by Calculated Risk on 8/21/2009 01:19:00 PM

Friday, August 21, 2009

DataQuick: California Bay Area home sales hit 4-year high

From DataQuick: Bay Area home sales hit 4-year high; median price up again

Bay Area home sales rose last month to the highest level for a July in four years as deals above $500,000 continued to accelerate. ...As always, be very careful with the median home price. DataQuick does a good job of explaining how it is being distorted by the mix of homes sold.

The median’s $43,000 gain between June and July was mainly the result of a shift toward a greater portion of sales occurring in higher-priced neighborhoods. The trend has been fueled this summer by several factors, including: More distress in high-end areas, leading to more motivated sellers; more buyers sensing a bottom could be near; and increased availability of larger home loans, which had become more expensive and far more difficult to obtain after the credit crunch hit two years ago.

...

As high-end sales have taken off in recent months, sales of foreclosures in less-expensive inland areas have tapered off. Last month 34.2 percent of the Bay Area homes that resold were foreclosure resales – homes resold in July that had been foreclosed on in the prior 12 months. Last month’s foreclosure resale level was the lowest since it was 33.3 percent in July 2008. Foreclosure resales peaked at 52 percent of all Bay Area resales in February this year.

...

“Evidence is mounting that in some areas we’ve approached at least a soft bottom for home prices,” [John Walsh, MDA DataQuick president] said. “But we continue to view that possibility with an abundance of caution, given all of the uncertainty over future foreclosure inventories and ongoing job cuts. The market remains vulnerable.”

A total of 8,771 new and resale houses and condos sold in the nine-county Bay Area last month. That was up 1.5 percent from 8,664 in June and up 15.6 percent from 7,586 in July 2008.

Although last month’s sales were the highest for the month of July in four years, and the highest for any month since August 2006, they were still 7.8 percent lower than the average of 9,512 homes sold during the month of July going back to 1988, when DataQuick’s statistics begin. July sales have varied between a low of 6,666 sales in 1995 and a peak of 14,258 in 2004.

... Foreclosure activity is off its recent peak but remains high by historical standards ...

emphasis added

Last year financing for higher priced homes was very difficult, so it is no surprise that with a combination of increasing distressed sales in the mid-to-high end areas, and more financing, sales have picked up some.

DOT: Vehicle Miles Increased in June

by Calculated Risk on 8/21/2009 12:56:00 PM

Although vehicle miles increased in June 2009 compared to June 2008, miles driven are still 3.3% below the peak for the month of June in 2007.

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by +2.0% (4.9 billion vehicle miles) for June 2009 as compared with June 2008. Travel for the month is estimated to be 256.7 billion vehicle miles.

Cumulative Travel for 2009 changed by -0.4% (-6.1 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the rolling 12 month of U.S. vehicles miles driven.

By this measure (used to remove seasonality) vehicle miles declined sharply and are now moving sideways.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. As the DOT noted, miles driven in June 2009 were 2.0% greater than in June 2008.

Year-over-year miles driven started to decline in December 2007, and really fell off a cliff in March 2008. This makes for an easier comparison for June 2009.

Existing Home Sales increase in July

by Calculated Risk on 8/21/2009 10:00:00 AM

The NAR reports: Strong Gain in Existing-Home Sales Maintains Uptrend

Existing-home sales – including single-family, townhomes, condominiums and co-ops – rose 7.2 percent to a seasonally adjusted annual rate of 5.24 million units in July from a level of 4.89 million in June, and are 5.0 percent above the 4.99 million-unit pace in July 2008.

...

Total housing inventory at the end of July rose 7.3 percent to 4.09 million existing homes available for sale, which represents a 9.4-month supply at the current sales pace, which was unchanged from June because of the strong sales gain.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July 2009 (5.24 million SAAR) were 7.2% higher than last month, and were 5.0% lower than July 2008 (4.99 million SAAR).

Here is another way to look at existing homes sales: Monthly, Not Seasonally Adjusted (NSA):

This graph shows NSA monthly existing home sales for 2005 through 2009. As in June, sales (NSA) were slightly higher in July 2009 than in July 2008.

This graph shows NSA monthly existing home sales for 2005 through 2009. As in June, sales (NSA) were slightly higher in July 2009 than in July 2008.It's important to note that many of these transactions are either investors or first-time homebuyers. Also many of the sales are distressed sales (short sales or REOs).

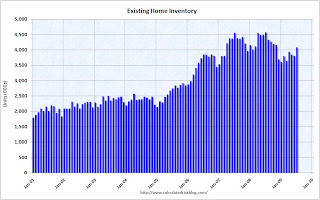

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory increased to 4.09 million in July. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory increased to 4.09 million in July. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.Typically inventory peaks in July or August. This increase in inventory was a little more than usual.

Note: many REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs and other shadow inventory - so this inventory number is probably low.

The fourth graph shows the 'months of supply' metric for the last six years.

The fourth graph shows the 'months of supply' metric for the last six years.Months of supply was steady at 9.4 months.

Sales increased, and inventory increased, so "months of supply" was steady. A normal market has under 6 months of supply, so this is still very high.

Note: New Home sales will be released next Wednesday.

Existing Home Sales and First-Time Buyers

by Calculated Risk on 8/21/2009 08:53:00 AM

Existing home sales for July will be released at 10 AM ET.

From CNBC: Existing Home Sales May Top 5 Million: ING Analysts

Existing home sales may have crossed the 5 million mark in July, as buyers are coming back to the market, analysts from ING bank said in a market research note Friday.But no mention of the first-time home buyer frenzy? As I noted earlier:

...

"The surge in the number of signed contracts… suggests existing home sales are about to cross the 5-million mark. There is a fair chance sales already crossed that barrier last month," the note said.

...

"Sales pushing above 5.1 million – the pre-Lehman level – would help to make a convincing case that this is not just a correction, but a real pick-up in activity," ING analysts wrote.

Expect a surge in existing home sales (and some new home sales) over the next few months. Expect all kinds of reports that the bottom has been reached. (Like the ING report via CNBC)

Expect the frenzy to end ...

Here is a repeat of a graph by buyer type in Q2 from the Campbell survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.According to the Campbell survey first-time buyers accounted for 43% of sales in Q2 (investors another 29%).

Source: Summary Report--Real Estate Agents Report on Home Purchases and Mortgages, Campbell Communications, June 2009 (excerpted with permission)

Thursday, August 20, 2009

Guaranty Bank: OTS Closes the Barn Door

by Calculated Risk on 8/20/2009 10:37:00 PM

It has been widely reported that the assets of Guaranty Bank (Texas) will be seized Friday by the FDIC and sold to Banco Bilbao Vizcaya Argentaria SA of Spain.

Meanwhile the OTS issued a Prompt Corrective Action (PCA) to Guaranty yesterday. Maybe they didn't get the memo ...

Also, from the WSJ: In New Phase of Crisis, Securities Sink Banks

Guaranty owns roughly $3.5 billion of securities backed by adjustable-rate mortgages, with two-thirds of the loans in foreclosure-wracked California, Florida and Arizona, according to the company's latest report. Delinquency rates on the holdings have soared as high as 40%, forcing write-downs last month that consumed all of the bank's capital.It's not just their own bad loans (usually C&D and CRE) taking down the local and regional banks, but also bad investments in securities based on other bank's bad loans. From the article:

Guaranty is one of thousands of banks that invested in such securities ...

One banking lawyer who asked not to be identified describes the result as a "wonderful chain of stupidity."I'm not sure it is so "wonderful" ...

CRE: ABI and Nonresidential Structure Investment

by Calculated Risk on 8/20/2009 07:36:00 PM

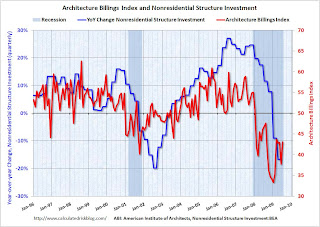

The American Institute of Architects (AIA) releases the Architecture Billings Index (ABI) monthly, and the AIA chief economist Kermit Baker frequently mentions there is an "approximate nine to twelve month lag time between architecture billings and construction spending." Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the ABI with the quarterly data on nonresidential construction investment from the Bureau of Economic Analysis.

Although there is only data back to 1996, it appears that after the ABI falls consistently below 50 (contraction of billings on mostly commercial projects), then nonresidential structure investment declines on a YoY basis about one year later.

And YoY investment increases about one year after the ABI surpasses 50.

This suggests that nonresidential structure investment will decline through most of 2010, with no bottom in sight (since the ABI is still well below 50).

Right now I'm expecting another major slump in nonresidential structure investment towards the end of this year (following the ABI slump at the end of 2008), and for nonresidential structure investment to decline throughout 2010.

U.S. Mortgage Market and Seriously Delinquent Loans by Type

by Calculated Risk on 8/20/2009 04:12:00 PM

A little more information from the MBA Q2 delinquency report (and market graph below): Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the U.S. mortgage market by type. There are about 45 million loans included in the MBA survey, and that is about 85% of the U.S. market.

This is a general breakdown, and apparently Alt-A is included in Prime (it would be helpful to break that out). The second graph shows the breakdown by type for loans that are either seriously delinquent (90+ days delinquent) or in the foreclosure process. There are about 3.6 million loans in this category.

The second graph shows the breakdown by type for loans that are either seriously delinquent (90+ days delinquent) or in the foreclosure process. There are about 3.6 million loans in this category.

Clearly subprime is disproportionately represented (much higher delinquency rate), but now over half the loans in this category are Prime - and the delinquency rate is growing faster for Prime. This is now a Prime foreclosure crisis.

For more, please see earlier posts:

MBA Forecasts Foreclosures to Peak at End of 2010 (several graphs)

MBA: Record 13.2 Percent of Mortgage Loans in Foreclosure or Delinquent in Q2 Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Hotel RevPAR off 16.2 percent

by Calculated Risk on 8/20/2009 02:46:00 PM

From HotelNewsNow.com: STR reports US performance for week ending 15 August 2009

In year-over-year measurements, the industry’s occupancy fell 6.9 percent to end the week at 63.9 percent. Average daily rate dropped 9.9 percent to finish the week at US$96.70. Revenue per available room for the week decreased 16.2 percent to finish at US$61.80.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 7.0% from the same period in 2008.

The average daily rate is down 9.9%, and RevPAR is off 16.2% from the same week last year.

Note: This is a multi-year slump. Although the occupancy rate was off 6.9 percent compared to last year, the occupancy rate is off about 11 percent compared to the same week in 2007.

As previously mentioned, the end of July and beginning of August is the peak leisure travel period. The peak occupancy rate for 2009 was probably four weeks ago at 67%. Also, business travel was off much more than leisure travel earlier this year, so the summer months are not as weak as other times of the year. September will be the real test for business travel.

FDIC: DIF Update, may soften Private Equity Rules

by Calculated Risk on 8/20/2009 01:32:00 PM

First there has been some discussion of the status of the Deposit Insurance Fund (DIF).

Bloomberg has some details: FDIC May Add to Special Fees as Mounting Failures Drain Reserve

... The fund had $13 billion on March 31, the lowest since 1992 when it was $178.4 million, the FDIC said. The 56 bank collapses since March 31 cost an estimated $16 billion.This special assessment is on top of the Q2 "emergency fee of 5 cents for every $100 of assets". So the FDIC still has resources to pay all insurance claims.

... the Federal Deposit Insurance Corp. to impose a special fee as soon as next month to boost reserves by $5.6 billion. ...

If the fund is drained, the FDIC also has the option of tapping a line of credit at the Treasury Department that Congress extended in May to $100 billion, with temporary borrowing authority of $500 billion through 2010.

And from the WSJ: FDIC to Soften Private-Equity Curbs

... The FDIC is expected to retreat from its July proposal that private-equity firms have a Tier 1 capital ratio of at least 15% in order to bid on failed banks, and instead require such investors to maintain ratios of at least 10% ...

The FDIC also is expected to ease parts of its proposal that would have required buyout firms to guarantee that they'd provide financial support to any of their banking subsidiaries. ... Buyout firms are still expected to complain about mandates that they hold on to bank charters for at least three years, which would constrain the firms from turning quick profits on the deals.

MBA Forecasts Foreclosures to Peak at End of 2010

by Calculated Risk on 8/20/2009 11:21:00 AM

On the MBA conference call concerning the "Q2 2009 National Delinquency Survey", MBA Chief Economist Jay Brinkmann said this morning:

Note: The MBA data shows about 5.8 million loans delinquent or in the foreclosure process nationwide. I believe the MBA surveys covers close to 90% of the mortgage market. Many of these loans will cure, but the foreclosure pipeline is still building.

A few graphs ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the delinquency and in foreclosure rates for all prime loans.

Prime loans account for all 78% of all loans.

"We're all subprime now!" NOTE: Tanta first wrote this saying in 2007 in response to the 'contained to subprime' statements.

The second graph shows just fixed rate prime loans (about 65.5% of all loans).

The second graph shows just fixed rate prime loans (about 65.5% of all loans).Prime ARMs have a higher delinquency rate than Prime FRMs, but the foreclosure crisis has now spread to Prime fixed rate loans.

Note that even in the best of times (with rapidly rising home prices in 2005), just over 2% of prime FRMs were delinquent or in foreclosure. However the cure rate was much higher back then since a delinquent homeowner could just sell their home.

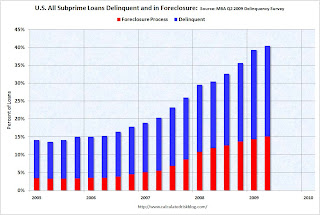

The third graph shows the delinquency and in foreclosure process rates for subprime loans.

The third graph shows the delinquency and in foreclosure process rates for subprime loans. Although the increases have slowed, about 40% of subprime loans are delinquent or in foreclosure.

The fourth graph shows the delinquency and foreclosure rates by state (add: and D.C. and Puerto Rico!).

The 'in foreclosure' rate can vary widely by state, because the process is fairly quick in some states, and very slow in other states (like Florida).

The 'in foreclosure' rate can vary widely by state, because the process is fairly quick in some states, and very slow in other states (like Florida).Although most of the delinquencies are in a few states - because of a combination of high delinquency rates and large populations - the crisis is widespread.

And a final comment: historically house prices do not bottom until after foreclosure activity peaks in a certain area. Since the subprime crisis delinquency rates might be peaking, it would not be surprising if prices are near a bottom in the low end areas. But in general I'd expect further declines in house prices - especially in mid-to-high end areas.

MBA: Record 13.2 Percent of Mortgage Loans in Foreclosure or Delinquent in Q2

by Calculated Risk on 8/20/2009 10:08:00 AM

From the Mortgage Bankers Association (MBA): Delinquencies Continue to Climb, Foreclosures Flat in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 9.24 percent of all loans outstanding as of the end of the second quarter of 2009, up 12 basis points from the first quarter of 2009, and up 283 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.We're all subprime now!

...

The delinquency rate breaks the record set last quarter. The records are based on MBA data dating back to 1972.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 4.30 percent, an increase of 45 basis points from the first quarter of 2009 and 155 basis points from one year ago. The combined percentage of loans in foreclosure and at least one payment past due was 13.16 percent on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

...

“While the rate of new foreclosures started was essentially unchanged from last quarter’s record high, there was a major drop in foreclosures on subprime ARM loans. The drop, however, was offset by increases in the foreclosure rates on the other types of loans, with prime fixed-rate loans having the biggest increase. As a sign that mortgage performance is once again being driven by unemployment, prime fixed-rate loans now account for one in three foreclosure starts. A year ago they accounted for one in five....” said Jay Brinkmann, MBA’s Chief Economist.

emphasis added

More to come ...

Philly Fed: "Some signs of stabilizing"

by Calculated Risk on 8/20/2009 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region's manufacturing sector is showing some signs of stabilizing ....

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from -7.5 in July to 4.2 this month. This is the highest reading of the index since November 2007. The percentage of firms reporting increases in activity (27 percent) was slightly higher than the percentage reporting decreases (23 percent). Other broad indicators also suggested improvement. The current new orders index edged six points higher, from -2.2 to 4.2, also its highest reading since November 2007. The current shipments index increased 10 points, to a slightly positive reading.

Labor market conditions remain weak. Firms continue to report declines in employment and work hours, but overall job losses were not as large this month. The current employment index increased from a weak reading of -25.3 to -12.9, its highest level in 11 months. Twenty-three percent of firms reported declines in employment this month, down from 30 percent in the previous month. ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

The index was been negative for 19 of the previous 20 months, before turning slightly positive this month. Employment is still weak.

Weekly Unemployment Claims Increase, Workers Exhausting Extended Benefits

by Calculated Risk on 8/20/2009 08:30:00 AM

The DOL reports weekly unemployment insurance claims increased to 576,000:

In the week ending Aug. 15, the advance figure for seasonally adjusted initial claims was 576,000, an increase of 15,000 from the previous week's revised figure of 561,000. The 4-week moving average was 570,000, an increase of 4,250 from the previous week's revised average of 565,750.The advance number for seasonally adjusted insured unemployment during the week ending Aug. 8 was 6.24 million.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 4,250 to 570,000, and is now 88,750 below the peak of 19 weeks ago. It appears that initial weekly claims have peaked for this cycle - but the average has increased 22,000 from the low of two weeks ago.

The number of initial weekly claims is still very high (at 576,000), indicating significant weakness in the job market. The four-week average of initial weekly claims will probably have to fall below 400,000 before the total employment stops falling.

It is difficult to calculate the number of workers who have exhausted their extended claims, but that number is expected to rise sharply over the next few months. From the O.C. Register: Estimate doubles for jobless losing benefits Sept. 1 (ht Keith)

An estimated 143,000 unemployed workers in California will exhaust their jobless benefits by Sept. 1, according to new figures released by the state Employment Development Department.

That's more than double the 61,906 state officials estimated a month ago. The number is based on workers who will exhaust the basic 26 weeks of benefits plus the three extensions approved by Congress.

If Congress does not approve a fourth extension in benefits, EDD projects that 264,000 Californians will be kicked off the unemployment rolls by the end of the year.

UK: BofE Forecasts Suggests Recession is Over

by Calculated Risk on 8/20/2009 12:11:00 AM

From The Times: City taken by surprise as Bank of England’s figures herald end of recession

Britain has emerged from the worst recession since the Second World War, new Bank of England figures suggested yesterday ...Note that the GDP figures in Britain are not annualized (0.4 percent is about 1.6 percent as reported in the U.S.)

Detailed forecasts published by the Bank showed that gross domestic product (GDP) will rise by 0.2 per cent between July and September, marking the first economic expansion since the first three months of last year. The Bank expects the economy to continue to expand in the fourth quarter, by 0.4 per cent, and sustain the recovery throughout next year.

The recession has apparently ended in Japan, Germany, and France.

Wednesday, August 19, 2009

FDIC to Discuss Off-balance-sheet Risk-based Capital Guidelines next week

by Calculated Risk on 8/19/2009 08:39:00 PM

On the agenda for the FDIC board meeting next week:

Memorandum and resolution re: Final Statement of Policy of Qualifications for Failed Bank Acquisitions.The first item is important because this is the issue supposedly limiting bids from private equity firms for failed banks. See from MarketWatch: FDIC chills private-equity bank bidders

Memorandum and resolution re: Final Rule on the Extension of the Transaction Account Guarantee Program.

Memorandum and resolution re: Notice of Proposed Rulemaking Regarding Risk-Based Capital Guidelines; Impact of Modifications to Generally Accepted Accounting Principles; Consolidation of Asset-Backed Commercial Paper Programs; and Other Related Issues.

On the second issue, from Reuters: US to study impact of new off-balance-sheet rules (ht jb)

U.S. regulators plan to gauge how severe of a hit banks will take from an accounting change that will force them to bring more than $1 trillion of assets back on their books.There is much more in the article.

Next week regulators expect to propose a rule that seeks input on whether banks need more time to build capital cushions against the assets that were once held by off-balance-sheet trusts.

Banks will still have to move the assets back on to their books on Jan. 1, 2010, but regulators want feedback on the impact of the accounting change and whether it might be prudent to phase in the risk-weighted capital that must be held against the assets.

Report: BBVA Submits Winning Bid for Guaranty Bank (Texas)

by Calculated Risk on 8/19/2009 05:03:00 PM

From Bloomberg: BBVA Said to Win FDIC Bidding for Guaranty Financial of Texas

Banco Bilbao Vizcaya Argentaria SA ... was selected to take over the assets of Guaranty Financial Group Inc. in a government-assisted transaction ...Guaranty might be seized tomorrow - or even today (like what happened with BankUnited after the deal was leaked).

Guaranty will be the second largest failure of the year.

Ouch. Colonial Left a Mark! (on Loans)

by Calculated Risk on 8/19/2009 04:06:00 PM

From Peter Eavis at the WSJ: Colonial Bank Marks a New Low for Loans

In doing the deal, BB&T is marking down Colonial loans and real-estate collateral by 37%, a number that reflects a large amount of estimated losses. The biggest mark is on construction loans; BB&T is cutting their value by 67%.And here is the BB&T presentation.

Click on slide for larger image in new window.

Click on slide for larger image in new window.Yes, Colonial had some really bad loans. Peter Eavis quoted Daryl Bible, BB&T's chief financial officer: "When we looked at Colonial's portfolio versus ours, we saw a lot of borrowers we turned away."

Still it appears the BB&T / Colonial marks are the lowest yet.

Moody’s: CRE Prices Off 36 Percent from Peak, Off 1% in June

by Calculated Risk on 8/19/2009 01:25:00 PM

From Bloomberg: U.S. Commercial Property Values Fall as Rent Declines Forecast

The Moody’s/REAL Commercial Property Price Indices fell 1 percent in June and are down 36 percent from their October 2007 peak, Moody’s Investors Service said in a report today.I think the office prices increase was an anomaly. Other CRE prices fell much faster.

...

“It’s too soon to call the bottom,” said Connie Petruzziello, a Moody’s analyst and co-author of the commercial property price report.

The Moody’s survey found a 4 percent increase in office prices in the second quarter compared with the previous three months ... Industrial properties ... fell 20 percent in the quarter, while apartments fell 16 percent and retail properties 8 percent.

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted - that is the name of the company (an unfortunate choice for a price index). Moody's CRE price index is a repeat sales index like Case-Shiller.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.

Failed Bank List, Including Percent Losses

by Calculated Risk on 8/19/2009 11:20:00 AM

As a companion to the Problem Bank List (unofficial), here is a list of failed banks since Jan 2007. Deposits, assets and estimated losses are all in thousands of dollars.

Losses for failed banks in 2009 are the initial FDIC estimates. The percent losses are as a percent of assets.

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. You can click on the number and see "the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Financial Reform: Don't hold your breath

by Calculated Risk on 8/19/2009 10:00:00 AM

From Bloomberg: Scholes, Merton Says Banks Should Value Assets Better (ht Brian)

Financial institutions should use mark-to-market accounting or list the hard-to-value securities on public exchanges whenever possible, Scholes said in a Bloomberg Radio interview yesterday. ...Don't hold your breath.

“I’d like to see us encourage many more securities held on the books of the banks be migrated to exchanges if possible,” he said. Doing so would “allow for market discovery and market pricing as much as possible,” Scholes added.

...

“This is not the way forward,” [Merton, Robert Kaplan and Scott Richard] wrote. “While regulators and legislators are keen to find simple solutions to complex problems, allowing financial institutions to ignore market transactions is a bad idea.”

And from the SEC: Sample Letter Sent to Public Companies on MD&A Disclosure Regarding Provisions and Allowances for Loan Losses (ht LDM)

Clear and transparent disclosure about how you account for your provision and allowance for loan losses has always been critically important to an investor’s understanding of your financial statements. ... Finally, although determining your allowance for loan losses requires you to exercise judgment, it would be inconsistent with generally accepted accounting principles if you were to delay recognizing credit losses that you can estimate based on current information and events. Where we believe a financial institution’s financial statements are inconsistent with GAAP, we will take appropriate action.Don't hold your breath.

emphasis added

And from the Jackson Hole conference in 1987: Restructuring the Financial System. Concluding remarks from Gerald Corrigan:

Clearly there is a broad-based consensus that something has to be done about restructuring our financial system. There is even a broadbased consensus as to why it has to be done. I certainly would count myself among those who put considerable urgency behind the task of getting it done.Nothing was done. Hopefully no one held their breath.