is the Recession Over?

by Calculated Risk on 7/15/2009 11:34:00 AM

Last night Merrill Lynch declared the recession over.

From Tom Petruno at the LA Times: 'Recession is over,' BofA Merrill Lynch tells investors

And from CNBC:

It is usually difficult to tell when a recession has ended - especially for a jobless recovery.

It took the National Bureau of Economic Research (NBER) Business Cycle Dating Committee over a year and half after the 2001 recession ended to call the trough of the cycle. And it took 21 months after the 1990-1991 recession ended for NBER to date the end of the recession.

From the 2003 announcement of the end of the 2001 recession:

The committee waited to make the determination of the trough date until it was confident that any future downturn in the economy would be considered a new recession and not a continuation of the recession that began in March 2001.The economy was still struggling in 2003 - especially employment - but the NBER committee members felt that any subsequent downturn would be considered a separate recession:

The committee noted that the most recent data indicate that the broadest measure of economic activity-gross domestic product in constant dollars-has risen 4.0 percent from its low in the third quarter of 2001, and is 3.3 percent above its pre-recession peak in the fourth quarter of 2000. Two other indicators of economic activity that play an important role in the committee's decisions-personal income excluding transfer payments and the volume of sales of the manufacturing and wholesale-retail sectors, both in real terms-have also surpassed their pre-recession peaks. Two other indicators the committee focuses on-payroll employment and industrial production-remain well below their pre-recession peaks. Indeed, the most recent data indicate that employment has not begun to recover at all. The committee determined, however, that the fact that the broadest, most comprehensive measure of economic activity is well above its pre-recession levels implied that any subsequent downturn in the economy would be a separate recession.This is relevant to today. It is very likely that any recovery will be very sluggish, and if the economy turns down within the next 6 to 12 months, the NBER would probably consider that a continuation of the Great Recession.

Here is the NBER dating procedure.

Note that the trough of the 1980 recession was only 12 months before the beginning of the 1981 recession, but the short recovery was fairly robust with real GDP up 4.4%. Those two recessions are frequently called a "double dip" recession, but the NBER considers them as two separate recessions.

I think the "official" recession will probably end sometime in the 2nd half of 2009, but the recovery will be very sluggish and there is a risk of a double dip recession. Roubini argues that the recession will end sometime in early 2010. Maybe. But I also think it will feel like a recession for some time, since the unemployment rate will probably rise through most of 2010, and stay elevated for a long period (a jobless recovery).

Industrial Production Declines, Capacity Utilization at Record Low in June

by Calculated Risk on 7/15/2009 09:15:00 AM

The Federal Reserve reported:

Industrial production decreased 0.4 percent in June after having fallen 1.2 percent in May. For the second quarter as a whole, output fell at an annual rate of 11.6 percent, a more moderate contraction than in the first quarter, when output fell 19.1 percent. Manufacturing output moved down 0.6 percent in June, with declines at both durable and nondurable goods producers. ... The rate of capacity utilization for total industry declined in June to 68.0 percent, a level 12.9 percentage points below its average for 1972-2008. Prior to the current recession, the low over the history of this series, which begins in 1967, was 70.9 percent in December 1982.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is at another record low (the series starts in 1967).

In addition to the weakness in industrial production, there is little reason for investment in new production facilities until capacity utilization recovers.

CPI up 0.7%; Core CPI up 0.2%

by Calculated Risk on 7/15/2009 08:31:00 AM

From the Census Bureau:

On a seasonally adjusted basis, the CPI-U increased 0.7 percent in June after rising 0.1 percent in May. The acceleration was largely caused by the gasoline index, which rose 17.3 percent in June and accounted for over 80 percent of the increase in the all items index.CPI is now off 1.2% year-over-year (YoY) - the largest YoY decline since the 1950s, but core CPI is up 1.7%.

...

The index for all items less food and energy rose 0.2 percent in June following a 0.1 percent increase in May.

...

The index for shelter rose 0.1 percent for the second straight month, as did the indexes of two of its major components, rent and owners' equivalent rent.

Meanwhile owners' equivalent rent (OER) is up 1.9% year-over-year, although only up 0.1% in June. I expect OER to decline soon.

MBA: Refinance Applications Increase as Mortgage Rates Decline

by Calculated Risk on 7/15/2009 08:11:00 AM

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, was 514.4, an increase of 4.3 percent on a seasonally adjusted basis from 493.1 one week earlier.

...

The Refinance Index increased 17.7 percent to 2009.4 from 1707.7 the previous week and the seasonally adjusted Purchase Index decreased 9.4 percent to 258.8 from 285.6 one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.05 percent from 5.34 percent ...

emphasis added

Click on graph for larger image in new window.

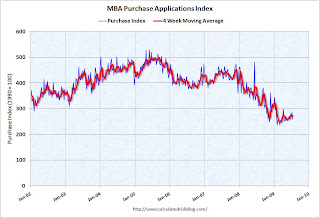

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

The Purchase index is somewhat above the recent lows, but the big story is the Refinance index - refinance activity is up sharply as mortgage rates declined.

Futures and Elizabeth Warren on Consumer Financial Protection

by Calculated Risk on 7/15/2009 12:41:00 AM

Futures are up tonight ...

Futures from barchart.com

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

And the Asian markets are up about 1%.

And Elizabeth Warren, Chair of the Congressional Oversight Panel for TARP.

Note: My personal view is that in a financially literate world, almost all borrowers would pay off their credit card balances monthly (there are exceptions).

Best to all.

Tuesday, July 14, 2009

Report: CIT Aid Package "working on details"

by Calculated Risk on 7/14/2009 08:32:00 PM

UPDATE: From the WSJ: CIT, Regulators Negotiate Details of Multipart Aid Package

CIT Group Inc. and federal regulators are working out details of an aid package ...The deal is not done and the FDIC can't be happy with a high level of brokered deposits. Another BFF candidate.

Under the plan regulators would allow CIT to transfer assets from its holding company to its bank in Utah; the Federal Reserve would let CIT pledge some of those assets at its discount window and the company would take steps to refinance some of its existing debt. ...

One likely concern for regulators is how CIT can fund a steep rise in assets at its Utah bank. Part of the company's strategy is to aggressively seek out deposits through brokers ...

CRE: Higher Vacancy Rates, Lower Rents in San Diego, Orange County and Las Vegas

by Calculated Risk on 7/14/2009 07:58:00 PM

Voit released quarterly reports today for CRE in Las Vegas, San Diego and Orange County.

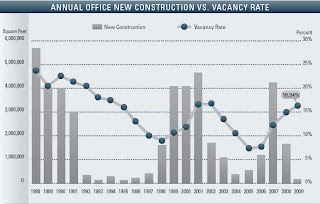

The reports show the vacancy rates are up and lease rates falling. It also shows new construction has slowed sharply. Here are a couple of graphs for Orange County and San Diego. We are seeing a similar pattern nationwide, although new construction in these areas probably slowed earlier than most of the country.

Click on graph for larger image in new window.

This graph shows the annual Orange County office vacancy rate and new construction since 1988. See Voit report for more.

In 2007 the rapid increase in the vacancy rate was due to a huge increase in new space combined with negative absorption as a number of Orange County financial companies (like New Century) went under. New construction has almost stopped, but the net absorption rate is still negative, so the vacancy rate is still rising.

Because of the concentration of subprime lenders in Orange County, the office space market was hit earlier than other areas of the country.

From the Voit report:

Net absorption for the county posted a negative 672,880 square feet for the second quarter of 2009, giving the office market a total of 1.5 million square feet of negative absorption for the year.The record year for new development in Orange County was 1988, when 5.7 million square feet of new space was added. The vacancy rate peaked at approximately 24% in 1988 (the S&L crisis related office boom).

...

During the first half of 2009, Orange County has added a total of 171,863 square feet. Over the past three and a half years, over seven million square feet of new construction has been completed in Orange County. ... Total space under construction checked in at 166,059 square feet at the end of the second quarter, which is almost half the amount that was under construction this same time last year.

The second graph is for San Diego. The dynamics are similar, but construction halted later than in Orange County. From Voit:

The second graph is for San Diego. The dynamics are similar, but construction halted later than in Orange County. From Voit: During the first half of 2009, San Diego County has added a total of 600,000 square feet. Over the past three and a half years, over 9.2 million square feet of new construction has been completed in San Diego County. ... Total space under construction checked in at 956,711 square feet at the end of the second quarter, which is less than half the amount that was under construction this same time last year ...Although Voit didn't provide a similar graph for Las Vegas, the situation is clearly worse:

At the close of the second quarter, approximately 10.9 million square feet of vacant office product remained on the market, producing an average vacancy rate of 22.1 percent. When excluding owner-user buildings, the vacancy rate jumps to 24.2 percent for speculative space. Vacancy rates are up from the 19.6 percent posted three months prior, while the comparison to the 16.9 percent vacancy rate from the second quarter of 2008 is even more dramatic.New office construction has almost stopped in these markets.

...

Some areas are expected to reach 30-percent vacancy rates ...

The market reported 1.4 million square feet of space that remained in some form of construction. It is worth noting that approximately 0.4 million square feet is located in projects that have stalled or delayed activity.

emphasis added

Manhattan Office Vacancy Rate Increases, Effective Rents off 44%

by Calculated Risk on 7/14/2009 05:06:00 PM

From Reuters: Manhattan office vacancies spike to 4-1/2 yr high (ht Brian)

The overall vacancy rate -- which includes space that will become available over the next six months -- rose 0.9 percentage point from the first quarter to 10.5 percent, the highest rate since the fourth quarter 2004, when it touched 11 percent. ...Sharply lower rents, reduced leverage and much higher cap rates - Brian calls this the "neutron bomb for RE equity"; destroys CRE investors, but leaves the buildings still standing.

Asking rent in the second quarter fell to $60.23 per square foot, down 15.9 percent from a year ago, Cushman said.

Factoring in months of free rent and work space improvements, effective rent in Manhattan already is off 44 percent from the peak in the first quarter 2008.

As Foreclosure Activity Surges, Obama Considers Rental Option

by Calculated Risk on 7/14/2009 03:38:00 PM

From Reuters: Obama mulls rental option for some homeowners-sources

Under one idea being discussed, delinquent homeowners would surrender ownership of their homes but would continue to live in the property for several years ... Officials are also considering whether the government should make mortgage payments on behalf of borrowers who cannot keep up with their home loansAnd another surge in foreclosure activity is reported today by ForeclosureRadar:

For the third consecutive month, foreclosure sales jumped significantly as lenders come off the moratorium. Foreclosure sales increased by 24.7 percent following a 31.9 percent increase in May, and a 35 percent April increase. Notices of Trustee Sale dropped by an unexpected 28.7 percent, with the timing of the drop indicating that it was in response to the California Foreclosure Prevention Act. This law was widely believed to have little or no impact on foreclosure filings, as it exempted the majority of large lenders that operate in the state.

...

After a 4.2 percent drop the prior month, Notices of Default, the initial step in the foreclosure process, rose by 11.8 percent to the second highest level on record at 45,691 filings. Year-overyear filings increased by 10.0 percent from June of 2008.

...

A total of 22,291 foreclosures were taken to sale at auction, representing loan value of $9.57 Billion dollars; a 24.7 percent increase from the prior month, though 8.2 percent lower than the prior year. The opening bids set by lenders were an average 39.3 percent lower than the loan balance, with 46.0 percent of sales discounted by 50.0 percent or more.

...

A new statistic we are watching closely is the number of properties actively scheduled for sale – meaning that a Notice of Trustee Sale has been filed to set the auction date and time, but the foreclosure has not yet been sold or cancelled. Under California’s foreclosure code, a foreclosure sale can be postponed repeatedly for one year before a new Notice of Trustee Sale has to be filed. While postponements are quite common, they have reached record levels in recent months, swelling the number of scheduled foreclosures 90.1 percent year-over-year to 113,141.

emphasis added

S&P Cuts Ratings on CMBS

by Calculated Risk on 7/14/2009 02:34:00 PM

Here come some Commercial Mortgage Backed Security (CMBS) rating cuts ...

UPDATE: From Dow Jones: Commercial Mtge-Backed Securities Index Hit By S&P Downgrades-Source

From S&P: S&P Lowers 23 Credit Suisse Comm Mortgage 2007-C3 Rtgs; 3 Afmd

NEW YORK (Standard & Poor's) July 14, 2009--Standard & Poor's Ratings Services today lowered its ratings on 23 classes of commercial mortgage-backed securities (CMBS) from Credit Suisse Commercial Mortgage Trust Series 2007-C3 and removed them from CreditWatch with negative implications...Here is an example: GSMS 2007-GG10 A4's (super senior with 30% credit support) were taken from AAA to BBB-. That is a significant cut, and below the street expectations.

The lowered ratings follow our analysis of the transaction using our recently released U.S. conduit and fusion CMBS criteria, which was the primary driver of the rating actions....

This is the beginning of the rating cuts associated with the S&P June 4th release of The Potential Rating Impact Of Proposed Methodology Changes On U.S. CMBS

Obama: Unemployment Rate will "tick up for several months"

by Calculated Risk on 7/14/2009 12:50:00 PM

From the WSJ: Obama Says Jobless Rate Likely to Tick Up for Several Months

"[How employment numbers are going to respond is not yet clear.]* My expectation is that we will probably continue to see unemployment tick up for several months," Mr. Obama told reporters ...*Added quote from AP.

Mr. Obama, who has said he believes joblessness will soon hit 10%, will visit Michigan later Tuesday, a state already dealing with double-digit unemployment.

While he said he doesn't have a "crystal ball," Mr. Obama said he anticipates unemployment will follow historical trends and lag "for some time" even after an economic recovery begins.

On the positive side, he said the U.S. has "seen some stabilization in the financial markets, and that's good because that means companies can borrow and banks are starting to lend again."

This is probably way too optimistic. Professor Roubini wrote today:

In the U.S., the unemployment rate, currently at 9.5%, is poised to rise above 10% by the fall. It should peak at 11% some time in 2010 and remain well above 10% for a long time.Although no one has a crystal ball, it does appear the unemployment rate will rise well into 2010 - and then stay elevated for some time as the U.S. suffers with another jobless recovery.

...

But these raw figures on job losses, bad as they are, actually understate the weakness in world labor markets. If you include partially employed workers and discouraged workers who left the U.S. labor force, for example, the unemployment rate is already 16.5%; even temporary employment is sharply down.

...

Moreover, many employers, seeking to “share the pain” of the recession and slow down the rate of layoffs, are now asking workers to accept cuts in both hours and hourly wages. Thus, the total effect of the recession on labor income of jobs, hours and wage reductions is much larger.

More Inventory Correction

by Calculated Risk on 7/14/2009 10:10:00 AM

The Manufacturing and Trade Inventories and Sales report from the Census Bureau today showed more evidence of declining inventories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Census Bureau reported:

Manufacturers' and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,368.1 billion, down 1.0 percent (±0.1%) from April 2009 and down 8.0 percent (±0.4%) from May 2008.The above graph shows the 3 month change (annualized) in manufacturers’ and trade inventories. The inventory correction was slow to start in this recession, but inventories are now declining sharply.

However, even with the sharp decline in inventories, the inventory to sales ratio has only declined to 1.42 in May - since sales have fallen sharply too.

However, even with the sharp decline in inventories, the inventory to sales ratio has only declined to 1.42 in May - since sales have fallen sharply too.There has been a race between declining sales and declining inventory. Even as sales start to stabilize (appears to be happening), inventory levels are still too high compared to the lower sales levels, and further inventory reductions are probably coming.