by Calculated Risk on 9/04/2009 06:08:00 PM

Friday, September 04, 2009

Bank Failure #85: First Bank of Kansas City, Kansas City, MO

A long weekend for resting

Also for failure

by Soylent Green is People

From the FDIC: Great American Bank, De Soto, Kansas, Assumes All of the Deposits of First Bank of Kansas City, Kansas City, Missouri

First Bank of Kansas City, Kansas City, Missouri, was closed today by the Missouri Division of Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Great American Bank, De Soto, Kansas, to assume all of the deposits of First Bank of Kansas City.A small one to start the day.

...

As of June 30, 2009, First Bank of Kansas City had total assets of $16 million and total deposits of approximately $15 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6 million. ... First Bank of Kansas City is the 85th FDIC-insured institution to fail in the nation this year, and the second in Missouri. The last FDIC-insured institution closed in the state was American Sterling Bank, Sugar Creek, on April 17, 2009.

Tax Credit: Mercury News Advocates Taxpayers pay $60 Thousand per Additional Home Sold

by Calculated Risk on 9/04/2009 04:29:00 PM

From the Mercury News: Editorial: Congress should expand $8,000 home-buyer tax credit (ht ShortCourage)

[I]t's crucial that when Congress returns from recess next week, lawmakers extend the soon-to-expire credit through 2010. And if they want to bolster the fledgling recovery, they'll expand eligibility.Do the math. $30 billion for an additional 500,000 sales equals $60,000 per house. Ouch.

Though the credit has helped stabilize the housing market nationally, in the pricey Bay Area, it hasn't been as helpful. ... Lifting the income caps and expanding the credit to all buyers of primary residences would nudge existing homeowners to move up. That would open up more houses in the red-hot lower end of the market, where many first-time buyers have been outbid by investors paying cash.

...

The National Association of Home Builders estimates that expanding and extending the credit through 2010 would generate 500,000 additional sales ... estimated to cost $30 billion ...

And forget the 500 thousand additional sales. The evidence suggests that interest is already waning (although there will be a flurry of activity at the end just like Cash-for-clunkers). My estimate is the program will cost taxpayers $100,000 per additional home sold. Not very efficient or effective.

Naught for Naughts Update

by Calculated Risk on 9/04/2009 03:12:00 PM

From Rex Nutting at MarketWatch: Lost decade for job growth

[T]he private sector didn't just lose jobs over the last month or the last year -- it's lost jobs over the last decade.Here is a different way to look at it: net jobs in the Naughts (2000 through 2009).

[The private sector] ended up with a net loss of 223,000 jobs since August 1999, according to the latest figures from the Bureau of Labor Statistics. Meanwhile, the nation's population has grown by 33.5 million people.

That's the worst job-creating performance by the private sector since, you guessed it, the Great Depression.

Click on graph for larger image.

Click on graph for larger image.Note: scale doesn't start at zero to show the change. This is a followup to Naught for the Naughts?.

The dashed lines show the level of private and total jobs at the end of the '90s (December 1999).

As Nutting notes, the private sector has lost jobs over the last decade, and is down 1.256 million jobs in the Naughts (so the decade will finish with net negative private sector jobs).

Total jobs are up 691 thousand since Dec 1999, and with four months to go, the race is on! If the economy loses about 172 thousand jobs on average over the next four months, total jobs will finish negative too.

Naught for the Naughts. A lost decade for employment.

Problem Bank List (Unofficial) Sep 4, 2009

by Calculated Risk on 9/04/2009 01:45:00 PM

This is an unofficial list of Problem Banks.

The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Changes and comments from surferdude808:

During the week, 12 institutions with aggregate assets of $17.7 billion were added to the Unofficial Problem Bank List.See description below table for Class and Cert (and a link to FDIC ID system).

The list stands at 421 institutions with assets of $267.8 billion.

Largest among the additions is Capmark Bank, a Utah-based industrial loan company with assets of $11.1 billion. Should the parent, Capmark Financial Group, not find a buyer this could be another costly failure. Other notable additions include the $2.4 billion Bank of the Cascades, Bend, Oregon; the $1.9 billion Citizens First Savings Bank, Port Huron, Michigan; and two bankers’ banks – Midwest Independent Bank in Missouri and Nebraska Bankers’ Bank.

All three deletions from the list were because of failure including Affinity Bank, Mainstreet Bank, and Bradford Bank. Lastly, the OTS issued a Prompt Corrective Action order against Vantus Bank, Sioux City, Iowa, which was already operating under a Cease & Desist order.

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Employment-Population Ratio, Part Time Workers, Average Workweek

by Calculated Risk on 9/04/2009 10:40:00 AM

A few more graphs based on the (un)employment report ...

Employment-Population Ratio Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph show the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce. As an example, in 1964 women were about 32% of the workforce, today the percentage is closer to 50%.

This measure fell in August to 59.2%, the lowest level since the early '80s. This also shows the weak recovery following the 2001 recession - and the current cliff diving!

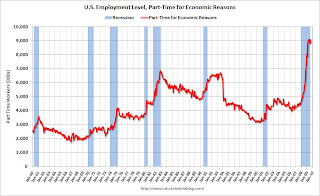

Part Time for Economic Reasons

From the BLS report:

In August, the number of persons working part time for economic reasons was little changed at 9.1 million. These individuals indicated that they were working part time because their hours had been cut back or because they were unable to find a full-time job. The number of such workers rose sharply in the fall and winter but has been little changed since March.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at 9.076 million. This is only slightly below the peak of 9.084 million in May.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at 9.076 million. This is only slightly below the peak of 9.084 million in May.Note: the U.S. population is significantly larger today (about 305 million) than in the early '80s (about 228 million) when the number of part time workers almost reached 7 million. That is the equivalent of about 9.3 million today, so population adjusted this is not quite a record.

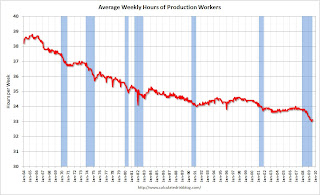

Average Weekly Hours

From the BLS report:

In August, the average workweek for production and nonsupervisory workers on private nonfarm payrolls was unchanged at 33.1 hours. The manufacturing workweek and factory overtime also showed no change over the month (at 39.8 hours and 2.9 hours, respectively).

The average weekly hours has been declining since the early '60s, but usually falls faster during a recession. Average weekly hours worked has essentially been flat since March.

The average weekly hours has been declining since the early '60s, but usually falls faster during a recession. Average weekly hours worked has essentially been flat since March.Some analyst look to an increase in this series as an indicator a recession is over. I guess they are still waiting.

Note: the graph doesn't start at zero to better show the change.

Earlier employment posts today:

Unemployment: Stress Tests, Unemployed over 26 Weeks, Diffusion Index

by Calculated Risk on 9/04/2009 09:40:00 AM

Note: earlier Employment post: Employment Report: 216K Jobs Lost, 9.7% Unemployment Rate . The earlier post includes a comparison to previous recessions.

Stress Test Scenarios Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rate compared to the stress test economic scenarios on a quarterly basis as provided by the regulators to the banks (no link).

This is a quarterly forecast: the Unemployment Rate for Q3 is an average of July and August (rounded to 9.6%), and will probably move higher. Once again, the unemployment rate is already higher than the "more adverse" scenario.

Note also that the unemployment rate has already exceeded the peak of the "baseline scenario".

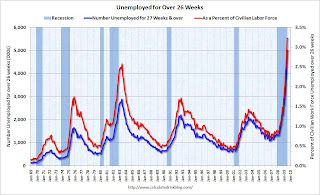

Unemployed over 26 Weeks

The DOL report yesterday showed seasonally adjusted insured unemployment at 6.2 million, down from a peak of about 6.9 million. This raises the question of how many unemployed workers have exhausted their regular unemployment benefits (Note: most are still receiving extended benefits, although this is about to change).

The monthly BLS report provides data on workers unemployed for 27 or more weeks, and here is a graph ... The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are almost 5.0 million workers who have been unemployed for more than 26 weeks (and still want a job). This is 3.2% of the civilian workforce.

The good news is there wasn't much of an increase from July. The bad news is many of these 5 million long term unemployed will start exhausting their extended unemployment benefits soon. According to the projections by the National Employment Law Project about 0.5 million will have exhausted their benefits by the end of this month (September) and about 1.5 million by the end of the year.

In California alone, from the O.C. Register: "an estimated 143,000 unemployed workers in California [exhausted] their jobless benefits by Sept. 1, according to new figures released by the state Employment Development Department".

Diffusion Index

Here is a look at how "widespread" the job losses are using the employment diffusion index from the BLS.

Although job losses continued in many of the major industry sectors in August, the declines have moderated in recent months.

BLS, August Employment Report

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Before last Summer, the all industries employment diffusion index was in the 40s, suggesting that job losses were limited to a few industries. However starting in September the diffusion index plummeted. In March, the index hit 19.6, suggesting job losses were very widespread. The index has recovered since then to 35.2 in August, suggesting job losses are not as widespread across industries as early this year - but losses continue in many industries.

The manufacturing diffusion index fell even further, from 40 in May 2008 to just 6 in January 2009. The manufacturing index has rebounded to 29.5 in August, indicating improvement, but still fairly widespread job losses across manufacturing industries.

Employment Report: 216K Jobs Lost, 9.7% Unemployment Rate

by Calculated Risk on 9/04/2009 08:30:00 AM

From the BLS:

Nonfarm payroll employment continued to decline in August (-216,000), and the unemployment rate rose to 9.7 percent, the U.S. Bureau of Labor Statistics reported today. Although job losses continued in many of the major industry sectors in August, the declines have moderated in recent months.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 216,000 in August. The economy has lost almost 5.83 million jobs over the last year, and 6.93 million jobs during the 20 consecutive months of job losses.

The unemployment rate increased to 9.7 percent. This is the highest unemployment rate in 26 years.

Year over year employment is strongly negative.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses have really picked up over the last year, and the current recession is now the 2nd worst recession since WWII in percentage terms (and the 1948 recession recovered very quickly) - and also in terms of the unemployment rate (only early '80s recession was worse).

The economy is still losing jobs at about a 2.6 million annual rate, and the unemployment rate will probably be above 10% soon. This is still a weak employment report - just not as bad as earlier this year. Much more to come ...

Thursday, September 03, 2009

FHA: The Next Bailout?

by Calculated Risk on 9/03/2009 09:25:00 PM

John Burns Consulting sent out a note today titled: FHA Likely To Be The Next Shoe To Drop

"The FHA's aggressive lending programs have continued throughout the housing downturn, causing its market share of the mortgage industry to grow from 2% in 2005 to 23% today. ... The FHA insurance fund, however, is likely running dry. ...And from the WSJ: Loan Losses Spark Concern Over FHA

While almost all of the experts believe that Congress would support the FHA if necessary (it's currently self-funded), we wonder if FHA officials will be under pressure to continue tightening their lending policies, which currently allow 96.5% mortgages to people with 600 FICO scores. ... Claims against the insurance fund have climbed, with roughly 7% of all FHA-insured loans now delinquent.

The Federal Housing Administration ... is in danger of seeing its reserves fall below the level demanded by Congress, according to government officials, in a development that could raise concerns about whether the agency needs a taxpayer bailout.Based on the issues at the FHA, the end of the tax credit, and more supply coming on the market, Burns concluded that "housing could see another leg down later this year or early next year":

...

Resulting FHA losses are offset by premiums paid by borrowers. Federal law says the FHA must maintain, after expected losses, reserves equal to at least 2% of the loans insured by the agency. The ratio last year was around 3%, down from 6.4% in 2007.

...

Officials said as recently as May that they didn't expect to fall below the 2% limit, but home price declines have exceeded those used to model their expected losses. Given the pace of those declines, "there is no way they will make the 2%" if the current study follows last year's methodology, says [Thomas Lawler, an independent housing economist].

[W]atch the growing controversy regarding the FHA very carefully. The decisions made to allow the FHA to continue lending will have a huge impact on the housing market, particularly when so few entry-level buyers have a substantial down payment.

Junk Bond Default Rate Passes 10 Percent

by Calculated Risk on 9/03/2009 08:09:00 PM

From Rolfe Winkler at Reuters: U.S. junk bond default rate rises to 10.2 pct -S&P

The U.S. junk bond default rate rose to 10.2 percent in August from 9.4 percent in July ... Standard & Poor's data showed on Thursday.Bad loans everywhere ...

The default rate is expected to rise to 13.9 percent by July 2010 and could reach as high as 18 percent if economic conditions are worse than expected, S&P said in a statement.

...

In another sign of corporate distress, the rating agency has downgraded $2.9 trillion of company debt year to date, up from $1.9 trillion in the same period last year.

Federal Reserve Assets and More

by Calculated Risk on 9/03/2009 04:30:00 PM

Just another mention: the Atlanta Fed puts out an Economic Highlights and Financial Highlights every week. They highlight different data each week ...

The Federal Reserve released the Factors Affecting Reserve Balances today. Total assets increased slightly to $2.119 trillion. This graph from the Atlanta Fed shows the breakdown in the assets (as of yesterday): Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

The size of the Fed’s balance sheet has largely been flat since March, remaining within a range of $2 trillion to $2.2 trillion.The overall size of the Fed’s balance sheet has been flat during the past few months, and the broad trends remain little changed. That is, the sizeable declines in short-term lending to financials and nonbank credit markets have largely been offset by increases in holdings of Treasury securities, mortgage-backed securities (MBS), and agency debt. On Friday, the Federal Reserve Board announced a reduction for the two September TAF auctions, lowering both from $100 billion to $75 billion. The Board has cut the amounts available in the TAF auctions three times in $25 billion increments (from the program’s maximum of $150 billion, last available in June).

The second graph shows a breakdown of Fed Treasury purchases by maturity. From the Atlanta Fed:

The second graph shows a breakdown of Fed Treasury purchases by maturity. From the Atlanta Fed: Decomposing the Fed’s purchases of Treasury securities by maturity shows a heavy focus in the four-to-seven-year and seven-to-10-year sectors, together making up half of all purchases so far.There is much more in the highlights. Enjoy.

But the last four Treasury purchases have been focused elsewhere, with the biggest purchases in the shorter end of the yield curve.The Fed has purchased a total of $276.4 billion of Treasury securities through September 2. Of the $271.8 billion in non-TIPS securities, the Fed has focused on the four-to-seven-year and seven-to-10-year sectors the most, purchasing approximately $65 billion in each (totaling about half of all purchases). The two-to-three-year and three-to-four-year sectors have also received a fair amount of attention, especially following two large purchases in the last week and a half in each sector. Recently, the Fed purchased $6.1 billion in the two-to-three-year sector on August 24, $2.3 billion in the 17-to-30-year sector on August 26, and $5.6 billion in the three-to-four-year sector on September 1. The FOMC statement released on Wednesday, August 12, said the Fed is “in the process of buying $300 billion of Treasury securities” by the end of October. This statement was an adjustment from previous statements that stated “up to” $300 billion in purchases would be made “by autumn.”

Hilton to Close Portland Hotel for Four Weeks this Winter

by Calculated Risk on 9/03/2009 02:35:00 PM

From The Oregonian: Portland's hotels face grim prospects (ht Shawn)

[F]or two weeks in November and one week each in December and January, the Hilton's presidential suite -- along with all other rooms in [the original 23-story building] -- will go dark. [The newer Hilton will remain open.]It is routine for hotels to close floors, but unusual to close an entire building (although Hilton has a newer tower across the street).

...

Downtown Portland hotels are also facing stiffer competition after Sage Hospitality Resources of Denver opened two new hotels with more than 500 rooms just as market went into its funk. At one of those hotels, The Nines, Sage's business was off so much that it sought a delay in loan payments to the City of Portland's urban renewal agency.

Marks, the Hilton general manager, said early this week that the hotel routinely shuts entire floors during slow weeks to cut cleaning and energy costs. He projects the Hilton's occupancy could be as low as 30 percent in some winter weeks.

There are a couple of key points in this story: occupancy has declined, especially business related travel, and there is too much new supply on the market. Lower demand meets higher supply, and the result is lower prices - and hotels cutting costs, closing buildings, and more and more hotels unable to meet their debt payments - and some even unable to make their payroll.

Hotel RevPAR off 22 Percent

by Calculated Risk on 9/03/2009 12:36:00 PM

Note: Last year Labor Day was a week earlier (Sept 1st in 2008, Sept 7th this year) and the Democratic National Convention was held August 25th to the 28th, both make the year-over-year comparison more difficult this week.

From HotelNewsNow.com: Labor Day, Democratic National Convention hampers US weekly numbers

Overall, the U.S. industry’s occupancy fell 12.4 percent in year-over-year comparisons to end the week at 54.4 percent. Average daily rate dropped 11.0 percent to finish the week at US$94.01. Revenue per available room for the week decreased 22.0 percent to finish at US$51.10.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 8.9% from the same period in 2008.

The average daily rate is down 11%, and RevPAR is off 22% from the same week last year.

Earlier this year business travel was off much more than leisure travel. So it was expected that the summer months would not be as weak as earlier in the year. September - after Labor Day (Sept 7th) - will be the real test for business travel, and for the hotel industry.

ISM Non-Manufacturing Index Shows Contraction in August

by Calculated Risk on 9/03/2009 10:00:00 AM

The August 2009 Manufacturing ISM report showed expansion, but the non-manufacturing sector was still contracting in August.

From the Institute for Supply Management: August 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector contracted in August, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.The service sector was still contracting in August, although contracting at a slightly slower pace than in July.

... "The NMI (Non-Manufacturing Index) registered 48.4 percent in August, 2 percentage points higher than the 46.4 percent registered in July, indicating contraction in the non-manufacturing sector for the 11th consecutive month but at a slower rate. The Non-Manufacturing Business Activity Index increased 5.2 percentage points to 51.3 percent. This is the first time this index has reflected growth since September 2008. The New Orders Index increased 1.8 percentage points to 49.9 percent, and the Employment Index increased 2 percentage points to 43.5 percent. The Prices Index increased 21.8 percentage points to 63.1 percent in August, indicating a substantial increase in prices paid from July. According to the NMI, six non-manufacturing industries reported growth in August. Respondents' comments are mixed about business conditions and the overall economy; however, there is an increase in comments indicating that there are signs of improvement going forward."

emphasis added

No recovery yet in the service sector ...

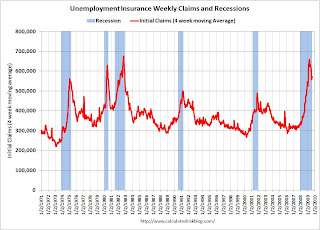

Weekly Unemployment Claims: Stuck at High Level

by Calculated Risk on 9/03/2009 08:30:00 AM

The DOL reports weekly unemployment insurance claims decreased to 570,000:

In the week ending Aug. 29, the advance figure for seasonally adjusted initial claims was 570,000, a decrease of 4,000 from the previous week's revised figure of 574,000. The 4-week moving average was 571,250, an increase of 4,000 from the previous week's revised average of 567,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Aug. 22 was 6,234,000, an increase of 92,000 from the preceding week's revised level of 6,142,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 4,000 to 571,250, and is now 87,500 below the peak in April.

It appears that initial weekly claims have peaked for this cycle. However it seem that weekly claims are stuck at a very high level; weekly claims have been around 570,000 for the last 8 weeks. This indicates continuing weakness in the job market. The four-week average of initial weekly claims will probably have to fall below 400,000 before the total employment stops falling.

Wednesday, September 02, 2009

The Accidental Landlords and Shadow Inventory

by Calculated Risk on 9/02/2009 11:15:00 PM

We've been discussing accidental landlords for a couple of years. Here is another article about homeowners becoming landlords out of necessity, from the WSJ: The Reluctant Landlords

With housing prices still in the dumps, many Americans are finding themselves in the uncomfortable position of landlord.The article discusses a few hapless homeowners, and I'll give the same advice as last year:

...

Hard data are scant on how many homeowners are renting out their homes, but anecdotal evidence suggests numbers are up. In one indication of the trend: More homeowners are converting their homeowners insurance to landlord policies that cover the additional risks of leasing out a home. Allstate Corp., the second largest home insurer in the U.S., reported a 27% increase in conversions in the first quarter from the previous year.

[T]hese accidental landlords are looking at prices from a few years ago, and deciding to wait to sell. In general this is a mistake. Owners should analyze the rent or sell decision based on current prices - and consider the probability that nominal prices will move lower or at best stay flat for several years.And on the shadow inventory, here is an excerpt from: The Surge in Rental Units

This is part of the shadow inventory that will eventually be sold and will help keep inventory levels high for years.

The supply of rental units has been surging:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been over 4.3 million units added to the rental inventory.

...

This increase in units has more than offset the recent strong migration from ownership to renting, so the rental vacancy rate is now at a record 10.6%.

Where did these approximately 4.3 million rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.1 million units completed as 'built for rent' since Q2 2004. This means that another 3.2 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

Whatever the reason for the conversion, many of these 3.2 million units are part of the shadow housing inventory. Especially the properties owned by accidental landlords, who will sell as soon as possible.

Gordon Brown's $1.1 Trillion G20 Consensus Unraveling

by Calculated Risk on 9/02/2009 08:21:00 PM

From The Times: Gordon Brown’s $1 trillion global rescue package unravels

Alistair Darling is scrambling to plug a gaping hole in the $1.1 trillion global rescue package agreed by G20 leaders in London — hailed at the time as Gordon Brown’s biggest success.Although discussing a policy exit strategy makes sense, it would seem premature to scale back the package. One or two quarters of GDP growth isn't a recovery.

Some countries, led by Germany, are even calling for the bailout to be scaled back amid fears that it risks burdening economies with too much debt and could encourage inflation.

The breakdown of unity reflects the different speeds at which countries are emerging from recession and conflicting views about the outlook for the global economy.

Besides, in the August Fed minutes released today, the U.S. is clearly relying on foreign economic growth to offset domestic weakness:

Consumer spending had been on the soft side lately. The new estimates of real disposable income that were reported in the comprehensive revision to the national income and product accounts showed a noticeably slower increase in 2008 and the first half of 2009 than previously thought. By themselves, the revised income estimates would imply a lower forecast of consumer spending in coming quarters. But this negative influence on aggregate demand was roughly offset by other factors, including higher household net worth as a result of the rise in equity prices since March, lower corporate bond rates and spreads, a lower dollar, and a stronger forecast for foreign economic activity.

Wilbur Ross: 500 More Banks to Fail by End of 2010

by Calculated Risk on 9/02/2009 05:23:00 PM

From CNBC: 500 More Banks to Fail By End of 2010: Wilbur Ross

“I’m not surprised that the [FDIC’s] list is continuing to grow,” Ross told CNBC. “I think there’s going to be at least 500 more banks fail between now and end of next year.”See video at link.

...

“The first wave of the big banks were the securitizations," he said. "The regional banks are the ones now going down. They mostly didn’t have much in the way of securitization but they all have construction loans, they have development loans, they all have loans on little shopping centers and they’ve got that kind of portfolio very heavily.”

...

“Yesterday, the FDIC held an auction for $1.3 billion of Alt-A loans, or liars loans, coming out of the failed Franklin Bank,” he said. “So that’s the first time FDIC has had an auction with them providing leverage to distressed investors. So we were bidders on it...I think it’s a good system that they’ve developed for getting rid of these assets.”

Hotel: More than Half Off

by Calculated Risk on 9/02/2009 03:01:00 PM

Remember all the half off sales? It is getting worse ...

From the WSJ: Hotel, 68% Off (ht James)

First Banks Inc. ... recently hired Atlas Hospitality Group to find buyers for the 179-room Lexington Plaza Waterfront Hotel. The asking price is nearly $19 million, just a third of the $58.4 million in debt, contractors' liens and unpaid taxes on the property.Twenty five percent? Can they even afford to pay their utility bills?

...

The report from the property's court-appointed receiver in May, the latest available, pegged the hotel's occupancy at 25%.

And in Hawaii: Maui Prince Hotel Faces Foreclosure

Mortgage-holders led by Wells Fargo Bank sued last week to foreclose on the 310-room [Maui Prince Hotel], following the owners' failure to pay the resort's $192.5 million mortgage when it came due in July. The foreclosure threatens to wipe out the $227.5 million in mezzanine debt held by a UBS fund and the $250 million in equity that Morgan Stanley and its partners put into the property.When the occupancy rates fall far enough, forget about paying the debt - worry about meeting payroll. A quote from the article:

"We do not have funding for payroll, but we are getting some funding for our accounts payable and basic operating expenses," said Donn Takahashi, president of Prince Resorts Hawaii ... "We cannot operate a top-notch resort in this fashion."I suspect we will see many more stories like these two.

FOMC Minutes: Consumer Spending Softer than Expected

by Calculated Risk on 9/02/2009 02:00:00 PM

Here are the August FOMC minutes. Economic outlook:

In the forecast prepared for the August FOMC meeting, the staff's outlook for the change in real activity over the next year and a half was essentially the same as at the time of the June meeting. Consumer spending had been on the soft side lately. The new estimates of real disposable income that were reported in the comprehensive revision to the national income and product accounts showed a noticeably slower increase in 2008 and the first half of 2009 than previously thought. By themselves, the revised income estimates would imply a lower forecast of consumer spending in coming quarters. But this negative influence on aggregate demand was roughly offset by other factors, including higher household net worth as a result of the rise in equity prices since March, lower corporate bond rates and spreads, a lower dollar, and a stronger forecast for foreign economic activity. All told, the staff continued to project that real GDP would start to increase in the second half of 2009 and that output growth would pick up to a pace somewhat above its potential rate in 2010. The projected increase in production in the second half of 2009 was expected to be the result of a slowing in the pace of inventory liquidation; final sales were not projected to increase until 2010. The step-up in economic activity in 2010 was expected to be supported by an ongoing improvement in financial conditions, which, along with accommodative monetary policy, was projected to set the stage for further improvements in household and business sentiment and an acceleration in aggregate demand.Added:

The staff forecast for inflation was also about unchanged from that at the June meeting. Interpretation of the incoming data on core PCE inflation was complicated by changes in the definition of the core measure recently implemented by the Bureau of Economic Analysis, as well as by unusually low readings for some nonmarket components of the price index. After accounting for these factors, the underlying pace of core inflation seemed to be running a little higher than the staff had anticipated. Survey measures of inflation expectations showed no significant change. Nonetheless, with the unemployment rate anticipated to increase somewhat during the remainder of 2009 and to decline only gradually in 2010, the staff still expected core PCE inflation to slow substantially over the forecast period; the very low readings on hourly compensation lately suggested that such a process might already be in train.

emphasis added

The future path of the federal funds rate would continue to depend on the Committee's evolving outlook, but, for now, given their forecasts for only a gradual upturn in economic activity and subdued inflation, members thought it most likely that the federal funds rate would need to be maintained at an exceptionally low level for an extended period. With the downside risks to the economic outlook now considerably reduced but the economic recovery likely to be damped, the Committee also agreed that neither expansion nor contraction of its program of asset purchases was warranted at this time.The Fed Staff still sees an immaculate recovery. That seems unlikely to me. But the FOMC seems a little less optimistic.

ABI: Personal Bankruptcy Filings up 24 Percent compared to August 2008

by Calculated Risk on 9/02/2009 11:46:00 AM

From the American Bankruptcy Institute: August Consumer Bankruptcy Filings up 24 Percent over Last Year

The 119,874 consumer bankruptcy filings in August represented a 24 percent increase over last year’s monthly total, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). Although an increase over the previous year, the August 2009 consumer filings represented a 5 percent decrease from the July 2009 total of 126,434. Chapter 13 filings constituted 28.3 percent of all consumer cases in August, unchanged from the July rate.Note that there is some month to month variability, so the decline from July is probably noise.

"Consumers are continuing to turn to bankruptcy as a shield from the sustained financial pressures of today’s economy," said ABI Executive Director Samuel J. Gerdano. "As a result, we expect consumer filings to top 1.4 million this year."

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q3 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 928 thousand personal bankrutpcy filings through Aug 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll take the over!