by Calculated Risk on 8/24/2009 04:00:00 PM

Monday, August 24, 2009

Misc: Long Hours at the FDIC, Foreclosures Movin' on Up!

Here is an email sent out by George Mason University today (thanks to KurtyBoy):

Beginning August 30, after hours parking in the FDIC parking garage, from 5:30 pm to 11:00 pm with a valid Mason Arlington permit, is no longer available.

Click on email for larger image in new window.

Click on email for larger image in new window.KurtyBoy adds: "Notice how the bullet about the parking has been added in a different font? Like a change that just got made.... "

Looks like long hours for Sheila Bair and crew.

And from Jim the Realtor:

Here is the market graph from Doug Short, Doug Short is matching up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Comment on First-time Homebuyer Tax Credit

by Calculated Risk on 8/24/2009 01:52:00 PM

A few comments on the first-time homebuyer tax credit:

The tax credit is up to 10% of the purchase price, or $8 thousand maximum. "First-time" homebuyers are defined as anyone who hasn't owned a primarily residence for the last 3 years (not really "first-time").

Fitch: "Dramatic" Decrease in Cure Rates for Delinquent Mortgage Loans

by Calculated Risk on 8/24/2009 12:04:00 PM

These are very important numbers ...

Press Release from Fitch: Fitch: Delinquency Cure Rates Worsening for U.S. Prime RMBS (ht BURN, Ron Wallstreetpit)

While the number of U.S. prime RMBS loans rolling into a delinquency status has recently slowed, this improvement is being overwhelmed by the dramatic decrease in delinquency cure rates that has occurred since 2006, according to Fitch Ratings. An increasing number of borrowers who are 'underwater' on their mortgages appear to be driving this trend, as Fitch has also observed.This really puts the recent rise in delinquencies in perspective. Look at this graph from MBA Forecasts Foreclosures to Peak at End of 2010

Delinquency cure rates refer to the percentage of delinquent loans returning to a current payment status each month. Cure rates have declined from an average of 45% during 2000-2006 to the currently level of 6.6%. ...

'Recent stability of loans becoming delinquent do not take into account the drastic decrease in delinquency cure rates experienced in the prime sector since the peak of the housing market,' said [Managing Director Roelof Slump]. 'While prime has shown the most precipitous decline, rates have dropped in other sectors as well.'

In addition to prime cure rates dropping to 6.6%, Alt-A cure rates have dropped to 4.3%, from an average of 30.2%, and subprime is down to 5.3% from an average of 19.4%. 'Whereas prime had previously been distinct for its relatively high level of delinquency recoveries, by this measure prime is no longer significantly outperforming other sectors,' said Slump.

... Furthermore, up to 25% of loans counted as cures are modified loans, which have been shown to have an increased propensity to re-default.

... 'As income and employment stress has spread, weaker prime borrowers become more likely to become delinquent in their loan payments and are less likely to become current again,' said Slump.

Regardless of aggregate roll-to-delinquent behavior, it will be difficult to argue that the market has stabilized or that performance has improved, until there is a concurrent increase in cure rates. This is especially true in the prime sector, which remains performing many times worse than historic averages. Prime 60+ delinquencies have more than tripled in the past year, from $9.5 billion to $28 billion total, or roughly $1.6 billion a month.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the delinquency and in foreclosure rates for all prime loans.

Prime loans account for all 78% of all loans.

Back in the 2000 to 2006 period, 45% of those delinquencies cured. Now, according to Fitch, only 6.6% cure - and a large percentage of those "cures" are modifications - and there is a large redefault rate on those loans.

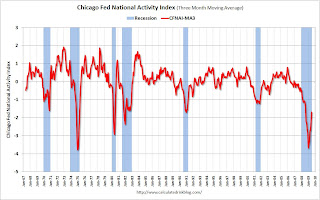

Chicago Fed: July National Activity Index

by Calculated Risk on 8/24/2009 10:33:00 AM

From the Chicago Fed: Index shows economic activity improved in April

The Chicago Fed National Activity Index was –0.74 in July, up from –1.82 in June. All four broad categories of indicators improved in July, while three of the four continued to make negative contributions to the index. Production-related indicators made a positive contribution to the index for the first time since October 2008 and for only the second time since December 2007.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"[T]he Chicago Fed National Activity Index (CFNAI), is a weighted average of 85 existing, monthly indicators of national economic activity. The CFNAI provides a single, summary measure of a common factor in these national economic data ...

[T]he CFNAI-MA3 appears to be a useful guide for identifying whether the economy has slipped into and out of a recession. This is useful because the definitive recognition of business cycle turning points usually occurs many months after the event. For example, even though the 1990-91 recession ended in March 1991, the NBER business cycle dating committee did not officially announce the recession’s end until 21 months later in December 1992. ...

When the economy is coming out of a recession, the CFNAI-MA3 moves significantly into positive territory a few months after the official NBER date of the trough. Specifically, after the onset of a recession, when the index first crosses +0.20, the recession has ended according to the NBER business cycle measures."

Note: this is based on only a few recessions, but this is one of the indicators to watch to determine when the recession ends. This suggests the economy was still in recession in July.

Of course this says nothing about economic purgatory ...

Roubini Concerned about Double Dip Recession

by Calculated Risk on 8/24/2009 08:52:00 AM

From Bloomberg: Roubini Sees Increasing Risk of Double-Dip Recession

Nouriel Roubini ... said the chance of a double-dip recession is increasing ... The global economy will bottom out in the second half of 2009, Roubini wrote ...There are still many problems in the economy, including the housing market, commercial real estate, household balance sheets (still too much debt), consumer spending, and more. As Roubini notes, there are significant risks "associated with exit strategies from the massive monetary and fiscal easing".

“There are risks associated with exit strategies from the massive monetary and fiscal easing,” Roubini wrote. “Policy makers are damned if they do and damned if they don’t.”

Government and central bank officials may undermine the recovery and tip their economies back into “stagdeflation” if they raise taxes, cut spending and mop up excess liquidity in their systems to reduce fiscal deficits, Roubini says. He defines “stagdeflation” as recession and deflation.

...

Roubini currently expects a U-shaped recovery, where growth will be “anemic and below trend for at least a couple of years,” he said.

From the WSJ: Policy Makers Seek to Learn From 1937's Stalled Comeback

The Great Depression was W-shaped. The stock-market collapse led to a steep economic decline. But by 1933, the economy had rebounded. Then a series of monetary and fiscal blunders drove the country back into a deep recession at the end of 1937.

That episode is at the heart of the debate over how quickly the government and the U.S. Federal Reserve should unwind the emergency measures they have taken to fend off a Depression-like contraction.

For the administration, the answer is clear: Err on the side of continued expansionary policies. "What you learned from that episode in 1937 is that it's not enough to be recovering," says Christina Romer, chairman of the president's Council of Economic Advisers and an expert on the Great Depression. "You don't want to do anything when you start recovering that nips it off too soon."

Sunday, August 23, 2009

Bove sees 150-200 more bank failures

by Calculated Risk on 8/23/2009 07:31:00 PM

From Reuters: Analyst Bove sees 150-200 more U.S. bank failures (ht Ron at WallStreetPit)

[Dick] Bove said "perhaps another 150 to 200 banks will fail," on top of 81 so far in 2009, adding stress to the FDIC's deposit insurance fund.Meredith Whitney said Friday that she expects around 300 banks to fail this cycle. With 109 failures so far (81 this year), 300 seems low. I'll take the over ...

...

Bove said the FDIC will likely levy special assessments against banks in the fourth quarter of this year and second quarter of 2010.

He said these assessments could total $11 billion in 2010, on top of the same amount of regular assessments. "FDIC premiums could be 25 percent of the industry's pretax income," he wrote.

Krugman: Economy in "Purgatory"

by Calculated Risk on 8/23/2009 06:09:00 PM

"We've got a problem with terminology because we usually say either the economy is in recession or the economy is recovering. Either you're in hell, or you're in heaven. And the trouble is we're actually in purgatory. We're actually in a situation almost for sure GDP is growing; almost for sure the business cycle leading committee will eventually decide that the recession ended this summer. But almost surely also we're still losing jobs. The unemployment rate is going to continue to rise. So we're in that infamous jobless recovery state."

...

"What we have now is a whole lot better than seeing the end of the world six months down the pike, but it is not good enough - or even remotely good enough."

emphasis added

Social Security: No Increase to 2010 Benefits or Maximum Contribution Base

by Calculated Risk on 8/23/2009 11:34:00 AM

For something a little different ...

For the first time since the automatic cost of living adjustments (COLA) were adopted in 1975, Social Security benefits will not increase in December 2009. This also means the contribution base (currently $106,800) will not increase in 2010.

There is also a reasonable chance that there will be little or no increase in benefits in 2011 (starting in December 2010). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the cost of living adjustments for social security benefits since 1975 (increases start in December, but are mostly for the following year).

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W1 for the three months in Q3 (July, August, September) and compares to the average for the proceeding year Q3 months. Note: this is not the headline CPI-U.

In 2007, the average of CPI-W was 203.596. In 2008, the average was 215.495. That gives an increase of 5.8%.

Since Q3 2008 CPI-W has fallen - to 210.526 in July - and CPI-W will certainly be below 215.295 in August and September.

Instead of cutting benefits by the change in CPI-W, the benefits will stay the same for 2010.

However, for 2011, the calculation is not based on Q3 2010 over Q3 2009, but Q3 2010 over the highest preceding Q3 average - the 215.495 in Q3 2008. This means CPI-W could increase 2.3% over the next year, and there would be no increase in Social Security benefits in 2011.

Contribution and Benefit Base

In addition, this means the contribution base will not increase in 2010. Although the base is calculated using the National Average Wage Index, the law - as currently written - prohibits an increase in the contribution and benefit base if COLA is not greater than zero.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.In 2011, for benefits, the increase will be zero or small because the calculation is based on CPI-W in Q3 2008.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

However, for the contribution base in 2011, if the COLA is even slightly positive, the increase will be based on changes in the national average wage index (not COLA).

Note: It seems very likely that the base in 2011 will be increased by new legislation, so this probably will not matter - but it does matter for 2010.

(1) CPI-W usually tracks CPI-U (headline number) pretty well. From the BLS:

The Bureau of Labor Statistics publishes CPIs for two population groups: (1)the CPI for Urban Wage Earners and Clerical Workers (CPI-W), which covers households of wage earners and clerical workers that comprise approximately 32 percent of the total population and (2) the CPI for All Urban Consumers (CPI-U) ... which cover approximately 87 percent of the total population and include in addition to wage earners and clerical worker households, groups such as professional, managerial, and technical workers, the self- employed, short-term workers, the unemployed, and retirees and others not in the labor force.

SFGate: First-Time Homebuyers Competing with Investors

by Calculated Risk on 8/23/2009 09:16:00 AM

We've discussed this all year, and this is happening in many low priced areas ...

From Carolyn Said at the San Francisco Chronicle: 'Cash is king' in market for foreclosed homes

"Since January, I've put in 10 bids (on foreclosed homes); some were up to $80,000 over asking price and were still turned down," said [first-time home buyer, Jay] Nielsen, 41, a medical assistant. Each time, the banks selected offers from investors with all-cash offers - even when those offers were lower than his, Nielsen said.There is a buying frenzy right now for first-time homebuyers trying to take advantage of the $8,000 tax credit (see 6 things to know for details) before the program expires at the end of November (must close escrow by then).

"Cash is king right now," said Glen Bell of Keller Williams Realty in Berkeley. For foreclosed homes, "a cash offer that hits the target price will many times trump a higher-priced offer with a loan. The ability to close has become just as important to banks as price. The prospect of a property being tied up longer, still on their books and then falling out is costly."

The result is that average consumers say they are being shut out because they can't compete against deep-pocketed investors snapping up homes to rent out or flip. ...

All-cash sales are most common where prices are low and bank-owned properties account for the lion's share of listings. In foreclosure-ridden Pittsburg, for instance, 42.7 percent of home sales in the first three weeks of July had no record of a purchase loan, according to county data analyzed by MDA DataQuick. The median price for those transactions was $105,000.

Meanwhile cash-flow investors are buying properties in the same price range (the numbers don't work on higher priced homes). In some of these areas, the only buyers are first-time homebuyers frequently using the tax credit as their downpayment and investors. The sellers are banks or short sales.

Not exactly signs of a healthy market.

Saturday, August 22, 2009

Krugman: Some call it recovery

by Calculated Risk on 8/22/2009 09:02:00 PM

Excerpt from Paul Krugman: Some call it recovery

The real problem here is that the standard language doesn’t make much allowance for the kind of gray zone we’re now in; that’s because in the pre-1990 era recessions tended to be V-shaped, so that jobs snapped back as soon as GDP turned around. I don’t think what we’re going through is good news — but GDP is almost surely rising, so the recession, as normally defined, is over.Excerpt from The Economist: U, V or W for recovery

...

But the economy is not recovering in the most crucial area, job creation ...

The world economy has stopped shrinking. That’s the end of the good newsIt does appear the cliff diving is over, and that the U.S. economy will grow in the 3rd quarter. But there are still more problems ahead for consumer spending and housing (I think housing is still the key - and I'll discuss this soon).

... a rebound based on stock adjustments is necessarily temporary, and one based on government stimulus alone will not last. Beyond those two factors there is little reason for cheer. America’s housing market may yet lurch down again as foreclosures rise, high unemployment takes its toll and a temporary home-buyers’ tax-credit ends (see article). Even if housing stabilises, consumer spending will stay weak as households pay down debt. In America and other post-bubble economies, a real V-shaped bounce seems fanciful.

An immaculate recovery seems remote.

Inland Empire: "The gold mine was construction"

by Calculated Risk on 8/22/2009 06:40:00 PM

Here is a followup story on the Inland Empire in California, from the NY Times: A Cul-de-Sac of Lost Dreams, and New Ones

This quote caught my eye:

"You have to think of it like a gold-mining town in a Clint Eastwood movie,” Mr. [John Husing, an economist whose expertise is Southern California] said. “Money comes to a place where there has never been any, and next there are tool stores, a saloon, a general store and so on. But the saloon doesn’t exist without the gold mine, and the gold mine here was construction.”Exactly. And the gold mine closed a few years ago.

Here is how I saw it in 2006 for the Inland Empire:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Fed's Bullard: Rates to Stay Low Longer than Market Expects

by Calculated Risk on 8/22/2009 01:37:00 PM

From Felix Salmon at Reuters: Fed official: rates to be kept low past upturn (ht Anthony)

Financial markets have not fully understood that the U.S. Federal Reserve's pledge to keep interest rates exceptionally low for an extended period means they will stay low beyond when officials normally would raise them, a top Fed official said on Friday.Bullard is repeating the FOMC statement:

"I don't think markets have really digested what that means," St Louis Fed President James Bullard said in an interview.

The Fed's strategy is aimed at promoting a future rise in inflation, which should provide an immediate boost in activity in anticipation of a future boom, but that hasn't happened, Bullard said.

The Committee ... continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period.Bullard thinks the markets haven't "digested what that means" - rates will be low for a long time - maybe through much or all of 2010.

Here is an interview with Bullard on a few other subjects, expects slow growth, discusses unwinding current policy.

Failed Banks and the Deposit Insurance Fund

by Calculated Risk on 8/22/2009 08:34:00 AM

As a companion to the Problem Bank List (unofficial), below is a list of failed banks since Jan 2007.

But first a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The graph shows the cumulative estimated losses to the FDIC Deposit Insurance Fund (DIF) and the quarterly assets of the DIF (as reported by the FDIC). Note that the FDIC takes reserves against future losses in the DIF, and collects fees and special assessments - so you can't just subtract estimated losses from assets to determine the assets remaining in the DIF.

The FDIC closed four more banks on Friday, and that brings the total FDIC bank failures to 81 in 2009. The following graph shows bank failures by week in 2009. Note: Week 1 on graph ends Jan 9th.

Note: Week 1 on graph ends Jan 9th.

The FDIC is seizing about 4 to 5 banks per week recently, and with over four months to go in 2009, this suggests close to 150 bank failures this year.

At the current pace there will be more failures in 2009 than in the early years of the S&L crisis. From 1982 thorough 1984 there were about 100 failures per year, and then the number of failures really increased as the 2nd graph shows. The 2nd graph covers the entire FDIC period (annually since 1934).

The 2nd graph covers the entire FDIC period (annually since 1934).

For a graph that includes the 1920s and early '30s (before the FDIC was enacted) see the 3rd graph here.

Of course the number of banks isn't the only measure. Many banks today have more branches, and far more assets and deposits.

Failed Bank List

Deposits, assets and estimated losses are all in thousands of dollars.

Losses for failed banks in 2009 are the initial FDIC estimates. The percent losses are as a percent of assets.

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. You can click on the number and see "the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Friday, August 21, 2009

Meredith Whitney: 300 Banks to Fail

by Calculated Risk on 8/21/2009 09:01:00 PM

From Bloomberg at Jackson Hole: (ht km4)

We are up to 81 bank failures this year, and 109 since the crisis started. With 391 banks on the unofficial problem bank list (and more to come), I think 300 is probably low. I'll take the over ...

Bank Failure #81: Down Goes Guaranty

by Calculated Risk on 8/21/2009 07:09:00 PM

Deep in the heart of Texas

Guaranty is ash

by Soylent Green is People

From the FDIC: BBVA Compass, Birmingham, Alabama, Assumes All of the Deposits of Guaranty Bank, Austin, Texas

Guaranty Bank, Austin, TX was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Added by request from Soylent Green is People:

As of June 30, 2009, Guaranty Bank had total assets of approximately $13 billion and total deposits of approximately $12 billion. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $3 billion. ... Guaranty Bank is the 81st FDIC-insured institution to fail in the nation this year, and the second in Texas. The last FDIC-insured institution closed in the state was Millennium State Bank of Texas, Dallas, July 2, 2009.

Bank Failures: #79 & #80: CapitalSouth Bank, Birmingham, Alabama and First Coweta, Newnan, Georgia

by Calculated Risk on 8/21/2009 06:10:00 PM

Georgia, running out of banks?

South will sink again...

by Soylent Green is People

From the FDIC: United Bank, Zebulon, Georgia, Assumes All of the Deposits of First Coweta, Newnan, Georgia

First Coweta, Newnan, Georgia was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....From the FDIC: IBERIABANK, Lafayette, Louisiana, Assumes All of the Deposits of CapitalSouth Bank, Birmingham, Alabama

As of July 31, 2009, First Coweta had total assets of $167 million and total deposits of approximately $155 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $48 million. ... First Coweta is the 79th FDIC-insured institution to fail in the nation this year, and the eighteenth in Georgia. The last FDIC-insured institution closed in the state was ebank, Atlanta, earlier today.

CapitalSouth Bank, Birmingham, Alabama, was closed today by the Alabama State Banking Department, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of June 30, 2009, CapitalSouth Bank had total assets of $617 million and total deposits of approximately $546 million....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $151 million. ... CapitalSouth Bank is the 80th FDIC-insured institution to fail in the nation this year, and the second in Alabama. The last FDIC-insured institution closed in the state was Colonial Bank, Montgomery, on August 14, 2009.

Bank Failure #78: ebank Atlanta, Georgia

by Calculated Risk on 8/21/2009 05:15:00 PM

Ebank has been pushed off-line

Now mere vapor ware.

by Soylent Green is People

From the FDIC: Stearns Bank, National Association, St. Cloud, Minnesota, Assumes All of the Deposits of ebank Atlanta, Georgia

ebank, Atlanta, Georgia, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...The costs to the DIF are esimtated at 44% of assets. Ouch.

As of July 10, 2009, ebank had total assets of $143 million and total deposits of approximately $130 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $63 million. ... ebank is the 78th FDIC-insured institution to fail in the nation this year, and the seventeenth in Georgia. The last FDIC-insured institution closed in the state was Security Bank of Jones County, Gray, on July 24, 2009.

It is Friday!

More on Existing Home Inventory

by Calculated Risk on 8/21/2009 04:00:00 PM

NEW Problem Bank List (Unofficial) Aug 21, 2009

Note: Market Graph at bottom ...

NOTE: the months line up with the lines on the following two graphs - sorry if that was confusing. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is another graph of inventory. This graph shows inventory since 2002 by year.

The dotted lines (2002 - 2004) are for the boom years. 2005 (dashed green) is the transition year at the end of the boom. And the solid colors are for the bust years. The second graph shows months of supply for the same years.

The second graph shows months of supply for the same years.

Although inventory and months of supply are lower than in 2007 and 2008, the levels are still very high.

It is important to watch inventory levels very carefully. If you look at the 2005 inventory data, instead of staying flat for most of the year (like the previous bubble years), inventory continued to increase all year. That was one of the key signs that led me to call the top in the housing market!

Note: there is probably a substantial shadow inventory – foreclosures coming as shown by the MBA delinquency survey yesterday, and homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time. There are also reports of REOs being held off the market, so inventory is probably under reported.

The third graph shows the year-over-year change in existing home inventory. My guess is prices will probably continue to fall until the months of supply reaches more normal levels (closer to 6 months compared to the current 9.4 months), and that will take some time.

My guess is prices will probably continue to fall until the months of supply reaches more normal levels (closer to 6 months compared to the current 9.4 months), and that will take some time.

However this general trend of declining year-over-year inventory levels is a positive for the housing market (while remembering the shadow inventory).

Here is the market graph from Doug Short, Doug Short matching up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Problem Bank List (Unofficial) Aug 21, 2009

by Calculated Risk on 8/21/2009 02:30:00 PM

This is an unofficial list of Problem Banks. Note: Reports are Guaranty (Texas) will be seized this afternoon.

The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay. The Fed and OTC data is more timely, and the OCC a little lagged. Credit: surferdude808.

Changes and comments from surferdude808:

While the number of institutions on the problem bank list only declined by a net one to 391 from 392 a week ago, there was a sizable decline in assets of $26b with the closures of Colonial Bank ($26.4b) and Community Bank of Nevada ($1.6b) on August 14th. Of the three other failures last Friday, two -- Union Bank, N.A., and Dwelling House S&L -- were under formal enforcement action while Community Bank of Arizona failed without being subject to a formal enforcement action or prompt corrective action order.DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

There are three additions during the week including the Savings Bank of Maine ($983.6m), Gardiner, ME; Royal Bank America ($735.2m), Narbeth, PA; and First Home Savings Bank ($241.7m), Mountain Grove, MO.

With the addition of a Maine based institution, 46 states and D.C. are represented on the problem list with only Alaska, Hawaii, New Hampshire, Vermont, and West Virginia not having an institution headquartered within their respective borders subject to formal enforcement action. Unlike the other five states, West Virginia did have a failure in 2008.

One other formal action issued during the week that may be from the twilight zone, the OTS issued a prompt corrective action order against Guaranty Bank on August 19th. With the numerous media reports circulating about the imminent closure of Guaranty Bank, what is the usefulness of a PCA order at the stage of the game?

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC