by Calculated Risk on 9/29/2009 10:33:00 AM

Tuesday, September 29, 2009

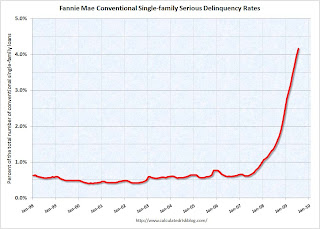

Fannie Mae Serious Delinquency Rate increases Sharply

Here is a hockey stick graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported that the serious delinquency rate for conventional loans in its single-family guarantee business increased to 4.17 percent in July, up from 3.94 percent in June - and up from 1.45% in July 2008.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans. These rates are based on conventional single-family mortgage loans and exclude reverse mortgages and non-Fannie Mae mortgage securities held in our portfolio."

Just more evidence of some shadow inventory and the next wave of foreclosures.

Update: These stats include Home Affordable Modification Program (HAMP) loans in trial modifications.

Case-Shiller House Prices increase in July

by Calculated Risk on 9/29/2009 09:00:00 AM

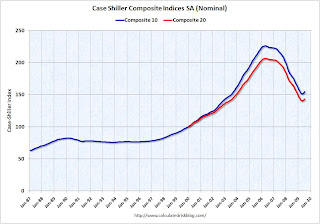

S&P/Case-Shiller released their monthly Home Price Indices for July this morning.

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). This is the Seasonally Adjusted data - others report the NSA data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.6% from the peak, and up about 1.3% in July.

The Composite 20 index is off 30.6% from the peak, and up 1.2% in July. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 12.8% from July 2008.

The Composite 20 is off 11.5% from last year.

This is still a very strong YoY decline.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices increased (SA) in 17 of the 20 Case-Shiller cities in July.

Prices increased (SA) in 17 of the 20 Case-Shiller cities in July.

In Las Vegas, house prices have declined 55.2% from the peak. At the other end of the spectrum, prices in Dallas are only off about 4.9% from the peak - and up in 2009. Prices have declined by double digits almost everywhere.

The debate continues - is the price increase because of the seasonal mix (distressed sales vs. non-distressed sales), the impact of the first-time home buyer frenzy on prices, and the slowdown in the foreclosure process (with a huge shadow inventory), or have prices actually bottomed? I think we will see further house price declines in many areas.

I'll compare house prices to the stress test scenarios soon.

Monday, September 28, 2009

The Housing Tax Credit and the Consumer Price Index

by Calculated Risk on 9/28/2009 11:14:00 PM

Here are some unintended consequences ...

According to the NAR, the "first-time" homebuyer tax credit will lead to an additional 350 thousand homes sold in 2009. As I've mentioned before, this tax credit is inefficient and poorly targeted, costing taxpayers about $43,000 for each additional home sold.

And where are those 350 thousand buyers coming from? My guess is most were probably renters (a few might have been living in their parent's basements!). Click on graph for larger image in new window.

Click on graph for larger image in new window.

And what will be the impact on the rental vacancy rate?

The rental vacancy rate was already at a record 10.6% in Q2 2009. Some quick math suggests the tax credit will push the national vacancy rate above 11% soon.

And that means even more pressure on rents (rents are already falling). This is good news for renters, but this will also lead to more apartment defaults, higher default rates for apartment CMBS, and more losses for small and regional banks.

And falling rents are already pushing down owners' equivalent rent (OER), and my guess is OER will probably turn negative soon. Since OER is the largest component of CPI (and almost 40% of core CPI), this will push down CPI for some time.

Extend the tax credit and we might be looking at the core CPI showing deflation. Welcome to the Fed's nightmare.

MBIA Cut to Junk

by Calculated Risk on 9/28/2009 08:38:00 PM

From Reuters: S&P cuts MBIA, MBIA Insurance as losses continue

Standard & Poor's on Monday cut its ratings on MBIA Inc and its structured finance insurance arm, MBIA Insurance Corp, citing an expectation the company will continue to take significant losses from insuring risky loans. ... The outlook for both companies is negative ...From S&P:

We downgraded MBIA and the holding company because macroeconomic conditions continue to contribute to losses on the group's structured finance products. Losses on MBIA's 2005-2007 vintage direct RMBS and CDO of ABS could be higher than we had expected. However, the downgrade also reflects potentially increased losses in other asset classes, including but not limited to CMBS and--for other years prior to 2005--within RMBS.There is still significant counterparty risk for the banks from both MBIA and Ambac.

...

The negative outlook on MBIA and the holding company reflects our view that adverse loss development on the structured finance book could continue. In the next few years, liquidity will likely be adequate to meet debt-service and holding-company obligations (including operating expenses). However, increased losses and earnings volatility could still occur. ... Considering the runoff nature of the franchise, it is unlikely that we would raise the rating. Alternatively, if there were increased losses within the investment portfolio, potential reserve charges, or diminished liquidity, we could take a negative rating action.

emphasis added

FDIC Considers Having Banks Prepay Assessments

by Calculated Risk on 9/28/2009 04:25:00 PM

From the Financial Times: FDIC considers calling for bank advances

The FDIC’s board, which meets on Tuesday to discuss options, is currently leaning towards asking banks to pay several years’ worth of its fees in advance ...The other alternatives are 1) borrowing from the Treasury, 2) borrowing from healthy banks, or 3) assessing banks another special fee.

excerpted with permission

The options of borrowing from the Treasury, or from healthy banks, are apparently off the table for now. On Friday, FDIC Chairwoman Sheila Bair said about borrowing from banks: "It's a possibility, I assume. I don't see that as a preferred option, but it is something in the statute."

So it appears the FDIC will ask for three years of assessments in advance, or about $36 billion according to Reuters.

The advantage to the banks of prepaying assessments (as opposed to another special assessment) is the banks don't have to record the expense immediately.

PIMCO: Personal Saving Rate to Exceed 8 Percent

by Calculated Risk on 9/28/2009 01:08:00 PM

From Bloomberg: Pimco’s Clarida Says U.S. Savings Rate May Exceed 8%

Pacific Investment Management Co. strategic adviser Richard Clarida said the U.S. savings rate may exceed 8 percent, hurting consumer spending and weighing on the economic recovery.The article mentions that future data suggests traders believe there is a 72 percent change that the Fed will raise the Fed Funds rate by April. I agree with Clarida that the Fed will not hike rates until late 2010 - at the earliest.

“I’m in the glass is half empty camp,” Clarida said during an interview in New York on Bloomberg radio. “Traditionally the consumer comes to the rescue of economic recoveries. We’ll see a more subdued consumer.”

...

“Economic growth will be choppy,” Clarida said. “We see the economy recovering. There will be some quarters above two percent, and others below.”

...

“At some point as unemployment declines, the Fed will need to renormalize rates,” Clarida said. “It’s too soon to tell the pace at which they will renormalize. I don’t think there will be a Fed hike until late 2010 or 2011.”

And here is a graph of the annual saving rate back to 1929(1). Note: 2009 is through Q2.

Click on graph for large image.

Click on graph for large image.Notice that the saving rate went negative during the Depression as household used savings to supplement income. And the saving rate rose to over 25% during WWII.

There is a long period of a rising saving rate (from after WWII to 1974) and a long period of a declining saving rate (from 1975 to 2008).

Some of the change in saving rate was related to demographics. As the large baby boom cohort entered the work force in the mid '70s, the saving rate declined (younger families usually save less), however I expected the saving rate to start to rise as the boomers reached their mid-40s (in the late '90s). This didn't happen.

Perhaps the twin bubbles - stock market and housing - deluded the boomers into thinking they had saved more than they actually had. It definitely appears many families treated mortgage equity extraction as part of their income during the bubble years - and the Home ATM is now closed.

Whatever the reason, I expect the saving rate to continue to rise over the next year or two. And that raises a question: what will be the impact on PCE of a rising saving rate?

I created the following scatter graph for the period from 1955 through early 2009. This compares the annual change in PCE with the annual change in the saving rate.

Note that R-squared is only .125, so there are other factors impacting PCE (like changes in income!).

Note that R-squared is only .125, so there are other factors impacting PCE (like changes in income!).But a rising saving rate does seem to suppress PCE (as expected). If the saving rate rises to 8% by the end of 2010 (as PIMCO expects), this suggests that real PCE growth will be about 1% below trend per year.

So with wages barely rising, and a rising saving rate suppressing PCE, I'd expect PCE growth to be sluggish for some time. And since PCE is usually one of the engines of recovery (along with residential investment), I expect the recovery to be very sluggish too (what Clarida calls "choppy").

(1)Note: much of this analysis is from MEW, Consumption and Personal Saving Rate in May.

Credit Indicators

by Calculated Risk on 9/28/2009 11:18:00 AM

I haven't posted this in some time. During the crisis these indicators showed the stress in the credit markets - now the LIBOR and TED spread just show that the Fed has been effective in lowering these rates. These might be interesting to watch as the Fed unwinds their various policy initiatives.

From Dow Jones: Key US Dollar Libor Downward Trend Stabilizes Monday

The cost of borrowing longer-term U.S. dollars in the London interbank market stabilized Monday, while the equivalent euro and sterling rates fell to record lows.That is good news for anyone with an ARM tied to the LIBOR.

Data from the BBA showed three-month dollar Libor ... remained unchanged from Friday at 0.2825%.

The three-month rate has fallen steeply since reaching 4.81875% on Oct. 10 2008, when interbank market tensions peaked.

Click on graph for larger image in new window.

Click on graph for larger image in new window.There has been improvement in the A2P2 spread. This has declined to 0.13. This is far below the record (for this cycle) of 5.86 after Thanksgiving, and is about the normal spread.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

The TED spread is now at the low end of the normal range of 19.22.

The TED spread is now at the low end of the normal range of 19.22. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is below 50 bps.

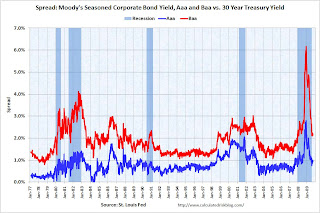

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.The spread has decreased sharply, but the spreads are still high, especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.

Chicago Fed Index: Economic activity lower in August

by Calculated Risk on 9/28/2009 08:42:00 AM

From the Chicago Fed: Index shows economic activity lower in August

The Chicago Fed National Activity Index was –0.90 in August, down from –0.56 in July. Three of the four broad categories of indicators made negative contributions to the CFNAI in August; the production and income category made a positive contribution to the index for the second consecutive month.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"[T]he Chicago Fed National Activity Index (CFNAI), is a weighted average of 85 existing, monthly indicators of national economic activity. The CFNAI provides a single, summary measure of a common factor in these national economic data ...

[T]he CFNAI-MA3 appears to be a useful guide for identifying whether the economy has slipped into and out of a recession. This is useful because the definitive recognition of business cycle turning points usually occurs many months after the event. For example, even though the 1990-91 recession ended in March 1991, the NBER business cycle dating committee did not officially announce the recession’s end until 21 months later in December 1992. ...

When the economy is coming out of a recession, the CFNAI-MA3 moves significantly into positive territory a few months after the official NBER date of the trough. Specifically, after the onset of a recession, when the index first crosses +0.20, the recession has ended according to the NBER business cycle measures."

Note: this is based on only a few recessions, but this is one of the indicators to watch to determine when the recession ends - although it will go positive a "few months after the official NBER date of the trough".

Sunday, September 27, 2009

Report: New Short-term Borrowing Rules being considered for Banks

by Calculated Risk on 9/27/2009 09:52:00 PM

The Financial Times reports that U.S. financial regulators are considering new ratios for banks to determine the dependence on short-term borrowing: US banks face short-term borrowing rules

... “Capital is critical, but liquidity enhancement is a necessary piece of the puzzle,” said Kevin Bailey, deputy comptroller [OCC] ...These measures are intended to gauge the liquidity of banks - and prevent future banks runs like with what happened at Bear Stearns and Lehman Brothers.

One ratio would compare a bank’s assets to its stable sources of funding, such as deposits or longer-term unsecured debt.

excerpted with permission

The Wall Street banks relied heavily on commercial paper, and when that market froze, the banks experienced a severe liquidity crisis.

Some smaller regional and local have relied on brokered deposits to fund their short term needs. The NY Times had a article on brokered deposits back in July: For Banks, Wads of Cash and Loads of Trouble

To lure the money from brokers, banks typically had to offer unusually high rates. That, in turn, often led them to make ever riskier loans, leaving them vulnerable when the economy collapsed. ...It sounds like the regulators are pushing back.

Hot money has bedeviled regulators for three decades and they are starting to fight back, albeit tentatively, devising new restrictions to keep the practice from taking more banks down. But in one of the hidden lobbying battles in Washington this year, the banks are pushing hard to keep the money flowing.

So far the banks are winning, and the hot money continues to fuel bank growth.

Mortgages: New Rules for High-Cost Loans take effect on Oct 1st

by Calculated Risk on 9/27/2009 05:12:00 PM

From the NY Times: New Rules Coming Soon

On Oct. 1, new rules adopted by the Federal Reserve will go into effect, requiring greater diligence on the part of mortgage lenders and brokers who make so-called high cost loans for borrowers with weak credit. The interest rates on these loans are at least 1.5 percentage points higher than the average prime mortgage rate.It is hard to believe it has taken this long. I think Uriah King meant "eight years (or more) too late"!

...

The regulations — finalized in July 2008 but only now being put into effect — bar lenders from making a high-cost mortgage without verifying that a borrower could repay the loan in the conventional way, and not simply through a foreclosure sale.

...

During the home lending boom from 2003 to 2006, subprime lenders would often offer loans without requiring borrowers to prove that they could make the monthly payments. With stated-income loans — or as some called them, “liar loans” — borrowers could easily fabricate annual income figures and even buy a home without a down payment.

...

According to Uriah King, a senior policy associate for the Center for Responsible Lending, a consumer advocacy group based in Durham, N.C., the new federal rules are “important, and they are good.”

But Mr. King says the new regulations are “five years too late.”

Here is the 2008 Press Release from the Fed:

The final rule adds four key protections for a newly defined category of "higher-priced mortgage loans" secured by a consumer's principal dwelling. For loans in this category, these protections will:• Prohibit a lender from making a loan without regard to borrowers' ability to repay the loan from income and assets other than the home's value. A lender complies, in part, by assessing repayment ability based on the highest scheduled payment in the first seven years of the loan. To show that a lender violated this prohibition, a borrower does not need to demonstrate that it is part of a "pattern or practice."

• Require creditors to verify the income and assets they rely upon to determine repayment ability.

• Ban any prepayment penalty if the payment can change in the initial four years. For other higher-priced loans, a prepayment penalty period cannot last for more than two years. This rule is substantially more restrictive than originally proposed.

• Require creditors to establish escrow accounts for property taxes and homeowner's insurance for all first-lien mortgage loans.

The Condo Glut

by Calculated Risk on 9/27/2009 12:46:00 PM

In Delaware from The News Journal: Justison Landing developer to auction condos

In a risky strategy to move condominiums, the developers of the much-ballyhooed Justison Landing complex on Wilmington's Riverfront plan to auction off a third of the units in the waterfront community next month.From the Jacksonville Business Journal: Summer House condos to be auctioned

...

Robert Buccini, a partner in Buccini/Pollin Group Inc. in Wilmington, said the auction of 38 condominiums and two town houses in a 120-condo building on the Christina River is designed to stimulate sales ... So far, about 25 condos have been sold in the building -- about two sales a month since the building was completed a year ago.

"We're basically selling at discount so we can move on to our next project," Buccini said.

Twenty-three condominiums in the Summer House in Old Ponte Vedra will go up for auction.From KUOW News in Seattle: Condo Glut

This weekend, 40 units are up for auction and the minimum bids are typically less than half the listed price. ... there is a veritable glut of brand new condominiums on the market. A few years ago, it seemed, every parking lot in downtown Seattle was being turned into condos. Many of those projects are coming on line now, during the worst real estate market in decades.And a twist in New Jersey, from the NY Times: In Jersey City, Jump-Starting Condo Sales

At Brix, which completed construction late last year, two thirds of the building's units are still unsold.

At the Saffron, a nearly complete 76-unit condominium complex in the thick of this city’s downtown, the Fields Development Group is trying something new ... The first units — a minimum of 9, a maximum of 15 — will be auctioned off before the grand opening and the start of conventional marketing."Stimulate"? "Jump-start"? Why not just call it "dump" or "liquidate"?

...

Ending sales with an auction — after fair-market values for a building have already been well established — is a tried-and true-technique, of course. But the auctioneers for the Saffron, at Sheldon Good & Company, say they have never conducted a “jump-start” auction before.

But this is a reminder that new high rise condos are not included in the new home inventory report from the Census Bureau, and are also not included in the existing home sales report from the NAR (unless they are listed). These uncounted units are concentrated in Miami, Las Vegas, San Diego and other large cities - but as these articles show, there are new condos almost everywhere.

The Fed and Subprime Lending: The Watchdog that Didn't Bark

by Calculated Risk on 9/27/2009 09:21:00 AM

From the WaPo: As Subprime Lending Crisis Unfolded, Watchdog Fed Didn't Bother Barking

... Under a policy quietly formalized in 1998, the Fed refused to police lenders' compliance with federal laws protecting borrowers, despite repeated urging by consumer advocates across the country and even by other government agencies.The failure of oversight was a serious and unfortunately common problem during the boom. For more examples see: Inspector General: FDIC saw risks at IndyMac in 2002 and Federal Reserve Oversight and the Failure of Riverside Bank of the Gulf Coast.

The hands-off policy, which the Fed reversed earlier this month, created a double standard. Banks and their subprime affiliates made loans under the same laws, but only the banks faced regular federal scrutiny. Under the policy, the Fed did not even investigate consumer complaints against the affiliates.

"In the prime market, where we need supervision less, we have lots of it. In the subprime market, where we badly need supervision, a majority of loans are made with very little supervision," former Fed Governor Edward M. Gramlich, a critic of the hands-off policy, wrote in 2007. "It is like a city with a murder law, but no cops on the beat."

... since its creation, the Fed has held a second job as a banking regulator, one of four federal agencies responsible for keeping banks healthy and protecting their customers. ... During the boom, however, the Fed left those powers largely unused. ... The Fed's performance was undercut by ... the doubts of senior officials about the value of regulation ...

The WaPo title reminds us of the conversation between Colonel Ross and Sherlock Holmes in Sir Arthur Conan Doyle's "Silver Blaze":

"Is there any point to which you would wish to draw my attention?"

"To the curious incident of the dog in the night-time."

"The dog did nothing in the night-time."

"That was the curious incident," remarked Sherlock Holmes.

Saturday, September 26, 2009

Banks: Troubled Asset Ratio

by Calculated Risk on 9/26/2009 09:25:00 PM

The American University School and MSNBC have created a tool for tracking the "troubled asset ratio" for banks. This tool allows you to search for individual banks.

Here is the description:

[The] “troubled asset ratio” ... compares the sum of troubled assets with the sum of Tier 1 Capital plus Loan Loss Reserves. Generally speaking, higher values in this ratio indicate that a bank is under more stress caused by loans that are not paying as scheduled.According to BankTracker, the national median troubled-asset ratio is 13 (a percentage of Tier 1 Capital plus Loan Loss Reserves). The most recent bank failure, Georgian Bank in Altanta Georgia had a ratio of 198.3.

Wendell Cochran, senior editor of the Investigative Reporting Workshop, and a former business reporter for the Kansas City Star, the Des Moines Register and Gannett News Service, was likely the first journalist to create this measure of bank health. He did that while covering banking for the Des Moines Register in the early 1980s. Later, at Gannett News Service, he was involved in projects published at USA TODAY and elsewhere that calculated this ratio for every bank and savings and loan in the nation.

Others do similar calculations. The most widely used is the so-called Texas Ratio, created during the 1980s by a banking consultant. You can find various formulas for calculating this ratio, but they generally are in line with the method used by the Investigative Reporting Workshop. There is no attempt here to value the non-loan assets that may also be causing bank problems, such as mortgage-backed securities, collateralized debt obligations, etc.

I looked up a few banks from the Unofficial Problem Bank List with Prompt Corrective Actions:

| Name | City | State | PCA | Troubled Asset Ratio |

|---|---|---|---|---|

| Peoples First Community Bank | Panama City | FL | 6/11/2009 | 362.8 |

| Warren Bank | Warren | MI | 8/3/2009 | 351.1 |

| Home Federal Savings Bank | Detroit | MI | 3/5/2009 | 193.2 |

| Bank of Elmwood | Racine | WI | 7/23/2009 | 182.5 |

| American United Bank | Lawrenceville | GA | 8/13/2009 | 155.3 |

| Heritage Bank | Topeka | KS | 3/31/2009 | 149.1 |

| Bank 1st | Albuquerque | NM | 8/31/2009 | 146.1 |

WaPo: An Interview with Barney Frank

by Calculated Risk on 9/26/2009 04:06:00 PM

From the WaPo: Barney Frank Talks Back A couple of excerpts:

Klein: What's the most important part of financial regulation?This is an interesting answer. About two years ago, I was asked to sum up the causes of the crisis in a few words, and I responded "Securitization and the lack of regulatory oversight". I then explained how rapid innovation in lending resulted in a disconnect between the borrower and the eventual debt holder.

Frank: Limiting securitization. I believe the single biggest issue here is that people invented ways to lend money without worrying if they got paid back or not by securitizing the loan. When I was younger, the theory was if you had a high risk tolerance, you went into stocks. If you were safe and stodgy, you bought debt. But debt became the volatile aspect here.

...

Klein: One theory of the crisis is that the problem wasn't traders and their high tolerance for risk. It was people fooling themselves into thinking this stuff was safe by slapping a triple-A rating on everything.

Frank: I agree; the theory has always been that people bought debt because it was safer. The basic problem was that 30 years ago when people lent other people money, they expected to be paid back by the people they lent money to. So they were very careful. Two years ago, most loans were being made by people who were going to sell those loans to other people and didn't expect to be paid back.

The mortgage lenders and Wall Street firms were disconnected from the performance of the actual loan (the "Originate-to-sell" model). At the same time, the rating agencies were evaluating the debt based on the historical performance of the old style lender-borrower relationship. The eventual debt holders relied on the rating agencies, without realizing the entire model had changed.

Meanwhile the regulators were not following this advice:

“Instruct regulators to look for the newest fad in the industry and examine it with great care. The next mistake will be a new way to make a loan that will not be repaid.”

William Seidman, "Full Faith and Credit", 1993.

There is nothing inherently wrong with securitization or financial innovation. But the regulators should always be on the lookout for "a new way to make a loan that will not be repaid".

IMF Managing Director: "Too early to claim victory"

by Calculated Risk on 9/26/2009 01:28:00 PM

A quote from Bloomberg: Strauss-Kahn Says Crisis Consequences Will Last Long Time

“We will still have rising unemployment at least for a year,” [International Monetary Fund Managing Director Dominique] Strauss-Kahn said via videolink in an address to the Yalta European Strategy Conference from Washington. “From this point of view, the crisis isn’t over. It is too early to claim victory, even that we have avoided the worst situation. The consequences will be there for a long time.”Strauss-Kahn makes several key points:

Earlier this week, Strauss-Kahn expressed concern about the social consquences of the crisis (via Reuters):

"In many areas of the world, what is at stake is not only higher unemployment or lower purchasing power, but life and death itself," Strauss-Kahn said.

"We don't just care about growth for growth's sake, we also want to safeguard peace and prevent war," he said, adding: "Indeed, when low-income countries were doing well over the past decade or so, the incidence of war declined significantly. The great fear is that this trend could be reversed."

L.A. Times: A House is a Home

by Calculated Risk on 9/26/2009 08:33:00 AM

From Peter Hong at the LA Times: Don't bank on your home as an ATM (ht Ann). A few excerpts:

For generations of Americans, a home was seen not simply as a dwelling, but as an engine of personal wealth. That view was promoted by the home-building and real estate sales industries as well as the U.S. government, which subsidized home loans and provided tax deductions for mortgage interest.It makes sense for people to buy houses as a place to live, not as an investment.

...

Now, however, the worst housing crash since the Great Depression may mean that a home purchase ought to be considered with the same warning issued to investors in securities: Past performance is not indicative of future results.

...

Leslie Appleton-Young, chief economist for the California Assn. of Realtors, said that the state's median home price used to rise and fall roughly in line with the national median. ... "It didn't really get out of whack until about four or five years ago," she said. "It was tied into financing."

With lax mortgage standards a thing of the past, at least for now, Appleton-Young said, home price increases will be more moderate in the future, which should lead people to "a much more realistic assessment of why they're buying a home. They'll do so more for the consumption value; it's a place to raise your family, not your nest egg."

...

"In the period post-World War II, you bought a home, gave your family a great place to live relative to the alternatives, and if all went well, in 20 years you didn't have a mortgage," said [Thomas Lawler, influential housing consultant and a former Fannie Mae official]. "That's what people ought to go back to."

Perhaps Leslie Appleton-Young has lost track of time, but four years ago was 2005 - the peak of the housing insanity. She probably meant four or five years before 2006 (when prices peaked) as to when house prices in California started to detach from fundamentals.

G-20 Agreements

by Calculated Risk on 9/26/2009 01:47:00 AM

From the NY Times: Group of 20 Agrees on Far-Reaching Economic Plan

The leaders pledged to rethink their economic policies in a coordinated effort to reduce the immense imbalances between export-dominated countries like China and Japan and debt-laden countries like the United States, which has long been the world’s most willing consumer.Imagine an export led recovery in the U.S. (as opposed to the typical recovery with consumer spending and housing leading the way). I'll believe it when I see it.

The United States will be expected to increase its savings rate, reduce its trade deficit and address its huge budget deficit. Countries like China, Japan and Germany will be expected to reduce their dependence on exports by promoting more consumer spending and investment at home.

... for the first time ever, each country agreed to submit its policies to a “peer review” from the other governments as well as to monitoring by the International Monetary Fund.

Friday, September 25, 2009

Problem Bank List (Unofficial) Sept 25, 2009

by Calculated Risk on 9/25/2009 07:36:00 PM

This is an unofficial list of Problem Banks.

Changes and comments from surferdude808:

Another week with significant changes to the Unofficial Problem Bank List as the FDIC released its enforcement actions for August. We will not get another release from the FDIC until the end of October.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

The Unofficial Problem Bank List grew by 23 institutions to 459 and aggregate assets total $297.2 billion, up from $294 billion last week. During the week, we added 25 institutions to the list while we removed 2 because of failure. The failures were Irwin Union Bank and Trust Company ($2.8 billion) and Irwin Union Bank, F.S.B. ($518 million).

The largest asset additions include First Mariner Bank ($1.3 billion), Baltimore, MD; Anchor Mutual Savings Bank ($657 million), Aberdeen, WA; and NexBank ($560 million), Dallas, TX.

For the other 23 additions, the average asset size is $178 million. The additions are concentrated in handful of states including Minnesota (5), California (4), Washington (4), and Georgia (3), which all continue to see banks with large CRE or C&D lending concentrations come under enforcement action.

The list includes 2 new Prompt Corrective Action orders the FDIC issued against American United Bank ($112 million), Lawrenceville, GA; and Bank 1st ($109 million), Albuquerque, NM. It is long overdue for the agencies to start issuing more PCA orders.

One other interesting item this week is that the FDIC issued a Cease & Desist order on August 31st against Georgian Bank ($2.2 billion), Atlanta, GA, which was closed today. We typically remove failures from the subsequent week’s list but, in this case, we did not add Georgian Bank otherwise aggregate assets would have been $299.4 billion.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #95: Georgian Bank, Atlanta, GA

by Calculated Risk on 9/25/2009 04:36:00 PM

Just five simple syllables

Foreclosure central

by Rob Dawg (SGIP out today)

From the FDIC: First Citizens Bank and Trust Company, Incorporated, Columbia, South Carolina, Assumes All of the Deposits of Georgian Bank, Atlanta, Georgia

Georgian Bank, Atlanta, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Friday starts early ...

As of July 24, 2009, Georgian Bank had total assets of $2 billion and total deposits of approximately $2 billion. In addition to assuming all of the deposits of the failed bank, First Citizens Bank agreed to purchase essentially all of the assets.

The FDIC and First Citizens Bank entered into a loss-share transaction on approximately $2 billion of Georgian Bank's assets. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $892 million. ... Georgian Bank is the 95th FDIC-insured institution to fail in the nation this year, and the nineteenth in Georgia. The last FDIC-insured institution closed in the state was First Coweta, Newnan, on August 21, 2009.

Freddie Exec Compensation, Bandos, Market and more

by Calculated Risk on 9/25/2009 04:00:00 PM

Michelle at Footnoted.org digs up the employment contract for Freddie Mac's new CFO: Taxpayer funded signing bonus at Freddie Mac?

• annual compensation of $3.5 million (this includes $675K in salary, $1.6 million in something called “additional annual salary” and $1.1 million in a target incentiveWhy is Freddie paying more than the private sector? And I bet Geithner is jealous about the house deal!

• a $1.95 million signing bonus

• immediate buyout of Kari’s house

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And the Bandos are moving on up in Miami! From nbcphiladelphia.com: After Miami's Ritzy Bubble Bursts, Squatters Move on Up

Miami's squatter problem has garnered national media attention over the past year and a half, as the foreclosure crisis threatened to transform the Magic City into something resembling a lawless, "Mad Max"-esque landscape.Maybe the lenders should sell the foreclosed homes?

The squatters mostly kept a low profile, moving in ... to neighborhoods where they could take over unnoticed.

But now come reports that squatters are seeking out more ritzy neighborhoods, including the pricey, tree-lined streets of Coral Gables.

...

A check of county records found that the home went into foreclosure over a year ago, just about the time residents said the alleged squatters showed up.

The bank which owns the property hired a realtor to sell it last month ...

And from the LA Times: Calls to renew home buyer tax credit get louder in Washington. Yeah, an expensive, poorly targeted tax credit for those not suffering during the recession. This isn't as dumb as allowing the FHA DAP to continue (Downpayment Assistance Program - the poster child for bad housing policy), but close. Why not a "first-time renters" tax credit for anyone who hasn't rented for 3 years? That makes as much economic sense.