by Calculated Risk on 9/08/2009 11:09:00 AM

Tuesday, September 08, 2009

U.K.: End of Recession, Not "return to normal"

From The Times: Recession is over but stagnation may follow

Britain’s economy grew for the first time over a three-month period since May last year, the National Institute of Economic and Social Research (NIESR) said today but warned that the end of recession could turn to a period of stagnation. ...And from Bloomberg: German Industrial Output Fell in July After June Gain

"This is the first time our GDP indicator has been higher over a three-month average since May of 2008 and reinforces our view that the recession ended in May of this year." ... However, NIESR added: "There may well be a period of stagnation now, with output rising in some months and falling in others; the end of the recession should not be confused with a return to normal economic conditions."

emphasis added

German industrial output fell in July after rising in June, suggesting the recovery from recession may be gradual.

Production declined 0.9 percent from June, when it rose a revised 0.8 percent, the Economy Ministry in Berlin said today.

U.S. Hiring Intentions "Sluggish"

by Calculated Risk on 9/08/2009 08:53:00 AM

From Manpower: Manpower Employment Outlook Survey Projects a Weak Hiring Pace for Q4 2009

"The hiring intentions of U.S. companies continue to be sluggish," said Manpower Inc. Chairman and CEO Jeff Joerres. "While there are areas within the U.S. which are showing an uptick, we have yet to see the robust hiring intentions that would indicate a full labor market recovery."

Of the more than 28,000 employers surveyed, a significant 69% expect no change in their October – December hiring plans. Twelve percent anticipate an increase in staff levels, while 14% expect a decrease in payrolls, resulting in a Net Employment Outlook of -2%. After seasonal adjustment, the Net Employment Outlook becomes -3%, the weakest in the history of the survey, which began in 1962. The final 5% of employers indicated they were undecided about their hiring intentions.

“Despite some moderating signs, such as the considerable number of employers that plan to maintain or increase staff levels, there will continue to be challenges for both job seekers and employers in the coming months,” said Jonas Prising, Manpower president of the Americas. “Hiring in the Wholesale & Retail Trade sector, for instance, is expected to be down in the fourth quarter, suggesting that employers will not be adding the quantity of holiday hires they have in the past.”

emphasis added

Monday Night Futures

by Calculated Risk on 9/08/2009 12:19:00 AM

Reuters is reporting comments by State Councillor Ma Kai indicating China will continue with their stimulative policies.

"The trend of economic stabilisation is still not firm, not solidified, not balanced, and we still face many difficulties and problems," Ma [said] ... "We will maintain the consistency and stability of macroeconomic policies and fully implement and constantly improve a package of plans."Futures are up ...

Futures from barchart.com

Bloomberg Futures.

CBOT mini-sized Dow

And the Asian markets are mostly up.

Best to all.

Monday, September 07, 2009

Jim the Realtor: Another Business Opportunity

by Calculated Risk on 9/07/2009 09:31:00 PM

Another laugh from Jim ... "and if you get busted, you can always say you lost your mind because ..."

One Family: Option ARM, failed Modification, Health Issues, Bankruptcy, and more

by Calculated Risk on 9/07/2009 05:50:00 PM

This story has it all: negative equity, Option ARM, health problems, a modification horror story and more - all with one family in Orange County.

From the O.C. Register: Family faces loss of home amid health crisis

... the Kempffs' option adjustable-rate mortgage payment skyrocketed to $4,300 a month from $2,500 last December. Seeing no way to afford the new payments, the Kempffs opted for a loan modification from their bank, IndyMac which was later purchased by OneWest from the FDIC in March.I'm curious about the timing in the article. IndyMac was seized by the FDIC on July 11, 2008, and was then run by the FDIC until March of 2009. Did this happen when IndyMac was being used by the FDIC to demonstrate how to modify loans? Tanta correctly predicted that the FDIC would discover that modifying loans was not easy, see: IndyMac-FDIC Mortgage Modification Plan: Still in the Real World

...

The Kempffs said they were told by an IndyMac representative on the phone that they had to miss three payments before a deal could be worked out. ... For a family that had never missed payments in 14 years of being homeowners, purposely skipping payments was hard for the Kempffs, but they consented.

I wrote a snotty post at the end of August after Sheila Bair's plan for "affordability modifications" of the former IndyMac loans was announced, the burden ofBack to the article:snotwisdom of which was my prediction that Bair was going to discover that it's a lot harder than she thinks to get successful mortgage modifications done on a wide scale in a very short period of time. However, I did express the hope that the Bair plan would prove remarkably successful and indicated my willingness to eat my words should it prove necessary.

Looks like I'll have to stick to my usual dry toast and bananas after all.

A OneWest Bank spokesperson said the Kempffs didn't qualify for a loan modification because the amount they owed on their first mortgage was more than $729,750.A sympathetic borrower - a professor at the University of California, Irvine with a serious health issue - negative equity, using the home as an ATM, an Option ARM, a personal bankruptcy, miscommunication with the lender on a modification (apparently while the FDIC was running IndyMac) - and a home in the upper middle price range. This story has it all.

The unpaid amount on the Kempffs' loan is $786,802.59, short of qualifying for a modification by about $60,000.

Since the Kempffs purchased their home in 2002, they took out loans and refinanced their mortgage. The equity from those transactions enabled the Kempff family to fix their cracked pool, remedy a slipping backyard slope by putting in three retaining walls, help three children pay for college and pay for the medical bills of their youngest son who had malignant melanoma.

...

Juergen Kempff, 65, has battled leukemia and lymphoma for a decade, on and off. His bone marrow has been debilitated from his treatments, and his oncologist has given him about six months to live.

...

Desperate to stall the foreclosure process, the Kempffs declared bankruptcy.

Comparing BLS Job Losses and DOL Unemployment Claims

by Calculated Risk on 9/07/2009 01:05:00 PM

A frequent question is how do the 570,000 initial weekly unemployment claims, as reported by the Dept of Labor (DOL), correspond to the 216,000 in monthly job losses as reported by the Bureau of Labor Statistics (BLS).

If about 2.4 million people filed initial weekly claims in a month (570,000 X 4 weeks), how come the economy only lost 216 thousand net jobs in August?

First, I think it is helpful to look at total hires and separations each month. The BLS has a survey called "Job Openings and Labor Turnover Survey" (JOLTS) that provides this information. The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers.

Note: Remember the CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people. See Jobs and the Unemployment Rate for a comparison of the two surveys.

The following graph shows hires (Green Line), Quits (blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and blue added together equals total separations.

Unfortunately this is a new series and only started in December 2000. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Notice that hires (green line) and separations (red and blue together) are pretty close each month. When the green line is above total separations, the economy is adding net jobs, when the green line is below total separations, the economy is losing net jobs.

Although initial claims are for people and JOLTS is for positions, this does show why initial claims are so high. In the first six months of 2009, an average of about 2.8 million jobs were lost involuntarily each month. If all of these people applied for unemployment claims, the average initial weekly unemployment claims would have been about 650,000 per week (2.8 million divided by 4.3 weeks per month). In fact weekly claims averaged just over 600,000 per week for the first six months of 2009. Note: "quits" don't receive unemployment insurance.

So even though there were about 4.2 million new hires each month during the first six months of 2009, people who lose their jobs involuntarily during a recession have a difficult time finding a new job right away, and most apply for unemployment benefits.

In better times, like 2005, about 2.26 million jobs were lost involuntarily each month, but weekly claims only averaged 330,000 per week (2.26 million divided by 4.3 week is 525,000). This shows when the economy is adding net jobs, a larger percentage of people can find new jobs right away and don't apply for unemployment insurance. But many people still do file for benefits.

Although we don't have JOLTS data for the '90s, even in the best of times for employment (like 1997), the U.S. averaged about 230 thousand initial unemployment claims per week - even though the economy added almost 3.4 million net jobs for the year. This just points out there is significant employment turnover in the U.S. economy, and many people lose their jobs involuntarily even in good times.

Final Note: Since weekly initial unemployment claims are related to involuntary separations - and the overall strength of the job market (Can people find a job right away?), there is no magic formula between initial claims and net jobs. It does appear that initial weekly claims will have to fall to about 400,000 per week before the economy starts adding jobs, see from Brad DeLong: Payroll Employment Starts Growing When Seasonally-Adjusted Unemployment Claims Fall Below 400K per Week or so... This is the graph from DeLong's post (click on graph for larger image.)

Profiles in Discouragement: Unemployed and Uncounted

by Calculated Risk on 9/07/2009 09:50:00 AM

From Michael Luo at the NY Times: Out of Work, Too Down to Search On, and Uncounted (ht Kai, Ann)

They were left out of the latest unemployment rate, as they are every month: millions of hidden casualties of the Great Recession who are not counted in the rate because they have stopped looking for work.Luo provides short stories about four people who have given up looking.

But that does not mean these discouraged Americans do not want to be employed. As interviews with several of them demonstrate, many desperately long for a job, but their inability to find one has made them perhaps the ultimate embodiment of pessimism as this recession wears on.

...

The official jobless rate, which garners the bulk of attention from politicians and the public, was reported on Friday to have risen to 9.7 percent in August. But to be included in that measure, which is calculated by the Bureau of Labor Statistics from a monthly nationwide survey, a worker must have actively looked for a job at some point in the preceding four weeks.

For an increasing number of people in this country who would prefer to be working, that is not the case.

Sunday, September 06, 2009

Survey: “The Anguish of Unemployment”

by Calculated Risk on 9/06/2009 08:34:00 PM

Laura Conaway at NPR Money highlights a new survey by the Rutgers University John J. Heldrich Center for Workforce Development.

From the Press Release:

A comprehensive national survey conducted among 1,200 Americans nationwide who have been unemployed and looking for a job in the past 12 months, including 894 who are still jobless, portrays a shaken, traumatized people coping with serious financial and psychological effects from an economic downturn of epic proportion.Here are the raw comments and stats from the survey.

...

The survey shows that the great recession of 2007-2009 may have long-lasting financial and psychological effects on millions of people, and therefore on the nation’s social fabric. Two thirds of respondents say they are depressed, over half have borrowed money from friends or relatives, and a quarter have skipped mortgage or rent payments. ...

More than half of the jobless think the changes in the economy will be fundamental and lasting, and when the unemployed are asked when the economy will recover, only 20% believe it will do so in the next year.

Click on graph for larger image in new window.

Click on graph for larger image in new window.From the report:

Over half of the unemployed have lost their jobs for the first time ... Job loss is hitting more affluent workers and educated professionals hard — a metric of the recession’s seismic impact. More than one in four of those who were unemployed for the first time earned $75,000 or more in their previous job; one in four first-time unemployed workers have at least a four-year college degree.

Summary Post

by Calculated Risk on 9/06/2009 02:00:00 PM

A few posts of interest this last week:

Enjoy the weekend!!! Best to all.

A Surge in Homeless Children

by Calculated Risk on 9/06/2009 11:00:00 AM

In the comments yesterday we were comparing the "feel" of the current recession compared to the early '80s. Back then it seemed there were many more homeless people, and camps of "Reaganvilles" (an echo of the Hoovervilles during Depression) were sprouting up around the country. I commented that it seems there are far fewer homeless people now, so this story caught my eye ...

From the NY Times: Surge in Homeless Children Strains School Districts

While current national data are not available, the number of schoolchildren in homeless families appears to have risen by 75 percent to 100 percent in many districts over the last two years, according to Barbara Duffield, policy director of the National Association for the Education of Homeless Children and Youth, an advocacy group.

There were 679,000 homeless students reported in 2006-7, a total that surpassed one million by last spring, Ms. Duffield said.

With schools just returning to session, initial reports point to further rises. In San Antonio, for example, the district has enrolled 1,000 homeless students in the first two weeks of school, twice as many as at the same point last year.

G-20 Agrees on Increasing Capital Requirements

by Calculated Risk on 9/06/2009 08:00:00 AM

From the WSJ: G-20 Agree to Boost Banks' Capital Requirements, Set Rules on Bonuses

The agreement on bankers' pay calls for a large portion of bonuses to be clawed back if bank performance subsequently deteriorates. It also calls for the deferral of a share of bonuses. ... More detailed proposals will be worked on in coming weeks by the Financial Stability Board ... Officials want the new rules in place before bonuses are paid out at year-end.And on capital requirements:

... the officials [agreed] that more needs to be done to boost banks' capital cushions "once recovery is assured." ...Here is the Communiqué - UK, 5 September 2009 (PDF 13KB)

In a victory for Mr. Geithner ... there was also agreement that the leverage of international banks – the ratio of their total equity to their total assets -- should be capped. ... Officials fear that if the capital is not raised, undercapitalized 'zombie banks' would be unable to lend and would block economic recovery.

And Declaration on further steps to strengthen the financial system, 5 September 2009 (PDF 15.5KB)

Saturday, September 05, 2009

Massachusetts: Workers Exhausting Unemployment Benefits

by Calculated Risk on 9/05/2009 10:38:00 PM

This is a story that will keep building as workers exhaust their extended unemployment benefits ...

From the Boston Globe: State jobless pay to end for many

Massachusetts is experiencing its first wave of jobless workers to exhaust unemployment benefits after nearly two years of rising unemployment, state labor officials said.And on extending the unemployment benefits for another 13 weeks, from the SF Chronicle: 4 stimulus breaks due to run out at year end

The state this week sent out letters notifying about 2,500 jobless workers that they had or would soon receive their last unemployment checks, having used up state and federal extensions that provided up to 79 weeks, or about 18 months, of benefits. The state expects about 21,000 jobless workers to run out of unemployment benefits by Thanksgiving.

The stimulus act increased the weekly unemployment benefit by $25 per week, allowed people to deduct up to $2,400 in benefits on their federal tax return and extended the federal government's extended benefits program, which provides additional compensation to people who have used up their regular state benefits.It is very likely that this bill will pass soon (the Senate bill is S. 1647).

In California, a person who exhausted 26 weeks of state benefits could get up to 20 more weeks under the first federal extension, then up to 13 weeks under a second extension and up to 20 weeks more under a third extension. The first and second extensions were supposed to expire in the spring but the stimulus extended them until Dec. 31. The stimulus also provided 100 percent federal funding for the third extension.

All these federal benefits sunset after Dec. 31. A person who was already receiving extended benefits on Jan. 1 could finish that round of benefits, but not start the next extension. A person who was still receiving their regular state benefits on Jan. 1 would get no extended benefits.

HR3404, sponsored by Rep. Jim McDermott, D-Wash., would extend all of the expiring provisions through next year. It also would create a fourth extension of up to 13 weeks for people in high-unemployment states.

When Will the Unemployment Rate hit 10%?

by Calculated Risk on 9/05/2009 07:25:00 PM

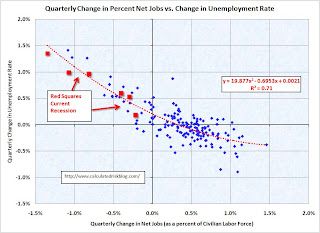

Although the unemployment rate is noisy month-to-month, we can use the graph and formula from Unemployment and Net Jobs to guess when the unemployment rate will reach 10%.

This graph from that previous posts shows the quarterly change in net jobs (on the x-axis) as a percentage of the civilian workforce, and the change in the unemployment rate on the y-axis.

The data is for the last 40 years: 1969 through Q2 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Red squares are for 2008, and for the first two quarters of 2009.

The U-3 headline unemployment rate for August was reported at 9.7% (this is actually rounded up from 9.66%).

If net job losses average over 200 thousand per month, the unemployment rate will probably hit 10% in October.

If net job losses average 100 to 200 thousand per month, the unemployment rate will probably reach 10% in November.

With 50 thousand net job losses per month, it will probably take until December.

And if the economy averages zero net job losses per month, the unemployment rate will probably hit 10% in January or so.

These are just estimates - the series is noisy month-to-month - and it is possible the unemployment rate could hit 10% this month.

As I noted previously, this graph also suggests the economy needs to be adding about 0.33 percent of the civilian workforce per quarter to keep the unemployment rate from rising. That is about 170 thousand net jobs per month. Note: The civilian workforce in August was 154.6 million. 0.33% of 154.6 million is 510 thousand jobs per quarter or 170 thousand per month.

Note that the trend line is a 2nd order polynomial (equation on graph). When the economy starts to add jobs, more people start looking for work - and the relationship between net jobs and unemployment rate is not linear.

Housing Starts and the Unemployment Rate

by Calculated Risk on 9/05/2009 01:49:00 PM

Here is an update. See the post last month for much more discussion ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows housing starts (both total and single unit) and unemployment (inverted).

You can see both the correlaton and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

This suggests unemployment might peak in Spring 2010.

Platinum and Taylor, Bean & Whitaker

by Calculated Risk on 9/05/2009 10:45:00 AM

From the WSJ: Failed Illinois Bank Has Ties to Fallen Mortgage Executive

The Illinois connection to Mr. Farkas' now-bankrupt mortgage banking empire of Taylor, Bean & Whitaker Mortgage Corp. was Rolling Meadows, Ill.-based Platinum Community Bank, which went down Friday with assets of $345.6 million and deposits of $305 million.Nice.

...

After acquiring Platinum, located in Chicago's northwest suburbs, Mr. Farkas sent an email to his staff in October 2008 saying the purchase was "without a doubt the MOST IMPORTANT acquisition we have ever made and offers opportunity for (Taylor Bean) to grow and prosper." Eventually, he said, Platinum would help "fund new production thereby eliminating funding challenges in the future. And it will lessen our reliance on other banks that have hampered our operations in the past." He also wrote that it was "imperative" for employees to set up personal bank accounts at Platinum.

NY Times: One-sixth of Construction Loans in Trouble

by Calculated Risk on 9/05/2009 07:59:00 AM

From Floyd Norris at the NY Times: Construction Loans Falter, a Bad Omen for Banks

Reports filed by banks with the Federal Deposit Insurance Corporation indicate that at the end of June about one-sixth of all construction loans were in trouble. With more than half a trillion dollars in such loans outstanding, that represents a source of major losses for banks.See the great charts in the article.

...

It is in commercial real estate construction — be it stores or office buildings — that the pain seems likely to rise. At the end of June, $291 billion in such loans was outstanding, down only a few billion from the peak reached earlier this year.

“On the commercial side,” said Matthew Anderson, a partner in Foresight Analytics, a research firm based in Oakland, Calif., “I think we are fairly early in the down cycle.”

The article makes the point that the local and regional banks were unable to compete with the larger banks for credit card loans (and residential mortgages too). So the smaller banks ended up overweighted in Construction & Development (C&D) and CRE loans. That isn't look good now, and most of the bank failures during the next couple of years will probably be because of CRE and C&D defaults.

I was looking back at some old posts, and I started writing about how CRE typically follows residential real estate back in 2006, and also about the excessive C&D and CRE loans concentrations of local and regional banks. Here is an excerpt from a post in March 2007:

The housing crisis is now front page news, but there is little discussion about U.S. bank exposure to CRE loans. If a CRE slump follows the residential real estate bust (the typical historical pattern), then the U.S. commercial banks might have a serious problem.The pattern is always the same: residential leads, CRE follows. And some lenders (and developers) never learn.

Friday, September 04, 2009

SEC Chairman Madoff? Corus and More

by Calculated Risk on 9/04/2009 09:55:00 PM

A few posts earlier today:

From the SEC: Investigation of Failure of the SEC to Uncover Bernard Madoff’s Ponzi Scheme - Public Version - :

The other NERO examiner noted that “[a]ll throughout the examination, Bernard Madoff would drop the names of high-up people in the SEC.” Madoff told them that Christopher Cox was going to be the next Chairman of the SEC a few weeks prior to Cox being officially named. He also told them that Madoff himself “was on the short list” to be the next Chairman of the SEC.Note: first posted at the WSJ Washington Wire.

emphasis added

The Corus auditor resigned. From a SEC 8-K filing today (ht jb):

On August 31, 2009, Corus Bankshares, Inc. (the “Company”), received notification from Ernst & Young, LLP (“E&Y”) of their resignation as the Company’s independent registered public accounting firm.There was no disagreement with the auditor, but I guess E&Y isn't sticking around for the FDIC party.

And a Cease & Desist for Granite Bank in North Carolina, from The Charlotte Observer: Bank of Granite under “cease and desist” order (ht Surferdude808)

Regulators have placed Bank of Granite Corp. under a so-called “cease and desist” order, the bank announced this afternoon.But what makes this one a little unusual:

Known for being conservative and thrifty, it was once praised by Warren Buffett as one of the best-run banks in the country.And here is a puzzle for you all (via Surferdude808). On the FDIC cert site, Platinum Community Bank is listed as having $148 million in assets. However, when the bank was seized today, the FDIC noted:

Platinum Community Bank, as of August 29, 2009, had total assets of $345.6 million and total deposits of $305.0 million.Did this bank really more than double their assets in 60 days? (Update: probably is related to the bank holding company)

Bank Failure #89: First State Bank, Flagstaff, AZ

by Calculated Risk on 9/04/2009 09:13:00 PM

First State Bank falls forcefully

Feds funds are famished.

by Soylent Green is People

From the FDIC: Sunwest Bank, Tustin, California, Assumes All of the Deposits of First State Bank, Flagstaff, Arizona

First State Bank, Flagstaff, Arizona, was closed today by the Arizona Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Sunwest Bank, Tustin, California, to assume all of the deposits of First State Bank.Five more today ... so far.

...

As of July 24, 2009, First State Bank had total assets of $105 million and total deposits of approximately $95 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $47 million. .... First State Bank is the 89th FDIC-insured institution to fail in the nation this year, and the third in Arizona. The last FDIC-insured institution closed in the state was Union Bank, National Association, Gilbert, on August 14, 2009.

Bank Failure #88: Community Bank, Rolling Meadows, Illinois

by Calculated Risk on 9/04/2009 08:08:00 PM

Platinum Bank now fools gold

Shut by tin star Fed

by Soylent Green is People

From the FDIC: FDIC Approves the Payout of Insured Deposits of Platinum Community Bank, Rolling Meadows, Illinois

The Federal Deposit Insurance Corporation (FDIC) approved the payout of the insured deposits of Platinum Community Bank, Rolling Meadows, Illinois. The bank was closed today by the Office of Thrift Supervision, which appointed the FDIC as receiver.No one wanted this one. That makes four today.

The FDIC will mail customers checks for their insured funds on Tuesday, September 8. Platinum Community Bank, as of August 29, 2009, had total assets of $345.6 million and total deposits of $305.0 million.

...

Platinum Community Bank is the 88th FDIC-insured institution to fail this year and the 15th in Illinois. The last bank to be closed in the state was Inbank, Oak Forest, earlier today. The FDIC estimates the cost of the failure to its Deposit Insurance Fund to be approximately $114.3 million.

Bank Failures #86 & #87: InBank, Oak Forest, IL, Vantus Bank, Sioux City, IA

by Calculated Risk on 9/04/2009 07:13:00 PM

Small fries, not big potatos

Is a whopper next?

by Soylent Green is People

From the FDIC: MB Financial Bank, National Association, Chicago, Illinois, Assumes All of the Deposits of InBank, Oak Forest, Illinois

InBank, Oak Forest, Illinois, was closed today by the Illinois Department of Financial and Professional Regulation, Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...FDIC: Great Southern Bank, Springfield, Missouri, Assumes All of the Deposits of Vantus Bank, Sioux City, Iowa

As of August 3, 2009, InBank had total assets of $212 million and total deposits of approximately $199 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $66 million. ... InBank is the 86th FDIC-insured institution to fail in the nation this year, and the 14th in Illinois. The last FDIC-insured institution closed in the state was Mutual Bank, Harvey, on July 31, 2009.

Vantus Bank, Sioux City, Iowa, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of August 28, 2009, Vantus Bank had total assets of $458 million and total deposits of approximately $368 million. ...

The FDIC and Great Southern Bank entered into a loss-share transaction on approximately $338 million of Vantus Bank's assets. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $168 million. .... Vantus Bank is the 87th FDIC-insured institution to fail in the nation this year, and the first in Iowa. The last FDIC-insured institution closed in the state was Hartford-Carlisle Savings Bank, Carlisle, on January 14, 2000.