by Calculated Risk on 8/19/2009 07:43:00 AM

Wednesday, August 19, 2009

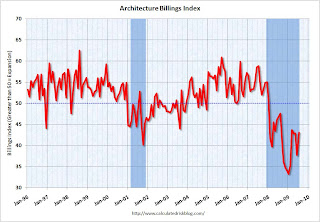

AIA: Architecture Billings Index shows Contraction in July

From Reuters: U.S. architecture billings index up in July: AIA

... The Architecture Billings Index rebounded more than 5 points last month to a reading of 43.1, reversing a similar decline in June, according to the American Institute of Architects.

The index has remained below 50, indicating contraction in demand for design services, since January 2008 ...

Credit remains tight and government stimulus funds have had little visible impact on project activity, AIA Chief Economist Kermit Baker said.

"There has been too much contraction in recent months to get overly optimistic about business conditions," Baker said.

...

Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions. The AIA's Billings Index, which began in 1995, is considered a measure of construction spending nine to 12 months in the future.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index is still below 50 indicating falling demand.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). This suggests further dramatic declines in CRE investment later this year and next.

New Appraisal Process Shifts Power

by Calculated Risk on 8/19/2009 12:02:00 AM

From David Streitfeld at the NY Times: In Appraisal Shift, Lenders Gain Power and Critics

Mike Kennedy, a real estate appraiser in Monroe, N.Y., was examining a suburban house a few years ago when he discovered five feet of water in the basement. The mortgage broker arranging the owner’s refinancing asked him to pretend it was not there.Streitfeld discusses the origins of the HVCC and the current situation (only the appraisal management companies and lenders are happy). Interesting story.

Brokers, real estate agents and banks asked appraisers to do a lot of pretending during the housing boom, pumping up values while ignoring defects. While Mr. Kennedy says he never complied, many appraisers did, some of them thinking they had no choice if they wanted work. A profession that should have been a brake on the spiral in home prices instead became a big contributor.

On May 1, a sweeping change took effect that was meant to reduce the conflicts of interest in home appraisals while safeguarding the independence of the people who do them.

Brokers and real estate agents can no longer order appraisals. Lenders now control the entire process.

The Home Valuation Code of Conduct is setting off a bitter battle. Mortgage brokers, lenders, real estate agents, regulators and appraisers are all arguing over whether an effort to fix one problem has created many new ones.

Tuesday, August 18, 2009

Update on Bank Bids: Guaranty (Texas) and Corus

by Calculated Risk on 8/18/2009 09:32:00 PM

From Reuters: Guaranty Financial draws bid -- sources

A consortium that is led by financial services executive Gerald Ford and includes several private equity firms submitted a bid for troubled bank Guaranty Financial, despite uncertainty over U.S. regulation guidelines, sources familiar with the matter said on Tuesday.Today was the deadine for bids for the assets of Guaranty ($14.4 billion in assets as of Q1). My guess is the bank will be seized this week.

It was unclear how many offers were submitted in total by Tuesday's deadline for bids, but sources said that there were also expected to be bids from other parties.

From Nick Timiraos at the WSJ: Corus Bids Enter the Final Stretch

New York developer the Related Cos. and Lubert-Adler Partners LP, a Philadelphia real-estate investment firm, have teamed up to bid on the assets of condo lender Corus Bank, joining a rival offer from Los Angeles private-equity fund Colony Capital LLC and iStar Financial Inc., the New York commercial-mortgage real-estate investment trust.From other reports, it appears the bidding on the assets of Corus will be open until Sept 3rd (Corus had $7.6 billion in assets as of Q1).

Several real-estate professionals see the Related-Lubert team as having the inside track to the bank's assets in a sale brokered by the Federal Deposit Insurance Corp., though other private-equity firms remain in the mix ...

These will be the 2nd and 4th largest failures of the year. Colonial had $25 billion in assets, and BankUnited had $12.8 billion in assets when they failed.

Judge: Banker "Culture of Corruption" was "Pernicious and pervasive"

by Calculated Risk on 8/18/2009 06:54:00 PM

The following article is about one of the ex-Credit Suisse brokers being found guilty of securities fraud. The judge's comments about the culture in financial services industry are on point ...

From Bloomberg: Ex-Credit Suisse Broker Eric Butler Guilty of Securities Fraud

U.S. District Judge Jack Weinstein ... asked lawyers for both Butler and the government, when they file sentencing papers, to put Butler’s acts in the context of “how pernicious and pervasive was the culture of corruption, lack of regulation” and “serious negligence in the financial services industry in supervising people like this.”Some of these operations made J.T. Marlin look legit (OK, another movie reference).

Market, Autos and Misc

by Calculated Risk on 8/18/2009 04:00:00 PM

Note: Google / Blogger is under a DDoS-style attack again - sorry for any inconvenience. Click on graph for larger image in new window.

Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

From Edmunds.com: “Cash for Clunkers” Sales on the Rapid Decline (ht Bob_in_MA)

The rush of automotive sales activity brought on by the "Cash for Clunkers" program is fading fast, according to Edmunds.com, whose latest study of car buyer behavior indicates that automotive purchase intent is down 31 percent from its peak in late July.And from a Guaranty Bank (Texas) NT 10-Q SEC filing:

“Now that there is plenty of money in the program and the most eager shoppers have already participated, the sense of urgency is gone, and the pace of intent decline is accelerating,” observed Edmunds.com CEO Jeremy Anwyl. "Inventories are getting lean and prices are climbing, giving consumers reasons to sit back."

Last week, activity was down 15 percent from the late July peak, and Edmunds.com analysts predict that in the coming days, purchase intent will return to levels seen before the launch of Cash for Clunkers. Purchase intent has proven to be a reliable leading indicator of sales to come in the following 90 days.

“Our research indicates that Cash for Clunkers buyers have come in three waves: the first was the informed, pent-up buyers who anxiously waited for the program to launch, while the second was the mass market who responded to advertising and other promotional coverage of the program,” recalls Edmunds.com Senior Analyst Jessica Caldwell. “Now the industry is largely servicing the third wave, which is generally made up of people who had to chase down copies of lost titles and other paperwork and are now able to finally participate. It is unclear where the customers will come from after this wave crests and breaks.”

As described in the July 23 8-K, the Company does not believe it is possible to raise sufficient capital to comply with the Orders to Cease and Desist described in the Company’s Current Report on Form 8-K filed on April 8, 2009. Accordingly, the Company no longer believes that it will be able to continue as a going concern.Bids for Guaranty's assets were due today, and it is very likely that Guaranty will be seized this week by the FDIC. Guaranty keeps repeating the warning - and still the stock is trading above zero ...

The Company continues to cooperate with the Office of Thrift Supervision (the “OTS”) and the Federal Deposit Insurance Corporation (“FDIC”) as they pursue alternatives for the business of the Bank. Any such transaction would not be expected to result in the receipt of any proceeds by the stockholders of the Company.

DataQuick: SoCal Sales Increase, Some Activity in High End Areas

by Calculated Risk on 8/18/2009 01:39:00 PM

From DataQuick: Southland home sales rise again as higher-cost areas awaken

Southern California homes sold last month at the fastest clip for a July in three years and the fastest pace for any month since December 2006. ...Last year sales were very low in the high end areas, so some year-over-year pickup isn't surprising. Unfortunately DataQuick didn't break out the actual numbers.

A total of 24,104 new and resale houses and condos closed escrow in San Diego, Orange, Los Angeles, Ventura, Riverside and San Bernardino counties last month. That was up 3.6 percent from 23,262 in June and up 18.6 percent from 20,329 a year ago, according to San Diego-based MDA DataQuick.

July’s sales total was 8.7 percent lower than the average number sold in July – 26,410 – since 1988, when DataQuick’s statistics begin. July home sales have ranged from a low of 16,225 in July 1995 to a peak of 38,996 in 2003.

Sales have increased year-over-year for 13 consecutive months. ...

Although sales of lower-cost foreclosures have tapered off, the high end of the housing market has awakened this summer from a long slumber, during which sales had been at or near record lows. July sales of existing single-family houses rose above a year ago in many coastal towns, including Manhattan Beach, Redondo Beach, Huntington Beach, Newport Beach, Carlsbad, Encinitas and La Jolla. Among the higher-cost Southland communities not posting such a gain were Malibu, Rancho Palos Verdes, Beverly Hills, Brentwood and Del Mar.

...

Last month 43.4 percent of the Southland houses and condos that resold had been foreclosed on in the prior year – the lowest level since June 2008. July’s foreclosure resales figure was down from 45.3 percent in June and from a peak 56.7 percent in February 2009.

...

“Have prices hit bottom? While some data continue to hint at that, it remains an especially risky call to make given the uncertainty over the magnitude of future job losses and foreclosures. The recent drop in foreclosure resales, coupled with the rise in high-end sales, has helped stabilize some of the regional home price measures. But there’s still quite a bit of distress out there, and plenty of unknowns with regard to how lenders and borrowers will choose to proceed,” said John Walsh, DataQuick president.

...

Investors and other absentee buyers, defined as those who will have their property tax bills sent to a different address, bought 19.4 percent of the Southland homes sold last month. That’s up from 15.5 percent a year ago and a monthly average since 2000 of about 15 percent. San Bernardino County had the highest share of absentee buyers in July: 27 percent.

...

Foreclosure activity remains near record levels ...

emphasis added

Close to 20% of properties are being bought by investors, and 43.4% are foreclosure resales. These numbers are still very high and will probably increase after the Summer.

Manhattan Office Buildings: Cap Rates More than Double

by Calculated Risk on 8/18/2009 12:06:00 PM

Here is an excerpt on cap rates in Manhattan ...

From Bloomberg: Manhattan Office Sales Ground to Halt in First Half

The scarcity of property sales has made it hard to calculate prices and yields, [CB Richard Ellis] said.The increase in cap rates suggests more than half off the peak prices of a few years ago - and probably even more since rents have fallen too (reducing operating income) and vacancy rates are rising sharply (pressuring rents more).

The so-called capitalization rate, or a property’s net operating income divided by purchase price, may have risen to about 7 percent for stable, prime Manhattan office buildings, CB Richard Ellis said.

During the peak, cap rates in Manhattan got as low as about 3 percent.

No wonder "buyers and sellers are far apart on bids"!

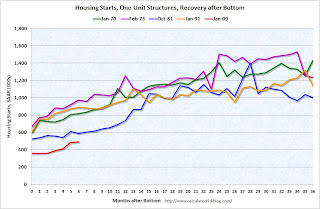

Comparing Housing Start Recoveries

by Calculated Risk on 8/18/2009 10:00:00 AM

It appears that single-family housing starts bottomed in January of this year. Single-family starts in July were 37 percent above the January low - based on the seasonally adjusted annual rate (SAAR).

How does this compare to previous housing recoveries? Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph compares the current recovery with four previous housing recoveries. The recoveries are labeled with the month that single-family housing starts bottomed.

Starts fell to record lows in the current housing bust (adjusted for changes in population, or number of households, would make the current bust even worse).

Usually housing starts increase steadily for the first two years following a housing bottom. The second graph shows the same data, normalized by setting the bottom for single-family housing starts to 100.

The second graph shows the same data, normalized by setting the bottom for single-family housing starts to 100.

This graph shows that housing starts usually double in the two years following the bottom. Starts increased 80 percent over two years in the recovery following the Jan 1991 bottom, and 136 percent in the recovery following the Jan 1970 bottom.

If starts doubled over the two years following the Jan 2009 bottom, single-family starts would recover to 715 thousand by Jan 2011. And looking at the first graph some people might think single-family starts might recover to a 1.1 million rate within 2 years. That seems very unlikely.

I started this year looking for the bottom in single family housing starts (and I think the bottom is in), but I expect the recovery to be sluggish because of all the excess housing units, and also because of the ongoing decline in the homeownership rate. I'll have more on this later - but hopefully these graphs show what many people expect.

Housing Starts Flat in July

by Calculated Risk on 8/18/2009 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 581 thousand (SAAR) in July, off slightly from June, but up sharply over the last three months from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 490 thousand (SAAR) in July, up slightly from June; 37 percent above the record low in January and February (357 thousand).

Permits for single-family units were 458 thousand in July, suggesting single-family starts might decline slightly in August.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building Permits:Note that single-family completions of 491 thousand are at the same level as single-family starts (490 thousand).

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 560,000. This is 1.8 percent (±1.4%) below the revised June rate of 570,000 and is 39.4 percent (±1.8%) below the July 2008 estimate of 924,000.

Single-family authorizations in July were at a rate of 458,000; this is 5.8 percent (±1.1%) above the revised June figure of 433,000.

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 581,000. This is 1.0 percent (±8.5%)* below the revised June estimate of 587,000 and is 37.7 percent (±5.1%) below the July 2008 rate of 933,000.

Single-family housing starts in July were at a rate of 490,000; this is 1.7 percent (±7.1%)* above the revised June figure of 482,000.

Housing Completions:

Privately-owned housing completions in July were at a seasonally adjusted annual rate of 802,000. This is 0.9 percent (±10.1%)* below the revised June estimate of 809,000 and is 26.4 percent (±6.9%) below the July 2008 rate of 1,089,000.

Single-family housing completions in July were at a rate of 491,000; this is 4.1 percent (±8.9%)* below the revised June figure of 512,000.

It now appears that single family starts bottomed in January. However I expect starts to remain at fairly low levels for some time as the excess inventory is worked off.

Monday, August 17, 2009

U.S. Population Distribution by Age, 1950 through 2050

by Calculated Risk on 8/17/2009 10:45:00 PM

As I follow up to my post Sunday, Health Care Spending and PCE, here is an animation of the U.S population distribution, by age, from 1950 through 2050. The population data and estimates are from the Census Bureau.

Note: the third graph (link) is a Dynamic Population Pyramid of the same data from the Census Bureau.

Watch for the original baby bust preceding the baby boom. Those are the people currently in retirement. With the original baby bust now at the age of peak health care expenses, these are the best of times (from a demographics perspective) for health care.

Animation updates every 2 seconds.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The second graph is from the Department of Health & Human Services.

Although it would be interesting to break down health care expense by more age groups - this graph does shows that health care expenses are almost three times higher for those over 65 than those under 65. So - in the first graph - as the baby boomers move into the last 4 columns, the health care expenses will rise sharply.

And from the Census Bureau: Dynamic Population Pyramid (1950 - 2050) (note: Iframe version removed - Census Bureau site was slowing down)

Super cool graph. The first graph is in percentages, the one from the Census Bureau is in actual numbers. For you Harold and Maude fans, there will be a lot of older women in 2050.

Recession Roommates

by Calculated Risk on 8/17/2009 08:51:00 PM

From Carolyn Said at the San Francisco Chronicle: More share space to shave costs in recession

Facing layoffs, pay cuts and furloughs, more people have turned to shared housing to help make ends meet. Craigslist ... says that its roommate-wanted postings over the past 12 months are up 60 percent for the Bay Area, and up 85 percent within San Francisco.It is common in a recession for households to double up by moving in with a friend or family member. However I'm not sure if taking in boarders is common in a recession ... although from the stories I've heard, it was very common during the Depression.

While young singles sharing digs to save money is nothing new, this new brand of "recession roommates" includes more families and couples who are sacrificing their privacy as a way to cope with the economic downturn.

...

The Census Bureau's American Community Survey showed a jump in cohabiting in 2007, the most recent survey year. In California, the number of "family households" with a roommate stood at 228,500 in 2007, up 9.6 percent from 2006. In "nonfamily households," 674,000 reported having roommates in 2007, a 9.4 percent increase from the previous year.

...

During the Great Depression, plenty of people rented out spare rooms to cope with hard times, said Los Altos resident Don McDonald, 91, whose family in Ohio took in boarders regularly. ... "(Boarders) always ate with us and were, in effect, part of the family. The old family photo album shows several of them over those years."

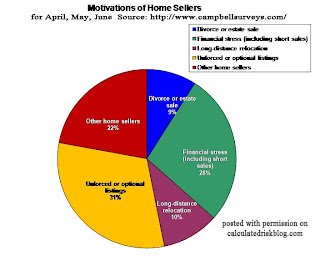

Home Seller Motivations

by Calculated Risk on 8/17/2009 06:32:00 PM

Here is some national data on buyer motivations in Q2. This is from a survey by Campbell Communications (posted with permission).

Credit: Summary Report--Real Estate Agents Report on Home Purchases and Mortgages, Campbell Communications, June 2009 Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the motivation of non-REO home sellers.

From Campbell Survey:

We told respondents, “Please think of the number of non-REO listings you currently have and then specify the number of home sellers by motivation. If more than one motivation applies, please select the single motivation that is most important; skip any motivation that does not apply.” Significantly, we found that unforced or optional listings account for only 31% of non-REO listings. Financial stress (including short sales) account for over a quarter. Other significant motivations include long distance relocation and divorce or estate sales.See Distressed Sales and Types of Buyers for a breakdown of REOs, short sales, and non-distressed buyers.

A previous survey question on home purchase transactions found that 51%, or approximately half, of the home purchase market is non-REO transactions. Combining the above question’s results with this data, we can impute that only 16% of the agent-sold residential real estate market—REO and non-REO properties—is a result of unforced or optional listings.

emphasis added

Report: Guaranty Bid Deadline Tomorrow, Corus Sept 3rd

by Calculated Risk on 8/17/2009 04:00:00 PM

First the market ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up 44.8% from the bottom (303 points), and still off 37.4% from the peak (585 points below the max).

The S&P 500 first hit this level on Oct 7, 1997; almost 12 years ago.Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

From Reuters: Guaranty bid deadline Tuesday, Corus Sept 3-sources

A U.S. regulator has extended a deadline to bid on Guaranty Financial Group assets to Tuesday, while bids for another troubled lender, Corus Bankshares Inc, are due Sept. 3, sources familiar with the situation said on Monday.Guaranty Bank (Texas) had about $14.4 billion in assets as of Q1, and Corus had $7.6 billion. See the current Problem Bank List (unofficial).

These will be the 2nd and 4th largest failures of the year. Colonial had $25 billion in assets, and BankUnited had $12.8 billion in assets when they failed.

Fed: Delinquency Rates Surged in Q2 2009

by Calculated Risk on 8/17/2009 02:42:00 PM

The Federal Reserve reports that delinquency rates rose in Q2 in all categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the delinquency rates at the commercial banks for residential real estate, commercial real estate and consumer credit cards.

Commercial real estate delinquencies (7.91%) are rising rapidly, and are at the highest rate since the early '90s (as delinquency rates declined following the S&L crisis).

Residential real estate (8.84%) and consumer credit card (6.7%) delinquencies are at the highest levels since the Fed started tracking the data (since Q1 '91).

Although there is credit deterioration everywhere, the rise in these three categories is especially significant. There was also a significant increase in C&I delinquencies (commerical & industrial) and Agricultural loans.

Note: The Fed defines commercial as "construction and land development loans, loans secured by multifamily residences, and loans secured by nonfarm, nonresidential real estate", and many of the problems are probably in the C&D loans. These are the loans that will lead to the closure of many more regional banks.

Also check out the charge-off rates. The charge-off rate for residential real estate increased from 1.81% to 2.34%, and for consumer credit cards from 7.64% to 9.55%!

Ouch!!!

Fed: Lending Standards Tighten, Loan Demand Weakens

by Calculated Risk on 8/17/2009 02:00:00 PM

From the Fed: The July 2009 Senior Loan Officer Opinion Survey on Bank Lending Practices

The July 2009 Senior Loan Officer Opinion Survey on Bank Lending Practices addressed changes in the supply of, and demand for, loans to businesses and households over the past three months. The survey also included two sets of special questions: The first set asked banks to rank the causes of declines this year in commercial and industrial (C&I) lending, and the second set asked banks about their expectations for lending standards going forward relative to the average level over the past decade. The results reported here are based on responses from 55 domestic banks and 23 U.S. branches and agencies of foreign banks.

In the July survey, domestic banks indicated that they continued to tighten standards and terms over the past three months on all major types of loans to businesses and households, although the net percentages of banks that tightened declined compared with the April survey. Demand for loans continued to weaken across all major categories except for prime residential mortgages. The fractions of domestic banks reporting additional weakening in demand in this survey were slightly lower than those in the April survey for C&I loans and home equity lines of credit, approximately the same for commercial real estate (CRE) and nontraditional residential mortgages, and slightly higher for consumer loans.

In response to a special question, domestic banks pointed to decreased loan demand and deteriorating credit quality as the most important reasons for declines in C&I lending this year. In response to a second special question, most banks reported that they expected their lending standards across all loan categories would remain tighter than their average levels over the past decade until at least the second half of 2010; for below-investment-grade firms and nonprime households, the expected timing is later, with many banks reporting that standards for such borrowers will remain tighter than average for the foreseeable future.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Note that any reading below zero for loan demand means less demand than the previous quarter. The slump in CRE investment is just getting started ...

More charts here for residential mortgage, consumer loans and C&I.

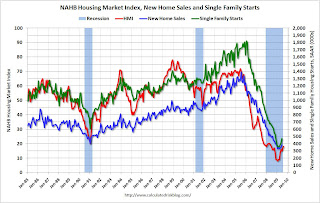

NAHB: Builder Confidence Slightly Higher in August

by Calculated Risk on 8/17/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 18 in August from 17 in July. The record low was 8 set in January.

This is still very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good. This second graph compares the NAHB HMI (left scale) with new home sales and single family housing starts (right scale). This is the August release for the HMI compared to the June data for starts and sales.

This second graph compares the NAHB HMI (left scale) with new home sales and single family housing starts (right scale). This is the August release for the HMI compared to the June data for starts and sales.

This shows that the HMI, single family starts and new home sales mostly move in the same direction - although there is plenty of noise month-to-month.

NOTE: For purposes of determining if starts are above or below sales, you have to use the quarterly data by intent. You can't compare the monthly total single family starts directly to new home sales, because single family starts include several categories not included in sales (like owner built units and high rise condos).

Press release from the NAHB (added):

Builder confidence in the market for newly built, single-family homes rose one point in August to its highest level in more than a year, according to the latest reading of the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. Building on a two-point gain in July, the HMI reached 18 this month, its highest point since June of 2008.

“Home builder expectations have been buoyed by the success of the first-time home buyer tax credit and its anticipated boost to buying activity leading up to the Nov. 30 expiration date,” said NAHB Chairman Joe Robson, a home builder from Tulsa, Okla. “The question is what happens after that ..."

...

“One very positive aspect of today’s report is the big gain registered in the component gauging home builders’ expectations for the next six months,” noted NAHB Chief Economist David Crowe. “This reflects anticipated sales stemming from the tax credit as well as recent signs that an economic recovery has begun. There is definitely a sense of hope among builders that the worst of the downturn is over and that a turning point is near at hand.”

...

NAHB is calling on Congress to extend the first-time home buyer tax credit for another year and to offer it to all income-eligible buyers.

Shanghai Cliff Diving

by Calculated Risk on 8/17/2009 11:03:00 AM

Just a note: The NAHB Housing Market Index will be released today at 1 PM ET, and the Fed Senior Loan Officer survey for July will probably be released today or tomorrow.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Shanghai SSE composite index is cliff diving again following the recent large increase. The index was off 5.8% on Friday today.

I've also added the S&P 500 for comparison (dashed blue line).

NY Fed: Empire State Manufacturing "Improved"

by Calculated Risk on 8/17/2009 08:33:00 AM

From the NY Fed: Empire State Manufacturing Survey

For the first time in considerably more than a year, the Empire State Manufacturing Survey indicates that conditions for New York manufacturers have improved. The general business conditions index increased 13 points, to 12.1, its highest level since November of 2007. Although the inventories index remained well below zero, the new orders and shipments indexes rose to their highest levels in many months. The prices paid index was positive, while the prices received index continued to be negative. Employment indexes were much improved from their recent low levels, although they remained below zero. Future indexes generally rose from last month and conveyed optimism about the six-month outlook; the capital expenditures index rose to its highest level in over a year.Here is the general business conditions index. Note that the data only goes back to July 2001 (chart to Jan 2002). Any reading above zero is expansion, so this index shows manufacturing is expanding in August.

Lowe's: 'Consumers Remain Cautious', Cuts Investment Plans

by Calculated Risk on 8/17/2009 08:17:00 AM

Press Release from Lowe's:

Lowe's Companies, Inc. ... the world's second largest home improvement retailer, today reported net earnings of $759 million for the quarter ended July 31, 2009, a 19.1 percent decline from the same period a year ago.According to the BEA data, home improvement has held up better than other areas of residential investment:

...

"Wavering consumer confidence, unseasonable weather in core markets, and restrained customer spending compared to last year's fiscal stimulus-aided results led to lower than expected sales in the second quarter," commented Robert A. Niblock, Lowe's chairman and CEO. "Cautious consumers remain reluctant to take on discretionary projects until signs of economic improvement are more evident."

...

In response to the challenging economic environment, which has resulted in declining demand for home improvement products, the company has re-evaluated its future store expansion plans. For 2010, expansion in North America will be below previously anticipated levels, and new store openings will likely be in the range of 35 to 45. Given this, the company has evaluated the pipeline of potential future store sites and made the decision to no longer pursue several projects.

emphasis added

Click on graph for updated image in new window.

Click on graph for updated image in new window.This graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.08% of GDP, well off the high of 1.31% in Q4 2005 - but just back to the average of the last 50 years of 1.07%.

This would seem to suggest there remains downside risk to home improvement spending. Home Depot and Lowes are the largest home improvement retailers, and their results are something to watch.

NOTE: Home improvement is a rough estimate by the BEA - and could be lower. Also, there could be changes in spending patterns leading to a higher percentage of GDP on home improvement.

Sunday, August 16, 2009

Report: Guaranty Bank Bids Due Monday

by Calculated Risk on 8/16/2009 10:40:00 PM

The Financial Times is reporting that regulators have ask prospective buyers to submit bids for Guaranty Bank on Monday.

Guaranty Bank had $14.4 billion in assets at the end of Q1.

From Reuters: Regulators want Guaranty bids by Monday: report

Regulators are hoping that three banks that had bid for Colonial Bank -- Canada's Toronto Dominion, JPMorgan and Spain's BBVA -- will step in to bid for Guaranty ... private equity consortium, which includes Blackstone Group LP, Carlyle, Oak Hill Capital, TPG and the Texas banker Gerald Ford, is also considering a bid for GuarantySounds like another fairly large bank failure this week.