by Calculated Risk on 9/16/2009 02:41:00 PM

Wednesday, September 16, 2009

Report: Fed Reviews Banks CRE Exposure

Better late than never ...

From Steve Liesman at CNBC: Fed Reviewing Banks' Commercial Real Estate Exposure (ht Bill)

The Federal Reserve is involved a broad review of commercial real estate exposures at the nation's largest regional banks, which Fed sources say is both the result of concern in that area but part of the "new normal" for how they will be supervising banks.Clearly the Fed has room for improvement. A review of bank failures (see: Federal Reserve Oversight and the Failure of Riverside Bank of the Gulf Coast) shows that the Fed recognized problems of excessive concentration and risk taking as early as 2003 - and the Fed did nothing.

...

People familiar with the examinations say the fed is "getting granular" looking, for example, at the differences in banks' concentration of construction loans vs. multifamily vs. motels and retail.

I think the Fed needs to explain how the new approach would have caught the problems at Riverside (as an example) in 2004 or so. Hopefully that is the point of this "new normal".

NAHB: Builder Confidence increases Slightly in September

by Calculated Risk on 9/16/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

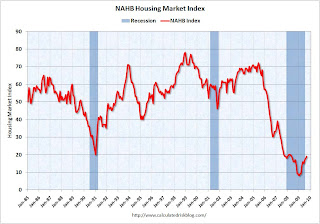

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 19 in September from 18 in August. The record low was 8 set in January.

This is still very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good. This second graph compares the NAHB HMI (left scale) with new home sales and single family housing starts (right scale). This is the September release for the HMI compared to the July data for starts and sales.

This second graph compares the NAHB HMI (left scale) with new home sales and single family housing starts (right scale). This is the September release for the HMI compared to the July data for starts and sales.

This shows that the HMI, single family starts and new home sales mostly move in the same direction - although there is plenty of noise month-to-month.

NOTE: For purposes of determining if starts are above or below sales, you have to use the quarterly data by intent. You can't compare the monthly total single family starts directly to new home sales, because single family starts include several categories not included in sales (like owner built units and high rise condos).

Press release from the NAHB (added): Builder Confidence Edges Up Again In September

Builder confidence in the market for newly built, single-family homes edged higher for a third consecutive month in September, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI rose one point to 19 this month, its highest level since May of 2008.

“Builders are seeing some improvement in buyer demand as a result of the first-time home buyer tax credit, and low mortgage rates and strong housing affordability have also helped to revive some optimism,” noted Joe Robson, chairman of the National Association of Home Builders (NAHB) and a home builder from Tulsa, Okla. “However, the window is now basically closed for being able to start a new home that can be completed in time for buyers to take advantage of the tax credit before it expires at the end of November, and builders are concerned about what will keep the market moving once the credit is gone. ....”

“Today’s report indicates that builders are starting to see some glimmers of light at the end of the tunnel in terms of improving sales activity,” said NAHB Chief Economist David Crowe. “However, the fact that the HMI component gauging sales expectations for the next six months slipped backward this month is a sign of their awareness that this is a very fragile recovery period and several major hurdles remain that could stifle the positive momentum. Those hurdles include the impending expiration of the $8,000 tax credit as well as the critical lack of credit for housing production loans and continuing problems with low appraisals that are sinking one quarter of all new-home sales. These concerns need to be addressed if we are to embark on a sustained housing recovery that will help bolster economic growth.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

Two out of three of the HMI’s component indexes recorded gains in September. The index gauging current sales conditions rose two points to 18, while the index gauging traffic of prospective buyers rose one point, to 17. Meanwhile, the index gauging sales expectations for the next six months declined one point, to 29.

All four regions posted gains in their HMI readings for September. The biggest improvement was registered in the Midwest, where a three-point gain brought its HMI to 19, the highest level since July of 2007. The Northeast posted a two-point gain to 24, the South posted a two-point gain to 19, and the West posted a one-point gain to 18, respectively.

emphasis added

Roubini: "Desperately seeking an exit strategy"

by Calculated Risk on 9/16/2009 11:48:00 AM

Nouriel Roubini writes: Desperately seeking an exit strategy

[T]he key issue for policy-makers is to decide when to mop up the excess liquidity and normalize policy rates – and when to raise taxes and cut government spending, and in which combination.In the short term - probably through most or all of 2010 - with the sluggish recovery, high unemployment and overcapacity, the major concern of policymakers will continue to be deflation.

The biggest policy risk is that the exit strategy from monetary and fiscal easing is somehow botched, because policy-makers are damned if they do and damned if they don't. If they have built up large, monetized fiscal deficits, they should raise taxes, reduce spending and mop up excess liquidity sooner rather than later.

The problem is that most economies are now barely bottoming out, so reversing the fiscal and monetary stimulus too soon – before private demand has recovered more robustly – could tip these economies back into deflation and recession. Japan made that mistake between 1998 and 2000, just as the United States did between 1937 and 1939.

But if governments maintain large budget deficits and continue to monetize them as they have been doing, at some point – after the current deflationary forces become more subdued – bond markets will revolt. When that happens, inflationary expectations will mount, long-term government bond yields will rise, mortgage rates and private market rates will increase, and one would end up with stagflation (inflation and recession).

...

Getting the exit strategy right is crucial: Serious policy mistakes would significantly heighten the threat of a double-dip recession.

Industrial Production, Capacity Utilization Increase in August

by Calculated Risk on 9/16/2009 09:15:00 AM

The Federal Reserve reported:

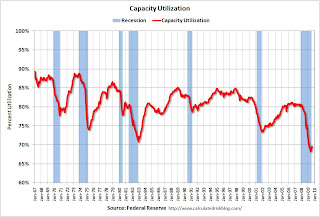

Industrial output rose 0.8 percent in August, following an upwardly revised increase of 1.0 percent in July. Production in manufacturing expanded 0.6 percent in August, and the index excluding motor vehicles and parts increased 0.4 percent. The gain in July for manufacturing was revised up 0.4 percentage point, to 1.4 percent; in addition, factory output for April through June is now somewhat less weak than reported previously. Production at mines moved up 0.5 percent in August. The output of utilities gained 1.9 percent, as temperatures swung from an unseasonably mild July to a slightly warmer-than-usual August. At 97.4 percent of its 2002 average, total industrial production was 10.7 percent below its level of a year earlier. In August, the capacity utilization rate for total industry advanced to 69.6 percent, a level 11.3 percentage points below its average for the period 1972 through 2008.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series has increased for two straight months, and is up slightly from the record low set in June (the series starts in 1967). Capacity Utilization had decreased in 17 of the previous 18 months.

Note: y-axis doesn't start at zero to better show the change.

Even excluding motor vehicles and parts, industrial production increased 0.4% in August. This suggests that the official recession ended sometime this Summer.

CPI Increases 0.4% in August, BLS Rent Measures Increase Slightly

by Calculated Risk on 9/16/2009 08:33:00 AM

From the BLS: Consumer Price Index Summary

On a seasonally adjusted basis, the Consumer Price Index for all Urban Consumers (CPI-U) rose 0.4 percent in August, the Bureau ofThe BLS measure for rent increased slightly (rounded to flat). And owners' equivalent rent (OER), the largest component of CPI, increased slightly even though rents have been falling in most areas.

Labor Statistics reported today. The index has decreased 1.5 percent over the last 12 months on a not seasonally adjusted basis.

...

The index for all items less food and energy also rose 0.1 percent in August, the second consecutive such increase.

...

the shelter index ... rose 0.1 percent in August after a 0.2 percent decline in July. The rent index was unchanged and the index for owners' equivalent rent increased 0.1 percent.

CPI has declined 1.5% compared to one year ago.

Tuesday, September 15, 2009

Streitfeld: The Housing Tax Credit Debate

by Calculated Risk on 9/15/2009 10:19:00 PM

From David Streitfeld at the NY Times: Fight Looming on Tax Break to Buy Houses

When Congress passed an $8,000 tax credit for first-time home buyers last winter, it was intended as a dose of shock therapy during a crisis. Now the question is becoming whether the housing market can function without it.Streitfeld discusses some of the proponents of extending and expanding the tax credit (like the NAR), and some of the opponents (most economists on the right and left).

As many as 40 percent of all home buyers this year will qualify for the credit. It is on track to cost the government $15 billion, more than twice the amount that was projected when Congress passed the stimulus bill in February.

Dean Baker of the Center for Economic and Policy Research called the credit “a questionable redistributive policy” from renters to home buyers, but said that he used it himself when he bought a house.Mark Zandi at Economy.com supports extending and expanding the tax credit because he believes the housing market is still in serious trouble:

He wrote on his blog: “Thank you very much, suckers!”

"The risks of not doing something like this are too great,” [Zandi] said. “I don’t think the coast is clear.”But if we actually look at the numbers, this is a poor choice for a second stimulus package. The NAR recently reported:

NAR estimates that about 1.8 to 2.0 million first-time buyers will take advantage of the $8,000 tax credit this year, with approximately 350,000 additional sales that would not have taken place without the credit.You can calculate the new $15 billion projection; 1.9 million times $8,000.

But this only resulted in 350,000 additional sales. Divide $15 billion by 350 thousand, and the program cost is about $43,000 per additional buyer. Very expensive.

Now the National Association of Home Builders estimates that expanding and extending the credit through 2010 would generate 500,000 additional sales at a cost of about $30 billion. So this is approximately $60,000 per additional house sold. And I think the cost will be much higher.

REMEMBER: Many homes will be sold to buyers who would have bought anyway without the credit. These buyers will still receive the credit. This year almost 2 million home buyers will claim the tax credit, but only 350,000 were additional buyers. That means this was a poorly targeted tax credit since so many people receive it who would have bought anyway. Targeting is the problem with any tax credit.

Mark Zandi is arguing to expand the credit all home buyers, including investors. Then the cost would be much higher than the $30 billion estimate - maybe $75 billion based on 5 million homes sold. Maybe closer to $90 billion if we include new home sales. But that would be a huge gift to a majority of buyers.

Here is a more effective tax credit:

The real problem is the number of households, not home sales. Many people have doubled up during the recession with friends and family, and will probably be looking to rent or buy once they get back on their feet. An incentive for new household formation (for people that were part of another household for the last year or two) would be much less expensive, would be more targeted (recipients would have to show they were part of another household) and would reduce the excess inventory of all housing units.

Credit Cards: Most Institutions Report higher Write-Offs in August

by Calculated Risk on 9/15/2009 07:42:00 PM

From Bloomberg: U.S. Credit-Card Defaults Resume Ascent as Unemployment Worsens (ht Bob_in_MA)

Bank of America said write-offs rose to 14.54 percent ... That compares with 13.81 percent in July ...As a reminder, the bank stress tests assumed a cumulative two year credit card loss rate of 18% to 20% for the more adverse scenario (only 12% to 17% for the baseline scenario). Right now losses are running worse than the more adverse scenario.

Citigroup’s soured loans rose to 12.14 percent last month, from 10.03 percent, while JPMorgan said write-offs advanced to 8.73 percent from 7.92 percent in July ...

Discover Financial Services ... said charge-offs rose to 9.16 percent from 8.43 percent in July. ...

Capital One Financial Corp. ... said charge-offs improved to 9.32 percent in August, from 9.83 percent.

...

Moody’s Investors Service has said it expects average U.S. charge-offs to peak at 12 percent to 13 percent in 2010.

Also credit card loss rates tend to the track unemployment - so, as the unemployment rate rises into 2010, the credit card charge-offs will probably increase some more.

LA Area Port Traffic in August

by Calculated Risk on 9/15/2009 05:15:00 PM

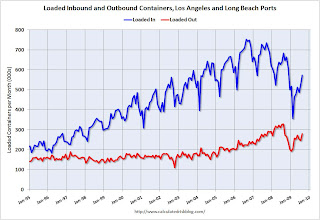

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 14.5% below August 2008.

Outbound traffic was 16.2% below August 2008.

There has been a clear recovery in U.S. exports (the year-over-year comparison was off 30% from December through February). And export traffic, at the LA area ports, is at the August 2007 level.

However, for imports, traffic is at the August 2003 level, and 2009 will probably be the weakest year for import traffic since 2002.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline in November.

The End of the Official Recession?

by Calculated Risk on 9/15/2009 02:32:00 PM

First, a nice mention in Newsweek (thank you): The Financial Meltdown in Words (see slide 4 for a quote from Feb 2005, ht Matthew, Eric)

On the end of the recession, from Bloomberg: Bernanke Says U.S. Recession ‘Very Likely’ Has Ended

“Even though from a technical perspective the recession is very likely over at this point, it’s still going to feel like a very weak economy for some time,” Bernanke said today at the Brookings Institution in Washington, responding to questions after a speech.Although I think the official recession has probably ended, it is worth remembering that one or two quarters of GDP growth doesn't necessarily mean the recession is over. Right in the middle of the '81/'82 recession, there was one quarter when GDP increase 4.9% (annualized).

On recession dating: 1The National Bureau of Economic Research (NBER) Business Cycle Dating Committee is the recognized group for calling dating recessions in the U.S. It is always difficult to tell when a recession has ended, especially with a jobless recovery (something I expect again). As an example, it took NBER over a year and half after the 2001 recession ended to call the trough of the cycle. And it took 21 months after the 1990-1991 recession ended for NBER to date the end of the recession.

From the 2003 announcement of the end of the 2001 recession:

The committee waited to make the determination of the trough date until it was confident that any future downturn in the economy would be considered a new recession and not a continuation of the recession that began in March 2001.The economy was still struggling in 2003 - especially employment - but the NBER committee members felt that any subsequent downturn would be considered a separate recession:

The committee noted that the most recent data indicate that the broadest measure of economic activity-gross domestic product in constant dollars-has risen 4.0 percent from its low in the third quarter of 2001, and is 3.3 percent above its pre-recession peak in the fourth quarter of 2000. Two other indicators of economic activity that play an important role in the committee's decisions-personal income excluding transfer payments and the volume of sales of the manufacturing and wholesale-retail sectors, both in real terms-have also surpassed their pre-recession peaks. Two other indicators the committee focuses on-payroll employment and industrial production-remain well below their pre-recession peaks. Indeed, the most recent data indicate that employment has not begun to recover at all. The committee determined, however, that the fact that the broadest, most comprehensive measure of economic activity is well above its pre-recession levels implied that any subsequent downturn in the economy would be a separate recession.This is relevant to today. It is very likely that any recovery will be very sluggish, and if the economy turns down within the next 6 to 12 months, the NBER would probably consider that a continuation of the Great Recession.

Yesterday San Francisco Fed President Janet Yellen argued the recovery would be "tepid". She pointed out that there will probably be a boost from an inventory correction in the 2nd half of 2009, but that that boost will be transitory:

I expect the biggest source of expansion in the second half of this year to come from a diminished pace of inventory liquidation by manufacturers, wholesalers, and retailers. Such a pattern is typical of business cycles. Inventory investment often is the catalyst for economic recoveries. True, the boost is usually fairly short-lived, but it can be quite important in getting things going. ...But then what happens in a couple of quarters? Where are the engines of growth? As Yellen noted:

The chances are slim for a robust rebound in consumer spending, which represents around 70 percent of economic activity. Of course, consumers are getting a boost from the fiscal stimulus package. But this program is temporary. Over the long term, consumers face daunting issues of their own.As I noted in March (see Business Cycle: Temporal Order), the usual engines for growth coming out of a recession are Personal Consumption expenditures (PCE), and Residential Investment (RI). If PCE is weak, we are left with residential investment. Although it appears RI has bottomed, I doubt we will see much of a rebound until the overhang of existing home inventory is reduced. That is one of the reason the DataQuick SoCal report this morning was so important - it might signal another downturn for sales in the existing home market (and possibly new home market).

Although I started the year looking for the sun, I remain concerned about the possibilities of a double dip recession - or at least a prolonged period of sluggish growth. And this means the unemployment rate will continue to rise well into 2010; I expect the unemployment rate to hit 10% in November (or so). See: When Will the Unemployment Rate hit 10%? .

There is an old saying: "A recession is when your neighbor loses his job, a depression is when you lose your job." Unfortunately 2010 will probably feel like a depression to a large number workers.

More on NBER and double dip recessions:

Here is the NBER dating procedure.

Note that the trough of the 1980 recession was only 12 months before the beginning of the 1981 recession, but the short recovery was fairly robust with real GDP up 4.4%. Those two recessions are frequently called a "double dip" recession, but the NBER considers them as two separate recessions.

1 Some of this post was excerpted from a previous post.

DataQuick: SoCal Home Sales Decline

by Calculated Risk on 9/15/2009 12:44:00 PM

From DataQuick: Southland home sales fall; median price edges up again

Home sales dipped in Southern California last month, the result of a thinning inventory of foreclosure properties and financial uncertainty among potential home buyers. ...Here are a few key points:

A total of 21,502 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in August. That was down 10.8 percent from 24,104 in July, and up 11.0 percent from 19,366 in August 2008, according to MDA DataQuick of San Diego.

Last month was the 14th in a row with a year-over-year sales increase. The decline from July to August was unusual, given an increase is normal for the season. August sales in DataQuick’s statistics, which go back to 1988, range from a low of 16,379 in 1992 to a high of 39,562 in 2003. The average is 27,458.

“There’s still a lot of uncertainty out there about prices, interest rates and the availability of mortgage money. Additionally, we don’t know if this drop in foreclosure resales is temporary. We’re hearing from public agencies and the banking industry that there’s still a lot of financial distress in the pipeline,” said John Walsh, MDA DataQuick president.

Foreclosure resales accounted for 38.8 percent of August’s resales activity, down from 40.7 percent in July and down from 45.5 percent in August 2008. In February this year it peaked at 56.7 percent. Most of the relative decline is due to an increase in non-foreclosure resales.

...

Changes in the median do not necessarily correspond to changes in home values in the current, atypical sales environment. Adjusting for shifts in market mix, it now appears that over the past two years homes in older, more costly neighborhoods have come down in value by about half as much as homes in newer, more affordable neighborhoods. Prices also fell sharply in some lower-cost, older communities where the use of risky subprime loans was high, triggering relatively high foreclosure rates.

... a common form of financing used by first-time home buyers in more affordable neighborhoods remains near record levels. Government-insured, FHA mortgages made up 37.4 percent of all purchase loans in August, up from 37.0 percent in July and 27.1 percent in August last year.

... Foreclosure activity remains near record levels. Financing with multiple mortgages is low, down payment sizes are stable, and non-owner occupied buying is above-average in some markets

Ghost Towns in Ireland

by Calculated Risk on 9/15/2009 10:26:00 AM

From Bloomberg: Ghost Towns May Haunt Ireland in Property Loan Gamble (ht Mike In Long Island)

Finance Minister Brian Lenihan will detail tomorrow how much Ireland will pay for about 90 billion euros ($131 billion) of real estate loans now crippling what as recently as 2006 was one of Europe’s most dynamic economies.The government is taking over most of the non-residential property loans in Ireland. It is amazing that these loans total about half of Ireland's GDP (not including residential).

...

The National Asset Management Agency, known as NAMA, will buy 18,000 loans at a discount from lenders led by Allied Irish Banks Plc and Bank of Ireland Plc. The agency will manage the loans, which amount to about half of Ireland’s gross domestic product. ... Most of the property-related loans of the biggest Irish banks are being taken over by the agency, excluding residential mortgages.

...

The office vacancy rate at the end of the second quarter was 21 percent in Dublin, compared with 8 percent in London and 10 percent in Berlin, according to CB Richard Ellis Group Inc. As many as 35,000 new homes are now vacant, estimates Davy, the country’s largest securities firm, up from 20,000 18 months ago.

emphasis added

Bernanke on Financial Crisis of 2008

by Calculated Risk on 9/15/2009 10:02:00 AM

Fed Chairman Ben Bernanke speaking on the financial crisis of 2008.

A live feed from C-SPAN.

From the Fed: Reflections on a Year of Crisis

NOTE: This is the same speech he gave last month. A history review ...

Retail Sales increase in August

by Calculated Risk on 9/15/2009 08:30:00 AM

On a monthly basis, retail sales increased 2.7% from July to August (seasonally adjusted), and sales are off 5.3% from August 2008 (retail ex food services decreased 6.3%).

Excluding motor vehicles, retail sales were up 1.1%.

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the core PCI price index from the BLS was used (August prices were estimated as the average increase over the previous 3 months).

Real retail sales (ex food services) declined by 6.3% on a YoY basis. The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed, but at a much lower level.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for August, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $351.4 billion, an increase of 2.7 percent (±0.5%) from the previous month, but 5.3 percent (±0.7%) below August 2008. Total sales for the June through August 2009 period were down 7.6 percent (±0.3%) from the same period a year ago. The June to July 2009 percent change was revised from -0.1 percent (±0.5%)* to -0.2 percent (±0.2%)*.It appears the cliff diving is over and the official recession probably ended in July. But retail sales are still far below the pre-recession level, and the recovery will probably be sluggish.

Monday, September 14, 2009

More on U.S. Possibly Selling Citi Stake

by Calculated Risk on 9/14/2009 11:04:00 PM

From the WSJ: Citigroup Explores Bid to Pare U.S. Stake

The tentative aim is for a joint stock sale. Under this scenario, Citigroup would issue as much as $5 billion in new shares, while the government would simultaneously sell an undetermined amount of the stock it is holding ... Citigroup could use proceeds from a stock sale to redeem some of the preferred stock the Treasury is holding ...If I have the numbers correct, the total U.S. bailout of Citi was $45 billion (not including guarantees). Then $25 billion of preferred stock was converted to common at $3.25 per share in February - and that is the 7.69 billion common shares we all own (through the Treasury).

The government converted its preferred shares into common stock at $3.25 a share. Citigroup's shares closed Monday at $4.52. That means the government's 7.7 billion shares have gained about $9.8 billion.

So the U.S. still holds $20 billion in preferred stock. This would be a start, although it might be premature considering all the toxic assets Citi probably still holds.

Report: U.S. Discussing Selling Citi Shares

by Calculated Risk on 9/14/2009 07:35:00 PM

From Bloomberg: U.S. Said to Explore Selling Stock Acquired in Citigroup Rescue (ht jb)

Bloomberg is reporting that the Treasury and Citigroup are discussing how the U.S. can sell the 34 percent stake (7.7 billion shares) that the U.S. acquired as part of the bailout. At $4.50 per share, the U.S. stake is worth almost $35 billion.

In the February bailout, the U.S. increased it's common stake in Citi by converting $25 billion in preferred shares into common. And the U.S. is still also guaranteeing about $306 billion in assets (per the bailout agreement last November).

But selling some common would be a good first step ...

Fed's Yellen: The Outlook for Recovery

by Calculated Risk on 9/14/2009 05:28:00 PM

This is a long excerpt, but worth reading ...

From San Francisco Fed President Janet Yellen: The Outlook for Recovery in the U.S. Economy

I am hugely relieved that our financial system appears to have survived this near-death experience. And, as painful as this recession has been, I believe that we succeeded in avoiding the second Great Depression that seemed to be a real possibility. Much of the recent economic data suggest that the economy has bottomed out and that the worst risks are behind us. The economy seems to be brushing itself off and beginning its climb out of the deep hole it’s been in.

That’s the good news. But I regret to say that I expect the recovery to be tepid. What’s more, the gradual expansion gathering steam will remain vulnerable to shocks. The financial system has improved but is not yet back to normal. It still holds hazards that could derail a fragile recovery. Even if the economy grows as I expect, things won’t feel very good for some time to come. In particular, the unemployment rate will remain elevated for a few more years, meaning hardship for millions of workers. Moreover, the slack in the economy, demonstrated by high unemployment and low utilization of industrial capacity, threatens to push inflation lower at a time when it is already below the level that, in the view of most members of the Federal Open Market Committee (FOMC) best promotes the Fed’s dual mandate for full employment and price stability. ...

I’m happy to report that the downturn has probably now run its course. This summer likely marked the end of the recession and the economy should expand in the second half of this year. A wide array of data supports this view. However, payrolls are still shrinking at a rapid pace, even though the momentum of job losses has slowed in the past few months. The housing sector finally seems to be improving. Home sales and starts are once again rising from very low levels, and home prices appear to be stabilizing, even rising in recent months according to some national measures. Meanwhile, manufacturing is also beginning to show signs of life, helped particularly by a rebound in motor vehicle production. Importantly, consumer spending finally is bottoming out.

A particularly hopeful sign is that inventories, which have been shrinking rapidly, now seem to be in better alignment with sales. That’s occurred because firms slashed production rapidly and dramatically in the face of slumping sales. Recent data suggest that this correction may be near an end and firms are now poised to step up production to match sales. In fact, I expect the biggest source of expansion in the second half of this year to come from a diminished pace of inventory liquidation by manufacturers, wholesalers, and retailers. Such a pattern is typical of business cycles. Inventory investment often is the catalyst for economic recoveries. True, the boost is usually fairly short-lived, but it can be quite important in getting things going. ...

The normal dynamics of the business cycle have also turned more favorable. Some economic sectors are growing again simply because they sank so low. The inventory adjustment I just discussed is one factor, although the biggest part of those benefits usually is only felt for a few quarters. But other business cycle patterns can be longer lasting. Demand for houses, durable goods such as autos, and business equipment is beginning to revive as households and firms replace or upgrade needed equipment and structures.

...

This time though rapid growth does not seem to be in store. My own forecast envisions a far less robust recovery, one that would look more like the letter U than V. ... A large body of evidence supports this guarded outlook. It is consistent with experiences around the world following recessions caused by financial crises. That seems to be because it takes quite a while for financial systems to heal to the point that normal credit flows are restored. That is what I expect this time. ...

Unfortunately, more credit losses are in store even as the economy improves and overall financial conditions ease. Certainly, households remain stressed. In the face of high and rising unemployment, delinquencies and foreclosures are showing no sign of turning around. The delinquency rate on adjustable-rate mortgages is now up to about 18 percent, and, on fixed-rate loans, it’s about 6 percent. Delinquencies on both types of loans have increased sharply over the past year and are still rising. ...

The chances are slim for a robust rebound in consumer spending, which represents around 70 percent of economic activity. Of course, consumers are getting a boost from the fiscal stimulus package. But this program is temporary. Over the long term, consumers face daunting issues of their own. In fact, it’s easy to draw a comparison between the financial state of households and that of financial institutions. For years prior to the recession, households went on a spending spree. This occurred during a period that economists call the “Great Moderation,” about two decades when recessions were infrequent and mild, and inflation was low and stable. Credit became ever easier to get and consumers took advantage of this to borrow and buy. Stock and home prices rose year after year, giving households additional wherewithal to keep spending. In this culture of consumption, the personal saving rate fell from around 10 percent in the mid-1980s to 1½ percent or lower in recent years. At the same time, households took on larger proportions of debt. From 1960 to the mid-1980s, debt represented a manageable 65 percent of disposable income. Since then, it has risen steadily, with a notable acceleration in the last economic expansion. By 2008, it had doubled to about 130 percent of income.

It may well be that we are witnessing the start of a new era for consumers following the traumatic financial blows they have endured. The destruction of their nest eggs caused by falling house and stock prices is prompting them to rebuild savings. The personal saving rate is finally on the rise, averaging almost 4½ percent so far this year. While certainly sensible from the standpoint of individual households, this retreat from debt-fueled consumption could reduce the growth rate of consumer spending for years. An increase in saving should ultimately support the economy’s capacity to produce and grow by channeling resources from consumption to investment. And higher investment is the key to greater productivity and faster growth in living standards. But the transition could be painful if subpar growth in consumer spending holds back the pace of economic recovery.

Weakness in the labor market is another factor that may keep the recovery in low gear for a while. ... While the August employment report offered more evidence that the pace of the decline has slowed, unemployment now stands at its highest level since 1983. My business contacts indicate that they will be very reluctant to hire again until they see clear evidence of a sustained recovery, and that suggests we could see another so-called jobless recovery in which employment growth lags the improvement in overall output. What’s more, wage growth has slowed sharply. Over the first half of this year, the employment cost index for private-industry workers has risen by a meager three-quarters of one percent. Unemployment, job insecurity, and low growth in incomes will undoubtedly take a toll on consumption. When the array of problems facing consumers is considered, it is hard to see how we can avoid sluggish spending growth.

Putting the whole puzzle together, the main impetus to growth in the second half of this year will be inventory investment. The boost it provides will be a big help for a while, but we will need to look to other sectors to sustain growth. The fact that the largest sector of the economy—consumer spending—is likely to be lackluster implies a less-than-robust expansion. Even the gradual recovery we expect will be vulnerable to shocks, especially from the financial sector. As I said, financial conditions are better, but not back to normal. And the likelihood of continuing losses by financial institutions will add new fuel to the credit crunch. In particular, small and medium-size banks could experience damaging losses on commercial real estate loans. Thus far, the largest losses have been on loans for construction and land development. Going forward, however, rising loan losses on other commercial real estate lending is likely because property values are falling, office vacancy rates are rising, and credit remains tight or nonexistent for those many property owners that will need to refinance mortgages over the next few years. Financial contagion from this sector is one of the most important threats to recovery.

The slow recovery I expect means that it could still take several years to return to full employment. The same is true for capacity utilization in manufacturing. It will take a long time before these human and capital resources are put to full use.

Report: BofA Execs to Face Civil Charges

by Calculated Risk on 9/14/2009 03:35:00 PM

From CNBC: BofA Execs to Face Charges from NY's Cuomo: Source

Attorney General Andrew Cuomo's office is likely to file civil charges against the executives over their role in failing to alert shareholders to mounting losses as well as accelerated bonus payments at Merrill ...Earlie today, from Bloomberg: Bank of America Settlement With SEC Over Merrill Bonuses Rejected by Judge

Bank of America Corp.’s $33 million settlement with the U.S. Securities and Exchange Commission over Merrill Lynch & Co. bonuses was rejected by a judge, who said the deal appeared to be a “contrivance” and ordered the case to trial on Feb. 1.Ouch. Bad day for BofA - but note that the NY charges will be civil, not criminal.

...

“The SEC gets to claim that it is exposing wrongdoing on the part of the Bank of America in a high-profile merger,” [U.S. District Judge Jed Rakoff] wrote. “The bank’s management gets to claim that they have been coerced into an onerous settlement by overzealous regulators. And all this is done at the expense not only of the shareholders, but also of the truth.”

...

“The parties’ submissions, when carefully read, leave the distinct impression that the proposed consent judgment was a contrivance designed to provide the SEC with the façade of enforcement and the management of the bank with a quick resolution of an embarrassing inquiry.”

More Accidental Landlords

by Calculated Risk on 9/14/2009 01:36:00 PM

From Shahien Nasiripour at the HuffPost: Unable To Sell Their Houses, Millions Of Homeowners Are Turning Into Landlordsmaybe

Since 2007 about 2.5 million homes have been converted into rentals, according to an analysis performed for The Huffington Post by Foresight Analytics, a real estate market research firm based in Oakland, Calif. The conversions account for about 85 percent of the increase in rental homes.The numbers are probably higher. As I noted in The Surge in Rental Units

Since Q2 2004, there have been over 4.3 million units added to the rental inventory.Note: I've been writing (and joking) about accidental landlords for several years.

...

Where did these approximately 4.3 million rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.1 million units completed as 'built for rent' since Q2 2004. This means that another 3.2 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

From Nasiripour on a prominent accidental landlord:

[A] growing number of homeowners ... have become landlords, often reluctantly, as they struggle to sell during one of the worst housing markets in recent memory. The most prominent example may be U.S. Treasury Secretary Timothy Geithner, who after failing to sell his $1.6 million home in a New York City suburb found tenants instead.I guess Geithner is holding on for a better market!

D.C.: "The commercial version of the subprime situation"

by Calculated Risk on 9/14/2009 10:53:00 AM

From the WaPo: Region's Office Space Vacancies Soaring

... property managers for the 1.4 million-square-foot [Constitution Center in Southwest Washington], which is scheduled to be completed in November, have yet to land any tenants ... Constitution Center is just one of several dozen existing, newly constructed or soon-to-be-completed office buildings in the Washington region that had vacancy rates in the 80 to 100 percent range as of midyear.This is happening all across the country: falling demand and still more office supply coming available as large commercial real estate projects are completed. This means falling rents and property values. And as the construction loans come due, there will be more and more losses for lenders.

... In June ... the amount of vacant space in the region soared nearly 24 percent, to 47 million square feet from 38 million during the same month a year earlier.

...

Throughout the region, gleaming new office towers have sprouted, but with few or no tenants: a 275,000-square-foot building at 55 M Street SE in the emerging Capitol Riverfront area of the District; the 230,700-square-foot Piedmont Pointe II and 208,000 Redlands projects in Montgomery County; and the 215,000-square-foot Parkridge Center 6 and 178,000-square-foot Dulles View North in Fairfax County. Many other projects have been put on hold.

...

With many commercial real estate loans coming due soon, some foresee trouble for the region's properties. "We may see the commercial version of the subprime situation," said Steve Silverman, director of the Montgomery County Department of Economic Development.

And investment in non-residential structures will probably be a drag on GDP (and construction employment) at least through 2010 as projects are completed.

The only good news for the economy is that CRE is a trailing sector (See Business Cycle: Temporal Order).

Fed's Duke on Accounting Changes

by Calculated Risk on 9/14/2009 08:44:00 AM

Fed Governor Elizabeth Duke presented some thoughts today on possible accounting changes: Regulatory Perspectives on the Changing Accounting Landscape

... I feel it is crucial that an accounting regime directly link reported financial condition and performance with the business model and economic purpose of the firm. It is difficult for me to comprehend the value of an accounting regime that doesn't make that link.Take a mortgage loan. If the business model is to hold the loan to maturity, Duke believes the loan should be valued based on future cash flow (considering the creditworthiness and capacity of the borrower). However if the business model is based on trading mortgage loans, then she believes the loan should be valued based on fair market prices.

As a regulator, I focus on the viability of individual financial institutions and the financial system as a whole. To be frank, it has been frustrating to try to assess that viability when the value of an asset is based on the nature of its acquisition rather than the way in which it is managed or the way in which its economic value is likely to be realized.

...

If the business model is predicated on the trading of financial instruments for the realization of value, or other strategies that essentially focus on short-term price movements, then fair value has relevance. In the trading business model, reporting fair value focuses risk management on short-term price movements and in most cases incentivizes management to define the organization's risk appetite and to mitigate risk through hedging or other means. Fair value also incentivizes the entity to raise and maintain capital at a level sufficient to cover the price volatility of its assets. For example, if the business model is an originate-to-distribute model, then fair value has relevance.

In contrast, if the business model is predicated on the realization of value through the return of principal and yield over the life of the financial instrument, then fair value is less relevant. Consider, for example, a bank that finances the operations of a commercial enterprise. The realization of value will come from the repayment of cash flows. Risk management is based on an assessment of the borrower's creditworthiness and the entity's ability to fund the loan to maturity. In this case, the accounting should incentivize the entity to maintain sufficient funding to hold the instrument to maturity and to hold a sufficient amount of capital to cover potential credit losses through the credit cycle, preferably in a designated reserve. Indeed, the use of fair value could create disincentives for lending to smaller businesses whose credit characteristics are not easily evaluated by the marketplace.

Admittedly, some have used the business model argument to manipulate accounting results. But the actions of those entities do not diminish the relevance of the business model to the measurement principle. Indeed, over time if the valuation model is not relevant to the business model, the business model itself is likely to change. Rather, the lesson to be learned from such manipulation is that we--preparers, users and auditors of financial statements--need to be vigilant in evaluating actual business practice, and restrict the use of particular measurement principles to the relevant business models.

To this end, safeguards should be implemented to eliminate a firm's ability to overstate gains or understate losses by switching back and forth between business models or by reclassifying assets from one business segment to another. For example, from a regulatory perspective, assets in a financial institution's liquidity reserve, by their nature, imply utility through sale and, therefore, should be valued at market price.

Duke goes on an discusses the Stress Test accounting and current FASB and IASB discussions.