by Calculated Risk on 8/05/2009 06:08:00 PM

Wednesday, August 05, 2009

Barry Gosin: State of Commercial Real Estate

Note: Corrected 2nd sentence: "Values were driven not by underlying demand ..."

Barry Gosin, CEO of Newmark Knight Frank: "The rise in rents were really never connected to real demand. Values were driven not by underlying demand, they were driven by liquidity, and cap rates, and the desire to invest in real estate. Then on the way down, our view is the rental market has relatively stabilized - how far do you go?"

CNBC: "Stabilized at what sort of levels?"

Gosin: "In some of the big cities where you had a tremendous runup, as much as 50% [off]. The rest of the countries where the rents are much lower, 15% to 20%."

CNBC: Oh my ...! (this section starts around 4:20)

Negative Equity: 16 Million Homeowners Underwater

by Calculated Risk on 8/05/2009 03:27:00 PM

Two separate reports ...

From Bloombeg: ‘Underwater’ U.S. Mortgages May Hit 48%, Deutsche Bank Reports

The percentage of properties “underwater” is forecast to rise to 48 percent, or 25 million homes, as property prices drop through the first quarter of 2011, according to [Deutsche Bank] analysts Karen Weaver and Ying Shen.I guess Deutsche Bank didn't get the memo about house prices finding a bottom.

Note: Deutsche Bank estimates 26% of homeowners are currently underwater, matching the data below from Economy.com. And Deutsche Bank sees the next wave hitting prime borrowersm, from the report:

While subprime and Option ARMs are currently the worst cohorts with underwater borrowers, we project that the next phase of the housing decline will have a far greater impact on prime borrowers (conforming and jumbo) ... By Q1 2011, we estimate that 41% of prime conforming borrowers and 46% of prime jumbo borrowers will be underwater, a significant increase over the percentage of these borrowers in Q1 2009. The impact of this is significant given that these markets have the largest share of the total mortgage market outstanding.From the WSJ: More Homeowners ‘Upside Down’ on Mortgages

Some 24% of owner-occupied homes had mortgage debt that exceeded the values of those homes at the end of June, according to data from Equifax and Moody’s Economy.com. That number rises to 32% when looking at the share of homeowners with mortgages that don’t have equity left in their homes.Mods won't help these

Overall, 16 million homeowners are “upside-down” on their mortgages, up from 10 million, or 15% of owner-occupied homes, one year ago.

Nearly 10% of owner-occupied homes now have mortgage debt with loan-to-value ratios of at least 125%, and roughly half of those homes have mortgage debt with loan-to-value ratios of 150% or more.

Although Deutsche Bank may be pessimistic on house prices, both reports suggests about 16 million homeowners are currently underwater, and probably another 5+ million have no equity.

WSJ: Taylor Bean to cease operations

by Calculated Risk on 8/05/2009 02:20:00 PM

WSJ Headline: Taylor Bean, 12th largest U.S. mortgage lender, to cease operations, won't fund mortgages in pipeline.

This is a significant story. Taylor Bean was the third largest FHA loan originator in May.

Update: Taylor Bean press release (ht Wayne)

TAYLOR BEAN MUST CEASE ALL ORIGINATION OPERATIONS EFFECTIVE IMMEDIATETLY

OCALA, FLORIDA – TAYLOR, BEAN & WHITAKER MORTGAGE CORP. (“TBW”) RECEIVED NOTIFICATION ON AUGUST 4, 2009 FROM THE U.S DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT, FREDDIE MAC AND GINNIE MAE (THE “AGENCIES”) THAT IT WAS BEING TERMINATED AND/OR SUSPENDED AS AN APPROVED SELLER AND/OR SERVICER FOR EACH OF THOSE RESPECTIVE FEDERAL AGENCIES. TBW HAS UNSUCCESSFULLY SOUGHT TO HAVE THE TERMINATION/SUSPENSION DECISIONS OF EACH OF THOSE AGENCIES REVERSED. AS A RESULT OF THESE ACTIONS, TBW MUST CEASE ALL ORIGINATION OPERATIONS EFFECTIVE IMMEDIATELY. REGRETTABLY, TBW WILL NOT BE ABLE TO CLOSE OR FUND ANY MORTGAGE LOANS CURRENTLY PENDING IN ITS PIPELINE. TBW IS COOPERATING WITH EACH OF THE AGENCIES WITH RESPECT TO ITS SERVICING OPERATIONS AND EXPECTS TO CONTINUE TO SERVICE MORTGAGE LOANS AS IT RESTRUCTURES ITS BUSINESS IN THE WAKE OF THESE EVENTS. WE UNDERSTAND THAT THIS COULD HAVE A SIGNIFICANT IMPACT ON OUR VALUED EMPLOYEES, CUSTOMERS AND COUNTERPARTIES, AND ARE VERY DISAPPOINTED THAT A LESS DRASTIC OPTION IS UNAVAILABLE.

BRE Properties: Rents to Decline well into 2010

by Calculated Risk on 8/05/2009 01:14:00 PM

"I think it is shaping up there is another leg down in terms of market rents and effective rents and that will be somewhere late this year or early [next] year where I think all the operators will move their rents down to basically handle the late stage of this recession."BRE is an apartment REIT in the West. Here are some comments from their conference call (hat tip Brian):

BRE CEO, Aug 5, 2009

“In our market footprint non farm jobs have decreased almost 800,000 or 5% year-over-year. We feel we are at the midpoint of the market cycle. Operating fundamentals will continue to be challenged until jobs stabilize. Past recession patterns and current forecast [suggest this will be] 15 to 18 months after GDP stabilizes, currently expected in the third or fourth quarter this year.This matches the data from the NMHC apartment market tightness survey released yesterday.

... our current views have not changed from the start of the year, specifically the rent curve should continue to decline well into 2010. Cumulative rent loss may be double digits and pricing power will not return until jobs turn positive which may be late 2010.

On the disposition front, we were successful in selling the two Sacramento assets that were classified as held for sale. One community sale occurred in June and the second in July generating growth proceeds of 65 million. The cap rate was 8.5%. ...

This environment calls to mind the Churchhill comment,”if you are going through hell, keep going.”

... we believe we are halfway through a tough two-year period for rents and operations.

Occupancy at the end of the second quarter was 95%, we are slightly north of that today. We have two positive variables available to us, higher traffic and favorable renewal rates.

... market rent in our communities is down 4% year-over-year and down 6% since September. Essentially all the market decline was realized during the end of the year in the first quarter. Rents have been flat since the end of March. Effective rents are down almost 9% from peak levels in '08.

..

Concessions and/or discount pricing are prevalent in all operating markets, available from private and public operators. Whether you call it a concession or effective rent, discounts are available. In this environment the customer is focused on the check writing experience so the concession is taking the form of the recurring discount off the monthly rent. ...

Historically we haven't used concessions. In most of our markets, they weren't necessary. They are proving useful [today] on two fronts. One, we needed to recover the occupancy line [in Q2] and wanted some immediate velocity. This proved successful. The concessions are also helping where we go from here. There is another leg down from people with job losses. Our view is to pick the appropriate time in each market to adjust rents and at that time begin to reduce concessions. The objective is to reduce concessions and discount at some point by the second half in 2010.

...

Renewals are running 55%. We don't lose many tenants to other properties, about 3%. Move outs to home purchases are running 8.5% down from 16% a year ago. Jobs are the drivers for move outs. If we combine job transfer, job loss, relocation, personal reasons and financial problems, these five factors total 30% of move out activity. Unscheduled move outs, evictions and skips are another 9%.

There remains a fairly healthy rent to own gap in our Orange County, Seattle and San Diego markets, in LA where there is virtually no and the Inland Empire is negative 15 to 20%. Phoenix is negative 5% and Denver has a positive rent to own gap.

...

Analyst: I'm trying to specifically narrow down what is going to cause another 5% [decline in rents] in an environment where job losses are decreasing?

BRE: We expect there to be continued sequential declines in job growth in all of our markets through at least the midpoint of 2010. Right now the economy.com forecast is showing that you go from negative sequential declines to a point of stabilization to a beginning of modest job growth through 2010 and into ' 11. We are using that forecast and erring on the side of conservatism. We are still [expecting] another leg down in rents. In February when we gave our comments we said we thought '09-'10 would be a two-year decline in a range of 10 to 15%. I think that's still where we are today. If it is not there, we will be thrilled and happy not to cut the rents all the way down. Right now I think it is shaping up there is another leg down in terms of market rents and effective rents and that will be somewhere late this year or early [next] year where I think all the operators will move their rents down to basically handle the late stage of this recession.

emphasis added

P&G: Expect Sales Flat or Down 3% in Calendar Q3

by Calculated Risk on 8/05/2009 12:16:00 PM

Yesterday I posted some comments from Multi-Color Corp. (makes labels mostly for consumer product companies): "While you would expect inventories to be replenished as the economy stabilizes, we have not seen a trend of increasing orders to date.”

Today, from the WSJ: P&G Sales, Profit Fall as Shoppers Opt for Cheaper Brands

P&G projected ... sales excluding acquisitions and divestitures would be flat to down 3% in the [Q3 2009]. On a conference call, company executives said results would improve sequentially after [Q3 2009].Some of this is classic consumer theory concerning inferior goods; as incomes fall, demand increases for generic products at the expense of more expensive brands.

... Sales of the higher-end, more discretionary line of Braun shavers fell sharply. But some of P&G's everyday brands also continued to see declines as consumers traded down to cheaper brands and private-label goods in grocery stores. ...

In recent years, Procter & Gamble has put more focus on higher-priced products, seeking to drive growth by getting consumers to trade up. That strategy has hurt the company during the recession as consumers cut discretionary spending in areas like beauty and traded down to cheaper pantry staples.

However it helps to remember that there is a usual temporal order1 for emerging from a recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment2 | ||

Housing usually leads the economy both into and out of recessions (this was true for the Great Depression too). And even though new home sales and single family housing starts may have bottomed, it seems unlikely with the the huge overhang of excess inventory and high levels of distressed sales, that residential investment will pick up significantly any time soon. Note: Residential investment is mostly new home construction and home improvements.

And that leaves Personal Consumption Expenditures (PCE), and that is why the ISM non-manufacturing numbers this morning and the P&G numbers matter. Away from auto sales, it is hard to find much evidence of a pick up in consumer demand.

I've seen some argue for a business led recovery. That is the wrong order. Sure, there will probably be some inventory replenishment since some companies probably cut back too far, but most companies already have too much capacity, so after the inventory adjustement what will happen? They will not need to expand until their sales pick up significantly.

So I still think the keys are Residential Investment (RI) and PCE, and therefore I think the recovery will be sluggish. Note that CRE and non-residential investment in structures is a lagging indicator for the economy.

1 From a post in March, (see Business Cycle: Temporal Order for the order in and out of a recession).

2 In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

ISM Non-Manufacturing Index Shows Contraction in July

by Calculated Risk on 8/05/2009 10:00:00 AM

From the Institute for Supply Management: July 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector contracted in July, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.The service sector was still contracting in July, and contracting at a slightly faster pace than in June.

The NMI (Non-Manufacturing Index) registered 46.4 percent in July, 0.6 percentage point lower than the 47 percent registered in June, indicating contraction in the non-manufacturing sector for the 10th consecutive month, at a slightly faster rate. The Non-Manufacturing Business Activity Index decreased 3.7 percentage points to 46.1 percent. The New Orders Index decreased 0.5 percentage point to 48.1 percent, and the Employment Index decreased 1.9 percentage points to 41.5 percent. The Prices Index decreased 12.4 percentage points to 41.3 percent in July, indicating a significant decrease in prices paid from June. According to the NMI, seven non-manufacturing industries reported growth in July. The majority of respondents' comments reflect a sense of uncertainty and cautiousness about business conditions."

emphasis added

It can't be emphasized enough - this is for July. No recovery yet.

Other Employment Reports

by Calculated Risk on 8/05/2009 08:27:00 AM

ADP reports:

Nonfarm private employment decreased 371,000 from June to July 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from May to June was revised by 10,000, from a decline of 473,000 to a decline of 463,000.Note: the BLS reported a 415,000 decrease in nonfarm private employment in June (-467,000 total nonfarm), so once again ADP was only marginally useful in predicting the BLS number.

On the Challenger job-cut report from CNBC: Planned layoffs accelerated in July

Planned layoffs at U.S. firms increased in July for the first time in six months, signaling more uneasy times for workers and a continued drag on consumer spending and the broader economy.The BLS reports Friday, and the consensus is for about 300,000 in reported job losses for July.

Planned job cuts announced by U.S. employers totaled 97,373 last month, up 31 percent from June when it had hit a 15-month low, according to a report released on Wednesday by global outplacement consultancy Challenger, Gray & Christmas, Inc.

July's announced job cuts brought the total so far this year to 994,048, 72 percent higher than the same span in 2008.

Tuesday, August 04, 2009

Farmland Values Decline

by Calculated Risk on 8/04/2009 11:59:00 PM

From the WSJ: Farm Real-Estate Values Post Rare Drop

The U.S. Agriculture Department said in its annual report that the value of all land and buildings on U.S. farms averaged $2,100 an acre Jan. 1, down 3.2% from last year. The decline in farm real-estate values was the first since 1987, the agency said.The Chicago Fed had a similar report a couple of months ago: Farmland Values and Credit Conditions

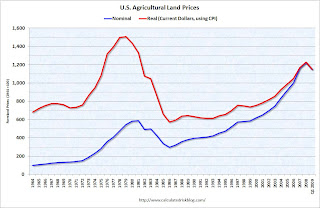

There was a quarterly decrease of 6 percent in the value of “good” agricultural land—the largest quarterly decline since 1985—according to a survey of 227 bankers in the Seventh Federal Reserve District on April 1, 2009. Also, the year-over-year increase in District farmland values eroded to just 2 percent in the first quarter of 2009.And here was a graph I posted in May based on the Chicago Fed report:

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graphs shows nominal and real farm prices based on data from the Chicago Fed.

In real terms, the current increase in farm prices wasn't as severe as the bubble in the late '70s and early '80s that led to numerous farm foreclosures in the U.S.

And as I noted in the earlier post, it was not surprising that John Mellencamp wrote "Rain On The Scarecrow" in 1985 after the farm bubble burst.

Resource: Failed Bank List with Enforcement Documents

by Calculated Risk on 8/04/2009 09:35:00 PM

ProPublica has a great table of failed banks with sortable columns by state, date and Federal regulator.

The database also includes links to public enforcement documents with the dates the documents were issued (Cease and Desist orders, Prompt Corrective Action directives, etc.).

As an example, Millennium State Bank of Texas was seized on July 2nd, 2009 and the FDIC entered a Cease and Desist order on the 19th of May 2009 FDIC. So the bank was closed less than two months after the Cease and Desist order was issued.

Other banks lasted longer, and a C&D isn't a guarantee of failure since some are cured.

A Federal Reserve Prompt Corrective Action (PCA) directive seems to have a very short leash. As an example BankFirst in South Dakota received a PCA directive on June 15th and was seized on July 17th.

If you go to the Federal Reserve enforcement list, you will see Written Agreements and Prompt Corrective Actions popping up fairly frequently. Here is one from yesterday:

The Federal Reserve Board on Monday announced the issuance of a Prompt Corrective Action Directive against Warren Bank, Warren, Michigan, a state chartered member bank.That makes Warren a BFF candidate in about a month. Also be on the lookout for Bank of Elmwood, Racine, Wisconsin (PCA on July 23rd).

A copy of the Directive is attached.

Attachment (51 KB PDF)

Note: the ProPublica list may be missing some enforcement documents. I found a Prompt Corrective Action for Community Bank of West Georgia on May 21st that isn't included - and the bank was seized a month later.

Taylor, Bean & Whitaker Suspended by FHA

by Calculated Risk on 8/04/2009 07:21:00 PM

From HUD: FHA Suspends Taylor, Bean & Whitaker Mortgage Corp. and Proposes to Sanction Two Top Officials

The Federal Housing Administration (FHA) today suspended Taylor, Bean and Whitaker Mortgage Corporation (TBW) of Ocala, Florida, thereby preventing the Company from originating and underwriting new FHA-insured mortgages. The Government National Mortgage Association (Ginnie Mae) is also defaulting and terminating TBW as an issuer in its Mortgage-Backed Securities (MBS) program and is ending TBW's ability to continue to service Ginnie Mae securities. This means that, effective immediately, TBW will not be able to issue Ginnie Mae securities, and Ginnie Mae will take control of TBW's nearly $25 billion Ginnie Mae portfolio.Taylor Bean is a major FHA lender, from the WSJ:

FHA and Ginnie Mae are imposing these actions because TBW failed to submit a required annual financial report and misrepresented that there were no unresolved issues with its independent auditor even though the auditor ceased its financial examination after discovering certain irregular transactions that raised concerns of fraud. FHA's suspension is also based on TBW's failure to disclose, and its false certifications concealing, that it was the subject of two examinations into its business practices in the past year.

"Today, we suspend one company but there is a very clear message that should be heard throughout the FHA lending world - operate within our standards or we won't do business with you," said HUD Secretary Shaun Donovan.

FHA Commissioner David Stevens said, "TBW failed to provide FHA with financial records that help us to protect the integrity of our insurance fund and our ability to continue a 75-year track record of promoting, preserving and protecting the American Dream. We were also troubled that the Company not only failed to disclose it was a target of a multi-state examination and a separate action by the Commonwealth of Kentucky, but then falsely certified that it had not been sanctioned by any state. FHA won't tolerate irresponsible lending practices."

Taylor Bean was the 12th largest U.S. mortgage lender in the first six months of this year, according to Inside Mortgage Finance, a trade publication. Among originators of FHA loans, Taylor Bean was the third largest in May, with a market share of 4%, according to the publication. Only Bank of America Corp. and Wells Fargo & Co. were larger.Taylor Bean was raided yesterday along with Colonial Bank by TARP inspectors. There is no indication if these actions are related.

Jim the Realtor: A CRE Foreclosure Cornucopia

by Calculated Risk on 8/04/2009 06:32:00 PM

Mostly CRE here ...

Setser takes post with National Economic Council

by Calculated Risk on 8/04/2009 05:14:00 PM

Dr. Brad Setser, author of the blog "Follow the Money", has taken a new job with the National Economic Council. Unfortunately this means no more blogging for Brad.

Here is an excerpt from Brad's farewell post: All great things have to end

Fundamentally this blog was about an issue – the United States’ trade deficit, the offsetting trade surpluses in other parts of the world and the capital flows that made this sustained “imbalance” possible. Most of my early blog posts argued, in one way or another, that taking on external debt to finance a housing and consumption boom wasn’t the best of ideas. Even if (or especially if) the deficit was financed by governments rather than private markets.Brad and I have had a number of great discussions over the years, and his blog always provided great information and insight. Brad's work really helped clarify the relationship between the U.S. current account deficit (trade deficit) and the housing bubble.

Brad, congratulations! Thanks for everything, and I wish you all the best at your new job!

Consumer Products: "No trend of increasing orders"

by Calculated Risk on 8/04/2009 04:11:00 PM

Brian sent me these comments from Multi-Color Corp. (this company makes labels mostly for consumer product companies: P&G was 19% of Q1 sales and Miller Beer was 13%.)

Multi-Color: “While there is increasing evidence that the worst of the recession may be over, we remain cautious about sales volume for the remainder of the year. While you would expect inventories to be replenished as the economy stabilizes, we have not seen a trend of increasing orders to date.”The end of cliff diving is not the same as green shoots!

Analyst: Just a few questions. The first would be can you talk about the phasing of order flow by month over the course of the quarter? And can you provide any color on how July trended?

Frank Gerace, Multi-Color CEO: Yes, order flow actually was pretty decent during the month of June, better than May, and then as July came in, July began looking more like May, so there was an improvement during June and then it kind of went back to the way it was looking in May. And what we're seeing now is just steady, stable, steady orders, no increases that we can speak of to date.

emphasis added

Homebuilder D.R. Horton: Good News, Bad News

by Calculated Risk on 8/04/2009 03:15:00 PM

From D.R. Horton:

D.R. Horton ... today reported a net loss for its third fiscal quarter ended June 30, 2009 of $142.3 million ... The quarterly results included $110.8 million in pre-tax charges to cost of sales for inventory impairments and write-offs of deposits and pre-acquisition costs related to land option contracts that the Company does not intend to pursue. The net loss for the same quarter of fiscal 2008 was $399.3 million ... Homebuilding revenue for the third quarter of fiscal 2009 totaled $914.1 million, compared to $1.4 billion in the same quarter of fiscal 2008. Homes closed totaled 4,240 homes, compared to 6,167 homes in the year ago quarter.Horton is the largest homebuilder in the U.S.

...

Donald R. Horton, Chairman of the Board, said, “Our net sales orders in the June quarter reflected a 22% sequential increase from our March quarter which was stronger than our usual seasonal trend. However, market conditions in the homebuilding industry are still challenging, characterized by rising foreclosures, high inventory levels of available homes, increasing unemployment, tight credit for homebuyers and weak consumer confidence."

...

The Company’s cancellation rate (cancelled sales orders divided by gross sales orders) for the third quarter of fiscal 2009 was 26%.

emphasis added

The bad news is they are still losing money and sales are way off from last year.

The good news is sales in calendar Q2 (fiscal Q3) were "stronger than [the] usual seasonal trend", and also cancellations are back to early 2006 levels.

The surge in cancellation rates was an important story after the bubble burst because the Census Bureau doesn't correct inventory levels if contracts are cancelled. Now it appears cancellation rates might be returning to more normal levels.

Note: What matters for inventory is the change in cancellation rate from a couple of quarters earlier, not the absolute level. For those interested in how the Census Bureau handles cancellations, see here.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the cancellation rate for Horton since the top of the housing bubble.

There appears to be a seasonal pattern (fewer cancellations in Q1), so this decline in calendar Q2 is definitely significant.

The cancellation rate could rise again if mortgage rates move higher, but this is a little bit of good news for the builders. These cancellation rates are still above normal (Note: "Normal" for Horton is in the 16% to 20% range, so 26% is still high.), but most of the home builders are reporting the lowest cancellation rates since late 2005 or early 2006.

The really bad news for Horton - and all homebuilders - is that sales will not rebound for the reasons outlined by Mr. Horton above, especially because of the huge overhang of excess inventory. In the low priced areas where inventory is currently low and activity high, most of the homes are selling below replacement cost and the builders can't compete. The big question for the builders is: Can they make money at these sales levels? I think the answer for many of them is no.

ABI: Personal Bankruptcy Filings up 34.3 Percent compared to July 2008

by Calculated Risk on 8/04/2009 12:25:00 PM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings Reach Highest Monthly Total Since 2005 Bankruptcy Law Overhaul

U.S. consumer bankruptcy filings reached 126,434 in July, the highest monthly total since the Bankruptcy Abuse Prevention and Consumer Protection Act was implemented in October 2005, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The July 2009 consumer filing total represented a 34.3 percent increase nationwide from the same period a year ago, and an 8.7 percent increase over the June 2009 consumer filing total of 116,365. Chapter 13 filings constituted 28.3 percent of all consumer cases in July, slightly above the June rate.

"Today's bankruptcy filing number reflects the sustained and growing financial stress on U.S. households," said ABI Executive Director Samuel J. Gerdano. "Rising unemployment on top of high pre-existing debt burdens is a formula for higher bankruptcies through the end of this year."

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 802 thousand personal bankrutpcy filings through July 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll take the over!

NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

by Calculated Risk on 8/04/2009 10:49:00 AM

Note from NMHC: "Market Tightness Index reading above 50 indicates that, on balance, apartment markets around the country are getting tighter; a reading below 50 indicates that market conditions are getting looser; and a reading of 50 indicates that market conditions are unchanged."

So the increase in the index to 20 implies lower occupancy rates and lower rents - "looser" apartment conditions - but at a slower pace of contraction than the previous month.

From the National Multi Housing Council (NMHC): Apartment Market Conditions Stabilizing, But Not Improving, According to NMHC Quarterly Survey

The apartment market continues to struggle, but shows early signs of possibly stabilizing, according to the National Multi Housing Council’s latest Quarterly Survey of Apartment Market Conditions.

All four of the survey's market indexes covering occupancy, sales volume, equity finance and debt finance remained below 50 (indicating conditions were worse than three months ago), but three of the four increased from the last quarter, with only the debt index recording a decline.

“Apartment demand remains tethered to an economy that continues to shed jobs at a fairly rapid pace,” noted NMHC Chief Economist Mark Obrinsky. “Financing is beginning to stabilize, but the market is still a long way from ‘normal’.”

“The survey also suggests that transaction activity is mainly being restrained by uncertainty in apartment property values—whether they have ‘bottomed out’—and not financing constraints. Only when this uncertainty fades are we likely to see a significant upturn in apartment transactions.”

Fears of future property value declines are behind the difficulty apartment firms are having in obtaining equity financing. In a special survey question, 67 percent of respondents said potentially falling property values best explained the lack of equity availability.

...

The Market Tightness Index rose from 16 to 20. This was the eighth straight quarter in which the index has been below 50, but it also the third straight quarter in which the index measure has been rising, as greater shares of respondents are reporting that vacancies are unchanged from the previous quarter rather than even looser.

emphasis added

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

Pending Home Sales Index Increases in June

by Calculated Risk on 8/04/2009 10:01:00 AM

From the NAR: Uptrend Continues in Pending Home Sales

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in June, rose 3.6 percent to 94.6 from an upwardly revised reading of 91.3 in May, and is 6.7 percent above June 2008 when it was 88.7.The increase in pending sales has been mostly from lower priced homes with demand from first time home buyers (taking advantage of the tax credit) and investors. As Yun notes, the demand from first time buyers will probably fade in another month or two.

...

"Activity has been consistently much stronger for lower priced homes,” [Lawrence Yun, NAR chief economist] said. “Because it may take as long as two months to close on a home after signing a contract, first-time buyers must act fairly soon to take advantage of the $8,000 tax credit because they must close on the sale by November 30.”

June PCE and Personal Saving

by Calculated Risk on 8/04/2009 08:31:00 AM

From the BEA: Personal Income and Outlays, June 2009

Personal income decreased $159.8 billion, or 1.3 percent, and disposable personal income (DPI) decreased $143.8 billion, or 1.3percent, in June, according to the Bureau of Economic Analysis.The temporary boost in the May saving numbers due to timing of American Recovery and Reinvestment Act of 2009 stimulus payments was reversed in June.

...

The June change in personal income reflects selected provisions of the American Recovery and Reinvestment Act of 2009, which boosted personal current transfer receipts in May much more than in June. Excluding these receipts ... personal income decreased $7.8 billion, or 0.1 percent, in June, following a decrease of $2.5 billion, or less than 0.1 percent, in May.

...

Real PCE -- PCE adjusted to remove price changes –- decreased 0.1 percent in June, in contrast to an increase of less than 0.1 percent in May.

...

Personal saving -- DPI less personal outlays -- was $504.8 billion in June, compared with $681.0 billion in May. Personal saving as a percentage of disposable personal income was 4.6 percent in June, compared with 6.2 percent in May.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the June Personal Income report. The saving rate was 4.6% in June. (5.4% with three month average)

Households are saving substantially more than during the last few years (when the saving rate was around 1.0%). The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but this will also keep pressure on personal consumption.

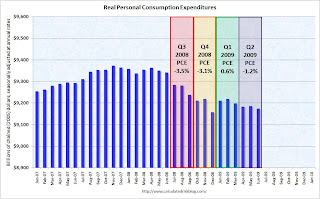

The following graph shows real Personal Consumption Expenditures (PCE) through June (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

PCE declined sharply in Q3 and Q4 2008 - the cliff diving - and has been relatively flat in Q1 and Q2 2009. Auto sales should gave a boost to PCE in Q3, but in general PCE will probably remain weak over the 2nd half of 2009 and into 2010 as households continue to repair their balance sheets.

Monday, August 03, 2009

Jim the Realtor: Prices falling at the high end

by Calculated Risk on 8/03/2009 10:30:00 PM

Prices are falling at the high end ...

"Poof, another notch down practically overnight ..."

Jim the Realtor: E-Ranch Balloon

Market and Credit Indicators

by Calculated Risk on 8/03/2009 07:42:00 PM

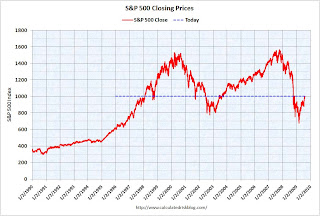

The S&P 500 closed above 1000 for the first time since last November. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up 48.2% from the closing bottom (326 points), and off 36% from the peak (563 points below the closing max).

The S&P 500 first hit this level in Feb 1998; over 11 years ago.

The British Bankers' Association reported that the three-month dollar Libor rates were fixed at a new record low of 0.472%. The LIBOR peaked at 4.81875% on Oct 10, 2008.  The A2P2 spread has declined to 0.26. The record (for this cycle) was 5.86 after Thanksgiving, and this is only slightly above the normal spread of around 20 bps.

The A2P2 spread has declined to 0.26. The record (for this cycle) was 5.86 after Thanksgiving, and this is only slightly above the normal spread of around 20 bps.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

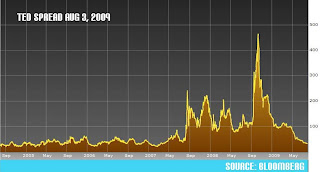

Meanwhile the TED spread has decreased further and is now at 29.4. This is the difference between the interbank rate for three month loans and the three month Treasury.

The peak was 463 on Oct 10th and the spread is now in the normal range. The final graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The final graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The spread has decreased sharply over the last few months. The spreads are still high, especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.Some of these indicators will be interesting to follow when the Fed eventually unwinds their current positions.