by Calculated Risk on 8/11/2009 05:23:00 PM

Tuesday, August 11, 2009

Taylor Bean BK "Imminent"

From the WSJ: Bankruptcy Filing Near for Taylor Bean

A bankruptcy filing is "imminent" for Taylor, Bean & Whitaker Mortgage Corp., lawyers representing the mortgage lender said in a federal court filing last week.No surprise.

...

Meanwhile, an internal email at Taylor Bean dated Monday, Aug. 10, referred to a new computer folder "to assemble all of our bankruptcy detailed spreadsheets and support."

Nothing new on Colonial Bank (or Corus Bank, or Guaranty Bank in Texas).

CIT created a little stir this morning with an NT 10-Q SEC filing. This was just a notice of CIT being unable to file on time - because the executives are busy - and that CIT expects to file by August 17th (just happens to be the date of the cash tender offer).

CIT reiterated in the NT 10-Q that:

If the tender offer is successfully completed, the Company intends to use the proceeds of the Credit Facility to complete the tender offer and make payment for the August 17 notes. Further, the Company and a Steering Committee of the bond holder lending group do not intend for the Company to seek relief under the U.S. Bankruptcy Code, but rather will pursue restructuring efforts as part of the comprehensive restructuring plan to enhance the Company’s liquidity and capital position. If the pending tender offer is not successfully completed, and the Company is unable to obtain alternative financing, an event of default under the provisions of the Credit Facility would result and the Company could seek relief under the U.S. Bankruptcy Code.That isn't new.

emphasis added

CIT also reiterated that there are substantial doubts that the company will continue as a going concern.

In addition, as disclosed in the same Current Report on Form 8-K, the Company’s funding strategy and liquidity position have been materially adversely affected by on-going stress in the credit markets, operating losses, credit ratings downgrades, and regulatory and cash restrictions such that there is substantial doubt about the Company’s ability to continue as a going concern.Also nothing new.

Draft Derivatives Bill Sent to Congress

by Calculated Risk on 8/11/2009 03:23:00 PM

From the Treasury:

... One of the most significant changes in the world of finance in recent decades has been the explosive growth and rapid innovation in the markets for credit default swaps (CDS) and other OTC derivatives. These markets have largely gone unregulated since their inception. Enormous risks built up in these markets – substantially out of the view or control of regulators – and these risks contributed to the collapse of major financial firms in the past year and severe stress throughout the financial system.It appears the proposed bill would require standard derivative products to be traded on exchanges, and that all companies involved in derivative trading would be subject to federal regulation.

Under the Administration's legislation, the OTC derivative markets will be comprehensively regulated for the first time. The legislation will provide for regulation and transparency for all OTC derivative transactions; strong prudential and business conduct regulation of all OTC derivative dealers and other major participants in the OTC derivative markets; and improved regulatory and enforcement tools to prevent manipulation, fraud, and other abuses in these markets.

I haven't found any mention of banning 'naked' CDS (something that was discussed a couple weeks ago), but I haven't read the entire proposal.

CBRE: Retail Cap Rates Increase Sharply in Q2

by Calculated Risk on 8/11/2009 12:41:00 PM

From CB Richard Ellis: U.S. Retail Cap Rates

Average US retail capitalization rates increased 55 basis points in the 2nd quarter of 2009 to 8.12% ...

As some owners were unable to hold on, cap rates continued the upward march in the 2nd quarter. The 55 basis point gain is the largest quarterly increase we have ever measured, even trumping 2008 Q4. ... Our preliminary review of closed sales and escrows in the 3rd quarter indicate cap rates are continuing to rise.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph from CBRE shows the retail cap rate since 2003. Note that 2009 was based on just Q1 and Q2, and Q2 is already at 8.12% - and CBRE sees an additional cap rate increase in the early Q3 data.

From Reuters in July, see: Strip Mall Vacancy Rate Hits 10%, Highest Since 1992

During the second quarter, the vacancy rate at U.S. strip malls reached 10 percent, the highest level since 1992, [Reis] said. ... asking rent fell 1.7 percent from a year ago to $19.28 per square foot. Asking rent fell 0.7 percent from the prior quarter. It was the largest single-quarter decline since Reis began tracking quarterly figures in 1999.Sharply lower rents, higher vacancy rates, reduced leverage and much higher cap rates - Brian calls this the "neutron bomb for RE equity"; destroys CRE investors, but leaves the buildings still standing.

Employment: Men, Women, Positions and People

by Calculated Risk on 8/11/2009 10:30:00 AM

Saturday I posted a description of the differences between the Current Population Survey (CPS: commonly called the household survey), and the Current Employment Statistics (CES: payroll survey).

The CPS gives the total number of people employed (and unemployed), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

So if you wanted to compare the number of men vs. the number of women in the labor force, which survey would you use? Not the CES because that is a measure of positions, and a person working two jobs would be counted twice. Instead you'd want to use the CPS (a count of people, not positions).

However, Professor Casey Mulligan writes in the NY Times Economix: When Will Women Become a Work-Force Majority?

It is possible that, for the first time in American history, women will make up a majority of the labor force late this summer.Uh, no.

emphasis added

First Mulligan means "work force" or "employed", not percent of labor force (the labor force includes unemployed workers too).

But more importantly, Mulligan means women will hold a majority of the positions as measured by the CES. Remember the CES excludes self-employed and farm jobs, and those are probably largely male. And perhaps women are more likely to work two jobs (the CES counts that as two positions).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent of men and women in the U.S. labor force. The percentage have been pretty stready for the last 15 years, although the current recession is impacting men more than women.

According to the BLS, there are 10.1 million more men in the labor force than women, but only 7.4 million more men are working.

The unemployment rate for men (20 & over) is 9.8% compared to 7.5% for women. Including teens (16 & over), the unemployment rate for men is 10.5% compared to 8.1% for women.

Catherine Rampell at the NY Times Economix picks up Mulligan's error: The Mancession

Casey B. Mulligan noted, for example, that for the first time in American history women are coming close to representing the majority of the national work force.At least Rampell used "work force" instead of "labor force" but she repeats Mulligan's error. Women are coming close to holding a majority of payroll jobs, but not a majority of the work force or labor force. Back in February, Rampell phrased it better:

With the recession on the brink of becoming the longest in the postwar era, a milestone may be at hand: Women are poised to surpass men on the nation’s payrolls, taking the majority for the first time in American history.To belabor this point: Say there were 50 women and 100 men in the work force, and each women worked two jobs (men only one). The CES would report 200 payroll positions; half for men, and half for women. The CPS would report 150 people had jobs, 50 women and 100 men. Would it be correct to say there were as many women in the work force as men? No.

Both surveys have value, and I'm using this to make a point: The CES is about positions. The CPS is about people.

Congressional Oversight Panel Warns of Threat to Smaller Banks

by Calculated Risk on 8/11/2009 08:38:00 AM

From MarketWatch: Oversight panel: Losses could pose threat to small banks

According to a report from the Congressional Oversight Panel, which is charged with overseeing the $700 billion Troubled Asset Relief program, or TARP, the 18 largest financial institutions with over $600 million in assets would "be able to deal with" whole-loan portfolio losses.Here is the report: August Oversight Report: The Continued Risk of Troubled Assets

However, the report's analysis of troubled whole loans -- based on a model developed by SNL Financial -- suggests they pose a threat to smaller public banks, those with $600 million to $100 billion in assets.

The problem of troubled assets is especially serious for the balance sheets of small banks. Small banks‘ troubled assets are generally whole loans, but Treasury‘s main program for removing troubled assets from banks‘ balance sheets, the PPIP will at present address only troubled mortgage securities and not whole loans. The problem is compounded by the fact that banks smaller than those subjected to stress tests also hold greater concentrations of commercial real estate loans, which pose a potential threat of high defaults. Moreover, small banks have more difficulty accessing the capital markets than larger banks. Despite these difficulties, the adequacy of small banks‘ capital buffers has not been evaluated under the stress tests.The FDIC will stay very busy.

emphasis added

Monday, August 10, 2009

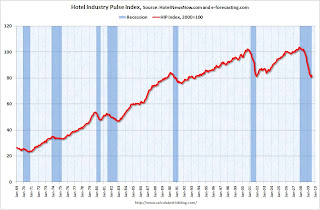

Hotel Industry Pulse Index Shows Slight Improvement in July

by Calculated Risk on 8/10/2009 11:58:00 PM

From HotelNewsNow.com: HIP increases by 1.6 in July; first sign of turning point

This morning, economic research firm e-forecasting.com, in conjunction with Smith Travel Research, announced that after 19 months of consecutive decline, HIP climbed 1.6 percent in July. HIP, the Hotel Industry’s Pulse index, is a composite indicator that gauges business activity in the US hotel industry in real-time. The latest increase brought the index to a reading of 82.2. The index was set to equal 100 in 2000.

...

“With HIP finally showing a slight improvement after 19 months of decline, it appears we may be seeing the light at the end of the tunnel” said Chad Church, Industry Research Manager at STR. “It will be important to monitor the pace of growth in the HIP over the second half of the year to see if July was an anomaly or a true turning point in this recession.”

...

The composite indicator is made with the following components: revenues from consumers staying at hotels and motels adjusted for inflation, room occupancy rate and hotel employment, along with other key economic factors that influence hotel business activity.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This index suggests that the cliff diving for the hotel industry might be over, although this is just one data point.

Over the last couple of years the hotel industry has been crushed. RevPAR (Revenue per available room) is off over 15% compared to the same period in 2008. And at the current occupancy and room rate levels, many hotels are losing money.

The end to cliff diving is not the same as new growth, but it is better than more cliff diving!

HIP historical data provided by HotelNewsNow.com and e-forecasting.com.

WaPo: Ailing States Face Bleak Outlook

by Calculated Risk on 8/10/2009 09:35:00 PM

From the WaPo: Stimulus Funds Bring Relief to States, but What About 2010?

As states across the country grapple with the worst economy in decades, most have cut services, forced workers to take unpaid days off, shut offices several days a month and scrambled to find new sources of revenue.The article discusses the budget situations for a number of states. But here is a little positive news from California State Controller John Chiang today:

The good news is that much of the pain this year has been cushioned by billions of dollars of federal stimulus money, which has allowed states and localities to avoid laying off teachers, prison guards, police officers and firefighters.

The bad news is that for the next fiscal year, beginning in July, the picture looks even bleaker. Revenue is expected to remain depressed, even if the national economy improves. There will be only half as much federal stimulus aid available, and many states have already used up their emergency reserves.

... When adjusting for Registered Warrants issued on personal income and corporate tax refunds, General Fund Revenue was 8% below July 2008. However, the pace of deterioration has slowed considerably relative to the 39.4%, 39%, and 17.7% deterioration in March, April, and May, respectively.

This slowing decline can be attributed to several factors ... First, the Governor signed a bill in October that imposes a 20% understatement penalty on corporate tax. Companies were given the option to avoid the penalty by filing an amended return and paying their actual tax liability by May 31, 2009. As a result, corporate taxes saw sharp increases as firms took action to avoid the penalty.

Second, the sales tax rate was increased on April 1 from 7.25% to 8.25%. This has helped to bolster the sales tax revenues collected by the State, which were up 20.8% from last July. Another policy change that has had a positive impact on California’s sales tax collections is the Federal Government’s “Cash for Clunkers” program. ... This program has been successful in boosting demand for new automobiles, and thus, generating additional tax revenues for California. Although this positive indicator is driven by economic incentives created by policy changes in Washington D.C. more than a genuine rebound in consumer activity, any encouraging signs in the economy were virtually nonexistent six months ago.

Auto Sales and the Unemployment Rate

by Calculated Risk on 8/10/2009 06:11:00 PM

On Saturday I posted a graph and some analysis of Housing Starts and the Unemployment Rate

Today I received a request for a similar graph of auto sales and the unemployment rate.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows light vehicles sales including SUVs and small trucks, and the unemployment rate (inverted - see right scale).

Light vehicle sales usually bottom sometime before the unemployment rate peaks - just like for housing starts. This makes sense since the usual two engines of recovery are housing and personal consumption. See Business Cycle: Temporal Order

New Market Graph

by Calculated Risk on 8/10/2009 04:20:00 PM

Click on graph for larger image in new window.

Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short sent me this new graph matching up the market bottoms (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Doug has probably jinxed the market!

New York Condo Shadow Inventory

by Calculated Risk on 8/10/2009 03:10:00 PM

From Crain's New York: Shadow units cast pall (ht Nick)

... In Manhattan in the first quarter, [condo] sales were halved from year-earlier levels even as more apartments flooded onto the market, leaving it choking on an 18.6-month supply of units. ...There are plenty of details in the article. This shadow inventory is a significant issue, especially in areas with high rise condos.

As bad as those figures look, they may actually overstate the health of the market. Industry experts point to a growing mountain of so-called shadow inventory that is not reflected in the data. This includes units that are held by developers in soon-to-be completed buildings, as well as those kept off the market by banks and by individual owners who are waiting for conditions to improve before they tack up “For Sale” signs.

“We are undercounting the housing stock,” says Jonathan Miller, chief executive of appraisal firm Miller Samuel Inc. ... In a report on Manhattan residential real estate this spring, Mr. Miller estimated that in addition to the 10,445 condominiums that showed up in unsold inventory, there were as many as 7,000 shadow units.

Just a reminder - the Census Bureau new home inventory report does not include high rise condos, so if these units are not listed, they are not counted anywhere.

Freddie Mac: Taylor Bean Losses could be "Significant"

by Calculated Risk on 8/10/2009 12:49:00 PM

From Bloomberg: Freddie Mac Says Its Loss From Taylor Bean May Be 'Significant'

Freddie Mac ... said the collapse of lender Taylor, Bean & Whitaker Mortgage Corp. may cause it “significant” losses.From the SEC filing:

...

The Ocala, Florida-based lender accounted for about 5.2 percent of Freddie Mac’s single-family mortgage purchases last year ... Freddie Mac can force lenders to repurchase defaulted loans that weren’t of the credit quality they represented, a use of its contracts already made harder by the collapses of IndyMac Bancorp., Washington Mutual Inc. and Lehman Brothers Holdings Inc., the company said.

...

Brian Faith, a spokesman for Fannie Mae, Freddie Mac’s Washington-based rival, said last week his company hasn’t done business with Taylor Bean “for some time.”

On August 4, 2009, we notified Taylor, Bean & Whitaker Mortgage Corp., or TBW, that we had terminated its eligibility, for cause, as a seller and servicer for us effective immediately. TBW accounted for approximately 5.2% and 2.7% of our single-family mortgage purchase volume activity for full-year 2008 and the six months ended June 30, 2009, respectively. We are in the process of determining our total exposure to TBW in the event it cannot perform its contractual obligations to us. The amount of our losses in such event could be significant.

Fed Poised to Halt Treasury Purchases Soon

by Calculated Risk on 8/10/2009 10:56:00 AM

The Fed has been a steady buyer of Treasury securities. It appears this program will end in September.

From the last FOMC statement:

[T]he Federal Reserve will buy up to $300 billion of Treasury securities by autumn.From Bloomberg last week: Fed Set to End Purchases, Two Former Governors Say

The Federal Reserve is set to halt its purchases of up to $300 billion in U.S. Treasuries in mid- September as scheduled, and will probably announce the decision next week, two former central bank governors said.

Click on graph for larger image in new window.

Click on graph for larger image in new window.According to the Cleveland Fed:

The New York Fed reports additional purchases of $7.0 billion on August 6 (mostly 7 year maturity), and $6.594 billion on August 10 (mostly 3 to 4 year).The Fed purchased $6.496 billion in Treasury securities on July 30, focused in the three–to-four year sector, and another $7.248 billion on August 5 with maturities between four and seven years. To date, the Fed has purchased $236 billion of Treasuries and will purchase up to $300 billion by autumn.

That puts the total Fed purchases at $250 billion of Treasuries, and the Fed will probably purchase $50 billion more - and then stop in September.

This will be an interesting sentence in the FOMC statement on Wednesday - and it will be interesting to see the reaction in the Treasury markets. The yield on the 10 year note is already creeping back up toward 4% (3.82% this morning), and that will push up mortgage rates.

Also from Bloomberg, on CRE and the Fed: Fed Focusing on Real-Estate Recession as Bernanke Convenes FOMC

The [CRE] industry is likely to be high on the agenda when Bernanke and his colleagues sit down in Washington tomorrow for the Federal Open Market Committee meeting on monetary policy. ... If nonresidential real estate remains in the doldrums, the Fed may be forced to leave emergency-lending programs in place and keep its benchmark interest rate close to zero for longer than some investors expect ...There is no question private nonresidential real estate will be under pressure from some time - this is no surprise.

More on Corus Bank

by Calculated Risk on 8/10/2009 09:01:00 AM

The following article is similar to the Chicago Tribune article last week, Corus Bankshares Inc. on cusp of crisis, but adds a little local color in Florida.

From the Miami Herald: Soured loans on South Florida condos sinking Corus Bankshares

Heavy with $182 million in construction loans, the long-awaited Trump International Hotel and Tower, a luxury hotel condominium in Fort Lauderdale beach, stands furnished, but empty, with not a single tenant inside.Also on potential bank failures, check out the Problem Bank Link (unofficial) I posted late Friday (Credit: surferdude808).

...

Close to foreclosure, the structure is part of Corus Bank's deeply troubled loan portfolio, which as of May 31 includes 14 outstanding condo loans in South Florida, of which 12 are over 90 days past due. At almost $1 billion, these South Florida construction loans form half of the $2 billion nonperforming loans across the United States that led Corus to warn last month that it may fail.

Corus is long past the June 18 deadline imposed by regulators to raise $390 million in capital, and many believe the Federal Deposit Insurance Corp. will seize the bank within a month -- once it finds a buyer.

...

According to Corus' financial statements, a key reason it lent so much money in Florida was ``the existence and strength of pre-sale contracts.'' Unlike most other states, Florida allows developers to sell condominium units before construction begins. Buyers generally put down a 20 percent deposit, of which half is used on construction costs. Essentially, these act as interest-free loans for the developers, who typically take out short-term loans from banks (like Corus) to build the condos. If the depositors walk away, however, developers are left with an empty building.

Sunday, August 09, 2009

CRE: Large SoCal Office Building Owner to Walk Away

by Calculated Risk on 8/09/2009 08:55:00 PM

From the WSJ: Maguire Properties Warns of Loan Defaults

Maguire Properties Inc., one of the largest office-building owners in Southern California, is planning to hand over control of seven buildings with some $1.06 billion in debt to creditors ...All of these buildings have negative cash flow with rising vacancies and falling rents. This is more losses for the lenders (or CMBS investors for six of these buildings).

Maguire ... notified the buildings' mortgage holders Friday that it expected "imminent default" on the loans.

The seven buildings, with 4.2 million square feet, make up about 20% of Maguire's portfolio. ... The company still has $3.5 billion in debt, and some analysts say that amount exceeds the value of its remaining properties. "Almost every building in [Maguire's] portfolio is under water," says Michael Knott, an analyst with Green Street Advisors.Maquire also owned the building recently built for subprime mortgage broker New Century in Irvine, and sold that building a couple of months ago for a substantial discount to construction costs.

Krugman: Reappoint Bernanke

by Calculated Risk on 8/09/2009 05:53:00 PM

From Bloomberg: Bernanke Should Be Appointed to a Second Term, Krugman Says

“He’s earned the right to a second term,” [Princeton University Economist Paul Krugman] ... said yesterday in an interview in Kuala Lumpur. “He turned the Fed into the financial intermediary of last resort. When the banking system failed to deliver capital where it was needed, he put the Fed into the markets.”Stiglitz is unsure: Stiglitz Says U.S. Facing a ‘Very Slow’ Recovery From Recession

...

“I think Bernanke has done a really good job,” Krugman said. “He failed to see this coming and he was behind the curve in early phases. But he’s been really very good in the sense that it’s really very hard to see how anyone could have done more to stem this crisis.”

When asked whether Bernanke should be reappointed so he can remain Fed chief after his current term expires Jan. 31, Stiglitz replied: “That’s a hard question.” A replacement is “something we ought to consider,” he said.And more from a couple of weeks ago: The Bernanke Reappointment Tour (Roubini says yes, Thoma says yes, and I'm uncertain).

Research on Homeownership Rate through 2030

by Calculated Risk on 8/09/2009 02:03:00 PM

Professor Arthur C. Nelson, Director of the Metropolitan Research Center at the University of Utah, has kindly sent me his new paper: "The New Urbanity: The Rise of a New America" (no link). Nelson sees a dramatic shift in American cities based on changes in demographics and in housing peferences. He believes this will lead to a "new era of infill and redevelopment."

Nelson also argues this will lead to a decline in the homeownership rate.

Note: Brief excerpts of Dr. Nelson's paper removed by request. This graph shows the homeownership by age group for three different time periods: 1985, 2000, and 2007. Back in 1985, the homeownership rate declined significantly after people turned 70. However, more recently, the homeownership rate has stayed above 80% for those in the 70 to 75 cohort, and close to 80% for people over 75.

This graph shows the homeownership by age group for three different time periods: 1985, 2000, and 2007. Back in 1985, the homeownership rate declined significantly after people turned 70. However, more recently, the homeownership rate has stayed above 80% for those in the 70 to 75 cohort, and close to 80% for people over 75.

I noted in April:

I expect the homeownership rate to remain high for the boomer generation too. Although there will probably be a geographic shift as the boomer generation retires (towards the sun states) and some downsizing, I don't think the aging of the boomer generation will negatively impact the homeownership rate for 15 years or more.So Dr. Nelson is coming to a different conclusion. He thinks the homeownership rate will fall to 63.5% by 2020, and I think it will stay a little higher as many older couples and singles stay in their homes.

This has significant implications for planning and homebuilders. If Nelson is correct, there will be a dramatic shift towards a "new urbanity" and away from suburbs. And also a shift towards more renting.

Professor Nelson sent me this projection:

| Home Tenure | 2005 | 2020 | Change | Percent Change in Supply | Share of Change in Supply | Tenure 2005 | Tenure 2020 |

|---|---|---|---|---|---|---|---|

| Owner-Homes (occupied and vacant) | 74,164 | 87,135 | 12,971 | 17% | 43% | 68.90% | 63.50% |

| Renter-Homes (occupied and vacant) | 35,903 | 53,254 | 17,351 | 48% | 57% | 31.10% | 36.50% |

| Total | 110,067 | 140,389 | 30,322 | ||||

| Source: Arthur C. Nelson, Director, Metropolitan Research Center | |||||||

Notice the shift to rental units in Nelson's projections. Nelson does note that there were over 2 million excess units in 2005, and that needs to worked off first. Nelson is projecting a need for 30 million new housing units over the next 15 years (I think this is high, but Nelson is expecting many more single person households).

This has huge implications for builders. Using Nelson's figures, home builders will only have to build about 800 thousand (on average) single family units per year through 2020 (after the excess is worked off). This is far below the 1.25 million per year seen in 2004 and 2005. That level of production is not coming back. Here is something I wrote in 2007: Home Builders and Homeownership Rates

[With the rising homeownership rate] the homebuilders was ... had the wind to their backs. Instead of 800K of new owner demand per year (plus replacement of demolished units, and second home buying), the homebuilders saw an additional 500K of new owner demand during the period 1995 to 2005. This doesn't include the extra demand from speculative buying. Some of this demand was satisfied by condo conversions and owner built units ...I think Nelson is correct about the trend, but might be overestimating the shift towards renting. Also I think using age 75 would be better for figure 1, so I think this shift will be delayed by about 10 years.

Looking ahead, if the homeownership rate stays steady, the demand for net additional homeowner occupied units would fall back to 800K or so per year (assuming steady population growth and persons per household). However the homeownership rate is declining, and this is now a headwind for the builders.

It appears the rate is declining at about 0.33% per year (Goldman's Hatzius estimated 0.5% per year). This would mean the net demand for owner occupied units would be 833K minus about 333K or 500K per year - about 40% of the net demand for owner occupied units for the period 1995 to 2005.

This means the builders have two problems over the next few years: 1) too much inventory, and 2) demand will be significantly lower over the next few years than the 1995-2005 period, and even when the homeownership rate stabilizes and the inventory is reduced, demand (excluding speculation) will only be about 2/3 of the 1995-2005 period.

Krugman: "Great free fall seems to be over"

by Calculated Risk on 8/09/2009 10:57:00 AM

From Bloomberg: U.S. Economy May Have Reached ‘Trough,’ Krugman Says

“It’s quite possible, though not certain, that retrospectively, we’ll say that the recession ended in July or August, maybe September,” Krugman said. “My guess is that we’ve bottomed out now, that August was probably the trough month.”The free fall may be over, but there are few green shoots at the bottom of the cliff.

...

A second stimulus package for the economy is still needed, and should be directed at state and local governments as well as infrastructure spending, he said in an interview in Kuala Lumpur. The world economy may face several years of weak growth without falling into a “double-dip” recession, he said.

...

“What we’re seeing is stabilization,” Krugman said. “We’re seeing that the great freefall and the nosedive seems to be over. It’s leveling out but that is very different from returning to normality.”

Saturday, August 08, 2009

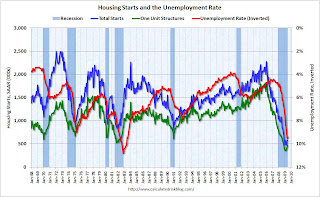

Housing Starts and the Unemployment Rate

by Calculated Risk on 8/08/2009 11:22:00 PM

Reader Mark sent me a link to a talk by Jon Fisher, a professor at the University of San Francisco School of Business. Jon made the point that housing starts and unemployment are inversely correlated.

Of course readers here know that housing lead the economy, and employment lags. So naturally housing and unemployment are inversely correlated with a lag.

Note: Dr. Leamer's Sept 2007 paper: Housing is the Business Cycle is an excellent overview of how housing leads the economy. (Something I covered extensively in 2005) Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows housing starts (both total and single unit) and unemployment (inverted).

You can see both the correlaton and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

This suggests unemployment might peak in Spring 2010.

Professor Fisher argued that unemployment will rise to about 10.4% and then fall rapidly. He is basing the rapid decline on a "V shaped" housing recovery similar to previous recessions. I disagree with that point.

In most earlier recessions, the slumps were caused by the Fed raising interest rates to fight inflation. When the Fed cut rates, housing bounced back sharply (V shaped).

Although this recession was led by a housing bust - and that makes it look similar to some previous periods - this recession was not engineered by the Fed raising rates, rather it was the busting of the credit and housing bubbles, and all the related problems that led the economy into recession. Since there is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think Fisher's forecast for a rapid decline in unemployment is also unlikely.

Jobs and the Unemployment Rate

by Calculated Risk on 8/08/2009 07:10:00 PM

FAQ: How can the unemployment rate fall if the economy is losing net jobs, especially since the population is growing?

This data comes from two separate surveys. The unemployment Rate comes from the Current Population Survey (CPS: commonly called the household survey), a monthly survey of about 60,000 households.

The jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of approximately 400,000 business establishments nationwide.

These are very different surveys: the CPS gives the total number of employed (and unemployed including the alternative measures), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

A couple of key concepts (from the BLS):

The CES employment series are estimates of nonfarm wage and salary jobs, not an estimate of employed persons; an individual with two jobs is counted twice by the payroll survey. The CES employment series excludes workers in agriculture and private households and the self-employed.And the CPS:

emphasis added

The CPS estimate of employment is for the total number of employed persons. Included are categories of workers that are not covered by the Current Employment Statistics (CES) survey: self-employed persons, private household workers, agriculture workers, unpaid family workers, and workers on leave without pay during the reference period. Multiple jobholders are counted once in the estimate of total employed.So in July, the headline CES number showed a loss of 247,000 non-farm private jobs (by the definitions above). The CPS showed a decline of 155,000 employed people.

Unemployed persons include those who did not have a job during the reference week, had actively looked for work in the prior 4 weeks, and were available for work. Actively looking for work includes activities such as contacting a possible employer, contacting an employment agency or employment center, having a job interview, sending out resumes, filling out job applications, placing or answering job advertisements, and checking union or professional registers.

These two surveys are almost always different, and both are useful.

But the unemployment rate fell, even though the CPS showed a decline in employed people. How can that be?

The CPS also showed a decline in the Civilian Labor Force Level by 422,000. And a decline in the number of unemployed people (U-3) of 267,000.

The unemployment rate is a ratio, with the numerator the number of unemployed, and the denominator the Civilian Labor Force - so these changes in both number lowered the unemployment rate to 9.4%.

If you want more details, see Monthly Employment Situation Report: Quick Guide to Methods and Measurement Issues

Although the CPS showed the labor force declined in July, over time the labor force will continue to grow - probably around 1.5 to 2.0 million people per year on average (once the economy starts to recover), and the CES will probably need to show the addition of around 125,000 jobs per month just to keep the unemployment rate steady (estimates vary of this number).

So remember, the jobs and unemployment rate come from two different surveys and are different measurements (one for positions, the other for people). Some months the numbers may not seem to make sense (lost jobs and falling unemployment rate), but over time the numbers will work out.

Another Apartment-to-Condo Conversion Disaster

by Calculated Risk on 8/08/2009 03:47:00 PM

From the Las Vegas Sun:

The worst investment over the past year was apartment conversions ... [Larry Murphy, president of SalesTraq] said.And the lender for the purchase and conversion of the Meridian? Corus Bank. From 2005:

The worst of the that segment was the Meridian at Hughes Center on Flamingo Road, east of the Strip that was converted from apartments to condominiums between 2005 and 2007, Murphy said.

The property, which had a failed attempt at trying to convert into a condo-hotel because of Clark County regulations, sold for $604 per square foot when it first entered the market. The average price was $539,000, Murphy said.

Through June, the average resale price has fallen to $87,611 or $121 a square foot, Murphy said. With that drop in price has come rising foreclosures. Murphy reports that 201 of the 680 units or 30 percent have been foreclosed upon, and that number is likely to rise. The foreclosures have been running as high as 25 a month so far in 2009, he said.

Murphy said he’s not surprised apartment conversions have fared the worst because in essence some are 20-year-old buildings that have a new granite countertop.

The Meridian consists of five four-story buildings containing 592,680 residential square feet.Not only has the average price fallen 84%, but the current average sales price of $121 per sq ft is significantly below the price of the loan amount from Corus in 2005 (of $188 per sq ft) - before the granite counter top improvements.

Corus ... felt comfortable with the market as this large conversion represents the Bank’s 8th transaction in the Las Vegas area within the last 13 months. “The Meridian appears to be a natural candidate for a condo conversion ...” said John Markowicz, Corus Bank Senior Vice President.

The Meridian appears to be a natural candidate for reconversion back to apartments.