by Calculated Risk on 8/16/2009 09:25:00 PM

Sunday, August 16, 2009

WSJ: Loss Rates for FDIC higher than during S&L Crisis

From the WSJ: Failed Banks Weighing on FDIC

For the 102 banks that have collapsed in the past two years, the FDIC's estimated cost averaged 34%. That is sharply higher than the 24% rate between 1989 and 1995, when 747 financial institutions were closed by regulators ... At three of the five banks that failed Friday, increasing the total to 77 so far this year, the financial hit to the agency's deposit-insurance fund is expected by the FDIC to be about 50% of their assets.The numbers for the Community Bank of Nevada, Las Vegas, Nevada are amazing. From the FDIC on Friday:

As of June 30, 2009, Community Bank of Nevada had total assets of $1.52 billion ... The cost to the FDIC's Deposit Insurance Fund is estimated to be $781.5 million.The question is: Why is the FDIC waiting so long on banks like Community Bank of Nevada?

Judge: WaMu's actions in Pushing for Foreclosure suggest "Bad Faith"

by Calculated Risk on 8/16/2009 03:54:00 PM

Jim Dwyer at the NY Times brings us the tale of WaMu pushing for foreclosure, even though the owner of the small multi-tenant building kept trying to pay in full after missing two payments in May and June 2008: Banks Help Small Debt Become a Big One (ht Edward)

Here is the order vacating the default from Judge Emily Jane Goodman:

"The facts in this case, in their simplicity, illustrate the state or property foreclosures in New York and the economic relationship and their borrowers, as well as the surrounding ironies."An interesting read.

WaMu actually had a strong incentive to push for foreclosure or payment in full (the entire amount of the note) or even to delay the proceedings. In the July 2008 Summons and Complaint, WaMu's attorney wrote:

As of the date hereof, (unless a different date is indicated) there is due the plaintiff upon said Note and Mortgage the following:So the note required 11.6% interest once the loan went into default (5% above the original rate). Since the building was worth more than the amount owed, by pushing for foreclosure, WaMu could collect this higher interest rate, legal fees, and other fees.

Principal balance : $460,283.26

Interest rate : 6.60%

Interest due from : April 1, 2008

Default interest : 11.60%

Default Interest due from : May 16, 2008

Late charges due as of : $150.09

May 1, 2008

Obligor shall also pay any prepayment, recapture and other fees as

set forth in the Note.

Since the default is vacated, the interest rate on late payments goes back to 6.6%, and I hope the Judge rules for WaMu's successor to pay the borrower's legal fees (usually a separate motion) - especially since she suggested WaMu had acted in bad faith.

A couple of excerpts from the Order:

"Even if the bank had no duty to alert defendant to the possible litigation, and even if their service methods are permissible, they clearly elected not to affect the most reliable available service - personal service - suggesting bad faith by Washington Mutual, especially when taken with their refusal to accept payment after only two months of lateness, as well as their decision to accelerate the entire loan."And from the footnotes:

The Court admonishes the Bank's counsel for submitting papers, referring to the oppositions papers of Owner's principal, a lawyer, as containing "fraud and deceit" and that his seeking to vacate the default and protect his property as "frivolous". These charges are not only disrespectful to another member of the bar, it is not supported by his or her papers.

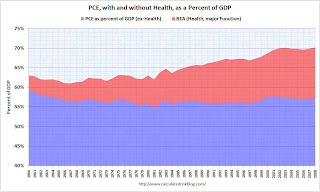

Health Care Spending and PCE

by Calculated Risk on 8/16/2009 01:28:00 PM

By request ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The graph shows health care spending as a percent of GDP using three measures.

The first BEA measure, by major type of product, is of health care services as percent of GDP.

The larger BEA measure, by major function, includes health goods and services as a percent of GDP.

The Department of Health and Human Services includes investment in equipment and structures and is the broadest measure of health care spending. See here for a description of the HHS estimates:

These statistics, termed National Health Expenditure Accounts (NHEA), are compiled with the goal of measuring the total amount spent in the United States to purchase health care goods and services during the year. The amount invested in medical sector structures and equipment and in non-commercial research in the United States, to procure health services in the future, is also included.Here are the HHS estimates. (Note: 2008 in graph is based on HHS forecast).

The NHEA are generally compatible with the National Income and Product Accounts (NIPA), but bring a more complete picture of the health care sector of the nation’s economy together in one set of statistics.

The second graph shows the broader BEA measure and Personal Consumption Expenditures (PCE) as a percent of GDP. (Note: we can't use the HHS measure because that includes investment, and investment is not included in PCE).

Important: y-axis doesn't start at zero to better show the change in PCE from health spending - Please do not use to compare health spending to overall PCE (starting from zero percent would be better).

Important: y-axis doesn't start at zero to better show the change in PCE from health spending - Please do not use to compare health spending to overall PCE (starting from zero percent would be better).This graph was inspired by an article in Business Week by Michael Mandel: Consumer Spending is *Not* 70% of GDP (ht jb).

Note that PCE ex-health has actually declined slightly over the last 50 years, but health care related spending has increased sharply (not exactly news!).

Mandel writes:

First, the category of “personal consumption expenditures” includes pretty much all of the $2.5 trillion healthcare spending, including the roughly half which comes via government.This isn't quite correct. Healthcare spending will be around $2.5 trillion this year (according to the HHS), but that includes investment (see first graph). The portion included in PCE is about $1.9 trillion (the blue line in the first graph and red shaded area in second graph).

But the more important point is what will happen in the future. From a demographic perspective, these are the best of times for healthcare expenses. The original baby busters (from 1925 to the early 1940s) are now at the peak medical expense years, but their medical care is being heavily supported by the baby boomers (now in their peak earning years).

Here is an animation I made several years ago to show this point. The shows the U.S. population distribution by age from 1920 to 2000 (plus 2005).

Watch for the original baby bust (shows up in 1930). Those are the people currently in retirement.

Animation updates every 2 seconds.

Just some food for thought ...

The Rentership Society

by Calculated Risk on 8/16/2009 10:11:00 AM

From the Boston Globe: President shifts focus to renting, not owning

The Obama administration, in a major shift on housing policy, is abandoning George W. Bush’s vision of creating an “ownership society’’ and instead plans to pump $4.25 billion of economic stimulus money into creating tens of thousands of federally subsidized rental units in American cities.This conversion of housing stock from ownership to rental units is already happening. Based on data from the Census Bureau, there have been over 4.3 million units added to the rental inventory since Q4 2004, far more than the 1.1 million new units completed as 'built for rent' since 2004. (see The Surge in Rental Units)

The idea is to pay for the construction of low-rise rental apartment buildings and town houses, as well as the purchase of foreclosed homes that can be refurbished and rented to low- and moderate-income families at affordable rates.

...

“People who were owners are going to be renting for a while,’’ said Margery Turner, vice president for research for The Urban Institute, a Washington think tank that studies social and economic policy.

“There is a housing stock that is sitting vacant. There is a real opportunity here’’ to use those homes as rental property and solve both problems, she said.

And this conversion is ongoing. According to the Campbell Survey, 29 percent of all existing home properties in Q2 were purchased by investors - probably mostly for use as rentals.

In addition, many of the modification programs are really turning homeowners into renters (or "debtowners"). Most mods just capitalize missed payments and fees, and reduce interest rates for a few years. Many of these "homeowners" will still have negative equity when the interest rate increases again, and this could be viewed as Single Family Public Housing.

The Rentership Society.

Saturday, August 15, 2009

Jim the Realtor: The $4 Million Gate

by Calculated Risk on 8/15/2009 10:59:00 PM

For a Saturday night - two stories from Jim - the 2nd one is a small high end development that was just foreclosed on by Wells Fargo.

Unemployed Workers Starting to Exhaust Extended Benefits

by Calculated Risk on 8/15/2009 06:50:00 PM

From Jack Katzanek at the Press-Enterprise: Time -- and benefits -- running out for Inland jobless (ht Rob Dawg)

... According to the state Employment Development Department, the number of Inland residents whose benefits already have been exhausted is negligible. Only 121 people -- 67 in San Bernardino County and 54 in Riverside County -- were in that situation at the end of July.The Inland Empire could go from 121 workers having exhausted their benefits now to over 21,000 by the end of the year. Ouch.

But the number of people facing that predicament could grow exponentially in the coming weeks.

In Riverside County, it is estimated that 12,000 people risk losing their benefits before the end of the year, and 10,500 more in San Bernardino County.

...

A bill to extend unemployment benefits for 13 weeks was introduced in Congress July 30 by Rep. Jim McDermott, D-Wash. It would apply to about 20 states with unemployment rates higher than 9 percent.

...

[Mike DeCesare, McDermott's spokesman's] research indicates that more than 200,000 people will lose their benefits each month starting in September.

emphasis added

The National Employment Law Project estimates that half a million workers will have exhausted their extended benefits by the end of September, and a total of 1.5 million by the end of the year. These numbers are about to increase sharply.

LA Area Ports: Export Traffic Declines in July

by Calculated Risk on 8/15/2009 01:48:00 PM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 22.0% below July 2008.

Outbound traffic was 22.7% below July 2008.

There had been some recovery in U.S. exports earlier this year (the year-over-year comparison was off 30% from December through February). And this showed up in the in the Q1 and Q2 GDP reports as net exports of goods and services added 2.64% and 1.38% to GDP in Q1 and Q2, respectively.

This data suggests exports in Q3 are off to a slow start.

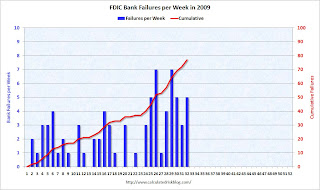

FDIC Bank Failure Update

by Calculated Risk on 8/15/2009 11:12:00 AM

Note: Here is a Problem Bank List (Unofficial) as of Aug 14th (sortable).

The FDIC closed five more banks on Friday, and that brings the total FDIC bank failures to 77 in 2009. The following graph shows bank failures by week in 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Note: Week 1 on graph ends Jan 9th.

The pace has really picked up recently, with the FDIC seizing almost 5 banks per week in July and August, and with 4 1/2 months to go, it seems 150 bank failures this year is likely.

The current pace suggests there will be more failures in 2009 than in the early years of the S&L crisis. From 1982 thorough 1984 there were about 100 failures per year, and then the number of failures really increased as the 2nd graph shows. There were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

There were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

The 2nd graph covers the entire FDIC period (annually since 1934).

For a graph that includes the 1920s and early '30s (before the FDIC was enacted) see the 3rd graph here.

Of course the number of banks isn't the only measure. Many banks today have more branches, and far more assets and deposits.

Colonial Bank had almost $25 billion in assets when it was seized yesterday. Guaranty (Texas, with close to $15.4 billion in assets) and Corus ($7.7 billion) are on the ropes, and the dollars could really add up.

The FDIC era source data is here - including by assets (in most cases) - under Failures and Assistance Transactions

The pre-FDIC data is here.

U.K. More Losses for Nationalized Buy-to-Let Lender

by Calculated Risk on 8/15/2009 08:42:00 AM

From The Times: Rising wave of fraud plunges Bradford & Bingley deeper into the red

Bradford & Bingley, the nationalised mortgage lender, has laid bare the dire state of its loan book and said that a rising wave of fraud dragged it to a £160 million loss for the first half of the year."Buy-to-let" is lending to investors for the purpose of renting the property. Some of these investors were really speculators buying for appreciation.

... the Council of Mortgage Lenders ... has forecast that 65,000 people will lose their homes this year, up from 40,000 last year and just under 26,000 in 2007.

B&B, which was the UK’s largest lender to landlords before it was broken up and its mortgage book nationalised last September, said yesterday that 40 per cent of its mortgage book was in negative equity, up from 30 per cent at the end of 2008. ...

B&B has 60 per cent of its book in buy-to-let and 20 per cent in self-certified loans, sometimes called “liars’ loans” because borrowers did not have to provide proof of salary.

...

Customers falling more than three months behind on repayments rose to 5.88 per cent of the book, from 4.6 per cent at the year-end. ...

The number of homeowners falling behind with mortgage repayments continued to climb in the second quarter. About 270,400 borrowers had missed three or more monthly payments between April and June, up from 264,700 in the first three months of the year. ...

The number of possession orders issued by the courts edged down in the second quarter [as] the “pre-action protocol” introduced late last year ... were dampening applications from lenders.

In some areas - like London - investors accounted for a majority of new home purchases in recent years (from a 2007 article):

According to London Development Research, two-thirds of all new homes built in the capital are being bought by investors.Rising delinquency rates, record foreclosures, more borrowers in negative equity ... sounds like the U.S.

Retailers Expect Slow Back-to-School Sales

by Calculated Risk on 8/15/2009 12:29:00 AM

From the NY Times: Retailers See Slowing Sales in Back-to-School Season

Halfway through the back-to-school shopping season, retail professionals are predicting the worst performance for stores in more than a decade ...From the National Retail Federation: NRF's 2009 Back-to-School and Back-to-College Surveys

The National Retail Federation, an industry group, expects the average family with school-age children to spend nearly 8 percent less this year than last. And ShopperTrak, a research company, predicted customer traffic would be down 10 percent from a year ago.

“This is going to be the worst back-to-school season in many, many years,” said Craig F. Johnson, president of Customer Growth Partners, a retailing consultant firm.

According to the National Retail Federation’s 2009 Back to School Consumer Intentions and Actions Survey, conducted by BIGresearch, the average family with students in grades Kindergarten through 12 is expected to spend $548.72 on school merchandise, a decline of 7.7 percent from $594.24 in 2008. ...There are some positive signs for the economy - like new home sales, auto sales increasing, and industrial production/capacity utilization possibly bottoming out - but without the consumer, any recovery will be sluggish at best.

According to the survey, the economy is having a major impact on back-to-school spending as four out of five Americans (85%) have made some changes to back-to-school plans this year as a result. Some of those changes impact spending, with 56.2 percent of back-to-school shoppers hunting for sales more often, 49.6 percent planning to spend less overall, 41.7 percent purchasing more store brand/generic products and 40.0 percent are planning to increase their use of coupons. Others say the economy has impacted lifestyle decisions, with 11.4 percent saying children will cut back on extracurricular activities or sports and 5.7 percent saying that the economy is impacting whether their children will attend a private or public school.

“The economy has clearly changed the spending habits of American families, which will likely create a difficult back-to-school season for retailers,” said Tracy Mullin, President and CEO of NRF.

Friday, August 14, 2009

Bank Failures #75 - #77: Union Bank, National Association, Gilbert, AZ, Community Bank of Nevada, Las Vegas, NV, Community Bank of Arizona, Phoenix, A

by Calculated Risk on 8/14/2009 09:34:00 PM

A "whale" also sleeps on beach

Sharks circle for more

by Soylent Green is People

From the FDIC: MidFirst Bank, Oklahoma City, Oklahoma, Assumes All of the Deposits of Union Bank, National Association, Gilbert, Arizona

Union Bank, National Association, Gilbert, Arizona, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: MidFirst Bank, Oklahoma City, Oklahoma, Assumes All of the Deposits of Community Bank of Arizona, Phoenix, Arizona

As of June 12, 2009, Union Bank, N.A. had total assets of $124 million and total deposits of approximately $112 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $61 million. ... Union Bank, N.A. is the 75th FDIC-insured institution to fail in the nation this year, and the second in Arizona. The last FDIC-insured institution to be closed in the state was Community Bank of Arizona, Phoenix, also today.

Community Bank of Arizona, Phoenix, Arizona, was closed today by the Arizona Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of June 30, 2009, Community Bank of Arizona had total assets of $158.5 million and total deposits of approximately $143.8 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $25.5 million. ... Community Bank of Arizona is the 76th FDIC-insured institution to fail in the nation this year, and the first in Arizona. The last FDIC-insured institution to be closed in the state was NextBank, Phoenix, on February 7, 2002.

From the FDIC: FDIC Creates a Deposit Insurance National Bank to Facilitate the Resolution of Community Bank of Nevada, Las Vegas, Nevada

Community Bank of Nevada, Las Vegas, Nevada, was closed today by the State Commissioner, by Order of the Nevada Financial Institutions Division, which then appointed Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of June 30, 2009, Community Bank of Nevada had total assets of $1.52 billion and total deposits of about $1.38 billion. ...

The FDIC as receiver will retain all the assets from Community Bank of Nevada for later disposition. Loan customers should continue to make their payments as usual.

The cost to the FDIC's Deposit Insurance Fund is estimated to be $781.5 million. Community Bank of Nevada is the 77th bank to fail this year and the third in Nevada. The last bank to be closed in the state was Great Basin Bank, Elko, on April 17, 2009

Hotel Owners Walking Away

by Calculated Risk on 8/14/2009 08:47:00 PM

From Kris Hudson at the WSJ: Hotels Deliver Some 'Jingle Mail'

... From San Diego to Dearborn, Mich., an increasing number of hotel owners in the U.S. market are simply walking away ...There is much more in the article.

Distressed noncasino hotel loans now cover more than 1,000 properties with a cumulative loan value of $16.8 billion, according to Real Capital Analytics ....

Delinquencies of loans on casinos that have hotels adds 31 properties and $8.6 billion in distressed loans to the mix.

... According to Trepp LLC, the delinquency rate for CMBS tied to hotels was 4.75% in the second quarter, up from 0.5% a year earlier. Debt-rating provider Fitch Ratings predicts that rate will jump to between 10% and 15% by year end.

A few points on hotels:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The peak occupancy rate for 2009 was probably three weeks ago at 67%.

And that is far below normal ... and it is all downhill for the rest of the year.

Note: Graph doesn't start at zero to better show the change.

Occupancy rates are far below historical levels, room rates are falling, there is more supply coming online - and many properties have too much debt. That spells Jingle Mail!

Bank Failure #74: Down Goes Colonial

by Calculated Risk on 8/14/2009 06:08:00 PM

Colonial colonized

Queen bee Bair in charge.

by Soylent Green is People

From the FDIC: BB&T, Winston-Salem, North Carolina, Assumes All of the Deposits of Colonial Bank, Montgomery, Alabama

Colonial Bank, Montgomery, Alabama, was closed today by the Alabama State Banking Department, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

Colonial Bank's 346 branches in Alabama, Florida, Georgia, Nevada and Texas will reopen under normal business hours beginning tomorrow and operate as branches of BB&T. ...

"The past 18 months have been a very trying period in the financial services arena, but the FDIC and its staff have performed as Congress envisioned when it created the corporation more than 75 years ago," said FDIC Chairman Sheila C. Bair. "Today, after protecting almost $300 billion in deposits since the current financial crisis began, the FDIC's guarantee is as certain as ever. Our industry funded reserves have covered all losses to date. In fact, losses from today's failures are lower than had been projected. I commend our staff for their excellent work in assuring once again a smooth transition for bank customers with these resolutions. The FDIC continues to stand by the nation's insured deposits with the full faith and credit of the U.S. government. No depositor has ever lost a penny of their insured deposits."

...

As of June 30, 2009, Colonial Bank had total assets of $25 billion and total deposits of approximately $20 billion. ... The FDIC and BB&T entered into a loss-share transaction on approximately $15 billion of Colonial Bank's assets.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $2.8 billion. ... Colonial Bank is the 74th FDIC-insured institution to fail in the nation this year, and the first in Alabama. The last FDIC-insured institution to be closed in the state was Birmingham FSB, Birmingham, on August 21, 1992.

Bank Failure #73: Dwelling House Savings and Loan Association, Pittsburgh, Pennsylvania

by Calculated Risk on 8/14/2009 04:38:00 PM

NOTE: This bank was on the Problem Bank List (Unofficial) released earlier. The bank had received a "PROMPT CORRECTIVE ACTION DIRECTIVE" on May 5th, and that is basically a "Hail Mary pass." - usually means failure.

Bureaucrats to clean up mess

We are new slum lords

by Soylent Green is People

From the FDIC: PNC Bank, National Association, Pittsburgh, Pennsylvania, Assumes All of the Deposits of Dwelling House Savings and Loan Association, Pittsburgh, Pennsylvania

Dwelling House Savings and Loan Association, Pittsburgh, Pennsylvania, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Just a tease ... but look at the losses as a percent of total assets.

As of March 31, 2009, Dwelling House Savings and Loan Association had total assets of $13.4 million and total deposits of approximately $13.8 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6.8 million. ... Dwelling House Savings and Loan Association is the 73rd FDIC-insured institution to fail in the nation this year, and the first in Pennsylvania. The last FDIC-insured institution to be closed in the state was Metropolitan Savings Bank, Pittsburgh, on February 2, 2007

Market and Bank Watch

by Calculated Risk on 8/14/2009 03:58:00 PM

There are reports that Colonial will be seized today.

Still waiting on Guaranty (Texas), Corus, and many others: see August 14 Problem Bank List (unofficial) below. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up 48.4% from the bottom (328 points), and still off 35.8% from the peak (561 points below the max).

The S&P 500 first hit this level in Feb 1998; over 11 years ago.Note: Doug may be a little slow updating today.

Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Problem Bank List (Unofficial) Aug 14, 2009

by Calculated Risk on 8/14/2009 03:00:00 PM

This is an unofficial list of Problem Banks. (Note: Reports are Colonial will be seized this afternoon)

The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay. The Fed and OTC data is more timely, and the OCC a little lagged. Credit: surferdude808.

Changes from last week (from surferdude808): The institution count is higher by three this week, with five additions and two deletions. Assets are $6.3b higher. About 60% of the increase in assets is due to the addition of Riverside National Bank of Florida, Fort Pierce, FL, which actually was placed under formal action during 2008q4 but it was not included in last week's list.

The other four additions included 2 institutions headquartered in Georgia, and one each in Florida and Kansas. The Georgia banks are based in metro Atlanta, where commercial real estate or construction & developement lending continue to weigh heavilly on the sector. Since August 2008, 21 banks in Georgia have failed.

There are 32 georgia-based institutions on this week's problem bank list, which represents the largest share (8.2%) of this week's total. The next highest shares include california at 7.7% and florida at 7.1%. The two removals from the problem bank list this week were the failures -- Community First Bank, Prineville, OR and Community National Bank of Sarasota, Venice, FL -- that closed on friday, August 7th.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. You can enter the certificate number in the Institution Directory (ID) system "which will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

First-time Home Buyer Frenzy

by Calculated Risk on 8/14/2009 01:03:00 PM

Yesterday I posted some data from Campbell Communications (National Data: Distressed Sales and Types of Buyers)

Here is a repeat of the graph by buyer type: According to the Campbell survey first-time buyers accounted for 43% of sales in Q2 (investors another 29%).

According to the Campbell survey first-time buyers accounted for 43% of sales in Q2 (investors another 29%).

Source: Summary Report--Real Estate Agents Report on Home Purchases and Mortgages, Campbell Communications, June 2009 (excerpted with permission)

These numbers are higher than the numbers reported by NAR for Q2:

"An NAR practitioner survey in June showed first-time buyers accounted for 29 percent of transactions, unchanged from May ..."However I believe the Campbell numbers are closer to actual.

I've talked with several people - and there is a buying frenzy right now. First-time homebuyers, especially those with a limited downpayment, are desperate.

From the Chicago Tribune: First-time buyers race to beat credit deadline

With a growing sense of urgency, first-time buyers are searching for homes, worried that time is running out on an $8,000 federal tax credit.Also from Reuters: Race is on as U.S. home buyer tax credit nears end

Real estate agents say they're seeing a surge of first-timers who want to close on a property by Nov. 30, the deadline for the credit. The rush has set off bidding wars and stirred up a normally quiet August market.

"We're inundated," said Paula Clark, an agent with Coldwell Banker.

To meet the Nov. 30 deadline, buyers need to have a contract by around Sept. 30, because inspections, mortgage approvals and other details typically take about two months.

"I am willing to settle for something" to finish buying quickly, said 20-year old Kielar, who works at the Denver County Jail, and is a part-time student. The tax credit carrot "is speeding up the process," she said, adding that "$8,000 could help remodel the house, redo carpets and cabinets."In addition $8,000 to the Federal tax credit, there are some state programs, as a nexample from Newsday.com: NYS rolls out tax credit for first-time home buyers - but most of the frenzy is being driven by the Federal Tax credit.

For loans backed by the Federal Housing Administration (FHA), which require a minimum 3.5 percent downpayment, the $8,000 can be also be applied upfront toward the purchase rather than later on tax returns like other mortgages.

A few key points:

Expect a surge in existing home sales (and some new home sales) over the next few months. Expect prices at the low end to rise (simple supply and demand). Expect all kinds of reports that the bottom has been reached.

Expect the frenzy to end ...

Report: BB&T to take Over Colonial Bancgroup

by Calculated Risk on 8/14/2009 11:23:00 AM

Update: BB&T Said to Be Taking Colonial in Year’s Biggest Bank Failure

BB&T Corp. ... is taking over offices and deposits of Colonial BancGroup Inc., according to a person familiar with the matter.

Colonial, Alabama’s second-largest bank, is being closed by regulators today, the person said, becoming the largest U.S. bank failure of 2009 ...

A call to Colonial spokeswoman Merrie Tolbert wasn’t immediately returned. “The FDIC does not comment on open institutions,” agency spokesman David Barr said in an e-mail.

Bank Failure Friday Articles

by Calculated Risk on 8/14/2009 10:55:00 AM

From Bloomberg: Toxic Loans Topping 5% May Push 150 Banks to Point of No Return (ht Brian, Mike, James)

More than 150 publicly traded U.S. lenders own nonperforming loans that equal 5 percent or more of their holdings, a level that former regulators say can wipe out a bank’s equity and threaten its survival.From Floyd Norris at the NY Times: Teetering on Failure, but Meeting Standards

The number of banks exceeding the threshold more than doubled in the year through June, according to data compiled by Bloomberg, as real estate and credit-card defaults surged. Almost 300 reported 3 percent or more of their loans were nonperforming ...

Missed payments by consumers, builders and small businesses pushed 72 lenders into failure this year, the most since 1992. More collapses may lie ahead as the recession causes increased defaults and swells the confidential U.S. list of “problem banks,” which stood at 305 in the first quarter. ...

Chicago- based Corus Bankshares Inc., Austin-based Guaranty Financial Group Inc. and Colonial BancGroup Inc. in Montgomery, Alabama, each with ratios of at least 6.5 percent, said in the past month that they expect to be shut.

Excluding the stress-test list, banks with nonperformers above 5 percent had combined deposits of $193 billion, according to Bloomberg data. That’s almost 15 times the size of the FDIC’s deposit insurance fund at the end of the first quarter.

It appears that Colonial BancGroup, which Mr. Lowder started with the acquisition of a small bank in Alabama in 1981, may soon become the largest bank failure of 2009, with more than $25 billion in assets.As I noted last night, court records indicate the FDIC issued a new Cease & Desist order to Colonial on August 11th. Among other restrictions, this new order required pre-approval of all "material transactions" - very rare.

...

If Colonial does fail, it will call into question both the effectiveness of the regulation of rapidly growing banks, and of the capital standards regulators use. Even now, Colonial claims to be adequately capitalized. As recently as March, it met the criteria for being “well capitalized,” the highest designation.

How could a bank be well capitalized and facing government orders to find more capital? One reason is that the government’s rules allow banks to ignore the declines in market value of many loans and other assets in computing how much capital they have. Had Colonial been forced to count the losses it had already acknowledged, its capital situation would have appeared dire earlier than it did.

...

By the end of 2006, 41 percent of Colonial’s $15 billion in lending was for construction, with most of that in Florida. An additional 28 percent was in commercial real estate, with Florida again dominating the book of loans.

Industrial Production, Capacity Utilization Increase in July

by Calculated Risk on 8/14/2009 09:15:00 AM

The Federal Reserve reported:

Industrial production increased 0.5 percent in July. Aside from a hurricane-related rebound in October 2008, the gain in July marked the first monthly increase since December 2007. Manufacturing output advanced 1.0 percent in July; most of the increase was due to a jump in motor vehicle assemblies from an annual rate of 4.1 million units in June to 5.9 million units in July. Excluding motor vehicles and parts, manufacturing production edged up 0.2 percent. The output of utilities fell 2.4 percent, reflecting unseasonably mild temperatures in July, and the output of mines increased 0.8 percent. At 96.0 percent of its 2002 average, total industrial production was 13.1 percent below its level of a year earlier. In July, the capacity utilization rate for total industry edged up to 68.5 percent, a level 12.4 percentage points below its 1972-2008 average.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up slightly from the record low set in June (the series starts in 1967). Capacity Utilization had decreased in 17 of the previous 18 months.

Note: y-axis doesn't start at zero to better show the change.

Much of the increase in industrial production was auto related. Also, there is little reason for investment in new production facilities until capacity utilization recovers.