by Calculated Risk on 8/14/2009 08:34:00 AM

Friday, August 14, 2009

CPI Flat, BLS Rent Measures Decline Slightly

From the BLS: Consumer Price Index Summary

On a seasonally adjusted basis, the CPI-U was unchanged in July following a 0.7 percent increase in June ... The index for all items less food and energy [Core] rose 0.1 percent in July following a 0.2 percent increase in June.Not only is the index for lodging off sharply, but the BLS measures for rent declined slightly (rounded to flat). Owners' equivalent rent (OER) is the largest component of CPI, and even though rents have been falling in most areas, OER was still increasing. The decline in July OER was very small, but it is a start.

...

The index for shelter fell 0.2 percent and the household energy index declined 0.3 percent. Within the shelter group, the indexes for rent and owners' equivalent rent were both unchanged in July after rising 0.1 percent in June. The index for lodging away from home turned down in July, falling 2.1 percent after increasing 0.3 percent in June, and has fallen 8.9 percent over the past 12 months.

Over the last 12 months, CPI has fallen 2.1 percent, the largest 12 month decline since 1950.

Thursday, August 13, 2009

Judge Rules for BofA Against Colonial Bank, New Cease & Desist Disclosed

by Calculated Risk on 8/13/2009 10:36:00 PM

Form Bloomberg: Bank of America Wins Order on Colonial Bank Assets

U.S. District Judge Adalberto Jordan in Miami issued the order after Bank of America sued Colonial yesterday in Miami, claiming Colonial is holding the cash and loans as a custodian for Ocala Funding Inc. The order notes that the suit relates to more than 6,000 mortgages worth more than $1 billion.In another action, from Ocala.com: Judge ties up over $4 million in Taylor Bean account

“To the extent that the interests of the public are implicated in this case, they weigh in favor of requiring Colonial to honor its contractual obligations and avoiding what would amount to a $1 billion heist,” the judge said in an order posted online today.

[Henley Holdings LLC] filed suit in the U.S. District Court for the Middle District of Florida, accusing Taylor Bean of breach of contract. It also sought temporary injunctive relief, asking the court to force Taylor Bean to immediately deposit the $4.7 million into an account at a separate bank.What is interesting about the second action is that apparently Colonial Bank disclosed a new FDIC Cease & Desist order dated Aug. 11th. I'm told the FDIC order instructs Colonial to obtain FDIC approval for most activities, requires "prompt and unrestricted access" to all bank documents and employees, and requires proceduces to prevent the destruction of any bank documents.

Henley was worried because Taylor Bean had essentially shut its doors, and because if Colonial failed, only $250,000 of Henley money would be covered by FDIC insurance.

That same day, a federal judge granted Henley's request and ordered at least $4.4 million of the company's funds put into an interest-bearing account within the court registry.

Court records show that Taylor Bean turned over that amount the next day.

Illinois Foreclosures: Increasing Again, Impacting 'more-affluent areas'

by Calculated Risk on 8/13/2009 08:50:00 PM

In early April, a Homeowner Protection Act was signed into law in Illinois that delayed foreclosures for a short period. Foreclosure filings plummeted for a couple of months, but filings are now increasing again.

From the Chicago Tribune: Foreclosure actions delayed in spring move into system in summer

Initial notices of default, the first legal step in the foreclosure process, dropped substantially in the six-county Chicago area during the past three months, largely because of a 70 percent drop in filings over a 30-day period begun in early April, according to a midyear report from Chicago-based think tank Woodstock Institute. However, foreclosure efforts appear to again be on the rise.The low end areas will always have the most foreclosures, but foreclosure activity is picking up in the mid-to-high end areas. But where will the buyers come from in the mid-to-high end areas?

In April, default notices were recorded on 5,539 homes in the Chicago area. After plummeting to 1,694 notices in May, default filings rose to 3,468 in June, Woodstock found.

...

Woodstock's data also shows that lower-income areas continue to have a higher raw number of foreclosures, but more-affluent areas are posting the bigger percentage gains in foreclosure activity. ...

Last month [according to RealtyTrac], 14,524 Illinois properties, 35 percent more than in June, received notices of initial default, sheriff sale and bank repossessions. During July, 6,770 Illinois homeowners were served with initial notices of default. That compares with 3,648 default notices in June, 3,139 notices in May and 6,407 notices in April. Bank repossessions, which increase the number of foreclosed homes for sale, also jumped. Lenders repossessed 3,700 Illinois homes last month.

First time buyers in affluent areas? I don't think so.

Investors looking for cash flow? The number don't work.

Move-up buyers selling their homes? A large number of sellers at the low-to-mid end are lenders ...

American CoreLogic: More than 15.2 Million Mortgage Holders Underwater

by Calculated Risk on 8/13/2009 06:05:00 PM

The First American CoreLogic Negative Equity Report for June 2009 is available on line. You have to sign up to read the report.

More than 15.2 million U.S. mortgages or 32.2 percent of all mortgaged properties were in negative equity position as of June 30, 2009 according to newly released data from First American CoreLogic. June’s negative equity share was slightly lower than the 32.5 percent as of the end of March 2009 and it reflects the recent flattening of monthly home price changes. As of June 2009, there were an additional 2.5 million mortgaged properties that were approaching negative equity and negative equity and near negative equity mortgages combined account for nearly 38 percent of all residential properties with a mortgage nationwide. The aggregate property value for loans in a negative equity position was $3.4 trillion, which represents the total property value at risk of default. In California, the aggregate value of homes that are in negative equity was $969 billion, followed by Florida ($432 billion), New Jersey ($146 billion), Illinois ($146 billion) and Arizona ($140 billion). Los Angeles had over $310 billion in aggregate property value in a negative equity position, followed by New York ($183 billion), Miami ($152 billion), Washington DC ($149 billion) and Chicago ($134 billion). ... Nevada (66 percent) had the highest percentage with nearly two‐thirds of mortgage borrowers in a negative equity position. In Arizona (51 percent) and Florida (49 percent), half of all mortgage borrowers were in a negative equity position. Michigan (48 percent) and California (42 percent) round out the top five states.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the percent of households with mortgages underwater by state (and near negative equity defined as with less than 5% equity).

UPDATE: States with no data from CoreLogic: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia, Wyoming.

The high population states of California and Florida account for almost 35% of all borrowers underwater, but this graph shows the problem is widespread.

California to Stop Issuing IOUs a Month Early

by Calculated Risk on 8/13/2009 04:28:00 PM

Update: Actual statement from Chiang: " ... to stop issuing IOUs on September 4, almost one month earlier than expected. ... the Controller will ask the board to approve a redemption date of September 4, which is almost one month earlier than the October 2 maturity date printed on the IOUs."

From Tom Petruno at the LA Times: California plans to pay off IOUs beginning Sept. 4

California expects to begin redeeming outstanding IOUs on Sept. 4, a month earlier than expected, thanks to cash savings from budget cuts, state Controller John Chiang announced today.And by popular request ...

He said the state also will need $10.5 billion in short-term loans from investors to get through the fiscal year ending next June 30.

...

The borrowing plan and the savings from the slashed state budget "should provide sufficient cash to meet all of California’s payment obligations through the fiscal year," Chiang said in a statement.

Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Hotel RevPAR off 16.5 Percent

by Calculated Risk on 8/13/2009 01:51:00 PM

From HotelNewsNow.com: STR reports US performance for week ending 8 August 2009

In year-over-year measurements, the industry’s occupancy fell 7.5 percent to end the week at 65.9 percent. Average daily rate dropped 9.7 percent to finish the week at US$97.32. Revenue per available room for the week decreased 16.5 percent to finish at US$64.10.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 7.3% from the same period in 2008.

The average daily rate is down 9.7%, and RevPAR is off 16.5% from the same week last year.

Comments: This is a multi-year slump. Although the occupancy rate was off 7.5 percent compared to last year, the occupancy rate is off about 11 percent compared to the same week in 2007.

As I noted last week, the end of July and beginning of August is the peak leisure travel period. The peak occupancy rate for 2009 was probably three weeks ago at 67%.

As I noted last week, the end of July and beginning of August is the peak leisure travel period. The peak occupancy rate for 2009 was probably three weeks ago at 67%.And that is far below normal ... and it is all downhill from here for the rest of the year.

Note: Graph doesn't start at zero to better show the change.

Business travel is off much more than leisure travel, so the summer months are not as weak as other times of the year. September will be the real test for business travel.

Meanwhile supply is still growing at about 3% this year, see here:

STR projects that at the end of 2009, supply will be up 3.0 percent, demand will be down 5.5 percent, occupancy will decline 8.4 percent, average daily rate will drop 9.7 percent, and revenue per available room will be down 17.1 percent.

BofA Sues Colonial for $1 Billion

by Calculated Risk on 8/13/2009 11:31:00 AM

From Reuters: Bank of America sues Colonial for $1 bln in loans, cash

Bank of America Corp sued Colonial BancGroup Inc for more than $1 billion in loans and cash ... Bank of America, which was the collateral agent for certain loans of Ocala Funding LLC, said Colonial refused to return more than $1 billion of loans and cash which it held as a custodian, agent and bailee. Ocala Funding was a commercial paper vehicle sponsored by Taylor, Bean & Whitaker Mortgage Corp (TBW)....It appears the FDIC is doing a little housekeeping (SEC 8-K filing):

Bank of America sought an emergency injunctive relief in a complaint filed with a U.S. federal court in Florida on Wednesday. ... The case is In re : Bank of America National Association vs Colonial Bank and John Doe, U.S. District Court, Southern District of Florida, Miami Division 1:09-cv-22384-AJ.

Colonial Bank ... received notice on August 10, 2009 from the Federal Deposit Insurance Corporation ... directing CBG Florida REIT Corp., an indirect subsidiary of the Bank, to exchange all outstanding shares of its Fixed-to-Floating Rate Perpetual Non-cumulative Preferred Stock, Class A, Series A ... for an equal amount of Fixed-to-Floating Rate Perpetual Non-cumulative Preferred Stock, Series A of BancGroupColonial appears to be in tatters, and my guess is the FDIC will seize the bank, before they find a buyer for the assets, and operate the bank as conservator. (like with IndyMac last year).

Report: Record Foreclosure Activity in July

by Calculated Risk on 8/13/2009 10:09:00 AM

RealtyTrac ... today released its July 2009 U.S. Foreclosure Market Report™, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 360,149 U.S. properties during the month, an increase of nearly 7 percent from the previous month and an increase of 32 percent from July 2008. The report also shows that one in every 355 U.S. housing units received a foreclosure filing in July.Something to remember: questions have been raised before about the RealtyTrac numbers (see Foreclosure numbers don’t add up), and RealtyTrac has only been tracking these numbers since 2005. For California, I use the DataQuick numbers for NOD activity (released quarterly), and available since the early '90s - but that is just one state.

“July marks the third time in the last five months where we’ve seen a new record set for foreclosure activity,” noted James J. Saccacio, chief executive officer of RealtyTrac. “Despite continued efforts by the federal government and state governments to patch together a safety net for distressed homeowners, we’re seeing significant growth in both the initial notices of default and in the bank repossessions.”

Retail Sales Decline Slightly in July

by Calculated Risk on 8/13/2009 08:31:00 AM

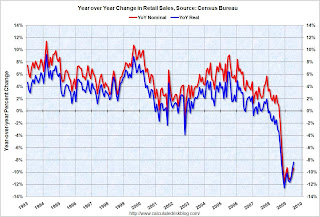

On a monthly basis, retail sales decreased 0.1% from June to July (seasonally adjusted), and sales are off 8.3% from July 2008 (retail ex food services decreased 9.3%).

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (July PCE prices were estimated as the average increase over the previous 3 months).

Real retail sales declined by 8.4% on a YoY basis. The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, and may have bottomed - but at a much lower level.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for July, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $342.3 billion, a decrease of 0.1 percent (±0.5%)* from the previous month and 8.3 percent (±0.7%) below July 2008. Total sales for the May through July 2009 period were down 9.0 percent (±0.5%) from the same period a year ago. The May to June 2009 percent change was revised from +0.6 percent (±0.5%) to +0.8 percent (±0.2%).Maybe the cliff diving is over, but retail sales are still at the bottom of the cliff ...

Weekly Unemployment Claims Increase

by Calculated Risk on 8/13/2009 08:30:00 AM

The DOL reports weekly unemployment insurance claims increased to 558,000:

In the week ending Aug. 8, the advance figure for seasonally adjusted initial claims was 558,000, an increase of 4,000 from the previous week's revised figure of 554,000. The 4-week moving average was 565,000, an increase of 8,500 from the previous week's revised average of 556,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Aug. 1 was 6,202,000, a decrease of 141,000 from the preceding week's revised level of 6,343,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 8,500 to 565,000, and is now 93,750 below the peak of 18 weeks ago. It appears that initial weekly claims have peaked for this cycle.

The number is still very high (at 558,000), indicating significant weakness in the job market. The four-week average of initial weekly claims will probably have to fall below 400,000 before the total employment stops falling.

The DOL report shows seasonally adjusted insured unemployment at 6.2 million, down from a peak of about 6.9 million. This raises the question of how many unemployed workers have exhausted their regular unemployment benefits (Note: most are still receiving extended benefits, although this is about to change).

The monthly BLS report provides data on workers unemployed for 27 or more weeks, and here is a repeat of that graph ...

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce. According to the BLS, there are almost 5.0 million workers who have been unemployed for more than 26 weeks (and still want a job). This is 3.2% of the civilian workforce.

It is more difficult to calculate the number of workers who have exhausted their extended claims, but that number is expected to rise sharply over the next few months.

Jim the Realtor: Investor Watch

by Calculated Risk on 8/13/2009 12:35:00 AM

Jim doesn't think much of this deal ...

Wednesday, August 12, 2009

National Data: Distressed Sales and Types of Buyers

by Calculated Risk on 8/12/2009 07:13:00 PM

Here is some national data on the number of distressed sales in Q2, and the types of homebuyers. This is from a survey by Campbell Communications (excerpted with permission).

Source: Summary Report--Real Estate Agents Report on Home Purchases and Mortgages, Campbell Communications, June 2009 Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Campbell survey broke REOs down into damaged and move-in ready.

According to this national survey of real estate agents, over 63% of sales were distressed sales in Q2. This is higher than the numbers reported by NAR. From NAR:

Distressed properties ... accounted for 31 percent of sales in June ... Distressed properties, which declined to 33 percent of all sales in May from 45 percent in April ...The Campbell numbers seem high to me. In Sacramento over 70% of sales in June were distressed, and I'd expect that area to well above the national level. But the NAR numbers seem low.

The second graph breaks out sales by buyer type.

The second graph breaks out sales by buyer type.According to the Campbell survey over 70% of sales in Q2 were to first-time buyers and investors.

Although we don't have historical data for distressed properties - or buyer types - this does suggest a market that is far from normal with few move-across or move-up buyers.

California AG Cracks Down on Loan Modifiers

by Calculated Risk on 8/12/2009 04:39:00 PM

From California AG Jerry Brown: Brown Orders Mortgage Foreclosure Consultants to Post $100,000 Bond or Face Prosecution (ht Matt at O.C. Register)

Threatening possible criminal and civil prosecution, Attorney General Edmund G. Brown Jr. today ordered 386 mortgage foreclosure consultants to post $100,000 bonds and register with his office.And check out some of this advertising that Brown demanded loan consultants substantiate:

He also ordered more than two dozen companies to justify suspicious loan modification claims made in "slick advertising," online and through the mail.

...

Brown has sent letters directing 386 mortgage foreclosure consultants to register with his office within 10 days and post $100,000 bond, or demonstrate why they are not required to. If the consultants are required to register and have failed to do so, they are subject to criminal penalties of up to a year in jail and fines ranging from $1,000 to $25,000 per violation. Eighty-five of these consultants are based in Los Angeles County, 133 in Orange County, 47 in the Inland Empire, 68 in San Diego County and seven in the Bay Area.

...

The State Bar of California today announced that it has obtained resignations from two lawyers and filed charges against a third for their loan modification activities.

· Brown directed Irsfeld, Irsfeld & Younger, LLP as corporate counsel for JL Richman, doing business as Home Retention Programs of Glendale, Calif. to substantiate its claims including: "Our team has 10 years of success in negotiating 90% of all mortgage loan modification requests to a successful outcome….For the modification requests we accept, our modification failure rate is less than 1%."The tips on avoiding scams can't be repeated enough.

· Brown directed 21st Century Real Estate Investment Corporation of Rancho Cucamonga to substantiate its written solicitations including: "[y]our proposed loan modification is a 30 year fixed/3.5% interest rate with a monthly payment of $495. Your monthly savings is $705. Total savings over a 30-year period is $253,800. . . . Your first payment will be negotiated to begin March 2009 - payable to your current lender for $495."

· Brown directed Mortgage Modification Solutions of Irvine to substantiate its claims including: "Our services are due to the FEDERAL MANDATE which makes it mandatory for mortgagees, upon the default of a single family mortgage, to engage in loss mitigation actions" and "Why $3995.00 is nothing compared to what you can accomplish in return? #1- It's 10 times more expensive to hire a CPA or a Financial Advisor to exclusively analyze & Research your financial affairs to create a plan acceptable to the Banking standards."

· Brown directed Alliance Law Center of San Diego to substantiate its letters to consumers stating: "Final Notice: 3/11/09, our review of certain information indicates you may be a victim of federal disclosure violations and/or predatory lending violations, therefore your loan may be invalid, and you may qualify for a loan modification saving you thousands of dollars."

FOMC Statement

by Calculated Risk on 8/12/2009 02:15:00 PM

Information received since the Federal Open Market Committee met in June suggests that economic activity is leveling out. Conditions in financial markets have improved further in recent weeks. Household spending has continued to show signs of stabilizing but remains constrained by ongoing job losses, sluggish income growth, lower housing wealth, and tight credit. Businesses are still cutting back on fixed investment and staffing but are making progress in bringing inventory stocks into better alignment with sales. Although economic activity is likely to remain weak for a time, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.

The prices of energy and other commodities have risen of late. However, substantial resource slack is likely to dampen cost pressures, and the Committee expects that inflation will remain subdued for some time.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. As previously announced, to provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of up to $1.25 trillion of agency mortgage-backed securities and up to $200 billion of agency debt by the end of the year. In addition, the Federal Reserve is in the process of buying $300 billion of Treasury securities. To promote a smooth transition in markets as these purchases of Treasury securities are completed, the Committee has decided to gradually slow the pace of these transactions and anticipates that the full amount will be purchased by the end of October. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is monitoring the size and composition of its balance sheet and will make adjustments to its credit and liquidity programs as warranted.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Donald L. Kohn; Jeffrey M. Lacker; Dennis P. Lockhart; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

emphasis added

A little Fed Preview

by Calculated Risk on 8/12/2009 01:08:00 PM

I just reread the previous Fed statement to refresh my mind on a few key sentences. Here is the statement from the June 24th meeting.

On the Fed funds rate, I expect no change to this sentence: "The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period."

But I expect some changes to the economic conditions paragraph. The key phrase last month was "the pace of economic contraction is slowing", and it will be interesting to see if the Fed sees the end of contraction now.

As I noted last week, the $300 billion program to buy Treasury securities is almost over, so there will probably be a comment on this program. More in an hour ...

Distressed Sales and Financing: Sacramento as Example

by Calculated Risk on 8/12/2009 10:00:00 AM

Just using Sacramento as an example ... I wish the NAR broke out the data like this! Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (normal resales), and distressed sales (Short sales and REO sales). Here is the July data.

They started breaking out REO sales last year, but this is only the second monthly report with short sales. Over two thirds of all resales (single family homes and condos) were distressed sales in July.

Total sales in July were off 7% compared to July 2008; the second month in a row with declining YoY sales.  The second graph breaks out sales by financing type for each July since 2002. (July 2004 was missing, June was used).

The second graph breaks out sales by financing type for each July since 2002. (July 2004 was missing, June was used).

This shows the significant shift to FHA loans and cash buyers (usually investors). Speculators used conventional loans during the bubble, but now cash flow investors are mostly buying with cash.

This suggests most of the activity in distressed bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credits), and investors paying cash.

Investors and first-time home buyers will be buying mostly in the low-to-mid priced areas. Inventories are down in the low priced areas, but with 67% distressed sales, there will be few move-up buyers for the higher priced areas.

Trade Deficit Increases in June

by Calculated Risk on 8/12/2009 08:30:00 AM

The Census Bureau reports:

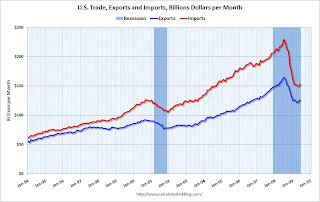

The ... total June exports of $125.8 billion and imports of $152.8 billion resulted in a goods and services deficit of $27.0 billion, up from $26.0 billion in May, revised. June exports were $2.4 billon more than May exports of $123.4 billion. June imports were $3.5 billion more than May imports of $149.3 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through June 2009.

Imports were up in June, mostly because of a spike in oil prices. Exports also increased in June. On a year-over-year basis, exports are off 22% and imports are off 31%.

The second graph shows the U.S. trade deficit, with and without petroleum, through June.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Import oil prices increased to $59.17 in June - up about 50% from the prices in February - and the fourth monthly increase in a row. Import oil prices will rise further for July and August.

It appears the cliff diving for U.S. trade might be over - especially for U.S. exports.

Tuesday, August 11, 2009

WSJ: JPMorgan Offering 23 Office Properties For Sale

by Calculated Risk on 8/11/2009 11:48:00 PM

From the WSJ: Feeling Roomy, J.P. Morgan Shops Its Space (ht BR)

J.P. Morgan Chase & Co. is marketing 23 office properties ... with a combined 7.1 million square feet of space, includes four notable towers: One Chase Manhattan Plaza, near Wall Street; Four New York Plaza, also in the Financial District; the former headquarters of Washington Mutual in a downtown Seattle skyscraper that also houses the city's art museum; and a landmarked 1929 Art Deco building in Houston, the former headquarters of Texas Commerce Bank.JPMorgan acquired most of this office space as part of recent acquisitions.

The portfolio is believed to be the largest single portfolio of office properties to hit the market this year and could raise more than $1 billion.

And a great quote:

"Vacant space right now is not ideal," said David Aubuchon, an analyst with Robert W. Baird & Co. ...No kidding! Not in a period with rapidly rising office vacancy rates.

Note: Aubuchon is comparing to a few years ago when vacant space was considered valuable by some CRE investors under the assumption that rents would increase sharply.

More Possible Bidders for Guaranty Bank

by Calculated Risk on 8/11/2009 10:32:00 PM

From Bloomberg: Blackstone, U.S. Bancorp, Ford May Bid for Ailing Guaranty Bank

Blackstone Group LP, Gerald Ford’s Flexpoint and U.S. Bancorp are considering bids for assets of Guaranty Financial Group Inc., the Texas lender that said last month it will probably fail, people familiar with the situation said.Soon.

...

Guaranty, whose backers include billionaire Carl Icahn and Omni Hotels owner Robert Rowling, would be the biggest bank to collapse this year and the largest failure since the seizure last September of Washington Mutual Inc.

And on Colonial Bank from The Birmingham News: Alabama State Banking Board meets; can't say if Colonial Bank a topic

A meeting of the Alabama State Banking Board that was to be held Wednesday regarding the future of Montgomery-based Colonial BancGroup has been canceled.Guaranty, with over $14 billion in assets, will probably not be the largest bank to fail for very long. Colonial had over $26 billion in assets according to their most recent filing.

The board met on Monday, said Elizabeth Bressler, general counsel for the Alabama State Banking Department. Under Alabama law, she said she could not comment on what happened at that meeting or whether it involved Colonial.

Corus only has about $7.6 billion in assets.

Report: Record Number of California Foreclosures Scheduled For Sale

by Calculated Risk on 8/11/2009 07:23:00 PM

From ForeclosureRadar: Record Number of Foreclosures Scheduled For Sale

[F]oreclosure stats were mixed, with Notice of Default filings flat, Notice of Trustee Sale filings rising by 31.6 percent and foreclosure sales dropping 22.7 percent. The number of properties scheduled for foreclosure sale – new Notices of Trustee Sale minus those sales that have cancelled or sold – rose to a record level ...Whether or not there is a flood of foreclosures soon appears to depend on the loan mods. Notice that foreclosures remain pending during the loan mod trial period - so it is possible that the lenders will start cancelling many of these 'Notices of Trustee Sale' soon if the mods are successful.

Foreclosures scheduled for sale rose to 124,874, a 10.4 percent increase from the prior month, and a 93.3 percent increase year-over-year from July 2008. The year-over-year increase is significant given that foreclosure sales in July 2008 set a record that has not again been reached. The increase appears to be primarily due to the fact that lenders are willingly postponing foreclosure sales.

...

Political pressure, financial incentives and the postponement of sales awaiting the completion of loan modification trial periods are likely reasons for the delays. The vast majority of foreclosures, 72 percent, are postponing either due to lenders request, or mutual agreement between the lender and borrower.

The average California foreclosure has a total loan balance of $425,134 on a home that is now worth $236,739.