by Calculated Risk on 9/22/2009 04:11:00 PM

Tuesday, September 22, 2009

A comment on Option ARMs

The impact of Option ARM recasts is a huge question mark.

Diana Olick at CNBC writes: ARM Payment Shock a Myth?

We've been talking a lot recently about the "next wave" of foreclosures that would be driven by adjustable rate mortgage resets. In a research note today, FBR's Paul miller is taking an interesting tack: "While we remain very concerned about the impact of continued job losses on default rates, our analysis suggests that payment shock from ARM resets should not be a problem, as long as the Federal Reserve can keep short-term rates at record lows."Stop right there. Resets are not a problem with low interest rates. The potential problems are from loan recasts.

From Tanta on resets and recasts:

"Reset" refers to a rate change. "Recast" refers to a payment change. ... "Recast" is really just a shorter word for "reamortize": you take the new interest rate, the current balance, and the remaining term of the loan, and recalculate a new payment that will fully amortize the loan over the remaining term.Since a large percentage of ARM borrowers chose the negatively amortizing option, their payments will jump when the loan is reamortized or recast. Of course the interest rate will still be low, and the recast will be at the low rate.

So it is really hard to tell what will happen.

We see cautionary articles all the time:

But I think the exact impact is uncertain. Many Option ARM borrowers are defaulting before the loan recasts, see: $134B of U.S. Option ARM RMBS To Recast by 2011 (note: Fitch is just looking at securitized Option ARMs, not loans in bank portfolios):

Of the $189 billion securitized Option ARM loans outstanding, 88% have yet to experience a recast event ... Of these loans that have not yet recast, 94% have utilized the minimum monthly payment to allow their loans to negatively amortize.For more on defaulting before recast, see: Option ARM Defaults Shrink Recast Wave, Barclays Says .

...

Further evidence of option ARM underperformance in the last year lies in the number of outstanding securitized Option ARMs either 90 days or more delinquent, in foreclosure or real estate-owned proceedings, which has increased from 16% to 37%. Total 30+ day delinquencies are now 46%, despite the fact that only 12% have recast and experienced an associated payment shock. Instead, negative and declining equity has presented a larger problem: due to high concentrations in California, Florida, and other states with rapidly declining home prices, average loan-to-value ratios have increased from 79% at origination to 126% today. 'Negative equity and payment shocks will continue as Option ARM loans recast in large numbers in the coming years,' said Somerville.

emphasis added

And it is important to remember that most of the Option ARM loans in the Wells Fargo portfolio (via Wachovia) recast in ten years, as noted by the Healdsburg Housing Bubble: Reset Chart from Credit Suisse has a Major Error From the Wells Fargo Q2 Conference Call:

[W]hile many other option ARM loans have recast periods as short as five years, our Pick-a-Pay loans generally have ten-year contractual recasts. As a result, we have virtually no loans where the terms recast over the next three years, allowing us more time to work with borrowers as they weather the current economic downturn.It is a little confusing. You can't just look at a chart of coming recasts and know when borrowers will default. The real problem for Option ARMs is negative equity, and the surge in defaults is happening before the loans recast.

But the recasts will matter too, since many of these borrowers used these mortgages as "affordability products", and bought the most expensive homes they could "afford" (based on monthly payments only). When the recasts arrive, these borrowers will have few options.

The Housing Tax Credit Debate is Heating Up

by Calculated Risk on 9/22/2009 02:36:00 PM

Really not much of a debate - most economists, left and right - oppose it.

Patrick Coolican has a great overview: Economists say extending tax credit for first-time homebuyers is bad policy

[I]t’s not surprising that Nevada’s congressional delegation has signed on to a plan to extend the credit and even make it more generous.And from economists:

“It’s working,” says Rep. Dina Titus, the 3rd District Democrat. “You can see the positive impact of it. It really is stimulating the economy, helping Realtors and developers and homebuilders and individual homebuyers.”

“It’s terrible policy,” says Mark Calabria of the libertarian Cato Institute.There is much much more in the article.

“It’s awful policy,” says Andrew Jakabovics, associate director for housing and economics at the liberal Center for American Progress. “It’s incredibly expensive. It’s not well targeted.”

...

“We paid $8,000 to at least 1.5 million people to do something they were going to do anyway,” Jakabovics says.

...

“A heck of a lot of people would have bought the house anyway,” says Ted Gayer, an economist at the Brookings Institution.

...

The tax break, due to expire at the end of November, is on track to cost $15 billion, twice what Congress had planned. In other words, it will cost $43,000 for every new homebuyer who would not have bought a house without the tax break.

Gayer also questions whether moving people from renting to owning is really all that useful ...

The tax credit is one, albeit very expensive, way to create more households, but rental vouchers to get people out of their parents’ basements should also be considered, economists say.

Here is a post estimating the cost of an additional housing unit sold.

Also, it seems the goal of any stimulus should be to create more households, not just move people from renting to owning.

Here is a quote from an economist who called the housing bubble (no link):

The housing tax credit is an enormously inefficient use of government resources, and it does not really focus on what the economy needs: more job creation, and a return to “normal” growth of households.

While I believe it is highly unlikely that it will be expanded – that’s just REALLY TOO DUMB, even for Congress – I do think that the current credit will be extended for a bit.

Thomas Lawler former Fannie Mae and Wall Street economist, Sept 18, 2009

Q2 2009: Mortgage Equity Extraction Strongly Negative

by Calculated Risk on 9/22/2009 01:14:00 PM

Note: This is not data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008. My thanks to Jim Kennedy and the other contributors for the pervious MEW updates. For those interested in the last Kennedy data, here is a post, and the spreadsheet from the Fed is available here.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q2 2009, the Net Equity Extraction was minus $48 billion, or negative 1.8% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

The Fed's Flow of Funds report shows the amount of mortgage debt outstanding is declining, and this is partially because of debt cancellation per foreclosure sales (and a little from modifications), and partially due to homeowners paying down their mortgages (as opposed to borrowing more). Note: most homeowners pay down their principal a little each month (unless they have an IO or Neg AM loan), so with no new borrowing, equity extraction would always be negative.

Clearly the Home ATM has now been closed for a few quarters.

Philly Fed State Coincident Indicators

by Calculated Risk on 9/22/2009 10:46:00 AM

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty states are showing declining three month activity. The index increased in 6 states, and was unchanged in 4.

Here is the Philadelphia Fed state coincident index release for August.

In the past month, the indexes increased in 11 states (Arkansas, Indiana, Montana, North Dakota, Nebraska, Rhode Island, South Carolina, South Dakota, Virginia, Vermont, and Wisconsin), decreased in 36, and remained unchanged in three (New Hampshire, Ohio, and Tennessee) for a one-month diffusion index of -50. Over the past three months, the indexes increased in six states (Arkansas, North Dakota, South Carolina, South Dakota, Vermont, and Wisconsin), decreased in 40, and remained unchanged in four (Mississippi, Montana, Nebraska, and Virginia) for a three-month diffusion index of -68.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

A large percentage of states still showed declining activity in August.

Bank Report: Asia Rebounding

by Calculated Risk on 9/22/2009 08:57:00 AM

From the NY Times: Asia Rebounding Rapidly, Bank Reports

The [Asian Development Bank] declared that economic growth in China would be 8.2 percent this year, 1.2 percentage points higher than the bank’s forecast in March, and 8.9 percent next year.This should help U.S. exporters.

The bank raised its 2009 growth forecast for India to 6 percent, from 5 percent predicted in March, and for developing Asian countries as a group to 3.9 percent, from 3.4 percent.

“Developing Asia is proving to be more resilient to the global downturn than was initially thought,” the bank said in a statement accompanying its semiyearly assessment.

A common factor among countries doing better than expected is that they have been able to offset weak exports by stimulating domestic demand more than anyone expected. ...

Note: The August west coast port traffic shows a clear pickup in exports.

Monday, September 21, 2009

Inspector General: FDIC saw risks at IndyMac in 2002

by Calculated Risk on 9/21/2009 11:59:00 PM

From the Inspector General Report:

Between 2001 and 2003, [Division of Insurance and Research] DIR risk assessments and quarterly banking profiles identified concerns about a number of issues, including:Matt Padilla at the O.C. Register has the story: FDIC saw risks at IndyMac in 2002 but failed to act• consumers’ ever-increasing debt load, the expansion of adjustable rate mortgages, and a potential housing bubble;In January 2002, DIR noted that non-recession-tested lending programs such as subprime lending and HLTV lending may pose the biggest threat to consumer loan portfolio credit quality in a slowing economy. In May 2003, DIR reported that there was a concern about the extent to which lenders’ scoring models under-predicted losses during the 2001 recession. DIR noted that many subprime lenders experienced loss rates higher than their models predicted and that some consumer lending business models had been found to be inadequate, including those that relied on the securitization market for funding and were, therefore, sensitive to market pricing changes.

• subprime and high loan-to-value (HLTV) lending as a risk in the event that the United States economy suffered a significant recession; and

• pricing and modeling charge-off risk with respect to the originate-to-sell model of the mortgage business.

The FDIC noted issues at IndyMac as early as 2002, but did not stop the bank’s risk taking, the report says.Clearly the FDIC DIR was on the right track in 2001 to 2003. Just like with the Federal Reserve failure of oversight, we need a clear explanation why no significant action was taken.

“It was not until August 2007 that the FDIC began to understand the implications that the historic collapse of the credit market and housing slowdown could have on IMB and took additional actions to evaluate IMB’s viability,” the report says.

...

Despite these risks, the FDIC switched to relying on examinations from the OTS from 2004 to mid 2007, a period in which Indymac “continued to rely heavily on volatile funding sources such as brokered deposits and (Federal Home Loan Bank) advances to fund its growth.”

...

IndyMac’s failure is expected to cost the FDIC’s insurance fund $10.7 billion.

Banks to Make Loans to FDIC?

by Calculated Risk on 9/21/2009 10:24:00 PM

From the NY Times: F.D.I.C. May Borrow Funds From Banks (ht RJ)

Senior regulators say they are seriously considering a plan to have the nation’s healthy banks lend billions of dollars to rescue the insurance fund that protects bank depositors. ...Of course healthy banks would be happy to lend money to the FDIC; it is completely risk free and backed by the Treasury (and taxpayers).

Bankers and their lobbyists like the idea ... The Federal Deposit Insurance Corporation, which oversees the fund, is said to be reluctant to use its authority to borrow from the Treasury.

...

Bankers worry that a special assessment of $5 billion to $10 billion over the next six months would crimp their profits and could push a handful of banks into deeper financial trouble or even receivership. And any new borrowing from the Treasury would be construed as a taxpayer bailout ...

Officials say that the F.D.I.C. will issue a proposed plan next week to begin to restore the financial health of the ailing fund.

Fed Funds and Unemployment Rate

by Calculated Risk on 9/21/2009 07:04:00 PM

The Real Time Economics blog at the WSJ discusses expectations for the Fed two day meeting that starts tomorrow: Expect Patience From the Fed (note: the statement will be released on Wednesday).

No one expects a rate hike, and the main focus will be on the economic outlook and whether MBS purchases will slow. Last month, the FOMC statement noted "economic activity is leveling out", and the statement this month might be slightly more positive.

The Fed also announced last month: "To promote a smooth transition in markets as these purchases of Treasury securities are completed, the Committee has decided to gradually slow the pace of these transactions ..."

And this month the committee might announce a "smooth transition" for the purchases of agency mortgage-backed securities - and extend the deadline a few months into 2010.

As far as "patience", the Fed's mission is to conduct "monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employment, stable prices, and moderate long-term interest rates". So unless inflation picks up significantly (unlikely in the near term with so much slack in the system), it is unlikely that the Fed will increase the Fed's Fund rate until sometime after the unemployment rate peaks. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Although there are other considerations, since the unemployment rate will probably continue to increase into 2010, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011.

Moody’s: CRE Prices Off 39 Percent from Peak, Off 5% in July

by Calculated Risk on 9/21/2009 04:16:00 PM

From Bloomberg: Moody’s Property Index Resumes ‘Steep’ Fall in July (ht James)

The Moody’s/REAL Commercial Property Price Indices fell 5.1 percent in July from the month before, Moody’s said today in a statement. The index is down almost 39 percent from its October 2007 peak.Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

...

Commercial property sales this year may fall to an 18-year low. This latest set of numbers suggests no letup in that trend, said Neal Elkin, president of Real Estate Analytics LLC, a New York firm that partners with Moody’s in producing the report.

“We are still vulnerable to moves on the downside,” Elkin said in a telephone interview. “As time passes, the distress and the stress among those who need to sell is growing.”

...

Florida apartment values tumbled 40 percent in a year, the report said.

“That’s eye-popping,” Elkin said. The decline is being caused in part by “a ripple effect” from the overbuilding of condominiums in those markets, many of which are now competing as rentals, he said.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted - that is the name of the company (an unfortunate choice for a price index). Moody's CRE price index is a repeat sales index like Case-Shiller.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.

Also note the comment from Neal Elkin about condos being converted to rental units. There has been a surge in rental units, and rents are falling in most areas - and this is also impacting Apartment building prices.

GAO Report: AIG Stabilized, Repayment "Unclear"

by Calculated Risk on 9/21/2009 03:00:00 PM

| First a repeat of Eric's great AIG cartoon! Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis |

A report on AIG from the General Accounting Office (GAO):

While federal assistance has helped stabilize AIG’s financial condition, GAO-developed indicators suggest that AIG’s ability to restructure its business and repay the government is unclear at this time. Indicators of AIG’s financial risk suggest that since AIG reported significant losses in late 2008, AIG’s operations, with federal assistance, have begun to show signs of stabilizing in mid 2009. Similarly, after a declining trend through 2008 and early 2009, indicators of AIG insurance companies’ financial risk suggest improved financial conditions that were largely results of federal assistance. Indicators of AIG’s repayment of federal assistance show some progress in AIG’s ability to repay the federal assistance; however, improvement in the stability of AIG’s business depends on the long-term health of the company, market conditions, and continued government support. Therefore, the ultimate success of AIG’s restructuring and repayment efforts remains uncertain. GAO plans to continue to review the Federal Reserve’s and Treasury’s monitoring efforts and report on these indicators to determine the likelihood of AIG repaying the government’s assistance in full and the government recouping its investment.

emphasis added

AIA: Architectural Billings Index Declines in August

by Calculated Risk on 9/21/2009 12:14:00 PM

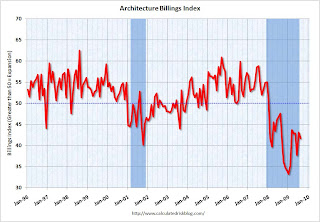

From Baltimore Business Journal: Architects report drop in future projects in August

... The American Institute of Architects said August’s Architectural Billings Index, an economic indicator of future construction activity, fell to 41.7 during the month, which is down from 43.1 in July.

...

“While there have been occasional signs of optimism over the last few months, the overwhelming majority of architects are reporting that banks are extremely reluctant to provide financing for projects and that new equity requirements and conservative appraisals are making it even more difficult for developers to get loans,” said Kermit Baker, AIA chief economist. “Until the anxiety within the financial community eases, these conditions are likely to continue.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). This suggests further dramatic declines in CRE investment through most of next year - at least.

Report: Mortgage Delinquencies increase in August

by Calculated Risk on 9/21/2009 11:09:00 AM

From Reuters: Mortgage Delinquencies Rise Alongside Unemployment (ht Ron Wallstreetpit)

Reuters reports that a record 7.58% of U.S. homeowners with mortgages were 30+ days delinquent in August, up from 7.32% in July ... and up from 4.89% in August 2008.

Reuters also notes that delinquencies are rising at "an accelerating pace".

This is one part of the coming "triple whammy" at the end of this year that Tom Lawler mentioned this morning: rising foreclosures, end of the Fed buying MBS, and the end of the housing tax credit.

We have to be a little careful with the delinquency numbers because they include homeowners in the trial period for modifications.

Note: This uses a different approach than the MBA. The MBA reported 9.24% of all loans outstanding were delinquent at the end of the 2nd quarter. Another 4.3% of loans were in the foreclosure process.

Housing: "Facing a triple whammy" at end of Year

by Calculated Risk on 9/21/2009 08:43:00 AM

"We could be facing a triple whammy at the end of the year: the expiration of the tax credit, the end of the Fed mortgage-buying program and rising foreclosures.”From Bloomberg: Housing Suffering Relapse Confronts Bernanke Credit Conundrum (ht Mike in Long Island) A few excerpts:

Thomas Lawler, housing economist

The Fed’s purchases of mortgage-backed debt so far this year have dwarfed net issues of such securities by Fannie Mae, Freddie Mac and government-run mortgage-bond insurer Ginnie Mae, which totaled about $440 billion through the end of August, said Walt Schmidt, a mortgage-bond strategist in Chicago at FTN Financial.These excerpts make three key points:

Once the Fed exits the market, the spread between yields on mortgage-backed debt and Treasury securities will have to rise, perhaps by a half percentage point, in order to attract other buyers, he said.

...

The impact of terminating the tax credit will show up first in the new-home market, said David Crowe, chief economist of the home-builders’ association.

“It takes at least four months to build a house, and you need to buy it before Dec. 1 to qualify,” he said. “If you haven’t started building it by now, it’s too late.”

...

Residential construction and home sales led the way out of the previous seven recessions going back to 1960, according to David Berson, chief economist of PMI Group, a mortgage insurer in Walnut Creek, California.

Sunday, September 20, 2009

Sunday Night Miscellaneous

by Calculated Risk on 9/20/2009 11:46:00 PM

From Paul Krugman on financial reform: Reform or Bust

I was startled last week when Mr. Obama, in an interview with Bloomberg News, questioned the case for limiting financial-sector pay: “Why is it,” he asked, “that we’re going to cap executive compensation for Wall Street bankers but not Silicon Valley entrepreneurs or N.F.L. football players?”Inferior goods in Japan! From the NY Times: Once Slave to Luxury, Japan Catches Thrift Bug

That’s an astonishing remark — and not just because the National Football League does, in fact, have pay caps. Tech firms don’t crash the whole world’s operating system when they go bankrupt; quarterbacks who make too many risky passes don’t have to be rescued with hundred-billion-dollar bailouts. Banking is a special case ...

Across the board, discount retailers are reporting increases in revenue — while just about everyone else is experiencing declines, in some cases, by double digits.Futures are off slightly ...

As a result, the luxury boutiques, once almighty here, are reeling.

...

In the 1970s and ’80s, and even as the economy limped through the ’90s, a wide group of consumers spent generously on Louis Vuitton bags and Hermès scarves — even at the expense of holidays, travel and, sometimes, meals and rent.

Now, the Japanese luxury market, worth $15 billion to $20 billion, has been among the hardest hit by the global economic crisis, according to a report by the consulting firm McKinsey & Company.

Futures from barchart.com

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

And the Asian markets are mixed.

Best to all.

Capital Spending and Consumer Spending

by Calculated Risk on 9/20/2009 08:41:00 PM

Earlier today I posted a couple of bullish views and I disagreed with the projections of an "Immaculate Recovery". Former IMF chief economist Michael Mussa suggested that consumer spending wouldn't lead this recovery, but that business investment would be strong.

This graph shows the general relationship between capital spending and consumer spending (ht Jan Hatzius, Capital Spending: The Caboose of a Slow Train). Note: Consumer spending lagged two quarters for best fit. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This suggests that consumer spending needs to pickup to above 1.5% year-over-year growth rate for business investment in equipment and software to be positive. If businesses expects consumer spending to pick up sharply, maybe they'd invest more - but few business owners expect a sharp pickup.

There might be a boost in capital spending because of a replacement cycle, but with all the slack in the economy (capacity utilization is near record lows and almost double digit unemployment), I definitely don't expect business spending to lead the recovery (as Mussa suggested).

NY Times: Financial Crisis Inquiry Commission

by Calculated Risk on 9/20/2009 04:11:00 PM

From a NY Times Editorial: Facts and the Financial Crisis

The Financial Crisis Inquiry Commission, created by Congress to examine the causes of the crisis, held its first public meeting last week. ... the meeting was a long time coming, and thin on substance.The NY Times asks some good questions:

In the run-up to the crisis, what did regulators, particularly the Federal Reserve, know and do in response to unconstrained lending? What were their thoughts about the way banks and investors worldwide increasingly disregarded risk?It will be interesting to read the 2004 FOMC transcripts to see if there was any discussion of lending standards, house prices and a credit bubble. It makes no sense that we have to wait 5+ years for the transcripts ...

Publicly, they did not act to curb the excesses. But internally, was there contrary analysis or dissent? Were there chances to take another course that we may learn from now in hindsight?

Answers to these questions are in files that are not public and in the heads of the people in positions of responsibility at the time. The commission must be aggressive in its pursuit of documents and unflinching in taking testimony at even the highest levels of government and business.

I suspect we will find some concerns expressed in 2004 - perhaps something similar to what Fed Economist Michael Prell said at the Dec 21, 1999 FOMC (about the stock market):

To illustrate the speculative character of the market, let me cite an excerpt from a recent IPO prospectus: ... “We do not expect to generate sufficient revenues to achieve profitability and, therefore, we expect to continue to incur net losses for at least the foreseeable future. If we do achieve profitability, we may not be able to sustain it.” Based on these prospects, the VA Linux IPO recorded a first-day price gain of about 700 percent and has a market cap of roughly $9 billion. Not bad for a company that some analysts say has no hold on any significant technology.I wouldn't be surprised to see something similar in the 2004 transcripts, but about housing and the credit markets.

The warning language I’ve just read is at least an improvement in disclosure compared to the classic prospectus of the South Sea Bubble era, in which someone offered shares in “A company for carrying on an undertaking of great advantage, but nobody to know what it is.” But, I wonder whether the spirit of the times isn’t becoming similar to that of the earlier period. ... At this point, those same people are abandoning all efforts at fundamental analysis and talking about momentum as the only thing that matters.

If this speculation were occurring on a scale that wasn’t lifting the overall market, it might be of concern only for the distortions in resource allocation it might be causing. But it has in fact been giving rise to significant gains in household wealth and thereby contributing to the rapid growth of consumer demand--something reflected in the internal and external saving imbalances that are much discussed in some circles.

emphasis added

A couple of Bullish Views

by Calculated Risk on 9/20/2009 01:07:00 PM

From James Grant in the WSJ: From Bear to Bull

Knocked for a loop, we forget a truism. With regard to the recession that precedes the recovery, worse is subsequently better. The deeper the slump, the zippier the recovery. To quote a dissenter from the forecasting consensus, Michael T. Darda, chief economist of MKM Partners, Greenwich, Conn.: "[T]he most important determinant of the strength of an economy recovery is the depth of the downturn that preceded it. There are no exceptions to this rule, including the 1929-1939 period."And from McClatchy Newspapers: Ex-IMF chief economist has rosy recovery view

Growth snapped back following the depressions of 1893-94, 1907-08, 1920-21 and 1929-33. If ugly downturns made for torpid recoveries, as today's economists suggest, the economic history of this country would have to be rewritten.

...

"At the business trough in 1933," Mr. Darda points out, "the unemployment rate stood at 25% (if there had been a 'U6' version of labor underutilization then, it likely would have been about 44% vs. 16.8% today. . . ). At the same time, the consumption share of GDP was above 80% in 1933 and the household savings rate was negative. Yet, in the four years that followed, the economy expanded at a 9.5% annual average rate while the unemployment rate dropped 10.6 percentage points."

...

Our recession, though a mere inconvenience compared to some of the cyclical snows of yesteryear, does bear comparison with the slump of 1981-82. In the worst quarter of that contraction, the first three months of 1982, real GDP shrank at an annual rate of 6.4%, matching the steepest drop of the current recession, which was registered in the first quarter of 2009. Yet the Reagan recovery, starting in the first quarter of 1983, rushed along at quarterly growth rates (expressed as annual rates of change) over the next six quarters of 5.1%, 9.3%, 8.1%, 8.5%, 8.0% and 7.1%. Not until the third quarter of 1984 did real quarterly GDP growth drop below 5%.

[Michael] Mussa, the former chief economist of the International Monetary Fund, presented a decidedly upbeat economic forecast last week that turned heads in the nation's capital. ...I disagree with these views.

"The recession is over and a global recovery is under way," he began, unveiling a pile of data and historical charts to support his view that forecasters regularly underestimate recoveries – and are doing so again.

Where the IMF foresees just 0.6 percent year-over-year growth in 2010 in the U.S. economy and 2.5 percent globally, Mussa sees 3.3 percent growth in the U.S. economy next year and 4.2 percent growth globally. He projects a U.S. growth rate of 4 percent from the middle of this year through the end of 2010.

"All forecasts tend to underpredict the recovery. … I think that's what we are seeing this time," said Mussa, now a senior fellow at the Peterson Institute for International Economics, a leading research organization in Washington.

...

Mussa pointed to forecasts made at the end of the 1981-1982 recession, the closest approximation to today's deep downturn. ...

The Reagan administration projected a growth rate from December 1982 to December 1983 of 3.1 percent, as did the Federal Reserve. In fact, the real growth rate turned out to be 6.3 percent.

...

Mussa concurs with most mainstream forecasters that consumers won't lead this recovery, and that Americans will sharply boost their savings to a 7 percent annual rate by the end of 2010.

What, then, will drive growth? Business investment, Mussa said ...

First, I expect a decent GDP rebound in Q3 and Q4 because of an inventory correction and exports. However this boost will be temporary.

But what will be the engine of growth in 2010? Usually consumer spending and residential investment lead the economy out of recession. Although I started the year expecting a bottom in new home sales and single family housing starts (and it appears that has happened), there is still too much existing home inventory for much of an increase in the short term.

And even Mussa agrees that consumers will remain under pressure as they repair their household balance sheets - yet he expects growth in business investment?

Goldman Sachs put on a research note on Friday: Capital Spending: The Caboose of a Slow Train (no link). Although the analysts noted a possible equipment replacement cycle, they also noted:

Few businesses will step up capital spending sharply unless they see a meaningful improvement in end demand for their products. Since the most important component of end demand for US companies is the domestic consumer, our cautious view of the outlook for personal consumption also implies a cautious view of capital spending, other things being equal. In essence, capital spending is the caboose of recovery, not the locomotive.There is already to much capacity, and until end demand absorbs some of that unused capacity, there won't be a meaningful increase in capital spending.

And on the comparison to the early '80s recession (both Grant and Mussa made this comparison), Krugman had some comments in early 2008: Postmodern recessions

A lot of what we think we know about recession and recovery comes from the experience of the 70s and 80s. But the recessions of that era were very different from the recessions since. Each of the slumps — 1969-70, 1973-75, and the double-dip slump from 1979 to 1982 — were caused, basically, by high interest rates imposed by the Fed to control inflation. In each case housing tanked, then bounced back when interest rates were allowed to fall again.And that means that the Fed can't just cut interest rates and boost housing. This recession is very different than the early '80s.

... Post-moderation recessions haven’t been deliberately engineered by the Fed, they just happen when credit bubbles or other things get out of hand.

This time housing will remain under pressure until the number of excess housing units (both owner occupied and rentals) decline to more normal levels.

So I think an "Immaculate Recovery" is very unlikely.

San Francisco: $30 Billion Option ARM Time Bomb

by Calculated Risk on 9/20/2009 08:49:00 AM

From Carolyn Said at the San Francisco Chronicle: $30 billion home loan time bomb set for 2010

From 2004 to 2008, "one in five people who took out a mortgage loan (for both purchases and refinancing) in the San Francisco metropolitan region ... got an option ARM," said Bob Visini, senior director of marketing in San Francisco at First American CoreLogic, a mortgage research firm. "That's more than twice the national average.The article has much more.

"People think option ARMs (will be) a national crisis," he said. "That's not really true. It's just in higher-cost areas like California where you see their prevalence."

...

First American shows more than 54,000 option ARMs issued here with a value of about $30.9 billion. Fitch shows more than 47,000 option ARMs here with a value of about $28 billion. Both say their data underestimate the totals.

...

Fitch said 94 percent of borrowers elected to make minimum payments only.

...

Unlike subprime loans, which were more commonly used for entry-level homes, option ARMs started out with high balances. In the five-county San Francisco area, option ARMs average about $584,000 and were used to buy homes averaging $823,000, according to an analysis of First American data.

That means they'll spawn foreclosures among upper-end homes.

...

"The average option ARM borrower is significantly underwater, so much that they don't think they'll get out," Sirotic said. On average nationwide, option ARM borrowers ... owe is 126 percent of their home's value, based on depreciation and not including the effects of negative amortization, Sirotic said.

Option ARMs were used as affordability products in mid-to-high priced areas of bubble states like California. Now most of the borrowers are significantly underwater, and this will lead to more foreclosures, and falling prices, in the mid-to-high end areas.

Saturday, September 19, 2009

Senator Dodd Pushing New Bank Regulatory Plan

by Calculated Risk on 9/19/2009 10:47:00 PM

From the NY Times: Leading Senator Pushes New Plan to Oversee Banks

[Sentator Dodd] is planning to propose the merger of four bank agencies into one super-regulator, an idea that is significantly different from what President Obama envisions.There is no question that the regulatory agencies reacted slowly to the obvious increase in risky loans in 2003 and 2004. I think any proposal should explain how a new "superagency" would have caught these problems earlier.

... the bill Mr. Dodd is preparing to make public in the coming weeks would be more ambitious and politically risky than the plan offered by the White House, which considered but then decided against combining the four banking agencies — the Federal Reserve, the Office of Thrift Supervision, the Federal Deposit Insurance Corporation and the Comptroller of the Currency — into one superagency.

...

In the House, Representative Barney Frank of Massachusetts, a Democrat and the chairman of the Financial Services Committee, has been working on legislation that is closer to the Obama plan on consolidation of the agencies.

...

Mr. Dodd has also rejected the administration’s proposal to have the Fed play the leading role as a so-called “systemic risk” regulator that examines the connections between regulated and unregulated companies for trouble spots that could disrupt the markets.

Need a hideout?

by Calculated Risk on 9/19/2009 06:51:00 PM

From the Chicago Sun Times: Capone lodge up for auction

Al Capone's "hideout retreat" in Wisconsin [is up for auction] minimum bid required: $2.5 million.A nice little hideaway ... maybe there is a secret vault ... hey, paging Geraldo!

"Located in the beautiful Northwoods of Wisconsin" near Couderay, the property includes 407 acres with a 37-acre private lake, according to an ad placed on the property announcing the foreclosure sale by Chippewa Valley Bank.

The buyer will get the original 1920s main lodge made of native fieldstone and featuring a massive split fieldstone fireplace. The sale also includes an eight-car garage renovated into a bar and restaurant, a bunkhouse, year-round caretaker's residence, guard tower and other outbuildings ...