by Calculated Risk on 9/25/2009 02:23:00 PM

Friday, September 25, 2009

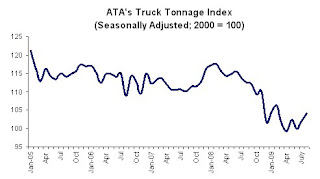

Truck Tonnage Index Increased in August

From the American Trucking Association: ATA Truck Tonnage Index Rose 2.1 Percent in August Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.1 percent in August, matching July’s increase of the same magnitude. The latest gain raised the SA index to 104.1 (2000=100), which was the best reading since February 2009. ... Compared with August 2008, SA tonnage fell 7.5 percent, which was the best year-over-year showing since November 2008. ...The Rail Freight Traffic shows some recent pickup too, but the level is still way below 2008 and 2007. (ht Bob_in_MA) Note: Trucking accounts for about 70% of tonnage carried by all modes of domestic freight transportation, and about 83% of total revenue.

“The gains in tonnage during July and August reflect a growing economy and less of an overhang in inventories,” [ATA Chief Economist Bob Costello] noted. “While I am optimistic that the worst is behind us, most economic indicators, including industrial output and household spending, suggest freight tonnage will exhibit moderate, and probably inconsistent, growth in the months ahead."

It appears the economy has reset to a new lower level, and growth will probably be sluggish. Trucking is probably benefiting from inventory restocking, and exports - the key positive areas for the economy.

Existing Home Turnover Ratio, and Distressing Gap

by Calculated Risk on 9/25/2009 12:16:00 PM

For graphs based on the new home sales report this morning, please see: New Home Sales Flat in August

The following graph is a turnover ratio for existing home sales. This is annual sales and year end inventory divided by the total number of owner occupied units. For 2009, sales were estimated at 4.8 million units, and inventory at the August level. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Although the turnover ratio has fallen from the bubble years, the level is still above the median for the last 40 years. This suggests 2009 is about a normal year for existing home turnover.

That might seem shocking based on all the reports of weak existing home sales. But the problem isn't the number of sales (except as compared to the bubble years), but the type and price of sales.

The reason turnover hasn't fallen further is because of all the distressed sales (foreclosures and short sales) primarily in the low priced areas. Distressed sales declined in August, and this is a major reason existing home sales declined.

There is another wave of foreclosures coming, so existing home sales might stay elevated for some time. Plus, the "first-time" homebuyers tax credit might be extended (a poorly targeted an inefficient credit).

Note: there is a substantial shadow inventory too.

All this distressed sales activity has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap. This graph shows existing home sales (left axis) and new home sales (right axis) through August.

This graph shows existing home sales (left axis) and new home sales (right axis) through August.

As I've noted before, I believe this gap was caused primarily by distressed sales. Even with the recent rebound in new and existing home sales, the gap is still very wide.

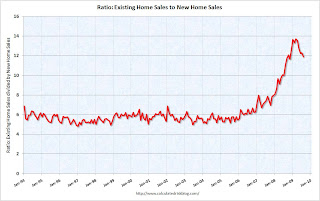

The third graph shows the same information, but as a ratio for existing home sales divided by new home sales. Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline back to the previous ratio.

Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline back to the previous ratio.

The ratio could decline because of a further increase in new home sales, or a decrease in existing home sales - or a combination of both. I expect the ratio will decline mostly from a decline in existing home sales as the first-time home buyer frenzy subsides, and as the foreclosure crisis moves into mid-to-high priced areas (with fewer cash flow investors).

New Home Sales Flat in August

by Calculated Risk on 9/25/2009 10:00:00 AM

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 429 thousand. This is a slight increase from the revised rate of 426 thousand in July (revised from 433 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. Sales in August 2009 were the same as August 2008. This is the 4th lowest sales for August since the Census Bureau started tracking sales in 1963.

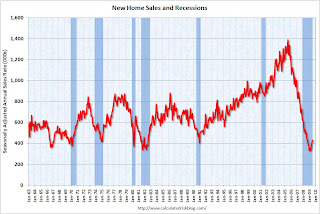

In August 2009, 38 thousand new homes were sold (NSA); the record low was 34 thousand in August 1981; the record high for August was 110 thousand in 2005. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but are now 30% above the low in January.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but are now 30% above the low in January.

Sales of new one-family houses in August 2009 were at a seasonally adjusted annual rate of 429,000 ...And another long term graph - this one for New Home Months of Supply.

This is 0.7 percent (±16.2%)* above the revised July rate of 426,000, but is 3.4 percent (±13.3%) below the August 2008 estimate of 444,000.

There were 7.3 months of supply in August - significantly below the all time record of 12.4 months of supply set in January.

There were 7.3 months of supply in August - significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of August was 262,000. This represents a supply of 7.3 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply and inventory have both peaked for this cycle, and new homes sales has probably also bottomed for this cycle. However any further recovery in sales will likely be modest because of the huge overhang of existing homes for sale.

I'll have more later ...

Durable Goods Orders off 2.4% in August

by Calculated Risk on 9/25/2009 08:33:00 AM

From the Census Bureau:

New orders for manufactured durable goods in August decreased $4.0 billion or 2.4 percent to $164.4 billion, the U.S. Census Bureau announced today. This was the second decrease in the last three months. This followed a 4.8 percent July increase. Excluding transportation, new orders were down slightly.So excluding civilian aircraft, durable goods orders were only down slightly.

Transportation equipment, also down two of the last three months, had the largest decrease, $4.0 billion or 9.3 percent to $39.5 billion. This was led by nondefense aircraft and parts, which decreased $3.7 billion.

The manufacturers continue to work down their unfilled orders and inventory:

Unfilled Orders

Unfilled orders for manufactured durable goods in August, down eleven consecutive months, decreased $2.8 billion or 0.4 percent to $737.1 billion. This was the longest streak of consecutive monthly decreases since the series was first published on a NAICS basis in 1992 ...

Inventories

Inventories of manufactured durable goods in August, down eight consecutive months, decreased $4.2 billion or 1.3 percent to $308.9 billion. This followed a 1.1 percent July decrease.

emphasis added

Thursday, September 24, 2009

CNBC: Lawler on Housing

by Calculated Risk on 9/24/2009 09:59:00 PM

Housing economist Thomas Lawler on CNBC this morning.

"It is virtual certainty that [foreclosure] sales will pick up. Various moratoria has actually diminished the pace of sales, but as people try to see who can qualify for the modification program. But the backlog of loans in foreclosure are rising, and foreclosure sales will 100% pickup, we just don't know when."

On tax credit: "It has been very very expensive, if you look at the number of people who have claimed the credit versus estimates of the incremental number of sales that wouldn't have occurred otherwise, looks it is costing the government about $40 thousand for every home sale generated."

FDIC: "Credit quality declined sharply" for Shared National Credits

by Calculated Risk on 9/24/2009 05:53:00 PM

From the FDIC: Credit Quality Declines in Annual Shared National Credits Review

Notes from the Fed:

A SNC is any loan and/or formal loan commitment, and any asset such as other real estate, stocks, notes, bonds and debentures taken as debts previously contracted, extended to borrowers by a supervised institution, its subsidiaries and affiliates. Further, a SNC must have an original amount that aggregates $20 million or more and either 1) is shared by three or more unaffiliated supervised institutions under a formal lending agreement or 2) a portion is sold to two or more unaffiliated supervised institutions with the purchasing institutions assuming their pro rata share of the credit risk.Some key findings:

• Criticized assets, which included SNCs classified as special mention, substandard, doubtful, or loss, reached $642 billion, up from $373 billion last year, and represented 22.3 percent of the SNC portfolio compared with 13.4 percent in 2008.

...

• Classified assets, which included SNCs classified as substandard, doubtful, or loss, rose to $447 billion from $163 billion and represented 15.5 percent of the SNC portfolio, compared with 5.8 percent in 2008. Classified dollar volume increased 174 percent from a year ago.

• Special mention assets, which exhibited potential weakness and could result in further deterioration if uncorrected, declined to $195 billion from $210 billion and represented 6.8 percent of the SNC portfolio, compared with 7.5 percent in 2008.

• The severity of criticism increased with the volume of SNCs classified as doubtful and loss rising to $110 billion, up from $8 billion in 2008. Loans in nonaccrual status also increased nearly eight times to $172 billion from $22 billion. Nonaccrual loans included $32 billion in credits classified as loss and $56 billion classified doubtful.

...

• Criticized volume was led by the Media and Telecom industry group with $112 billion, Finance and Insurance with $76 billion, and Real Estate and Construction with $72 billion. These three groups also represented the highest shares of criticized credits with 17.3 percent, 11.7 percent, and 11.2 percent of criticized credits in the SNC portfolio, respectively.

Click on graph for larger image in new window.

Click on graph for larger image in new window.A record $447 billion in assets were classified as substandard, doubtful, or a loss, almost triple the peak following the 2001 recession. As a percent of commitments, the current 15.5% of loans "classified" far exceeds the previous peak in 1991 of just under 10% of loans.

Also, according to the FDIC, nonbanks held 47 percent of classified assets despite owning only 21.2 percent of the SNC portfolio. American Banker has an excellent quote: Syndicated Loan Losses Skyrocket

"Anyone could get credit from banks because banks knew they would have ready and willing buyers of syndicated loans even if red lights were blinking when the loans were booked." ... said Karen Shaw Petrou, the managing director of Federal Financial Analytics Inc.

Fed: Homeowner Mortgage Obligations Still Historically High

by Calculated Risk on 9/24/2009 03:35:00 PM

The Federal Reserve released the Household Debt Service and Financial Obligations Ratios for Q2 today.

NOTE from Fed: "The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only a rough approximation of the current debt service ratio faced by households. Nonetheless, this rough approximation may be useful if, by using the same method and data series over time, it generates a time series that captures the important changes in household debt service payments."

Because of these limitations, the Financial Obligations Ratio (FOR) should be used to look at changes over time, not the absolute value of the ratio. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the homeowner financial obligations for consumer and mortgage debt as a percent of disposable personal income (DPI) since 1980.

"The homeowner mortgage FOR includes payments on mortgage debt, homeowners' insurance, and property taxes, while the homeowner consumer FOR includes payments on consumer debt and automobile leases."

Consumer financial obligations are still a little high historically, but mortgage obligations are very high (especially considering the level of interest rates). Just like after the housing bubble of the late '80s/ early '90s, it will probably take some time for the mortgage FOR to decline to more normal levels.

Hotel RevPAR off 18.3 Percent

by Calculated Risk on 9/24/2009 12:43:00 PM

We are now into the business travel season, and as expected, RevPAR is off sharply from 2008.

From HotelNewsNow.com: Oahu Island occupancy increases in STR weekly numbers

Overall the U.S. industry’s occupancy fell 8.6 percent to end the week at 59.6 percent. Average daily rate dropped 10.5 percent to finish the week at US$98.34. Revenue per available room for the week decreased 18.3 percent to finish at US$58.57.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 8.4% from the same period in 2008.

The average daily rate is down 1.5%, and RevPAR is off 18.3% from the same week last year.

After Labor Day business travel becomes far more important for the hotel industry than leisure travel, and so far there is no evidence that business travel is recovering significantly - especially at the high end - from Bloomberg: Luxury Hotels in U.S. Risk Default as $850 Rooms Remain Empty

Loans secured by more than 1,500 hotels with a total outstanding balance of $24.5 billion may be in danger of default, according to Realpoint LLC, ... “All segments are showing signs of distress but the luxury segment carries much higher loan balances and is more clearly affected,” [said] Frank Innaurato [of] Realpoint ...

Occupancy among chains with the costliest rooms fell to 60 percent in the first half from 70 percent a year earlier, according to Smith Travel Research. The decline was the industry’s largest for that period. ...

The U.S. hotel loan-delinquency rate may climb to 8.2 percent by year-end, Morgan Stanley analysts led by Andy Day said in a June 23 report. That would match the peak from the last recession in 2001.

Upscale hotels are suffering from “a heightened focus on prudent corporate travel expenditures,” as well as the pullback in vacation travel, Day said.

emphasis added

More on Existing Home Inventory

by Calculated Risk on 9/24/2009 11:54:00 AM

First, on the "shadow inventory" from Bloomberg: Housing Crash to Resume on 7 Million Foreclosures, Amherst Says

The crash in U.S. home prices will probably resume because about 7 million properties that are likely to be seized by lenders have yet to hit the market, Amherst Securities Group LP analysts said.The report suggests that modifications might help - but not much. From the report:

The “huge shadow inventory,” reflecting mortgages already being foreclosed upon or now delinquent and likely to be, compares with 1.27 million in 2005, the analysts led by Laurie Goodman wrote today in a report. Assuming no other homes are on the market, it would take 1.35 years to sell the properties based on the current pace of existing-home sales, they said.

...

“The favorable seasonals will disappear over the coming months, and the reality of a 7 million-unit housing overhang is likely to set in,” they said.

We don’t think they can help significantly. The 12-month recidivism rate on modifications has historically been about 70%. ... We have argued ... that HAMP modifications are unlikely to be successful in the long run as it does not address negative equity, the single most important determinant of default. And the borrower will still face payment shock as the payments begins to ramp up after the 5 year period in which the payments are fixed.The analysts estimate the overhang could be reduced by about 1 million units if the modifications are more successful than historical modifications.

Let’s say we are wrong and the HAMP modifications work much better than older style modifications. How much of the 7 million unit overhang can be cured by modification? The answer is “not much.”

However HAMP could spread out the flow of this shadow inventory over several years. So the size of the wave of more inventory is uncertain.

On the timing, from the WSJ yesterday:

"There's going to be a flood [of bank-owned homes] listed for sale at some point," says John Burns, a real-estate consultant based in Irvine, Calif.I think the 7 million estimate is probably high (that is HUGE), but there is definitely a large shadow inventory for the existing home market - so keep that in mind when looking at the following graphs:

...

"We are going to see a spike from now to the end of the year in foreclosures as we take people out of the running" for a loan modification or other alternatives, says a Bank of America Corp. spokeswoman. Foreclosure sales had dropped to "abnormally low" levels in response to government efforts to stem foreclosures, she adds.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is another graph of inventory. This graph shows inventory since 2002 by year.

The dotted lines (2002 - 2004) are for the boom years. 2005 (dashed green) is the transition year at the end of the boom. And the solid colors are for the bust years.

Inventory levels in August were below the levels of 2006.

The second graph shows months of supply for the same years.

The second graph shows months of supply for the same years."Months of supply" is lower than in 2007 and 2008, but higher than in 2006 since sales are lower. The level is still high.

The third graph shows the year-over-year change in existing home inventory.

In general prices would probably continue to fall until the months of supply reaches more normal levels (closer to 6 months compared to the current 8.5 months).

In general prices would probably continue to fall until the months of supply reaches more normal levels (closer to 6 months compared to the current 8.5 months).Without the huge overhang of shadow inventory, this general trend of declining year-over-year inventory levels would be considered a strong positive for the housing market. However - right now - these declines are probably misleading.

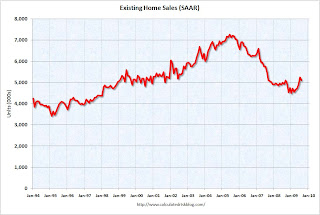

Existing Home Sales Decline in August

by Calculated Risk on 9/24/2009 10:00:00 AM

The NAR reports: Existing-Home Sales Ease Following Four Monthly Gains

Existing-home sales – including single-family, townhomes, condominiums and co-ops – declined 2.7 percent to a seasonally adjusted annual rate1 of 5.10 million units in August from a pace of 5.24 million in July, but remain 3.4 percent above the 4.93 million-unit level in August 2008. In the previous four months, sales had risen a total of 15.2 percent.

...

Total housing inventory at the end of August fell 10.8 percent to 3.62 million existing homes available for sale, which represents an 8.5-month supply at the current sales pace, down from a 9.3-month supply in July. Unsold inventory totals are 16.4 percent lower than a year ago

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Aug 2009 (5.1 million SAAR) were 2.7% lower than last month, and were 3.4% higher than August 2008 (4.93 million SAAR).

Here is another way to look at existing homes sales: Monthly, Not Seasonally Adjusted (NSA):

This graph shows NSA monthly existing home sales for 2005 through 2009. As in June and July, sales (NSA) were slightly higher in August 2009 than in August 2008.

This graph shows NSA monthly existing home sales for 2005 through 2009. As in June and July, sales (NSA) were slightly higher in August 2009 than in August 2008.It's important to note that many of these transactions are either investors or first-time homebuyers. Also many of the sales are distressed sales (short sales or REOs).

An NAR practitioner survey shows first-time buyers purchased 30 percent of homes in August, and that distressed homes accounted for 31 percent of transactions; both were unchanged from July.

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.62 million in August. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

The third graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.62 million in August. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.Typically inventory peaks in July or August.

Note: many REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs and other shadow inventory - so this inventory number is probably low.

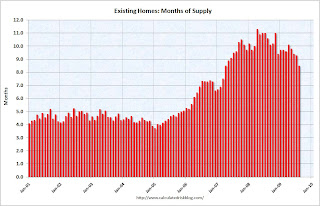

The fourth graph shows the 'months of supply' metric for the last six years.

The fourth graph shows the 'months of supply' metric for the last six years.Months of supply was steady at 8.5 months.

Sales decreased, but inventory decreased more, so "months of supply" declined. A normal market has under 6 months of supply, so this is still very high.

Note: New Home sales will be released tomorrow.

Weekly Unemployment Claims Decline

by Calculated Risk on 9/24/2009 08:33:00 AM

The DOL reports weekly unemployment insurance claims decreased to 530,000:

In the week ending Sept. 19, the advance figure for seasonally adjusted initial claims was 530,000, a decrease of 21,000 from the previous week's revised figure of 551,000. The 4-week moving average was 553,500, a decrease of 11,000 from the previous week's revised average of 564,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Sept. 12 was 6,138,000, a decrease of 123,000 from the preceding week's revised level of 6,261,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 11,000 to 553,500, and is now 105,250 below the peak in April.

Initial weekly claims have peaked for this cycle, however the continuing high level of weekly claims indicates significant weakness in the job market. The four-week average of initial weekly claims will probably have to fall below 400,000 before total employment stops falling.

Wednesday, September 23, 2009

Volcker on Financial Reform

by Calculated Risk on 9/23/2009 11:10:00 PM

Former Fed Chairman Paul Volcker testifies in front of the House Financial Services Committee at 9 AM ET on Thursday about financial reform.

For those interested, here is the webcast.

Here is his prepared statement. A few excerpts:

However well justified in terms of dealing with the extreme threats to the financial system in the midst of crisis, the emergency actions of the Federal Reserve, the Treasury, and ultimately the Congress to protect the viability of particular institutions – their bond holders and to some extent even their stockholders – have inevitably left an indelible mark on attitudes and behavior patterns of market participants.Volcker goes on to disagree with the Treasury plan to name banks that are “systemically important” or "too big to fail".• Will not the pattern of protection for the largest banks and their holding companies tend to encourage greater risk-taking, including active participation in volatile capital markets, especially when compensation practices so greatly reward short-term success?What all this amounts to is an unintended and unanticipated extension of the official “safety net”, an arrangement designed decades ago to protect the stability of the commercial banking system. The obvious danger is that with the passage of time, risk-taking will be encouraged and efforts at prudential restraint will be resisted. Ultimately, the possibility of further crises – even greater crises – will increase.

• Are community or regional banks to be deemed “too small to save”, raising questions of competitive viability?

• Does not the extension of support to non-banks, and even to affiliates of commercial firms, undercut the banking/commerce divide, ultimately weakening the commercial banking system?

• Will not investors in money market mutual funds find reassurance in the fact that when push came to shove, the Treasury with an extreme interpretation of its authority, took action to preserve those funds ability to meet their declared commitment to pay their investors at par upon demand?

There is no easy answer, no one-size fits all contingencies. Experience, not only here but in every country with highly developed, inter-connected financial systems and institutions bears out one point. Governments are not willing to withhold financial and other support for failing institutions when there is a clear threat to the intertwined fabric of the financial system. What can be done is to put in place arrangements to minimize the extent of emergency intervention and to damp expectations of government “bailouts”.

Think of the practical difficulties of such designation. Can we really anticipate which institutions will be systemically significant amid the uncertainties in future crises and the complex inter-relationships of markets? Was Long Term Capital Management, a hedge fund, systemically significant in 1998? Was Bear Stearns, but not Lehman? How about General Electric’s huge financial affiliate, or the large affiliates of other substantial commercial firms? What about foreign institutions operating in the United States?Volcker argues for a more traditional approach that sounds like the return of Glass-Steagall.

All hard questions. In practice the “border problem” seems intractable. In fair financial weather, the important institutions will feel competitively hobbled by stricter standards. In times of potential crisis, it would be the institution left out of the “too big to fail” club that will fear disadvantage.

Jim the Realtor: New Homes in San Diego

by Calculated Risk on 9/23/2009 07:09:00 PM

Just so you know, builders are still building in parts of San Diego (Carmel Valley). Pretty amazing ...

"Completely sold out. Sold out of all available properties. They're still building more. ... how about this, 250 people on the waiting list."

Falling Rents, Credit Card Defaults, and Market

by Calculated Risk on 9/23/2009 04:00:00 PM

Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

From Bloomberg: Manhattan Apartment Rents Drop as Employers Cut Jobs (ht Mike In Long Island)

Manhattan apartment rents dropped an average of at least 8 percent ...From Reuters: U.S. credit card defaults rise to record: Moody's (ht Ron Wallstreetpit)

Rents for studio apartments fell 11 percent to an average of $1,763, according to the broker’s data on deals in May through August compared with the same period a year earlier. The cost of a one-bedroom declined 8 percent to an average of $2,425. Two-bedrooms declined 11 percent to $3,421 and three- bedroom units fell 8 percent to $4,633.

The U.S. credit card charge-off rate rose to a record high in August ...And just a note: The consensus estimate for existing home sales tomorrow is 5.35 million SAAR. I'll take the under.

The Moody's credit card charge-off index -- which measures credit card loans that banks do not expect to be repaid -- rose to 11.49 percent in August from 10.52 percent in July.

...

"We continue to call for a recovery of the credit card sector to begin once industry average charge-offs peak in mid-2010 between 12 percent and 13 percent," Moody's said in a report.

FOMC Statement: Slow MBS Purchases

by Calculated Risk on 9/23/2009 02:15:00 PM

Information received since the Federal Open Market Committee met in August suggests that economic activity has picked up following its severe downturn. Conditions in financial markets have improved further, and activity in the housing sector has increased. Household spending seems to be stabilizing, but remains constrained by ongoing job losses, sluggish income growth, lower housing wealth, and tight credit. Businesses are still cutting back on fixed investment and staffing, though at a slower pace; they continue to make progress in bringing inventory stocks into better alignment with sales. Although economic activity is likely to remain weak for a time, the Committee anticipates that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will support a strengthening of economic growth and a gradual return to higher levels of resource utilization in a context of price stability.

With substantial resource slack likely to continue to dampen cost pressures and with longer-term inflation expectations stable, the Committee expects that inflation will remain subdued for some time.

In these circumstances, the Federal Reserve will continue to employ a wide range of tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of $1.25 trillion of agency mortgage-backed securities and up to $200 billion of agency debt. The Committee will gradually slow the pace of these purchases in order to promote a smooth transition in markets and anticipates that they will be executed by the end of the first quarter of 2010. As previously announced, the Federal Reserve’s purchases of $300 billion of Treasury securities will be completed by the end of October 2009. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is monitoring the size and composition of its balance sheet and will make adjustments to its credit and liquidity programs as warranted.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Donald L. Kohn; Jeffrey M. Lacker; Dennis P. Lockhart; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

emphasis added

Retail Hiring Outlook "Jobs Scarce"

by Calculated Risk on 9/23/2009 12:30:00 PM

From the WSJ: Holiday Jobs Look Scarce as Pessimism Grips Retail

... About 40% of stores surveyed across a broad swath of retailing ... told the Hay Group, a human resources consulting firm, that they expect to hire between 5% and 25% fewer temporary workers this year than last ...Seasonal retail hiring will be watch closely. Here is a repeat of a graph from a post a couple weeks ago: Seasonal Retail Hiring

That's a grimmer outlook than the Hay survey found a year ago, when 29% of retailers said they would be slashing their holiday workforce.

...

A third of retailers in the survey said they expect sales during Christmas to decline 5% to 25% this year. Another third expect sales to remain the same as last year. Researcher Retail Forward estimates last year was the worst selling season in 42 years with sales declining 4.5% in the fourth quarter. It also issued a forecast predicting sales will be flat with last year's weak numbers."

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. This graph shows the historical net retail jobs added for October, November and December by year.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This really shows the collapse in retail hiring in 2008. This also shows how the season has changed over time - back in the '80s, retailers hired mostly in December. Now the peak month is November, and many retailers start hiring seasonal workers in October.

The WSJ article is a little confusing. First they are comparing to last year (with 40% of retailers saying they will hire fewer workers than in 2008). But there is this paragraph:

In a typical Christmas season, the retail sector contributes about 700,000 temporary jobs to the economy. If retailers decrease those numbers by 10% to 20%, that would translate to a potential loss of more than 100,000 jobs this year just when they are most in demand.The 700,000 number is about right (as shown on the graph), but if retailers hire at the pace of last year, employment will be off 300,000 or so from normal.

DOT: Vehicle Miles increase in July

by Calculated Risk on 9/23/2009 10:49:00 AM

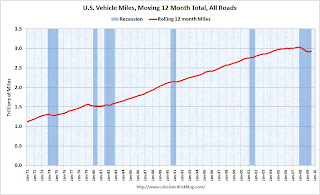

Although vehicle miles increased in July 2009 compared to July 2008, miles driven are still 1.3% below the peak for the month of July in 2007.

The Dept of Transportation reports on U.S. Traffic Volume Trends:

Travel on all roads and streets changed by +2.3% (5.8 billion vehicle miles) for July 2009 as compared with July 2008. Travel for the month is estimated to be 263.4 billion vehicle miles.

Cumulative Travel for 2009 changed by 0.0% (-0.6 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the rolling 12 month of U.S. vehicles miles driven.

By this measure (used to remove seasonality) vehicle miles declined sharply, and are set to slowly increase.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. As the DOT noted, miles driven in July 2009 were 2.3% greater than in July 2008.

Year-over-year miles driven started to decline in December 2007, and really fell off a cliff in March 2008. This makes for an easier comparison for July 2009.

MBA: 30 Year Mortgage Rates Fall Below 5 Percent

by Calculated Risk on 9/23/2009 08:58:00 AM

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, increased 12.8 percent on a seasonally adjusted basis from one week earlier, which was a holiday shortened week. ...

The Refinance Index increased 17.4 percent from the previous week as, for the first time since mid-May, the 30-year fixed rate dipped below 5 percent. The seasonally adjusted Purchase Index increased 5.6 percent from one week earlier, driven by applications for government-insured loans.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.97 percent from 5.08 percent ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

Tuesday, September 22, 2009

WSJ: Delayed Foreclosures and "Shadow" Inventory

by Calculated Risk on 9/22/2009 09:43:00 PM

From Ruth Simon and James Hagerty at the WSJ: Delayed Foreclosures Stalk Market

... Legal snarls, bureaucracy and well-meaning efforts to keep families in their homes are slowing the flow of properties headed toward foreclosure sales, even when borrowers are in deep distress. ... some analysts believe the delays are ... creating a growing "shadow" inventory of pent-up supply that will eventually hit the market.The foreclosures are coming. How many and when is the question. But based on the comments from the BofA spokeswoman, it sounds like foreclosures will "spike" in Q4.

...

Ivy Zelman ... believes three million to four million foreclosed homes will be put up for sale in the next few years. The question is whether the flow of these homes onto the market will resemble "a fire hose or a garden hose or a drip," she says.

... "We are going to see a spike from now to the end of the year in foreclosures as we take people out of the running" for a loan modification or other alternatives, says a Bank of America Corp. spokeswoman. Foreclosure sales had dropped to "abnormally low" levels in response to government efforts to stem foreclosures, she adds.

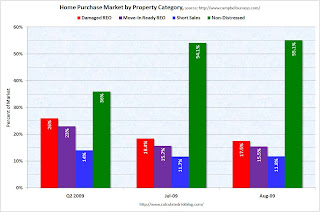

Home Purchase Market by Property Category

by Calculated Risk on 9/22/2009 06:28:00 PM

This is from a monthly survey by Campbell Communications (posted with permission).

Source: Campbell/Inside Mortgage Finance Monthly Survey of Real Estate Market Conditions, Campbell Communications, June 2009 Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Campbell survey broke REOs down into damaged and move-in ready. Distressed sales also include short sales.

Mark Hanson has pointed out that "organic" sales (non-distressed) have a seasonal pattern, and that distressed sales are basically steady all year. This new monthly data from Campbell Surveys should show that change in mix over the next few months.