by Calculated Risk on 7/22/2009 10:24:00 AM

Wednesday, July 22, 2009

Herald Tribune: Flipping Fraud Ignored

From the Herald Tribune series on mortgage fraud in Florida: Flipping fraud ignored by police and prosecutors

In November 2005, when the real estate market in Florida had just begun to slow, the state’s top law enforcement agency issued a warning that mortgage fraud was about to wreak financial havoc.Here are the first three in the series:

In sober language, a 36-page Florida Department of Law Enforcement report explained that banks would collapse and losses would be counted in “hundreds of billions of dollars.”

...

The report, which was not released to the public but was sent to prosecutors and law enforcement officials across the state, laid out a series of responses to help prevent or lessen the disaster.

But instead of heeding the warning, most law enforcement officials ... did nothing.

Even the most basic recommendation in the FDLE assessment — posting a notice at the county courthouse warning that mortgage fraud is a criminal offense — was ignored in Sarasota County.

Today ... the scope of fraud has overwhelmed state and federal law enforcement agencies to the point that only the most egregious cases are likely to be prosecuted.

In addition to the FBI’s 2,500 cases, state agencies, including the Attorney General and FDLE, have pursued a few hundred more dating back to 2000.

But the amount of fraud dwarfs the number of cases being pursued, the Herald-Tribune found. The Herald-Tribune analyzed nearly 19 million property transactions looking for one type of housing fraud — illegal property flipping. The newspaper found more than 50,000 transactions in which prices increased so much, so quickly, that fraud experts interviewed by the newspaper deemed them highly suspicious.

'Flip that house' fraud cost billions

Flippers' toll: On Gulf Coast, half a billion in defaults

The king of the Sarasota flip

Note: And from Tanta in 2007 (my former co-blogger): Unwinding the Fraud for Bubbles

MBA: Mortgage Rates Increased Last Week

by Calculated Risk on 7/22/2009 08:37:00 AM

The MBA reports:

he Market Composite Index, a measure of mortgage loan application volume, was 528.9, an increase of 2.8 percent on a seasonally adjusted basis from 514.4 one week earlier.

...

The Refinance Index increased 4.0 percent to 2089.7 from 2009.4 the previous week and the seasonally adjusted Purchase Index increased 1.3 percent to 262.1 from 258.8 one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.31 percent from 5.05 percent ...

emphasis added

Click on graph for larger image in new window.

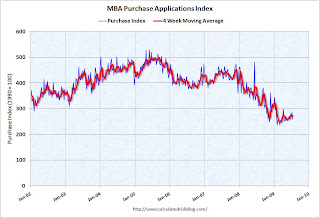

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

Mortgage rates increased last week, but will decline again with the Ten Year yield falling this week.

AIA: Architecture Billings Index Declines in June

by Calculated Risk on 7/22/2009 01:44:00 AM

From Reuters: U.S. architecture billings index down in June - AIA

... The Architecture Billings Index fell more than 5 points last month to a reading of 37.7, after a slight increase in the prior month, according to the American Institute of Architects.

The index has remained below 50, indicating contraction in demand for design services, since January 2008. ...

"It appears as though we may have not yet reached the bottom of this construction downturn," AIA Chief Economist Kermit Baker said. "Architecture firms are struggling and concerned that construction market conditions will not even improve ... next year."

...

Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions. The AIA's Billings Index, which began in 1995, is considered a measure of construction spending nine to 12 months in the future.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index is still below 50 indicating falling demand.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). This suggests further dramatic declines in CRE investment later this year and next.

Earlier this month, the AIA lowered their forecast for commercial construction, from Bloomberg: U.S. Commercial Construction to Drop 16% This Year, Report Says

Construction spending on offices, retail centers and hotels is likely to fall 16 percent this year and 12 percent in 2010, more than previously forecast, the American Institute of Architects said.

...

Hotel construction is likely to decline 26 percent this year and 17 percent in 2010, the institute said. Industrial spending is forecast to dip 0.8 percent this year and 28 percent in 2010, according to the report.

CRE Developer: "We’re dumbfounded"

by Calculated Risk on 7/22/2009 12:41:00 AM

“We’re dumbfounded. We’ve been working on this deal for four-and-a-half years. I don’t know how, all of a sudden, the numbers don’t work.”From the Minneapolis / St. Paul Business Journal: SuperTarget planned for Woodbury now on hold (ht Arnold)

JMW Development Principal Mark Johnson

Target recently informed JMW that it would not proceed with the project unless it receives “a pretty significant discount” from its previously negotiated deal, JMW Principal Mark Johnson said.Maybe Target has lowered their retail sales estimates for the store? Just saying ...

“We’re dumbfounded,” Johnson said, noting that Target officials had told him as recently as June 24 that the project was on track.

Tuesday, July 21, 2009

Mortgage Fraud in Florida

by Calculated Risk on 7/21/2009 10:11:00 PM

The Herald Tribune has a series of article on mortgage fraud in Florida (ht Ed)

Here are the first three in the series:

'Flip that house' fraud cost billions

Fraudulent property flipping ran rampant during this decade's housing boom, with $10 billion in suspicious deals in Florida alone, a Herald-Tribune investigation has found.Flippers' toll: On Gulf Coast, half a billion in defaults

The deals -- many of them inflated sales among friends, family and business associates -- drove up property values and tax bills during the boom, fed bank bailouts and failures after the boom, and fueled the foreclosure wave that has gutted property values.

Unscrupulous property flippers would buy houses or condos, then drive up the price in a few days or weeks by selling it to someone they knew. Buyers used the inflated price to get bank loans for more than the property was worth, leaving money for flippers to split as profit.

More than 100 properties from Palmetto to North Port doubled in price in a single day during the recent real estate boom. Proposed condos -- no more than ideas on paper -- flipped two or three times before anyone moved in.The king of the Sarasota flip

Instead of selling properties to outside buyers, [Craig Adams] created a real estate market where his hand-picked buyers and sellers could set the price they wanted, and repeated flips made Adams hundreds of thousands of dollars in real estate sales commissions.The Herald Tribune has a graphic on hot spots for flipping fraud in Florida, and some supporting documents.

In some cases, Adams and his associates bought a house, marked up the price and quickly sold it to another associate ... Using the inflated sale price, they qualified for a mortgage that more than covered the actual purchase, then divided the remaining cash among themselves, according to seven people familiar with the deals.

...

"They had a joke," said Melone, who did property deals with one of Adams' associates. "They said: 'We're getting low on money. Let's go buy a property.'"

Apple Conference Call Comments

by Calculated Risk on 7/21/2009 06:06:00 PM

Just a couple of comments ... (ht Brian)

Analyst: ... on the commodities [components]. I'm just curious as to which ones you expect to be sort of challenging going forward?Interesting that any component is constrained - probably because of inventory cuts by suppliers in Q4 and Q1.

AAPL: In terms of going forward, the market for DRAM and the market for large sized displays has shifted to a constrained environment and the pricing has moved accordingly. The NAND market has now begun to stabilize and we expect it to move towards a supply/demand balance. Hard drives and optical drives are recovering from a constrained supply environment and pricing is declining at less than historical rates as a result.

Analyst: When you look at consumer spending and you look at K12 and state and local government, is there any detail you can give on the education or the pro segment?Once again consumer spending is relatively better off than business spending. Business spending on software and equipment was probably off some more in Q2 (after declining 28.1% SAAR in Q4 and 33.7% SAAR in Q1).

AAPL: Relative to the market, the consumer market performed relatively better for us. The US K12 institutional business is weak, as you might expect. It is getting hit by budgets short falls. And last quarter we saw very negligible amounts, if any, of the stimulus funds flow all the way to the state and district levels. And so that may or may not occur this quarter. In the pro business, the pro business has also been affected more by the economy than the consumer businesses. And you can see that somewhat in our ASPs as people that were buying those that were in commercial accounts and small business accounts are delaying purchases.

Bill to Ban Naked CDS, CIT Terms and Market

by Calculated Risk on 7/21/2009 04:05:00 PM

Update: "We'll probably ban naked credit default swaps."

House Agriculture Committee Chairman Collin Peterson, from Reuters: US House bill to require clearing of OTC derivatives

Orginal Post: I've heard that Agriculture chairman Collin Peterson and Financial Services Committee chairman Barney Frank (share oversight of of futures markets) are in agreement to have derivatives go through clearinghouses and to ban naked credit default swaps as part of the omnibus financial reform bill. More soon ...

Since several stories have the details wrong, here is the vig on the CIT loan:

"The Credit Facility has a two and a half year maturity and bears interest at LIBOR plus 10%, with a 3% LIBOR floor, payable monthly. It provides for (i) a commitment fee of 5% of the total advances made thereunder, payable upon the funding of each advance, (ii) an unused line fee with respect to undrawn commitments at the rate of 1% per annum and (iii) a 2% exit fee on amounts prepaid or repaid and the unused portion of any commitment."That is a minimum 13% after paying back 5% immediately as a commitment fee. Tony Soprano would be proud.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Elizabeth Warren on Consumer Financial Product Agency

by Calculated Risk on 7/21/2009 03:16:00 PM

Baseline Scenario has a guest piece by Elizabeth Warren, chair of the Congressional Oversight Panel and the Leo Gottlieb Professor of Law at Harvard University: Three Myths about the Consumer Financial Product Agency. Professor Warren outlines three myths, and the concludes:

"At the end of the day, industry lobbyists try hard to invent myths and make things sound confusing to intimidate the public and to keep policymakers from acting. But this issue is simple: keeping safety and soundness and consumer protection together has not ensured safety and soundness, has not protected consumers, has not fostered choice and innovation, and has not minimized regulatory burden. In fact, the current regulatory structure that combines consumer protection with other bank oversight responsibilities has led to the kind of bad regulatory oversight that has led us to this crisis. The CFPA would put someone in Washington—someone with real power—who cares about customers. That’s good for families, good for market competition, and good for our economy."

Feldstein: Risk of Double Dip

by Calculated Risk on 7/21/2009 01:27:00 PM

From Bloomberg: Harvard’s Feldstein Sees Risk of ‘Double-Dip’ Recession in U.S.

... “There is a real danger this is going to be a double dip and that after six months or so we’ll have some more bad news,” [Martin] Feldstein, the former head of the National Bureau of Economic Research and Reagan administration adviser, said today in an interview on Bloomberg Television. “We could slide down again in the fourth quarter.”This was the key point of the Texas Instruments post yesterday (with conference call comments on inventory). There is a possibility of short term growth as companies rebuild inventories, but then an extended period of sluggishness since end demand is flat.

The economy could “flatten out” or “even be positive” in the third quarter, and then it’s likely to contract again in the last three months of the year as the effects of the federal stimulus program wear off and companies finish rebuilding inventories, he said.

“There isn’t going to be enough to sustain a really solid recovery,” he said, even though recent data has provided some “good news” on the economy.

Philly Fed State Coincident Indicators: Widespread Recession in June

by Calculated Risk on 7/21/2009 11:28:00 AM

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty seven states are showing declining three month activity.

This is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in 46 states in June, and was unchanged in 1 state. Here is the Philadelphia Fed state coincident index release for June.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for June 2009. In the past month, the indexes increased in three states (Mississippi, North Dakota, and Vermont), decreased in 46, and remained unchanged in one (North Carolina) for a one-month diffusion index of -86. Over the past three months the indexes increased in two states (Mississippi and North Dakota), decreased in 47, and remained unchanged in one (Montana) for a three-month diffusion index of -90.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

Almost all states showed declining activity in June. Still a very widespread recession ...

CIT: More than $1.5 billion in losses, No FDIC Guaranteed Debt

by Calculated Risk on 7/21/2009 10:14:00 AM

Bernanke Testimony at 10AM ET

by Calculated Risk on 7/21/2009 09:47:00 AM

Fed Chairman Ben Bernanke will testify before the House Financial Services Committee at 10 AM (semiannual Humphrey-Hawkins testimony on monetary policy).

Prepared testimony below the video links ...

Here is the CNBC feed.

And a live feed from C-SPAN.

Prepared Testimony: Semiannual Monetary Policy Report to the Congress

Bernanke: The Fed’s Exit Strategy

by Calculated Risk on 7/21/2009 08:57:00 AM

Note: Federal Reserve Chairman Ben Bernanke testifies at 10AM today in front of the House Financial Services Committee. I'll post a video link ...

From Fed Chairman Ben Bernanke: The Fed’s Exit Strategy

The depth and breadth of the global recession has required a highly accommodative monetary policy. Since the onset of the financial crisis nearly two years ago, the Federal Reserve has reduced the interest-rate target for overnight lending between banks (the federal-funds rate) nearly to zero. We have also greatly expanded the size of the Fed’s balance sheet through purchases of longer-term securities and through targeted lending programs aimed at restarting the flow of credit.There is much more, but clearly the Fed expects policy to be accommodative for some time, and when the appropriate time comes, the Fed believes they have an exit strategy to avoid inflation.

These actions have softened the economic impact of the financial crisis. They have also improved the functioning of key credit markets, including the markets for interbank lending, commercial paper, consumer and small-business credit, and residential mortgages.

My colleagues and I believe that accommodative policies will likely be warranted for an extended period. At some point, however, as economic recovery takes hold, we will need to tighten monetary policy to prevent the emergence of an inflation problem down the road. The Federal Open Market Committee, which is responsible for setting U.S. monetary policy, has devoted considerable time to issues relating to an exit strategy. We are confident we have the necessary tools to withdraw policy accommodation, when that becomes appropriate, in a smooth and timely manner.

emphasis added

Retail Space: Vacant in Manhattan

by Calculated Risk on 7/21/2009 12:06:00 AM

From the NY Times: The Rent Signs Are Sprouting

The storefront vacancy rate in Manhattan is now at its highest point since the early 1990s — an estimated 6.5 percent — and is expected to exceed 10 percent by the middle of next year ...For more on retail vacancies, see: Reis: Strip Mall Vacancy Rate Hits 10%, Highest Since 1992

Some of the more desirable shopping districts are littered with empty storefronts. For example, Fifth Avenue between 42nd Street and 49th Street, the stretch just south of Saks Fifth Avenue, has a vacancy rate of 15.3 percent, according to the brokerage Cushman & Wakefield.

In SoHo, from West Houston Street to Grand Street and Broadway to West Broadway, among the high-end boutiques, art galleries and restaurants, 1 in 10 retail spaces are now empty or about to be.

Monday, July 20, 2009

California Budget Deal Reached

by Calculated Risk on 7/20/2009 10:18:00 PM

From the SacBee: Schwarzenegger, lawmakers reach state budget agreement

Gov. Arnold Schwarzenegger and legislative leaders agreed Monday to balance Californias $26 billion deficit ... The proposal includes spending cuts to programs ranging from schools to welfare-to-work to prisons. It takes money from local governments, including borrowing $2 billion that the state will repay starting in 2013 and taking gas taxes that normally go toward local road projects.

More CIT News

by Calculated Risk on 7/20/2009 08:23:00 PM

Press Release: CIT Announces $3 Billion Credit Facility and Initiates Recapitalization Plan (ht jb)

CIT Group Inc. ... today announced that it entered into a $3 billion loan facility provided by a group of the Company’s major bondholders. CIT further announced that it intends to commence a comprehensive restructuring of its liabilities to provide additional liquidity and further strengthen its capital position.Cancelling the earnings release and conference call, and proposing a 20% haircut on debt due in 30 days, does not inspire confidence.

Today’s actions, including a $3 billion secured term loan with a 2.5 year maturity (the “Term Loan Financing”), are intended to provide CIT with liquidity necessary to ensure that its important base of small and middle market customers continues to have access to credit. Term loan proceeds of $2 billion are committed and available today, with an additional $1 billion expected to be committed and available within 10 days.

...

As the first step in a broader recapitalization plan, CIT has commenced a cash tender offer for its outstanding Floating Rate Senior Notes due August 17, 2009 ... for $825 for each $1,000 principal amount of notes tendered on or before July 31, 2009. Lenders in the Term Loan Financing have agreed to tender all of their August 17 notes. ...

Additional information regarding the financing will be available in a Form 8-K to be filed by the Company with the Securities and Exchange Commission. Further, the Company’s earnings release and conference call previously scheduled for July 23, 2009, have been cancelled. The Company will report its results for the quarter ended June 30, 2009 when it files its quarterly report on Form 10-Q.

emphasis added

TXN Conference Call

by Calculated Risk on 7/20/2009 06:40:00 PM

Texas Instruments is seeing a pickup in orders, but is this just inventory restocking or because of a pickup in end demand?

From the conference call (ht Brian):

Analyst: You mentioned that visibility has improved markedly. And it's obvious in a way because your bookings were up and your backlog is higher. Are there -- is there anything that you're hearing or seeing from your customers that says to you what we're seeing is more sustainable than one might have thought a quarter ago?It sounds like TI's customers are trying to match their inventory to their new lower level of shipments, but it isn't clear there is any pickup in end demand.

TXN: Well, the signals that we're seeing, Glen, have to do with the rate of decline that we're seeing in their inventory levels. It has slowed substantially. Which certainly signals to us that they believe their inventories are much better aligned now with their true end demand. So that's probably one of the better signals that we're seeing. And the second, of course, is the orders. We actually saw our backlog for the current quarter increase about 27% versus where we were 90 days ago. In other words, starting the third quarter, we had 27% more backlog than we did starting the second quarter. So that's given us increased visibility and increased confidence for the third quarter.

Analyst: your guidance [for Q3 indicates] the mid-point would be up 7.8% from where you came in in Q2. I'm curious how much of that you feel is [inventory] restocking which might occur in the channel. I just note that a little more typical seasonal might be up maybe 3% to 4%.

TXN: Where we have great visibility in terms of actually knowing the specifics of inventory trends will be at distribution. When we start moving out into the OEMs and EMS , we generally will have a feel for what's going on, but it's difficult to be specific. If you just look at for example last quarter, our largest customer which did report last week announced that they reduced their inventory 14%, the other area where I said we had great visibility was at distribution where we saw inventory go down 10%. So, between those two guys alone, they represent half of our revenue, in second quarter we continued to ship below the rate at which they're shipping out. The other half of our revenue basically we think there are general trends that probably match the other half -- the first half I described. So going into third quarter, we know based upon the half of our revenue that I just described, our shipments entering the quarter are below the rate at which the customers are shipping out. So we know or we believe there's more room to go in terms of what I would call the convergence of our shipments and the rate at which our customers are [shipping]. Does it go beyond that and have those customers start to replenish inventory, that wouldn't be surprising just given the seasonality of third quarter coming into the holiday market. But I don't want to speculate on what will or will not happen other than a normal seasonal trend would indicate that.

Roubini: Slow Recovery, Double Dip Recession Possible

by Calculated Risk on 7/20/2009 05:30:00 PM

From CNBC: Roubini: Economic Recovery to Be 'Very Ugly'

"The recovery is going to be subpar," [Nouriel] Roubini said. "I see a one percent growth in the economy in the next few years. There will also be 11 percent unemployment next year and the recovery is going to be slow. It's going to feel like a recession even when it ends."

...

When asked about the economy Monday, Roubini said, "We may be out of a freefall for the financial system," said Roubini. "We have seen the worst in that sense. But in my view there is a sluggish U shaped recovery that might go into a W double dip if we don't fix the problems in the economy."

...

On a second stimulus: "I think there will be another one toward the end of the year. We need to have more shovel ready labor intensive infrastructure projects. We'll need it."

DOT: Vehicle Miles Flat YoY

by Calculated Risk on 7/20/2009 03:09:00 PM

This is the second consecutive month were vehicles miles driven were flat, or slightly above, the comparable month in 2008 (May 2009 compared to the May 2008).

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by +0.1% (0.2 billion vehicle miles) for May 2009 as compared with May 2008. Travel for the month is estimated to be 257.3 billion vehicle miles.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the rolling 12 month of U.S. vehicles miles driven. (label corrected: trillions)

By this measure (used to remove seasonality) vehicle miles declined sharply and are now moving sideways.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. As the DOT noted, miles driven in May 2009 were 0.1% greater than in May 2008.

Year-over-year miles driven started to decline in December 2007, and really fell off a cliff in March 2008. This makes for an easier comparison for May 2009.

Moody's: Inadequate Loan Loss Provisions for Banks

by Calculated Risk on 7/20/2009 02:28:00 PM

From Bloomberg: Banks Fail to Make Adequate Loan-Loss Provisions, Moody’s Says (ht Brian, Bob_in_MA)

Banks have failed to make adequate provision for the losses on loans and securities they face before the end of next year ... U.S. banks may incur about $470 billion of losses and writedowns by the end of 2010, which may cause the banks to be unprofitable in the period ...This can't just be regional and community banks - this must include some of the stress test 19. Maybe it is time for another round of stress tests.

“Large loan losses have yet to be recognized in the banking system,” Moody’s said. “We expect to see rising provisioning needs well into 2010.”